|

|

市場調査レポート

商品コード

1510740

北米の税務ソフトウェア市場:地域別分析 - 製品別、税タイプ別、展開タイプ別、エンドユーザー別、企業規模別、業界別、予測(~2030年)North America Tax Software Market Forecast to 2030 - Regional Analysis - by Product, Tax Type, Deployment Type, End User, Enterprise Size, and Vertical |

||||||

|

|||||||

| 北米の税務ソフトウェア市場:地域別分析 - 製品別、税タイプ別、展開タイプ別、エンドユーザー別、企業規模別、業界別、予測(~2030年) |

|

出版日: 2024年05月07日

発行: The Insight Partners

ページ情報: 英文 111 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

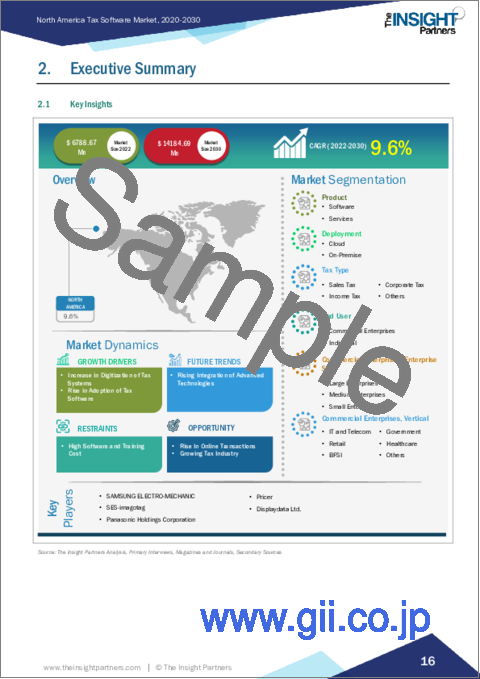

北米の税務ソフトウェアの市場規模は、2022年に67億8,867万米ドルに達し、2022~2030年にかけてCAGR 9.6%で成長し、2030年には141億8,469万米ドルに達すると予測されています。

先端技術の統合が北米の税務ソフトウェア市場を後押し

会計部門は急成長しており、税務プロセスを合理化する先進技術のニーズが高まっています。例えば、国際貿易機関(ITA)によると、2020年の米国からカナダへの会計サービスの輸出額は3億3,500万米ドル、米国からカナダへの輸入額は4億5,000万米ドルでした。会計業界全体が、デジタル革命の中でクラウドコンピューティングと自動化の出現を目の当たりにしています。クラウド会計は、会計士が定期的に仕事をし、顧客とコミュニケーションをとる方法を広く変えました。クラウドベースのソリューションにより、会計士は場所を選ばずに会計業務を行うことができます。Xero Corporationによると、クラウド会計を利用している会計事務所は、対前年比で15%の収益増加を報告しています。また、クラウド会計を利用している会計事務所は、このプロセスを利用していない会計事務所に比べ、5倍の顧客を集め、サービスを提供することに成功しています。会計事務所によるAI技術の使用は、生産性を高め、会計業界を繁栄させるために増加しています。生産性を向上させ、より多くの情報に基づいた意思決定を行うために高度なツールを使用することは、今後数年間でより多くの支持を集めると予想されます。AIのような技術の使用は、会計事務所がより多くの洞察を生み出し、支出を削減するのに役立つと思われます。Sage Groupによると、会計士の55%が今後数年間でAIを活用する可能性があるといいます。AIは、自動化された税務申告などのサービスを改善し、税務申告の手続きを通じて納税者を教育するのに役立ちます。さらに、AIは脱税の特定、税務書類からの主要データの抽出、会計ソフトへの自動的な情報投入のために導入され、税務専門家の負担を軽減することができます。

今後数年間は、税務申告、銀行業務、監査、給与計算など、労働集約的な業務を時間短縮するための業務プロセスの自動化が強力に推進されると予想されます。自動化を利用することで、会計事務所はプロセスの完了に必要な全体的な時間を短縮し、エラーの数を減らすことができます。このように、自動化とクラウド技術は会計業界における最も重要な動向となり、市場成長にプラスに働くと予想されます。

北米の税務ソフトウェアの市場概要

北米の税務ソフトウェア市場は、米国、カナダ、メキシコに区分されます。この地域は、ソフトウェアソリューションの採用に関しては成熟した市場です。例えば、Employbl Inc.によると、2023年8月には米国全体で6,727社以上のソフトウェア会社が存在しました。Avalara、Sage Group Plc、Thomson Reuters Corp、Xero Ltdなどの税務ソフトウェアプロバイダーは、個人や企業に効率的でミスのない税務申告プロセスを提供するため、高度な税務ソフトウェア・ソリューションを提供しています。このように、複数の大手税務ソフトウェアプロバイダーの存在は、北米の税務ソフトウェア市場にプラスの影響を与えています。

Avalaraによると、2023年10月、この地域では2020年に公認会計士(CPA)人口の75%が退職し、若い世代が会計士という職業に興味を示さなくなったため、人材確保の課題に直面し始めました。人手不足の企業は、熟練労働者の雇用よりも、業務やワークフローを改善するためのテクノロジーの導入に注力しています。彼らは人工知能(AI)ソリューションの採用を学んでいます。Avalaraの調査によると、最高財務責任者(CFO)は効率性、収益性、生産性を促進するためにAI技術の採用を好んでいます。このように、AIの利点に関する個人や専門家の間でAIソリューションに対する認識と人気が高まっていることが、AIベースの税務ソフトウェア・ソリューションの採用を後押ししています。AIソリューションの需要に応えるため、市場プレーヤーはこの地域の税務ソフトウェア市場を推進するいくつかのソリューションを発表しています。例えば、2023年4月、AIを搭載した税務ソフトウェアの新興企業が、Mercury Financial、Acorns、B9、Movesなどの金融機関、フィンテック、給与計算プロバイダーと提携して、AIを活用した税務ソリューションを発表しました。このソリューションは、米国人が税金の見積もり、最適化、申告を進めるのを支援するために立ち上げられました。政府は、税制におけるデジタル化の導入に力を入れています。例えば、2020年にはデジタルサービス税法(Act)の立法案が作成されました。さらに2021年予算で提示されました。国際交渉では、OECD/G20の包括的枠組み加盟国137カ国が、国際税制改革のための2本柱プランに関する声明に合意しました。この声明は結果的にG20首脳と財務大臣によって承認されました。政府はこの法律を2024年までに実施する予定です。このように、税制にデジタル化を導入するための政府によるこのような実践は、予測期間中の税務ソフトウェア市場の成長にとって有利な機会を生み出します。

北米の税務ソフトウェア市場の収益と2030年までの予測(100万米ドル)

北米の税務ソフトウェア市場セグメンテーション

北米の税務ソフトウェア市場は、製品タイプ、展開タイプ、税タイプ、エンドユーザー、国に区分されます。

製品別に見ると、北米の税務ソフトウェア市場はソフトウェアとサービスに二分されます。2022年の北米の税務ソフトウェア市場では、ソフトウェア分野が大きなシェアを占めています。

展開タイプ別では、北米の税務ソフトウェア市場はクラウドとオンプレミスに二分されます。2022年の北米の税務ソフトウェア市場では、クラウドセグメントが大きなシェアを占めています。

税タイプ別に基づき、北米の税務ソフトウェア市場は売上税、所得税、法人税、その他に区分されます。2022年の北米の税務ソフトウェア市場では、売上税セグメントが最大のシェアを占めています。

エンドユーザー別に見ると、北米の税務ソフトウェア市場は商業企業と個人に二分されます。2022年の北米の税務ソフトウェア市場では、商業企業セグメントが大きなシェアを占めています。さらに、商業企業セグメントは、企業規模(大企業、中企業、小企業)と業種(IT・通信、小売、BFSI、政府、ヘルスケア、その他)に分類されます。

国別では、北米の税務ソフトウェア市場は米国、カナダ、メキシコに区分されます。2022年の北米の税務ソフトウェア市場は米国が独占しました。

Sage Group Plc、Thomson Reuters Corp、Xero Ltd、IRIS Software Group Ltd、Wolters Kluwer NV、Intuit Inc、HRB Digital LLC、Wealthsimple Technologies Inc、SAP SE、CloudTax Incは、北米の税務ソフトウェア市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の税務ソフトウェアの市場情勢

- 概観

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の税務ソフトウェア市場:主要業界力学

- 税務ソフトウェア市場:主要業界力学

- 市場促進要因

- 税務システムのデジタル化の増加

- 税務ソフトウェア導入の増加

- 市場抑制要因

- 高いソフトウェアとトレーニングコスト

- 市場機会

- オンライン取引の増加

- 税業界の成長

- 今後の動向

- 先端技術の統合の高まり

- 促進要因と抑制要因の影響

第6章 税務ソフトウェア市場:北米市場分析

- 税務ソフトウェア市場収益(2020~2030年)

- 税務ソフトウェア市場の予測と分析

第7章 北米の税務ソフトウェア市場分析:製品別

- ソフトウェア

- サービス

第8章 北米の税務ソフトウェア市場分析:展開タイプ別

- クラウド

- オンプレミス

第9章 北米の税務ソフトウェア市場分析:税タイプ別

- 売上税

- 所得税

- 法人税

- その他

第10章 北米の税務ソフトウェア市場分析:エンドユーザー別

- 商業企業

- 個人

第11章 北米の税務ソフトウェア市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第13章 企業プロファイル

- Sage Group Plc

- Thomson Reuters Corp

- Xero Ltd

- IRIS Software Group Ltd

- Wolters Kluwer NV

- Intuit Inc

- HRB Digital LLC

- Wealthsimple Technologies Inc

- SAP SE

- CloudTax Inc

第14章 付録

List Of Tables

- Table 1. Tax Software Market Segmentation

- Table 2. Tax Software Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) - Product

- Table 4. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) -Deployment Type

- Table 5. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) - Tax Type

- Table 6. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) - End User

- Table 7. US: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 8. US: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 9. US: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 10. US: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 11. US: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 12. US: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 13. Canada: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 14. Canada: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 15. Canada: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 16. Canada: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 17. Canada: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 18. Canada: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 19. Mexico: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 20. Mexico: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 21. Mexico: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 22. Mexico: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 23. Mexico: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 24. Mexico: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 25. List of Abbreviation

List Of Figures

- Figure 1. Tax Software Market Segmentation, By Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Tax Software Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Tax Software Market Revenue (US$ Million), 2020 - 2030

- Figure 6. Tax Software Market Share (%) - Product, 2022 and 2030

- Figure 7. Software Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 8. Services Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Tax Software Market Share (%) - Deployment Type, 2022 and 2030

- Figure 10. Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 11. On-Premise Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. Tax Software Market Share (%) - Tax Type, 2022 and 2030

- Figure 13. Sales Tax Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Income Tax Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. Corporate Tax Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 16. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Tax Software Market Share (%) - End User, 2022 and 2030

- Figure 18. Commercial Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. Large Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. Medium Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Small Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. IT & Telecom Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. Retail Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 24. BFSI Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. Government Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. Healthcare Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 27. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 28. Individual Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. North America: Tax Software Market, By Key Country - Revenue 2022 (US$ Million)

- Figure 30. North America: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 31. US: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 32. Canada: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Mexico: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

The North America tax software market is expected to grow from US$ 6,788.67 million in 2022 to US$ 14,184.69 million by 2030. It is estimated to grow at a CAGR of 9.6% from 2022 to 2030.

Rising Integration of Advanced Technologies Fuels North America Tax Software Market

The accountancy sector is growing at a fast pace, increasing the need for advanced technologies to streamline tax processes. For example, according to the International Trade Agency (ITA), in 2020, US exports to Canada in accounting services were valued at US$ 335 million, and US imports from Canada were valued at US$ 450 million. The entire accountancy industry is witnessing the emergence of cloud computing and automation amid the digital revolution. Cloud accountancy has widely transformed how accountants work regularly and communicate with their customers. Cloud-based solutions enable accountants to run accounting tasks from any location. According to Xero Corporation, accounting firms using cloud accounting have reported a 15% growth in year-over-year revenue. Also, the accounting practices using cloud accounting have managed to gather and serve five times more customers than those who do not use this process. The use of AI technology by accounting firms is increasing to boost productivity and flourish the accounting industry. Using advanced tools to increase productivity and make more informed decisions are expected to gain more traction in the coming years. The use of technologies such as AI will help accounting firms generate more insight and reduce expenditures. According to the Sage Group, 55% of accountants are likely to leverage AI in the coming years. AI helps improve services such as automated tax filing and helps educate taxpayers through the procedure of tax filing. Moreover, AI can be implemented for identifying tax evasion, extracting key data from tax documents, and automatically feeding information into accounting software, lowering the load on tax professionals.

In the coming years, automation of business processes for making labor-intensive activities such as tax preparation, banking, audits, and payroll less time-consuming is expected to gain strong momentum. Using automation would allow accounting firms to reduce the overall time required to complete processes and lower the number of errors. Thus, automation and cloud technologies are expected to be the most significant trends in the accounting industry, thereby positively favoring market growth.

North America Tax Software Market Overview

The North America tax software market is segmented into the US, Canada, and Mexico. The region has a mature market when it comes to the adoption of software solutions. For example, according to Employbl Inc., in August 2023, there were over 6,727 software companies across the US. A vast presence of tax software providers, such as Avalara, Sage Group Plc, Thomson Reuters Corp, and Xero Ltd, provide advanced tax software solutions to individuals and businesses, to offer them efficient and errorless tax filing processes. Thus, the presence of several leading tax software providers is positively influencing the tax software market in North America.

According to Avalara, in October 2023, the region started to face staffing challenges as ~75% of the Certified Public Accountant (CPA) workforce retired in 2020, and the younger generation is less interested in the accountant profession. Short-workforce businesses are focused on adopting technologies to improve their operations and workflow rather than hiring skilled labor. They are learning to adopt artificial intelligence (AI) solutions. According to a survey by Avalara, Chief Financial Officers (CFOs) prefer adopting AI technology to foster efficiency, profitability, and productivity. Thus, the growing awareness and popularity of AI solutions among individuals and professionals regarding the benefits of AI fuels the adoption of AI-based tax software solutions. to cater to the demand for AI solutions, the market players are launching several solutions that propel the region's tax software market. For example, in April 2023, an AI-powered tax software startup launched an AI-driven tax solution in partnership with financial institutions, fintech, and payroll providers, including Mercury Financial, Acorns, B9, and Moves. The solution was launched to help Americans advance in estimating, optimizing, and filing their taxes. The government's focus on introducing digitalization in the tax system has increased. For example, in 2020, legislative proposals for the Digital Services Tax Act (Act) were drafted. It was further presented in Budget 2021. In international negotiations, 137 members of the OECD/G20 Inclusive Framework agreed to a statement on a two-pillar plan for international tax reform. The statement was consequently endorsed by G20 Leaders and Finance Ministers. The government is planning to implement this act by 2024. Thus, such practices by the government to bring digitalization into the tax system create a lucrative opportunity for the growth of the tax software market during the forecast period.

North America Tax Software Market Revenue and Forecast to 2030 (US$ Million)

North America Tax Software Market Segmentation

The North America tax software market is segmented into product, deployment type, tax type, end user, and country.

Based on product, the North America tax software market is bifurcated into software and services. The software segment held a larger share of the North America tax software market in 2022.

In terms of deployment type, the North America tax software market is bifurcated into cloud and on-premise. The cloud segment held a larger share of the North America tax software market in 2022.

Based on tax type, the North America tax software market is segmented into sales tax, income tax, corporate tax, and others. The sales tax segment held the largest share of the North America tax software market in 2022.

Based on end user, the North America tax software market is bifurcated into commercial enterprises and individual. The commercial enterprises segment held a larger share of the North America tax software market in 2022. Further, commercial enterprises segment is categorized into enterprise size (large enterprises, medium enterprises, and small enterprises) and vertical (IT and telecom, retail, BFSI, government, healthcare, and others).

Based on country, the North America tax software market is segmented into the US, Canada, and Mexico. The US dominated the North America tax software market in 2022.

Sage Group Plc, Thomson Reuters Corp, Xero Ltd, IRIS Software Group Ltd, Wolters Kluwer NV, Intuit Inc, HRB Digital LLC, Wealthsimple Technologies Inc, SAP SE, and CloudTax Inc are some of the leading companies operating in the North America tax software market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Tax Software Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in Value Chain

5. North America Tax Software Market - Key Industry Dynamics

- 5.1 Tax Software Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Digitization of Tax Systems

- 5.2.2 Rise in Adoption of Tax Software

- 5.3 Market Restraints

- 5.3.1 High Software and Training Cost

- 5.4 Market Opportunities

- 5.4.1 Rise in Online Transactions

- 5.4.2 Growing Tax Industry

- 5.5 Future Trends

- 5.5.1 Rising Integration of Advanced Technologies

- 5.6 Impact of Drivers and Restraints:

6. Tax Software Market - North America Market Analysis

- 6.1 Tax Software Market Revenue (US$ Million), 2020 - 2030

- 6.2 Tax Software Market Forecast and Analysis

7. North America Tax Software Market Analysis - Product

- 7.1 Software

- 7.1.1 Overview

- 7.1.2 Software Market, Revenue and Forecast to 2030 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services Market, Revenue and Forecast to 2030 (US$ Million)

8. North America Tax Software Market Analysis - Deployment Type

- 8.1 Cloud

- 8.1.1 Overview

- 8.1.2 Cloud Market, Revenue and Forecast to 2030 (US$ Million)

- 8.2 On-Premise

- 8.2.1 Overview

- 8.2.2 On-Premise Market, Revenue and Forecast to 2030 (US$ Million)

9. North America Tax Software Market Analysis - Tax Type

- 9.1 Sales Tax

- 9.1.1 Overview

- 9.1.2 Sales Tax Market Revenue and Forecast to 2030 (US$ Million)

- 9.2 Income Tax

- 9.2.1 Overview

- 9.2.2 Income Tax Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Corporate Tax

- 9.3.1 Overview

- 9.3.2 Corporate Tax Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. North America Tax Software Market Analysis - End User

- 10.1 Commercial Enterprises

- 10.1.1 Overview

- 10.1.2 Commercial Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3 Commercial Enterprises, By Enterprise Size

- 10.1.3.1 Large Enterprises

- 10.1.3.1.1 Overview

- 10.1.3.1.2 Large Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.2 Medium Enterprises

- 10.1.3.2.1 Overview

- 10.1.3.2.2 Medium Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.3 Small Enterprises

- 10.1.3.3.1 Overview

- 10.1.3.3.2 Small Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.1 Large Enterprises

- 10.1.4 Commercial Enterprises, By Vertical

- 10.1.4.1 IT & Telecom

- 10.1.4.1.1 Overview

- 10.1.4.1.2 IT & Telecom Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.2 Retail

- 10.1.4.2.1 Overview

- 10.1.4.2.2 Retail Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.3 BFSI

- 10.1.4.3.1 Overview

- 10.1.4.3.2 BFSI Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.4 Government

- 10.1.4.4.1 Overview

- 10.1.4.4.2 Government Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.5 Healthcare

- 10.1.4.5.1 Overview

- 10.1.4.5.2 Healthcare Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.6 Others

- 10.1.4.6.1 Overview

- 10.1.4.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.1 IT & Telecom

- 10.2 Individual

- 10.2.1 Overview

- 10.2.2 Individual Market Revenue and Forecast to 2030 (US$ Million)

11. North America Tax Software Market - Country Analysis

- 11.1 North America: Tax Software Market

- 11.1.1 North America: Tax Software Market, By Key Country - Revenue 2022 (US$ Million)

- 11.1.2 North America: Tax Software Market, by Key Country

- 11.1.2.1 US: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.1.1 US: Tax Software Market, by Product

- 11.1.2.1.2 US: Tax Software Market, by Deployment Type

- 11.1.2.1.3 US: Tax Software Market, by Tax Type

- 11.1.2.1.4 US: Tax Software Market, by End User

- 11.1.2.1.4.1 US: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.1.4.2 US: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.2 Canada: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.2.1 Canada: Tax Software Market, by Product

- 11.1.2.2.2 Canada: Tax Software Market, by Deployment Type

- 11.1.2.2.3 Canada: Tax Software Market, by Tax Type

- 11.1.2.2.4 Canada: Tax Software Market, by End User

- 11.1.2.2.4.1 Canada: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.2.4.2 Canada: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.3 Mexico: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.3.1 Mexico: Tax Software Market, by Product

- 11.1.2.3.2 Mexico: Tax Software Market, by Deployment Type

- 11.1.2.3.3 Mexico: Tax Software Market, by Tax Type

- 11.1.2.3.4 Mexico: Tax Software Market, by End User

- 11.1.2.3.4.1 Mexico: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.3.4.2 Mexico: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.1 US: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Sage Group Plc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Thomson Reuters Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Xero Ltd

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 IRIS Software Group Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Wolters Kluwer NV

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Intuit Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 HRB Digital LLC

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Wealthsimple Technologies Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 SAP SE

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 CloudTax Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About the Insight Partners

- 14.2 Word Index