|

市場調査レポート

商品コード

1752103

RegTech(レグテック)の世界市場(~2035年):コンポーネントタイプ別、展開タイプ別、用途タイプ別、エンドユーザータイプ別、地域別、産業動向、予測RegTech Market, Till 2035: Distribution by Type of Component, Type of Deployment, Type of Application, Type of End User, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| RegTech(レグテック)の世界市場(~2035年):コンポーネントタイプ別、展開タイプ別、用途タイプ別、エンドユーザータイプ別、地域別、産業動向、予測 |

|

出版日: 2025年06月12日

発行: Roots Analysis

ページ情報: 英文 173 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

RegTech(レグテック)市場の概要

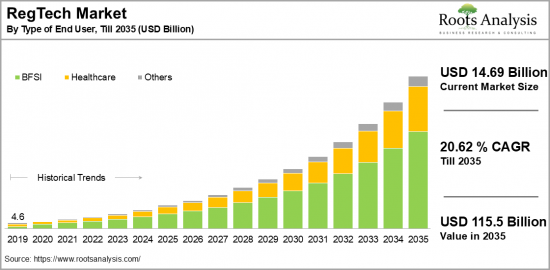

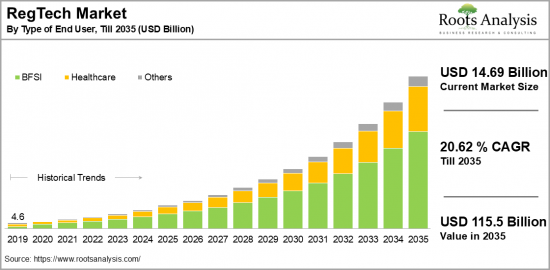

世界のRegTech(レグテック)の市場規模は、現在の146億9,000万米ドルから2035年までに1,155億米ドルに達すると予測され、2035年までの予測期間にCAGRで20.62%の成長が見込まれます。

RegTech(レグテック)市場:成長と動向

RegTech(レグテック)とはRegulatory Technologyの略で、より効率的かつ効果的な方法で企業の規制遵守を支援する技術の利用を指します。RegTech(レグテック)の主な目的は、コンプライアンス、リスク管理、規制業務に関連するプロセスを強化および自動化することです。2008年の世界金融危機は、RegTech(レグテック)企業の登場を促す重要な出来事となりました。これを受けて、世界中の数多くの規制当局や政府が、将来の同様の危機を回避するために新たな法律を施行しました。企業のコンプライアンスコストの増加は、RegTech(レグテック)のような、より効率的な技術主導のソリューションへの需要を高めました。

こうした技術の必要性を認識したRegTech(レグテック)企業は、コンプライアンス管理に用いる先進のツールやサービスを提供することで、規制上の要求に応える金融機関の支援を開始しました。技術の急速な進歩と不正行為の脅威の高まりが、RegTech(レグテック)市場の範囲を広げています。さらに、金融サービスにおけるデジタルトランスフォーメーションと規制要件の高まりが、市場成長を後押ししています。重要なのは、金融部門がRegTech(レグテック)ソリューションやサービスに大きく依存している主要産業であることで、主にその急速なデジタルトランスフォーメーションによって、データ管理、自動化、AI主導の知見への注目が高まっています。

結果として、業界の参入企業は、コンプライアンス自動化ツールやマネーロンダリング防止ソリューションを提供するために金融技術革新を活用することで、規制報告ソリューションに対する需要の増加によってもたらされる機会を捉えています。さらに、AI、機械学習、ブロックチェーンにおける継続的な技術の進歩が、RegTech(レグテック)製品の能力を強化しています。さらに、クラウドベースのRegTech(レグテック)ソリューションの動向の高まりとリアルタイムのリスク管理の必要性により、RegTech(レグテック)市場は予測期間に大きく成長する見込みです。

当レポートでは、世界のRegTech(レグテック)市場について調査分析し、市場規模の推計と機会の分析、競合情勢、企業プロファイル、近年の発展などの情報を提供しています。

目次

セクション1 レポートの概要

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクション2 定性的な知見

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 規制シナリオ

セクション3 市場の概要

第8章 主要企業の包括的なデータベース

第9章 競合情勢

第10章 ホワイトスペース分析

第11章 企業の競争力の分析

第12章 RegTech(レグテック)市場におけるスタートアップエコシステム

セクション4 企業プロファイル

第13章 企業プロファイル

- 章の概要

- Accuity

- ACTICO

- Apiax

- Ascent

- BearingPoint Software

- Broadridge Financial

- Chainalysis

- ComplyAdvantage

- Deloitte

- Drata

- Elliptic

- Hummingbird

- IBM

- Jumio

- MetricStream

- Mitratech

- Onfido

- SymphonyAI

- Thomson Reuters

- Wolters Kluwer

セクション5 市場動向

第14章 メガトレンド分析

第15章 アンメットニーズの分析

第16章 特許分析

第17章 近年の発展

セクション6 市場機会の分析

第18章 世界のREGテック市場

第19章 市場機会:部品タイプ別

第20章 市場機会:展開タイプ別

第21章 市場機会:用途タイプ別

第22章 市場機会:エンドユーザータイプ別

第23章 北米のRegTech(レグテック)市場の機会

第24章 欧州のRegTech(レグテック)市場の機会

第25章 アジアのRegTech(レグテック)市場の機会

第26章 中東・北アフリカ(MENA)のRegTech(レグテック)市場の機会

第27章 ラテンアメリカのRegTech(レグテック)市場の機会

第28章 その他の地域のRegTech(レグテック)市場の機会

第29章 市場集中分析:主要企業別

第30章 隣接市場の分析

セクション7 戦略ツール

第31章 勝利の鍵となる戦略

第32章 ポーターのファイブフォース分析

第33章 SWOT分析

第34章 バリューチェーン分析

第35章 Rootsの戦略的提言

セクション8 その他の独占的知見

第36章 1次調査からの知見

第37章 レポートの結論

セクション9 付録

第38章 表形式データ

第39章 企業・団体のリスト

第40章 カスタマイズの機会

第41章 Rootsのサブスクリプションサービス

第42章 著者詳細

RegTech Market Overview

As per Roots Analysis, the global regtech market size is estimated to grow from USD 14.69 billion in the current year to USD 115.5 billion by 2035, at a CAGR of 20.62% during the forecast period, till 2035.

The opportunity for regtech market has been distributed across the following segments:

Type of Component

- Solution

- Service

Type of Deployment

- Cloud

- On-Premises

Type of Application

- Anti-Money Laundering & Fraud Management

- Identity Management Regulatory Intelligence

- Regulatory Reporting

- Risk & Compliance Management

Type of End User

- BFSI

- Government

- Healthcare

- IT & Telecom

- Non-Financial

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

REGTECH MARKET: GROWTH AND TRENDS

RegTech, stands for regulatory technology, refers to the application of technology to assist businesses in adhering to regulations in a more efficient and effective manner. The primary aim of regtech is to enhance and automate processes related to compliance, risk management, and regulatory tasks. The 2008 global financial crisis served as a pivotal event that inspired the emergence of regtech companies. In response, numerous regulators and governments around the globe implemented new laws to avert a similar crisis in the future. This increase in compliance costs for businesses has heightened the demand for more efficient, technology-driven solutions like regtech.

Recognizing the necessity for such technology, regtech companies began supporting financial institutions in meeting regulatory demands by providing advanced tools and services for compliance management. The swift advancement of technology and the rising threat of fraudulent activities have broadened the regtech market's scope. Additionally, the digital transformation within financial services and the escalating regulatory requirements are propelling market growth. Importantly, the financial sector is the primary industry that relies heavily on regtech solutions and services, mainly due to its rapid digital transformation that has intensified the focus on data management, automation, and insights driven by artificial intelligence.

As a result, industry participants are seizing the opportunity presented by the increasing demand for regulatory reporting solutions by utilizing financial technology innovations to provide compliance automation tools and anti-money laundering solutions. Moreover, ongoing technological advancements in artificial intelligence, machine learning, and blockchain have bolstered the capabilities of regtech offerings. Additionally, driven by the rising trend of cloud-based regtech solutions and the necessity for real-time risk management, the regtech market is anticipated to grow significantly during the forecast period.

REGTECH MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global regtech market is segmented into solution and service. According to our estimates, currently, solution segment captures the majority share of the market. This can be attributed to the significant demand for compliance management solutions.

However, services segment is anticipated to grow at a relatively higher CAGR during the forecast period. This increase is linked to the demand for professional services and expertise in managing tools and regulatory change management solutions in a cost-effective way.

Market Share by Type of Deployment

Based on type of deployment, the regtech market is segmented into cloud and on-premises. According to our estimates, currently, cloud-based deployment segment captures the majority of the market. This can be attributed to the rising demand for cloud-based regtech solutions and advantages like scalability, flexibility, and the ability to process data in real-time.

Additionally, a significant characteristic of cloud platforms is their capability to integrate seamlessly with other emerging technologies such as AI. The demand for cloud solutions is further enhanced by advancements in machine learning and big data analytics. However, on-premises segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Application

Based on type of application, the regtech market is segmented into anti-money laundering & fraud management, identity management, regulatory intelligence, regulatory reporting, and risk & compliance management. According to our estimates, currently, risk & compliance management segment captures the majority share of the market. This can be attributed to the widespread applicability across various industries, particularly in the finance, healthcare, insurance, and legal sectors.

Additionally, the rising complexity of regulations and the expenses associated with non-compliance drive the demand for solutions that can streamline compliance practices and manage risks, thus boosting market growth. However, anti-money laundering & fraud management segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of End User

Based on type of end user, the regtech market is segmented into BFSI, government, insurance, IT & telecom, non-financial, and others. According to our estimates, currently, BFSI industry captures the majority share of the market. Numerous organizations, including banks, insurance firms, and investment companies, are required to adhere to a broad spectrum of regulations ranging from know your customer (KYC) to anti-money laundering.

Further, the healthcare sector is increasingly implementing regtech and identity access management solutions to comply with patient privacy regulations and detect billing fraud. Consequently, the healthcare industry is expected to experience a higher compound annual growth rate (CAGR) during the forecast period.

Market Share by Geographical Regions

Based on geographical regions, the regtech market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market.

However, the market in Asia is anticipated to grow at a relatively higher CAGR during the forecast period. Countries in Asia, particularly those that are developing, are undergoing a digital transformation where nearly all business sectors are adopting advanced risk assessment technologies to streamline their operations. Regarding compliance technology in finance, governments in the region continue to enforce regulations concerning data breaches and fraud, which is contributing to the growth of the regtech market in this area.

Example Players in RegTech Market

- Clara Foods

- Eden Brew

- Formo

- Ginkgo Bioworks

- Impossible Food

- Legendairy Foods

- Modern Meadow

- Moo Free

- Motif FoodWorks

- Mycorena

- New Culture

- Triton Algae Innovation

REGTECH MARKET: RESEARCH COVERAGE

The report on the regtech market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the regtech market, focusing on key market segments, including [A] type of component, [B] type of deployment, [C] type of application, [D] type of end user, and [E] geographical regions

- Competitive Landscape: A comprehensive analysis of the companies engaged in the regtech market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the regtech market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in regtech industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the regtech domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the regtech market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the regtech market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in regtech market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of RegTech Market

- 6.2.1. Type of Component

- 6.2.2. Type of Deployment

- 6.2.3. Type of Application

- 6.2.4. Type of End User

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. RegTech: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE REG TECH MARKET

- 12.1. RegTech: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Accuity *

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. ACTICO

- 13.4. Apiax

- 13.5. Ascent

- 13.6. BearingPoint Software

- 13.7. Broadridge Financial

- 13.8. Chainalysis

- 13.9. ComplyAdvantage

- 13.10. Deloitte

- 13.11. Drata

- 13.12. Elliptic

- 13.13. Hummingbird

- 13.14. IBM

- 13.15. Jumio

- 13.16. MetricStream

- 13.17. Mitratech

- 13.18. Onfido

- 13.19. SymphonyAI

- 13.20. Thomson Reuters

- 13.21. Wolters Kluwer

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMEET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL REG TECH MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global RegTech Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. RegTech Market for Solution: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. RegTech Market for Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

- 19.8.1. Secondary Sources

- 19.8.2. Primary Sources

- 19.8.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYMENT

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. RegTech Market for Cloud: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. RegTech Market for On-Premises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

- 20.8.1. Secondary Sources

- 20.8.2. Primary Sources

- 20.8.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. RegTech Market for AML & Fraud Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. RegTech Market for Identity Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. RegTech Market for Regulatory Intelligence: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. RegTech Market for Regulatory Reporting: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.10. RegTech Market for Risk & Compliance Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.11. Data Triangulation and Validation

- 21.11.1. Secondary Sources

- 21.11.2. Primary Sources

- 21.11.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF END USER

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. RegTech Market for BFSI: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. RegTech Market for Government: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. RegTech Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.9. RegTech Market for IT & Telecom: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.10. RegTech Market for Non-Financial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.11. RegTech Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.12. Data Triangulation and Validation

- 22.12.1 Secondary Sources

- 22.12.2. Primary Sources

- 22.12.3. Statistical Modeling

23. MARKET OPPORTUNITIES FOR REGTECH IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. RegTech Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. RegTech Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. RegTech Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. RegTech Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. RegTech Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR REGTECH IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. RegTech Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. RegTech Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. RegTech Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. RegTech Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. RegTech Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. RegTech Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. RegTech Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. RegTech Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. RegTech Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.9. RegTech Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.10. RegTech Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.11. RegTech Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.12. RegTech Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.13. RegTech Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.14. RegTech Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.15. RegTech Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.16. RegTech Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR REGTECH IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. RegTech Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. RegTech Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. RegTech Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. RegTech Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. RegTech Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. RegTech Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. RegTech Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR REGTECH IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. RegTech Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. RegTech Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 26.6.2. RegTech Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. RegTech Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. RegTech Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. RegTech Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. RegTech Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.7. Neuromorphic Computing Marke in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.8. RegTech Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR REGTECH IN LATIN AMERICA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. RegTech Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. RegTech Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. RegTech Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. RegTech Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. RegTech Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. RegTech Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. RegTech Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR REGTECH IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. RegTech Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. RegTech Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. RegTech Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. RegTech Market in Other Countries

- 28.7. Data Triangulation and Validation

29. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 29.1. Leading Player 1

- 29.2. Leading Player 2

- 29.3. Leading Player 3

- 29.4. Leading Player 4

- 29.5. Leading Player 5

- 29.6. Leading Player 6

- 29.7. Leading Player 7

- 29.8. Leading Player 8