|

市場調査レポート

商品コード

1721381

AIチップ市場 (~2035年):チップタイプ・処理タイプ・技術・機能・用途・エンドユーザー・企業タイプ・地域別の産業動向と世界の予測AI Chip Market, Till 2035: Distribution by Type of Chip, Type of Processing, Type of Technology, Type of Function, Type of Application, Type of End-User, Type of Enterprise and Geographical Regions : Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| AIチップ市場 (~2035年):チップタイプ・処理タイプ・技術・機能・用途・エンドユーザー・企業タイプ・地域別の産業動向と世界の予測 |

|

出版日: 2025年05月08日

発行: Roots Analysis

ページ情報: 英文 192 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

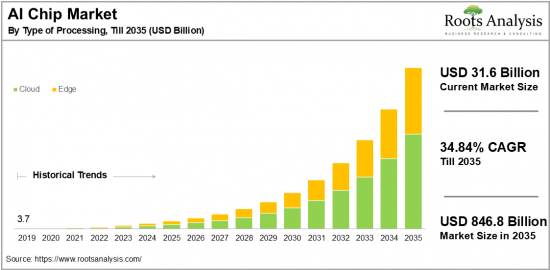

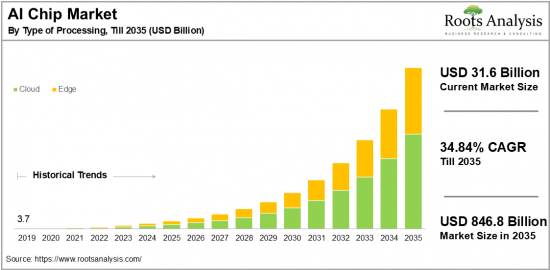

世界のAIチップの市場規模は、現在の316億米ドルから、予測期間中はCAGR 34.84%で推移し、2035年には8,468億米ドルに成長すると予測されています。

現在進行中の技術的進歩と投資家の関心の高まりに後押しされ、世界のAIチップ市場は予測期間中に健全なペースで成長すると予想されています。

AIチップの市場機会:セグメント別

チップタイプ別

- ASIC

- CPU

- FPGA

- GPU

- その他

処理タイプ別

- クラウド

- エッジ

技術

- マルチチップモジュール

- システムインパッケージ

- システムオンチップ

- その他

機能別

- 推論

- トレーニング

用途別

- コンピュータビジョン

- 自然言語処理

- ネットワークセキュリティ

- ロボット工学

- その他

エンドユーザー別

- 農業

- 自動車

- 政府機関

- ヘルスケア

- 人的資源

- 製造

- 小売

- その他

企業タイプ別

- 大企業

- 中小企業

地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米諸国

- 欧州

- オーストリア

- ベルギー

- デンマーク

- フランス

- ドイツ

- アイルランド

- イタリア

- オランダ

- ノルウェー

- ロシア

- スペイン

- スウェーデン

- スイス

- 英国

- その他の欧州諸国

- アジア

- 中国

- インド

- 日本

- シンガポール

- 韓国

- その他のアジア諸国

- ラテンアメリカ

- ブラジル

- チリ

- コロンビア

- ベネズエラ

- その他のラテンアメリカ諸国

- 中東・北アフリカ

- エジプト

- イラン

- イラク

- イスラエル

- クウェート

- サウジアラビア

- UAE

- その他の中東・北アフリカ諸国

- 世界のその他の地域

- オーストラリア

- ニュージーランド

- その他の国

AIチップ市場:成長と動向

フォーブスによると、企業の64%がAIが自社の業務生産性を向上させると考えています。さらに、2030年までに走行中の車両のうち10台に1台が自動運転車になると予測されています。このような状況の中、AIチップはAIおよびロボティクスの将来を効率性とイノベーションの向上によって牽引しています。

AIの導入は、インターネットとデジタル技術の急速な拡大に後押しされ、主要産業で着実に進んでいます。実際、ChatGPTはわずか5日間で100万人以上のユーザーを獲得し、AIへの受容が急速に進んでいることを示しています。

AIチップ市場は、世界的なイノベーションとデジタルトランスフォーメーションへの移行において、重要な要素となりつつあり、AIにおける技術的効率の向上を目指しています。自然言語処理や機械学習の進展は、その可能性を最大限に引き出すうえで重要であり、電力効率や応答速度を高める役割を果たしています。また、NVIDIAの最新GPUや、IntelのGaudiプロセッサ、エッジAIなどは、現代におけるリアルタイム意思決定の促進において中核的な存在となっています。最近では、2024年9月にCerebras Systemsが最新AIチップCerebras Inferenceを発表し、NVIDIAのGPUの20倍の速度を誇り、1つのチップ上に4兆個以上のトランジスタを搭載しているとしています。

当レポートでは、世界のAIチップの市場を調査し、 市場概要、背景、市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクションII:定性的洞察

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 規制シナリオ

セクションIII:市場概要

第8章 主要企業の包括的データベース

第9章 競合情勢

第10章 ホワイトスペース分析

第11章 競合分析

第12章 AIチップ市場におけるスタートアップエコシステム

セクションIV: 企業プロファイル

第13章 企業プロファイル

- 章の概要

- Alibaba Group

- Amazon Web Services

- Apple

- Avaamo

- Baidu

- Hewlett Packard

- IBM

- IPsoft

- Meta

- Microsoft

- NVIDIA

- Nuance Communications

- Oracle

- Salesforce

- SAP SE

- SoundHound

セクションV:市場動向

第14章 メガトレンド分析

第15章 アンメットニーズの分析

第16章 特許分析

第17章 最近の動向

セクションVI:市場機会分析

第18章 世界のAIチップ市場

第19章 エージェントシステム別の市場機会

第20章 応用分野別の市場機会

第21章 エージェントの役割別の市場機会

第22章 技術別の市場機会

第23章 製品タイプ別の市場機会

第24章 北米におけるAIチップの市場機会

第25章 欧州におけるAIチップの市場機会

第26章 アジアにおけるAIチップの市場機会

第27章 中東・北アフリカにおけるAIチップの市場機会

第28章 ラテンアメリカにおけるAIチップの市場機会

第29章 世界のその他の地域におけるAIチップの市場機会

第30章 市場集中分析:主要企業別分布

第31章 隣接市場分析

セクションVII:戦略ツール

第32章 主要成功戦略

第33章 ポーターのファイブフォース分析

第34章 SWOT分析

第35章 バリューチェーン分析

第36章 ROOTSの戦略的提言

セクションVIII:その他の独占的洞察

第37章 1次調査からの洞察

第38章 報告書の結論

セクションIX:付録

第39章 表形式データ

第40章 企業・団体一覧

第41章 カスタマイズの機会

第42章 ROOTSサブスクリプションサービス

第43章 著者詳細

GLOBAL AI CHIP MARKET: OVERVIEW

As per Roots Analysis, the global AI chip market size is estimated to grow from USD 31.6 billion in the current year to USD 846.8 billion by 2035, at a CAGR of 34.84% during the forecast period, till 2035.

Driven by the ongoing technological advancements and increasing interest from investors, the global AI chip market is expected to grow at a healthy pace during the forecast period.

The opportunity for AI chip market has been distributed across the following segments:

Type of Chip

- Application-Specific Integrated Circuit (ASIC)

- Central Processing Unit (CPU)

- Field Programmable Gate Array (FPGA)

- Graphics Processing Unit (GPU)

- Others

Type of Processing

- Cloud

- Edge

Type of Technology

- Multi-Chip Module

- System in Package

- System on Chip

- Others

Type of Function

- Inference

- Training

Type of Application

- Computer Vision

- Nature Language Processing

- Network Security

- Robotics

- Others

End-Users

- Agriculture

- Automotive

- Government

- Healthcare

- Human Resources

- Manufacturing

- Retail

- Others

Type of Enterprise

- Large

- Small and Medium Enterprise

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

AI CHIP MARKET: GROWTH AND TRENDS

According to Forbes, 64% of companies believe that artificial intelligence (AI) will enhance their business productivity. Additionally, projections suggest that by 2030, one in ten vehicles on the road will be self-driving. In this context, AI chips are driving the future of AI and robotics through increased efficiency and innovation. These AI chips are specialized integrated circuits designed to execute complex algorithmic tasks related to AI. It is important to note that there are a variety of applications for AI chips across different sectors, including healthcare, finance, automotive, and telecommunications. Some of the key benefits of utilizing these chips include improved operational efficiency, rapid real-time responses, and the ability to process vast amounts of data quickly and effectively. Moreover, the AI chips provide a range of advanced capabilities such as natural language processing, image recognition, and predictive analytics. Notably, the adoption of AI in major sectors is rising, driven by the fast expansion of the internet and digital technologies. Interestingly, ChatGPT managed to attract over 1 million users within just five days, highlighting the growing acceptance of AI.

The AI chip market is becoming an important element in the worldwide transition towards innovation and digital transformation, aiming for greater technological efficiency in AI. Natural language processing and machine learning have been crucial in realizing its full potential, enhancing power efficiency and response speed. Further, cutting-edge GPUs from NVIDIA and Intel's Gaudi processors, along with edge AI, are pivotal in facilitating real-time decision-making in this modern landscape. Recently, in September 2024, Cerebras Systems introduced its latest AI chip, the Cerebras Inference, which claims to be 20 times faster than NVIDIA's GPUs and features over 4 trillion transistors on a single chip.

AI CHIP MARKET: KEY SEGMENTS

Market Share by Type of Chip

Based on the type of chip, the global AI chip market is segmented into application-specific integrated circuit (ASIC), central processing unit (CPU), field programmable gate array (FPGA), graphics processing unit (GPU) and others. According to our estimates, currently, central processing unit (CPU) segment captures the majority share of the market. This can be attributed to extensive usage and the significant installed base of CPUs in data centers and edge devices. However, application-specific integrated circuit (ASIC) segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Processing

Based on the type of processing, the AI chip market is segmented into cloud and edge. According to our estimates, currently, cloud segment captures the majority share of the market. This can be attributed to its capability to satisfy high-performance needs, offer scalability and flexibility, facilitate data centralization, and ensure cost efficiency. However, edge segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Technology

Based on the type of technology, the AI chip market is segmented into multi-chip module, system in packaging, system on chip and others. According to our estimates, currently, system on chip segment captures the majority share of the market; further, this segment is anticipated to grow at a higher CAGR in the future. This can be attributed to its capability to combine multiple components into a single chip, which is especially beneficial for AI applications.

Market Share by Type of Function

Based on the type of function, the AI chip market is segmented into inference and training. According to our estimates, currently, inference segment captures the majority share of the market; further, this segment is anticipated to grow at a higher CAGR in the future. This can be attributed to the rising use of AI to improve operations and enhance customer experience. Data centers are expanding their AI capabilities, which is increasing the demand for high-performance inference chips.

Market Share by Type of Application

Based on the type of application, the AI chip market is segmented into computer vision, natural language processing, network security, robotics and others. According to our estimates, currently, computer vision segment captures the majority share of the market further, this segment is anticipated to grow at a higher CAGR in the future. This can be attributed to its essential function in enhancing automation and efficiency across numerous industries. The growing dependence on AI-driven systems for applications like quality control, surveillance, and real-time data analysis has resulted in increased demand for specialized chips capable of processing complex visual data.

Market Share by End-users

Based on the end-users, the AI chip market is segmented into agriculture, automotive, government, healthcare, human resources, manufacturing, retail and others. According to our estimates, currently, healthcare segment captures the majority share of the market. This can be attributed to the rising demand for patient data management, medical imaging analysis, and diagnostic applications that utilize AI chip technology, enhancing efficiency and accuracy in healthcare delivery. However, automotive segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Enterprise

Based on the type of enterprise, the AI chip market is segmented into large and small and medium enterprises. According to our estimates, currently, large enterprise segment captures the majority share of the market. This can be attributed to their considerable financial resources, extensive research and development capabilities, established presence in the market, and commitment to business growth. However, small and medium enterprise segment is anticipated to grow at a higher CAGR during the forecast period

Market Share by Geographical Regions

Based on the geographical regions, the AI chip market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to the concentration of major technology firms, significant investments in artificial general intelligence research and development, along with a well-established infrastructure. However, market share in Asia is anticipated to grow at a higher CAGR during the forecast period.

Example Players in AI Chip Market

- Advanced Micro Devices

- Amazon

- General Vision

- Gyrfalcon Technology

- Huawei Technologies

- IBM

- Infineon Technologies

- Intel

- Kneron

- Microsoft

- MYTHIC

- Nvidia

- NXP Semiconductors

- Qualcomm Incorporated

- Samsung Electronics

- Toshiba

- Wave Computing

AI CHIP MARKET: RESEARCH COVERAGE

The report on the AI chip market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the AI chip market, focusing on key market segments, including [A] type of chip, [B] type of processing, [C] type of technology, [D] type of function, [E] type of application, [F] end-users, [G] type of enterprise and [H] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the AI chip market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the AI chip market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] AI chip portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in AI chip industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the AI chip domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the AI chip market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the AI chip market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the significance of edge AI in the AI chip market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- Which type of AI chip is expected to dominate the market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of AI chip Market

- 6.2.1. Type of Agent System

- 6.2.2. Areas of Application

- 6.2.3. Type of Agent Role

- 6.2.4. Type of Product

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. AI chip: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPETITIVE COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE AI CHIP MARKET

- 12.1. AI chip Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Alibaba Group

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Amazon Web Services

- 13.4. Apple

- 13.5. Avaamo

- 13.6. Baidu

- 13.7. Google

- 13.8. Hewlett Packard

- 13.9. IBM

- 13.10. IPsoft

- 13.11. Meta

- 13.12. Microsoft

- 13.13. NVIDIA

- 13.14. Nuance Communications

- 13.15. Oracle

- 13.16. Salesforce

- 13.17. SAP SE

- 13.18. SoundHound

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMEET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL AI CHIP MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global AI chip Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF AGENT SYSTEM

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. AI chip Market for Multi-agent: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. AI chip Market for Single agent: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

- 19.8.1. Secondary Sources

- 19.8.2. Primary Sources

- 19.8.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON AREAS OF APPLICATION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. AI chip Market for Customer Service & Virtual Assistants: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. AI chip Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

- 20.8.1. Secondary Sources

- 20.8.2. Primary Sources

- 20.8.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPES OF AGENT ROLE

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. AI chip Market for Code Generation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. AI chip Market for Customer Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. AI chip Market for Marketing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. AI chip Market for Productivity & Personal Assistants: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.10. AI chip Market for Sales: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.11. Data Triangulation and Validation

- 21.11.1. Secondary Sources

- 21.11.2. Primary Sources

- 21.11.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. AI chip Market for Deep Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. AI chip Market for Machine Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. AI chip Market for Build Your Own Agents: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. AI chip Market for Ready to Deploy Agents: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.8. Data Triangulation and Validation

- 23.8.1. Secondary Sources

- 23.8.2. Primary Sources

- 23.8.3. Statistical Modeling

24. MARKET OPPORTUNITIES FOR AI CHIP IN NORTH AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. AI chip Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. AI chip Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. AI chip Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. AI chip Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. AI chip Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR AI CHIP IN EUROPE

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. AI chip Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. AI chip Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. AI chip Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. AI chip Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. AI chip Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. AI chip Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. AI chip Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. AI chip Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. AI chip Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.9. AI chip Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.10. AI chip Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.11. AI chip Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.12. AI chip Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.13. AI chip Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.14. AI chip Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.15. AI chip Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.16. AI chip Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR AI CHIP IN ASIA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. AI chip Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. AI chip Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. AI chip Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. AI chip Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. AI chip Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. AI chip Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. AI chip Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR AI CHIP IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. AI chip Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. AI chip Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 27.6.2. AI chip Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. AI chip Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. AI chip Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. AI chip Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. AI chip Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.7. AI chip Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.8. AI chip Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR AI CHIP IN LATIN AMERICA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. AI chip Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. AI chip Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. AI chip Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. AI chip Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.4. AI chip Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.5. AI chip Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.6. AI chip Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR AI CHIP IN REST OF THE WORLD

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. AI chip Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.1. AI chip Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.2. AI chip Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.3. AI chip Market in Other Countries

- 29.7. Data Triangulation and Validation

30. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 30.1. Leading Player 1

- 30.2. Leading Player 2

- 30.3. Leading Player 3

- 30.4. Leading Player 4

- 30.5. Leading Player 5

- 30.6. Leading Player 6

- 30.7. Leading Player 7

- 30.8. Leading Player 8

31. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

32. KEY WINNING STRATEGIES

33. PORTER FIVE FORCES ANALYSIS

34. SWOT ANALYSIS

35. VALUE CHAIN ANALYSIS

36. ROOTS STRATEGIC RECOMMENDATIONS

- 36.1. Chapter Overview

- 36.2. Key Business-related Strategies

- 36.2.1. Research & Development

- 36.2.2. Product Manufacturing

- 36.2.3. Commercialization / Go-to-Market

- 36.2.4. Sales and Marketing

- 36.3. Key Operations-related Strategies

- 36.3.1. Risk Management

- 36.3.2. Workforce

- 36.3.3. Finance

- 36.3.4. Others