|

|

市場調査レポート

商品コード

1859660

高純度ガスの世界市場:タイプ別、機能別、製造プロセス別、貯蔵・流通・輸送別、最終用途産業別、地域別 - 2030年までの予測High Purity Gas Market by Type (High Atmospheric Gas, Noble Gas, Carbon Gas, Other Gases), Storage & Distribution and Transportation, Function, Manufacturing Process, End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 高純度ガスの世界市場:タイプ別、機能別、製造プロセス別、貯蔵・流通・輸送別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年10月30日

発行: MarketsandMarkets

ページ情報: 英文 334 Pages

納期: 即納可能

|

概要

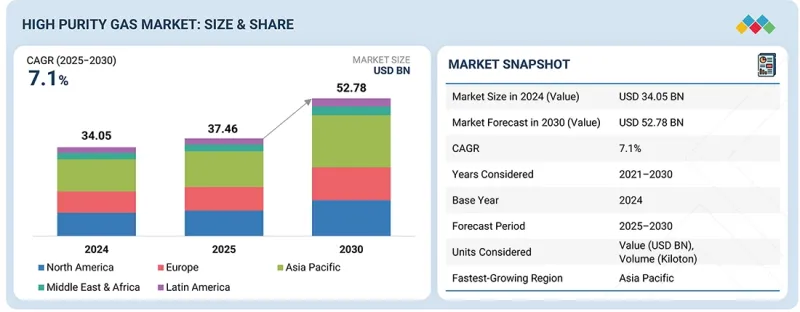

高純度ガスの市場規模は、2025年に374億6,000万米ドルと推定され、2025年から2030年までのCAGRは7.1%と見込まれており、2030年には527億8,000万米ドルに達すると予測されています。

高純度ガス市場は、半導体、エレクトロニクス、ヘルスケア分野からの需要の高まりに後押しされています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額、数量(キロトン) |

| セグメント別 | タイプ別、機能別、製造プロセス別、貯蔵・流通・輸送別、最終用途産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、ラテンアメリカ、中東・アフリカ |

AIチップ、電気自動車、5Gインフラの進歩による半導体製造製造セクターの成長が、窒素、アルゴン、水素などの超高純度ガスの需要を大幅に押し上げています。また、製薬、バイオテクノロジー分野、研究所における分析機器の使用の増加も、高純度ガス市場の成長に寄与しています。さらに、産業オートメーションや太陽光発電のような再生可能エネルギーソリューションへの投資の増加も、世界的に高純度ガスソリューションの需要を高めています。

貯蔵・輸送・輸送別では、2024年の高純度ガス市場全体では、マーチャントリキッドセグメントが第2位のシェアを獲得しました。このセグメントの市場は、費用対効果と物流と条件のバランスによって牽引されています。マーチャント・リキッド供給は、経済性の低いバルク・パイプライン配送と高コストのシリンダー配送の間の常識的な中間点として機能し、一貫した純度レベルで中~大量のガスを必要とする産業にサービスを提供しています。極低温タンク構成と断熱輸送システムにおける最近の進歩は、長距離液体ガス配送の安全性と効率を向上させています。そのスケーラブルな配送能力は、専用パイプラインへの投資を必要とせず、半導体、化学、ヘルスケア分野の複数の顧客にガスを配送できるという明確な利点をサプライヤーに提供しています。このように、商用の液体ガスは、あらゆる地域や分散型のアプローチに適した選択肢であり続けています。

半導体、フラットパネルディスプレイ、医薬品など、還元雰囲気やキャリアガス用途に超高純度水素を必要とする様々な産業で大規模な利用が続いているため、2024年には水素製造プロセスが高純度ガス市場で2番目に大きなセグメントとなっています。グリーン水素とよりクリーンな精製プロセスへの投資の増加も、必要なエレクトロニクス・グレードの水素を製造する精製技術への需要を高めています。燃料電池やエネルギー貯蔵のような新しい用途での水素の利用拡大も、PSAやメンブレンによる高純度水素製造の需要に貢献しました。水素の確立された産業利用、そして現在の新しいエネルギーベースの機会は、水素に強い市場ポジションを与えています。

2024年、北米は世界の高純度ガス市場で第2位のシェアを占めました。この地域の市場は、強力な半導体製造、高度なヘルスケアシステムの存在、洗練された研究エコシステムによって牽引されています。最近では、米国のCHIPSおよび科学法に代表されるように、チップ製造への投資が増加しており、窒素、アルゴン、水素などの超高純度ガスへの需要が高まっています。さらに、多くの大手製薬会社やバイオテクノロジー会社は、この地域の高純度ガス製造会社の存在から恩恵を受けており、ライフサイエンスや材料設計の分野でも研究開発の重要性が高まっています。北米の強力な高純度ガス市場シェアは、確立された流通網、精製システムの進歩、厳格な品質基準に支えられています。

当レポートでは、世界の高純度ガス市場について調査し、タイプ別、機能別、製造プロセス別、貯蔵・流通・輸送別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 技術分析

- AI/生成AIが高純度ガス市場に与える影響

- 特許分析

- 規制状況

- 主要な会議とイベント

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響- 高純度ガス市場

第6章 高純度ガス市場(タイプ別)

- イントロダクション

- 高気圧ガス

- 希ガス

- 炭素ガス

- その他

第7章 高純度ガス市場(機能別)

- イントロダクション

- 絶縁

- 照明

- 冷却剤

第8章 高純度ガス市場(製造プロセス別)

- イントロダクション

- 空気分離

- 水素製造

第9章 高純度ガス市場(貯蔵・流通・輸送別)

- イントロダクション

- ボンベ/パッケージガス

- マーチャントリキッド

- トン数

第10章 高純度ガス市場(最終用途産業別)

- イントロダクション

- エレクトロニクス

- 金属生産

- 化学薬品

- 石油・ガス

- 医療・ヘルスケア

- 飲食品

- その他

第11章 高純度ガス市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- LINDE PLC

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- MESSER SE & CO. KGAA

- NIPPON SANSO HOLDINGS CORPORATION

- IWATANI CORPORATION

- DAIGAS GROUP

- SOL SPA

- INGAS

- GRUPPO SIAD

- RESONAC HOLDINGS CORPORATION

- AKELA-N

- その他の企業

- ALCHEMIE GASES & CHEMICALS PVT. LTD.

- BHURUKA GASES LIMITED

- CHEMIX SPECIALTY GASES AND EQUIPMENT

- ULTRA PURE GASES(I)PVT. LTD.

- COREGAS

- SERALGAZ

- PURITYPLUS

- WOIKOSKI OY

- SPECIALTY GASES COMPANY LIMITED

- MESA SPECIALTY GASES & EQUIPMENT

- QINGDAO BAIGONG INDUSTRIAL AND TRADING CO., LTD.

- AGT INTERNATIONAL

- AMERICAN WELDING AND GAS