|

|

市場調査レポート

商品コード

1441454

自動車用AUTOSARプラットフォーム(2024年)Automotive AUTOSAR Platform Research Report, 2024 |

||||||

|

|||||||

| 自動車用AUTOSARプラットフォーム(2024年) |

|

出版日: 2024年02月18日

発行: ResearchInChina

ページ情報: 英文 410 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

AUTOSARは、ソフトウェア定義車両への動向の中で、よりオープンで協調的なエコシステムへと進化しています。

2023年12月7日、AUTOSARは最新規格、AUTOSAR Release R23-11をリリースしました。機能面では、情報セキュリティ、機能安全、通信プロトコルスタックの3つの側面に重点を置いた更新となっています。

Release R23-11では、AUTOSARアダプティブプラットフォーム(AP)のアーキテクチャが再調整され、その機能が再編成されて記述されています。アーキテクチャはFoundation、Platform Service、Standardized App/Interface、Vehicle Serviceに再分割されます。

ここで、Vehicle Serviceの機能コンポーネント(FC)は、APのすべてのマシン上に配置される必要はありませんが、車両内で利用可能です。Platform Serviceは、単一のAPマシンに対して特定の機能を提供することに部分的に責任を負い、Standardized App/Interfaceは、標準インターフェースまたはアプリケーションを提供し、Foundationは、APマシンのローカル機能とC++ライブラリを提供します。

AUTOSARは、機能標準のアップグレードと改良の継続的な活動に加え、よりオープンな姿勢で他のサードパーティ組織と協力し、新たな自動車エコシステムを構築し、ソフトウェア定義車両のような新たな動向に直面するインテリジェントビークル市場の活況を後押しします。

2023年3月、AUTOSAR、COVESA、Eclipse SDV、SOAFEは共同でSDV Allianceを設立しました。この提携の主な目的は、SDVエコシステムにおける活動を連携させることです。SDV Allianceは、これらの取り組みやその他の外部組織からSDVに関する既存の記述を取り入れることで、SDVを構成する要素の明確で統一された定義に合意します。

次に、Allianceは各組織のさまざまな技術、調査手法、標準に目を向け、SDVの開発においてそれらがどのように協力できるかを示します。SDVは単一の産業コンソーシアムで扱うには概念的に複雑すぎることを認識し、各組織のコアコンピタンスとさまざまな実行環境を検討することで、Allianceはこれらのスキルを結集して共同のSDVビジョンを作成します。

CES 2024において、SDV Allianceは最初の統合青写真を発表し、ソフトウェア定義車両の促進に寄与します。

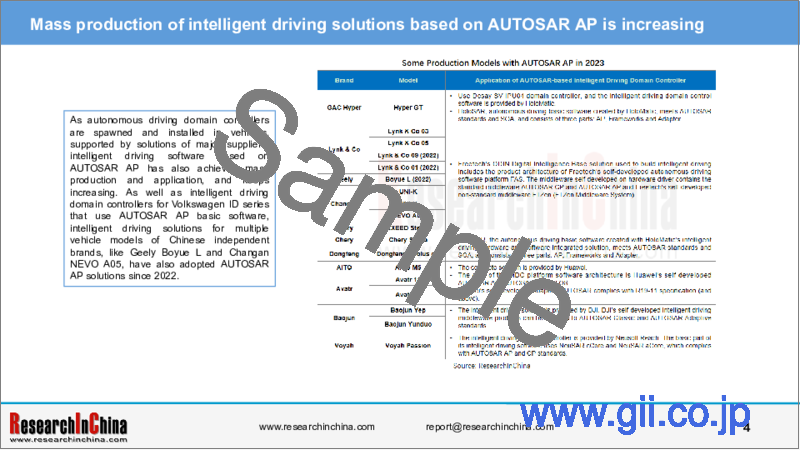

AUTOSAR APに基づくインテリジェントドライビングソリューションの量産が増加しています。

主要サプライヤーのソリューションに支えられ、自律走行ドメインコントローラーが誕生し、車両に搭載される中、AUTOSAR APベースのインテリジェントドライビングソフトウェアも量産および利用を実現し、増加の一途をたどっています。VolkswagenIDシリーズのインテリジェントドライビングドメインコントローラーがAUTOSAR AP基本ソフトウエアを採用しているほか、2022年以降、Geely Boyue LやChangan NEVO A05など、中国独立系ブランドの複数の車種のインテリジェントドライビングソリューションもAUTOSAR APソリューションを採用しています。

Freetechは、自社開発の自律走行ソフトウェアプラットフォームであるFASを含むドメイン制御ソリューション、ODIN Digital Intelligence Baseを発表しました。FASはハードウェアドライバー上で自社開発されたミドルウェアで、標準ミドルウェアAUTOSAR CPとAUTOSAR AP、非標準ミドルウェアFTZen(FTZen Middleware System)を含み、EM管理、ステータスマシン管理、EOL、通信管理、データサービス、ノードサービスなどを実現します。従って、FASツールチェーンはAP、CP、非標準ミドルウェアの構成も提供します。

ODINデジタルインテリジェンスベースに基づき、フリーテックはADC15、ADC20、ADC25、ADC30といった複数のドメインコントローラー製品を立ち上げ、量産しています。

当レポートでは、中国および国外の自動車用AUTOSARプラットフォームについて調査分析し、AUTOSAR市場の現状と動向、AUTOSARの利用と事例、企業のプロファイルなどを提供しています。

目次

第1章 AUTOSARの概要

- AUTOSAR標準のイントロダクション

- AUTOSARの分類

- AUTOSARアダプティブプラットフォーム(AP)

- AUTOSARパートナーシップ

- 中国におけるAUTOSEMOの開発

第2章 AUTOSAR市場の現状と動向

- AUTOSAR市場の現状

- 主要サプライヤーのAUTOSARソリューションレイアウト

- 中国におけるAUTOSARのローカリゼーション

- AUTOSAR開発ルート

第3章 AUTOSARの利用と事例

- OEMによるAUTOSARの利用

- 中央統合型アーキテクチャにおけるAUTOSARの利用動向

- 自動車用OSにおけるAUTOSARの利用

- イーサネットとその他の通信におけるAUTOSARの利用

- インテリジェントドライビングにおけるAUTOSARの利用

- 車両制御におけるAUTOSARの利用

- コックピットにおけるAUTOSARの利用

- OTAにおけるAUTOSARの利用

第4章 国外のAUTOSAR企業

- Vector

- Elektrobit

- ETAS

- WindRiver

- KPIT

- TaTa Elxsi

- Autron

- Siemens Mentor Graphics

- Apex.AI

- PopcornSAR

第5章 中国のAUTOSAR企業

- Neusoft Reach

- Huawei

- iSoft

- Jingwei HiRain

- Hinge Technology

- Lancong Technology

- Novauto

- UAES

- Zuxia Technology

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more open and cooperative ecosystem.

On December 7, 2023, AUTOSAR released the latest standard AUTOSAR Release R23-11. From a functional perspective, the update focuses on three aspects: information security, functional safety and communication protocol stack.

In the Release R23-11, the architecture of AUTOSAR Adaptive Platform (AP) is readjusted, and its functions are reorganized and described. The architecture is re-divided into Foundation, Platform Service, Standardized App/Interface and Vehicle Service.

Wherein, the function components (FC) of Vehicle Service are not required to be deployed on every Machine of the AP, but available within the vehicle. Platform Service is partially responsible for providing specific functions for a single AP Machine; Standardized App/Interface provides standard interfaces or applications; Foundation provides local functions and C++ library of an AP Machine.

In addition to continuous efforts to upgrade and improve functional standards, AUTOSAR will take a more open attitude and cooperate with other third-party organizations to build a new automotive ecosystem and favor the boom of the intelligent vehicle market, in the face of new trends such as software-defined vehicles.

In March 2023, AUTOSAR, COVESA, Eclipse SDV and SOAFE jointly formed the SDV Alliance, a "collaboration of collaborations". The main purpose of the collaboration is to align efforts in the SDV ecosystem. By embracing existing descriptions of SDV from each of these efforts, as well as other external organizations, the SDV Alliance will agree on a clear and unified definition of what constitutes an SDV. ?

The Alliance will then look at the different technologies, methodologies, and standards of each organization and show how they can work together for the development of the SDV.? Recognizing that the SDV is conceptually too complex to be handled in a single industry consortium, and by looking at each of the organization's core competencies and varied execution environments, the Alliance will pool these skills to create a joint SDV vision.??

At CES 2024, the SDV Alliance announced its first integration blueprint, contributing to promoting software-defined vehicles.

Mass production of intelligent driving solutions based on AUTOSAR AP is increasing.

As autonomous driving domain controllers are spawned and installed in vehicles, supported by solutions of major suppliers, intelligent driving software based on AUTOSAR AP has also achieved mass production and application, and keeps increasing. As well as intelligent driving domain controllers for Volkswagen ID series that use AUTOSAR AP basic software, intelligent driving solutions for multiple vehicle models of Chinese independent brands, like Geely Boyue L and Changan NEVO A05, have also adopted AUTOSAR AP solutions since 2022.

Freetech launched ODIN Digital Intelligence Base, a domain control solution that includes FAS, its self-developed autonomous driving software platform. FAS, middleware self-developed on hardware driver, contain standard middleware AUTOSAR CP and AUTOSAR AP and non-standard middleware FTZen (FTZen Middleware System), and enables EM management, status machine management, EOL, communication management and data services, node services and so on. Accordingly, the FAS toolchain also provides configurations for AP, CP, and non-standard middleware.

Based on ODIN Digital Intelligence Base, Freetech has launched multiple domain controller products such as ADC 15, ADC 20, ADC 25 and ADC30, and has mass-produced them.

HoloMatic tailored basic software HoloSAR for autonomous driving application scenarios. HoloSAR meets AUTOSAR standards and SOA, and consists of three parts: AP, Frameworks and Adapter. HoloSAR builds a complete, loosely coupled and scalable software architecture, supports global communication and diagnosis protocols like DDS, SOME/IP, Zero-Copy and DoIP, and can provide flexible engineering configuration and a complete code generation toolchain, greatly reducing the workload of migration and deployment of autonomous driving algorithms for different hardware domain control platforms. HoloMatic's software and hardware integrated autonomous driving solution has been designated by leading automakers like Chery and Dongfeng, and has begun to be installed in several new vehicle models of Chery STERRA and Dongfeng Aeolus e-Pi from late 2023.

AUTOSAR attracts increasing attention in the Chinese market, and localization is accelerating.

Driven by the boom of intelligent vehicles in China, AUTOSAR catches the increasing attention of the Chinese market, specifically:

First, AUTOSAR works hard on layout in the Chinese market. In 2022, the organization established China Center in the country. By organizing AUTOSAR-related public training, cooperating with universities, and holding AUTOSAR open conferences, it makes greater efforts to promote and improve its services in the Chinese market.

Moreover, the number of AUTOSAR's Chinese members is increasing, and they have a bigger say. The number of AUTOSAR's members in China increased from 21 in 2019 to over 60 in 2023, and Neusoft Reach, iSoft, Jingwei HiRain are all its premium partners. In 2023, Huawei became AUTOSAR's Premium Partner Plus (there are only three worldwide, and the other two are Vector and Denso). Premium Partner Plus need to send a Project Leader to participate in management of formulation of AUTOSAR standards, and co-decision on standardization, In the future, ever more Chinese voices will be heard in formulation of AUTOSAR specifications.

Second, in China there are increasing software vendors using AUTOSAR. Neusoft Reach, iSoft, Jingwei HiRain, Huawei, Baidu, EnjoyMove Tech, HoloMatic Technology, Freetech, Novauto, Hinge Tech, Zhicong Technology, and CICV among others make product layout in line with AUTOSAR standards.

Third, in the trend towards localization of automotive chips and OS in China, AUTOSAR software vendors vigorously adapt to domestic MCUs and other chip products, accelerating mass production and application of Chinese full-stack solutions. Under the wave of localization of basic software and chips, there is an increasing demand for independent R&D of automotive software platforms. In China, AUTOSAR-based software development has also transitioned from the "introduction phase" to the "application phase", and will enter the "innovation phase" in the future, absorbing the quintessence of AUTOSAR and empowering independent automotive software development. In recent years, quite a few basic software vendors have worked on adaptation to domestic MCU and OS products to accelerate the mass production of domestic solutions and application in vehicles.

Finally, factors including intelligent vehicle development and policies will bring the opportunities of domestic replacement of AUTOSAR, especially in the field of intelligent driving.

With the rapid iteration of EEA, a unified standard for intelligent driving basic software middleware has yet to form. Currently AUTOSAR AP is one of the options, and many OEMs or suppliers with software strength, such as Technomous, Zuxia Technology and IMotion Automotive Technology, will choose to self-develop middleware products.

Table of Contents

1 Overview of AUTOSAR

- 1.1 Introduction to AUTOSAR Standard

- 1.1.1 Introduction to AUTOSAR

- 1.1.2 Birth Background and Purpose of AUTOSAR (1)

- 1.1.3 Birth Background and Purpose of AUTOSAR (2)

- 1.1.4 AUTOSAR Architecture

- 1.1.5 AUTOSAR Basic Software Layer (1)

- 1.1.6 AUTOSAR Basic Software Layer (2)

- 1.1.7 AUTOSAR Package Basic Software and Call Upper-layer Applications via A Standardized Interface

- 1.1.8 AUTOSAR Interface

- 1.1.9 AUTOSAR Methodology

- 1.1.10 AUTOSAR Development Process

- 1.1.11 Tool Chain Involved in AUTOSAR CP Development

- 1.1.12 Tool Chain Involved in AUTOSAR AP Development

- 1.2 Classification of AUTOSAR

- 1.2.1 Types of AUTOSAR

- 1.2.2 Comparison between AUTOSAR Classic Platform (CP) and AUTOSAR Adaptive Platform (AP) (1)

- 1.2.3 Comparison between AUTOSAR Classic Platform (CP) and AUTOSAR Adaptive Platform (AP) (2)

- 1.2.4 Evolution of AUTOSAR CP/AUTOSAR AP

- 1.2.5 Execution Mode of AUTOSAR CP/AUTOSAR AP

- 1.2.6 Interaction Examples of AUTOSAR CP/AUTOSAR AP

- 1.2.7 AUTOSAR CP Architecture

- 1.3 AUTOSAR Adaptive Platform (AP)

- 1.3.1 Latest AUTOSAR AP Architecture (1)

- 1.3.2 Latest AUTOSAR AP Architecture (2)

- 1.3.3 AUTOSAR Runtime for Adaptive Applications (ARA)

- 1.3.4 Three Pillars

- 1.3.5 AUTOSAR AP Supports Address Space Virtualization

- 1.3.6 Boot Sequence

- 1.3.7 Methodology

- 1.3.8 Development Method

- 1.3.9 Development Flow

- 1.3.10 Tasks Undertaken by Vendors in AUTOSAR AP Development Process

- 1.3.11 AUTOSAR AP Toolchain Business Models

- 1.4 AUTOSAR Partnership

- 1.4.1 Introduction

- 1.4.2 Organizational Structure

- 1.4.3 Working Groups

- 1.4.4 User Groups

- 1.4.5 Members

- 1.4.6 Rights and Obligations of Various Types of Members

- 1.4.7 China Center

- 1.4.8 Partners in China

- 1.4.9 Self-positioning of AUTOSAR in Automotive Ecosystem

- 1.4.10 Standards

- 1.5 Development of AUTOSEMO in China

- 1.5.1 Based on AUTOSAR Architecture, AUTOSEMO Was Established

- 1.5.2 The Establishment of AUTOSEMO Promotes Local Development of AUTOSAR

- 1.5.3 AUTOSEMO Standard Roadmap

- 1.5.4 AUTOSEMO Releases

- 1.5.5 AUTOSEMO Released China Automotive Basic Software Development White Paper 4.0

- 1.5.6 Technical Ecosystem of AUTOSEMO Member Units

- 1.5.7 AUTOSEMO Released ASF Technical Specification 1.0 and Middleware System ASF

2 Status Quo and Trends of AUTOSAR Market

- 2.1 Status Quo of AUTOSAR Market

- 2.1.1 Status Quo of AUTOSAR outside China

- 2.1.2 Status Quo of AUTOSAR inside China

- 2.1.3 AUTOSAR Business Models

- 2.1.4 Software Vendors Gain Greater Competitive Edges by Investment and Acquisition

- 2.1.5 Application of AUTOSAR in Software of OEMs: outside China

- 2.1.6 Application of AUTOSAR in Software of OEMs: inside China

- 2.1.7 Basic Software Layout Mode of OEMs

- 2.1.8 Is It Necessary for OEMs to Self-develop Middleware? (1): Supplier's Perspective

- 2.1.9 Is It Necessary for OEMs to Self-develop Middleware? (1): OEM's Perspective

- 2.1.10 Advantages and Disadvantages of Automakers Independently Developing AUTOSAR AP Standard-compliant Software Platforms

- 2.1.11 Is It Necessary for OEMs to Self-develop Middleware? (3): Summary

- 2.2 AUTOSAR Solution Layout of Main Suppliers

- 2.2.1 Main Tools Involved in AUTOSAR

- 2.2.2 Main AUTOSAR Tool Suppliers

- 2.2.3 AUTOSAR Solution Layout of Main Suppliers (1): outside China

- 2.2.4 AUTOSAR Solution Layout of Main Suppliers (2): outside China

- 2.2.5 AUTOSAR Solution Layout of Main Suppliers (1): inside China

- 2.2.6 AUTOSAR Solution Layout of Main Suppliers (2): inside China

- 2.2.7 AUTOSAR Solution Layout of Main Suppliers (3): inside China

- 2.2.8 The Latest Versions of AUTOSAR Products of Main Suppliers

- 2.3 AUTOSAR Localization in China

- 2.3.1 AUTOSAR Localization Layout Mode in China

- 2.3.2 Main Problems in Development of Chinese Software

- 2.3.3 Driving Factors for AUTOSAR Localization Layout

- 2.3.4 Development Plan for Localization of Basic Software Middleware in China Intelligent Connected Vehicle EEA

- 2.3.5 AUTOSAR Localization Layout Strategy (1)

- 2.3.6 AUTOSAR Localization Layout Strategy (2)

- 2.3.7 AUTOSAR Localization Layout Strategy (3)

- 2.3.8 AUTOSAR Localization Layout Cases

- 2.3.9 Opportunities Brought by Domestic Replacement of AUTOSAR in China

- 2.3.10 Cases of Domestic Replacement of AUTOSAR in China (1)

- 2.3.11 Cases of Domestic Replacement of AUTOSAR in China (2)

- 2.3.12 Cases of Domestic Replacement of AUTOSAR in China (3)

- 2.3.13 Domestic Real-time Vehicle Control Operating System Providers in China Have Successively Launched Open Source Plans

- 2.3.14 Localization of Real-time Vehicle Control Operating Systems

- 2.4 AUTOSAR Development Route

- 2.4.1 Development Challenges Faced by AUTOSAR Suppliers

- 2.4.2 AUTOSAR Technology Evolution Route

- 2.4.3 AUTOSAR Release Update Process

- 2.4.4 New Features in AUTOSAR Release R23-11 (1)

- 2.4.5 New Features in AUTOSAR Release R23-11 (2)

- 2.4.6 New Features in the Latest AUTOSAR Releases: R22-11 & R21-11 (1)

- 2.4.7 New Features in the Latest AUTOSAR Releases: R21-11 & R20-11 (2)

- 2.4.8 AUTOSAR AP Development Plan

- 2.4.9 New Features Added in Future AUTOSAR AP

- 2.4.10 AUTOSAR Technology Development Trends

- 2.4.11 AUTOSAR's Vision of Cooperation with Third Parties

- 2.4.12 AUTOSAR's Software Ecosystem Business Relations with Other Third-party Organizations

- 2.4.13 Joint Development Cases of AUTOSAR and COVESA in Software-Defined Vehicles

- 2.4.14 AUTOSAR's New Opening Strategy

- 2.4.15 Established SDV Alliance

3 AUTOSAR Application and Cases

- 3.1 Application of AUTOSAR by OEMs

- 3.1.1 AUTOSAR-based Layered Structure for Intelligent Connected Vehicles

- 3.1.2 AUTOSAR AP Application

- 3.1.3.1 Mercedes-Benz's Basic Software Platform and AUTOSAR Application

- 3.1.3.2 Application of AUTOSAR in MB.OS System in Mercedes-Benz's Latest R&D

- 3.1.4.1 Volkswagen's Basic Software Platform and AUTOSAR Application

- 3.1.4.2 Volkswagen's AUTOSAR AP-based Universal Software Architecture (1)

- 3.1.4.3 Volkswagen's AUTOSAR AP-based Universal Software Architecture (2)

- 3.1.4.4 AUTOSAR in Volkswagen Body Control Domain

- 3.1.5 Volvo's Basic Software Platform and AUTOSAR Application

- 3.1.6.1 Toyota's Basic Software Platform and AUTOSAR Application

- 3.1.6.2 Toyota's EEA Evolution and AUTOSAR BSW Migration

- 3.1.6.3 Toyota Zonal Architecture Adopts AUTOSAR-based SOA

- 3.1.7.1 Great Wall Motor's Basic Software Platform and AUTOSAR Application

- 3.1.7.2 AUTOSAR Application in GEEP 4.0 Architecture of Great Wall Motor (1)

- 3.1.7.3 AUTOSAR Application in GEEP 4.0 Architecture of Great Wall Motor (2)

- 3.1.7.4 AUTOSAR Application in Next-generation Vehicle-cloud Integrated Intelligent Ecosystem Architecture of Great Wall Motor

- 3.1.7.5 Great Wall Motor's Cockpit Software Architecture

- 3.1.7.6 Great Wall Motor's Cockpit Software Architecture In9.0

- 3.1.8 Geely's Basic Software Platform and AUTOSAR Application

- 3.1.9.1 Changan's Basic Software Platform and AUTOSAR Application

- 3.1.9.2 AUTOSAR Application in the Latest SDA of Changan

- 3.1.10.1 FAW Hongqi's Basic Software Platform and AUTOSAR Application

- 3.1.10.2 AUTOSAR Application in Hongqi EEA Computing Platform

- 3.1.10.3 AUTOSAR Application in Hongqi's TSN Ethernet Multi-domain Controller

- 3.1.11.1 GAC's Basic Software Platform and AUTOSAR Application

- 3.1.11.2 SOA Software Platform for X-soul Architecture (1)

- 3.1.11.3 SOA Software Platform for X-soul Architecture (2)

- 3.1.11.4 GAC Psi OS

- 3.1.12.1 Xpeng's Basic Software Platform and AUTOSAR Application

- 3.1.12.2 AUTOSAR Application in Xpeng X-EEA 3.0/3.5

- 3.1.12.3 AUTOSAR Application in Xpeng's Intelligent Driving Domain Controller

- 3.1.12.4 AUTOSAR Application in Xpeng's ZCU & VIU

- 3.1.12.5 AUTOSAR Application in Xpeng's Intelligent Cockpit Domain Controller

- 3.1.13.1 SAIC's Basic Software Platform and AUTOSAR Application

- 3.1.13.2 AUTOSAR Application in SOA Software Platform of SAIC Z-ONE

- 3.1.14 BYD's Basic Software Platform and AUTOSAR Application

- 3.2 Application Trends of AUTOSAR in Central Integrated Architecture

- 3.2.1 With the Evolution of EEA, Automotive Software Increases and Becomes More Complex

- 3.2.2 AUTOSAR Application in Digital Connected Vehicle EEA

- 3.2.3 Application of AUTOSAR in Central Integrated EEA

- 3.2.4 Application of AUTOSAR in Central Integrated EEA

- 3.2.5 Location of AUTOSAR AP in Centralized Architecture (1)

- 3.2.6 Location of AUTOSAR AP in Centralized Architecture (2)

- 3.2.7 Central Computing Unit based on AUTOSAR AP (1)

- 3.2.8 Central Computing Unit based on AUTOSAR AP (2)

- 3.2.9 Application of AUTOSAR in Visteon's Central Integrated EEA

- 3.2.10 Typical AUTOSAR-based Central Control Domain Solutions

- 3.2.11 Selection of AUTOSAR CP+AP in Software Architecture of Central Computing Unit (1)

- 3.2.12 Selection of AUTOSAR CP+AP in Software Architecture of Central Computing Unit (2)

- 3.2.13 Selection of AUTOSAR CP+AP in Software Architecture of Central Computing Unit (3)

- 3.2.14 Application of AUTOSAR CP/AP in Central Computing Units of Main Suppliers

- 3.2.15 AUTOSAR Application Cases in Cross-domain Fusion Central Computing (1)

- 3.2.16 AUTOSAR Application Cases in Cross-domain Fusion Central Computing (2)

- 3.2.17 AUTOSAR Application Cases in Cross-domain Fusion Central Computing (3)

- 3.2.18 AUTOSAR Application Cases in Cross-domain Fusion Central Computing (4)

- 3.2.19 AUTOSAR Application in Basic Software for Zone Controllers of Main Suppliers

- 3.2.20 AUTOSAR Application Cases in Zone Controllers (1)

- 3.2.21 AUTOSAR Application Cases in Zone Controllers (2)

- 3.3 Application of AUTOSAR in Vehicle OS

- 3.3.1 Vehicle Intelligent Computing Basic Software Architecture in Cross-domain Fusion Trend

- 3.3.2 Demand for Vehicle OS Increases in Cockpit-driving Integration Trend

- 3.3.3 Whether A Standardized Vehicle OS Will Appear in the Industry

- 3.3.4 Vehicle OS Middleware and Current AUTOSAR Selection inside and outside China

- 3.3.5 AUTOSAR Application in Vehicle OS Layout of Main Suppliers (1)

- 3.3.6 AUTOSAR Application in Vehicle OS Layout of Main Suppliers (2)

- 3.3.7 AUTOSAR Application in Vehicle OS Layout of Main Suppliers (3)

- 3.3.8 Cases of Vehicle OS Applying AUTOSAR CP/AP (1)

- 3.3.9 Cases of Vehicle OS Applying AUTOSAR CP/AP (2)

- 3.3.10 Cases of Vehicle OS Applying AUTOSAR CP/AP (3)

- 3.3.11 Cases of Vehicle OS Applying AUTOSAR CP/AP (4)

- 3.3.12 Cases of Vehicle OS Applying AUTOSAR CP/AP (5)

- 3.3.13 Cases of Vehicle OS Applying AUTOSAR CP/AP (6)

- 3.3.14 Cases of Vehicle OS Applying AUTOSAR CP/AP (7)

- 3.3.15 Cases of Vehicle OS Applying AUTOSAR CP/AP (8)

- 3.3.16 Cases of Vehicle OS Applying AUTOSAR CP/AP (9)

- 3.3.17 Cases of Vehicle OS Applying AUTOSAR CP/AP (10)

- 3.3.18 Cases of Vehicle OS Applying AUTOSAR CP/AP (11)

- 3.4 AUTOSAR Application in Ethernet and Other Communications

- 3.4.1 Main Vehicle Internal Network Management Modes

- 3.4.2 AUTOSAR Application in Vehicle Communication

- 3.4.3 AUTOSAR CP Begins to Support DDS

- 3.4.4 AUTOSAR CP ECU Communication (1)

- 3.4.5 AUTOSAR CP ECU Communication (2)

- 3.4.6 AUTOSAR Increases the Use of Ethernet in Vehicle Architecture

- 3.4.7 AUTOSAR AP and Ethernet Communication (SOME/IP) Protocols

- 3.4.8 Integration of AUTOSAR AP and DDS

- 3.4.9 AUTOSAR Application Cases in Vehicle Communication Products (1)

- 3.4.10 AUTOSAR Application Cases in Vehicle Communication Products (2)

- 3.4.11 AUTOSAR Application Cases in Vehicle Communication Products (3)

- 3.4.12 AUTOSAR Application Cases in Vehicle Communication Products (4)

- 3.4.13 AUTOSAR Application Cases in Vehicle Communication Products (5)

- 3.4.14 AUTOSAR Application Cases in Vehicle Communication Products (6)

- 3.4.15 AUTOSAR Application Cases in Vehicle Communication Products (7)

- 3.4.16 AUTOSAR Application Cases in Vehicle Communication Products (8)

- 3.4.17 AUTOSAR Application Cases in Vehicle Communication Products (9)

- 3.5 AUTOSAR Application in Intelligent Driving

- 3.5.1 Current Optional Middleware Solutions for Intelligent Driving Basic Software (1)

- 3.5.2 Current Optional Middleware Solutions for Intelligent Driving Basic Software (2)

- 3.5.3 Intelligent Driving Middleware ROS 2

- 3.5.4 Differences between ROS 2 and AUTOSAR AP

- 3.5.5 Baidu Self-developed Intelligent Driving Middleware Cyber RT

- 3.5.6 Impacts of AUTOSAR on Autonomous Driving Characteristics

- 3.5.7 AUTOSAR AP Promotes ADAS Development

- 3.5.8 AUTOSAR AP Selection for Domain Controller Software Architecture (1)

- 3.5.9 AUTOSAR AP Selection for Domain Controller Software Architecture (2)

- 3.5.10 Advantages of AUTOSAR AP Application in Intelligent Driving Basic Software

- 3.5.11 Shortcomings of AUTOSAR AP Application in Intelligent Driving Basic Software

- 3.5.12 Application of AUTOSAR AP in Autonomous Driving

- 3.5.13 The Proportion of AUTOSAR AP Application in Autonomous Driving Is Increasing (1)

- 3.5.14 The Proportion of AUTOSAR AP Application in Autonomous Driving Is Increasing (2)

- 3.5.15 The Proportion of AUTOSAR AP Application in Autonomous Driving Is Increasing (3)

- 3.5.16 AUTOSAR Support for Autonomous Driving OS and Software Platform of Main Suppliers (1)

- 3.5.17 AUTOSAR Support for Autonomous Driving OS and Software Platform of Main Suppliers (2)

- 3.5.18 AUTOSAR Support for Autonomous Driving OS and Software Platform of Main Suppliers (3)

- 3.5.19 AUTOSAR Support for Autonomous Driving OS and Software Platform of Main Suppliers (4)

- 3.5.20 AUTOSAR Support for Autonomous Driving OS and Software Platform of Main Suppliers (5)

- 3.5.21 AUTOSAR Application in Intelligent Driving Domain Controllers of Foreign Suppliers

- 3.5.22 AUTOSAR Application in ADAS/AD Domain Controllers of Chinese Suppliers (1)

- 3.5.23 AUTOSAR Application in ADAS/AD Domain Controllers of Chinese Suppliers (2)

- 3.5.24 AUTOSAR Application in ADAS/AD Domain Controllers of Chinese Suppliers (3)

- 3.5.25 AUTOSAR Application in ADAS/AD Domain Controllers of Chinese Suppliers (4)

- 3.5.26 Main Autonomous Driving Basic Software Middleware Cases (1)

- 3.5.27 Main Autonomous Driving Basic Software Middleware Cases (2)

- 3.5.28 Main Autonomous Driving Basic Software Middleware Cases (3)

- 3.5.29 Main Autonomous Driving Basic Software Middleware Cases (4)

- 3.5.30 Main Autonomous Driving Basic Software Middleware Cases (5)

- 3.5.31 Main Autonomous Driving Basic Software Middleware Cases (6)

- 3.5.32 Main Autonomous Driving Basic Software Middleware Cases (7)

- 3.5.33 Main Autonomous Driving Basic Software Middleware Cases (8)

- 3.5.34 Main Autonomous Driving Basic Software Middleware Cases (9)

- 3.5.35 Main Autonomous Driving Basic Software Middleware Cases (10)

- 3.5.36 Main Autonomous Driving Basic Software Middleware Cases (11)

- 3.5.37 Main Autonomous Driving Basic Software Middleware Cases (12)

- 3.5.38 Main Autonomous Driving Basic Software Middleware Cases (13)

- 3.5.39 Main Autonomous Driving Basic Software Middleware Cases (14)

- 3.6 AUTOSAR Application in Vehicle Control

- 3.6.1 Body Domain Controller Software System (1)

- 3.6.2 Body Domain Controller Software System (2)

- 3.6.3 How to Select AUTOSAR in Body Domain Control?

- 3.6.4 AUTOSAR Application in Body/Motion Domain Controllers of Main Suppliers

- 3.6.5 How to Select AUTOSAR in Power Domain Control (1)

- 3.6.6 How to Select AUTOSAR in Power Domain Control (2)

- 3.6.7 ETAS and UAES Cooperates to Provide AUTOSAR-based XCU Solutions

- 3.6.8 O-Film's 5th Generation Body Domain Controller

- 3.6.9 AUTOSAR Application in Body Domain Control Products of Nobo Automotive Technology

- 3.6.10 AUTOSAR-based Universal Body Domain Controller Developed by Neusoft Reach

- 3.6.11 AUTOSAR Solution for AERI New Energy Vehicle Control Unit (VCU)

- 3.6.12 ZTE Develops Vehicle Control OS Based on AUTOSAR

- 3.6.13 CAIC's Vehicle Operating System Technology Platform Is Based on AUTOSAR

- 3.7 AUTOSAR Application in Cockpits

- 3.7.1 Requirements of Intelligent Cockpits for AUTOSAR in EEA Evolution

- 3.7.2 Requirements of Intelligent Cockpit Functions for AUTOSAR AP

- 3.7.3 Application of AUTOSAR in Cockpit Domain Controllers of Chinese Manufacturers (1)

- 3.7.4 Application of AUTOSAR in Cockpit Domain Controllers of Chinese Manufacturers (2)

- 3.7.5 AUTOSAR Is Used in Bosch's Cockpit Integration and Control

- 3.7.6 Volkswagen's Cockpit Domain Controllers Adopt AUTOSAR

- 3.7.7 Nobo Automotive Technology's Cockpit Domain Controllers Adopt AUTOSAR

- 3.7.8 Wingtech's Intelligent Cockpit Domain Controllers Are Integrated with AUTOSAR

- 3.7.9 AUTOSAR Application in Harman's Cockpit Software Platforms

- 3.7.10 AUTOSAR Application in Megatronix's Cockpit Software Platforms

- 3.7.11 ZTE's Intelligent Cockpit OS Adopts AUTOSAR

- 3.8 AUTOSAR Application in OTA

- 3.8.1 OTA Update Process

- 3.8.2 Standardized Functions in OTA Updates

- 3.8.3 OTA Advantages of AUTOSAR AP

- 3.8.4 Adaptive AP UCM Specifically Designed for OTA (1)

- 3.8.5 Adaptive AP UCM Specifically Designed for OTA (2)

- 3.8.6 OTA Protection Mechanism in AUTOSAR AP

- 3.8.7 Vehicle Computer Network OTA Demonstration System Developed by AUTOSAR China User Group

- 3.8.8 OTA Cases Based on AUTOSAR AP

- 3.8.9 ETAS OTA Integration solution with AUTOSAR AP

- 3.8.10 Neusoft Reach NeuSAR aCore Is Used in OTA

- 3.8.11 ABUP's SOA OTA Solution Practice Based on AUTOSAR

- 3.8.12 Integration of OTA and EB Corbos Products

4 Foreign AUTOSAR Companies

- 4.1 Vector

- 4.1.1 Profile

- 4.1.2 Vector AUTOSAR Solution MICROSAR Adaptive

- 4.1.3 Features of MICROSAR Adaptive Solution

- 4.1.4 MICROSAR Adaptive Architecture

- 4.1.5 Benefits of MICROSAR Adaptive

- 4.1.6 Vector AUTOSAR Adaptive Functional Safety Solution

- 4.1.7 Vector AUTOSAR Classic Functional Safety Solution

- 4.1.8 Vector AUTOSAR Classic Toolchain Used to Develop ECUs

- 4.1.9 Vector AUTOSAR Adaptive Toolchain

- 4.1.10 Vector Adaptive Microsar Product Line

- 4.1.11 Dynamics

- 4.2 Elektrobit

- 4.2.1 Profile

- 4.2.2 EB Basic Software Platform Products

- 4.2.2 EB AUTOSAR-related Products Development Roadmap

- 4.2.2 EB tresos Product Line

- 4.2.3 EB Classic AUTOSAR Solution: EB tresos 9.0

- 4.2.3 EB tresos 9.0 VS 8.0

- 4.2.3 New Features of EB tresos 9.0

- 4.2.4 EB tresos Software Tool Product: EB tresos Studio

- 4.2.5 EB Adaptive AUTOSAR Solution: EB corbos

- 4.2.6 EB Adaptive AUTOSAR Solution: Product Architecture

- 4.2.7 EB Adaptive AUTOSAR-based Solution: HPC Software Architecture

- 4.2.8 EB xelor Software Platform for Next-generation Vehicle Electronics Architecture

- 4.2.9 Application: EB tresos Based on Hardware Platform

- 4.2.10 Main Dynamics and Partners

- 4.3 ETAS

- 4.3.1 Profile

- 4.3.2 ETAS AUTOSAR CP Solution: RTA-CAR

- 4.3.3 ETAS AUTOSAR CP Solution: RTA-CAR Toolchain

- 4.3.4 ETAS AUTOSAR AP Solution (1): RTA-VRTE

- 4.3.5 ETAS AUTOSAR AP Solution (2): RTA-VRTE Software Architecture

- 4.3.6 ETAS AUTOSAR Software Architecture Design Tool: ISOLAR-VRTE

- 4.3.7 ETAS AUTOSAR Software Architecture Design Tools

- 4.3.8 ETAS AUTOSAR Software Architecture Design Tool: RTA-VRTE SDK

- 4.3.9 ETAS Provides Highly Integrated End-to-end Software Solutions

- 4.3.10 ETAS AUTOSAR Cooperation Dynamics

- 4.4 WindRiver

- 4.4.1 Profile

- 4.4.2 AUTOSAR Adaptive Software Platform

- 4.4.3 AUTOSAR Adaptive Software Platform Structure

- 4.4.4 AUTOSAR Business Dynamics

- 4.5 KPIT

- 4.5.1 Profile

- 4.5.2 Operation

- 4.5.3 AUTOSAR Adaptive Platform: KSAR Adaptive

- 4.5.4 AUTOSAR Classic Platform:KSAR Classic

- 4.5.5 AUTOSAR Software Tool Products (1)

- 4.5.6 AUTOSAR Software Tool Products (2)

- 4.5.7 AUTOSAR Software Tool Product: K-SAR Editor

- 4.6 TaTa Elxsi

- 4.6.1 Profile

- 4.6.2 AUTOSAR-related Products: AUTOSAR Classic

- 4.6.3 AUTOSAR-related Products: AUTOSAR Adaptive

- 4.6.4 AUTOSAR Compatible Configuration Tool: eZyconfig

- 4.6.5 AUTOSAR-related Services

- 4.6.6 Tata Elxsi with Green Hills Launched Its Latest AUTOSAR Compatible Platform

- 4.6.7 Software-Defined Vehicle Solutions

- 4.6.8 Cases: AUTOSAR-based Cockpit Architecture

- 4.6.9 Cases: AUTOSAR-based Monitoring System Solution

- 4.6.10 Cases: AUTOSAR-based Service-oriented Communication Process

- 4.6.11 Development of TATA AUTOSAR

- 4.7 Autron

- 4.7.1 AUTOSAR-related Products: Standard Software Platform

- 4.7.2 AUTOSAR-related Products: High Performance Software Platform

- 4.7.3 Dynamics

- 4.8 Siemens Mentor Graphics

- 4.8.1 Profile

- 4.8.2 AUTOSAR-related Products: Capital VSTAR

- 4.8.3 AUTOSAR-related Products: Capital VSTAR Embedded Software

- 4.8.4 AUTOSAR-related Products: Capital VSTAR MCAL

- 4.8.5 AUTOSAR-related Products: Capital VSTAR Tools

- 4.8.6 AUTOSAR-related Products: Capital VSTAR Virtualizer

- 4.8.7 AUTOSAR Empowers Functional Safety and Cyber Security

- 4.8.8 Siemens AUTOSAR-based Universal Platform Components

- 4.8.9 Siemens Capital E/E System

- 4.8.10 Major Events

- 4.9 Apex.AI

- 4.9.1 Profile

- 4.9.2 Main Product: Apex.middleware

- 4.9.3 Integration of AUTOSAR and ROS 2

- 4.9.4 Dynamics

- 4.10 PopcornSAR

- 4.10.1 Profile

- 4.10.2 PopcornSAR Tool Kit

- 4.10.3 AutoSAR.io

- 4.10.4 PARA

- 4.10.5 PACON IDE

- 4.10.6 PopcornSAR Adaptive Tool Development Roadmap

5 Chinese AUTOSAR Companies

- 5.1 Neusoft Reach

- 5.1.1 Profile

- 5.1.2 openVOC Open Technology Framework

- 5.1.3 Development History of NeuSAR

- 5.1.4 NeuSAR 4.2

- 5.1.5 NeuSAR aCore Architecture

- 5.1.6 NeuSAR cCore Architecture

- 5.1.7 NeuSAR SF

- 5.1.8 NeuSAR SF Vehicle Message Bus

- 5.1.9 NeuSAR Python Development Framework

- 5.1.10 NeuSAR Python+WebService Development Framework

- 5.1.11 NeuSAR DevKit

- 5.1.12 Centralized Central Computing Unit X-Center 2.0

- 5.1.13 Neusoft Reach Participated in Promoting AUTOSEMO Construction

- 5.2 Huawei

- 5.2.1 Huawei Became A PP+ Member of AUTOSAR

- 5.2.2 Self-developed AUTOSAR

- 5.2.3 Self-developed AUTOSAR CP and AP Architecture

- 5.2.4 Huawei Intelligent Digital Vehicle Platform (iDVP)

- 5.2.5 Self-developed Operating System

- 5.2.6 VOS Architecture

- 5.2.7 Vehicle-level Basic Software and SOA Service Framework

- 5.2.8 AOS Architecture

- 5.2.9 Huawei MDC Autonomous Driving Computing Platform Adopts AUTOSAR

- 5.3 iSoft

- 5.3.1 Profile

- 5.3.2 AUTOSAR Classic and Toolchain Products

- 5.3.3 AUTOSAR Adaptive and Toolchain products

- 5.3.4 Vehicle Software Solution for Vehicle Open System Architecture

- 5.3.5 Cloud System Solutions

- 5.3.6 Automotive Basic Software Ecosystem

- 5.3.7 Business Model

- 5.3.8 Partners

- 5.4 Jingwei HiRain

- 5.4.1 Profile

- 5.4.2 AUTOSAR Solutions

- 5.4.3 AUTOSAR Solution: INTEWORK-EAS-CP

- 5.4.4 INTEWORK-EAS-CP Toolchain Products

- 5.4.5 AUTOSAR Solution: INTEWORK-EAS-AP

- 5.4.6 INTEWORK-EAS-AP Toolchain Products

- 5.4.7 SOA Software Platform Practice based on AUTOSAR Technology

- 5.4.8 Vehicle OS Business

- 5.4.9 AP Development Plan

- 5.4.10 Independently Developed the MCAL Platform

- 5.4.11 APP Application Cases

- 5.5 Hinge Technology

- 5.5.1 Profile

- 5.5.2 AUTOSAR Solution: AUTOSAR Adaptive Solution

- 5.5.3 SOME/IP Protocol Stack and Automated SOA Tools

- 5.5.4 AUTOSAR Application Practice: Smart Antenna

- 5.6 Lancong Technology

- 5.6.1 Profile

- 5.6.2 AUTOSAR Solution: BlueSAR

- 5.6.3 Main Customers and Project Cases

- 5.6.4 Product Delivery Mode

- 5.7 Novauto

- 5.7.1 Profile

- 5.7.2 AUTOSAR Software Solution

- 5.7.3 Highly Reliable System Software for Intelligent Driving

- 5.7.4 Partners

- 5.8 UAES

- 5.8.1 SOA Software Development

- 5.8.2 Open Software Platform Based on AUTOSAR

- 5.8.3 Service-oriented Automotive Software Development Platform USP 2.0

- 5.8.4 AUTOSAR Partners

- 5.9 Zuxia Technology

- 5.9.1 Profile

- 5.9.2 Intelligent Driving Operating System Earth

- 5.9.3 Earth Is Deeply Suitable for Black Sesame A1000

- 5.9.4 Partners