|

|

市場調査レポート

商品コード

1609466

自動運転トラック市場の評価:自動運転レベル・推進力・地域別の機会および予測 (2018-2032年)Autonomous Trucks Market Assessment, By Level of Autonomous Driving, By Propulsion, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 自動運転トラック市場の評価:自動運転レベル・推進力・地域別の機会および予測 (2018-2032年) |

|

出版日: 2024年12月11日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動運転トラックの市場規模は、2024年の5億2,311万米ドルから、予測期間中はCAGR 20.06%で推移し、2032年には22億5,829万米ドルの規模に成長すると予測されています。

トラック運送業界における労働力不足は、輸送・ロジスティクスの展望を再構築する主な触媒の1つとして浮上しています。多くの企業は、特に長距離貨物において、この持続的な人手不足に対応するため、人間のドライバーへの依存を減らすことを目指しています。この問題の緊急性により、自動運転ソリューションが、増大する物資輸送需要に対応するためのより現実的な選択肢となっています。自動運転トラックはルートを最適化し、燃料を節約し、停止する必要がないため、物流全体の効率を高めます。

Tesla, Inc.などの企業はすでに、自動運転EVの試験走行の成功を通じてこれらの利点を実証しており、長距離輸送コストの大幅削減を約束しています。自動運転トラックの主な原動力は、自動運転技術、AI、センサー技術の信頼性と安全性の向上です。機械学習アルゴリズムとますます高度化するセンサーシステムの革新は、こうした車両の能力を高め、技術企業と従来の自動車製造業者の両方からの投資拡大に寄与しています。

さらに、政府の支援と進化する規制の枠組みも自動運転技術の採用を後押ししています。いくつかの政府は、自動運転車の研究、開発、試験を後押しする政策を導入しており、市場の成長をさらに後押ししています。規制の枠組みがより明確化され、支援的になるにつれて、製造業者は自動運転トラック技術に投資するインセンティブを得ています。

当レポートでは、世界の自動運転トラックの市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、産業構造、市場成長への影響因子の分析、ケーススタディ、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 製品と市場の情報

- ブランド認知モード

- 購入決定時に考慮される要素

- プライバシーと規制に関する考察

第5章 世界の自動運転トラック市場の展望

- 市場規模の分析・予測

- 市場シェアの分析・予測

- 自動運転レベル別

- 推進力別

- 地域別

- 企業シェア分析

- 市場マップ分析

第6章 北米の自動運転トラック市場の展望

- 市場規模の分析・予測

- 市場シェアの分析・予測

- 国別市場評価

- 米国

- カナダ

- メキシコ

第7章 欧州の自動運転トラック市場の展望

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の自動運転トラック市場の展望

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の自動運転トラック市場の展望

- ブラジル

- アルゼンチン

第10章 中東・アフリカの自動運転トラック市場の展望

- サウジアラビア

- UAE

- 南アフリカ

第11章 需給分析

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 PESTLE分析

第15章 市場力学

- 市場促進要因

- 市場の課題

第16章 市場動向・展開

第17章 ケーススタディ

第18章 競合情勢

- 上位5社の競合マトリックス

- 上位5社のSWOT分析

- 上位10社の情勢

- TuSimple, Inc.

- Waymo LLC

- Embark Trucks, Inc.

- Tesla, Inc.

- Caterpillar Inc.

- AB Volvo

- Continental AG

- Daimler Truck AG

- PACCAR Inc

- Scania CV AB

第19章 戦略的提言

第20章 当社について・免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 2. Global Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 3. Global Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 4. Global Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 5. Global Autonomous Trucks Market Share (%), By Region, 2018-2032F

- Figure 6. North America Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 7. North America Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 8. North America Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

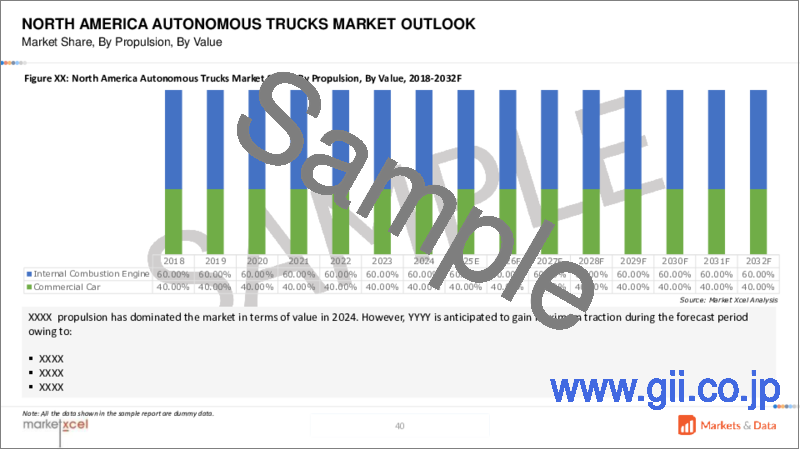

- Figure 9. North America Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 10. North America Autonomous Trucks Market Share (%), By Country, 2018-2032F

- Figure 11. United States Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 12. United States Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 13. United States Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 14. United States Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 15. Canada Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 16. Canada Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 17. Canada Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 18. Canada Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 19. Mexico Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 20. Mexico Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 21. Mexico Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 22. Mexico Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 23. Europe Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 24. Europe Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 25. Europe Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 26. Europe Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 27. Europe Autonomous Trucks Market Share (%), By Country, 2018-2032F

- Figure 28. Germany Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 29. Germany Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 30. Germany Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 31. Germany Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 32. France Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 33. France Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 34. France Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 35. France Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 36. Italy Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 37. Italy Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 38. Italy Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 39. Italy Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 40. United Kingdom Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 41. United Kingdom Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 42. United Kingdom Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 43. United Kingdom Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 44. Russia Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 45. Russia Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 46. Russia Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 47. Russia Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 48. Netherlands Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 49. Netherlands Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 50. Netherlands Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 51. Netherlands Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 52. Spain Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 53. Spain Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 54. Spain Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 55. Spain Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 56. Turkey Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 57. Turkey Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 58. Turkey Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 59. Turkey Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 60. Poland Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 61. Poland Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 62. Poland Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 63. Poland Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 64. South America Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 65. South America Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 66. South America Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 67. South America Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 68. South America Autonomous Trucks Market Share (%), By Country, 2018-2032F

- Figure 69. Brazil Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 70. Brazil Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 71. Brazil Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 72. Brazil Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 73. Argentina Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 74. Argentina Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 75. Argentina Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 76. Argentina Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 77. Asia-Pacific Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 78. Asia-Pacific Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 79. Asia-Pacific Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 80. Asia-Pacific Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 81. Asia-Pacific Autonomous Trucks Market Share (%), By Country, 2018-2032F

- Figure 82. India Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 83. India Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 84. India Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 85. India Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 86. China Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 87. China Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 88. China Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 89. China Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 90. Japan Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 91. Japan Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 92. Japan Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 93. Japan Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 94. Australia Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 95. Australia Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 96. Australia Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 97. Australia Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 98. Vietnam Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 99. Vietnam Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 100. Vietnam Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 101. Vietnam Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 102. South Korea Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 103. South Korea Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 104. South Korea Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 105. South Korea Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 106. Indonesia Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 107. Indonesia Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 108. Indonesia Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 109. Indonesia Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 110. Philippines Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 111. Philippines Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 112. Philippines Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 113. Philippines Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 114. Middle East & Africa Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 115. Middle East & Africa Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 116. Middle East & Africa Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 117. Middle East & Africa Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 118. Middle East & Africa Autonomous Trucks Market Share (%), By Country, 2018-2032F

- Figure 119. Saudi Arabia Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 120. Saudi Arabia Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 121. Saudi Arabia Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 122. Saudi Arabia Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 123. UAE Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 124. UAE Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 125. UAE Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 126. UAE Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 127. South Africa Autonomous Trucks Market, By Value, In USD Million, 2018-2032F

- Figure 128. South Africa Autonomous Trucks Market, By Volume, in Units, 2018-2032F

- Figure 129. South Africa Autonomous Trucks Market Share (%), By Level of Autonomous Driving, 2018-2032F

- Figure 130. South Africa Autonomous Trucks Market Share (%), By Propulsion, 2018-2032F

- Figure 131. By Level of Autonomous Driving Map-Market Size (USD Million) & Growth Rate (%), 2024

- Figure 132. By Propulsion Map-Market Size (USD Million) & Growth Rate (%), 2024

- Figure 133. By Region Map-Market Size (USD Million) & Growth Rate (%), 2024

Global autonomous trucks market is projected to witness a CAGR of 20.06% during the forecast period 2025-2032, growing from USD 523.11 million in 2024 to USD 2,258.29 million in 2032.

The labor shortage in the trucking industry has emerged as one of the main catalysts reshaping the transportation and logistics landscape. Many companies aim to reduce their dependence on human drivers in response to this persistent shortage, especially in long-haul freight. The urgency of this problem has made autonomous solutions a more viable choice to address the growing transportation demand for goods. Autonomous trucks optimize routes, save fuel, and do not require halting, enhancing overall logistics efficiency. Companies like Tesla, Inc. are already demonstrating these advantages through successful test runs of self-driving electric vehicles, promising major savings in long-haul transport costs. The main driver for autonomous trucks is the advancing reliability and safety of autonomous driving technologies, artificial intelligence, and sensor technology. Innovations in machine-learning algorithms and increasingly advanced sensor systems are enhancing the capabilities of such vehicles, contributing to higher investment from both technology firms and traditional automotive manufacturers.

Moreover, government support and evolving regulatory frameworks drive the adoption of autonomous technologies. Several governments have introduced policies that boost autonomous vehicle research, development, and testing, further fueling market growth. Manufacturers have more incentives to invest in autonomous truck technologies as their regulatory frameworks become more defined and supportive.

For instance, in March 2024, the U.S. government designated USD 118 million in funds to the U.S. Department of Transportation for Automated Driving Systems (ADS) research that facilitates innovation and development of new tests, tools, and procedures to properly evaluate the safety of new technologies surrounding highly and fully automated vehicles.

Technological Advancements Boost the Global Autonomous Trucks Market

Technological innovations lead the growth of the global autonomous trucks market, changing the transportation and logistics management paradigm. The engagement of artificial intelligence (AI) and machine learning (ML) is crucial, as these enable vehicles to process huge amounts of data from arrays of sensors and cameras, allowing them to move around with precision and accuracy in highly complex and dynamic road environments in real time. For example, sophisticated AI algorithms provide such critical operations as object detection, route optimization, and obstacle avoidance, which improve the safety and efficiency of autonomous activity manyfold. Advances in sensor technology, such as Light Detection and Ranging (LiDAR) and radar systems, have dramatically increased the reliability and efficiency of autonomy for trucking vehicles. Such equipment determines a detailed environmental map, allowing vehicles to decide, as human drivers do. The developments in these technologies are ongoing, so autonomous trucks are being designed to drive safely in all different conditions, accelerating their use across logistics, agriculture, and mining industries.

For instance, in January 2024, Daimler Truck AG partnered with Aeva Inc. and Torc Robotics, Inc. to supply advanced 4D LiDAR technology for series production of autonomous trucks. Aeva Inc. will supply its latest Atlas automotive grade 4D LiDAR technology to Daimler Truck and collaborate with Torc Robotics. LiDAR technology enables SAE Level 4 autonomous vehicle capabilities for the autonomous-ready Freightliner Cascadia truck platform.

Government Initiatives Fuel the Global Autonomous Trucks Market

Countries realize that autonomous trucking will bring them benefits, such as efficiency improvement, reduction of operational costs, and improved safety; hence, they are developing regulatory frameworks for testing and commercialization. For instance, in June 2022, the United States approved several pilot programs where Einride AB tested and operated autonomous trucks on public roads. Autonomous vehicles will run on public roads with mixed traffic while carrying out real-life workflows. This will feature the transport of commodities and collaboration with different warehouse teams for loading and unloading. This regulatory guidance legitimates autonomous technology and encourages investment and development within the sector. In Europe, the European Commission has introduced policies to establish a unified framework for autonomous vehicles, promoting cross-border testing and operations. Countries like Sweden and Germany are leading the way by enacting laws that permit Level 4 autonomous operations in designated areas under supervision, thereby setting a precedent for other nations. These initiatives are critical as they provide a structured approach to integrating autonomous trucks into existing transportation networks, addressing safety concerns while fostering public acceptance.

Moreover, infrastructure investments are fundamental in supporting the rollout of self-driving trucks. The United States Infrastructure Investment and Jobs Act features provisions to enhance digital and physical infrastructure elements required to operate self-driving trucks in its territory, including smart highways and dedicated testing facilities. In China, the government is investing massively into smart logistics infrastructure, hence connected highways, charging stations, and electrical trucking routes.

Dominance of Level 2-Semi-Automated Driving in Global Autonomous Trucks Market

The global autonomous trucks market is dominated by level 2 semi-automated driving, indicating a shift in the automobile automation landscape. Level 2 semi-automated driving is still the most widely adopted when giving the overall market expansion trends; manufacturers and customers alike are increasingly adopting advanced driver assistance systems (ADAS), though enhancing driver control and safety are primarily the characteristics of Level 2 automation. This has the potential to give specific functions to the cars like adaptive cruise control, lane departure assistance, and automatic parking, yet still requires a human in the driver's seat, so it's a level that best caters to those who want some level of life while still being behind the wheel sometimes. Level 2 is especially appealing to any developed economy, including the U.S., Germany, and Japan, in which knowledge about the benefits of autonomous driving continues to spread. These Level 2 vehicles offer features that ensure safety and minimize driver fatigue, making them practical vehicles for personal and business use.

For instance, in May 2023, Robert Bosch GmbH and PlusAI, Inc collaborated on assisted driving solutions for commercial vehicles. Software and hardware technology integration enable Level 2 semi-automated driving features. L2++ benefits for commercial vehicles include driver retention, fuel economy savings, and reduced accidents. Bosch's portfolio of commercial vehicles supports software-defined trucks with software, sensors, vehicle computers, and actuators.

North America Dominates Global Autonomous Trucks Market

North America is expected to hold one of the leading positions in the worldwide autonomous trucks market through technological advancements, huge investments, and supporting regulatory frameworks. This dominance is fueled by the region's robust infrastructure and a strong focus on research and development, which have created fertile ground for innovation in autonomous technologies. Major auto and technology companies based in the U.S. and Canada have accelerated the deployment of autonomous trucks like Waymo LLC and TuSimple, Inc.; these are leading initiatives that encompass significant pilot projects to expand their autonomous freight networks. For example, TuSimple's plans to upgrade its network in Texas represent the aggressive strategies that this industry is adopting. In addition, collaborations between logistics companies and independent developers of autonomous technologies will become more widespread, further fuel the pace of market growth. Government policies are essential in this growth trajectory; they increase investor confidence and attract numerous companies to enter the market. Similarly, laws in Canada have also been transformed to permit public highway testing of autonomous trucks. North America remains firmly positioned as a key location for autonomous vehicle development.

For instance, in September 2024, Continental AG announced that fully self-driving trucks, Level 5, are about to make their debut on US highways. This move toward autonomous trucks is attractive to the logistics industry, which is suffering from a huge shortage of drivers.

Future Market Scenario (2025-2032F)

Continuous evolution of technologies is enhancing the capabilities of autonomous trucks, making it feasible for trucks to operate with minimal human intervention, thus improving safety and operational efficiency.

Autonomous trucks can operate around the clock without breaks, addressing labor shortages while simultaneously reducing operational costs associated with human drivers.

Governments worldwide are increasingly recognizing the potential benefits of autonomous trucking technology. Initiatives aimed at developing regulatory frameworks that facilitate testing and deployment are becoming more common.

Key Players Landscape and Outlook

The global autonomous trucks market is a dynamic and rapidly evolving landscape characterized by a diverse array of key players and a promising outlook. Leading manufacturers such as Daimler Truck AG and AB Volvo are at the forefront, investing heavily in innovative technologies to integrate autonomous capabilities into their commercial vehicles. Tesla, Inc., renowned for its electric vehicles, is also making significant strides in this sector, leveraging advancements in artificial intelligence and sensor technology to revolutionize freight transport. Emerging companies like TuSimple, Inc. are carving out their niche by focusing on autonomous freight transportation. Meanwhile, Waymo LLC, originally a Google project, continues to lead in self-driving technology, collaborating with logistics firms to enhance its market presence. Tier 1 suppliers such as Continental AG and Robert Bosch GmbH play crucial roles by providing essential components that enable advanced driver-assistance systems (ADAS). As companies continue to leverage technological advancements and forge strategic partnerships, autonomous trucks are set to become a cornerstone of future logistics solutions, reshaping the transportation industry as we know it.

For instance, in October 2024, PlusAI, Inc., together with the Traton SE brands Scania CV AB, marked the successful completion of their initial phase of collaboration to bring driverless trucks to the world.

For instance, in February 2022, Waymo LLC announced its plans to start testing its self-driving trucks in Texas in strategic partnership with C.H. Robinson Worldwide, Inc., a leading global logistics service provider.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Product and Market Intelligence

- 4.2. Mode of Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.3.1. Features and Other Value-Added Service

- 4.3.2. Compatibility

- 4.3.3. Autonomous Level

- 4.3.4. Propulsion Type

- 4.3.5. Efficiency of Solutions

- 4.3.6. After-Sales Support

- 4.4. Consideration of Privacy and Regulations

5. Global Autonomous Trucks Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Level of Autonomous Driving

- 5.2.1.1. Level 1-Assistance Systems

- 5.2.1.2. Level 2-Semi-Automated Driving

- 5.2.1.3. Level 3-Conditionally Automated Driving

- 5.2.1.4. Level 4-Highly Automated Driving

- 5.2.1.5. Level 5-Fully Automated Driving

- 5.2.2. By Propulsion

- 5.2.2.1. Internal Combustion Engine

- 5.2.2.2. Electric

- 5.2.3. By Region

- 5.2.3.1. North America

- 5.2.3.2. Europe

- 5.2.3.3. Asia-Pacific

- 5.2.3.4. South America

- 5.2.3.5. Middle East and Africa

- 5.2.4. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Level of Autonomous Driving

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Level of Autonomous Driving

- 5.3.2. By Propulsion

- 5.3.3. By Region

6. North America Autonomous Trucks Market Outlook, 2018-2032F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Level of Autonomous Driving

- 6.2.1.1. Level 1-Assistance Systems

- 6.2.1.2. Level 2-Semi-Automated Driving

- 6.2.1.3. Level 3-Conditionally Automated Driving

- 6.2.1.4. Level 4-Highly Automated Driving

- 6.2.1.5. Level 5-Fully Automated Driving

- 6.2.2. By Propulsion

- 6.2.2.1. Internal Combustion Engine

- 6.2.2.2. Electric

- 6.2.3. By Country Share

- 6.2.3.1. United States

- 6.2.3.2. Canada

- 6.2.3.3. Mexico

- 6.2.1. By Level of Autonomous Driving

- 6.3. Country Market Assessment

- 6.3.1. United States Autonomous Trucks Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Level of Autonomous Driving

- 6.3.1.2.1.1. Level 1-Assistance Systems

- 6.3.1.2.1.2. Level 2-Semi-Automated Driving

- 6.3.1.2.1.3. Level 3-Conditionally Automated Driving

- 6.3.1.2.1.4. Level 4-Highly Automated Driving

- 6.3.1.2.1.5. Level 5-Fully Automated Driving

- 6.3.1.2.2. By Propulsion

- 6.3.1.2.2.1. Internal Combustion Engine

- 6.3.1.2.2.2. Electric

- 6.3.1.2.1. By Level of Autonomous Driving

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Autonomous Trucks Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Autonomous Trucks Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Autonomous Trucks Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Autonomous Trucks Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Autonomous Trucks Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Demand Supply Analysis

12. Value Chain Analysis

13. Porter's Five Forces Analysis

14. PESTLE Analysis

15. Market Dynamics

- 15.1. Market Drivers

- 15.2. Market Challenges

16. Market Trends and Developments

17. Case Studies

18. Competitive Landscape

- 18.1. Competition Matrix of Top 5 Market Leaders

- 18.2. SWOT Analysis for Top 5 Players

- 18.3. Key Players Landscape for Top 10 Market Players

- 18.3.1. TuSimple, Inc.

- 18.3.1.1. Company Details

- 18.3.1.2. Key Management Personnel

- 18.3.1.3. Products and Services

- 18.3.1.4. Financials (As Reported)

- 18.3.1.5. Key Market Focus and Geographical Presence

- 18.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisitions

- 18.3.2. Waymo LLC

- 18.3.3. Embark Trucks, Inc.

- 18.3.4. Tesla, Inc.

- 18.3.5. Caterpillar Inc.

- 18.3.6. AB Volvo

- 18.3.7. Continental AG

- 18.3.8. Daimler Truck AG

- 18.3.9. PACCAR Inc

- 18.3.10. Scania CV AB

- 18.3.1. TuSimple, Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.