|

|

市場調査レポート

商品コード

1494589

液体石鹸市場の評価:製品・用途・カテゴリー・フレグランス・パッケージ・価格帯・用途・流通チャネル・地域別の機会および予測 (2017-2031年)Liquid Soap Market Assessment, By Product, By Usage, By Category, By Fragrance, By Packaging, By Price Range, By Application, By Distribution Channel, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 液体石鹸市場の評価:製品・用途・カテゴリー・フレグランス・パッケージ・価格帯・用途・流通チャネル・地域別の機会および予測 (2017-2031年) |

|

出版日: 2024年06月14日

発行: Markets & Data

ページ情報: 英文 236 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の液体石鹸の市場規模は、2023年の353億4,000万米ドルから、2024年から2031年の予測期間中は7%のCAGRで推移し、2031年には605億8,000万米ドルの規模に成長すると予測されています。

個人の衛生と健康の重要性に対する消費者の意識の高まり、天然・有機液体石鹸への需要の高まり、マイルドで優しい製品を好む消費者、公共トイレへのスマート液体石鹸ディスペンサーの設置、天然・有機製品への需要の高まり、無毒で化学物質不使用の液体石鹸の導入などの要因が、世界の液体石鹸市場の成長を促進しています。また、従来の固形石鹸よりも便利で衛生的であるため、若者の間で液体石鹸の使用率が上昇していることも、市場の成長をさらに増大させています。

アップサイクルされた成分や機能性成分の使用も市場の成長を促進しています。例えば、2023年11月、Eurofragranceは、悪臭対策効果を提供するアップサイクル成分を含む液体石鹸のVerdenixを発売しました。自然なプロセスでアップサイクルされた材料から作られこの革新的製品は、ハンドソープやボディソープ、食器洗い用の液体製品でブースターとして作用し、悪臭を除去します。

液体石鹸のパッケージングにおける技術の進歩とスマートディスペンサーの導入も、消費者の利便性を向上させ、市場の成長を促進しています。タッチフリーのハンドディスペンサーの導入が液体石鹸市場の成長を高めています。

硫酸塩とパラベンフリーの液体石鹸に対する消費者の嗜好の高まりが勢いを増す:

これらの化学物質が健康や環境に与える潜在的影響に対する意識の高まりから、消費者は硫酸塩やパラベンフリーの液体石鹸を好むようになっています。ラウリル硫酸ナトリウムなどの硫酸塩は、石鹸に含まれる界面活性剤の中でもっとも一般的なものですが、皮膚に悪影響を与えます。ラウリル硫酸ナトリウムなどの界面活性剤は、泡立ちをよくする一方で、肌に負担をかけ、肌荒れや乾燥を引き起こし、湿疹や皮膚炎などの症状を悪化させる可能性があります。また、パラベンは、パーソナルケア製品の保存期間を延ばすために使用される防腐剤です。パラベンは体内でエストロゲンを模倣し、癌やその他の生殖障害のリスクを高める可能性があるため、ホルモンの乱れにパラベンが関与している可能性を指摘する研究もあります。これらのことから、消費者はこうした刺激の強い化学物質を含まず、皮膚反応を最小限に抑えたマイルドな代替品を求めるようになっています。

当レポートでは、世界の液体石鹸の市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分・地域別の詳細分析、産業構造、市場成長への影響因子の分析、ケーススタディ、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 顧客の声

- 人口統計

- 製品・市場のインテリジェンス

- ブランド認知のモード

- 購入決定時に考慮される要素

- プライバシーと安全規制に関する考察

- 購入チャネル

- 購入頻度

- 既存または予定ユーザー

- 友人や家族からの推薦/オンラインレビュー

- ブランドアンバサダーやインフルエンサーマーケティングが製品/ブランドの浸透に果たす役割

第5章 世界の液体石鹸市場の展望

- 市場規模・予測

- 製品別

- バス&ボディソープ

- キッチンソープ

- 洗濯石鹸

- その他

- 用途別

- 個人

- 家庭

- カテゴリー別

- 有機品

- 従来品

- フレグランス別

- 香り付き

- 無香料

- パッケージ別

- パウチ

- チューブ

- ディスペンサー

- ボトル

- その他

- 価格帯別

- 大衆

- プレミアム

- ラグジュアリー

- 用途別

- 家庭用

- 商用

- 流通チャネル別

- オフライン

- オンライン

- 地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

- 企業別市場シェア

第6章 世界の液体石鹸市場の展望:地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

第7章 市場マッピング、2023年

- 製品別

- 用途別

- カテゴリー別

- フレグランス別

- パッケージ別

- 価格帯別

- 用途別

- 流通チャネル別

- 地域別

第8章 マクロ環境と産業構造

- 需給分析

- 輸出入分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

- 成長推進因子

- 成長阻害因子 (課題・制約)

第10章 主要企業の情勢

- 市場リーダー上位5社の競合マトリックス

- 市場リーダー上位5社の市場収益分析

- M&A・ジョイントベンチャー (該当する場合)

- SWOT分析 (参入5社)

- 特許分析 (該当する場合)

第11章 価格分析

第12章 ケーススタディ

第13章 主要企業の展望

- Unilever PLC

- The Procter & Gamble Company

- Johnson & Johnson Consumer Inc.

- Henkel Corporation

- Mountain Valley Spring India Pvt. Ltd. (Forest Essentials)

- Bath & Body Works, Inc.

- Colgate-Palmolive Company

- Reckitt Benckiser Group PLC

- Beiersdorf AG

- Neal's Yard (Natural Remedies) Limited

第14章 戦略的提言

第15章 当社について・免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 3. Global Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 4. Global Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 5. Global Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 6. Global Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 7. Global Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 8. Global Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 9. Global Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 10. Global Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 11. Global Liquid Soap Market Share (%), By Region, 2017-2031F

- Figure 12. North America Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 13. North America Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 14. North America Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 15. North America Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 16. North America Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 17. North America Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 18. North America Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 19. North America Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 20. North America Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 21. North America Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 22. North America Liquid Soap Market Share (%), By Country, 2017-2031F

- Figure 23. United States Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 24. United States Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 25. United States Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 26. United States Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 27. United States Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 28. United States Liquid Soap Market Share (%), By Fragrance, 2017-2031F

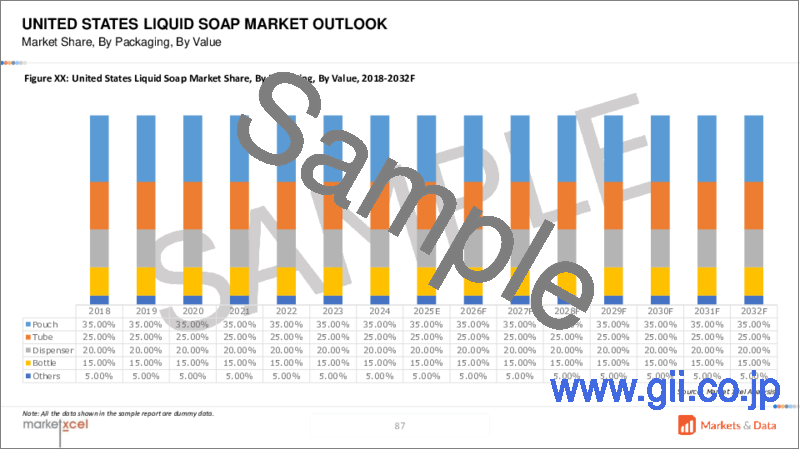

- Figure 29. United States Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 30. United States Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 31. United States Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 32. United States Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 33. Canada Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 34. Canada Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 35. Canada Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 36. Canada Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 37. Canada Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 38. Canada Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 39. Canada Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 40. Canada Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 41. Canada Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 42. Canada Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 43. Mexico Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 44. Mexico Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 45. Mexico Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 46. Mexico Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 47. Mexico Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 48. Mexico Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 49. Mexico Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 50. Mexico Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 51. Mexico Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 52. Mexico Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 53. Europe Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 54. Europe Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 55. Europe Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 56. Europe Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 57. Europe Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 58. Europe Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 59. Europe Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 60. Europe Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 61. Europe Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 62. Europe Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 63. Europe Liquid Soap Market Share (%), By Country, 2017-2031F

- Figure 64. Germany Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 65. Germany Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 66. Germany Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 67. Germany Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 68. Germany Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 69. Germany Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 70. Germany Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 71. Germany Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 72. Germany Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 73. Germany Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 74. France Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 75. France Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 76. France Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 77. France Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 78. France Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 79. France Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 80. France Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 81. France Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 82. France Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 83. France Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 84. Italy Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 85. Italy Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 86. Italy Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 87. Italy Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 88. Italy Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 89. Italy Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 90. Italy Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 91. Italy Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 92. Italy Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 93. Italy Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 94. United Kingdom Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 95. United Kingdom Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 96. United Kingdom Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 97. United Kingdom Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 98. United Kingdom Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 99. United Kingdom Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 100. United Kingdom Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 101. United Kingdom Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 102. United Kingdom Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 103. United Kingdom Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 104. Russia Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 105. Russia Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 106. Russia Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 107. Russia Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 108. Russia Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 109. Russia Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 110. Russia Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 111. Russia Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 112. Russia Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 113. Russia Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 114. Netherlands Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 115. Netherlands Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 116. Netherlands Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 117. Netherlands Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 118. Netherlands Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 119. Netherlands Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 120. Netherlands Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 121. Netherlands Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 122. Netherlands Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 123. Netherlands Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 124. Spain Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 125. Spain Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 126. Spain Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 127. Spain Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 128. Spain Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 129. Spain Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 130. Spain Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 131. Spain Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 132. Spain Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 133. Spain Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 134. Turkey Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 135. Turkey Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 136. Turkey Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 137. Turkey Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 138. Turkey Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 139. Turkey Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 140. Turkey Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 141. Turkey Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 142. Turkey Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 143. Turkey Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 144. Poland Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 145. Poland Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 146. Poland Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 147. Poland Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 148. Poland Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 149. Poland Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 150. Poland Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 151. Poland Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 152. Poland Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 153. Poland Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 154. South America Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 155. South America Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 156. South America Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 157. South America Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 158. South America Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 159. South America Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 160. South America Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 161. South America Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 162. South America Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 163. South America Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 164. South America Liquid Soap Market Share (%), By Country, 2017-2031F

- Figure 165. Brazil Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 166. Brazil Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 167. Brazil Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 168. Brazil Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 169. Brazil Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 170. Brazil Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 171. Brazil Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 172. Brazil Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 173. Brazil Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 174. Brazil Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 175. Argentina Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 176. Argentina Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 177. Argentina Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 178. Argentina Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 179. Argentina Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 180. Argentina Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 181. Argentina Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 182. Argentina Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 183. Argentina Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 184. Argentina Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 185. Asia-Pacific Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 186. Asia-Pacific Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 187. Asia-Pacific Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 188. Asia-Pacific Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 189. Asia-Pacific Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 190. Asia-Pacific Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 191. Asia-Pacific Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 192. Asia-Pacific Liquid Soap Market Share (%), By Price Range, 2016-2030

- Figure 193. Asia-Pacific Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 194. Asia-Pacific Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 195. Asia-Pacific Liquid Soap Market Share (%), By Country, 2017-2031F

- Figure 196. India Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 197. India Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 198. India Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 199. India Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 200. India Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 201. India Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 202. India Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 203. India Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 204. India Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 205. India Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 206. China Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 207. China Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 208. China Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 209. China Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 210. China Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 211. China Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 212. China Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 213. China Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 214. China Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 215. China Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 216. Japan Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 217. Japan Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 218. Japan Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 219. Japan Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 220. Japan Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 221. Japan Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 222. Japan Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 223. Japan Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 224. Japan Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 225. Japan Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 226. Australia Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 227. Australia Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 228. Australia Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 229. Australia Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 230. Australia Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 231. Australia Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 232. Australia Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 233. Australia Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 234. Australia Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 235. Australia Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 236. Vietnam Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 237. Vietnam Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 238. Vietnam Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 239. Vietnam Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 240. Vietnam Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 241. Vietnam Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 242. Vietnam Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 243. Vietnam Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 244. Vietnam Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 245. Vietnam Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 246. South Korea Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 247. South Korea Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 248. South Korea Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 249. South Korea Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 250. South Korea Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 251. South Korea Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 252. South Korea Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 253. South Korea Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 254. South Korea Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 255. South Korea Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 256. Indonesia Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 257. Indonesia Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 258. Indonesia Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 259. Indonesia Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 260. Indonesia Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 261. Indonesia Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 262. Indonesia Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 263. Indonesia Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 264. Indonesia Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 265. Indonesia Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 266. Philippines Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 267. Philippines Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 268. Philippines Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 269. Philippines Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 270. Philippines Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 271. Philippines Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 272. Philippines Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 273. Philippines Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 274. Philippines Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 275. Philippines Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 276. Middle East & Africa Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 277. Middle East & Africa Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 278. Middle East & Africa Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 279. Middle East & Africa Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 280. Middle East & Africa Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 281. Middle East & Africa Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 282. Middle East & Africa Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 283. Middle East & Africa Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 284. Middle East & Africa Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 285. Middle East & Africa Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 286. Middle East & Africa Liquid Soap Market Share (%), By Country, 2017-2031F

- Figure 287. Saudi Arabia Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 288. Saudi Arabia Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 289. Saudi Arabia Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 290. Saudi Arabia Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 291. Saudi Arabia Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 292. Saudi Arabia Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 293. Saudi Arabia Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 294. Saudi Arabia Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 295. Saudi Arabia Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 296. Saudi Arabia Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 297. UAE Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 298. UAE Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 299. UAE Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 300. UAE Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 301. UAE Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 302. UAE Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 303. UAE Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 304. UAE Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 305. UAE Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 306. UAE Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 307. South Africa Liquid Soap Market, By Value, In USD Billion, 2017-2031F

- Figure 308. South Africa Liquid Soap Market, By Volume, In Thousand Liters, 2017-2031F

- Figure 309. South Africa Liquid Soap Market Share (%), By Product, 2017-2031F

- Figure 310. South Africa Liquid Soap Market Share (%), By Usage, 2017-2031F

- Figure 311. South Africa Liquid Soap Market Share (%), By Category, 2017-2031F

- Figure 312. South Africa Liquid Soap Market Share (%), By Fragrance, 2017-2031F

- Figure 313. South Africa Liquid Soap Market Share (%), By Packaging, 2017-2031F

- Figure 314. South Africa Liquid Soap Market Share (%), By Price Range, 2017-2031F

- Figure 315. South Africa Liquid Soap Market Share (%), By Application, 2017-2031F

- Figure 316. South Africa Liquid Soap Market Share (%), By Distribution Channel, 2017-2031F

- Figure 317. By Product Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 318. By Usage Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 319. By Category Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 320. By Fragrance Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 321. By Packaging Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 322. By Price Range Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 323. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 324. By Distribution Channel Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 325. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global liquid soap market is projected to witness a CAGR of 7% during the forecast period 2024-2031, growing from USD 35.34 billion in 2023 to USD 60.58 billion in 2031. Factors such as growing awareness of the importance of personal hygiene and health among consumers, rising demand for natural and organic liquid soaps, consumers' preference for mild and gentle products, installation of smart liquid soap dispensers in public restrooms, increasing demand for natural and organic products, and introduction of toxic free and chemical free liquid soaps are driving the global liquid soap market growth. Also, the rising usage of liquid soaps among youngsters due to convenience and hygiene over traditional bar soaps is further augmenting the market growth.

The use of upcycled and functional ingredients in liquid soaps is driving the market's growth. For instance, in November 2023, Eurofragrance launched Verdenix, an upcycled ingredient used in liquid soap to offer malodour counteraction benefits. The innovation, made from upcycled material through a natural process, acts as a booster in hand and body wash applications, as well as in dishwashing liquid products, to eliminate the foul smell.

Technological advancements in the packaging of liquid soaps and the introduction of smart dispenser units are driving the growth of the liquid soap market due to an increase in the convenience of consumers. The introduction of technologically advanced touch-free hand dispensers has heightened the growth of the liquid soap market. These dispensers eliminate manual pumping or washing hands with bar soap, easing the usage, encouraging frequent handwashing, and driving market growth. Moreover, liquid soaps further augment the market growth due to touchless usage.

Consumers' Rising Preference for Sulphates and Paraben-Free Liquid Soaps to Gain Momentum

Awareness about these chemicals' potential health and environmental impacts drives consumers towards a preference for sulfate and paraben-free liquid soaps. Sulfates, such as sodium lauryl sulfate and sodium laurate sulfate, are probably the most common surfactants in soaps that harm the skin. They help create lather, but as they're harsh on the skin and can lead to skin irritation, dryness, and worsen conditions such as eczema and dermatitis. Parabens, on the other hand, are preservatives used to extend the shelf life of personal care products. Some studies point to their potential role in hormonal disruptions, as parabens can mimic estrogen in the body and may increase the risk of breast cancer and other reproductive disorders. Consequently, consumers are increasingly seeking milder alternatives which are free from these harsh chemicals, minimizing the skin reactions.

Consumers' preference for a greater number of products which fit into a more natural, environmentally friendly lifestyle is on the rise. Sulfate and paraben free liquid soaps are often positioned as being more natural and eco-friendlier.

For instance, in July 2023, Bath & Body Works, Inc. launched its latest reformulated hand soap collection. The collection has been manufactured without parabens, sulphates, and dyes, containing natural essential oils, Vitamin E, aloe, and shea extract.

Sustainable Packaging to Gain Momentum

Sustainable packaging in the liquid soap markets, such as biodegradable plastics, recycled materials, and refills, appeals to eco-conscious consumers, driving the market growth. Refill packs are becoming increasingly popular, where customers can buy soap in bulk and refill their used bottles. It reduces consumption of single-use plastics, promoting a circular economy. Manufacturers are increasingly offering fashionable, long-term dispensers made of glass or high-quality plastics which are reusable to attract eco-conscious consumers. Brands offering sustainable packaging gain a competitive advantage in terms of goodwill and customer loyalty.

Different packaging materials, such as aluminum, PET plastic, and cartoons, are being used for liquid soaps to contribute to growing environmental concerns and appeal to eco-conscious consumers. Recycled materials, such as post-consumer recycled plastics and paper-based packaging, lower dependence on virgin materials and reduce the overall carbon footprint.

In March 2024, Grove Collaborative Holdings, Inc. launched Grove Co., which rebranded with a ready-to-use range of daily home essentials in beautifully sustainable aluminum packaging. The aluminum packaging introduced for liquid dish soap, hand liquid soap, and laundry detergent liquid is recyclable.

In July 2023, Dr. Bronner's launched a new soap refill carton packaging for its liquid soap, Pure-Castile. Using these sustainable refill packs, consumers will be able to minimize their plastic usage by 82% as compared to the post-consumer recycled plastic bottles.

Dispenser to Dominate Global Liquid Market Share

Dispenser packaging dominates the liquid soap market, offering convenience, hygiene, and growing consumers' preferences. A dispenser, in the form of a pump bottle, offers ease of use; without needing to touch the container, which maintains hygiene. It is important when different users use the same soap, such as in public restrooms and hospitals. Dispenser packaging is versatile enough to accommodate different liquid soap formulations that include moisturizing, antibacterial, and scented varieties to suit a range of consumer needs, hence, owing to their popularity.

The controlled dispensing mechanism minimizes waste by using the right amount of soap per application as compared to a tube and being cost-effective and eco-friendly. Moreover, the dispenser packaging is sustainable as it is mostly designed for refills, which helps remove the need for continuous purchase of new bottles. For instance, in July 2023, Bath and Body Works introduced a hand soap collection which features a dispenser bottle with recycled plastic. These dispenser bottles are made with 50% recycled plastic. The company introduced their hand soap refills which can be refilled in an empty hand soap dispenser bottle.

Asia-Pacific to Dominate the Global Liquid Soap Market Share

Asia-Pacific consists of the most highly populated countries in the world, including China and India. The large and growing population in the region forms a tremendous market for hygiene and personal care products, such as liquid soap. According to the United States Census Bureau, in 2024, China's population was 1.412 billion, while India's was 1.417 billion.

Furthermore, economic development across most Asian countries has made most people in the region be with a higher disposable income. The improved level of disposable income increases the chances of people being able to afford and use a wide range of personal care products, including liquid soap. Further, lifestyle changes in Asia-Pacific become fast, with a fast move to convenient and easy-to-use products. Liquid soap, with its user-friendly packaging and dispensing systems, would fall right into these changing preferences. Moreover, the increasing awareness of the importance of health and hygiene in the region is further augmenting the market growth.

Future Market Scenario (2024 - 2031F)

The market is witnessing growth and is anticipated to grow exponentially in the future as well due to several factors.

The technological advancements and innovation in the formulation, ingredients, and texture of the product is anticipated to propel the market's growth. Manufacturers are continuously developing new liquid soap varieties such as medicinal properties, elimination of foul smell and added moisturizing properties, appealing to the consumers with different requirements.

The introduction of refills and sustainable packaging, which has a low carbon footprint, is expected to increase the market's visibility in the forecast years.

Expansion of e-commerce platform is another catalyst which is expected to contribute to the growing demand for liquid soaps in the forecast period.

Key Players Landscape and Outlook

Key players in the global liquid soap market are helping the growth by focusing on continuous product innovation, retail expansions, and strategic marketing. The manufacturers are actively expanding their product portfolio, increasing the base of the customers, and catering to their evolving needs.

The key players are expanding their product portfolios to offer convenience to the consumers with the launch of the latest products. For instance, in May 2024, The Procter & Gamble Company expanded their laundry care range with the launch of Tide Professional Commercial Laundry Detergent and Downy Professional Fabric Softener, offering the businesses a trusted clean in one wash. Tide Professional Laundry liquid detergent is available in different sizes viz., 105 oz. and 170 oz.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Voice of Customer

- 4.1. Demographics (Age/Cohort Analysis - Baby Boomers and Gen X, Millennials, Gen Z; Gender; Income - Low, Mid and High; Geography; Nationality; etc.)

- 4.2. Product and Market Intelligence

- 4.3. Mode of Brand Awareness

- 4.4. Factors Considered in Purchase Decisions

- 4.4.1. Ingredients

- 4.4.2. Functionality

- 4.4.3. Packaging

- 4.4.4. Reviews and Recommendations

- 4.4.5. Brand Image

- 4.4.6. Product Variety and Range

- 4.4.7. Innovation

- 4.4.8. Price

- 4.4.9. Availability and Accessibility

- 4.4.10. Promotional Discounts

- 4.5. Consideration of Privacy and Safety Regulations

- 4.6. Purchase Channel

- 4.7. Frequency of Purchase

- 4.8. Existing or Intended User

- 4.9. Recommendations from friends, family/online reviews

- 4.10. Role of Brand Ambassador or Influencer Marketing on Product/Brand Absorption

5. Global Liquid soap Market Outlook, 2017-2031F

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. By Product

- 5.2.1. Bath and Body Soap

- 5.2.1.1. Body Wash and Shower Gel

- 5.2.1.2. Facewash

- 5.2.1.3. Handwash

- 5.2.1.4. Shampoo

- 5.2.1.5. Intimate Wash

- 5.2.1.6. Others

- 5.2.2. Kitchen Soap

- 5.2.3. Laundry Soap

- 5.2.4. Others

- 5.2.1. Bath and Body Soap

- 5.3. By Usage

- 5.3.1. Personal

- 5.3.1.1. Bathing

- 5.3.1.2. Handwashing

- 5.3.1.3. Others

- 5.3.2. Household

- 5.3.2.1. Laundry

- 5.3.2.2. Dishwashing

- 5.3.2.3. Surface Cleaning

- 5.3.2.4. Others

- 5.3.1. Personal

- 5.4. By Category

- 5.4.1. Organic

- 5.4.2. Conventional

- 5.5. By Fragrance

- 5.5.1. Scented

- 5.5.2. Non-Scented

- 5.6. By Packaging

- 5.6.1. Pouch

- 5.6.2. Tube

- 5.6.3. Dispenser

- 5.6.4. Bottle

- 5.6.5. Others

- 5.7. By Price Range

- 5.7.1. Mass Segment

- 5.7.2. Premium Segment

- 5.7.3. Luxury Segment

- 5.8. By Application

- 5.8.1. Residential

- 5.8.2. Commercial

- 5.8.2.1. Hospitality Sector

- 5.8.2.2. Healthcare Sector

- 5.8.2.3. Others

- 5.9. By Distribution Channel

- 5.9.1. Offline

- 5.9.1.1. Supermarkets and Hypermarkets

- 5.9.1.2. Specialty Stores

- 5.9.1.3. Others

- 5.9.2. Online

- 5.9.2.1. E-commerce Websites

- 5.9.2.2. Company Owned Website

- 5.9.1. Offline

- 5.10. By Region

- 5.10.1. North America

- 5.10.2. Europe

- 5.10.3. Asia-Pacific

- 5.10.4. South America

- 5.10.5. Middle East and Africa

- 5.11. By Company Market Share (%), 2023

6. Global Liquid Soap Market Outlook, By Region, 2017-2031F

- 6.1. North America*

- 6.1.1. Market Size & Forecast

- 6.1.1.1. By Value

- 6.1.1.2. By Volume

- 6.1.2. By Product

- 6.1.2.1. Bath and Body Soap

- 6.1.2.1.1. Body Wash and Shower Gel

- 6.1.2.1.2. Facewash

- 6.1.2.1.3. Handwash

- 6.1.2.1.4. Shampoo

- 6.1.2.1.5. Intimate Washe

- 6.1.2.1.6. Others

- 6.1.2.2. Kitchen Soap

- 6.1.2.3. Laundry Soap

- 6.1.2.4. Others

- 6.1.2.1. Bath and Body Soap

- 6.1.3. By Usage

- 6.1.3.1. Personal

- 6.1.3.1.1. Bathing

- 6.1.3.1.2. Handwashing

- 6.1.3.1.3. Others

- 6.1.3.2. Household

- 6.1.3.2.1. Laundry

- 6.1.3.2.2. Dishwashing

- 6.1.3.2.3. Surface Cleaning

- 6.1.3.2.4. Others

- 6.1.3.1. Personal

- 6.1.4. By Category

- 6.1.4.1. Organic

- 6.1.4.2. Conventional

- 6.1.5. By Fragrance

- 6.1.5.1. Scented

- 6.1.5.2. Non-Scented

- 6.1.6. By Packaging

- 6.1.6.1. Pouch

- 6.1.6.2. Tube

- 6.1.6.3. Dispenser

- 6.1.6.4. Bottle

- 6.1.6.5. Others

- 6.1.7. By Price Range

- 6.1.7.1. Mass Segment

- 6.1.7.2. Premium Segment

- 6.1.7.3. Luxury Segment

- 6.1.8. By Application

- 6.1.8.1. Residential

- 6.1.8.2. Commercial

- 6.1.8.2.1. Hospitality Sector

- 6.1.8.2.2. Healthcare Sector

- 6.1.8.2.3. Others

- 6.1.9. By Distribution Channel

- 6.1.9.1. Offline

- 6.1.9.1.1. Supermarkets and Hypermarkets

- 6.1.9.1.2. Specialty Stores

- 6.1.9.1.3. Others

- 6.1.9.2. Online

- 6.1.9.2.1. E-commerce Websites

- 6.1.9.2.2. Company Owned Website

- 6.1.9.1. Offline

- 6.1.10. United States*

- 6.1.10.1. Market Size & Forecast

- 6.1.10.1.1. By Value

- 6.1.10.1.2. By Volume

- 6.1.10.2. By Product

- 6.1.10.2.1. Bath and Body Soap

- 6.1.10.2.1.1. Body Wash and Shower Gel

- 6.1.10.2.1.2. Facewash

- 6.1.10.2.1.3. Handwash

- 6.1.10.2.1.4. Shampoo

- 6.1.10.2.1.5. Intimate Wash

- 6.1.10.2.1.6. Others

- 6.1.10.2.2. Kitchen Soap

- 6.1.10.2.3. Laundry Soap

- 6.1.10.2.4. Others

- 6.1.10.2.1. Bath and Body Soap

- 6.1.10.3. By Usage

- 6.1.10.3.1. Personal

- 6.1.10.3.1.1. Bathing

- 6.1.10.3.1.2. Handwashing

- 6.1.10.3.1.3. Others

- 6.1.10.3.2. Household

- 6.1.10.3.2.1. Laundry

- 6.1.10.3.2.2. Dishwashing

- 6.1.10.3.2.3. Surface Cleaning

- 6.1.10.3.2.4. Others

- 6.1.10.3.1. Personal

- 6.1.10.4. By Category

- 6.1.10.4.1. Organic

- 6.1.10.4.2. Conventional

- 6.1.10.5. By Fragrance

- 6.1.10.5.1. Scented

- 6.1.10.5.2. Non-Scented

- 6.1.10.6. By Packaging

- 6.1.10.6.1. Pouch

- 6.1.10.6.2. Tube

- 6.1.10.6.3. Dispenser

- 6.1.10.6.4. Bottle

- 6.1.10.6.5. Others

- 6.1.10.7. By Price Range

- 6.1.10.7.1. Mass Segment

- 6.1.10.7.2. Premium Segment

- 6.1.10.7.3. Luxury Segment

- 6.1.10.8. By Application

- 6.1.10.8.1. Residential

- 6.1.10.8.2. Commercial

- 6.1.10.8.2.1. Hospitality Sector

- 6.1.10.8.2.2. Healthcare Sector

- 6.1.10.8.2.3. Others

- 6.1.10.9. By Distribution Channel

- 6.1.10.9.1. Offline

- 6.1.10.9.1.1. Supermarkets and Hypermarkets

- 6.1.10.9.1.2. Specialty Stores

- 6.1.10.9.1.3. Others

- 6.1.10.9.2. Online

- 6.1.10.9.2.1. E-commerce Websites

- 6.1.10.9.2.2. Company Owned Website

- 6.1.10.9.1. Offline

- 6.1.10.1. Market Size & Forecast

- 6.1.11. Canada

- 6.1.12. Mexico

- 6.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2. Europe

- 6.2.1. Germany

- 6.2.2. France

- 6.2.3. Italy

- 6.2.4. United Kingdom

- 6.2.5. Russia

- 6.2.6. Netherlands

- 6.2.7. Spain

- 6.2.8. Turkey

- 6.2.9. Poland

- 6.3. Asia-Pacific

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Vietnam

- 6.3.6. South Korea

- 6.3.7. Indonesia

- 6.3.8. Philippines

- 6.4. South America

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.5. Middle East and Africa

- 6.5.1. Saudi Arabia

- 6.5.2. UAE

- 6.5.3. South Africa

7. Market Mapping, 2023

- 7.1. By Product

- 7.2. By Usage

- 7.3. By Category

- 7.4. By Fragrance

- 7.5. By Packaging

- 7.6. By Price Range

- 7.7. By Application

- 7.8. By Distribution Channel

- 7.9. By Region

8. Macro Environment and Industry Structure

- 8.1. Demand Supply Analysis

- 8.2. Import Export Analysis

- 8.3. Value Chain Analysis

- 8.4. PESTEL Analysis

- 8.4.1. Political Factors

- 8.4.2. Economic System

- 8.4.3. Social Implications

- 8.4.4. Technological Advancements

- 8.4.5. Environmental Impacts

- 8.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.5. Porter's Five Forces Analysis

- 8.5.1. Supplier Power

- 8.5.2. Buyer Power

- 8.5.3. Substitution Threat

- 8.5.4. Threat from New Entrant

- 8.5.5. Competitive Rivalry

9. Market Dynamics

- 9.1. Growth Drivers

- 9.2. Growth Inhibitors (Challenges and Restraints)

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (By Value, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. Unilever PLC

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products and Services

- 13.1.4. Financials (As reported)

- 13.1.5. Key Market Focus and Geographical Presence

- 13.1.6. Recent Developments

- 13.2. The Procter & Gamble Company

- 13.3. Johnson & Johnson Consumer Inc.

- 13.4. Henkel Corporation

- 13.5. Mountain Valley Spring India Pvt. Ltd. (Forest Essentials)

- 13.6. Bath & Body Works, Inc.

- 13.7. Colgate-Palmolive Company

- 13.8. Reckitt Benckiser Group PLC

- 13.9. Beiersdorf AG

- 13.10. Neal's Yard (Natural Remedies) Limited

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.