|

市場調査レポート

商品コード

1850269

動物遺伝学:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Animal Genetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 動物遺伝学:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月09日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

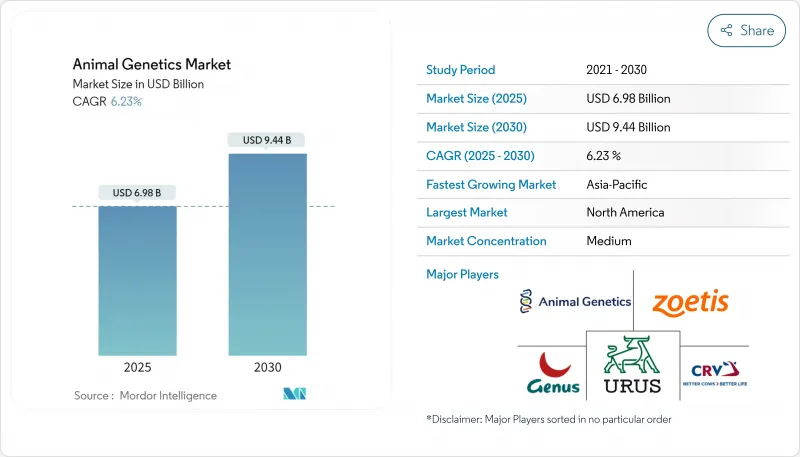

動物遺伝学の市場規模は2025年に69億8,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは6.23%で、2030年には94億4,000万米ドルに達すると予測されます。

この健全なペースは、高品質の動物性タンパク質に対する持続的な需要、ゲノムツールの幅広い利用、ゲノム選抜と従来の飼育法を融合させた精密育種の台頭を反映しています。北米は、先進的な研究所、支持的な規制、人工授精とゲノム検査の早期導入により、研究サイクルが短く、商業的利用が高い水準に維持されているため、依然として最大の地域貢献国です。アジア太平洋は、牛群の拡大、政府の生産性向上計画、アクセスコストを下げる国内ジェノタイピングセンターのネットワーク拡大に支えられ、急速に追い上げています。製品面では、依然として生きた家畜が主な収益源であるが、ロジスティクス、凍結保存、デジタル注文の改善に伴い、遺伝子材料、特に凍結精液と胚は急速な成長を記録しています。技術競争の中心は、経済性が証明された人工授精であり、CRISPRや関連する遺伝子編集ツールは、規制の道筋が明らかになるにつれて、実験的なものから商業規模へと移行しつつあります。エンドユーザーの需要は動物病院へとシフトしており、家畜とコンパニオンアニマルの両方で遺伝子診断が日常的に行われるようになっています。

世界の動物遺伝学市場の動向と洞察

高収量の耐病性家畜品種への需要

食糧システムに対する圧力の高まりにより、遺伝的耐病性が生産性の中核を担うようになりました。マーカー支援選択により抵抗性遺伝子座が迅速に特定されるようになり、CRISPRにより作出されたPRRS抵抗性豚は、精密な編集がいかにコストのかかるアウトブレイクを抑制できるかを実証しています。バイヤーはまた、抗生物質不使用のラベルに報酬を与え、抵抗性形質を明確な価格プレミアムに変えます。育種会社は抵抗性マーカーを成長や効率性の形質とバンドルすることで対応し、政府は抗菌剤使用を削減するプロジェクトに助成金を振り向ける。密集した農場群を抱えるアジア太平洋地域の生産者は、耐性をリスク保険と見なしており、検証済みの遺伝学に対する地域的需要を牽引しています。

先進遺伝子技術の採用増加

シーケンシングコストの低下と高スループットSNPアレイにより、中規模生産者にもゲノム検査が開放されました。統合予測モデルは現在、ゲノム、成績、環境記録を組み合わせ、飼料効率、耐暑性、メタン緩和のための選択を可能にしています。例えば酪農プログラムでは、ルーメン微生物に関連したSNPパネルを用いて栄養吸収効率を高め、飼料コストと排出量を削減しています。欧州と北米の官民パートナーシップは、参照集団に共同資金を提供し、遺伝的利益を維持する長期的なデータフローを確保しています。

ゲノムシークエンシングの高コストが採用を阻む

シーケンシングが安価になったとはいえ、機器の初期費用やサンプルごとの手数料が依然として小規模農家の足かせとなっています。遺伝的利益の現金への変換がより遅い牛肉企業では、採用は慎重です。生産量に基づく価格設定スキームと国の補助金によって、コストは部分的に相殺されているが、アクセスは依然として不均一です。このような格差は、産業プレーヤーと家族経営の農場との間の業績格差を拡大する危険性があり、政策立案者はラボ施設の共有や段階的なサービスパッケージの検討を促しています。

セグメント分析

畜産動物セグメントは2024年の動物遺伝学市場の62.54%を占め、これは商業的バイヤーが証明された雄牛、牡牛、雄羊、および生産実績のある繁殖用家畜に持続的なプレミアムを付けていることを反映しています。ブリーダーは、エリート種牡馬の価格がしばしば5万米ドルを超えることを正当化するために、農場でのパフォーマンステスト、ショー会場での知名度、デジタル血統プラットフォームに投資しています。貿易は、国境を越えた移動を簡素化する改善されたロジスティクスと検疫ハブから利益を得ています。

凍結保存の進歩が出荷リスクを低減し、デジタル化された注文ポータルが世界のバイヤーを多様な生殖質在庫に結びつけるため、絶対額は小さいもの、遺伝物質はCAGR 6.98%で急速に拡大しています。胚のガラス固化は現在、解凍後の生存率が90%を超え、生牛を輸入せずに迅速な遺伝的飛躍を望む新興市場の酪農家の間で利用が広がっています。精液は手頃な価格であるため、依然として生産量のリーダーであるが、プレミアム胚とDNAライブラリーはより利益率の高いニッチを生み出しています。最終製品の多様性と提供の柔軟性により、遺伝素材は2030年までの全体的な動物遺伝学市場の成長を上回る。

2024年の動物遺伝学市場売上の48.15%は遺伝形質・性能検査です。このサービスは、乳量、枝肉品質、飼料要求率、回復力形質に関する詳細なデータを取得し、それらをDNAマーカーと統合して選択指標を精緻化します。クラウドベースのダッシュボードは現在、生産者にリアルタイムのベンチマークを提供し、繁殖サイクルごとの反復的改善を促しています。豚肉と鶏肉を統合した経営からの需要は、飼料効率のわずかな向上が何百万頭という頭数にわたって複合的に作用するため、高い生産量を維持しています。

CAGR 7.01%で予測されるDNAタイピングと親子鑑定は、1検体あたりのシークエンシングコストが急落していることと、検体を一晩で中央ラボに郵送するハンドヘルド収集キットの普及から恩恵を受けています。コンパニオンアニマルクリニックがサンプルのシェアを伸ばしているが、畜産業者も血統表示を検証し、品種別健康プログラムのコンプライアンスを実施するために親子鑑定パネルを採用しています。DNAタイピングを形質検査にバンドルしたパッケージは、検査施設が付加価値分析をアップセルするのに役立ち、動物遺伝学市場での地位を強化しています。

地域分析

北米が最大の地域であり続け、2024年の動物遺伝学市場シェアの37.34%を占める。近代的なラボのインフラ、熟練したAI技術者の基盤、そして規制当局の寛容な姿勢が採用を強化しています。2025年のFDAによる遺伝子編集豚肉の承認は、フードチェーンにおける精密育種が受け入れられつつあることを示しています。米国農務省の見通しでは、2034年までに牛肉、豚肉、ブロイラーの生産量がそれぞれ11.1%、10.0%、11.5%増加すると予測されており、優れた遺伝子に対する地域全体の需要が強化されます。ウシの微生物叢から発見された小型のCRISPRタンパク質であるSubCas9は、より的を絞った編集を可能にし、オフターゲットのリスクを低減します。

アジア太平洋地域は、2030年までのCAGRが最速の7.75%になります。中国が地方品種用の国産ゲノムチップを展開し、インドが雌牛1頭当たりの乳用牛の生産高を上げるために雌雄識別精液を推進します。可処分所得の増加と食生活の変化により、肉、卵、乳製品への需要が拡大し、生産量を増加させ輸入を削減するための遺伝子改良への投資が促されます。ゲノミクスにおける官民パートナーシップは検査価格を引き下げ、中規模農場の参加を支援します。こうした努力の積み重ねが、動物遺伝学市場における同地域のウェイトを予測期間の各年で押し上げています。

欧州は、ブリーダーの戦略を形成する厳格な福祉と持続可能性の規範に支えられ、大きな地位を占めています。特に豚と家禽の系統では、生産性と家畜の福祉を両立させるバランスの取れた選抜指標が重視されています。南米は引き続き強力な牧草資源を収益化しています。ブラジルとアルゼンチンでは、耐暑性と無角の形質を持つ遺伝子編集牛の導入が活発です。中東とアフリカの一部では、規模は小さいもの、厳しい気候や限られた飼料供給に対抗するためにゲノミクスが研究されています。日本とアルゼンチンにおける規制の明確化は、特定の遺伝子組換え家畜が非遺伝子組換え作物として適格であることから、他の管轄区域に刺激を与え、遺伝子製品の国境を越えた取引を円滑にする可能性があります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高収量で病気に強い家畜品種の需要

- 大規模生産と高品質品種のための高度な遺伝子技術の導入の増加

- 北米の牛人工授精における性別判別精液技術の急速な導入

- 都市市場におけるコンパニオンアニマルの遺伝子検査の成長

- 中国とベトナムにおけるASF後の政府補助金による豚群再建

- 欧州におけるA2A2 B-カゼインをターゲットとした乳製品遺伝子プログラムの拡大

- 市場抑制要因

- ゲノム配列解析の高コストが導入を制限

- 育種協同組合における熟練した遺伝学者の不足

- 国境を越えた遺伝資源取引に対するバイオセキュリティ規制

- CRISPR遺伝子編集に関するEUの倫理的および規制上のハードル

- サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- 動物

- 牛

- 豚

- 家禽

- 犬

- 馬

- 水産養殖種

- その他

- 遺伝物質

- 精液

- 胚

- DNAとその他の遺伝資源

- 動物

- 検査サービスタイプ別

- 遺伝性疾患検査

- 遺伝的特性とパフォーマンスの検査

- DNA型判定と親子鑑定

- その他の専門検査

- 技術別

- 人工授精(AI)

- 胚移植(ET)

- マーカーアシストとゲノム選択

- CRISPRと遺伝子編集

- その他の生殖補助技術

- エンドユーザー別

- 繁殖会社および協会

- 畜産農家/農場

- 動物病院と専門クリニック

- 研究・学術機関

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Genus PLC

- Hendrix Genetics BV

- Zoetis Inc.

- Topigs Norsvin

- Cobb-Vantress Inc.

- Aviagen Group

- CRV Holding BV

- Select Sires Inc.

- STgenetics

- Semex Alliance

- Alta Genetics Inc.

- Neogen Corporation

- ABS Global Inc.

- Genex Co-operative Inc.

- Grimaud Groupe

- Eurogene AI Services

- Sexing Technologies

- Envigo RMS LLC

- Bovine Elite LLC

- Nugenomics Ltd.