|

|

市場調査レポート

商品コード

1777122

ADASと自動運転のTier 1サプライヤー(2025年)- 中国企業ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 - Chinese Companies |

||||||

|

|||||||

| ADASと自動運転のTier 1サプライヤー(2025年)- 中国企業 |

|

出版日: 2025年07月30日

発行: ResearchInChina

ページ情報: 英文 450 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

L2の時代には、国際的なADAS Tier 1サプライヤーが先行者優位の技術力で市場を独占していました。産業がL2+以上のドメイン(L2+、L2.5、L2.9)に入ると、国内のADAS Tier 1サプライヤーは、ミッドレンジコンピューティングチップの性能最適化、エンドツーエンドアーキテクチャのアルゴリズムハードウェア調整、局所的なシナリオへの迅速な対応という3つのコア能力に依存してブレークスルーを達成し、徐々に市場を独占するようになっています。

ResearchInChinaは、2024年~2025年の国内ADAS Tier 1サプライヤー25社の戦略的レイアウト(世界の動向、国境を越えた技術)、技術的道筋(チップの選択、エンドツーエンドインテリジェントドライビングのイテレーション)、製品ポートフォリオ戦略(インテリジェントドライビングソリューション、ドライビング・パーキング統合、コックピット・ドライビング、ドライビング・パーキング統合、セントラルコンピューティングプラットフォーム、その他のドメインコントロール製品)を体系的に分解し、7つの主な進化動向をまとめています。

動向1:L2.5/L2.9が新車搭載率No.1の急成長市場セグメントとなる

増分市場(新発売車)の点から、2023年~2025年の乗用車の国内インテリジェントドライビング搭載パターンは、大きな差別化の動向を示しています。L2.5/L2.9インテリジェントドライビングが飛躍的に伸びています。2023年に発売された新型車のうち、L2.5とL2.9スマートドライビングを搭載したのはそれぞれ4.57%と3.3%に過ぎませんでした。しかし、2025年1~4月期には、L2.5スマートドライビングを搭載した新車の比率は30.20%、L2.9は34.82%に急増し、市場への浸透が著しいです。

従来のL1~L2のインテリジェントドライビング機能の搭載率は引き続き低下しており、より先進のインテリジェントドライビング機能に対する消費者の需要が市場構造を再構築していることを反映しています。

動向2:2024年~2025年、インテリジェントドライビングは「ハイエンドオプション」から「全国標準」へと普及の「転換点」を迎える

2023年、L2.9のADAS機能は中上級モデルをターゲットとしました。搭載率で見ると、25~30万元、30万元超のモデルの搭載率が高いです。具体的には、25万~30万元のモデルのL2.9搭載率がもっとも高く、2023年の23.4%から2025年1~4月には53.5%まで上昇しました。50万元以上のハイエンドモデルのL2.9搭載率は2023年の7.5%から2025年1~4月には32.2%へともっとも急速に伸びました。

インテリジェントドライビング技術のロードマップが徐々に明らかになるにつれて、多くのOEMが技術的道筋、都市のカバー範囲、用途、コストの面で都市NOAに注目しています。競合は熾烈な段階に入っています。2024年以降、L2.9が普及し始めました。2024年、L2.9はまず15万元~20万元の価格帯のモデルに下降し、さらに10万元~15万元の価格帯のモデルをカバーするようになっています。これは、高レベルの自動運転に対するユーザーの認識と受容が徐々に高まっていることを示しており、高レベルの自動運転は多くのOEMのコア競争力も反映しています。

動向3:ADASのTier 1サプライヤーが徐々に5大競争陣営を形成

複数回の市場競合を経て、国内のスマートドライビングのTier 1サプライヤーは徐々に5大競争陣営を形成しています。各陣営は、差別化された技術的道筋とリソースの蓄積に依存し、独自の市場競争力を構築しています。

動向4:世界展開が加速し、国内のADAS Tier 1サプライヤーは国外に乗り出す

動向5:新たな中演算能力インテリジェントドライビングチップが性能とコストのバランスを取るコアキャリアーとなる

動向6:エンドツーエンドモデルの進化が加速する中、国内のインテリジェントドライビングの産業チェーンは「演算能力競争」から「アルゴリズム・ハードウェア協力的最適化」へと変化する

動向7:Tier 1 ADASサプライヤーは、EAIのレイアウトを加速し、技術の相同性を促進要因とする第2の成長曲線を求める

当レポートでは、中国のADASと自動運転のTier 1サプライヤーについて調査分析し、ADASシステムの搭載数と搭載率、製品とソリューションの比較などの情報を提供しています。

目次

第1章 中国のADAS市場の詳細な分析

- 中国の乗用車用ADASシステムの搭載数と搭載率(2023年~2025年)(1)

- 中国の乗用車用ADASシステムの搭載数と搭載率(2023年~2025年)(2)

- 乗用車におけるL2+ ADASの搭載数と搭載率(2024年~2025年)(1)

- 乗用車におけるL2+ ADASの搭載数と搭載率(2024年~2025年)(2)

- 乗用車におけるL2+ ADASの搭載数と搭載率(2024年~2025年)(1)

- 乗用車におけるL2+ ADASの搭載数と搭載率(2024年~2025年)(2)

- 乗用車におけるL2.5+ ADASの搭載数と搭載率(2024年~2025年)(1)

- 乗用車におけるL2.5+ ADASの搭載数と搭載率(2024年~2025年)(2)

- 乗用車におけるL2.9+ ADASの搭載数と搭載率(2024年~2025年)(1)

- 乗用車におけるL2.9+ ADASの搭載数と搭載率(2024年~2025年)(2)

- 中国の乗用車用ADASソリューション(2023年~2025年)

- 中国の乗用車用L2 ADASソリューション(2023年~2025年)

- 中国の主な新乗用車モデル向けL2 ADASソリューション(2024年)

- 中国の乗用車用L2 ADASソリューション(2023年~2024年)

- 中国の主な新乗用車モデル向けL2+ ADASソリューション(2024年)

- 中国の乗用車用L2.5 ADASソリューション(1)

- 中国の主な新乗用車モデル向けL2.5 ADASソリューション(2024年)

- 中国の乗用車用L2.9 ADASソリューション(2023年~2024年)

- 中国の主な新乗用車モデル向けL2.9 ADASソリューション(2024年)

- 中国のインテリジェントドライビング市場における4つの主要動向(2023年~2025年)

- 中国のTier 1サプライヤー間の競争パターンの探究(1)

- 中国のTier 1サプライヤー間の競争パターンの探究(2):L2/L2+インテリジェントドライビングサプライヤー市場

- 中国のTier 1サプライヤー間の競争パターンの探究(3):L2.5/L2.9インテリジェントドライビングサプライヤー市場

- 中国のTier 1サプライヤー間の競争パターンの探究(4):インテリジェントドライビングチップサプライヤー市場

- 中国のTier 1サプライヤー間の競争パターンの探究(5):インテリジェントドライビングソリューション

- 中国のTier 1サプライヤー間の競争パターンの探究(6):ADAS対応車両モデル

第2章 各Tier 1サプライヤーの製品とソリューションの比較

- 6 Major Strategic Priorities of Tier 1 ADAS Suppliers in China in 2025

- Trend 1:

- Trend 2:

- Trend 3:

- Trend 4:

- Trend 5:

- Comparison of Radar Layout between Major Tier 1 Suppliers in China

- Comparison of Front View Camera Layout between Major Tier 1 Suppliers in China

- Front View Camera Evolution of Tier 1 Suppliers

- Comparison of LiDAR Layout between Major Tier 1 Suppliers

- LiDAR Evolution

- Comparison of Domain Controllers/Computing Platforms between Major Tier 1 Suppliers in China(2)

- Comparison of Domain Controllers/Computing Platforms between Major Tier 1 Suppliers in China(6)

- Comparison of Intelligent Driving Solutions between Major Tier 1 Suppliers in China(1)

- Comparison of Intelligent Driving Solutions between Major Tier 1 Suppliers in China(2)

- Comparison of Intelligent Driving Solutions between Major Tier 1 Suppliers in China(7)

第3章 Tier 1サプライヤーの製品とソリューション

- Desay SV

- Jingwei Hirain

- Baidu Apollo

- Huawei

- Neusoft Reach

- Freetech

- iMotion

- SenseAuto

- Yihang.AI

- MAXIEYE

- Momenta

- MINIEYE

- PhiGent Robotics

- NavInfo

- QCraft

- Zhuoyu Technology

- Horizon Robotics

- DeepRoute.ai

- Joyson Electronics

- Huaqin Technology

- TZTEK

- Lenovo Vehicle Computing

- KEBODA

- Baolong Automotive

- Qianli Technology

第4章 Tier 1産業チェーンにおける競合と協力の探究

- 中国のインテリジェントドライビング市場におけるサプライチェーン関係

- 中国のTier 1サプライヤーとOEMの協力モデルの探究(1)

- 中国のTier 1サプライヤーとOEMの協力モデルの探究(2)

- 中国のTier 1サプライヤーとOEMの協力モデルの探究(3)

- 中国のTier 1サプライヤーとOEMの協力モデルの探究(4)

- 中国のTier 1サプライヤーとチップベンダーの協力モデルの探究

- 中国のソフトウェア開発とTier 1サプライヤー間の協力の探究(1)

- 中国のソフトウェア開発とTier 1サプライヤー間の協力の探究(2)

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the L2 era, international ADAS Tier 1 suppliers monopolized the market with their first-mover technology advantage. When the industry entered the arena of L2 + and above (L2 +, L2.5, L2.9), domestic ADAS Tier 1 suppliers relied on three core capabilities to achieve breakthroughs - performance optimization of mid-range computing chips, algorithm hardware coordination of end-to-end architecture, and rapid response of localized scenarios, gradually becoming the dominant force in the market.

This qualitative change in the industry is directly reflected in the continuous expansion of domestic ADAS Tier 1 suppliers in 2022: ResearchInChina's first report domestic ADAS Tier 1 suppliers only covered 7 companies, focusing on the implementation of basic functions; in 2023, it increased to 12 companies, incorporating algorithm-driven emerging players; in 2024, it expanded to 20 companies, covering cross-border transformation players; and in 2025, it included 25 companies.

ResearchInChina systematically deconstructs the strategic layout (global expansion, cross-border technology), technical paths (chip selection, end-to-end intelligent driving iteration), and product portfolio strategies (intelligent driving solutions, driving-parking integration, cockpit-driving, driving-parking integration, central computing platforms and other domain control products) of 25 domestic ADAS Tier 1 suppliers in 2024-2025, and summarizes seven major evolution trends:

Trend 1: L2.5/L2.9 becomes the fastest-growing market segment with the highest installation rate in new cars

From the perspective of the incremental market (newly launched vehicles), the domestic intelligent driving installation pattern of passenger cars shows a significant trend of differentiation during 2023-2025. L2.5/L2.9 intelligent driving has grown by leaps and bounds. Only 4.57% and 3.3% of new models launched in 2023 were equipped with L2.5 and L2.9 smart driving, respectively. However, by January-April 2025, the proportion of new cars equipped with L2.5 smart driving had soared to 30.20%, and L2.9 34.82%, showing strong market penetration.

The installation rate of traditional L1-L2 intelligent driving functions continues to decline, reflecting that consumers' demand for higher-level intelligent driving functions is reshaping the market structure.

Trend 2: In 2024-2025, intelligent driving entered the "turning point" in terms of popularization, from a "high-end optional" to a "nationwide standard"

In 2023, L2.9 ADAS functions targeted mid-range and high-end models. From the perspective of installation rate, models with a price of RMB250,000-300,000 and above RMB300,000 had a higher installation rate. Specifically, models with a value of RMB 250,000 to RMB 300,000 had the highest L2.9 installation rate which increases from 23.4% in 2023 to 53.5% in January-April 2025. The L2.9 installation rate of high-end models worth RMB 500,000 or more grew the fastest from 7.5% in 2023 to 32.2% in January-April 2025.

As the roadmap for intelligent driving technology gradually becomes clearer, many OEMs are focusing on urban NOA in terms of technology paths, city coverage, application and costs. Competition has entered a fierce stage. Since 2024, L2.9 has begun to spread. It first descended to models priced between RMB150,000 and RMB200,000 in 2024 and further covered models priced at RMB100,000~150,000 This shows that users' recognition and acceptance of high-level autonomous driving are gradually increasing,and high-level autonomous driving also reflects the core competitiveness of many OEMs.

Trend 3: Tier 1 suppliers of ADAS gradually form five major competitive camps

After multiple rounds of market competition, domestic Tier 1 suppliers of smart driving have gradually formed five major competitive camps. Each camp relies on differentiated technology paths and resource endowments to build unique market competitiveness:

Camp 1: Local veteran Tier 1 suppliers who transfer to full-stack solutions

With Desay SV and Jingwei Hirain as typical representatives, they focus on building full-stack capabilities of "hardware-software-services" by virtue of their long-term experience in hardware research and development and stable customer base. By strengthening the development of intelligent driving software (such as perception algorithm iteration, planning and control strategy optimization), they are transforming from traditional hardware suppliers to providers of integrated hardware and software solutions, and take "full product line coverage + customer ecosystem precipitation" as a barrier to deeply bind the intelligent driving system upgrade needs of independent and joint venture OEMs.

Camp 2: International Tier 1 suppliers who propose localization

With Bosch, Continental, and Aptiv as the core, they have long dominated the domestic L2 ADAS market (such as ACC and AEB) thanks to their global technology research and development systems. As the demand for high-level assisted driving rises, they cooperate with domestic OEMs and ADAS start-ups through "technology licensing + local collaboration" to accelerate the localization adaptation of intelligent driving solutions, and simultaneously deploy high-level assisted driving scenarios such as L2+/L2.5/L2.9 to dominate the market.

Camp 3: Algorithm-driven Tier 1 suppliers

Algorithm-driven Tier 1 suppliers represented by Freetech, iMotion, Zhuoyu, QCraft, Momenta, and SenseAuto start from the core capabilities of algorithms/software (such as end-to-end planning and control, visual perception algorithms), vertically integrate sensors (such as customized cameras, lidar adaptation), domain controller hardware research and development through the "downward technology extension" strategy, and horizontally expand full-stack intelligent driving solutions. With "software-defined intelligent driving" as the core, they focus on the L2+ and higher-level markets, and gradually become mainstream suppliers by virtue of fast algorithm iteration and scenario adaptability.

Camp 4: Technology companies

Technology companies represented by Baidu and Huawei have become novel top Tier 1 suppliers in China, with full-stack software and hardware solutions.

Camp 5: Companies which conduct cross-border transformation

They entered the market from auto parts and other fields, typical examples being Huaqin, TZTEK, Keboda and other companies. In the wave of electrification, connectivity, intelligence and sharing from 2019 to 2022, they laid out intelligent driving domain controller product lines on the basis of their existing supply chain resources. Through "hardware research and development + ecological cooperation" (teaming up with algorithm companies to supplement software capabilities), they quickly entered the intelligent driving hardware market and filled the gap between traditional components and intelligent driving systems.

Each camp forms differentiated competition around technical barriers (full stack/algorithm/hardware), market positioning (L2-L2.9), and ecological synergy (OEM binding/cross-border cooperation), and jointly promotes the domestic intelligent driving Tier 1 suppliers ecology from "hardware dependence" to "technical independence" and from "functional coverage" to "deep scenario cultivation".

Trend 4: Global layout accelerates, and domestic Tier 1 ADAS suppliers embark go overseas

In the era of Assisted Driving 2.0, the speed of technology iteration and localized response capabilities have become new competitive factors. Chinese companies are breaking the traditional supply chain pattern with rapid innovation in the fields of smart cockpits, domain controllers, etc. (such as cockpit-driving integration solutions, multi-sensor fusion algorithms), as well as the cost advantages brought by large-scale production.

For domestic leading Tier 1 ADAS suppliers, relying on stable growth in cash flow and deep technical accumulation, accelerating global layout has become their core strategy to break through the market ceiling and enhance international competitiveness.

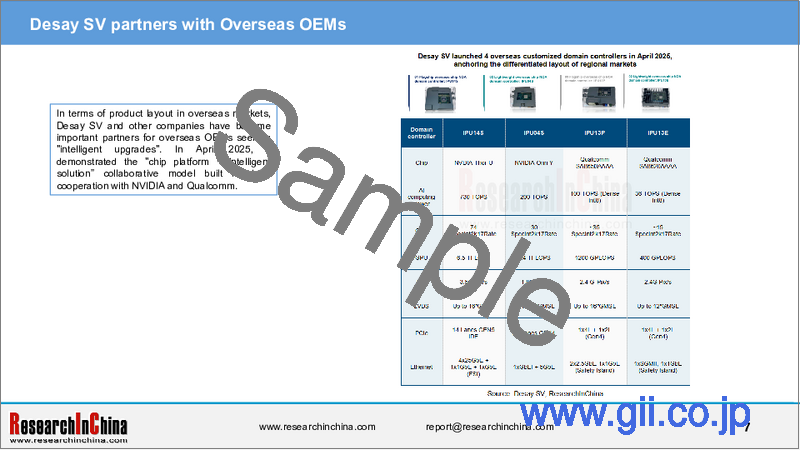

For example, Desay SV is building a globally competitive intelligent driving solution system through a combination strategy of "product adaptation + local development + ecological integration". From 2020 to 2024, its overseas revenue increased year by year with a compound growth rate of 28.9%, reaching RMB1.708 billion in 2024.

In terms of product layout in overseas markets, Desay SV and other companies have become important partners for overseas OEMs seeking "intelligent upgrades". In April 2025, it demonstrated the "chip platform + intelligent solution" collaborative model built in deep cooperation with NVIDIA and Qualcomm.

Trend 5: The emerging medium-computing-power intelligent driving chips have become the core carrier for balancing performance and cost

ResearchInChina 's survey on the new solutions of 25 domestic Tier 1 ADAS suppliers in 2024-2025 shows that L2.5/L2.9 mainly requires the computing power of 80-150TOPS (automotive-grade AI computing power), which is exactly offered by mid-range chips - compared with high-end chips (300TOPS and above), their unit computing power cost is reduced by more than 60%, and they can cover more than 90% of scenarios through algorithm optimization, accurately matching the mainstream market's demand for "uncompromising performance, affordable cost".

The current domestic intelligent driving chip market has seen a core triangle ecology consisting of Horizon Robotics, Qualcomm, and NVIDIA, but the positioning of the three is significantly differentiated:

NVIDIA Orin still dominates the high-end market (vehicles priced above RMB300,000), supporting L2+ to L4 functions in all scenarios with its CUDA ecosystem and high computing power (254-2000TOPS), but its BOM cost is high and it is difficult to sink into the mainstream market;

Qualcomm Snapdragon Ride Flex relies on the heterogeneous computing advantages of mobile chips to occupy a certain share in "cockpit-driving integration", and its automotive-grade mass production cycle and ecological adaptability should be improved;

Horizon Journey 6 (J6E/J6M) has become the core carrier of domestic substitution: more than half of the new intelligent driving solutions launched in 2024-2025 choose Horizon J6E/J6M, forming a technical path of "algorithm optimization drives computing power efficiency improvement, and hardware cost adapts to mid-range market demand", presenting a differentiated development logic of "intelligent driving algorithm addition and computing power configuration subtraction", making up for the marginal cost of computing power through algorithm innovation, and achieving a balance between performance and cost.

Trend 6: Amid the accelerated evolution of end-to-end models, the domestic intelligent driving industry chain is transforming from "computing power competition" to "algorithm-hardware collaborative optimization"

Starting from 2023, the evolution of end-to-end models has accelerated, and the domestic intelligent driving industry chain is transforming from "computing power competition" to "algorithm-hardware collaborative optimization". Major intelligent driving chip companies have promoted intelligent driving technology to a wider market through ecological layout. From the perspective of mass production and delivery, the leading Tier 1 ADAS suppliers made breakthroughs in mass production based on end-to-end model architectures and covered many models from AITO, IM, WEY Blue Mountain, Li Auto and so on in 2024-2025.

In the dimension of technological evolution, Tier 1 ADAS suppliers accelerate breakthroughs through architecture iteration and model upgrades. Huawei built an end-to-end perception base with GOD 2.0 + RCR 2.0 in 2023, and it advanced to WEWA to realize a "vehicle-cloud" behavior model closed loop in 2025. SenseAuto transitioned from "perception integration" to UniAD in 2023-2024, and launched a generative intelligent driving solution in 2025, introducing reinforcement learning. With the help of "world model + reinforcement learning", vehicles will have long-term thinking chain reasoning capabilities and make human-like decision-making. In April 2025, QCraft officially announced a one-model end-to-end solution based on a single Horizon J6M chip.

Huawei WEWA: It consists of the world engine on the cloud and the world action model on the vehicle. The world engine on the cloud side uses diffusion generation model technology to generate various extreme driving scenarios, such as bizarre accidents (for example, when there is a vehicle or obstacle blocking the view ahead, a non-motorized vehicle or pedestrian suddenly jumps out from the roadside, and the driver fails to avoid it in time, often causing an accident) and sudden braking of the front car, etc., to solve the long-tail problems that are common in the industry in the way of "AI training AI". The world action model on the vehicle is trained based on sensor data, builds a native base model, and introduces the MOE system.

SenseAuto R-UniAD innovatively introduces a world model and reinforcement learning to build a new paradigm of generative intelligent driving. The "SenseAuto Enlightenment" world model accurately simulates the physical laws, traffic rules and motion laws of the real world through 3D reconstruction and physical modeling, and builds a "virtual environment" similar to the Go board. Reinforcement learning repeatedly simulates problem scenarios, optimizes the end-to-end model, solves specific scenario problems and achieves generalization, breaks through the upper limit of human driving behavior and reduces the cost and risk of data collection. It is expected that by the end of 2025, this intelligent driving solution will be mass-produced for vehicles.

QCraft's one-model end-to-end solution based on the single journey chip: In terms of software algorithms, in order to address the safety risks caused by the black box characteristics of end-to-end technology, QCraft integrates the "space-time joint planning" experience that has been fully verified in mass production into the one model end-to-end design. In the online model training stage, a safety alignment mechanism is introduced; at the offline training level, a world model based on motion simulation is adopted. From model architecture design, training strategy, to technical infrastructure, it is ensured that the entire end-to-end model can fully play the advantages of flexibility and high upper limit, and high lower limit and higher safety can also be achieved.

Momenta's R6 flywheel model: In 2024, the one-model end-to-end solution was implemented on a large scale, and was available nationwide. In the second half of 2025, the R6 flywheel model based on reinforcement learning will be released, and reinforcement learning will be introduced for model training.

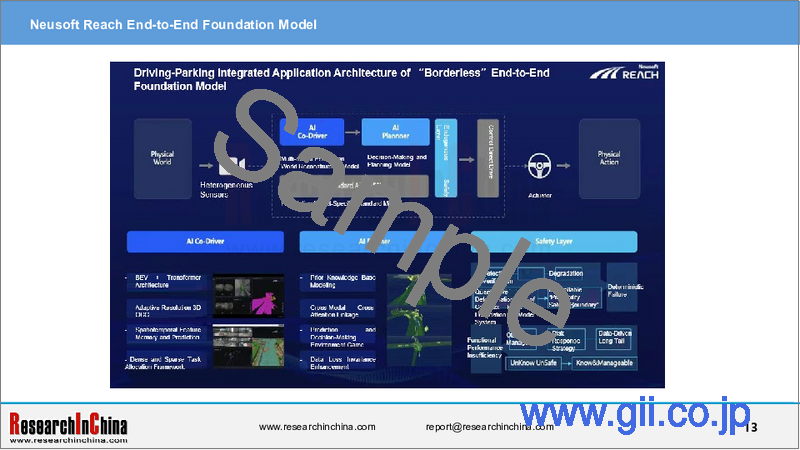

Neusoft Reach launched the next-generation two-model end-to-end solution at the end of 2024: AI Co-Driver (world restoration model) + AI Planner (decision-making & planning model)

Neusoft Reach's full-stack self-developed end-to-end model architecture is based on the AI Co-Driver. Through heterogeneous sensor fusion, the real physical world is mapped into high-dimensional vector data to provide a basis for decision-making; on the other hand, based on the AI Planner, it combines physical laws with human common sense modeling to achieve a closed loop in complex scenarios. In order to solve problems like the "black box principle", high debugging difficulty and poor explainability of AI foundation model technology, the company has established an intrinsic safety layer for foundation model applications, aiming to empower all L2 assisted driving products with functional safety mechanisms, SOTIF mechanisms and a full-process quality system for safe development that meet the safety requirements of advanced assisted driving, and significantly improve the overall safety level.

Trend 7: Tier 1 ADAS suppliers accelerate the layout in EAI and seek a second growth curve driven by technology homology

In essence, Tier 1 ADAS suppliers enter the EAI arena to build a new growth engine through "automotive intelligent technology spillover". Intelligent driving and EAI are highly reused at the level of sensors (lidar/cameras), computing power platforms (automotive-grade chips), and algorithms (path planning/motion control). Tier 1 ADAS suppliers can embark on the pan-robotics field with "automotive-grade technology". From the perspective of the products deployed, there are "hardware migration" and "software empowerment"; from the perspective of access, acquisition, investment, establishment of subsidiaries, etc. are the ways.

Analysis on iMotion's entry into EAI

iMotion has acquired related companies and anchored specific application scenarios such as charging to accurately enter the robot arena. iMotion Robot, a wholly-owned subsidiary of iMotion, went into operation in March 2025, integrating autonomous driving and robotics technology, targeting the EAI market. On May 12, 2025, iMotion Robot acquired 2/3 of Suzhou Little Craftsman Robot's shares and became the controlling shareholder of the latter.

Lenovo Vehicle Computing's layout in the pan-robotics field

Lenovo Vehicle Computing launched the pan-robotics intelligent computing platform - RH1 in May 2025. The domain controller has a DL computing power of up to 2000TOPS, supports FP4 to provide Drive-LLM support for LLMs and VLMs, accelerates edge deployment and performance optimization, and provides a solid foundation for multimodal intelligent applications. In addition, Lenovo Vehicle Computing has strategically invested in a number of pan-robotics companies through "financial support + technology output + joint development", and achieved large-scale applications in multiple fields of pan-robotics.

China's intelligent driving industry is undergoing a critical transition from technology verification to value realization. Cost optimization driven by mid-range computing chips, algorithm hardware collaboration led by end-to-end architectures, ecological breakthroughs accelerated by global layout, and technology spillover effects initiated by EAI jointly forge the core momentum of industrial upgrading.

Table of Contents

1 In-depth Analysis on the Chinese ADAS Market

- Installation Volume and Installation Rate of Passenger Car ADAS System in China, 2023-2025 (1)

- Installation Volume and Installation Rate of Passenger Car ADAS System in China, 2023-2025 (2)

- Installations and Installation Rate of L2+ ADAS in Passenger Cars, 2024-2025 (1)

- Installations and Installation Rate of L2+ ADAS in Passenger Cars, 2024-2025 (2)

- Installations and Installation Rate of L2+ ADAS in Passenger Cars, 2024-2025 (1)

- Installations and Installation Rate of L2+ ADAS in Passenger Cars, 2024-2025 (2)

- Installations and Installation Rate of L2.5+ ADAS in Passenger Cars, 2024-2025 (1)

- Installations and Installation Rate of L2.5+ ADAS in Passenger Cars, 2024-2025 (2)

- Installations and Installation Rate of L2.9+ ADAS in Passenger Cars, 2024-2025 (1)

- Installations and Installation Rate of L2.9+ ADAS in Passenger Cars, 2024-2025 (2)

- ADAS Solutions for Passenger Cars in China, 2023-2025

- L2 ADAS Solutions for Passenger Cars in China, 2023-2025

- L2 ADAS Solutions for Main New Passenger Car Models in China, 2024

- L2 ADAS Solutions for Passenger Cars in China, 2023-2024

- L2+ ADAS Solutions for Main New Passenger Car Models in China, 2024

- L2.5 ADAS Solutions for Passenger Cars in China (1)

- L2.5 ADAS Solutions for Main New Passenger Car Models in China, 2024

- L2.9 ADAS Solutions for Passenger Cars in China, 2023-2024

- L2.9 ADAS Solutions for Main New Passenger Car Models in China, 2024

- Four Major Trends in China's Intelligent Driving Market, 2023-2025

- Exploration of Competitive Pattern between Tier 1 Suppliers in China (1)

- Exploration of Competitive Pattern between Tier 1 Suppliers in China (2): L2/L2+ Intelligent Driving Supplier Market

- Exploration of Competitive Pattern between Tier 1 Suppliers in China (3): L2.5/L2.9 Intelligent Driving Supplier Market

- Exploration of Competitive Pattern between Tier 1 Suppliers in China (4): Intelligent Driving Chip Supplier Market

- Exploration of Competitive Pattern between Tier 1 Suppliers in China (5): Intelligent Driving Solutions

- Exploration of Competitive Pattern between Tier 1 Suppliers in China (6): ADAS-supported Vehicle Models

2 Comparison of Products and Solutions between Tier 1 Suppliers

- 6 Major Strategic Priorities of Tier 1 ADAS Suppliers in China in 2025

- Trend 1:

- Trend 2:

- Trend 3:

- Trend 4:

- Trend 5:

- Comparison of Radar Layout between Major Tier 1 Suppliers in China

- Comparison of Front View Camera Layout between Major Tier 1 Suppliers in China

- Front View Camera Evolution of Tier 1 Suppliers

- Comparison of Lidar Layout between Major Tier 1 Suppliers

- Lidar Evolution

- Comparison of Domain Controllers/Computing Platforms between Major Tier 1 Suppliers in China (2)

- Comparison of Domain Controllers/Computing Platforms between Major Tier 1 Suppliers in China (6)

- Comparison of Intelligent Driving Solutions between Major Tier 1 Suppliers in China (1)

- Comparison of Intelligent Driving Solutions between Major Tier 1 Suppliers in China (2)

- Comparison of Intelligent Driving Solutions between Major Tier 1 Suppliers in China (7)

3 Products and Solutions of Tier 1 Suppliers

- 3.1 Desay SV

- Profile

- Core Business Layout

- Strategic Priorities in 2025

- Operation in 2024

- R&D Investment and Key R&D Projects in 2024

- Supply Chain Distribution and Core Clients in 2024

- Intelligent Driving Layout

- Intelligent Driving Sensor Layout

- Front View Camera: 17MP

- Forward Radar: FRD02/03

- Corner Radar: CRD03P, CRD03H

- Intelligent Driving Domain Controller (1): Domain Controller Evolution

- Intelligent Driving Domain Controller (2)

- Launch of Next-generation Central Computing Platform: ICPS02H

- Deep Cooperation with NVIDIA and Qualcomm

- Cockpit-driving Integration Solution: ICPS01E

- Intelligent Driving Cooperation Model

- Smart Solution

- Major Customers and Ecological Partners

- 3.2 Jingwei Hirain

- Profile

- Business Model

- Strategic Priorities in 2025

- Overseas Strategy

- Operation in 2024

- Progress of the Top Ten Research Projects in 2024

- Core Business

- Progress of Key Core Technologies in the Field of Intelligent Driving in 2024

- Intelligent Driving Layout (1)

- Intelligent Driving Layout (2)

- Main sensors

- Radar Layout

- Parameters of 4D Radar

- Launch of Long-range Imaging Radar: LRR615

- LiDAR layout

- High-precision Positioning Module

- IFC Evolution

- Overview of Driving-Parking Integrated Products

- Driving-Parking Integrated Controller: ADCU (1)

- Driving-Parking Integrated Controller: ADCU (2)

- High-end Intelligent Driving Domain Controller: New Product

- High Performance Computing (HPC) Platform

- Central Computing Platform (CCP)

- Customers and Ecological Partners

- 3.3 Baidu Apollo

- Profile

- Strategic Layout in the Field of Intelligent Driving

- Business Model

- Intelligent Driving Technology

- Intelligent Product Matrix Layout

- Intelligent Driving Sensor Layout

- Intelligent Driving Positioning + Map

- Apollo Computing Unit (ACU)

- Algorithm + Chip Layout (1)

- Algorithm + Chip Layout (2)

- Algorithm + Chip Layout (8)

- Chassis-by-Wire Technology

- Intelligent Driving Solution

- City Driving Max (1)

- City Driving Max (2)

- ASD (1)

- ASD (2)

- Highway Driving Pro

- Apollo Parking

- Cockpit-driving Integration

- Intelligent Driving Hardware Configuration Solution - Perception

- Business Model 2: Robotaxi Commercialization Progress (1)

- Business Model 2: Robotaxi Commercialization Progress (2)

- Business Model 2: Robotaxi Commercialization Progress (3)

- Intelligent Driving Business Partners

- 3.4 Huawei

- Profile

- Business of Intelligent Automotive Solution (IAS) Business Unit (BU) (1)

- Business of Intelligent Automotive Solution (IAS) Business Unit (BU) (2)

- Camera

- Radar (1)

- Radar (2)

- Lidar (1): 96 Lines and 192 Lines

- Lidar (2): 96 Lines and 192 Lines

- Lidar (3): High-precision Solid-state Lidar

- Lidar Product Portfolio and Technology Evolution

- MDC Intelligent Driving Computing Platform (1)

- MDC Intelligent Driving Computing Platform (2)

- MDC Intelligent Driving Computing Platform (3)

- MDC Intelligent Driving Computing Platform (4)

- Central Supercomputing (ADCSC)

- HI Full-stack Intelligent Vehicle Solution (1)

- HI Full-stack Intelligent Vehicle Solution (2)

- ADS 1.0

- ADS 2.0 (1)

- ADS 2.0 (2): Driving

- ADS 2.0 (3): Parking

- ADS 2.0 (4)

- ADS 3.0 (1): End-to-end

- ADS 3.0 (2): End-to-end

- ADS 3.0 (3): ASD 3.0 VS. ASD 2.0

- ADS 4.0 (1): WEWA

- ADS 4.0 (2): Sensor Hardware Configuration

- ADS 4.0 (3): ASD 4.0 VS. ASD 3.0

- ADS 4.0 (4): Comparison of Intelligent Driving Versions

- Intelligent Driving Route (ADS 1.0->ADS 4.0)

- Production Models and Customers

- Strategic Goals for Humanoid Robots

- Progress in Commercialization of Humanoid Robots

- 3.5 Neusoft Reach

- Profile

- Autonomous Driving Product Matrix

- Front View Smart Camera (1): X- Cube3.0

- Front View Smart Camera (2): X- Cube4.0

- X-Cube Evolution

- ADAS Domain Controller: M-box

- Driving-parking Integrated Domain Controller (1): X-BOX 3.0 & X-BOX 4.0

- Driving-parking Integrated Domain Controller (2): X-BOX 3.0 & X-BOX 4.0

- Driving-parking Integrated Domain Controller (2): X-BOX 5.0

- X-BOX Evolution (1)

- X-BOX Evolution (2)

- End-to-end Foundation Model (1)

- End-to-end Foundation Model (2)

- End-to-end Foundation Model Helps Upgrade the Intelligent Driving Product Matrix (1)

- End-to-end Foundation Model Helps Upgrade the Intelligent Driving Product Matrix (2)

- Central Computing Platform (1)

- Central Computing Platform (2)

- SOA

- Basic Software: NeuSAR (1)

- Basic Software: NeuSAR (2)

- Intelligent Driving Partners and Mass Production Customers

- 3.6 Freetech

- Profile (1)

- Profile (2)

- Product Matrix

- Operation in 2022~2024

- Intelligent Driving Solution (1)

- Intelligent Driving Solution (2)

- Intelligent Driving Solution (3)

- ODIN: ODIN 1.0->ODIN 3.0

- Domain Controller Solution and Evolution

- Domain Controller Solution 1: ADC15, ADC1x

- Domain Controller Solution 2: ADC20

- Domain Controller Solution 2: Architecture of ADC20

- Domain Controller Solution 3: ADC25-J "Smart Sharing Universal Edition"

- Domain Controller Solution 3: Architecture of ADC25

- Domain Controller Solution 4: ADC30

- Domain Controller Solution 4: Architecture of ADC30

- Domain Controller Solution 5: Architecture of the Next-generation ADC-X

- Perception Solution Configuration

- Camera: Front View Camera for Passenger Cars

- Camera: FVC3

- Camera Module (1)

- Camera Module (2)

- Radar

- CMS, DMS

- Recent Dynamics and Mass Production Designation

- 3.7 iMotion

- Profile

- Strategic Layout and Planning

- Innovative Business Exploration: Robot Arena

- Operation in 2024

- Business Model

- Product Matrix

- Front View All-in-one: iFC series

- Domain Controller (1): SuperVison

- Domain Controller (2): iDC100/iDC300/iDC500

- Domain Controller (3): IDC 510Pro/IDC 510 Based on Horizon J6

- Intelligent Driving Solution

- Intelligent Driving Technology Evolution

- Autonomous Driving Algorithm and Software (1)

- Autonomous Driving Algorithm and Software (2)

- Autonomous Driving Algorithm and Software (3)

- Autonomous Driving Algorithm and Software (4)

- Production Models and Major Partners

- 3.8 SenseAuto

- Profile

- Strategic Priorities in the Field of Intelligent Driving in 2025

- Intelligent Driving Layout

- "Cockpit-driving-cloud" Trinity Layout

- Intelligent Driving Solution

- Comparison of Intelligent Driving Solutions of Five Major Intelligent Driving Suppliers Based on Horizon J6M

- Comparison of SOP of Six Major Intelligent Driving Suppliers Based on Horizon J6M

- End-to-end Autonomous Driving Evolution

- Generative Intelligent Driving: R-UniAD (1)

- Generative Intelligent Driving: R-UniAD (2)

- Comparison of Tier 1 Solutions That Use "Reinforcement Learning + World Model" to Deeply Integrate and Open a New Paradigm for End-to-end Intelligent Driving

- Intelligent Simulation Toolchain, Technology Innovation and Cost Reduction

- Mass Production

- 3.9 Yihang.AI

- Profile

- Strategic Layout in 2025

- NOA SOP

- Product Matrix

- Duxing Intelligent Driving Platform Three Versions of Urban Intelligent Driving

- Solution 1: Front View All-in-one

- Solution 2: Basic Version of Driving-parking Integration

- Solution 3: Flagship Version of Driving-parking Integration

- Solution 4: NOA Driving-parking Integrated Algorithm Model

- Specialized Camera

- Cooperation Model and Dynamics

- 3.10 MAXIEYE

- Profile

- Intelligent Driving Technology Development Strategy

- Intelligent Driving Business and Planning

- Visual Perception System

- Full-stack Intelligent Driving Technology

- Intelligent Driving Solution

- MAXIPILOT 1.0

- MAXIPILOT 1.0 PLUS

- MAXIPILOT 2.0-NOM

- Partners

- 3.11 Momenta

- Profile

- Autonomous Driving Strategy

- Intelligent Driving Technology Evolution

- L4 Robotaxi Layout

- Intelligent Driving Solution (1)

- Intelligent Driving Solution (2)

- Algorithm Development Path

- End-to-end Solution (1)

- End-to-end Solution (2)

- Core Algorithm (1)

- Core Algorithm (2)

- Production Models

- 3.12 MINIEYE

- Profile (1)

- Profile (2)

- Operation in the Past Four Years

- Product Matrix

- Product Layout in the Field of Intelligent Driving (1)

- Product Layout in the Field of Intelligent Driving (2)

- iPilot Series: iPilot 4 and iPilot 4 Plus

- iPilot Series: iPilot 2/3/3 plus

- iPilot Series: iPilot 1/1 eco/1 plus

- iSafety Product: D2

- iPilot 1 Driving-Parking Integration Hardware Structure

- iPilot 1Driving-Parking Integration System Structure

- iPilot 1 Driving-Parking Integration Time-Division Multiplexing

- Trends, Customers and Development Direction in 2022-2025

- 3.13 PhiGent Robotics

- Profile

- Core Technology

- Binocular Stereo Vision Technology

- Intelligent Driving Solution

- PhiGo Pro Autonomous Driving Solution Based on Journey 6

- PhiGo Pro Intelligent Driving Solution: Based on J6E

- End-to-end Foundation Model (1)

- End-to-end Foundation Model (2)

- End-to-end Foundation Model (3)

- Phigo Pro (single-J5 version) (1)

- Phigo Pro (single-J5 version) (2)

- PhiVision 1.0 (1)

- PhiVision 1.0 (2)

- PhiVision 2.0

- PhiMotion1.0

- PhiMotion2.0

- PhiCMS

- Camera

- Positioning in Robot Industry Chain

- Dynamics and Partners

- 3.14 NavInfo

- Profile

- Four Main Business Lines (1)

- Four Main Business Lines (2)

- New Product Technology Layout amid the Five Major Trends in the Industry

- Strategic Layout in Intelligent Driving in 2025

- Operation in 2024

- Intelligent Driving Product Matrix

- Product Planning

- Driving-parking Integration Solution (1)

- Driving-parking Integration Solution (2)

- New Driving-parking Integration Product: Based on SA8620/SA8650

- Cockpit-parking Integration Product: SA8255

- Cockpit-driving-parking Integration Product: AC8025+J3

- Cockpit-driving Integrated Domain Controller Solution

- Application Service Capabilities

- Ecological Partners

- Major Customers and Partners

- Production model

- 3.15 QCraft

- Profile

- "Dual Engine Strategy"

- Product Matrix in the Field of Intelligent Driving

- Robobus Layout

- Intelligent Driving Solution Evolution

- Release of End-to-end Urban NOA Solution Based on Single Journey 6M

- Comparison between Intelligent Driving Solutions Based on Horizon J5 and J6

- One-model End-to-end Architecture

- Mid- to High-end Intelligent Driving Products and Solutions Based on Journey 6 (1)

- Mid- to High-end Intelligent Driving Products and Solutions Based on Journey 6 (2)

- Mid- to High-end Intelligent Driving Products and Solutions Based on Journey 5 (1)

- Mid- to High-end Intelligent Driving Products and Solutions Based on Journey 5 (2)

- Core Intelligent Driving Technology (1)

- Core Intelligent Driving Technology (2)

- Data and Model Training Closed Loop

- Partners

- 3.16 Zhuoyu Technology

- Profile

- Development History

- Automotive Product Layout: Hardware

- Automotive Product Layout: Camera

- Automotive Product Layout: INS with Trinocular Vision and LiDAR Assembly (1)

- Automotive Product Layout: INS with Trinocular Vision and LiDAR Assembly (2)

- Automotive Product Layout: blind-spot filling radar - Zhizhou

- Intelligent Driving Domain Controller (1)

- Intelligent Driving Domain Controller (2)

- Chengxing Platform

- Chengxing Platform-based Intelligent Driving Solution Evolution

- End-to-end World Model

- GenDrive: Generative Intelligent Driving Solution Based on End-to-end World model

- Two-Model End-to-end Parsing

- One-Model Explainable End-to-end Parsing

- VLA Model and L3/L4 Intelligent Driving Planning

- End-to-end Mass Production Customers

- Cooperative Production Model

- 3.17 Horizon Robotics

- Profile (1)

- Profile (2)

- Intelligent Driving Team Organizational Structure Adjustment

- Intelligent Driving Solution (1)

- Intelligent Driving Solution (2)

- Intelligent Driving Chip Series

- J6 Has Become the Choice of Many OEMs

- Intelligent Driving Solutions Based on J6M

- 3.18 DeepRoute.ai

- Product Layout and Strategic Deployment

- Intelligent Driving Evolution

- Intelligent Driving Solution (1)

- Intelligent Driving Solution (2)

- Intelligent Driving Solution (3)

- Frontier Technology Layout

- Launch of VLA Model

- Architecture of VLA

- Production model

- 3.19 Joyson Electronics

- Profile

- Product and Solution Portfolio

- Operation in 2024

- Relationship between Joynext and Joyson Electronics

- Profile of Joynext

- Key Points of Joynext's Strategic Layout in 2025-2026

- Joynext's Driving-parking Integrated Domain Controller

- Joynext's Front View All-in-one: nCam Series

- Joynext's Cockpit-driving Integration Solution: nCCU Series

- 3.20 Huaqin Technology

- Profile

- Operation in 2024

- Product Layout in the Automotive Electronics Field

- Intelligent Driving Domain Controller: Based on Horizon J6E/J6M

- Other Intelligent Driving Hardware Products

- 3.21 TZTEK

- Profile

- Revenue in 2024

- Layout in the Pan-robotics Field

- Layout in the Field of Intelligent Driving

- Domain Controller in the Passenger Car OEM Market

- L4 Domain Controller: TADC-Orin-2

- 3.22 Lenovo Vehicle Computing

- Profile

- Intelligent Driving Product Layout

- Intelligent Driving Product SOP and Customers

- Layout in the Pan-robotics Field

- 3.23 KEBODA

- Profile

- Operation in 2024

- Layout in the Field of Intelligent Driving (1)

- Layout in the Field of Intelligent Driving (2)

- Layout in the Field of Intelligent Driving (3)

- 3.24 Baolong Automotive

- Profile (1)

- Profile (2)

- Business Focus in 2025

- Operation in 2024

- Layout in the Field of Intelligent Driving (1)

- Layout in the Field of Intelligent Driving (2)

- Intelligent Driving Solution

- Driving-parking Integrated Domain Controller

- Front View All-in-one (1)

- Front View All-in-one (2)

- Radar

- Ultrasonic Radar

- 3.25 Qianli Technology

- Profile

- Intelligent Driving Solution and Roadmap

- Positioning and Strategy

4 Exploration of Competition & Cooperation in Tier 1 Industry Chain

- Supply Chain Relationships in China's Intelligent Driving Market

- Exploration of Cooperation Model between Tier 1 Suppliers and OEMs in China (1)

- Exploration of Cooperation Model between Tier 1 Suppliers and OEMs in China (2)

- Exploration of Cooperation Model between Tier 1 Suppliers and OEMs in China (3)

- Exploration of Cooperation Model between Tier 1 Suppliers and OEMs in China (4)

- Exploration of Cooperation Model between Tier 1 Suppliers and Chip Vendors in China

- Exploration of Software Development and Cooperation between Tier 1 Suppliers in China (1)

- Exploration of Software Development and Cooperation between Tier 1 Suppliers in China (2)