|

|

市場調査レポート

商品コード

1482382

中国のカーエレクトロニクスOEM/ODM/EMS産業(2024年)Automotive Electronics OEM/ODM/EMS Industry Report, 2024 |

||||||

|

|||||||

| 中国のカーエレクトロニクスOEM/ODM/EMS産業(2024年) |

|

出版日: 2024年05月10日

発行: ResearchInChina

ページ情報: 英文 340 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

現在、中国のカーエレクトロニクス産業におけるOEMは、Luxshare Precision、Flextronics、Wistron、Quantaといった従来のコンシューマーエレクトロニクスのEMSプロバイダーを含むコンシューマーエレクトロニクスから転換したOEM、Wieson Automotive、Maruhi Electronicといったカーエレクトロニクスに特化した組立メーカー、Joyson Electronic、Hangsheng ElectronicsといったTier 1サプライヤーのOEMとアセンブリ事業の3つのタイプに大別できます。

OEMがカーエレクトロニクス分野に参入する3つの道

カーエレクトロニクス分野に参入する複数のメーカーの成長経路をまとめると、ほとんどの企業は買収、協業などの方法で自動車の産業チェーンに参加し、コア技術を獲得することで自動車産業への参入ペースを速め、市場を拡大し、産業の集中度を高めています。Huaqin Technology、Wingtech Technology、Luxshare Precisionなどのメーカーは、カーエレクトロニクス分野や合弁企業を設立し、カーエレクトロニクスの分野で新たなビジネスの成長余地を模索しています。

コンシューマーエレクトロニクスからカーエレクトロニクスへの役割転換に必要なリソースの構築には時間がかかり、基幹自動車部品の供給に直接参入する可能性は低いです。そのため、カーエレクトロニクスに手を出し始めたばかりのメーカーのほとんどは、付加価値も技術的敷居も低い製品から始めています。

経路1:例えば、Foxconnは2005年、中国台湾の4大自動車用ワイヤーハーネスメーカーの1つで、バッテリーケーブル、リバースレーダー、スマートデバイスなどの電子部品を製造するAnTec Electric Systemを買収しました。これによりFoxconnは自動車分野に進出しました。2010年、FoxconnはTeslaのサプライヤーシステムに参入し、センターコンソールのタッチスクリーン・パネル、コネクター、カバーなどの部品を提供しました。2013年、FoxconnはMercedes-BenzやBMWといった国際的な大手自動車企業のサプライチェーンシステムに参入しました。

経路2:Pegatronのカーエレクトロニクス分野への第一歩は、業界のメーカーと協力して自動車の基礎知識を強化することです。その後、関連する新技術を独自に学び、カーエレクトロニクス市場での足がかりを準備しました。例えば、Pegatronが開発した商業用ロボットAriaは、自動運転車の基礎となるHDマップや障害物回避などの技術を使用しているため、実は自動車参入への準備なのです。

経路3:Luxshare Precisionは、ワイヤーハーネスのOEMとアセンブリからコンシューマーエレクトロニクス分野に手を出し、徐々に接続ワイヤー、コネクター、音響・無線周波数デバイス、ワイヤレス充電、電子モジュールなどの生産に拡大しました。Luxshare Precisionは、コンシューマーエレクトロニクスと同じように、得意とするコネクターからカーエレクトロニクス分野に足を踏み入れ、さまざまな買収を通じてカーエレクトロニクス分野に参入しました。

Luxshare Precisionは2008年にDelphiにUSBケーブルを供給し、早くも自動車市場に参入しました。自動車市場に参入した後、「内発的成長とエピタキシャル成長」という並行発展戦略を企画し、投資、M&A、自主開発を経て、自動車部品のTier 1サプライヤーとなっています。2011年、Luxshare PrecisionはLuxshare Precision Industry(Kunshan)Co., Ltd.を設立し、まず自動車用コネクターやワイヤーハーネスなどの部品事業を展開しました。2012年、Luxshare PrecisionはFujian JK Wiring Systems Co., Ltd.を買収し、自動車用コネクター分野に進出し、Densoのサプライチェーンに参入しました。2013年、Luxshare Precisionは製品ラインと顧客ネットワークをさらに拡大し、ドイツのSUK(SUKはBMWとMercedes-Benzのドアロック用プラスチック部品のコアサプライヤー)を買収してドイツの自動車メーカーのサプライチェーンに参入しました。

当レポートでは、中国のカーエレクトロニクスOEM/ODM/EMS産業について調査分析し、などの情報を提供しています。

目次

第1章 カーエレクトロニクスOEM/ODM/EMS産業の概要

- カーエレクトロニクスOEM/ODM/EMSモデルと開発動向

- カーエレクトロニクス市場がEMS産業に新たな機会をもたらす

- 自動車Tier 1サプライヤーがOEM/ODM/EMS事業を開始

- カーエレクトロニクスOEM/ODM/EMS企業とそのレイアウト戦略のサマリー

第2章 カーエレクトロニクスOEM/ODM/EMS:製品別

- ドメインコントローラーOEM/ODM/EMS

- LiDAR OEM/ODM/EMS

- スケートボードシャーシOEM/ODM/EMS

- 自動車シート部品OEM/ODM/EMS

- 車両ディスプレイアセンブリOEM/ODM/EMS

- 車両OEM/ODM/EMS

- 車両通信モジュールOEM/ODM/EMS

- EICシステムOEM/ODM/EMS

- カーエレクトロニクスPCBA OEM/ODM/EMS

- 車両ワイヤレス充電モジュールOEM/ODM/EMS

第3章 カーエレクトロニクスOEM/ODM/EMSの重要ポイント

- カーエレクトロニクスOEM/ODM/EMS企業の成長経路

- カーエレクトロニクスOEM/ODM/EMS企業の競争優位性

- カーエレクトロニクスOEM/ODM/EMSの生産障壁:セグメント別

- カーエレクトロニクスOEM/ODM/EMS企業間の収益と粗利益の比較

第4章 カーエレクトロニクスOEM/ODM/EMS企業 - 他産業から変革するEMSプロバイダー

- Foxconn

- Quanta

- Pegatron

- Wistron

- Flextronics

- Universal Scientific Industrial (USI)

- PRIME Technology

- Luxshare Precision

- BYD Electronics

- DBG Technology

- Sunny Optical

- IMI

- MAXWAY

- Longtech

- Jabil

- Compal

- Inventec

- Wingtech Technology

- Huaqin Technology

第5章 カーエレクトロニクスOEM/ODM/EMS企業 - 自動車OEM/ODM/EMSに注力するメーカー

- Wieson Automotive

- Maruhi Electronics

- Magna

第6章 カーエレクトロニクスOEM/ODM/EMS企業 - OEM/ODM/EMS事業に従事するTier 1サプライヤー

- Desay SV

- Hytera

- PATEO CONNECT+

- Foryou Corporation

- Joyson Electronic

- Hangsheng Electronics

Automotive electronics OEM/ODM/EMS research: top players' revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics industry can be roughly divided into three types: those that transform from consumer electronics, including conventional consumer electronics EMS providers such as Luxshare Precision, Flextronics, Wistron and Quanta; assembly manufacturers that focus on automotive electronics, such as Wieson Automotive and Maruhi Electronic; OEM and assembly businesses of Tier 1 suppliers like Joyson Electronic and Hangsheng Electronics.

Three paths for OEMs to enter the automotive electronics field

From the summary of the growth paths of some manufacturers entering the automotive electronics field, it can be seen that: most companies participate in the automotive industry chain by acquisition, cooperation and other ways, and acquire core technologies to quicken their pace of entering the automotive industry, make an expansion in the market and improve industry concentration. Manufacturers including Huaqin Technology, Wingtech Technology and Luxshare Precision have established automotive electronics divisions or joint ventures to find new business growth space in the field of automotive electronics.

It takes some time to build up resources required to switch the role from consumer electronics to automotive electronics, and it is unlikely to directly enter the supply of core automotive parts. Therefore most manufacturers that have just begun to dabble in automotive electronics have started with products with low added value and low technical threshold.

Path 1: Take Foxconn as an example. In 2005, Foxconn acquired AnTec Electric System, one of the four major automotive wiring harness manufacturers in China Taiwan, which manufactures electronics such as battery cables, reversing radars and smart devices. Foxconn thereby set foot in the automotive field. In 2010, Foxconn entered Tesla's supplier system, providing center console touch screen panels, connectors, covers and other components. In 2013, Foxconn entered the supply chain systems of international automotive giants like Mercedes-Benz and BMW.

Path 2: Take Pegatron as an example. Pegatron's first step into the automotive electronics field is to cooperate with industry manufacturers to reinforce basic vehicle knowledge. It has then independently learned related new technologies to prepare for a foothold in the automotive electronics market. For instance, Aria, the commercial robot developed by Pegatron, is actually a preparation for entry into automotive, because Aria uses such technologies as HD maps and obstacle avoidance, which are the basis for autonomous vehicles.

Path 3: Take Luxshare Precision as an example. Luxshare Precision dabbled in the consumer electronics field starting with wire harness OEM and assembly, and gradually expanded to the production of connecting wires, connectors, acoustic and radio frequency devices, wireless charging, electronic modules and other products. Luxshare Precision set foot in the automotive electronics field by the same way as consumer electronics, starting with connectors which it excels at, and then breaking into the automotive electronics field through a range of acquisitions.

Luxshare Precision stepped into the automotive market as early as 2008 by supplying USB cables to Delphi. After entering the automotive market, it proposed the parallel development strategy of "endogenous growth and epitaxial growth", and has become a Tier 1 supplier of auto parts by way of investment, mergers and acquisitions and self-development. In 2011, Luxshare Precision established Luxshare Precision Industry (Kunshan) Co., Ltd., first developing components businesses like automotive connectors and wiring harnesses; in 2012, Luxshare Precision acquired Fujian JK Wiring Systems Co., Ltd., thereby forging into the automotive connector field, and entered the supply chain of Denso; in 2013, Luxshare Precision further expanded its product lines and customer network and entered the supply chains of German automakers by acquiring Germany's SUK (SUK is a core supplier of plastic parts for door locks of BMW and Mercedes-Benz).

The success in the automotive wiring harness and connector product lines has helped Luxshare Precision to expand other automotive products, and has also offered great assistance for it in intelligent cockpit, intelligent driving and other product lines. In recent years, Luxshare Precision has made a gradual expansion from conventional vehicles to new energy vehicles, for example, it collaborated with RoboSense for a foray into the LiDAR market, and teamed up with Chery to enter the vehicle ODM field.

Luxshare Precision's domain controller business mainly adopts OEM (original equipment manufacturer) and JDM (joint design manufacturer) models, with development ideas similar to consumer electronics. In addition, Luxshare Precision dabbles in other automotive products similar to consumer electronics such as wireless charging by partnering with its major clients.

The competitive edges of automotive electronics OEMs: large-scale delivery experience + vertical integration capability.

For manufacturers that enter the automotive electronics OEM field from different industries or fields, their original genes determine their competitive edges in the field:

The advantage of consumer electronics EMS providers lies in their large-scale delivery experience gathered in consumer electronics, supply chain management capabilities, and strong sense of cost control;

Assembly manufacturers that specialize in automotive electronics have mature production processes and manufacturing management and quality systems thanks to their years of deployments in automotive electronics, and have accumulated a lot of customer resources. This is their edge that consumer electronics manufacturers do not have;

For automotive Tier 1 suppliers that are engaged in hardware OEM business, their know-how and product R&D capabilities in the automotive industry are their competitive edges that differentiate them from consumer electronics OEM giants.

At present, mainstream automakers in China attach ever more importance to companies with experience in consumer electronics when selecting supply chain partners. In particular, the entry of conventional consumer electronics OEM giants has significantly lowered the hardware design and production threshold of auto parts.

These consumer electronics EMS providers with years of efforts have built up rapid iteration capabilities, developed a sense of cost control, gained an edge in supply chain system, and had quick response capabilities and understanding of the ecosystem in consumer electronics. They can well help OEMs to promote and apply new products and new technologies.

The large-scale delivery experience and vertical integration capability are more in favor of manufacturers to secure automotive electronics OEM orders. Moreover the capabilities of supply chain management, quality and cost control, localized quick response, and technology development are all the focus of attention from customers in the automotive industry chain.

In June 2023, Foxconn received orders for electronic control units (ECUs) from Tesla and planned to produce them at the Mexican factory of its Business Group D. The factory of Foxconn (Hon Hai) in Mexico has advantages in mass production scale, personnel, cost and price. Meanwhile nearby supply also allows Hon Hai to better serve the American market and provide stable supply chain support for Tesla in the market. This will also further shorten the delivery time.

The growth trend of automotive electronics OEMs: develop from assembly and OEM to high value-added R&D and design links.

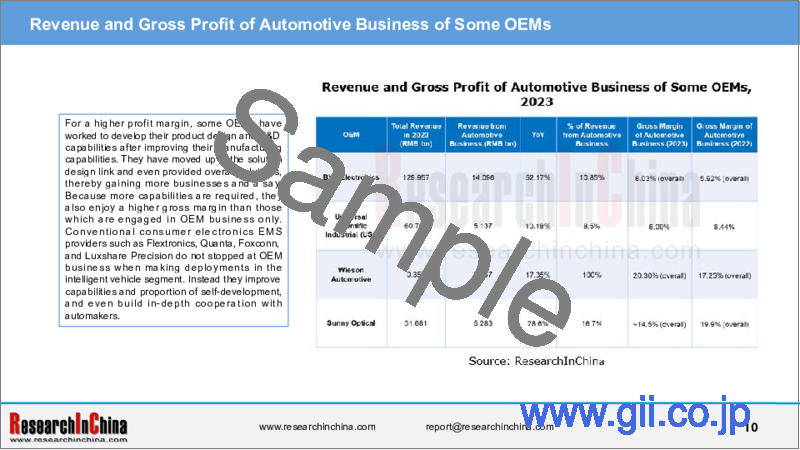

In recent two years, the price war in the Chinese automotive industry has become increasingly fierce, and OEMs have very extremely controlled and squeezed their costs. For OEMs engaged in automotive electronics assembly and processing, their profit margins will be very limited if they only act as hardware OEMs. As seen in the comparison of gross margin of automotive business between some OEMs in 2022 and 2023, the gross margin of each company's automotive business showed a downward trend in 2023.

For a higher profit margin, some OEMs have worked to develop their product design and R&D capabilities after improving their manufacturing capabilities. They have moved up to the solution design link and even provided overall solutions, thereby gaining more businesses and a say. Because more capabilities are required, they also enjoy a higher gross margin than those which are engaged in OEM business only. Conventional consumer electronics EMS providers such as Flextronics, Quanta, Foxconn, and Luxshare Precision do not stopped at OEM business when making deployments in the intelligent vehicle segment. Instead they improve capabilities and proportion of self-development, and even build in-depth cooperation with automakers.

Table of Contents

Chapter 1 Overview of Automotive Electronics OEM/ODM/EMS Industry

- 1.1 Automotive Electronics OEM/ODM/EMS Model and Development Trends

- 1.1.1 Emergence of Automotive Electronics OEM/ODM/EMS

- 1.1.2 Automotive Electronics OEM/ODM/EMS Model

- 1.1.3 Development Trends of Automotive Electronics OEM/ODM/EMS Model

- 1.1.4 Purchasing and Processing Methods of Automotive Electronics OEM/ODM/EMS Companies

- 1.2 The Automotive Electronics Market Brings New Opportunities to the EMS Industry

- 1.2.1 Global Mobile Phone Shipments and Market Share, 2023

- 1.2.2 The Automotive Electronics Market Has Become A Breakthrough for Consumer Electronics EMS Providers

- 1.2.3 EMS Providers Have Started Entry into the Automotive Field and Deploy Automotive Electronics

- 1.3 Automotive Tier 1 Suppliers Start OEM/ODM/EMS Business

- 1.3.1 Three Paths for OEMs to Intelligence

- 1.3.2 Three Roles That Tier 1 Suppliers Will Play in the Future (1)

- 1.3.3 Three Roles That Tier 1 Suppliers Will Play in the Future (2)

- 1.4 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies

- 1.4.1 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (1)

- 1.4.2 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (2)

- 1.4.3 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (3)

- 1.4.4 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (4)

- 1.4.5 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (5)

- 1.4.6 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (6)

- 1.4.7 Summary of Automotive Electronics OEM/ODM/EMS Companies and Their Layout Strategies (7)

Chapter 2 Automotive Electronics OEM/ODM/EMS (by Product)

- 2.1 Domain controller OEM/ODM/EMS

- 2.1.1 Domain Controller OEM/ODM/EMS Model

- 2.1.1.1 Three Development Cooperation Models of Domain Controllers

- 2.1.1.2 Five Production & Business Models of Domain Controllers (1)

- 2.1.1.3 Five Production & Business Models of Domain Controllers (2)

- 2.1.1.4 Five Production & Business Models of Domain Controllers (3)

- 2.1.1.5 Three Profit Sharing Models of Domain Controllers

- 2.1.1.6 Domain Controller OEM/ODM/EMS Model: Origin

- 2.1.1.7 Domain Controller OEM/ODM/EMS Model: Division of Labor Logic under the Separation of Software and Hardware

- 2.1.1.8 Domain Controller OEM/ODM/EMS Model: Provide Domain Controller Hardware OEM/ODM/EMS and Hardware Highly Related Underlying System Development

- 2.1.1.9 Domain Controller OEM/ODM/EMS Model: Interest Pursuit of Each Core Participant

- 2.1.1.10 Domain Controller OEM/ODM/EMS Model: Cost Breakdown

- 2.1.1.11 Domain Controller OEM/ODM/EMS Model: Typical Cooperation Cases (1)

- 2.1.1.12 Domain Controller OEM/ODM/EMS Model: Typical Cooperation Cases (2)

- 2.1.1.13 Mainstream Domain Controller OEM/ODM/EMS Companies (1)

- 2.1.1.14 Mainstream Domain Controller OEM/ODM/EMS Companies (2)

- 2.1.1.15 Mainstream Domain Controller OEM/ODM/EMS Companies (3)

- 2.1.1.16 Strategic Choices of OEMs (1)

- 2.1.1.17 Strategic Choices of OEMs (2)

- 2.1.1.18 Strategic Choices of OEMs (3)

- 2.1.1.19 Strategic Choices of OEMs (4)

- 2.1.1.20 Strategic Choices of OEMs (5)

- 2.1.2 Intelligent Driving Domain Controller OEM/ODM/EMS

- 2.1.2.1 Installation Rate of L1/L2/L2+/L2++/L2+++/L3-L4 (Robotaxi) Autonomous Driving System in China

- 2.1.2.2 Attached Data Sheet: Installation Rate of L1/L2/L2+/L2++/L2+++/L3-L4 (Robotaxi) Autonomous Driving System in China

- 2.1.2.3 China's Passenger Car Autonomous Driving Domain Controller Shipments (10,000 Units), 2023-2027E

- 2.1.2.4 China's Passenger Car Autonomous Driving Domain Controller Market Size (RMB100 Million), 2023-2027E

- 2.1.2.5 Cost of Autonomous Driving Domain Controllers in China: Prices and Target Markets of Differently Positioned Products

- 2.1.2.6 Competitive Landscape of Autonomous Driving Domain Controller Vendors

- 2.1.2.7 Characteristics of Autonomous Driving Domain Controller Layout of OEMs

- 2.1.2.8 Installation of Intelligent Driving Domain Controllers, 2023

- 2.1.2.9 Why OEMs Choose to Self-develop Autonomous Driving Domain Controllers?

- 2.1.2.10 How OEMs Self-develop Autonomous Driving Domain Controllers?

- 2.1.3 Cockpit Domain Controller OEM/ODM/EMS

- 2.1.3.1 China's Digital Cockpit Market Size

- 2.1.3.2 China's Intelligent Cockpit Domain Controller Shipments (10,000 Units), 2023-2027E

- 2.1.3.3 Competitive Landscape of Intelligent Cockpit Domain Controllers (Roles Pursued by Three-party Players)

- 2.1.3.4 Characteristics of Cockpit Domain Controller Layout of OEMs (1)

- 2.1.3.5 Characteristics of Cockpit Domain Controller Layout of OEMs (2)

- 2.1.1 Domain Controller OEM/ODM/EMS Model

- 2.2 LiDAR OEM/ODM/EMS

- 2.2.1 LiDAR Industry Chain

- 2.2.2 LiDAR Cost Breakdown

- 2.2.3 LiDAR Installation by Chinese and Foreign Automakers

- 2.2.4 Automotive LiDAR Market (1)

- 2.2.5 Automotive LiDAR Market (2): Automotive LiDAR Market Structure, 2023

- 2.2.6 Automotive LiDAR Market (3): China's Automotive LiDAR Shipments, 2023-2027E

- 2.2.7 Automotive LiDAR Market (4): China's Automotive LiDAR Market Size, 2023-2027E

- 2.2.8 Automotive LiDAR Production Model 1

- 2.2.9 Automotive LiDAR Production Model 2

- 2.2.10 Comparison of Advantages and Disadvantages between the Two Production Models

- 2.2.11 How Small and Medium-sized LiDAR Companies Choose Production Models?

- 2.2.12 Production Models and Capacity of Automotive LiDAR OEMs in China (1)

- 2.2.13 Production Models and Capacity of Automotive LiDAR OEMs in China (2)

- 2.2.14 LiDAR: Module OEM/ODM/EMS

- 2.2.15 LiDAR: MEMS Galvanometer OEM/ODM/EMS

- 2.2.16 Summary of OEM/ODM/EMS Companies of Automotive LiDAR and Components (1)

- 2.2.17 Summary of OEM/ODM/EMS Companies of Automotive LiDAR and Components (2)

- 2.2.18 Summary of OEM/ODM/EMS Companies of Automotive LiDAR and Components (3)

- 2.3 Skateboard Chassis OEM/ODM/EMS

- 2.3.1 Skateboard Chassis

- 2.3.2 Advantages of Skateboard Chassis

- 2.3.3 Challenges in Application of Skateboard Chassis in Vehicles

- 2.3.4 Cooperative Production Models of Skateboard Chassis

- 2.3.5 Skateboard Chassis OEM/ODM/EMS Cases

- 2.4 Automotive Seat Components OEM/ODM/EMS

- 2.4.1 Core Components of Automotive Seat

- 2.4.2 Automotive Seating Industry Chain Structure

- 2.4.3 Self-production of Core Components of Tier 1 Automotive Seat Suppliers

- 2.4.4 Cost Structure of Automotive Seating

- 2.4.5 Value of A Single Automotive Seat

- 2.4.6 Outsourcing in Automotive Seating Market

- 2.4.7 Summary of Automotive Seat Frame OEM/ODM/EMS Companies in China

- 2.5 Vehicle Display Assembly OEM/ODM/EMS

- 2.5.1 Vehicle Display Industry Chain Map

- 2.5.2 Portraits of Vehicle Display Assembly Players

- 2.5.3 As OEMs have A Bigger Say, Some Vehicle Display Tier 1 Suppliers Will Become Integrators

- 2.5.4 TOP10 Center Console Display Assembly Suppliers, 2023

- 2.5.5 Global Vehicle Display Panel Shipments

- 2.5.6 Summary of Vehicle Display Integrators (1)

- 2.5.7 Summary of Vehicle Display Integrators (2)

- 2.5.8 Tesla Model 3 Car Display Dismantling Case: Electronic Design

- 2.5.9 Tesla Model 3 Car Display Dismantling Case: Structural Design and Display Parameters

- 2.5.10 Tesla Model 3 Car Display Dismantling Case: Manufacturing Scheme and Supply Chain

- 2.6 Vehicle OEM/ODM/EMS

- 2.6.1 Vehicle OEM/ODM/EMS Model

- 2.6.2 Vehicle OEM/ODM/EMS Model 1

- 2.6.3 Vehicle OEM/ODM/EMS Model 2

- 2.6.4 Problems in Vehicle OEM/ODM/EMS Model

- 2.6.5 Opportunities for Vehicle OEM/ODM/EMS

- 2.6.6 Players in Vehicle OEM/ODM/EMS Market

- 2.6.7 Summary of Some Auto Brands That Choose OEM/ODM/EMS

- 2.7 Vehicle Communication Module OEM/ODM/EMS

- 2.7.1 Vehicle Communication Module: Production Models and Capacity of Manufacturers

- 2.7.2 Vehicle Communication Module Industry Chain: Module OEM/ODM/EMS Companies Are at the Upstream End of the Industry Chain

- 2.7.3 Vehicle Communication Module OEM/ODM/EMS Companies

- 2.8 EIC System OEM/ODM/EMS

- 2.8.1 Power Battery OEM/ODM/EMS Model 1

- 2.8.2 Power Battery OEM/ODM/EMS Model 2

- 2.8.3 Automotive BMS OEM/ODM/EMS Model

- 2.8.4 Automotive EIC System OEM/ODM/EMS Companies (1)

- 2.8.5 Automotive EIC System OEM/ODM/EMS Companies (2)

- 2.9 Automotive Electronics PCBA OEM/ODM/EMS

- 2.9.1 Automotive Electronics PCBA Production Process

- 2.9.2 Automotive Electronics PCBA OEM/ODM/EMS Model

- 2.9.3 PCBA OEM/ODM/EMS Requirements

- 2.9.4 Automotive Electronics PCBA OEM/ODM/EMS Companies (1)

- 2.9.5 Automotive Electronics PCBA OEM/ODM/EMS Companies (2)

- 2.9.6 Automotive Electronics PCBA OEM/ODM/EMS Companies (3)

- 2.9.7 Automotive Electronics PCBA OEM/ODM/EMS Companies (4)

- 2.10 Vehicle Wireless Charging Module OEM/ODM/EMS

- 2.10.1 Vehicle Wireless Charging Module Dismantling Cases (1)

- 2.10.2 Vehicle Wireless Charging Module Dismantling Cases (2)

- 2.10.3 Summary of Automotive Wireless Charging Module OEM/ODM/EMS Companies

Chapter 3 Key Points of Automotive Electronics OEM/ODM/EMS

- 3.1 Growth Paths of Automotive Electronics OEM/ODM/EMS Companies

- 3.1.1 Growth Path Trends of Automotive Electronics OEM/ODM/EMS Companies

- 3.1.2 Summary of Growth Paths of Automotive Electronics OEM/ODM/EMS Companies (1)

- 3.1.3 Summary of Growth Paths of Automotive Electronics OEM/ODM/EMS Companies (2)

- 3.1.4 Summary of Growth Paths of Automotive Electronics OEM/ODM/EMS Companies (3)

- 3.1.5 How to Enter the Field of Automotive Electronics OEM/ODM/EMS?

- 3.1.6 What Are the Models for EMS Providers to Enter the Automotive Electronics OEM/ODM/EMS Industry?

- 3.1.7 Case Study on Growth Paths of Automotive Electronics Business of Leading OEM/ODM/EMS Companies (1)

- 3.1.8 Case Study on Growth Paths of Automotive Electronics Business of Leading OEM/ODM/EMS Companies (2)

- 3.1.9 Case Study on Growth Paths of Automotive Electronics Business of Leading OEM/ODM/EMS Companies (3)

- 3.2 Competitive Edges of Automotive Electronics OEM/ODM/EMS Companies

- 3.2.1 Comparison of Advantages and Disadvantages between Companies in the Automotive Electronics OEM/ODM/EMS Field

- 3.2.2 Responsibilities of EMS Providers in Automotive Electronics (1)

- 3.2.3 Responsibilities of EMS Providers in Automotive Electronics (2)

- 3.2.4 Summary of Competitive Edges of Automotive Electronics OEM/ODM/EMS Companies (1)

- 3.2.5 Summary of Competitive Edges of Automotive Electronics OEM/ODM/EMS Companies (2)

- 3.2.6 Summary of Competitive Edges of Automotive Electronics OEM/ODM/EMS Companies (3)

- 3.2.7 Required Capabilities of Automotive Electronics OEM/ODM/EMS Companies (1)

- 3.2.8 Required Capabilities of Automotive Electronics OEM/ODM/EMS Companies (2)

- 3.3 Production Barriers to Automotive Electronics OEM/ODM/EMS (by Segment)

- 3.3.1 Barriers to Mass Production of Domain Controller

- 3.3.2 Barriers to Mass Production of Skateboard Chassis

- 3.3.3 Barriers to Mass Production of Automotive PCBA

- 3.3.4 Barriers to Mass Production of Vehicle Display Assembly

- 3.4 Comparison of Revenue and Gross Profit between Automotive Electronics OEM/ODM/EMS Companies

- 3.4.1 Analysis Sheet of Automotive Business Revenue/Gross Profit of EMS Providers, 2023 (1)

- 3.4.2 Analysis Sheet of Automotive Business Revenue/Gross Profit of EMS Providers, 2023 (2)

- 3.4.3 Analysis Sheet of Automotive Business Revenue/Gross Profit of EMS Providers, 2023 (3)

- 3.4.4 Analysis Sheet of Automotive Business Revenue/Gross Profit of EMS Providers, 2023 (4)

Chapter 4 Automotive Electronics OEM/ODM/EMS Companies - EMS Providers Transforming from Other Industries

- 4.1 Foxconn

- 4.1.1 The Road to Automotive OEM/ODM/EMS

- 4.1.2 Settled in Zhengzhou to Operate Auto Manufacturing Business

- 4.1.3 Auto Manufacturing Platform

- 4.1.4 Automotive OEM/ODM/EMS Model, Production Capacity and Customer Base

- 4.1.5 Core Auto Manufacturing Technologies and Industry Chain Layout

- 4.1.6 Key Technical Capabilities of Components

- 4.1.7 Vehicle CDMS Cases

- 4.1.8 Auto Parts OEM/ODM/EMS Cases (1)

- 4.1.9 Auto Parts OEM/ODM/EMS Cases (2)

- 4.2 Quanta

- 4.2.1 Global Production Bases of Automotive Business

- 4.2.2 Business Model

- 4.2.3 Automotive Electronics Layout and OEM/ODM/EMS Customers

- 4.3 Pegatron

- 4.3.1 Automotive Electronics Layout

- 4.3.2 Production Bases of Automotive Electronics Business

- 4.3.3 Automotive Electronics OEM/ODM/EMS Model

- 4.4 Wistron

- 4.4.1 Development History and Automotive Business Layout

- 4.4.2 Operation

- 4.4.3 Manufacturing Bases of Automotive Business

- 4.4.4 Cooperation between Xtronics Kunshan Factory and NIO

- 4.4.5 Xtronics Kunshan Factory: Manufacturing Capacity

- 4.4.6 Xtronics Kunshan Factory: Quality Management Capabilities

- 4.4.7 Wistron NeWeb

- 4.4.8 Automotive Electronics Lines of Wistron NeWeb

- 4.4.9 Advantages of Automotive Solutions of Wistron NeWeb

- 4.4.10 Wistron NeWeb Cooperated with XXXX to Produce Automotive 4D Imaging Radar

- 4.5 Flextronics

- 4.5.1 Operation and Automotive Business Layout

- 4.5.2 Global Product Strategy of Automotive Division

- 4.5.3 Automotive Business Model

- 4.5.4 Assisted Design Manufacturing (ADM) Model

- 4.5.5 Typical ADM Cases

- 4.5.6 Self-development Capabilities: Autonomous Driving Domain Controllers Based on Orin Platform

- 4.5.7 Competitive Edges of Automotive Electronics Business (1)

- 4.5.8 Competitive Edges of Automotive Electronics Business (2)

- 4.5.9 Automotive Electronics OEM/ODM/EMS: Cooperative Customer Base

- 4.6 Universal Scientific Industrial (USI)

- 4.6.1 Operation

- 4.6.2 Gross Margin and Sales of Automotive Business in the Past Decade

- 4.6.3 Automotive Electronics Production Bases in China

- 4.6.4 Automotive Electronics Business Layout

- 4.6.5 OEM/ODM/EMS Model of Automotive Business

- 4.6.6 Automotive Power Module OEM/ODM/EMS

- 4.7 PRIME Technology

- 4.7.1 Business Status

- 4.7.2 Production Bases

- 4.7.3 Supply Chain

- 4.7.4 Automotive Electronics OEM/ODM/EMS Services

- 4.8 Luxshare Precision

- 4.8.1 Operation

- 4.8.2 The Road to Entering Automotive

- 4.8.3 Strategic Layout of Automotive Business

- 4.8.4 Product Lines and Cooperation Models of Automotive Electronics

- 4.8.5 Cooperation with Chery

- 4.8.6 Customer Base of Automotive Business

- 4.8.7 Automotive Electronics OEM/ODM/EMS Cases

- 4.9 BYD Electronics

- 4.9.1 Business Status and Operation

- 4.9.2 Production Bases for Automotive Products

- 4.9.3 Vehicle OEM/ODM/EMS Customers

- 4.9.4 Vehicle OEM/ODM/EMS Cases

- 4.10 DBG Technology

- 4.10.1 Business Status and Operation

- 4.10.2 Core Processes

- 4.10.3 Customer Base of Automotive Electronics Business

- 4.10.4 Automotive Electronics OEM/ODM/EMS: EMS Model

- 4.10.5 Automotive Electronics OEM/ODM/EMS Cases (1)

- 4.10.6 Automotive Electronics OEM/ODM/EMS Cases (2)

- 4.11 Sunny Optical

- 4.11.1 Business Status and Operation

- 4.11.2 Production Bases for Automotive Products

- 4.11.3 Automotive Product Layout

- 4.11.4 Automotive Product Lines (1)

- 4.11.5 Automotive Product Lines (2)

- 4.11.6 Automotive Product Lines (3)

- 4.11.7 Application Scenarios of Products in Vehicles

- 4.11.8 Deployment of Automotive Optical Parts

- 4.11.9 Automotive Electronics OEM/ODM/EMS Customers

- 4.12 IMI

- 4.12.1 Business Status

- 4.12.2 Automotive Electronics OEM/ODM/EMS Bases

- 4.12.3 Competitive Edges in Automotive Electronics OEM/ODM/EMS

- 4.13 MAXWAY

- 4.13.1 Business Status and Production Bases

- 4.13.2 Automotive Electronics OEM/ODM/EMS Model: EMS Model

- 4.13.3 Status Quo of OEM/ODM/EMS Production Lines

- 4.13.4 EMS: Engineering Capabilities

- 4.13.5 EMS: Supply Chain Management Capabilities

- 4.13.6 EMS: PCBA Manufacturing Capabilities

- 4.13.7 OEM/ODM/EMS Technical Support and Manufacturing Capabilities

- 4.14 Longtech

- 4.14.1 Business Status and Operation

- 4.14.2 Cooperation Model of Automotive Electronics Business

- 4.14.3 Production Bases of OEM/ODM/EMS Business

- 4.14.4 List of Customized Intelligent Controllers for Automotive Electronics (1)

- 4.14.5 List of Customized Intelligent Controllers for Automotive Electronics (2)

- 4.14.6 List of Customized Intelligent Controllers for Automotive Electronics (3)

- 4.14.7 List of Customized Intelligent Controllers for Automotive Electronics (4)

- 4.14.8 Major Customers and Cooperation Models in Automotive Electronics

- 4.15 Jabil

- 4.15.1 Automotive Electronics Production Bases in China

- 4.15.2 Intelligent Manufacturing Full Life Cycle Solutions

- 4.15.3 Accumulated Capabilities

- 4.15.4 Products and Customers of Automotive Electronics OEM/ODM/EMS

- 4.16 Compal

- 4.16.1 Layout and Development History of Automotive Electronics Business

- 4.16.2 Automotive Electronics Production Bases

- 4.16.3 Compal Chongqing: Vehicle Display Production and Assembly Capacity

- 4.17 Inventec

- 4.17.1 Automotive Electronics Business Layout

- 4.17.2 Development History of Automotive Electronics Business

- 4.17.3 Production Bases of Automotive Business

- 4.18 Wingtech Technology

- 4.18.1 Global Layout

- 4.18.2 ODM Business Direction

- 4.18.3 Automotive Electronics ODM Business Layout

- 4.18.4 Automotive Electronics Self-development Capabilities

- 4.19 Huaqin Technology

- 4.19.1 Business Development History

- 4.19.2 Global Layout and Automotive Electronics Production Bases

- 4.19.3 Automotive Electronics Business Layout

- 4.19.4 Core Capabilities of Intelligent Hardware ODM Business

Chapter 5 Automotive Electronics OEM/ODM/EMS Companies - Manufacturers Focusing on Automotive OEM/ODM/EMS

- 5.1 Wieson Automotive

- 5.1.1 Operation

- 5.1.2 Six Major Vehicle Electrical Solutions

- 5.1.3 PCBA OEM/ODM/EMS Production Lines (1)

- 5.1.4 PCBA OEM/ODM/EMS Production Lines (2)

- 5.1.5 PCBA OEM/ODM/EMS: Quality Management Capabilities

- 5.1.6 PCBA OEM/ODM/EMS: Manufacturing and Management Capabilities (1)

- 5.1.7 PCBA OEM/ODM/EMS: Manufacturing and Management Capabilities (2)

- 5.1.8 PCBA OEM/ODM/EMS: Product Verification Capabilities

- 5.1.9 Customer Base and Cooperation Model in Automotive Industry

- 5.2 Maruhi Electronics

- 5.2.1 Business Status

- 5.2.2 Automotive Electronics Layout

- 5.2.3 Competitive Edges

- 5.2.4 Production Bases and Production Lines

- 5.2.5 Production Equipment Capacity

- 5.2.6 Intelligent Manufacturing Management

- 5.2.7 Major Customers

- 5.3 Magna

- 5.3.1 Operation

- 5.3.2 Automotive Product Layout

- 5.3.3 Industrial Layout Mode

- 5.3.4 Global OEM/ODM/EMS Business

- 5.3.5 OEM/ODM/EMS Vehicle Models

- 5.3.6 Layout and OEM/ODM/EMS Opportunities in China

- 5.3.7 Help Chinese Automakers Go Overseas and Achieve Localized Production

- 5.3.8 Vehicle Manufacturing System

Chapter 6 Automotive Electronics OEM/ODM/EMS Companies - Tier 1 Suppliers Engaged in OEM/ODM/EMS Business

- 6.1 Desay SV

- 6.1.1 Automotive Electronics Business Layout

- 6.1.2 Operation in 2023

- 6.1.3 Operating Margin in 2023

- 6.1.4 Distribution of Production Bases

- 6.1.5 Customer Structure

- 6.1.6 Business Model

- 6.1.7 Business Model Cases

- 6.1.8 Three Major Barriers to Desay SV as A Hardware Solution Supplier

- 6.2 Hytera

- 6.2.1 Operation

- 6.2.2 OEM Business Evolution History

- 6.2.3 Automotive Electronics OEM Business Layout

- 6.2.4 Automotive Electronics OEM Customers

- 6.2.5 Intelligent Manufacturing Capabilities

- 6.2.6 Intelligent Test Line for Automotive Electronics

- 6.3 PATEO CONNECT+

- 6.3.1 Business Layout

- 6.3.2 Production Bases

- 6.3.3 Manufacturing Advantages

- 6.3.4 Business Model

- 6.4 Foryou Corporation

- 6.4.1 Business Layout

- 6.4.2 Distribution of Holding Companies

- 6.4.3 Operation in 2023

- 6.4.4 OEM/ODM/EMS Cases

- 6.5 Joyson Electronic

- 6.5.1 Development History and Business Status

- 6.5.2 Organizational Structure and Corresponding Business Divisions

- 6.5.3 Operation in 2023

- 6.5.4 R&D Investment in 2023

- 6.5.5 Joynext's Domain Controller Hardware Has All-round Advantages

- 6.5.6 OEM/ODM/EMS Cases

- 6.6 Hangsheng Electronics

- 6.6.1 Layout of Core Products

- 6.6.2 Suppliers

- 6.6.3 Customer Base