|

|

市場調査レポート

商品コード

1503299

ミリ波技術市場の2030年までの予測:製品別、部品別、周波数帯別、用途別、地域別の世界分析Millimeter Wave Technology Market Forecasts to 2030 - Global Analysis By Product, Component, Frequency Band, Application and By Geography |

||||||

カスタマイズ可能

|

|||||||

| ミリ波技術市場の2030年までの予測:製品別、部品別、周波数帯別、用途別、地域別の世界分析 |

|

出版日: 2024年06月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

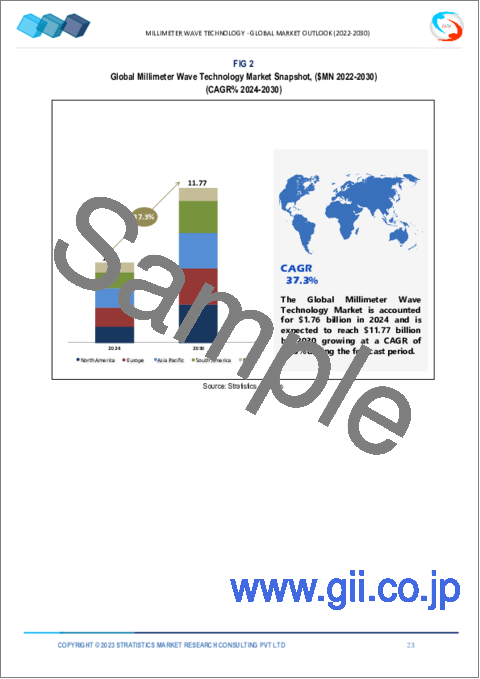

Stratistics MRCによると、世界のミリ波技術市場は2024年に17億6,000万米ドルを占め、予測期間中のCAGRは37.3%で2030年には117億7,000万米ドルに達する見込みです。

ミリ波技術とは、30~300ギガヘルツの電磁波の波長範囲を指し、従来の無線周波数よりも高く、赤外線よりも低い電磁スペクトルのセグメントを占める。この技術は、大容量のデータを超高速で伝送できるのが特徴で、5Gネットワークのような将来の無線通信システムには欠かせないです。さらに、ミリ波信号は波長が短いため、より正確な指向性伝送が可能になり、利用可能な周波数帯をより効率的に利用できます。

Ericssonによると、5Gの加入件数は2019~2027年にかけて世界的に急増し、1,200万件以上から40億件以上に増加すると予想されています。加入件数は、東南アジア、北東アジア、インド、ネパール、ブータンで最も多くなると予測されています。

広帯域幅用途に対する需要の高まり

ミリ波技術は、さまざまなセグメントで広帯域幅用途の需要が高まっているため、脚光を浴びています。30~300ギガヘルツのミリ波は、データ伝送、特に5Gネットワーク、高解像度ビデオストリーミング、自律走行車など、高速データ転送速度を必要とする用途に大きな利点をもたらします。従来の低周波数帯とは異なり、ミリ波は短距離で大量のデータを伝送できるため、ネットワークの混雑が懸念される密集した都市環境に最適です。

機器の高コスト

電磁スペクトルの高周波領域で動作するミリ波技術は、特殊な部品やインフラを必要とするため、低周波数帯の技術に比べ、開発、製造、展開に本質的にコストがかかります。しかし、通信、レーダー・システム、その他の用途のためのミリ波インフラへの初期投資は多額であるため、その展開は、費用便益比が費用を正当化できるセグメントや業界にさらに限定されます。

モバイル・データ・トラフィックの増加

消費者がモバイル機器でのストリーミングやゲーム、その他のデータ集約的な活動のために、より高速で信頼性の高い接続性を求めるようになり、従来の無線周波数帯は混雑しつつあります。MmWave技術は、より広い帯域幅を提供する高い周波数を利用することで、大幅に高速なデータ転送レートを可能にするソリューションを記載しています。さらに、mmWave信号は波長が短いため、より正確なビームフォーミング技術と高い空間再利用が可能になり、ネットワークの容量と効率が向上します。

標準化の欠如

ミリ波技術市場は、標準化の欠如による大きな課題に直面しており、その普及と発展を妨げています。通信、レーダー、画像処理などの用途に高周波電波を利用するこの技術は、周波数帯域、プロトコル、機器の仕様が地域や業界ごとに分断されています。この統一性の欠如は、さまざまな機器やネットワーク間の相互運用性を複雑にし、互換性、性能の一貫性、全体的な信頼性に対する懸念を引き起こしています。

COVID-19の影響:

当初、世界のサプライチェーンの混乱はミリ波デバイスの製造と展開の遅れにつながり、ベンダーとエンドユーザーの双方に影響を与えました。封鎖措置と社会的距離の規範は、実地試験と設置をさらに妨げ、この新興技術の採用率を鈍化させました。個人消費の減少や経済情勢の不透明感から、企業は高速データ伝送のためにミリ波技術に大きく依存する5Gインフラへの投資を見直すようになりました。しかし、パンデミック(世界的大流行)が拡大するにつれ、強固な通信ネットワークの重要性が認識されるようになり、5G技術への関心と投資が継続されるようになりました。

予測期間中、発振器部門が最大となる見込み

発振器セグメントは、ミリ波スペクトラムで動作するデバイスに不可欠な周波数制御ソリューションを提供することで、予測期間中に最大となる見込みです。30GHzから300GHzのミリ波は、正確な周波数生成と安定性を必要とするが、発振器はこれを実現します。これらの部品は、通信、自動車レーダー、画像システム、航空宇宙など様々な用途に必要なコヒーレント信号の生成を可能にします。高速データ転送と低遅延通信の需要が高まる中、ミリ波技術は5Gネットワークやその先で不可欠なものとなりつつあります。このセグメントの発振器には、電圧制御発振器(VCO)、位相同期ループ(PLL)、周波数シンセサイザーなどがあり、それぞれがミリ波システムの特定の周波数と安定性の要件を満たすように調整されています。

予測期間中、VバンドセグメントのCAGRが最も高くなる見込み

予測期間中にCAGRが最も高くなると予想されるのはVバンドセグメントです。40~75GHzの周波数帯域で動作するVバンドには、高いデータ転送速度、低遅延、豊富な周波数帯域といった利点があります。これらの特性は、5Gネットワーク、通信用バックホール、無線インフラ用のポイント・ツー・ポイント通信リンクなど、高速データ伝送を必要とする用途に特に適しています。スモールセルネットワークの展開拡大や広帯域用途の需要増は、無線通信インフラの将来形成におけるVバンドの重要性をさらに際立たせています。

最大のシェアを占める地域

推定期間中、北米地域が最大シェアを占めました。北米の高度通信セクターは、大手通信事業者による5Gインフラへの多額の投資と相まって、この地域をミリ波技術採用の最前線に位置付けています。データ速度の高速化、低遅延、ネットワーク容量の拡大に対する需要が、米国とカナダの都市中心部におけるミリ波技術の広範な展開を促進しています。この技術的進歩は、モバイル・ブロードバンドサービスの強化をサポートするだけでなく、自律走行車、医療、スマートシティなどのセグメントにおける新たな用途開拓を促進し、ミリ波技術市場における北米のリーダーシップをさらに強固なものにしています。

CAGRが最も高い地域:

欧州地域は予測期間中、収益性の高い成長を維持する見込みです。政府の規制は主に、ミリ波技術の展開と運用に不可欠な周波数割り当てと標準準拠に焦点を当てています。欧州各国政府は、明確なガイドラインと標準を確立することで、ミリ波システムの相互運用性と信頼性を確保し、企業、投資家、消費者を含む利害関係者の信頼を醸成しています。さらに、欧州の規制機関は、資金提供プログラムや助成金を通じて、ミリ波技術の研究開発にインセンティブを与えることも多いです。

無料のカスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます。

- 企業プロファイル

- 追加市場参入企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推定・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携別の主要企業のベンチマーキング

目次

第1章 エグゼクティブ概要

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 脅威

- 製品分析

- 用途分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界のミリ波技術市場:製品別

- イントロダクション

- イメージングとスキャンシステム

- 通信機器

- レーダーと衛星通信システム

第6章 世界のミリ波技術市場:部品別

- イントロダクション

- アンプ

- 発振器

- アンテナとトランシーバー

- 周波数変換器

- 放射計

- その他

第7章 世界のミリ波技術市場:周波数帯別

- イントロダクション

- Eバンド

- Vバンド

- その他

第8章 世界のミリ波技術市場:用途別

- イントロダクション

- 軍事・防衛

- 医療

- 自動車・輸送

- その他

第9章 世界のミリ波技術市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他のアジア太平洋

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他の中東・アフリカ

第10章 主要開発

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイリング

- E-Band Communications, LLC

- Fujitsu Ltd

- Intel Corporation

- L3Harris Technologies

- LightPointe Communications, Inc

- Mitsubishi Electric Corporation

- NEC Corporation

- Qualcomm Technologies

- Samsung Electronics

- Trex Enterprises Corporation

List of Tables

- Table 1 Global Millimeter Wave Technology Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Millimeter Wave Technology Market Outlook, By Product (2022-2030) ($MN)

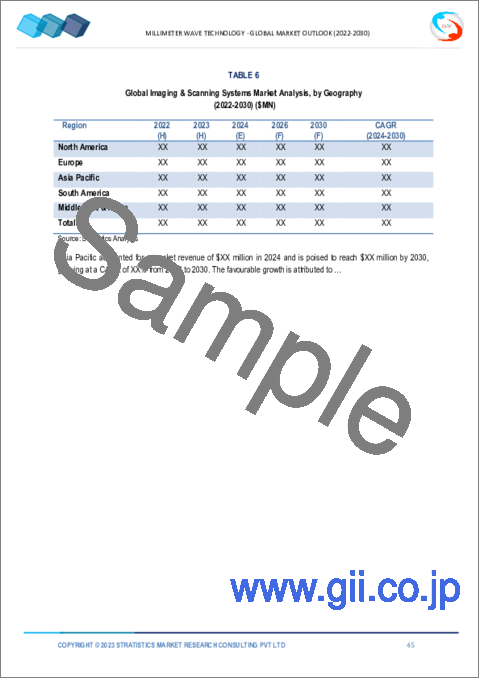

- Table 3 Global Millimeter Wave Technology Market Outlook, By Imaging & Scanning Systems (2022-2030) ($MN)

- Table 4 Global Millimeter Wave Technology Market Outlook, By Telecommunication Equipment (2022-2030) ($MN)

- Table 5 Global Millimeter Wave Technology Market Outlook, By Radar & Satellite Communication Systems (2022-2030) ($MN)

- Table 6 Global Millimeter Wave Technology Market Outlook, By Component (2022-2030) ($MN)

- Table 7 Global Millimeter Wave Technology Market Outlook, By Amplifiers (2022-2030) ($MN)

- Table 8 Global Millimeter Wave Technology Market Outlook, By Oscillators (2022-2030) ($MN)

- Table 9 Global Millimeter Wave Technology Market Outlook, By Antennas & Transceivers (2022-2030) ($MN)

- Table 10 Global Millimeter Wave Technology Market Outlook, By Frequency Converters (2022-2030) ($MN)

- Table 11 Global Millimeter Wave Technology Market Outlook, By Radiometers (2022-2030) ($MN)

- Table 12 Global Millimeter Wave Technology Market Outlook, By Other Components (2022-2030) ($MN)

- Table 13 Global Millimeter Wave Technology Market Outlook, By Frequency Band (2022-2030) ($MN)

- Table 14 Global Millimeter Wave Technology Market Outlook, By E-Band (2022-2030) ($MN)

- Table 15 Global Millimeter Wave Technology Market Outlook, By V-Band (2022-2030) ($MN)

- Table 16 Global Millimeter Wave Technology Market Outlook, By Other Frequency Bands (2022-2030) ($MN)

- Table 17 Global Millimeter Wave Technology Market Outlook, By Application (2022-2030) ($MN)

- Table 18 Global Millimeter Wave Technology Market Outlook, By Military & Defense (2022-2030) ($MN)

- Table 19 Global Millimeter Wave Technology Market Outlook, By Healthcare (2022-2030) ($MN)

- Table 20 Global Millimeter Wave Technology Market Outlook, By Automotive & Transportation (2022-2030) ($MN)

- Table 21 Global Millimeter Wave Technology Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 22 North America Millimeter Wave Technology Market Outlook, By Country (2022-2030) ($MN)

- Table 23 North America Millimeter Wave Technology Market Outlook, By Product (2022-2030) ($MN)

- Table 24 North America Millimeter Wave Technology Market Outlook, By Imaging & Scanning Systems (2022-2030) ($MN)

- Table 25 North America Millimeter Wave Technology Market Outlook, By Telecommunication Equipment (2022-2030) ($MN)

- Table 26 North America Millimeter Wave Technology Market Outlook, By Radar & Satellite Communication Systems (2022-2030) ($MN)

- Table 27 North America Millimeter Wave Technology Market Outlook, By Component (2022-2030) ($MN)

- Table 28 North America Millimeter Wave Technology Market Outlook, By Amplifiers (2022-2030) ($MN)

- Table 29 North America Millimeter Wave Technology Market Outlook, By Oscillators (2022-2030) ($MN)

- Table 30 North America Millimeter Wave Technology Market Outlook, By Antennas & Transceivers (2022-2030) ($MN)

- Table 31 North America Millimeter Wave Technology Market Outlook, By Frequency Converters (2022-2030) ($MN)

- Table 32 North America Millimeter Wave Technology Market Outlook, By Radiometers (2022-2030) ($MN)

- Table 33 North America Millimeter Wave Technology Market Outlook, By Other Components (2022-2030) ($MN)

- Table 34 North America Millimeter Wave Technology Market Outlook, By Frequency Band (2022-2030) ($MN)

- Table 35 North America Millimeter Wave Technology Market Outlook, By E-Band (2022-2030) ($MN)

- Table 36 North America Millimeter Wave Technology Market Outlook, By V-Band (2022-2030) ($MN)

- Table 37 North America Millimeter Wave Technology Market Outlook, By Other Frequency Bands (2022-2030) ($MN)

- Table 38 North America Millimeter Wave Technology Market Outlook, By Application (2022-2030) ($MN)

- Table 39 North America Millimeter Wave Technology Market Outlook, By Military & Defense (2022-2030) ($MN)

- Table 40 North America Millimeter Wave Technology Market Outlook, By Healthcare (2022-2030) ($MN)

- Table 41 North America Millimeter Wave Technology Market Outlook, By Automotive & Transportation (2022-2030) ($MN)

- Table 42 North America Millimeter Wave Technology Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 43 Europe Millimeter Wave Technology Market Outlook, By Country (2022-2030) ($MN)

- Table 44 Europe Millimeter Wave Technology Market Outlook, By Product (2022-2030) ($MN)

- Table 45 Europe Millimeter Wave Technology Market Outlook, By Imaging & Scanning Systems (2022-2030) ($MN)

- Table 46 Europe Millimeter Wave Technology Market Outlook, By Telecommunication Equipment (2022-2030) ($MN)

- Table 47 Europe Millimeter Wave Technology Market Outlook, By Radar & Satellite Communication Systems (2022-2030) ($MN)

- Table 48 Europe Millimeter Wave Technology Market Outlook, By Component (2022-2030) ($MN)

- Table 49 Europe Millimeter Wave Technology Market Outlook, By Amplifiers (2022-2030) ($MN)

- Table 50 Europe Millimeter Wave Technology Market Outlook, By Oscillators (2022-2030) ($MN)

- Table 51 Europe Millimeter Wave Technology Market Outlook, By Antennas & Transceivers (2022-2030) ($MN)

- Table 52 Europe Millimeter Wave Technology Market Outlook, By Frequency Converters (2022-2030) ($MN)

- Table 53 Europe Millimeter Wave Technology Market Outlook, By Radiometers (2022-2030) ($MN)

- Table 54 Europe Millimeter Wave Technology Market Outlook, By Other Components (2022-2030) ($MN)

- Table 55 Europe Millimeter Wave Technology Market Outlook, By Frequency Band (2022-2030) ($MN)

- Table 56 Europe Millimeter Wave Technology Market Outlook, By E-Band (2022-2030) ($MN)

- Table 57 Europe Millimeter Wave Technology Market Outlook, By V-Band (2022-2030) ($MN)

- Table 58 Europe Millimeter Wave Technology Market Outlook, By Other Frequency Bands (2022-2030) ($MN)

- Table 59 Europe Millimeter Wave Technology Market Outlook, By Application (2022-2030) ($MN)

- Table 60 Europe Millimeter Wave Technology Market Outlook, By Military & Defense (2022-2030) ($MN)

- Table 61 Europe Millimeter Wave Technology Market Outlook, By Healthcare (2022-2030) ($MN)

- Table 62 Europe Millimeter Wave Technology Market Outlook, By Automotive & Transportation (2022-2030) ($MN)

- Table 63 Europe Millimeter Wave Technology Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 64 Asia Pacific Millimeter Wave Technology Market Outlook, By Country (2022-2030) ($MN)

- Table 65 Asia Pacific Millimeter Wave Technology Market Outlook, By Product (2022-2030) ($MN)

- Table 66 Asia Pacific Millimeter Wave Technology Market Outlook, By Imaging & Scanning Systems (2022-2030) ($MN)

- Table 67 Asia Pacific Millimeter Wave Technology Market Outlook, By Telecommunication Equipment (2022-2030) ($MN)

- Table 68 Asia Pacific Millimeter Wave Technology Market Outlook, By Radar & Satellite Communication Systems (2022-2030) ($MN)

- Table 69 Asia Pacific Millimeter Wave Technology Market Outlook, By Component (2022-2030) ($MN)

- Table 70 Asia Pacific Millimeter Wave Technology Market Outlook, By Amplifiers (2022-2030) ($MN)

- Table 71 Asia Pacific Millimeter Wave Technology Market Outlook, By Oscillators (2022-2030) ($MN)

- Table 72 Asia Pacific Millimeter Wave Technology Market Outlook, By Antennas & Transceivers (2022-2030) ($MN)

- Table 73 Asia Pacific Millimeter Wave Technology Market Outlook, By Frequency Converters (2022-2030) ($MN)

- Table 74 Asia Pacific Millimeter Wave Technology Market Outlook, By Radiometers (2022-2030) ($MN)

- Table 75 Asia Pacific Millimeter Wave Technology Market Outlook, By Other Components (2022-2030) ($MN)

- Table 76 Asia Pacific Millimeter Wave Technology Market Outlook, By Frequency Band (2022-2030) ($MN)

- Table 77 Asia Pacific Millimeter Wave Technology Market Outlook, By E-Band (2022-2030) ($MN)

- Table 78 Asia Pacific Millimeter Wave Technology Market Outlook, By V-Band (2022-2030) ($MN)

- Table 79 Asia Pacific Millimeter Wave Technology Market Outlook, By Other Frequency Bands (2022-2030) ($MN)

- Table 80 Asia Pacific Millimeter Wave Technology Market Outlook, By Application (2022-2030) ($MN)

- Table 81 Asia Pacific Millimeter Wave Technology Market Outlook, By Military & Defense (2022-2030) ($MN)

- Table 82 Asia Pacific Millimeter Wave Technology Market Outlook, By Healthcare (2022-2030) ($MN)

- Table 83 Asia Pacific Millimeter Wave Technology Market Outlook, By Automotive & Transportation (2022-2030) ($MN)

- Table 84 Asia Pacific Millimeter Wave Technology Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 85 South America Millimeter Wave Technology Market Outlook, By Country (2022-2030) ($MN)

- Table 86 South America Millimeter Wave Technology Market Outlook, By Product (2022-2030) ($MN)

- Table 87 South America Millimeter Wave Technology Market Outlook, By Imaging & Scanning Systems (2022-2030) ($MN)

- Table 88 South America Millimeter Wave Technology Market Outlook, By Telecommunication Equipment (2022-2030) ($MN)

- Table 89 South America Millimeter Wave Technology Market Outlook, By Radar & Satellite Communication Systems (2022-2030) ($MN)

- Table 90 South America Millimeter Wave Technology Market Outlook, By Component (2022-2030) ($MN)

- Table 91 South America Millimeter Wave Technology Market Outlook, By Amplifiers (2022-2030) ($MN)

- Table 92 South America Millimeter Wave Technology Market Outlook, By Oscillators (2022-2030) ($MN)

- Table 93 South America Millimeter Wave Technology Market Outlook, By Antennas & Transceivers (2022-2030) ($MN)

- Table 94 South America Millimeter Wave Technology Market Outlook, By Frequency Converters (2022-2030) ($MN)

- Table 95 South America Millimeter Wave Technology Market Outlook, By Radiometers (2022-2030) ($MN)

- Table 96 South America Millimeter Wave Technology Market Outlook, By Other Components (2022-2030) ($MN)

- Table 97 South America Millimeter Wave Technology Market Outlook, By Frequency Band (2022-2030) ($MN)

- Table 98 South America Millimeter Wave Technology Market Outlook, By E-Band (2022-2030) ($MN)

- Table 99 South America Millimeter Wave Technology Market Outlook, By V-Band (2022-2030) ($MN)

- Table 100 South America Millimeter Wave Technology Market Outlook, By Other Frequency Bands (2022-2030) ($MN)

- Table 101 South America Millimeter Wave Technology Market Outlook, By Application (2022-2030) ($MN)

- Table 102 South America Millimeter Wave Technology Market Outlook, By Military & Defense (2022-2030) ($MN)

- Table 103 South America Millimeter Wave Technology Market Outlook, By Healthcare (2022-2030) ($MN)

- Table 104 South America Millimeter Wave Technology Market Outlook, By Automotive & Transportation (2022-2030) ($MN)

- Table 105 South America Millimeter Wave Technology Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 106 Middle East & Africa Millimeter Wave Technology Market Outlook, By Country (2022-2030) ($MN)

- Table 107 Middle East & Africa Millimeter Wave Technology Market Outlook, By Product (2022-2030) ($MN)

- Table 108 Middle East & Africa Millimeter Wave Technology Market Outlook, By Imaging & Scanning Systems (2022-2030) ($MN)

- Table 109 Middle East & Africa Millimeter Wave Technology Market Outlook, By Telecommunication Equipment (2022-2030) ($MN)

- Table 110 Middle East & Africa Millimeter Wave Technology Market Outlook, By Radar & Satellite Communication Systems (2022-2030) ($MN)

- Table 111 Middle East & Africa Millimeter Wave Technology Market Outlook, By Component (2022-2030) ($MN)

- Table 112 Middle East & Africa Millimeter Wave Technology Market Outlook, By Amplifiers (2022-2030) ($MN)

- Table 113 Middle East & Africa Millimeter Wave Technology Market Outlook, By Oscillators (2022-2030) ($MN)

- Table 114 Middle East & Africa Millimeter Wave Technology Market Outlook, By Antennas & Transceivers (2022-2030) ($MN)

- Table 115 Middle East & Africa Millimeter Wave Technology Market Outlook, By Frequency Converters (2022-2030) ($MN)

- Table 116 Middle East & Africa Millimeter Wave Technology Market Outlook, By Radiometers (2022-2030) ($MN)

- Table 117 Middle East & Africa Millimeter Wave Technology Market Outlook, By Other Components (2022-2030) ($MN)

- Table 118 Middle East & Africa Millimeter Wave Technology Market Outlook, By Frequency Band (2022-2030) ($MN)

- Table 119 Middle East & Africa Millimeter Wave Technology Market Outlook, By E-Band (2022-2030) ($MN)

- Table 120 Middle East & Africa Millimeter Wave Technology Market Outlook, By V-Band (2022-2030) ($MN)

- Table 121 Middle East & Africa Millimeter Wave Technology Market Outlook, By Other Frequency Bands (2022-2030) ($MN)

- Table 122 Middle East & Africa Millimeter Wave Technology Market Outlook, By Application (2022-2030) ($MN)

- Table 123 Middle East & Africa Millimeter Wave Technology Market Outlook, By Military & Defense (2022-2030) ($MN)

- Table 124 Middle East & Africa Millimeter Wave Technology Market Outlook, By Healthcare (2022-2030) ($MN)

- Table 125 Middle East & Africa Millimeter Wave Technology Market Outlook, By Automotive & Transportation (2022-2030) ($MN)

- Table 126 Middle East & Africa Millimeter Wave Technology Market Outlook, By Other Applications (2022-2030) ($MN)

According to Stratistics MRC, the Global Millimeter Wave Technology Market is accounted for $1.76 billion in 2024 and is expected to reach $11.77 billion by 2030 growing at a CAGR of 37.3% during the forecast period. Millimeter wave technology refers to a range of electromagnetic wavelengths between 30 and 300 gigahertz, occupying a segment of the electromagnetic spectrum higher than traditional radio frequencies but lower than infrared waves. This technology is characterized by its ability to transmit large amounts of data at very high speeds, making it crucial for future wireless communication systems like 5G networks. Moreover, millimeter wave signals have shorter wavelengths, enabling more precise directional transmission and allowing for more efficient use of available spectrum.

According to Ericsson, 5G subscriptions are expected to surge globally between 2019 and 2027, rising from over 12 million to over 4 billion. Subscriptions are predicted to be highest in South East Asia, North East Asia, India, Nepal, and Bhutan.

Market Dynamics:

Driver:

Rising demand for high bandwidth applications

Millimeter wave technology is gaining prominence due to the escalating demand for high-bandwidth applications across various sectors. These waves, which range from 30 to 300 gigahertz, offer significant advantages in data transmission, particularly for applications requiring rapid data transfer rates such as 5G networks, high-definition video streaming, and autonomous vehicles. Unlike traditional lower-frequency bands, millimeter waves can carry vast amounts of data over short distances, making them ideal for dense urban environments where network congestion is a concern.

Restraint:

High cost of equipment

Millimeter wave (mmWave) technology, which operates in the high-frequency range of the electromagnetic spectrum, requires specialized components and infrastructure that are inherently more expensive to develop, manufacture, and deploy compared to lower-frequency technologies. However, the initial investment in mmWave infrastructure for telecommunications, radar systems, and other applications is substantial, further limiting its deployment to areas or industries where the cost-benefit ratio justifies the expense.

Opportunity:

Increasing mobile data traffic

As consumers demand faster and more reliable connectivity for streaming, gaming, and other data-intensive activities on their mobile devices, traditional wireless spectrum bands are becoming congested. MmWave technology offers a solution by utilizing higher frequencies that provide wider bandwidths, enabling significantly faster data transfer rates. Moreover, mmWave signals have shorter wavelengths, allowing for more precise beamforming techniques and higher spatial reuse, which enhances network capacity and efficiency.

Threat:

Lack of standardization

The Millimeter Wave Technology Market faces significant challenges due to a lack of standardization, impeding its widespread adoption and development. This technology, which utilizes high-frequency radio waves for applications like telecommunications, radar, and imaging, suffers from fragmentation in terms of frequency bands, protocols, and equipment specifications across different regions and industries. This lack of uniformity complicates interoperability between various devices and networks, raising concerns about compatibility, performance consistency, and overall reliability.

Covid-19 Impact:

Initially, disruptions in global supply chains led to delays in manufacturing and deployment of millimeter wave devices, impacting both vendors and end-users. Lockdown measures and social distancing norms further hampered field trials and installations, slowing down the adoption rate of this emerging technology. Reduced consumer spending and uncertainty in economic conditions prompted companies to reassess their investments in 5G infrastructure, which heavily relies on millimeter wave technology for high-speed data transmission. However, as the pandemic unfolded, there was also an increased recognition of the importance of robust telecommunications networks, driving continued interest and investment in 5G technologies.

The Oscillators segment is expected to be the largest during the forecast period

Oscillators segment is expected to be the largest during the forecast period by providing essential frequency control solutions for devices operating in the millimeter wave spectrum. Millimeter waves, ranging from 30 GHz to 300 GHz, require precise frequency generation and stability, which oscillators deliver. These components enable the generation of coherent signals necessary for various applications such as telecommunications, automotive radar, imaging systems, and aerospace. With the increasing demand for high-speed data transfer and low-latency communications, millimeter wave technology is becoming indispensable in 5G networks and beyond. Oscillators within this segment include voltage-controlled oscillators (VCOs), phase-locked loops (PLLs), and frequency synthesizers, each tailored to meet specific frequency and stability requirements of millimeter wave systems.

The V-Band segment is expected to have the highest CAGR during the forecast period

V-Band segment is expected to have the highest CAGR during the forecast period. Operating within the frequency range of 40 to 75 GHz, V-Band offers several advantages such as high data transfer rates, low latency, and abundant spectrum availability. These characteristics make it particularly suitable for applications requiring high-speed data transmission, such as 5G networks, backhaul for telecommunications, and point-to-point communication links for wireless infrastructure. The expanding deployment of small-cell networks and the increasing demand for high-bandwidth applications further underscore V-Band's relevance in shaping the future of wireless communication infrastructure.

Region with largest share:

North America region dominated the largest share of the market over the extrapolated period. North America's advanced telecommunications sector, coupled with substantial investments by major carriers in 5G infrastructure, positions the region at the forefront of millimeter wave technology adoption. The demand for faster data speeds, low latency, and increased network capacity is driving widespread deployment of millimeter wave technology across urban centers in the United States and Canada. This technological advancement not only supports enhanced mobile broadband services but also facilitates the development of new applications in areas such as autonomous vehicles, healthcare, and smart cities, further solidifying North America's leadership in the millimeter wave technology market.

Region with highest CAGR:

Europe region is poised to hold profitable growth during the forecast period. Government regulations primarily focus on spectrum allocation and standards compliance, which are essential for the deployment and operation of millimeter wave technologies. By establishing clear guidelines and standards, governments across Europe ensure interoperability and reliability of millimeter wave systems, thereby fostering confidence among stakeholders including businesses, investors, and consumers. Moreover, regulatory bodies in Europe often incentivize research and development in millimeter wave technology through funding programs and grants.

Key players in the market

Some of the key players in Millimeter Wave Technology market include E-Band Communications, LLC, Fujitsu Ltd, Intel Corporation, L3Harris Technologies, LightPointe Communications, Inc, Mitsubishi Electric Corporation, NEC Corporation, Qualcomm Technologies, Samsung Electronics and Trex Enterprises Corporation.

Key Developments:

In December 2023, T-Mobile made public its attainment of another milestone in 5G technology within the United States. This achievement involved a test that utilized 5G standalone millimeter wave (mmWave) on its operational network. Through a partnership with Qualcomm Technologies, Inc. and Telefonaktiebolaget LM Ericsson, the company combined eight channels of mmWave spectrum, resulting in download speeds exceeding 4.3 Gbps, all achieved without the need for other mid-band or low-band spectrum

In August 2023, Fujitsu Limited revealed the development of a 5G millimeter wave chip capable of multiplexing up to four beams through a singular millimeter-wave chip designed for the radio units (RU) of 5G base stations. This advancement was conducted as part of the Research & Development Project for the Enhanced Infrastructure for Post 5G.

In March 2023, Siklu has made a strategic agreement with WAV and MBSI WAV. These companies are full-service distributors of LTE, wireless broadband, fiber, networking, and Wi-Fi equipment. This development would provide pre-sales engineering, stocking, network design, and post-sales services for Siklu's solutions operating in the 60/70 and 80 GHz bands. This service caters to various applications such as residential connectivity and video security.

In February 2023, Qualcomm Technologies, Inc., and Telefonaktiebolaget LM Ericsson announced the launch of the first mobile 5G mmWave network commercially available at an event held in Barcelona, Spain, at MWC 2023. The network will allow compatible user device partners to access the Ericsson-powered 5G mmWave network at the event. The event showcased the range of 5G mmWave devices of Qualcomm Technologies powered by Snapdragon mobile platforms.

In June 2022, Researchers at Tokyo Tech and NEC Corporation have launched a phased-array beamformer for the 5G millimeter wave (mmWave) band. This product enables ultra-low latency in communication along with data rates of over 10 Gbps and a massive capacity to accommodate several users.

Products Covered:

- Imaging & Scanning Systems

- Telecommunication Equipment

- Radar & Satellite Communication Systems

Components Covered:

- Amplifiers

- Oscillators

- Antennas & Transceivers

- Frequency Converters

- Radiometers

- Other Components

Frequency Bands Covered:

- E-Band

- V-Band

- Other Frequency Bands

Applications Covered:

- Military & Defense

- Healthcare

- Automotive & Transportation

- Other Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 Application Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Millimeter Wave Technology Market, By Product

- 5.1 Introduction

- 5.2 Imaging & Scanning Systems

- 5.3 Telecommunication Equipment

- 5.4 Radar & Satellite Communication Systems

6 Global Millimeter Wave Technology Market, By Component

- 6.1 Introduction

- 6.2 Amplifiers

- 6.3 Oscillators

- 6.4 Antennas & Transceivers

- 6.5 Frequency Converters

- 6.6 Radiometers

- 6.7 Other Components

7 Global Millimeter Wave Technology Market, By Frequency Band

- 7.1 Introduction

- 7.2 E-Band

- 7.3 V-Band

- 7.4 Other Frequency Bands

8 Global Millimeter Wave Technology Market, By Application

- 8.1 Introduction

- 8.2 Military & Defense

- 8.3 Healthcare

- 8.4 Automotive & Transportation

- 8.5 Other Applications

9 Global Millimeter Wave Technology Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 E-Band Communications, LLC

- 11.2 Fujitsu Ltd

- 11.3 Intel Corporation

- 11.4 L3Harris Technologies

- 11.5 LightPointe Communications, Inc

- 11.6 Mitsubishi Electric Corporation

- 11.7 NEC Corporation

- 11.8 Qualcomm Technologies

- 11.9 Samsung Electronics

- 11.10 Trex Enterprises Corporation