|

市場調査レポート

商品コード

1910830

MaaS(Mobility-as-a-Service)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Mobility As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MaaS(Mobility-as-a-Service)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

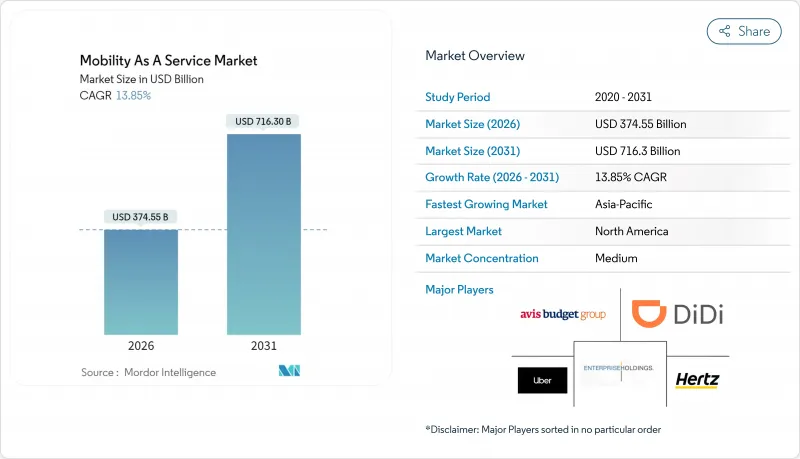

MaaS(Mobility-as-a-Service)市場は、2025年の3,289億8,000万米ドルから2026年には3,745億5,000万米ドルへ成長し、2026~2031年にかけてCAGR13.85%で推移し、2031年には7,163億米ドルに達すると予測されています。

都市部の人口増加、スマートフォンの普及継続、環境意識の高まりにより、消費者は自家用車の所有から、統合型共有型マルチモーダルな交通サービスへと移行しています。API標準化、電気・水素推進技術の採用、シームレスな決済イノベーションがプラットフォーム間の相互運用性を加速させ、顧客体験を向上させるとともに、プロバイダの収益多様化を推進しています。施策立案者は、官民連携を優先し電気自動車の大規模導入を促進するゼロエミッション目標を推進しています。一方、5GとIoTのアップグレードにより、リアルタイムでの車両管理と予測型移動管理が可能となっています。既存の配車サービス大手と新興の専門MaaS(Mobility as a Service)事業者間の競争激化により、企業は差別化を図るため、人工知能、データ収益化、サブスクリプションモデルへの積極的な投資を進めています。

世界のMaaS(Mobility-as-a-Service)市場の動向と洞察

欧州の都市におけるマイクロモビリティと公共交通の統合

マイクロモビリティと従来型公共交通システムのシームレスな統合により、マルチモーダルな交通ネットワークが構築され、ファーストマイル/ラストマイルの接続性が大幅に向上しています。ヘルシンキやウィーンなどの欧州の都市がこの統合を先導しており、公共輸送当局が自転車シェアリングや電動スクーターサービスを統合型モビリティプラットフォームに積極的に組み込んでいます。この統合は顕著な成果をもたらしており、国際交通フォーラムの報告によれば、適切に統合されたマイクロモビリティは都市回廊における公共輸送の利用者数を最大35%増加させることが可能です。最も成功している事例では、交通ハブ近くに戦略的に配置された標準化されたドッキングステーション、統一決済システム、リアルタイム利用可能データが特徴となっています。交通アクセスの向上に加え、この統合は都市計画の優先順位を再構築しています。バルセロナのような都市では、公共交通駅に直接接続するマイクロモビリティ専用レーンを整備するため、道路インフラの再設計が進められています。

政府のゼロエミッション目標がEV中心のMaaS包装を推進

アジア太平洋のをはじめとする各地域における厳しい排出削減目標が、EV配車・電気自動車シェアリング電動自転車レンタルを包括的なモビリティ包装に統合した、電気自動車中心のMaaSサービスの開発を促進しています。中国が2030年までに自動車の40%を電気自動車とすることを義務付けたことを受け、Didiなどの企業はゼロエミッション輸送手段のみを提供する「グリーンアライアンス」MaaSバンドルを開始しました。これらのEV中心のサービスは大きな注目を集めており、TUV SUDの報告によれば、電気モビリティサービスは従来型自動車利用と比較して都市交通の排出量を最大70%削減できるとのことです。

米国各州における規制枠組みのセグメント化

米国各州の交通規制が不統一なパッチワーク状になっているため、全国展開を目指すMaaSプロバイダは大きな運営上の課題に直面しています。各州が異なるライセンシング要件、保険義務、運営制限を課しているためです。この規制のセグメント化により、企業は州ごとに特化した運営モデルを開発せざるを得ず、コンプライアンスコストが大幅に増加し、市場浸透が遅れています。連邦高速道路局は、この規制調和の欠如により、複数の州で事業を展開するMaaSプロバイダの運営コストが、より統一された規制環境で事業を行うプロバイダと比較して最大35%高くなっていることを指摘しています。

セグメント分析

ライドヘイリングは、確立されたユーザー基盤と広範なドライバーネットワークを活用し、2025年に45.85%のシェアでMaaS市場を独占し、市場リーダーシップを維持しています。しかしながら、マイクロモビリティサービス(スクーター/自転車シェアリング)は、ファーストマイル/ラストマイル接続課題への有効性から、2026~2031年にかけてCAGR19.12%と予測される最速成長セグメントとして台頭しています。IAAモビリティ報告書によれば、IoT接続性と高性能バッテリーを搭載したマイクロモビリティソリューションは、安定性の向上とリアルタイム利用状況追跡によりユーザー体験を大幅に向上させます。この成長は、自治体によるマイクロモビリティ専用レーンや駐輪区域のインフラ整備拡大によってさらに後押しされています。

カーシェアリングセグメントでは、固定のピックアップ・ドロップオフ場所を不要とする柔軟なフリーフローティングモデルの導入により、大幅な革新が進んでいます。一方、バスシェアリングサービスは企業環境やキャンパス環境で注目を集めています。スクーターシェアリングセグメントは、一部市場での規制上の課題があるも、導入コストの低さと高いユーザー普及率により急速に拡大しています。

技術プラットフォームは2025年に37.72%の市場シェアを占め、サービス統合とユーザーインターフェースを可能にする基盤インフラとしてこのセグメントを牽引しています。一方、決済・ウォレットソリューションは、マルチモーダル移動体験における重要な摩擦点を解消するため、2026~2031年にかけて20.95%のCAGRで最も急速な成長を遂げています。特にオープンループ決済システムの登場は変革的であり、PaymentGenesの報告によれば、このシステムを導入したMaaSプラットフォームはクローズドループシステム利用プラットフォームと比較し、最大40%高いユーザー定着率を達成しています。これらのシステムにより、ユーザーは事前に資金をチャージしたり、異なるサービス間で複数の決済手段を維持したりする必要がなくなります。

旅程計画・ナビゲーションソリューションは、混乱を予測しリアルタイムで代替案を提案できる人工知能の統合により進化を続けています。接続性とテレマティクスソリューションは車両追跡・フリート管理機能の強化を実現し、保険サポートサービスは共有モビリティ利用者の特有のニーズに対応すべく拡大しています。

乗用車は2025年時点で56.63%の市場シェアを維持し、ライドヘイリングやカーシェアリングサービスがMaaSエコシステムにおいて引き続き重要な位置を占めることを示しています。しかしながら、自律走行ポッドは管理された環境やファースト/ラストマイル接続において有力な解決策を提供するため、2026~2031年にかけて22.74%のCAGRで最も高い成長率を達成すると予測されています。IEEE Intelligent Transportation Systems Magazineに掲載された調査によれば、自律型モジュール型車両技術は従来型固定路線交通と比較して運用コストを最大40%削減しつつ、サービスの柔軟性を向上させることが実証されています。これらの自動運転ポッドは、自律運転向けにインフラを最適化できるキャンパス環境、ビジネスパーク、計画コミュニティにおいて特に効果的です。

マイクロモビリティ車両(電動自転車、電動スクーター)は、優れた機動性と駐車利便性を提供する密集した都市部を中心に、市場シェアを拡大し続けています。シャトルやバスは、乗車率を最適化し待ち時間を削減するオンデマンドチャネルアルゴリズムの導入により進化を遂げています。

地域別分析

アジア太平洋は、密集した都市、高度なデジタル決済、協調的なインフラ投資を活かし、2025年のMaaS(Mobility-as-a-Service)市場シェアの34.12%を占めました。中国では主要都市圏における自動車登録制限が通勤者を共有プラットフォームへ誘導し、インドでは拡大する中産階級が手頃な配車サービスを積極的に利用しています。シンガポールの「スマートネイション構想」は公共交通、マイクロモビリティ、統一決済を単一の市民アプリに統合し、ベストプラクティスの統合事例を示しています。

北米は市場規模で第2位です。高い所有コスト、都市部の再密集化、企業の出張における持続可能性の義務が、共有モビリティの成長を推進していますが、州ごとの規制の相違により、全国的なプラットフォームの規模拡大は遅れています。サンフランシスコ、オースティン、トロントにおける技術的リーダーシップが、予測分析と自動運転のパイロット事業の早期導入を支えています。電気自動車フリートに対する政府の優遇措置が、この地域におけるモビリティの転換をさらに強化しています。

中東・アフリカは、2031年まで14.05%のCAGRで、この地域で最も急速な拡大が見込まれています。湾岸協力会議(GCC)加盟各国政府は、NEOMや抽出物ポシティなどのスマートシティのメガプロジェクトにおいてMaaSを優先し、自動運転シャトルや統合運賃システムに資本を割り当てています。アブドゥル・ラティフ・ジャミール社とジョビー・アビエーション社は、最大200機の電気垂直離着陸機を導入する覚書を締結し、地上サービスを拡充し、マルチモーダルネットワークを強化することで、新たな航空モビリティの野心を示しています。

その他の特典

- エクセル形態の市場予測(ME)シート

- 3か月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 欧州の都市におけるマイクロモビリティと公共交通の統合

- 政府のゼロエミッション目標がEV中心のMaaSバンドルを促進(アジア太平洋)

- API標準化(NeTEx、GTFS-RT)によるアカウントベースチケット発行の実現

- ラテンアメリカにおけるMaaSスーパーアプリへのベンチャーキャピタル資金調達の急増

- 5G/IoTによるリアルタイムモビリティオーケストレーション

- 北米の法人向け出張の持続可能性要件

- 市場抑制要因

- 米国各州における分断された規制枠組み

- GDPR/CCPAによるデータプライバシーコンプライアンスコスト

- 運転手・事業者への補助金による収益性の課題

- レガシー交通ITシステムによる統合深度制限

- バリュー/サプライチェーン分析

- 規制の展望

- 技術の展望

- ポーターのファイブフォース分析

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測(金額(米ドル))

- サービスタイプ別

- ライドシェアリング

- カーシェアリング

- 自転車シェアリング

- スクーターシェアリング

- バスシェアリング

- ソリューション別

- 技術プラットフォーム

- 決済とウォレット

- 旅行計画とナビゲーション

- 接続性とテレマティクス

- 保険とサポートサービス

- 車種別

- 乗用車

- マイクロモビリティ車両(電動自転車、電動スクーター)

- シャトルバスと路線バス

- 自律走行ポッド

- 輸送手段別

- 一般向け

- 民間

- ビジネスモデル別

- サブスクリプション(モビリティバンドル、法人向けプラン)

- 従量課金制

- ピアツーピア

- チケット販売のみのアグリゲーター

- 用途別

- パーソナルモビリティ

- ビジネス/法人向けモビリティ

- 物流とラストマイル配送

- エンドユーザー別

- 個人

- 企業

- 政府と自治体機関

- オペレーティングシステム別

- iOS

- Android

- その他

- HarmonyOS

- KaiOS

- Windows/PWA

- 推進力別

- 内燃機関(ICE)

- 電気自動車

- ハイブリッド

- 水素燃料電池

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米の地域

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- 北欧諸国

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア

- 南米

- ブラジル

- チリ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- トルコ

- 南アフリカ

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Uber Technologies Inc.

- Didi Chuxing

- Lyft Inc.

- Grab Holdings Ltd.

- FREE NOW(GMBH)

- Bolt Technology OU

- MaaS Global(Whim)

- Moovit Inc.

- Citymapper Ltd.

- Via Transportation Inc.

- Beeline Mobility

- UbiGo AB

- ティアMobility SE

- Lime Technology Inc.

- Bird Global Inc.

- Bridj Technology Pty Ltd.

- Zipcar(AVIS Budget Group)

- The Hertz Corporation

- Enterprise Holdings Inc.

- Free2Move(STELLANTIS)

- BlaBlaCar(Comuto SA)

- Gojek(GoTo Group)

- Uber Technologies Inc.

- 市場機会と将来展望

- 空白領域とアンメットニーズ評価

- Government-Funded MaaS Vouchers for Low-Income Commuters

- Carbon-Credit Trading Linked to MaaS Usage Data

- AI-Driven Dynamic Fare Bundling and Personalised Subscriptions

- B2B Fleet Electrification Partnerships with OEMs

- Autonomous On-Demand Shuttle Networks Post~2028年

- Insurance-as-a-Service Platforms Tailored for MaaS Operators

- 空白領域とアンメットニーズ評価