|

|

市場調査レポート

商品コード

1423749

水蒸気メタン改質水素生成市場の2030年までの予測:容量、技術、用途、地域別の世界分析Steam Methane Reforming Hydrogen Generation Market Forecasts to 2030 - Global Analysis By Capacity (Large-Scale SMR Systems, Small-Scale SMR Systems and Other Capacities), Technology, Application and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 水蒸気メタン改質水素生成市場の2030年までの予測:容量、技術、用途、地域別の世界分析 |

|

出版日: 2024年02月02日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の水蒸気メタン改質水素生成市場は2023年に1,438億米ドルを占め、予測期間中にCAGR 8.1%で成長し、2030年には2,480億米ドルに達する見込みです。

水蒸気メタン改質水素生成市場は、水蒸気メタン改質(SMR)プロセスによる水素生成に焦点を当てた産業を指します。この方法では、高温でメタンを水蒸気と反応させて水素、一酸化炭素、二酸化炭素を生成します。SMR技術は、天然ガスを原料として大規模な水素製造に広く採用されています。

IEA 2019によると、日本と中国は水素開発の可能性が最も高い最大のLNG輸入国です。

高まる水素需要

低炭素経済への移行において水素が重要な役割を果たすようになり、輸送、製造、エネルギーの各業界で、大規模水素製造のためのSMR技術への依存度が高まっています。需要の急増は、クリーン・エネルギー・キャリアとしての水素の多用途性と、多様な分野での応用に後押しされています。国や産業界が排出削減目標の達成や環境規制の遵守に努める中、水素の重要性は高まり続けており、SMRはその効率性と拡張性から、水素製造に適した方法として位置づけられています。

高い初期資本コスト

大規模なSMRインフラを確立するには、改質器や関連設備の建設、既存設備の適合に多額の初期投資が必要となります。このような初期資本投資の経済的負担は、特に代替水素製造技術と比較して、潜在的な投資家や業界関係者にとっての抑止力になり得る。世界的に産業界と政府がよりクリーンなエネルギー源への移行を模索している中、SMRプロジェクトに必要とされる多額の初期資本支出は、その経済的実行可能性を妨げ、市場の成長を減速させる可能性があります。

技術の進歩

SMR技術の絶え間ない革新と改善は、水素製造プロセスの効率、信頼性、環境性能を高める上で重要な役割を果たします。高度な触媒開発、プロセスの最適化、斬新なエンジニアリング・ソリューションなどのイノベーションは、SMRをよりコスト効率が高く、環境的に持続可能なものにするのに貢献しています。さらに、業界が発展するにつれて、継続的な研究開発の努力は、既存のSMRプロセスを最適化するだけでなく、再生可能エネルギー源を水素製造に統合する道を開く画期的な進歩をもたらし、よりクリーンで持続可能なエネルギー環境という広範な目標に合致しています。

エネルギー集約度と効率への懸念

SMRプロセスは、高温で作動し、多大なエネルギー投入を必要とするため、代替の水素製造方法と比較して、全体的な効率について懸念が生じる。SMRのエネルギー集約的な性質は、運転コストの一因となるだけでなく、エネルギー効率と持続可能な慣行がますます重視されるようになっていることと相反します。業界が二酸化炭素排出量を最小限に抑えようと努力する中、天然ガスを水素に変換するSMRの効率が相対的に低いことが制限要因となり、進化するクリーンエネルギー技術の情勢におけるSMRの魅力に影響を与える可能性があります。

COVID-19の影響:

世界の景気後退は産業活動の縮小を招き、製造業や運輸業など様々な分野の水素需要に影響を与えました。サプライチェーンの混乱、労働力不足、移動の制限も、新しいSMR施設の建設と試運転に影響を与え、プロジェクトの遅れにつながった。しかし、エネルギー市場を取り巻く不確実性と産業界による資本支出の減少は、SMR技術を利用したものを含む大規模水素製造プロジェクトへの投資を制約しました。

予測期間中、大規模SMRシステム部門が最大となる見込み

大規模SMRシステム分野は、予測期間中最大になると予想されます。大規模SMRシステムは、大量の水素を生産する能力を示し、工業プロセス、精製、燃料電池のような新興アプリケーションの多様なニーズに応えます。既存の天然ガスインフラを活用する能力は、よりクリーンなエネルギー源へと移行しつつある産業界にコスト効率の高い道筋を提供します。さらに、持続可能で再生可能なエネルギーソリューションへの世界のシフトにおいて水素が中心的な役割を果たすという、水素経済諸国の発展を支える役割も、このセグメントのブームに拍車をかけています。

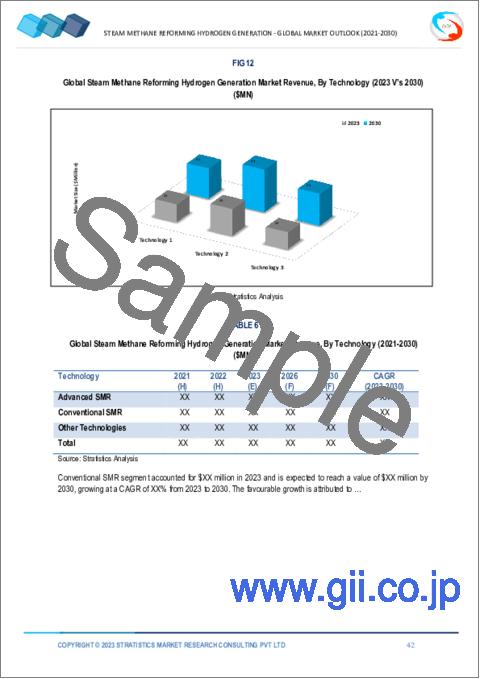

高度 SMR分野は予測期間中CAGRが最も高くなると予想されます。

産業界が水素製造における効率向上、炭素排出削減、持続可能性向上の必要性を認識しているため、先進 SMR分野は予測期間中CAGRが最も高くなると予想されます。先進SMRシステムには、触媒技術の革新、プロセスの最適化、炭素回収・貯留(CCS)ソリューションとの統合が含まれることが多いです。さらに、こうした進歩は、水素製造の環境フットプリントの低減に貢献するだけでなく、よりクリーンなエネルギー源を求める世界の動きにも合致しています。

最大のシェアを占める地域

予測期間を通じて、アジア太平洋地域が市場の最大シェアを占めました。この地域の急速な工業化とクリーンエネルギー・ソリューションへの関心の高まりが、様々な分野での水素需要を促進しています。中国、日本、韓国のような国々は、野心的な水素生産目標を達成するために、大規模SMRシステムの採用を先導しています。さらに、世界のサプライチェーンにおけるアジア太平洋地域の戦略的位置づけと、新興経済諸国へのコミットメントが、SMRプロセスの革新と技術進歩を促進し、世界の水素情勢の軌道を形成する極めて重要なプレーヤーとなっています。

CAGRが最も高い地域:

アジア太平洋地域は、予測期間中に収益性の高い成長を遂げると推定されます。持続可能な開発と二酸化炭素排出量の削減に焦点を当て、中国、日本、韓国を含むこの地域の数カ国は、水素製造に関する厳しい規制と野心的な目標を実施しています。支援政策、財政的インセンティブ、補助金は、大規模水素製造のためのSMR技術への投資を産業界に促しています。さらに、各国政府は、よりクリーンなエネルギーへの移行における水素の役割を認識し、水素経済の発展を積極的に推進しています。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレイヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 技術分析

- アプリケーション分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の水蒸気メタン改質水素生成市場:容量別

- 大規模SMRシステム

- 小規模SMRシステム

- その他の容量

第6章 世界の水蒸気メタン改質水素生成市場:技術別

- 高度なSMR

- 従来のSMR

- その他の技術

第7章 世界の水蒸気メタン改質水素生成市場:用途別

- 化学薬品

- 発電

- 石油精製

- 輸送機関

- その他の用途

第8章 世界の水蒸気メタン改質水素生成市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイル

- Air Liquide

- Air Products & Chemicals, Inc

- Ally Hi-Tech Co., Ltd

- Ballard Power Systems Inc

- Doosan Corporation

- Hydrogenics Corporation

- Iwatani Corporation

- Linde plc

- Mahler AGS GmbH

- McDermott International, Inc

- Mitsubishi Heavy Industries, Ltd

- Chevron Corporation

- Plug Power Inc

- Siemens Energy AG

- Taiyyon Nippon Sanso Corporation

List of Tables

- Table 1 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Capacity (2021-2030) ($MN)

- Table 3 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Large-Scale SMR Systems (2021-2030) ($MN)

- Table 4 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Small-Scale SMR Systems (2021-2030) ($MN)

- Table 5 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Capacities (2021-2030) ($MN)

- Table 6 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Technology (2021-2030) ($MN)

- Table 7 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Advanced SMR (2021-2030) ($MN)

- Table 8 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Conventional SMR (2021-2030) ($MN)

- Table 9 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Technologies (2021-2030) ($MN)

- Table 10 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Application (2021-2030) ($MN)

- Table 11 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Chemicals (2021-2030) ($MN)

- Table 12 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Power generation (2021-2030) ($MN)

- Table 13 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Petroleum refining (2021-2030) ($MN)

- Table 14 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Transportation (2021-2030) ($MN)

- Table 15 Global Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 16 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Country (2021-2030) ($MN)

- Table 17 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Capacity (2021-2030) ($MN)

- Table 18 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Large-Scale SMR Systems (2021-2030) ($MN)

- Table 19 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Small-Scale SMR Systems (2021-2030) ($MN)

- Table 20 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Capacities (2021-2030) ($MN)

- Table 21 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Technology (2021-2030) ($MN)

- Table 22 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Advanced SMR (2021-2030) ($MN)

- Table 23 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Conventional SMR (2021-2030) ($MN)

- Table 24 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Technologies (2021-2030) ($MN)

- Table 25 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Application (2021-2030) ($MN)

- Table 26 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Chemicals (2021-2030) ($MN)

- Table 27 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Power generation (2021-2030) ($MN)

- Table 28 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Petroleum refining (2021-2030) ($MN)

- Table 29 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Transportation (2021-2030) ($MN)

- Table 30 North America Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 31 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Country (2021-2030) ($MN)

- Table 32 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Capacity (2021-2030) ($MN)

- Table 33 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Large-Scale SMR Systems (2021-2030) ($MN)

- Table 34 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Small-Scale SMR Systems (2021-2030) ($MN)

- Table 35 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Capacities (2021-2030) ($MN)

- Table 36 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Technology (2021-2030) ($MN)

- Table 37 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Advanced SMR (2021-2030) ($MN)

- Table 38 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Conventional SMR (2021-2030) ($MN)

- Table 39 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Technologies (2021-2030) ($MN)

- Table 40 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Application (2021-2030) ($MN)

- Table 41 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Chemicals (2021-2030) ($MN)

- Table 42 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Power generation (2021-2030) ($MN)

- Table 43 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Petroleum refining (2021-2030) ($MN)

- Table 44 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Transportation (2021-2030) ($MN)

- Table 45 Europe Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 46 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Country (2021-2030) ($MN)

- Table 47 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Capacity (2021-2030) ($MN)

- Table 48 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Large-Scale SMR Systems (2021-2030) ($MN)

- Table 49 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Small-Scale SMR Systems (2021-2030) ($MN)

- Table 50 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Capacities (2021-2030) ($MN)

- Table 51 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Technology (2021-2030) ($MN)

- Table 52 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Advanced SMR (2021-2030) ($MN)

- Table 53 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Conventional SMR (2021-2030) ($MN)

- Table 54 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Technologies (2021-2030) ($MN)

- Table 55 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Application (2021-2030) ($MN)

- Table 56 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Chemicals (2021-2030) ($MN)

- Table 57 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Power generation (2021-2030) ($MN)

- Table 58 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Petroleum refining (2021-2030) ($MN)

- Table 59 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Transportation (2021-2030) ($MN)

- Table 60 Asia Pacific Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 61 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Country (2021-2030) ($MN)

- Table 62 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Capacity (2021-2030) ($MN)

- Table 63 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Large-Scale SMR Systems (2021-2030) ($MN)

- Table 64 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Small-Scale SMR Systems (2021-2030) ($MN)

- Table 65 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Capacities (2021-2030) ($MN)

- Table 66 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Technology (2021-2030) ($MN)

- Table 67 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Advanced SMR (2021-2030) ($MN)

- Table 68 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Conventional SMR (2021-2030) ($MN)

- Table 69 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Technologies (2021-2030) ($MN)

- Table 70 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Application (2021-2030) ($MN)

- Table 71 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Chemicals (2021-2030) ($MN)

- Table 72 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Power generation (2021-2030) ($MN)

- Table 73 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Petroleum refining (2021-2030) ($MN)

- Table 74 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Transportation (2021-2030) ($MN)

- Table 75 South America Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 76 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Country (2021-2030) ($MN)

- Table 77 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Capacity (2021-2030) ($MN)

- Table 78 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Large-Scale SMR Systems (2021-2030) ($MN)

- Table 79 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Small-Scale SMR Systems (2021-2030) ($MN)

- Table 80 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Capacities (2021-2030) ($MN)

- Table 81 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Technology (2021-2030) ($MN)

- Table 82 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Advanced SMR (2021-2030) ($MN)

- Table 83 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Conventional SMR (2021-2030) ($MN)

- Table 84 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Technologies (2021-2030) ($MN)

- Table 85 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Application (2021-2030) ($MN)

- Table 86 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Chemicals (2021-2030) ($MN)

- Table 87 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Power generation (2021-2030) ($MN)

- Table 88 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Petroleum refining (2021-2030) ($MN)

- Table 89 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Transportation (2021-2030) ($MN)

- Table 90 Middle East & Africa Steam Methane Reforming Hydrogen Generation Market Outlook, By Other Applications (2021-2030) ($MN)

According to Stratistics MRC, the Global Steam Methane Reforming Hydrogen Generation Market is accounted for $143.8 billion in 2023 and is expected to reach $248.0 billion by 2030 growing at a CAGR of 8.1% during the forecast period. The Steam Methane Reforming Hydrogen Generation Market refers to the industry focused on the production of hydrogen through the steam methane reforming (SMR) process. This method involves the reaction of methane with steam at high temperatures to produce hydrogen, carbon monoxide, and carbon dioxide. SMR technology is widely employed for large-scale hydrogen production, utilizing natural gas as a feedstock.

According to IEA 2019, Japan and China are the largest LNG importers with the highest potential for hydrogen development.

Market Dynamics:

Driver:

Growing demand for hydrogen

With hydrogen emerging as a key player in the transition towards a low-carbon economy, industries spanning transportation, manufacturing, and energy are increasingly relying on SMR technology for large-scale hydrogen production. The surge in demand is fueled by hydrogen's versatility as a clean energy carrier and its application in diverse sectors. As nations and industries strive to meet emission reduction targets and comply with environmental regulations, the importance of hydrogen continues to grow, positioning SMR as a preferred method for its production due to its efficiency and scalability.

Restraint:

High initial capital costs

Establishing large-scale SMR infrastructure involves substantial upfront expenditures for constructing reformers, related equipment, and adapting existing facilities. The financial burden of these initial capital investments can be a deterrent for potential investors and industry players, particularly in comparison to alternative hydrogen production technologies. As industries and governments globally seek to transition towards cleaner energy sources, the significant initial capital outlay required for SMR projects may hinder their economic viability, slowing down the market's growth.

Opportunity:

Technological advancements

Continuous innovation and improvements in SMR technology play a crucial role in enhancing the efficiency, reliability, and environmental performance of hydrogen production processes. Innovations such as advanced catalyst developments, process optimization, and novel engineering solutions contribute to making SMR more cost-effective and environmentally sustainable. Moreover, as the industry evolves, ongoing research and development efforts lead to breakthroughs that not only optimize existing SMR processes but also pave the way for the integration of renewable energy sources into hydrogen production, aligning with the broader goals of a cleaner and more sustainable energy landscape.

Threat:

Energy intensity and efficiency concerns

The SMR process, operating at high temperatures and requiring substantial energy inputs, raises apprehensions about overall efficiency compared to alternative hydrogen production methods. The energy-intensive nature of SMR not only contributes to operational costs but also conflicts with the increasing emphasis on energy efficiency and sustainable practices. As industries strive to minimize their carbon footprint, the relatively lower efficiency of SMR in converting natural gas to hydrogen becomes a limiting factor, potentially affecting its attractiveness in the evolving landscape of clean energy technologies.

Covid-19 Impact:

The global economic downturn led to a contraction in industrial activities, impacting the demand for hydrogen across various sectors such as manufacturing and transportation. Disruptions in the supply chain, labor shortages, and restricted mobility also affected the construction and commissioning of new SMR facilities, leading to project delays. However, the uncertainty surrounding energy markets and reduced capital expenditures by industries constrained investments in large-scale hydrogen production projects, including those utilizing SMR technology.

The Large-Scale SMR Systems segment is expected to be the largest during the forecast period

Large-Scale SMR Systems segment is expected to be the largest during the forecast period. Large-scale SMR systems exhibit the capability to produce substantial quantities of hydrogen, catering to the diverse needs of industrial processes, refining, and emerging applications like fuel cells. Their ability to leverage existing natural gas infrastructure provides a cost-effective pathway for industries transitioning towards cleaner energy sources. Furthermore, the segment's boom is further fueled by its role in supporting the development of a hydrogen economy, wherein hydrogen plays a central role in the global shift towards sustainable and renewable energy solutions.

The Advanced SMR segment is expected to have the highest CAGR during the forecast period

Advanced SMR segment is expected to have the highest CAGR during the forecast period as industries recognize the need for enhanced efficiency, reduced carbon emissions, and improved sustainability in hydrogen production. Advanced SMR systems often involve innovations in catalyst technologies, process optimization, and integration with carbon capture and storage (CCS) solutions. Moreover, these advancements not only contribute to lowering the environmental footprint of hydrogen production but also align with the global push for cleaner energy sources.

Region with largest share:

Asia Pacific region dominated the largest share of the market throughout the projected period. Rapid industrialization, coupled with the region's increasing focus on clean energy solutions, is fueling the demand for hydrogen across diverse sectors. Countries like China, Japan, and South Korea are spearheading the adoption of large-scale SMR systems to meet their ambitious hydrogen production goals. Additionally, the Asia Pacific's strategic positioning in the global supply chain and its commitment to developing a hydrogen economy are driving innovation and technological advancements in SMR processes, making it a pivotal player in shaping the trajectory of the global hydrogen landscape.

Region with highest CAGR:

Asia Pacific region is estimated to witness profitable growth over the extrapolated period. With a focus on sustainable development and reducing carbon emissions, several countries in the region, including China, Japan, and South Korea, have implemented stringent regulations and ambitious targets for hydrogen production. Supportive policies, financial incentives, and subsidies are encouraging industries to invest in SMR technology for large-scale hydrogen production. Furthermore, governments are actively promoting the development of a hydrogen economy, recognizing its role in the transition to cleaner energy.

Key players in the market

Some of the key players in Steam Methane Reforming Hydrogen Generation market include Air Liquide, Air Products & Chemicals, Inc, Ally Hi-Tech Co., Ltd, Ballard Power Systems Inc, Doosan Corporation, Hydrogenics Corporation, Iwatani Corporation, Linde plc, Mahler AGS GmbH, McDermott International, Inc, Mitsubishi Heavy Industries, Ltd, Chevron Corporation, Plug Power Inc, Siemens Energy AG and Taiyyon Nippon Sanso Corporation.

Key Developments:

In September 2022, Raven SR completed its successful trial for the Steam reformer producing hydrogen rich syngas from methane. Its non-combustion and catalyst free design will exceed the typical performance of the SMR process. The technology is set to come into operation by the first half of 2023.

In June 2022, Air Liquide and Siemens Energy created a joint venture dedicated to the production of industrial-scale renewable hydrogen electrolyzers. Air Liquide is one of the leading industries in the hydrogen market, offering several hydrogen production services and SMR technologies.

In April 2022, Wood unveiled its new SMR technology with the capability to achieve 95% of CO2 emissions reduction when compared to the tradition SMR unit. It is applicable to both brownfield and greenfield projects, thereby reducing the overall costs of the process for the operators.

Capacities Covered:

- Large-Scale SMR Systems

- Small-Scale SMR Systems

- Other Capacities

Technologies Covered:

- Advanced SMR

- Conventional SMR

- Other Technologies

Applications Covered:

- Chemicals

- Power generation

- Petroleum refining

- Transportation

- Other Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Technology Analysis

- 3.7 Application Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Steam Methane Reforming Hydrogen Generation Market, By Capacity

- 5.1 Introduction

- 5.2 Large-Scale SMR Systems

- 5.3 Small-Scale SMR Systems

- 5.4 Other Capacities

6 Global Steam Methane Reforming Hydrogen Generation Market, By Technology

- 6.1 Introduction

- 6.2 Advanced SMR

- 6.3 Conventional SMR

- 6.4 Other Technologies

7 Global Steam Methane Reforming Hydrogen Generation Market, By Application

- 7.1 Introduction

- 7.2 Chemicals

- 7.3 Power generation

- 7.4 Petroleum refining

- 7.5 Transportation

- 7.6 Other Applications

8 Global Steam Methane Reforming Hydrogen Generation Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 Air Liquide

- 10.2 Air Products & Chemicals, Inc

- 10.3 Ally Hi-Tech Co., Ltd

- 10.4 Ballard Power Systems Inc

- 10.5 Doosan Corporation

- 10.6 Hydrogenics Corporation

- 10.7 Iwatani Corporation

- 10.8 Linde plc

- 10.9 Mahler AGS GmbH

- 10.10 McDermott International, Inc

- 10.11 Mitsubishi Heavy Industries, Ltd

- 10.12 Chevron Corporation

- 10.13 Plug Power Inc

- 10.14 Siemens Energy AG

- 10.15 Taiyyon Nippon Sanso Corporation