|

市場調査レポート

商品コード

1850116

ヘルスケア分析:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Healthcare Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ヘルスケア分析:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月10日

発行: Mordor Intelligence

ページ情報: 英文 130 Pages

納期: 2~3営業日

|

概要

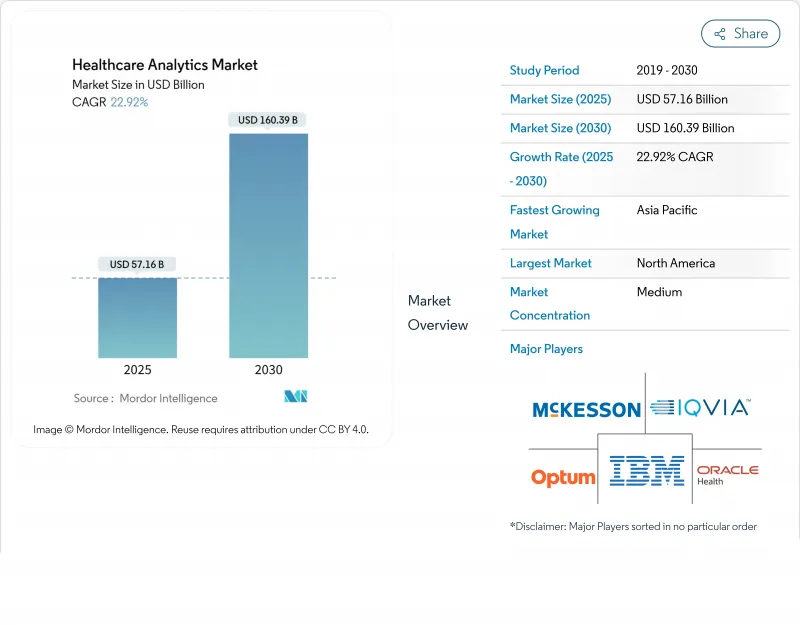

ヘルスケア分析市場は、2025年に571億6,000万米ドル、2030年には1,603億9,000万米ドルに達する見通しであり、予測期間中のCAGRは22.92%と堅調です。

支払者と医療提供者の協力関係の拡大、AI主導のデータパイプラインの広範な展開、クラウドネイティブな分析環境への着実なシフトが収益成長を加速させています。プロバイダー・ネットワークは予測リスク・スコアに依存する集団健康プログラムを拡大し、ライフサイエンス企業は規制当局の承認を迅速化するために臨床試験デザインに実世界のエビデンスを組み込み続けています。同時に、ベンチャー投資家は、過密な病院ITチームにローコードデータ統合ツールをもたらす分析新興企業を支持し、既存プラットフォームベンダーに活発な買収パイプラインを形成しています。ハイパースケールクラウドプロバイダー、レガシーEHR企業、そして純粋なアナリティクス専門企業が、ジェネレーティブAIやドメイン固有の大規模言語モデルを既存のワークフローに統合しようと競争する中で、競合は激化しています。

世界のヘルスケア分析市場の動向と洞察

バリュー・ベース・ケアへの移行

フィーフォー・サービスからバリュー・ベース・ケア(VBC)モデルへの移行により、ヘルスケア分析の要件は根本的に変化しています。VBC市場は、組織が臨床成果を財務実績に結びつけるアナリティクス・ソリューションを求めているため、5,000億米ドルから1兆米ドルに倍増すると予測されています。このような成長軌道にもかかわらず、現在、プライマリ・ケアの開業医の46%しかバリューベース支払いに参加していないため、導入を妨げる経済的障壁や管理負担に対処できるアナリティクス・ベンダーにとって、大きな市場ギャップが生じています(英連邦基金、2024年7月)。この移行期には、より洗練された患者中心のケアマネジメントアナリティクスが必要です。このアナリティクスは、ダイナミックな患者のニーズに適応することができ、また、診療報酬との関連性が高まっている健康の公平性の指標など、コスト削減以外の成果も測定することができます。

医薬品開発と患者安全性向上のためのリアルワールド・エビデンスの義務化

米国、欧州連合(EU)、日本の規制当局は、生命科学のスポンサーに対し、無作為化試験データを実世界のエビデンスで補完するよう奨励しています。製薬会社は、ラベルの拡大、安全性サーベイランス、希少疾患研究をサポートするために、非識別化されたクレームや登録情報を統合しています。ライフサイエンス分析チームは学術医療センターと提携し、縦断的な詳細を犠牲にすることなくプライバシー基準を満たす連携データネットワークを構築することが増えています。この連携により、ペタバイト規模のデータセットを堅牢な血統追跡で処理できる高性能分析プラットフォームへの投資が促進されます。米国食品医薬品局(FDA)による電子的エンドポイントに関する新たなガイダンスは、透明性が高く監査可能なアルゴリズムの必要性を強調しています。

.

断片的なデータ標準とコンプライアンスコスト

普遍的に採用されている相互運用性のフレームワークがないため、複数サイトでのアナリティクス展開における抽出と変換のコストが上昇します。HIPAA、GDPR、各国固有のローカリゼーションルールなど、プライバシーに関する法規制が異なるため、高度な同意管理ワークフローが必要になります。国境を越えた遠隔医療プログラムを運営する病院では、データセットを各クラウド間で二重化する必要があり、ストレージ予算が膨らみ、アクセスガバナンスが複雑になります。このような構造的な摩擦は、導入スケジュールを遅らせ、予算を高度な分析からコンプライアンス・ツールへと振り向け、短期的な支出の勢いを弱めています。

セグメント分析

記述的アナリティクスは引き続き最大の売上貢献者で、2024年のヘルスケア分析市場シェアの46.3%を占める。組織は、基本的な規制当局への報告や請求の判定要件を満たすために、引き続きレトロスペクティブ・ダッシュボードに依存しています。予算に制約のある地域病院は、データガバナンスの基盤を構築する一方で、記述的なモジュールをエントリーレベルのソリューションと見なしています。これと並行して、予測分析は24%のCAGRを記録しており、これは分析カテゴリの中で最高です。ケアマネジメント・チームは、リスクの高い患者にフラグを立て、アウトリーチ・リソースの優先順位を決めるために、リスク傾向スコアを導入しています。ベンダーのロードマップでは、ソリューションが電子カルテのワークフローに組み込まれた後のモデルのメンテナンスを容易にするため、自動MLと説明可能なAI機能に特に重点が置かれています。

ほぼリアルタイムの敗血症アラート、うっ血性心不全増悪の早期警告システム、手術室スケジューリング最適化装置への需要が、予測セグメントの軌道をさらに下支えしています。予測レベルのヘルスケア分析市場規模は、病院ネットワークがベッドサイド・モニターからのストリーミング・テレメトリーを解禁するにつれて拡大すると予測されます。市場参入企業は、正式なデータ科学のトレーニングを受けていない臨床医を対象に、ドラッグ・アンド・ドロップ式のモデルビルダーを提供することで差別化を図っています。アプリケーションカタログが成長するにつれて、プラットフォームの統合が迫り、ハイエンドのプロバイダーは、説明的、診断的、および処方的モジュールを統一されたサブスクリプション層にバンドルしています。

ソフトウェア・ライセンスは、高価格の全社的なプラットフォーム契約により、2024年には総売上の60.2%を占める。これらの契約は通常、データ統合、視覚化、高度なモデリング・エンジンをバンドルしており、ベンダーは永続的にアカウントを管理できます。とはいえ、ベンダー主導の設定、データ品質の改善、管理されたモデルパフォーマンスのサポートを顧客が求めているため、サービス契約はCAGR 25.5%で拡大しています。アウトソーシングサービスは、労働力不足に直面している病院や、24時間体制での分析監視を必要とするグローバルな臨床試験ネットワークを運営する生命科学企業にとって魅力的です。

多くのプロバイダーは、初期導入時に社内チームを補強するためにモジュール型サービスを選択します。このハイブリッド・アプローチは、システムのアップタイムを確保しながら、初期資本支出を削減します。サービスプロバイダーは、データマッピング作業を合理化するために自動化を導入し、価値実現までの時間を短縮するケースが増えています。病院のCFOが予測可能な営業費用を求める中、サブスクリプションベースのマネージドサービスが支持され、予測期間中、コンポーネントサービス部門はソフトウェアとの収益格差を縮小することになります。サービスに起因するヘルスケア分析市場規模は、レガシーソフトウェアのインストールが耐用年数を迎えるにつれて、より大きな更新予算を獲得することが期待されます。

地域分析

北米は、成熟したEHRの導入、価値ベースの支払い制度の普及、ベンチャーキャピタルの好意的な資金流入により、2024年の世界売上高の48.6%を占めました。プロバイダーの統合が支出力を増大させる一方、21世紀治療法などの厳しい相互運用性規制がアプリケーション・プログラミング・インターフェース・ベンダーの活気あるエコシステムを促進しています。品質報告に対する保険償還の義務化は、日常業務にアナリティクスをさらに浸透させ、この地域のリーダー的地位を維持しています。

欧州は、国家登録とアウトカムベースの調達モデルを優先するスカンジナビア諸国を筆頭に、堅調な需要で続いています。地域ごとのデータ保護規則があるため調達サイクルは長くなるが、共通の医療データスペースを確立するための汎欧州イニシアチブは、中期的な基準の調和を約束するものです。公共部門の研究コンソーシアムも、希少疾患やパンデミック対策に焦点を当てた国境を越えたデータ共有プロジェクトに資金を提供することで、利用を促進しています。

アジア太平洋地域はCAGR 22.9%で最も急成長している地域です。インド、インドネシア、タイでは、政府資金による保険の拡大により、スケーラブルな分析インフラを必要とする新しいデータセットが生み出されています。中国の各省では、病院の再入院ペナルティを組み込んだ価値ベースの償還スキームを試験的に導入しており、国内の分析ベンダーは予測モデルを現地の病院情報システムに統合する動きを加速させています。オーストラリアとシンガポールはクラウドファーストの国家医療IT戦略を推進し、グローバルプラットフォームプロバイダーに門戸を開きます。その結果、アジア太平洋地域のヘルスケア分析市場規模は、現在の成長軌道を踏まえると、2030年以降まもなく絶対収益で欧州を追い抜くと予測されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 価値に基づくケアへの移行

- 医薬品開発と患者の安全性を強化するためのリアルワールドエビデンスの義務化

- クラウド導入とAI対応医療ツール

- ベンチャーキャピタル投資と保険プロセスのデジタル化

- アナリティクス系スタートアップへのVC流入

- 保険のデジタル化が不正分析を促進

- 市場抑制要因

- 断片化されたデータ標準とデータ保護規制へのコンプライアンスコスト

- 熟練した専門家の不足とサイバーセキュリティの脅威

- HIPAA/GDPRコンプライアンスコストの上昇

- 病院のデータレイクに対するサイバー攻撃の激化

- 規制の見通し

- テクノロジーの見通し

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 分析タイプ別

- 記述的分析

- 診断分析

- 予測分析

- 処方的分析

- 認知分析

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- 配送方法別

- オンプレミス

- クラウドベース

- ハイブリッド

- 用途別

- 臨床分析

- 財務およびRCM分析

- 運用および管理分析

- 人口健康管理

- 不正検出とリスク分析

- ライフサイエンス/R&D分析

- エンドユーザー別

- ヘルスケア提供者

- ヘルスケア支払者

- ライフサイエンス企業

- 公衆衛生機関

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- 3M Company

- Veradigm Inc.

- Oracle Health

- Digital Reasoning Systems Inc.

- Information Builders, Inc.(IBI)

- International Business Machines Corporation(IBM)

- IQVIA Holdings Inc.

- McKesson Corporation

- MedeAnalytics, Inc.

- Optum, Inc.

- Koninklijke Philips N.V.

- Health Catalyst, Inc.

- VitreosHealth, Inc.

- Inovalon, Inc.

- SAS Institute Inc.

- Verisk Analytics, Inc.

- CitiusTech, Inc.

- Merative

- SAP SE

- Microsoft Corporation

- Siemens Healthineers AG

- Deloitte Consulting LLP