|

|

市場調査レポート

商品コード

1274857

衛星通信事業者は次の大きな打ち上げに向け、D2D、IoT、クラウドに賭ける:パートナーシップが通信事業者たちの混乱を和らげるが、厳しい見通しの中、根本的に強い衛星事業者だけが成功し、資本を集めるSatellite Players Bet on Direct-to-Device (D2D), IoT, and Cloud for Next Big Liftoff: Partnerships will Allay Disruption Fears among Telcos, yet only Fundamentally Strong Satellite Businesses will Thrive and Attract Capital amid Gloomy Outlook |

||||||

|

|||||||

| 衛星通信事業者は次の大きな打ち上げに向け、D2D、IoT、クラウドに賭ける:パートナーシップが通信事業者たちの混乱を和らげるが、厳しい見通しの中、根本的に強い衛星事業者だけが成功し、資本を集める |

|

出版日: 2023年05月11日

発行: MTN Consulting, LLC

ページ情報: 英文 11 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

当レポートでは、衛星通信事業者にとって新たな成長市場となりうる3つの市場について調査し、従来の通信市場への影響、通信事業者の衛星パートナーシップによる収益機会、衛星通信事業者が直面する主な課題についても考察しています。

ビジュアル

範囲

対象企業

|

|

目次

- サマリー

- 衛星通信事業者は、競合の激化、マクロの不確実性、ニッチな分野への注目の懸念を抑止するため、視点を多様化している

- Direct-to-device(D2D)、IoT、クラウドベースのサービスにおいて変革の機会が現れる

- 通信会社は心配する必要があるか

- 規制のハードルを乗り越え、一定の資本の流れを確保することは衛星事業者にとって厄介なことが判明する

- 付録

List of Figures

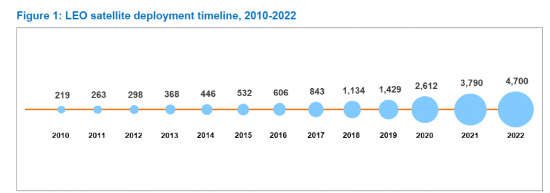

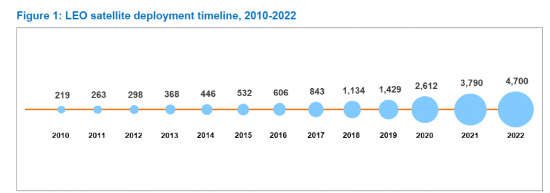

- Figure 1: LEO satellite deployment timeline, 2010-2022

- Figure 2: Illustration of OQ Technology's operating model

- Figure 3: D2D revenue opportunity for telcos (US$B)

- Figure 4: Private investments in the space economy, 2015-22 (US$B)

This brief report explores three potential new growth markets for satellite operators who are looking to overcome intense competition, tough macro conditions, and the niche nature of their market. The report also discusses the impact on the traditional telecom market, revenue opportunity for telcos from satellite partnerships, and key challenges confronting satellite operators.

VISUALS

Satellite operators are being forced to expand their addressable markets in the near term, courtesy several factors: rising competition, with the emergence of players such as SpaceX along with several upstarts including AST SpaceMobile and Lynk; a tough funding climate resulting from a grim economic outlook and rising interest rates; and, market concentration risks arising from the current focus on satellite broadband internet. To address the situation, operators are raising stakes in new pursuits and developing new offerings. MTN Consulting expects three new potential addressable markets to provide transformational opportunities for satellite operators in the next 2-4 years. These include Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services. Looking at these market opportunities, a thought may arise whether satellite operators are trying to disrupt the traditional telecom market. But the reality is that telcos will continue to be the primary service provider for wireless access. Telcos are also going to benefit from partnerships with satellite operators as they will aid in providing an enhanced experience for telco customers, reinforced by ubiquitous coverage. For satellite operators though, navigating the regulatory hurdles and ensuring constant capital flow are key concerns; several players from the current herd will vanish in the next 3-5 years.

COVERAGE:

Companies mentioned:

|

|

Table of Contents

- Summary

- Satellite operators eye diversification to deter rising competition, macro uncertainty, and niche focus concerns

- Transformational opportunities emerge in Direct-to-device (D2D), IoT, and cloud-based services

- Should telcos worry?

- Navigating regulatory hurdles and ensuring constant capital flow will prove tricky for satellite operators

- Appendix