|

市場調査レポート

商品コード

1302347

リチウム二次電池向けコバルトフリー正極の開発動向と市場見通し<2023> Development Trends and Market Outlook for Cobalt-free Cathodes for Lithium Secondary Batteries |

||||||

|

|||||||

| リチウム二次電池向けコバルトフリー正極の開発動向と市場見通し |

|

出版日: 2023年06月29日

発行: SNE Research

ページ情報: 英文 180 Pages

納期: お問合せ

|

- 全表示

- 概要

- 目次

コバルトフリー(NMx)正極材料市場は2022年から利用が始まり、2023年に正極材料需要全体の1%、2025年に6%、2030年に12%を占めると予測されています。一方、コバルトフリー(NMx)正極材料の価格の見通しは、2023年の14米ドル/kgから、2025年に12米ドル/kg、2030年に9米ドル/kgに低下し、CAGRで-5.5%の推移が予測されています。

当レポートでは、世界のリチウムイオン電池市場と電気自動車(EV)市場について調査分析し、コバルトフリー正極材料の開発動向と見通しをまとめています。

目次

第1章 リチウムイオン電池市場とEV市場の状況

- リチウムイオン電池市場の状況と見通し

- 世界のリチウムイオン電池市場の状況

- 世界のxEVリチウムイオン電池の需要の見通し

- 世界のxEV向けリチウムイオン電池市場の見通し

- 電気自動車市場の状況と見通し

- 世界のEV市場の状況と見通し

- 中国のEV市場の状況と見通し

- 欧州のEV市場の状況と見通し

- 韓国のEV市場の状況と見通し

- 日本のEV市場の状況と見通し

第2章 二次電池向けリチウム正極の状況

- 二次電池向けリチウム正極の開発状況

- リチウムイオン電池の正極の種類

- 高電圧正極技術

- LFP/LMFP、ブレードバッテリー

- NCM単結晶

- バイモーダル技術

- 4要素NCMA技術

- 世界の正極材料市場の需要の予測

- 中国の市場規模の予測:正極タイプ別

- リチウムイオン電池正極の原材料の状況

- コバルト、ニッケル金属の価格状況

- 主要国のコバルト、ニッケル金属の生産と埋蔵量

- 主要国のリチウムの生産と埋蔵量

- LiOH、Li2CO3の価格状況

- NCM523/811の価格状況

- バッテリー価格の変化

第3章 コバルトフリー正極の開発状況

- Coフリー正極材料の概要

- 層状構造のコバルトフリー正極材料

- 層状正極材料におけるコバルト(Co)の役割

- Hi-Niコバルトフリー正極材料の特徴と開発状況

- Ni-Mn系コバルトフリー正極材料(NMx)の特徴と開発状況

- 非層状コバルトフリー正極材料

- Hi-Mn系正極材料の開発状況

- オリビン系(LFP、LMFP)正極材料の開発状況

- スピネル系(LMO、LNMO)正極材料の開発状況

- 無秩序岩塩構造材料の開発状況

- SVOLTとコバルトフリーの商業化の見通し

- コバルトフリー正極開発のSVOLTの歴史

- SVOLTのビジネス範囲

- 将来の技術開発計画

第4章 非リチウム系コバルトフリー:NiB開発状況

- Naイオン電池(NiB)の概要

- ナトリウムイオン電池の原理

- ナトリウムイオン電池とリチウム二次電池の比較

- ナトリウムイオン電池の価格競争力の分析

- ナトリウムイオン電池の有力な材料候補

- NiB材料の開発と状況

- ナトリウムイオン電池向け正極の開発

- ナトリウムイオン電池向け負極の開発

- ナトリウムイオン電池の開発状況

- ナトリウムイオン電池の将来の見通し

- ナトリウムイオン電池の市場見通し:調査企業別

第5章 コバルトフリー正極市場の見通し

- コバルトフリー正極市場の予測(2018年~2030年)

- コバルトフリー正極の需要の予測(2018年~2030年)

- コバルトフリー正極の価格の予測(2018年~2030年)

第6章 コバルトフリー正極材料に関する電池特許の分析

- Hanyang University

- LG

- POSCO

- SVOLT

- Univ. Texas

- Nano One

Lithium rechargeable batteries began to be applied to electric vehicles (EVs) around 2010, and now, in what can be described as an "electric vehicle revolution," the EV industry is exploding around the world, and the market for lithium rechargeable batteries is growing rapidly.

Unlike other lithium secondary battery materials, cathode materials use expensive metals such as Ni and Co, which can cause price problems. It is possible to reuse expensive metals through the implementation of recycling technologies, but the larger the market, the more additional metals are required, which can be a barrier to market expansion.

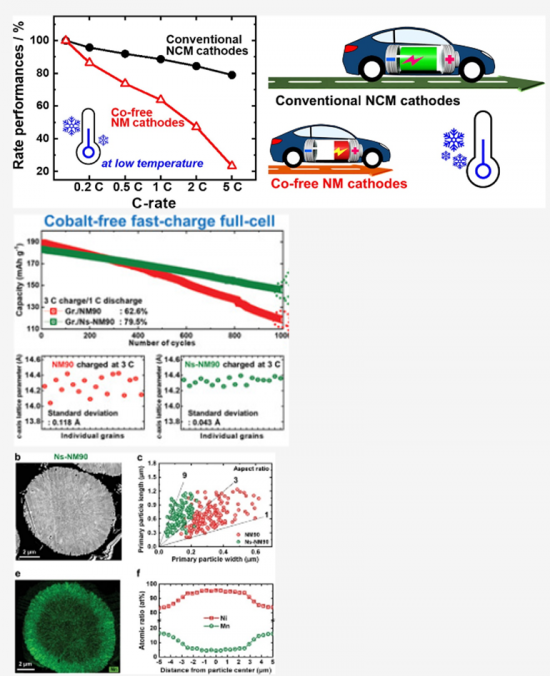

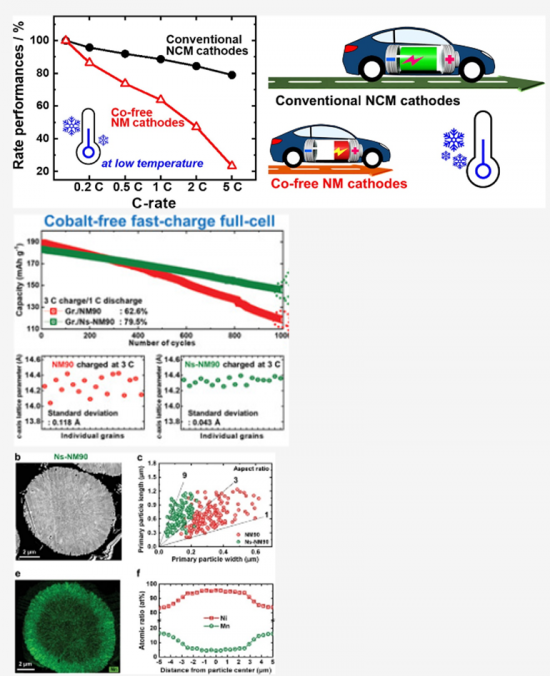

The driving range, which is the most important performance of an electric vehicle, is determined by the energy density of the battery it is equipped with. The energy density of a battery is directly related to the available capacity of the cathode material. In NCM and NCA anodes, higher Ni content has the advantage of increasing the usable capacity and thus improving the energy density, so high-nickelization research has been actively conducted to increase the nickel content of the cathode, but the increase in nickel content is accompanied by a sharp decrease in life stability and thermal stability at the expense of increased usable capacity.

In addition to high-nickelization, another issue that is attracting attention in NCM and NCA cathode materials is the cobalt-free (Co free) cathode material. Cobalt is a major raw material for cathode materials that accounts for the most costs in the manufacture of electric vehicle batteries. As the demand for batteries is increasing rapidly, the price of cobalt is also skyrocketing.

As the transition to electric vehicles accelerates, the movement to reduce the use of cobalt in order to secure stable raw materials and lower prices is emerging as a new challenge in the battery industry. Therefore, in order to solve these problems, it is necessary to use the most expensive cobalt metal in very small amounts (Co-less), or ultimately, high-performance Co free cathode materials that do not use cobalt.

According to SNE Research, the market for cobalt-free (NMx) cathode materials began to be applied in 2022, and is expected to account for 1% of total cathode material demand in 2023, 6% in 2025, and 12% in 2030. Meanwhile, the price outlook for cobalt-free (NMx) cathode materials is expected to decline from $14/kg in 2023 to $12/kg in 2025, and $9/kg in 2030, with a compound annual growth rate (CAGR) of -5.5%.

This report provides a comprehensive overview of the development of cobalt-free cathode materials. It provides a detailed analysis of the global lithium-ion battery market and electric vehicle (EV) market, as well as the Chinese and European lithium-ion battery market and EV status. The report also discusses the development trends and prospects of cathode materials, and summarizes the development trends and prospects of cobalt-free cathode materials. In particular, the report analyzes the technologies and patents of Chinese and domestic companies that are leading the development and application of cobalt-free cathode materials, in order to identify the key technologies of cobalt-free cathode materials.

This report by SNE Research is expected to provide insight into the technology and market of cobalt-free cathode materials, as well as be a great help in understanding the industry surrounding it.

Strong Points of the Report:

- 1. A comprehensive overview of cobalt-free cathode materials and abundant technical content.

- 2. Considerations for design and synthesis through case studies of cobalt-free cathode materials

- 3. Presentation of the development trends and future technological and market outlook of cobalt-free cathode materials

- 4. Presentation of key technologies and prospects of sodium-ion batteries, which are non-lithium cobalt batteries

- 5. Patent analysis of major cobalt-free cathode material development companies and research institutes.

Table of Contents

1. State of the Lithium-ion Battery and EV Market

- 1.1. Lithium-ion Battery Market Status and Outlook

- 1.1.1. Global Lithium-ion Battery Market Status

- 1.1.2. Global xEV Lithium-ion Battery Demand Outlook

- 1.1.3. Global Lithium-ion Battery Market Outlook for xEVs

- 1.1.4~8. China's Lithium-ion Battery Market Status

- 1.1.9~10. Europe's Lithium-ion Battery Market Status

- 1.1.11. South Korea's Lithium-ion Battery Market Status

- 1.1.12. Japan's Lithium-ion Battery Market Status

- 1.2. Electric Vehicle Market Status and Outlook

- 1.2.1. Global EV Market Status and Outlook

- 1.2.2. China's EV Market Status and Outlook

- 1.2.3. Europe's EV Market Status and Outlook

- 1.2.4. South Korea's EV Market Status and Outlook

- 1.2.5. Japan's EV Market Status and Outlook

2. State of Lithium Cathode for Secondary Battery

- 2.1. Status of Lithium Cathode Development for Secondary Battery

- 2.1.1. Types of Cathodes for Lithium-ion Batteries

- 2.1.2. High Voltage Cathode Technology

- 2.1.3. LFP/LMFP, Blade battery

- 2.1.4. NCMSingle Crystal

- 2.1.5. Bimodal Technology

- 2.1.6. Four-element NCMA Technology

- 2.1.7. Global Cathode Materials Market Demand Forecast

- 2.1.8. Market Size Forecast by Cathode Type in China

- 2.2. Status of Lithium-ion Battery Cathode Raw Materials

- 2.2.1. Co, Ni Metal Price Status

- 2.2.2. Production and Reserves of Co and Ni Metals in Major Countries

- 2.2.3. Lithium Production and Reserves in Major Countries

- 2.2.4. LiOH, Li2CO3 Price Status

- 2.2.5. NCM523/811 Price Status

- 2.2.6. Battery Price ($/Wh) Changes

3. Status of Cobalt-free Cathode Development

- 3.1. Overview of Co-free Cathode Materials

- 3.1.1~2. Cobalt-free Cathode Materials, Need and Problems

- 3.1.3~4. Cobalt-free Cathode Material Classification and Characteristics

- 3.2. Layered Structure Cobalt-free Cathode Materials

- 3.2.1. The Role of Cobalt (Co) in Layered Cathode Materials

- 3.2.2. Features and Development Status of Hi-Ni Cobalt-free Cathode Materials

- 3.2.3. Features and Development Status of Ni-Mn Based Cobalt-free Cathode Materials (NMx)

- 3.3. Non-layered Cobalt-free Cathode Materials

- 3.3.1. Development Status of Hi-Mn-based Cathode Materials

- 3.3.2. Development Status of Olivine-based (LFP, LMFP) Cathode Materials

- 3.3.3. Development Status of Spinel-based (LMO, LNMO) Cathode Materials

- 3.3.4. Development Status of Disordered Rock Salt Structure Materials

- 3.4. SVOLT and Outlook for Cobalt-free Commercialization

- 3.4.1. SVOLT History of Cobalt-free Cathode Development

- 3.4.2. SVOLT Business Scope

- 3.4.3. Future Technology Development Plan

4. Non-lithium-based Cobalt-free: NiB Development Status

- 4.1. Na Ion Battery (NiB) Overview

- 4.1.1. Principle of Sodium-Ion Battery

- 4.1.2. Sodium-Ion Battery vs. Lithium Secondary Battery Comparison

- 4.1.3. Analyzing the Price Competitiveness of Sodium-Ion Batteries

- 4.1.4. Leading Material Candidates for Sodium-Ion Batteries

- 4.2. NiB Material Development and Status

- 4.2.1. Cathode Development for Sodium-Ion Batteries

- 4.2.2. Anode Development for Sodium-Ion Batteries

- 4.2.3. Sodium-Ion Battery Development Status

- 4.2.4. The Future Prospects for Sodium-Ion Batteries

- 4.2.5. Market Outlook for Sodium-Ion Batteries by Research Firm

5. Cobalt-free Cathode Market Outlook

- 5.1. Cobalt-free Cathode Market Forecast ('18 ~ '30)

- 5.1.1. NMx Cathode Market Outlook(1)

- 5.1.1. NMx Cathode Market Outlook(2)

- 5.2. Cobalt-free Cathode Demand Forecast ('18 ~ '30)

- 5.2.1. Market Demand Outlook for NMx cathodes (1)

- 5.2.1. Market Demand Outlook for NMx cathodes (2)

- 5.3. Cobalt-free Cathode Price Forecast ('18 ~ '30)

- 5.3.1. NMx Cathode Price Outlook (1)

- 5.3.1. NMx Cathode Price Outlook (2)

6. Battery Patent Analysis for Cobalt-free Cathode Materials

- 6.1. Hanyang University

- 6.2. LG

- 6.3. POSCO

- 6.4. SVOLT

- 6.5. Univ. Texas

- 6.6. Nano One