|

|

市場調査レポート

商品コード

1566207

半導体ファウンドリの市場規模、シェア、成長分析、技術別、ファウンドリタイプ別、用途別、地域別 - 産業予測、2024年~2031年Semiconductor Foundry Market Size, Share, Growth Analysis, By Technology (CMOS, BiCMOS), By Foundry Type (Pure Play Foundry, IDMs), By Application (Automotive, Consumer Electronics), By Region - Industry Forecast 2024-2031 |

||||||

|

|||||||

| 半導体ファウンドリの市場規模、シェア、成長分析、技術別、ファウンドリタイプ別、用途別、地域別 - 産業予測、2024年~2031年 |

|

出版日: 2024年10月03日

発行: SkyQuest

ページ情報: 英文 221 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

半導体ファウンドリの世界市場規模は、2022年に1,069億2,000万米ドルと評価され、2023年の1,156億米ドルから2031年には2,158億8,000万米ドルに成長し、予測期間(2024-2031年)のCAGRは8.12%で成長する見通しです。

自動車産業は、より安全な個人輸送に対する需要の急増と、電気自動車や自律走行車の台頭によって顕著な回復を遂げており、ECU、インフォテインメントシステム、センサーなどの重要部品に使用される半導体の要件を大幅に高めています。欧州委員会は、2030年までに少なくとも3,000万台の電気自動車を道路に普及させるという野心的な目標を掲げており、特に死角検出やバックアップカメラなどの機能に対する需要がさらに加速しています。インドでは、政府が2031年までにすべての自動車にADAS(先進運転支援システム)を搭載することを義務化しようとしており、半導体ニーズがさらに高まっています。しかし、自動車メーカーは現在、8インチ半導体の生産能力の限られた成長によって悪化した半導体部品の広汎な不足による生産課題に取り組んでおり、短期的な価格上昇を招いています。この状況は、乗用車と商用車の世界の需要の大幅な減少によってさらに悪化し、自動車セクターの収益に悪影響を及ぼしています。とはいえ、米国の半導体ファウンドリ市場は、業界の制約が解消され、自動車技術にさらなるイノベーションが生まれるにつれて、今後の予測期間においても持続的なCAGRを維持し、底堅い成長を示すと予想されます。

目次

イントロダクション

- 調査の目的

- 定義

- 市場範囲

調査手法

- 情報調達

- 二次データソースと一次データソース

- 市場規模予測

- 市場の想定と制限

エグゼクティブサマリー

- 市場概要見通し

- 供給需要動向分析

- セグメント別機会分析

市場力学と見通し

- 市場力学

- 促進要因

- 機会

- 抑制要因

- 課題

- ポーターの分析

主な市場の考察

- 主な成功要因

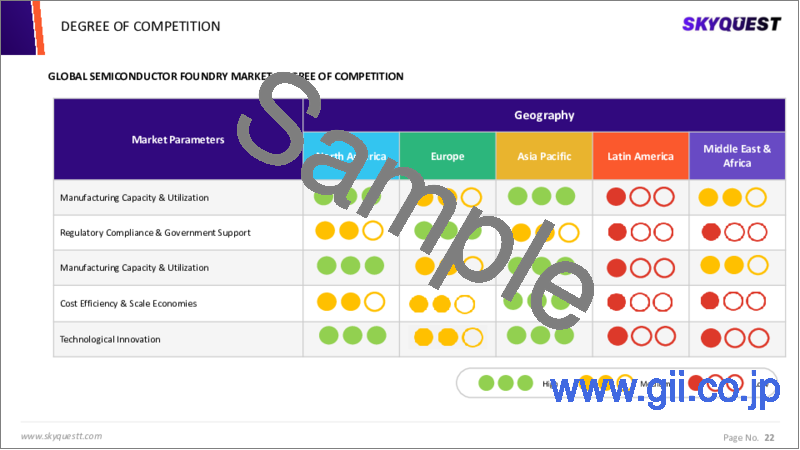

- 競合の程度

- 主な投資機会

- 市場のエコシステム

- 技術分析

- 特許分析

半導体ファウンドリ市場:技術別

- 市場概要

- シーモス

- ビシモス

- ガリウムヒ素

半導体ファウンドリ市場:ファウンドリタイプ別

- 市場概要

- ピュアプレイファウンドリー

- IDM

半導体ファウンドリ市場:用途別

- 市場概要

- 自動車

- 家電

- 産業

- ヘルスケア

- その他

半導体ファウンドリ市場規模:地域別

- 市場概要

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東・アフリカ(MEA)

- GCC諸国

- 南アフリカ

- その他中東・アフリカ地域

競合情勢

- 上位5社の比較

- 主要企業の市場ポジショニング(2023年)

- 主な市場企業が採用した戦略

- 市場における最近の活動

- 主要企業の市場シェア(2023年)

主要企業プロファイル

- Taiwan Semiconductor Manufacturing Company Limited

- Samsung Group

- United Microelectronics Corporation

- GlobalFoundries

- SMIC

- Tower Semiconductor

- Powerchip Semiconductor Manufacturing Corp.

- Vanguard International Semiconductor Corporation

- Hua Hong Semiconductor Limited

- DB HITEK

- Intel Corporation

- Dongbu HiTek

- Hua Hong Semiconductor Limited

- Infineon Technologies AG

- Renesas Electronics

- Microchip Technology Inc.

- Silicon Labs

- Broadcom, Inc.

- Cypress Semiconductor

- AnSem N.V.

- Maxim Integrated

- NXP Semiconductors

Global Semiconductor Foundry Market size was valued at USD 106.92 billion in 2022 and is poised to grow from USD 115.6 billion in 2023 to USD 215.88 billion by 2031, growing at a CAGR of 8.12% during the forecast period (2024-2031).

The automotive industry is experiencing a notable recovery, driven by surging demand for safer personal transportation and the rise of electric and autonomous vehicles, which are significantly increasing the requirement for semiconductors used in critical components like ECUs, infotainment systems, and sensors. The European Commission's ambitious goal of having at least 30 million electric vehicles on the roads by 2030 has further accelerated this demand, particularly for features like blind-spot detection and backup cameras. In India, the government is pushing for the mandatory inclusion of Advanced Driver Assistance Systems (ADAS) in all vehicles by 2031, further propelling semiconductor needs. However, automotive manufacturers are currently grappling with production challenges due to a pervasive shortage of semiconductor components, exacerbated by limited growth in 8-inch semiconductor production capacity, which has resulted in short-term price increases. This situation is compounded by a significant decline in global demand for passenger and commercial vehicles, negatively affecting revenue in the automotive sector. Nevertheless, the US semiconductor foundry market is anticipated to show resilient growth, maintaining a sustainable compound annual growth rate (CAGR) in the upcoming forecast period, as the industry's constraints are addressed and more innovations emerge in automotive technology.

Top-down and bottom-up approaches were used to estimate and validate the size of the Global Semiconductor Foundry market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Semiconductor Foundry Market Segmental Analysis

Global Semiconductor Foundry Market is segmented by Technology, Foundry Type, Application, and Region. Based on Technology, the market is segmented into CMOS, BiCMOS, GaAs. Based on Foundry Type, the market is segmented into Pure Play Foundry, IDMs. Based on Application, the market is segmented into Automotive, Consumer Electronics, Industrial, Healthcare, Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Global Semiconductor Foundry Market

The Global Semiconductor Foundry market is experiencing robust growth, primarily driven by the escalating demand for integrated circuits (ICs) across diverse sectors such as automotive, consumer electronics, healthcare, military applications, and smart home devices. The proliferation of IoT-enabled products is significantly increasing the need for advanced ICs, which, in turn, boosts demand for semiconductor foundries capable of producing these complex components. Additionally, substantial government investments aimed at advancing semiconductor technology in various countries further catalyze industry growth, positioning the foundry sector as a critical player in meeting the ever-evolving requirements of an increasingly connected world.

Restraints in the Global Semiconductor Foundry Market

The Global Semiconductor Foundry market faces significant restraints due to tariff disruptions and shifts in global trade dynamics. The industry, predominantly influenced by the United States' longstanding market leadership, risks a substantial decrease in its market share-projected at 16%-due to rising trade tensions, particularly with China. The imposition of restrictive tariffs on industrial goods and materials essential for chip production exacerbates this challenge, creating an unstable business environment. Consequently, manufacturers may increasingly pivot their focus towards the Asia Pacific region, potentially undermining the competitive edge of US semiconductor firms and altering the global landscape of semiconductor manufacturing.

Market Trends of the Global Semiconductor Foundry Market

The Global Semiconductor Foundry market is experiencing significant growth, driven by the escalating demand for semiconductors across various industries, particularly in automotive applications due to the rise of autonomous driving technologies. This surge necessitates enhanced production capacities and innovations in automotive chips, prompting foundries to intensify their focus on this sector. Additionally, the expanding integration of semiconductors in telecommunications, computing, networking, and consumer electronics further fuels demand, creating a robust market landscape. As tech advancements accelerate, the foundry sector is poised for continued expansion, with strategic investments and partnerships aimed at meeting the evolving needs of diverse industries.

Table of Contents

Introduction

- Objectives of the Study

- Definitions

- Market Scope

Research Methodology

- Information Procurement

- Secondary & Primary Data Sources

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Market Overview Outlook

- Supply Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Dynamics

- Drivers

- Opportunities

- Restraints

- Challenges

- Porters Analysis

- Competitive rivalry

- Threat of Substitute Products

- Bargaining Power of Buyers

- Threat of New Entrants

- Bargaining Power of Suppliers

Key Market Insights

- Key Success Factor

- Degree of Competition

- Top Investment Pockets

- Ecosystem of the Market

- Technology Analysis

- Patent Analysis

Semiconductor Foundry Market, By Technology

- Market Overview

- CMOS

- BiCMOS

- GaAs

Semiconductor Foundry Market, By Foundry Type

- Market Overview

- Pure Play Foundry

- IDMs

Semiconductor Foundry Market, By Application

- Market Overview

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Others

Semiconductor Foundry Market Size by Region

- Market Overview

- North America

- USA

- Canada

- Europe

- Germany

- Spain

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC Countries

- South Africa

- Rest of MEA

Competitive Landscape

- Top 5 Player Comparison

- Market Positioning of Key Players, 2023

- Strategies Adopted by Key Market Players

- Recent Activities in the Market

- Key Companies Market Share (%), 2023

Key Company Profiles

- Taiwan Semiconductor Manufacturing Company Limited

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Samsung Group

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- United Microelectronics Corporation

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- GlobalFoundries

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- SMIC

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Tower Semiconductor

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Powerchip Semiconductor Manufacturing Corp.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Vanguard International Semiconductor Corporation

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hua Hong Semiconductor Limited

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- DB HITEK

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Intel Corporation

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Dongbu HiTek

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hua Hong Semiconductor Limited

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Infineon Technologies AG

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Renesas Electronics

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Microchip Technology Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Silicon Labs

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Broadcom, Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Cypress Semiconductor

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- AnSem N.V.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Maxim Integrated

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- NXP Semiconductors

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments