|

|

市場調査レポート

商品コード

1567948

自動車ソフトウェアのビジネスモデルとサプライヤーのレイアウト(2024年)Automotive Software Business Models and Suppliers' Layout Research Report, 2024 |

||||||

|

|||||||

| 自動車ソフトウェアのビジネスモデルとサプライヤーのレイアウト(2024年) |

|

出版日: 2024年09月30日

発行: ResearchInChina

ページ情報: 英文 450 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

OEMのソフトウェア開発は「プラットフォーム化」に向かって発展し、源流でのコスト削減を実現する

2024年、OEMの組織構造はますます頻繁に調整され、熾烈な競争の自動車市場に対応するために戦略をリアルタイムで調整する必要があります。あるOEMは、企業の売上やその他の現状を安定させるために組織構造を調整し、あるOEMは、企業のソフトウェアと新しいビジネスの焦点を推進するために、組織構造、特に研究開発ビジネスチームを調整します。

ローカルOEMは研究開発の組織構造を変更し、ソフトウェア開発戦略を再構築する

近年、XPeng Motorsは、大規模な組織構造の調整を継続し、同時に、インテリジェントで競争の激しい自動車市場と向き合うために、コスト削減と効率化、予算削減などの多くの措置を提案しています。2024年7月、XPeng Motorsの自動運転部門は新たな組織再編を開始しました。Xpengの自動運転部門は3つの新しいセグメントを設立しました。AIモデル開発、AIアプリケーション開発、AI効率開発です。AIモデル開発部門は主にエンドツーエンドのモデル開発を担当し、AIエンドツーエンドのインテリジェントドライビング技術のレイアウトを強化します。

2024年8月、SAICはIMとRisingブランドの研究開発事業をSAIC Group Innovation Research and Development Institute(SAIC R & D Institute)に統合します。このうち、IMとRisingブランドの研究開発チーム、パワーバッテリー、インテリジェントドライブ、シャーシなどの技術プロジェクトは、SAIC R & D Instituteに一元的に移行され、R & D Instituteで統一および調整されます。全サブブランドの研究開発力を一元化し、統一的に発展させるというこのモデルは、自動車製造グループが一般的に採用している「大型研究開発機関」モデルです。このモデルを通じて、製品のプラットフォームと標準化されたレイアウトが実施され、研究開発コストの平等な分担を実現し、源流でのコスト削減に努めています。

多国籍自動車メーカーが中国のローカルソフトウェアサプライチェーンとの協力を強化

現在、多国籍自動車メーカーの中国現地化展開は新たな段階に入っています。これは以前の「縫製」補助装飾・開発とは異なりますが、根本的にシステムを再構築し、積極的に戦略を調整し、積極的に中国の自動車市場の新たな変化に対処するためにレイアウトします。それは以下のように要約できます。

・中国の現地の投資・研究開発センターのレイアウトを増やします。例えば2022年3月、Mercedes-Benzは、中国における研究開発レイアウトをさらに拡大するため、上海に研究開発センターを設立すると発表しました。上海の研究開発センターは、インテリジェントな相互接続、自動運転、ソフトウェアとハードウェアの開発、ビッグデータを重視します。2023年4月、Volkswagen Groupは約10億ユーロを投資し、インテリジェントコネクテッド電気自動車に焦点を当てた研究開発、イノベーション・調達センターを設立すると発表しました。

・中国の現地チームの権限をさらに開放し、中国の現地のカスタマイズ戦略を強化します。現在、Mercedes-Benz、BMW、Volkswagenなどの国外自動車メーカーは、中国の現地チームの権限をさらに開放するため、中国の現地カスタマイズ開発モデルを提案しています。

・中国の現地サプライヤーと積極的に協力します。例えば、Mercedes-BenzはMomenta、Tencent、AISpeechなどと深く協力し、VolkswagenはThunderSoft、Horizon、XPeng Motorsなどと深く協力しています。

当レポートでは、中国の自動車産業について調査分析し、自動車ソフトウェアのビジネスモデルや、国内外のサプライヤーのレイアウトに関する情報を提供しています。

目次

第1章 自動車ソフトウェアのビジネスモデルと動向の分析

- インテリジェント車両ソフトウェアの産業チェーンの概要

- 主要OEMのソフトウェアシステムサプライチェーン構築と組織構造調整

- インテリジェント車両ソフトウェア関連サプライヤーのビジネスモデルの概要

- スマートカーソフトウェアビジネスモデルの開発動向

第2章 OEMのソフトウェアイノベーション戦略への対応に関する分析

- Mercedes-Benz

- BYD

- BMW

- Volkswagen

- Ford

- SAIC

- Great Wall Motor

- Geely

- Changan Automobile

- Xpeng

- Li Auto

- FAW

- Chery

第3章 自動車オペレーティングシステムのビジネスとレイアウトのモデル

- 自動車オペレーティングシステムビジネスモデルの現状と動向

- 車両OS

- 主な自動車オペレーティングシステム

- 主な自動車ミドルウェアのビジネスモデル

- AUTOSAR

第4章 インテリジェントコックピットのビジネスとレイアウトのモデル

- インテリジェントコックピットソフトウェアシステムのビジネスモデルと動向

- 自動車HMIデザイン

- 自動車音声のビジネスモデルと動向

- 自動車地図ナビゲーションのビジネスモデルと動向

- 自動車音響システム

- AR-HUDソフトウェア

- インコックピットビジョン(DMS/OMS)のビジネスモデルと動向

- マルチモーダルフュージョンインタラクション

- AI基盤モデルのコックピット用途

第5章 自動運転のビジネスとレイアウトのモデル

- 自動運転システムソフトウェアのビジネスモデルの現状と動向

- 中高級ADASソリューションのビジネスモデル

- L3/L4自動運転システムのビジネスモデル

第6章 自動車クラウドプラットフォームのビジネスとレイアウトのモデル

- クラウドプラットフォームソフトウェアのビジネスモデルの現状と動向

- クラウドネイティブ

- OTA

- TSP/MNO車両インターネットサービスプロバイダー

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classifies smart car software into three categories: basic software layer, application software layer, and cloud software layer, as well as several sub-categories.

The software development of OEMs is developing towards "platformization" to achieve cost reduction at the source

In 2024, the organizational structure of OEMs are adjusted more and more frequently, and strategies need to be adjusted in real time to cope with the fiercely competitive automotive market. Some OEMs adjust their organizational structure in order to stabilize the company's sales and other status quo, and some adjust their organizational structure, especially R & D business team, to promote the company's software and new business focus.

Local OEMs conduct R & D organizational structure change, and restructure software development strategy

In recent years, XPeng Motors has continued to adjust its organizational structure on a large scale, and at the same time proposed a number of measures such as cost reduction and efficiency increase, budget reduction, etc., to face the intelligent and highly competitive automotive market. In July 2024, XPeng Motors' autonomous driving department ushered in another organizational restructuring. Xpeng's autonomous driving department established three new segments: AI model development, AI application development, and AI efficiency development. The AI model development department is mainly responsible for end-to-end model development, which is to strengthen the layout of AI end-to-end intelligent driving technology.

In August 2024, SAIC is unifying R & D business of IM and Rising brands into SAIC Group Innovation Research and Development Institute (referred to as SAIC R & D Institute). Among them, the R & D teams of IM and Rising brands, as well as technical projects such as power batteries, intelligent driving, and chassis, will be centrally migrated to SAIC R & D Institute, and unified and coordinated by R & D Institute. This model of centralizing the R & D power of all its sub-brands and developing them uniformly is the "large R & D institute" model commonly used by automobile manufacturing groups. Through this model, the platform and standardized layout of products are carried out to achieve equal sharing of R & D costs and strive to reduce costs at the source.

Multinational automakers strengthen cooperation with China's local software supply chain

At present, the localization development of multinational automakers in China has entered a new stage. This is different from the previous "sewing" auxiliary decoration and development, but to fundamentally restructure the system, actively adjust the strategy, and actively layout to cope with the new changes in China's auto market. It can be summarized as follows:

Increase China's local investment and R & D center layout. For example, in March 2022, Mercedes-Benz announced the establishment of a R & D center in Shanghai to further expand its R & D layout in China. The Shanghai R & D center will focus on intelligent interconnection, autonomous driving, software and hardware development and big data. In April 2023, Volkswagen Group announced that it will invest about 1 billion euros to establish a R & D, innovation and procurement center focusing on intelligent connected electric vehicles.

Further open up the authority of China's local teams and strengthen China's local customization strategy. At present, Mercedes-Benz, BMW, Volkswagen and other foreign automakers have proposed China's local customized development model to further open up the authority of China's local teams.

Actively cooperate with local Chinese suppliers. For example, Mercedes-Benz has in-depth cooperation with Momenta, Tencent, AISpeech, etc.; Volkswagen has in-depth cooperation with ThunderSoft, Horizon, XPeng Motors, etc.

In recent years, Volkswagen Group has actively promoted the layout of intelligent software. In Chinese market, Volkswagen Group has completely delegated the R & D decision-making power to the team in the Chinese market. From hardware platform of the model to electronic and electrical architecture to intelligent driving, cockpit, and even design, the local team makes independent decisions and makes local solutions. Volkswagen is responding to the challenges of its development in China and reshaping its software business by strengthening partnerships and leveraging external expertise.

In May 2023, Volkswagen Group announced the establishment of the largest R & D center in Hefei besides the German headquarters, investing about 1 billion euros, namely Volkswagen (China) Technology Co., Ltd., to systematically strengthen R & D strength "in China, for China". On April 11, 2024, Volkswagen Group (China) announced that it would invest 2.50 billion euros to further expand production and innovation center in Hefei, Anhui.

At the same time, starting from 2023, Volkswagen will cooperate with Horizon, ThunderSoft, XPeng Motors, SAIC and other local Chinese companies in the fields of E/E architecture, cockpit, intelligent driving, UI/UX and so on.

Software suppliers promote "customized development" to "IP/platformization" layout, the software R&D cycle is greatly compressed, and the cost reduction cycle is started

The IP/platformization layout of the software supplier's products helps OEM reduce costs and increase efficiency

At present, the automotive software business mainly includes customized software development and design, technical services, software IP authorization/licensing, and system integration, and the fees mainly include one-time fee NRE, software authorization/licensing, and royalty paid per piece.

In recent years, software suppliers in China's automotive market have mainly focused on software customized development or technical service business. Especially in the field of intelligent cockpit and intelligent driving. As to customized supply model, suppliers need to improve their company's reputation and expand market demand by developing new technologies and solutions through customized development with OEMs at the early stage.

With the emergence of mass production effect, in order to further improve efficiency and achieve large-scale product production at the same time, the software supplier business has gradually developed from "customization" to "IP/platformization". On the one hand, through IP or platformization product layout, OEMs can reduce costs and increase efficiency at a greater level, shorten the development cycle; on the other hand, it is more conducive to the large-scale replication of supplier business and the polishing and optimization of smart vehicle products, expanding the company's profit margins.

Taking cockpit platform products as an example, many suppliers offer cockpit platform products, which not only ensure high performance, but also achieve performance such as shortening development cycles and reducing costs through platform to meet the needs of highly competitive OEMs.

Cloud-native, AI large models help explore new models of software development and shorten development cycles

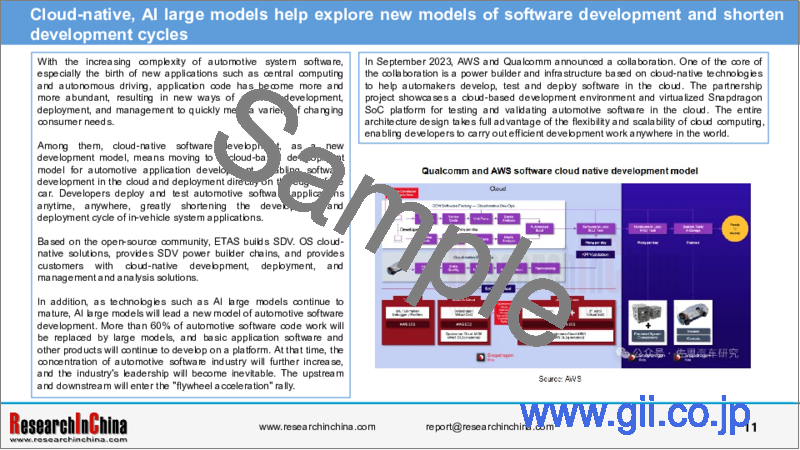

With the increasing complexity of automotive system software, especially the birth of new applications such as central computing and autonomous driving, application code has become more and more abundant, resulting in new ways of software development, deployment, and management to quickly meet a variety of changing consumer needs.

Among them, cloud-native software development, as a new development model, means moving to a cloud-based development model for automotive application development, enabling software development in the cloud and deployment directly on the edge of the car. Developers deploy and test automotive software applications anytime, anywhere, greatly shortening the development and deployment cycle of in-vehicle system applications.

In September 2023, AWS and Qualcomm announced a collaboration. One of the core of the collaboration is a power builder and infrastructure based on cloud-native technologies to help automakers develop, test and deploy software in the cloud. The partnership project showcases a cloud-based development environment and virtualized Snapdragon SoC platform for testing and validating automotive software in the cloud. The entire architecture design takes full advantage of the flexibility and scalability of cloud computing, enabling developers to carry out efficient development work anywhere in the world.

Based on the open-source community, ETAS builds SDV. OS cloud-native solutions, provides SDV power builder chains, and provides customers with cloud-native development, deployment, and management and analysis solutions.

In addition, as technologies such as AI large models continue to mature, AI large models will lead a new model of automotive software development. More than 60% of automotive software code work will be replaced by large models, and basic application software and other products will continue to develop on a platform. At that time, the concentration of automotive software industry will further increase, and the industry's leadership will become inevitable. The upstream and downstream will enter the "flywheel acceleration" rally.

Vehicle-level OS platform, OEMs and suppliers coordinate layout

At present, vehicle OS products are mainly composed of standardized middleware such as Hypervisor, underlying OS, AUTOSAR, other core middleware and tool chains, etc., to realize the operating system of the central computing unit software system function.

At present, there are three main paths for OEMs in China to deploy vehicle OS: full-stack self-development, internal incubation of Tier1, and joint development.

At present, except for some OEMs with strong R & D strength, most OEMs tend to implement the layout of the whole vehicle OS through the model of joint development with suppliers. In the face of the customized needs of OEMs, the supplier's software development team is an ideal partner for OEMs, which can cooperate in R & D and help customers quickly develop products, shortening product launch time.

In the face of the vehicle-level OS market, software suppliers have launched platform-based vehicle OS solutions and flexible supply methods to help OEMs quickly create suitable software platform products for central computing. For example, ThunderSoft launched the vehicle AquaDrive OS system, ArcherMind Technology's cross-domain vehicle Fusion OS, Kotei KCar-OS, ETAS's end-to-end vehicle OS solution, Huawei iDVP intelligent digital base, etc.

In addition, under the trend of SOA software frameworks, cooperation models such as OEMs, Tier1, and software developers are no longer chimney-like, but in-depth strategic cooperation models. Through partnerships and ecological integration, the entire OS can be more open and serve the development of the entire industry.

Table of Contents

1 Analysis of Automotive Software Business Model and Trend

- 1.1 Overview of Intelligent Vehicle Software Industry Chain

- 1.1.1 Definition and Architecture of Intelligent Vehicle Software

- 1.1.2 Categories Covered by Intelligent Vehicle Software

- 1.1.3 Evolution of Intelligent Vehicle Software Architecture:

- 1.1.4 Changes in Automotive Software Development Methods of OEMs

- 1.1.5 Categories of Automotive Software Suppliers

- 1.1.6 Software Empowers OEMs to Realize Value

- 1.1.7 Development Trends of Intelligent Vehicle Software

- 1.1.8 Automotive Software Market Size

- 1.2 Software System Supply Chain Establishment and Organizational Structure Adjustment of Major OEMs

- 1.2.1 Organizational Structure Adjustment of OEMs in Software R&D

- 1.2.1.1 Organizational Structure Adjustment Strategies of OEMs (1):

- 1.2.1.2 Organizational Structure Adjustment Strategies of OEMs (2):

- 1.2.1.3 Organizational Structure Adjustment Strategies of OEMs (3):

- 1.2.1.4 Organizational Structure Adjustment Strategies of OEMs (4):

- 1.2.1.5 R&D Organizations, R&D Investment and Team Size of Major OEMs

- 1.2.2 Software System Supply Chain Construction Strategies of Major OEMs

- 1.2.2.1 Software Layout Strategies of OEMs (1):

- 1.2.2.2 Software Layout Strategies of OEMs (2):

- 1.2.2.3 Software Layout Strategies of OEMs (3):

- 1.2.2.4 Software Layout Strategies of OEMs (4):

- 1.2.2.5 Software Layout Strategies of OEMs (5):

- 1.2.2.6 Software Layout Strategies of OEMs (6):

- 1.2.2.7 Software Layout Strategies of OEMs (7):

- 1.2.2.8 Software System Supply Chain Construction of OEMs: NIO

- 1.2.2.9 Software System Supply Chain Construction of OEMs: Xpeng

- 1.2.2.10 Software System Supply Chain Construction of OEMs: Li Auto

- 1.2.2.11 Software System Supply Chain Construction of OEMs: Leapmotor

- 1.2.2.12 Software System Supply Chain Construction of OEMs: Neta

- 1.2.2.13 Software System Supply Chain Construction of OEMs: ZEEKR

- 1.2.2.14 Software System Supply Chain Construction of OEMs: IM

- 1.2.2.15 Software System Supply Chain Construction of OEMs: GAC

- 1.2.2.16 Software System Supply Chain Construction of OEMs: Chery

- 1.2.2.17 Software System Supply Chain Construction of OEMs: Voyah

- 1.2.1 Organizational Structure Adjustment of OEMs in Software R&D

- 1.3 Summary of Business Models of Intelligent Vehicle Software Related Suppliers

- 1.3.1 Main Business Types of Software Suppliers

- 1.3.2 Main Charging Models of Software Suppliers

- 1.3.3 Software Licensing Fees for Some Intelligent Vehicle Software Modules

- 1.3.4 Automotive Software Sales Models

- 1.3.5 Summary of Business Models of Major Automotive Software Suppliers by Product (1)

- 1.3.6 Summary of Business Models of Major Automotive Software Suppliers by Product (2)

- 1.3.7 Summary of Business Models of Major Automotive Software Suppliers by Product (3)

- 1.3.8 Summary of Business Models of Major Automotive Software Suppliers by Product (4)

- 1.3.9 Summary of Business Models of Major Automotive Software Suppliers by Product (5)

- 1.3.10 Summary of Business Models of Major Automotive Software Suppliers by Product (6)

- 1.3.11 Summary of Business Models of Major Automotive Software Suppliers by Product (7)

- 1.3.12 Business models of Major Automotive Software Products

- 1.3.13 Business Models of Major Automotive Software Suppliers

- 1.3.14 Evolution Trend of Role of Software Suppliers under SVD Trend

- 1.3.15 Software Development Strategies of OEMs

- 1.3.16 Software Value Realization Solution of Suppliers

- 1.3.17 Evolution Trend of Value Realization Mode of Intelligent Vehicle Software

- 1.3.18 Proportion of Value Realization Mode of Intelligent Vehicle Software

- 1.4 Development Trend of Smart Vehicle Software Business Model

- 1.4.1 Changes in Intelligent Vehicle Software Supply Models

- 1.4.1.1 Role Transformation of Software Suppliers under SVD Trend (Tier2-Tier1/Tier0.5)

- 1.4.1.2 Automotive Software Supply Models (1):

- 1.4.1.3 Automotive Software Supply Models (2):

- 1.4.1.4 Automotive Software Supply Models (3):

- 1.4.2 Software Business Exploration Models (1):

- 1.4.2.1 Charging Strategies of Software Suppliers:

- 1.4.2.2 Case 1:

- 1.4.2.3 Case 2:

- 1.4.3 Software Business Exploration Models (2):

- 1.4.3.1 Exploration of Software Suppliers in Charging Models:

- 1.4.3.2 Case:

- 1.4.4 Development Trends of Business Models by Software Product

- 1.4.4.1 Future Automotive Software Product Development Trends and Business Model Exploration (1)

- 1.4.4.2 Future Automotive Software Product Development Trends and Business Model Exploration (2)

- 1.4.5 New Development Models of Intelligent Vehicle Software (1):

- 1.4.5.1 Future Central Computing Will Be Oriented Towards Value Development, and Development Methods Will Become More Open

- 1.4.5.2 The New Cloud Native Development Model Facilitates Simultaneous Development of Software and Hardware and Shortens the Development Cycle

- 1.4.5.3 Case 1:

- 1.4.5.4 Case 2:

- 1.4.5.5 Case 3:

- 1.4.5.6 Case 4:

- 1.4.5.7 Case 5:

- 1.4.5.8 Case 6:

- 1.4.6 New Development Models of Intelligent Vehicle Software (2):

- 1.4.6.1 AI Foundation Model Software Development

- 1.4.6.2 AI Foundation Models are Used for Software Development and Testing

- 1.4.6.3 Case 1:

- 1.4.1 Changes in Intelligent Vehicle Software Supply Models

2. Analysis on OEMs' Response to Software Innovation Strategy

- 2.1 Mercedes-Benz

- 2.1.1 Software Business Layout

- 2.1.2 Layout Mode of MB.OS

- 2.1.3 Construction of Software Division

- 2.1.4 Software Layout Strategy:

- 2.1.5 Localized Software Business Layout in China

- 2.1.6 Software Partners

- 2.2 BYD

- 2.2.1 Intelligent Layout Planning

- 2.2.2 Self-developed BYD OS

- 2.2.3 Intelligent Organizational Adjustment:

- 2.2.4 Intelligent Driving Business Layout Evolves from Cooperation to Independent R&D (1)

- 2.2.5 Intelligent Driving Business Layout Evolves from Cooperation to Independent R&D (2)

- 2.2.6 Intelligent Driving Business Layout Evolves from Cooperation to Independent R&D (3)

- 2.3 BMW

- 2.3.1 Software Business Layout: Continuous Evolution of IVI System

- 2.3.2 Software business layout: In-depth Layout in Intelligent Driving Cooperation

- 2.3.3 Localized Software Business Layout in China:

- 2.3.4 Localized Software Business Layout in China:

- 2.3.5 Localized Software Business Layout in China: Partners

- 2.4 Volkswagen

- 2.4.1 Software Platform Planning

- 2.4.2 Process of Software Team Construction

- 2.4.3 The Latest Software Organizational Structure in China

- 2.4.4 Establishment of the Largest R&D Center in China

- 2.4.5 Software Team Layout in China: Local Solution Layout

- 2.4.6 Core Business in China

- 2.4.7 Partners

- 2.5 Ford

- 2.5.1 Software Business Layout

- 2.5.2 Software Business Team (1)

- 2.5.3 Software Business Team (2):

- 2.5.4 Software Business Layout Strategy:

- 2.6 SAIC

- 2.6.1 Software Business Layout

- 2.6.2 Software Business Layout Strategy (1):

- 2.6.3 Software Business Layout Strategy (2):

- 2.6.4 Software Business Layout Strategy (3):

- 2.6.5 Software Business Layout Strategy (4):

- 2.6.6 R&D Team Adjustment:

- 2.6.7 Personnel Change: A Major Reshuffle of Senior Management

- 2.6.8 Evolution of Z-One Galaxy Full Stack Solution

- 2.6.9 Z-One Galaxy Full Stack Solution 3.0

- 2.6.10 Z-One Galaxy's First-generation Central Brain Software System

- 2.6.11 Z-One Galaxy's Second-generation Central Brain Software System

- 2.7 Great Wall Motor

- 2.7.1 Status Quo of Intelligent Business Layout

- 2.7.2 Layout of Coffee Intelligence

- 2.7.3 Forest Ecosystem

- 2.7.4 Software Layout Strategy (1):

- 2.7.5 Software Layout Strategy (2):

- 2.7.6 Software Team Construction:

- 2.7.7 Organizational Architecture Adjustment

- 2.7.8 Software Cooperation Ecosystem

- 2.8 Geely

- 2.8.1 Software Business Layout

- 2.8.2 Software Business Layout Strategy:

- 2.8.3 Software Business Layout Planning

- 2.8.4 R&D Architecture Adjustment:

- 2.9 Changan Automobile

- 2.9.1 Software Business Layout

- 2.9.2 Software Business Planning

- 2.9.3 R&D System Reform

- 2.9.4 Software Business Team Construction:

- 2.9.5 Software Business Team Construction:

- 2.10 Xpeng

- 2.10.1 Software Business Layout

- 2.10.2 Distribution of R&D Centers

- 2.10.3 Continuous Adjustment of Organizational Structure

- 2.10.4 Personnel Reshuffle and AI-oriented Organizational Change

- 2.10.5 Autonomous Driving Team

- 2.11 Li Auto

- 2.11.1 Software Business Layout

- 2.11.2 Organizational Architecture Adjustment

- 2.11.3 R&D Center

- 2.11.4 Intelligent Driving Software Business Layout

- 2.11.5 Li OS

- 2.12 FAW

- 2.12.1 Intelligent Layout

- 2.12.2 Global R&D Layout

- 2.12.3 Hongqi Intelligent HIS Software Architecture

- 2.13 Chery

- 2.13.1 Intelligent Layout Planning

- 2.13.2 Software Business Layout

- 2.13.3 Intelligent Driving Business Layout

- 2.13.4 Zhuojie Joint Innovation Center

3 Automotive Operating System Business and Layout Models

- 3.1 Status Quo and Trends of Automotive Operating System Business Models

- 3.1.1 Types of Automotive Operating Systems

- 3.1.2 Synergy and Symbiosis between Narrow Operating Systems and Generalized Operating Systems

- 3.1.3 Automotive Operating System Business Models

- 3.1.4 Business Models of Automotive Basic Software (Generalized Operating Systems) by Module

- 3.1.5 Business Models of Major Automotive Operating System Enterprises

- 3.1.6 Smart Cockpit OS Business Models

- 3.1.7 Business Models of Autonomous Driving OS Suppliers

- 3.1.8 Development Trends and Business Model Exploration of Automotive Operating Systems

- 3.2 Vehicle OS

- 3.2.1 Definition of Vehicle OS

- 3.2.2 Framework of Vehicle OS

- 3.2.3 Purpose of Vehicle OS

- 3.2.4 Evolution of Vehicle OS Development Models

- 3.2.5 Market Opportunities for Vehicle OS Suppliers

- 3.2.6 Role Transformation of Automotive OS Software Suppliers

- 3.2.7 Evolution of Business Models under the Trend of Vehicle OS

- 3.2.8 Vehicle OS Layout Modes of OEMs

- 3.2.9 Business Models (1):

- 3.2.10 Business Models (2):

- 3.2.11 Business Models (3):

- 3.2.12 Vehicle OS Composition and Business Models of Suppliers (1)

- 3.2.13 Vehicle OS Composition and Business Models of Suppliers (2)

- 3.2.14 Vehicle OS Composition and Business Models of Suppliers (3)

- 3.2.15 Vehicle OS Composition and Business Models of Suppliers (4)

- 3.2.16 Vehicle OS Layout Cases of Suppliers (1):

- 3.2.17 Vehicle OS Layout Cases of Suppliers (2):

- 3.2.18 Vehicle OS Layout Cases of Suppliers (3):

- 3.2.19 Vehicle OS Layout Cases of Suppliers (4):

- 3.2.20 Vehicle OS Layout Cases of Suppliers (5):

- 3.2.21 Vehicle OS Layout Cases of Suppliers (6):

- 3.2.22 Vehicle OS Layout Cases of Suppliers (7):

- 3.2.23 Vehicle OS Layout Cases of Suppliers (8):

- 3.2.24 Vehicle OS Layout Cases of Suppliers (9):

- 3.2.25 Vehicle OS Layout Cases of Suppliers (10):

- 3.2.26 Vehicle OS Layout Cases of Suppliers (11):

- 3.3 Main Underlying Automotive Operating Systems

- 3.3.1 Basic Automotive Operating Systems and Business Models

- 3.3.2 Automotive RTOS and Business Models (1)

- 3.3.3 Automotive RTOS and Business Models (2)

- 3.3.4 Intelligent Driving Operating Systems and Business Models (1)

- 3.3.5 Intelligent Driving Operating Systems and Business Models (2)

- 3.3.6 Intelligent Driving Operating Systems and Business Models (3)

- 3.3.7 Intelligent Driving Operating Systems and Business Models (4)

- 3.3.8 Intelligent Driving Operating Systems and Business Models (5)

- 3.3.9 Cockpit Operating Systems and Business Models (1)

- 3.3.10 Cockpit Operating Systems and Business Models (2)

- 3.4 Main Automotive Middleware Business Models

- 3.4.1 Types of Middleware Suppliers

- 3.4.2 Business Models of Middleware Suppliers

- 3.4.3 Business Models of Middleware Suppliers

- 3.4.4 ROS Middleware Products and Business Models

- 3.4.5 DDS Middleware Products and Business Models (1)

- 3.4.6 DDS Middleware Products and Business Models (2)

- 3.4.7 DDS Middleware Products and Business Models (3)

- 3.4.8 Communication Middleware Products and Business Models

- 3.4.9 MCAL Middleware Products and Business Models (1)

- 3.4.10 MCAL Middleware Products and Business Models (2)

- 3.4.11 Autonomous Driving Middleware Products and Business Models (1)

- 3.4.12 Autonomous Driving Middleware Products and Business Models (2)

- 3.4.13 Autonomous Driving Middleware Products and Business Models (3)

- 3.4.14 Autonomous Driving Middleware Products and Business Models (4)

- 3.4.15 Autonomous Driving Middleware Products and Business Models (5)

- 3.4.16 Autonomous Driving Middleware Products and Business Models (6)

- 3.4.17 Autonomous Driving Middleware Products and Business Models (7)

- 3.4.18 Autonomous Driving Middleware Products and Business Models (8)

- 3.4.19 Other Middleware Products and Business Models (1)

- 3.4.20 Other Middleware Products and Business Models (2)

- 3.4.21 Other Middleware Products and Business Models (2)

- 3.5 AUTOSAR

- 3.5.1 AUTOSAR Industry Chain

- 3.5.2 Business Models of AUTOSAR Software Tool Suppliers (1)

- 3.5.3 Business Models of AUTOSAR Software Tool Suppliers (2)

- 3.5.4 Business Models of AUTOSAR Software Tool Suppliers (3)

- 3.5.5 Business Models of AUTOSAR Software Tool Suppliers (4)

- 3.5.6 Business Models of AUTOSAR Software Tool Suppliers (5)

- 3.5.7 Business Models of AUTOSAR Software Tool Suppliers (6)

- 3.5.8 Business Models of AUTOSAR Software Tool Suppliers (7)

- 3.5.9 Business Models of AUTOSAR Software Tool Suppliers (8)

4 Intelligent Cockpit Business and Layout Models

- 4.1 Intelligent Cockpit Software System Business Models and Trends

- 4.1.1 Cockpit Application Software Layer Industry Chain

- 4.1.2 Main Cockpit Application Software Module Business Models

- 4.1.3 Trends of Main Cockpit Application Software Module Business Models

- 4.1.4 Evolution Trends of Intelligent Cockpit System Development

- 4.1.5 Four Supply Models of Intelligent Cockpit Systems

- 4.1.6 The Cockpit Platform Development Cycle of Major Suppliers Continues to Shorten

- 4.1.7 Main Intelligent Cockpit Software Platform Suppliers and Business Models (1)

- 4.1.1 Main Intelligent Cockpit Software Platform Suppliers and Business Models (2)

- 4.1.9 Main Intelligent Cockpit Software Platform Suppliers and Business Models (3)

- 4.2 Automotive HMI Design

- 4.2.1 Automotive HMI Software Business Models

- 4.2.2 Automotive 3D Engine-equipped Intelligent Cockpit Layout and Business Models

- 4.2.3 Typical Business Models (1):

- 4.2.4 Typical Business Models (2):

- 4.2.5 Typical Business Models (3):

- 4.2.6 Products and Business Models of Major HMI Designers (1)

- 4.2.7 Products and Business Models of Major HMI Designers (2)

- 4.2.8 Products and Business Models of Major HMI Designers (3)

- 4.2.9 Products and Business Models of Major HMI Designers (4)

- 4.2.10 Products and Business Models of Major HMI Designers (5)

- 4.2.11 Latest Products and Business Models of Major HMI Design Software Suppliers (6)

- 4.2.12 3D HMI Engine Layout and Business Models of Major Suppliers (7)

- 4.3 Automotive Voice Business Models and Trends

- 4.3.1 Automotive Voice Industry Chain

- 4.3.2 Automotive Voice Industry Supply:

- 4.3.3 Customization of Automotive Voice Functions

- 4.3.4 Automotive Voice Suppliers Expand Their Monotonous Business to All-in-one Business

- 4.3.5 AI Foundation Models Support the Development of Automotive Voice

- 4.3.6 Typical Business Models (1):

- 4.3.7 Typical Business Models (2):

- 4.3.8 Typical Business Models (3):

- 4.3.9 Typical Business Models (4):

- 4.3.10 Typical Business Models (5):

- 4.3.11 Typical Business Models (6):

- 4.3.12 Main Voice Software Suppliers and Business Models (1)

- 4.3.13 Main Voice Software Suppliers and Business Models (2)

- 4.3.14 Main Voice Software Suppliers and Business Models (3)

- 4.3.15 Main Voice Software Suppliers and Business Models (4)

- 4.3.16 Main Voice Software Suppliers and Business Models (5)

- 4.3.17 Main Voice Software Suppliers and Business Models (6)

- 4.4 Automotive Map Navigation Business Models and Trends

- 4.4.1 HD Map Business Models (1):

- 4.4.2 HD Map Business Models (2):

- 4.4.3 Cooperation Mode between HD Map Suppliers and OEMs

- 4.4.4 Monetization

- 4.4.5 HD Map Profit Models

- 4.4.6 Changes in Business Models of Map Suppliers amid the Development of Urban NOA

- 4.4.7 Cases of Business Models:

- 4.4.8 Automotive Navigation Map Business Models of Main Suppliers (1)

- 4.4.9 Automotive Navigation Map Business Models of Main Suppliers (2)

- 4.4.10 HD Map Business Models of Main Suppliers (1)

- 4.4.11 HD Map Business Models of Main Suppliers (2)

- 4.4.12 HD Map Business Models of Main Suppliers (3)

- 4.4.13 HD Map Business Models of Main Suppliers (4)

- 4.4.14 Light Intelligent Driving Map Business Models of Major Suppliers (1)

- 4.4.15 Light Intelligent Driving Map Business Models of Major Suppliers (2)

- 4.5 Automotive Acoustic System

- 4.5.1 Status Quo of Acoustic Software Business Models

- 4.5.2 Summary of Business Models of Acoustic Software Suppliers

- 4.5.3 Evolution of Acoustic Software Procurement Models of OEMs:

- 4.5.4 Exploration of Acoustic Software Business Models

- 4.5.5 Typical Models (1):

- 4.5.6 Typical Models (2):

- 4.5.7 Typical Models (3):

- 4.5.8 Typical Models (4):

- 4.5.9 Typical Models (5):

- 4.5.10 Typical Models (6):

- 4.5.11 Typical Models (7):

- 4.5.12 Typical Models (8):

- 4.5.13 Acoustic Software Suppliers and Business Models (1)

- 4.5.14 Acoustic Software Suppliers and Business Models (2)

- 4.5.15 Acoustic Software Suppliers and Business Models (3)

- 4.5.16 Acoustic Software Suppliers and Business Models (4)

- 4.5.17 Acoustic Software Suppliers and Business Models (5)

- 4.5.18 Acoustic Software Suppliers and Business Models (6)

- 4.5.19 Acoustic Software Suppliers and Business Models (7)

- 4.6 AR-HUD Software

- 4.6.1 Core AR HUD Technology

- 4.6.2 Main Directions for AR-HUD Software Upgrade

- 4.6.3 AR Creator Has Become The Core Element of AR-HUD, and Software Capabilities Are Particularly Important

- 4.6.4 AR HUD Software Supply Models

- 4.6.5 AR HUD Software Supply Models

- 4.6.6 AR HUD Quotation Logic

- 4.6.7 Typical Models (1):

- 4.6.8 Typical Models (2):

- 4.6.9 Typical Models (3):

- 4.6.10 Typical Models (4):

- 4.6.11 Typical Models (5):

- 4.6.12 Typical Models (6):

- 4.6.13 HUD Software Suppliers and Business Models (1)

- 4.6.14 HUD Software Suppliers and Business Models (2)

- 4.6.15 HUD Software Suppliers and Business Models (3)

- 4.6.16 HUD Software Suppliers and Business Models (4)

- 4.6.17 HUD Software Suppliers and Business Models (5)

- 4.7 In-cockpit Vision (DMS/OMS) Business Models and Trends

- 4.7.1 In-cockpit Vision Industry Chain

- 4.7.2 Cost Composition of In-cockpit Vision Industry

- 4.7.3 In-cockpit Vision Quotation Logic

- 4.7.4 In-cockpit Vision Business Models

- 4.7.5 Typical Models (1):

- 4.7.6 Typical Models (2):

- 4.7.7 Typical Models (3):

- 4.7.8 DMS Visual Perception Algorithm Suppliers and Business Models (1)

- 4.7.9 DMS Visual Perception Algorithm Suppliers and Business Models (2)

- 4.7.10 DMS Visual Perception Algorithm Suppliers and Business Models (3)

- 4.7.11 DMS Visual Perception Algorithm Suppliers and Business Models (4)

- 4.7.12 DMS Visual Perception Algorithm Suppliers and Business Models (5)

- 4.8 Multi-modal Fusion Interaction

- 4.8.1 Multi-modal Interactive Software Supply Trend: Transition from Single-module Supply to Integrated Supply

- 4.8.2 Product Model Strategies of HMI Suppliers (1):

- 4.8.3 Product Model Strategies of HMI Suppliers (2):

- 4.8.4 Product Model Strategies of HMI Suppliers (3):

- 4.8.5 Multi-modal Fusion Interactive Layout Modes (1):

- 4.8.6 Multi-modal Fusion Interactive Layout Modes (2):

- 4.8.7 Multi-modal Fusion Interactive Layout Modes (2):

- 4.8.8 Multi-modal Fusion Interactive Software Suppliers and Business Models (1)

- 4.8.9 Multi-modal Fusion Interactive Software Suppliers and Business Models (2)

- 4.8.10 Multi-modal Fusion Interactive Software Suppliers and Business Models (3)

- 4.9 Cockpit Application of AI Foundation Models

- 4.9.1 Exploration of Main Business Models of AI Foundation Models

- 4.9.2 Main AI Foundation Model Layout Modes of OEMs

- 4.9.3 Typical Models (1):

- 4.9.4 Typical Models (2):

- 4.9.5 Typical Models (3):

- 4.9.6 Typical Models (4):

- 4.9.7 Typical Models (5):

- 4.9.8 Typical Models (6):

- 4.9.9 Typical Models (7):

- 4.9.10 Typical Models (8):

- 4.9.11 Layout and Business Models of GPT (1): Generative AI Foundation Models

- 4.9.12 Layout and Business Models of GPT (2): Generative AI Foundation Models

- 4.9.13 Layout and Business Models of GPT (3): Generative AI Foundation Models

- 4.9.14 Layout and Business Models of GPT (4): Generative AI Foundation Models

5 Autonomous Driving Business and Layout Models

- 5.1 Status Quo and Trends of Autonomous Driving System Software Business Models

- 5.1.1 Autonomous Robotaxi Business Model Exploration

- 5.1.2 Autonomous Driving Supply Chain Model

- 5.1.3 Autonomous Driving Classification

- 5.1.4 Autonomous Driving Software Layer Industry Chain

- 5.1.5 Autonomous Driving Layout Modes of OEMs

- 5.1.6 Autonomous Driving R&D Models of OEMs

- 5.1.7 Intelligent Driving Software Algorithm Supply Models

- 5.1.8 Intelligent Driving Algorithm Module Price

- 5.1.9 OEMs' Ecological Layout of Autonomous Driving Software

- 5.1.10 Autonomous Driving Business Models of OEMs:

- 5.2 Business Models of Mid-to-high-level ADAS Solutions

- 5.2.1 Typical Layout Models (1):

- 5.2.2 Typical Layout Models (2):

- 5.2.3 Typical Layout Models (3):

- 5.2.4 Typical Layout Models (4):

- 5.2.5 Typical Layout Models (5):

- 5.2.6 Competition among Intelligent Driving Suppliers Is Fierce as It Concerns Survival

- 5.2.7 High-level Intelligent Driving Supply Strategies (1):

- 5.2.8 High-level Intelligent Driving Supply Strategies (2):

- 5.2.9 Supply Strategies of Major High-level Intelligent Driving Suppliers (3):

- 5.2.10 Supply Strategies of Major High-level Intelligent Driving Suppliers (4):

- 5.2.11 ADAS Solution Suppliers and Business Models (1)

- 5.2.12 ADAS Solution Suppliers and Business Models (2)

- 5.2.13 ADAS Solution Suppliers and Business Models (3)

- 5.2.14 ADAS Solution Suppliers and Business Models (4)

- 5.2.15 ADAS Solution Suppliers and Business Models (5)

- 5.2.16 ADAS Solution Suppliers and Business Models (6)

- 5.3 L3/L4 Autonomous Driving System Business Models

- 5.3.1 Exploration of Business Model of autonomous Robotaxi

- 5.3.2 Robotaxi Cost Structure

- 5.3.3 Robotaxi Cooperation Models

- 5.3.4 Development Path of Major Robotaxi Players

- 5.3.5 Typical Models (1):

- 5.3.6 Typical Models (2):

- 5.3.7 Typical Models (3):

- 5.3.8 Development Trends of Robotaxi Business Models

- 5.3.9 Major L4 Autonomous Driving Technology Suppliers and Business Models (1)

- 5.3.10 Major L4 Autonomous Driving Technology Suppliers and Business Models (2)

6 Automotive Cloud Platform Business and Layout Models

- 6.1 Status Quo and Trends of Cloud Platform Software Business Models

- 6.1.1 Cloud Platform Layer Module Business Models

- 6.1.2 Cooperation Models between Cloud Platform Service Providers and OEMs

- 6.1.3 Cloud Platform Service Forms and Charging Models

- 6.1.4 Service Forms of Major Cloud Platform Providers

- 6.1.5 Development Trends of Automotive Cloud Services

- 6.1.6 Three Major Development Directions of Automotive Cloud Service Demand

- 6.1.7 Five Major Characteristics of Automotive Cloud Service Demand

- 6.1.8 Key Decisions of OEMs in Purchasing Cloud Services

- 6.1.9 Cloud Applications of OEMs

- 6.1.10 Automotive Cloud Business Models

- 6.1.11 Cloud Layout Strategies of OEMs

- 6.1.12 Development Trends of Vehicle-cloud Integration

- 6.1.13 Exploration of Future Automotive Cloud Service Business Models

- 6.2 Cloud Native

- 6.2.1 Development History of Cloud Native

- 6.2.2 Cloud-native Architecture Applications Gradually Realize the Concept of Cloud Empowering Cars and Cars Serving People

- 6.2.3 Development of Cloud Native Technology

- 6.2.4 The Combination of Data Lakes and Cloud Native Has Become a Hot Spot for Cloud Platform Enterprises to Explore

- 6.2.5 Cloud Native Business Models

- 6.2.6 Cloud Native Layout Modes of OEMs

- 6.2.7 Business Models (1):

- 6.2.8 Business Models (2):

- 6.2.9 Business Models (3):

- 6.2.10 Business Models (4):

- 6.2.11 Business Models (5):

- 6.2.12 Cloud Native Product Cases of Suppliers (1):

- 6.2.13 Cloud Native Product Cases of Suppliers (2):

- 6.2.14 Cloud Native Product Cases of Suppliers (3):

- 6.2.15 Cloud Native Product Cases of Suppliers (4):

- 6.3 OTA

- 6.3.1 OTA Industry Chain

- 6.3.2 OTA Business Models

- 6.3.3 OTA Operation Models

- 6.3.4 Evolution Trends of OTA Technology Follow the Development of Intelligent Vehicles

- 6.3.5 Supply Strategies of OTA Suppliers (1):

- 6.3.6 Supply Strategies of OTA Suppliers (2):

- 6.3.7 OTA Suppliers and Business Models (1)

- 6.3.8 OTA Suppliers and Business Models (2)

- 6.3.9 OTA Suppliers and Business Models (3)

- 6.3.10 OTA Suppliers and Business Models (4)

- 6.4 TSP/MNO Internet of Vehicles Service Providers

- 6.4.1 Internet of Vehicles Business Models

- 6.4.2 Value of Internet of Vehicles TSP

- 6.4.3 Internet of Vehicles TSP Business Models

- 6.4.4 Exploration of V2X Payment Models

- 6.4.5 Typical Business Models:

- 6.4.6 Internet of Vehicles Service Providers and Business Models (1)

- 6.4.7 Internet of Vehicles Service Providers and Business Models (2)

- 6.4.8 Internet of Vehicles Service Providers and Business Models (3)