|

市場調査レポート

商品コード

1852137

セントラルフィル薬局自動化:市場シェア分析、産業動向&統計、成長予測(2025年~2030年)Central Fill Pharmacy Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| セントラルフィル薬局自動化:市場シェア分析、産業動向&統計、成長予測(2025年~2030年) |

|

出版日: 2025年08月25日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

概要

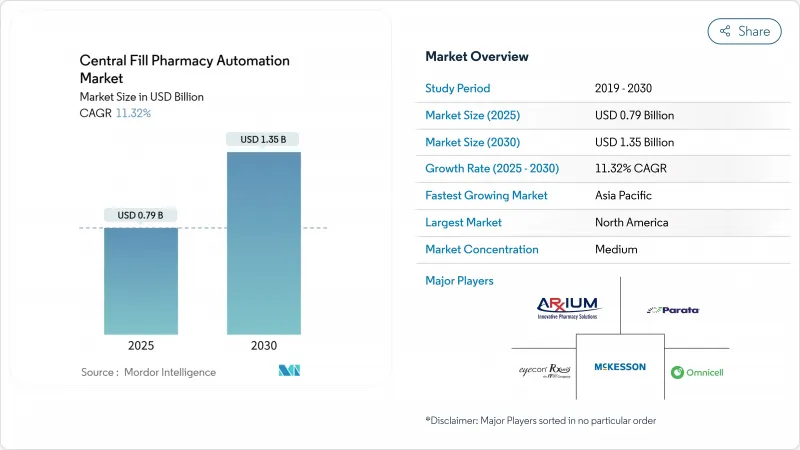

セントラルフィル薬局自動化の市場規模は2025年に7億9,000万米ドル、2030年には13億5,000万米ドルに達すると予測され、CAGRは11.32%です。

この成長軌道は、人件費の上昇、薬剤師不足の深刻化、すでに毎月1,600万件を超える処方箋の通信販売量の加速を反映しています。投資の勢いは、医薬品サプライチェーンセキュリティ法(Drug Supply Chain Security Act)に基づく追跡・追跡規則の厳格化、投薬の正確性に対する需要の高まり、マイクロフルフィルメントハブを展開したウォルグリーンの年間5億米ドルのフルフィルメント削減のような小売業者のコスト削減成功によってさらに強まっています。医薬品不足を発見する人工知能ツール、24時間365日稼働するIoT連動ロボット、サービスベースの資金調達モデルは、病院、小売、通販事業者の対応可能ベースを拡大し続けています。これらの力を総合すると、セントラルフィル薬局自動化市場は世界の薬局サプライチェーン近代化におけるミッションクリティカルな柱として位置づけられています。

世界のセントラルフィル薬局自動化市場の動向と洞察

ハイスループット処方箋フルフィルメントへの需要の高まり

1日2万件以上の処方箋を処理する施設では、産業レベルの処理能力を維持する高度なロボットセルが必要とされています。ウォルグリーンの最新のマイクロ・フルフィルメント・ハブでは、約200の地域店舗で年間約1,300万枚の処方箋を処理しており、現在達成可能な規模の優位性を強調しています。処方箋1枚あたりのコストを13%削減し、在庫回転率を向上させ、調剤ミスを抑制する自動画像検証チェックポイントを組み込んでいるためです。通販の取扱量は2020年以降126%増加しており、処方箋はさらに少ないが大規模な拠点に集中し、人による監視は少なく、24時間365日稼働しています。この動向は、処方箋のフルフィルメントを、消費財の流通と同様に、コンベアによる順序付け、ロボットによる誘導、パレタイゼーションを必要とする製造ワークフローとして急速に再定義しつつあります。

人件費の上昇と業務効率化の必要性

薬剤師の卒業者数が10%減少する一方で、志願者数は過去10年間で60%減少しており、賃金圧力が高まっています。カリフォルニア州議会法案1286は、強制的な人員配置比率を追加し、チェーンに給与を増加させることなく能力を増強するよう促しています。自動化されたセルは、技術者の準備時間を59%削減し、薬剤師のチェック時間を80%削減することができ、高コストの都市市場で迅速な投資回収を生み出します。また、24時間稼働のロボットにより、時間外労働の割増をなくし、スケジューリングのギャップを緩和することで、薬剤師は予防接種などの臨床サービスにシフトすることができます。

熟練した自動化労働力の限られた利用可能性

ロボット化された薬局では、投薬規制、ソフトウェア統合、機械的トラブルシューティングの相互作用に精通した技術者が必要とされます。しかし、特に職業訓練プログラムが遅れている新興市場では、技術人材は依然として不足しています。6カ月から12カ月の専門コースが必要で、薬学部の定員割れが人材流路をさらに狭めています。市場のリーダーたちは現在、現場でのトレーニングと遠隔監視をバンドルしてギャップを補っているが、人材不足は依然として導入スケジュールを長期化させ、サポートコストを引き上げています。地域によっては、サービス・エコシステムが成熟するまでアップグレードを完全に延期するところもあります。

セグメント分析

2024年のセントラルフィル薬局自動化市場では、機器が63.67%のシェアを占めており、高速ロボット分注、自動パウチ包装機、ビジョンベースの検証ラインがその中心となっています。ScriptPro社のSPシリーズなどの自動化装置は、シフトあたり何千ものスクリプトを準備しながら、99.6%のアップタイムを報告しています。しかし、サービスのセントラルフィル薬局自動化市場規模は、オーナーが予知保全、最適化分析、コンプライアンスサポートを求めているため、CAGR 13.56%で急速に拡大しています。Omnicell社のXT Amplifyに代表される成果連動型プログラムは、臨床ベンチマークと機器のアップグレードを統合し、エラーの削減とスループットを最大化します。ロボットによるピックパスの微調整、新たなシリアル化義務の習得、監査員の満足度を高めるために、施設は分野横断的な専門知識を必要としているため、コンサルティングや労働力トレーニングの契約は増加しています。

グリーンフィールドのハブには、コンベア、自動倉庫、ラベリングトンネル、ディスパッチソーターが必要であるため、機器のセントラルフィル薬局自動化市場シェアの優位性は損なわれていないです。それでも、サービスの継続的な収益の魅力に惹かれて、ベンダーはハードウェアのリフレッシュ・サイクル、クラウド・ソフトウェア、24時間365日の遠隔監視を含むサブスクリプション・バンドルの作成を促しています。その結果、セントラルフィル薬局自動化業界は、個別の資本販売から、複数年にわたる収益の可視性を確保するソリューション・ライフサイクル・パートナーシップへとシフトしています。

地域分析

北米は2024年にセントラルフィル薬局自動化市場の46.87%を占め、長期にわたるDSCSAのシリアル化期限と大規模拠点に有利なチェーン薬局の統合に支えられています。Omnicell、BD、ScriptProは広範なサービスフリートとデータ主導の契約を維持し、迅速な展開とサイト間のベンチマークを可能にしています。35の州における電子処方法やカリフォルニア州の人員比率規則を含む州の義務化は、広範な自動化のケースをさらに強化します。CoverMyMedsのサービス・ベース・モデルのような独創的な資金調達は、中規模グループでの採用を拡大し続けています。

アジア太平洋地域は、CAGR12.56%と予測される急成長地域です。医薬品製造のデジタル化を推進する中国の政策が、シノファームの自動倉庫のような大規模な導入を後押ししています。日本では、高齢化と医薬品安全性の義務化により、病院がパウチ検査とトレーサビリティへの投資を進めています。インド、韓国、シンガポールでは、スマート製造技術に対する政府補助金により、ロボット調剤、在庫分析、コールドチェーン包装の導入基盤が拡大します。

欧州は、医薬品検査協力スキームと各国特有のe-ヘルス改革に支えられ、引き続き安定した成長に寄与しています。イタリアにあるDr.Maxの14,000m2のオートメーションセンターは、SSI SCHAEFERシャトルタワーとGeekplus AMRを使用して全国にスクリプトを配信し、マルチベンダーによる大規模なオーケストレーションを披露しています。デンマークの2024年薬局法改正により、病院薬局が外来患者に直接調剤できるようになり、アドレス可能なハブネットワークが広がります。持続可能性の目標は、欧州の事業者がエネルギー効率の高いシャトルシステムを導入し、ロボット調剤とともにリサイクル可能なパッケージングストリームを統合する動機付けとなります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ハイスループット処方箋フルフィルメントへの需要の高まり

- 人件費の上昇と業務効率化の必要性

- 通信販売とEコマース薬局チャネルの拡大

- 医薬品の安全性と正確性の重視

- 高度な分析とロボティクスの採用

- 薬局のサプライチェーンにおける垂直統合

- 市場抑制要因

- 熟練した自動化労働力の限られた入手可能性

- 高い設備投資要件

- レガシーシステム統合の課題

- 集中調剤に対する規制上の制約

- 規制情勢

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品・サービス別

- 設備

- 自動調剤システム

- 自動包装&ラベリングシステム

- 自動医薬品配合システム

- その他の設備

- サービス

- インプリメンテーション&インテグレーション・サービス

- メンテナンス&サポートサービス

- コンサルティング&トレーニングサービス

- 設備

- エンドユーザー・タイプ別

- 病院所有の中央充填薬局

- 小売チェーン中央充填施設

- 通信販売とオンライン薬局

- 長期介護(LTC)薬局

- 処理能力別

- 低(5k Rx以下/1日)

- 中(5k~20k Rx/1日)

- 高(20k Rx以上/1日)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- ARxIUM Inc

- Cornerstone Automation Systems LLC

- KUKA AG

- McKesson Corporation

- Omnicell Inc

- Parata Systems LLC

- Quality Manufacturing Systems Inc

- RxSafe LLC

- R/X Automation Solutions

- ScriptPro LLC

- Swisslog Healthcare

- Tension Packaging & Automation

- Capsa Healthcare(Kirby Lester)

- Knapp AG

- Innovation Associates

- Yuyama Co., Ltd.

- AmerisourceBergen Corporation

- MedAvail Holdings Inc

- GSL Solutions Inc

- Talyst Systems(Swisslog)

- TecSys Inc