|

|

市場調査レポート

商品コード

1510741

アジア太平洋の税務ソフトウェア:2030年市場予測-地域別分析-製品タイプ、税目、展開タイプ、エンドユーザー、企業規模、業種別Asia Pacific Tax Software Market Forecast to 2030 - Regional Analysis - by Product, Tax Type, Deployment Type, End User, Enterprise Size, and Vertical |

||||||

|

|||||||

| アジア太平洋の税務ソフトウェア:2030年市場予測-地域別分析-製品タイプ、税目、展開タイプ、エンドユーザー、企業規模、業種別 |

|

出版日: 2024年05月07日

発行: The Insight Partners

ページ情報: 英文 115 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の税務ソフトウェア市場は、2022年の55億8,540万米ドルから2030年には143億1,100万米ドルに成長すると予測されています。2022~2030年のCAGRは12.5%と推定されます。

税務システムのデジタル化の増加がアジア太平洋の税務ソフトウェア市場を押し上げる

小売業界は、オンライン・ショッピングの動向の高まりとともに大きな変貌を遂げています。全米小売業協会(NRF)によると、2023年の小売売上高は2022年に比べて4~6%増加すると予想されています。2021年には、小売売上高は2020年比で7%以上増加しました。このように、オンラインショッピング利用者の増加により、小売業者の効率化を支援する様々な先進技術ソリューションが継続的に導入されています。小売業向け税務ソフトウェア市場の企業は、財務諸表、請求書、法的契約書から電子メールや領収書まで、さまざまな膨大な量の機密データを管理しています。小売企業は、より高い利益を得るために利害関係者からの大きな圧力に直面しています。ソリューション提供や価格設定の進歩はもはや障壁ではなく、注文の正確性を高め、ビジネスを最適化し、処理能力を最大化するために、自動化システムの導入が進んでいます。税務の自動化は、小売業における業務の重要な一部であり、小売業者がさまざまなシステムから売上データを集計し、小売消費税の要件に対応するのに役立ちます。自動化は、業務の利便性を高め、最小限の人的労力でコンプライアンスを確保するのに役立ちます。さらに、小売業にデジタル化を導入することで、税金のプリントアウトや領収書の必要性がなくなります。政府は、VATの提出に紙の記録の代わりにデジタル記録を受け入れ始めているからです。そのため、小売セクターにおけるデジタル化と税務自動化の範囲が拡大するにつれ、税務ソフトウェア・プロバイダーは、より多くの小売市場に対応するようになっています。小売セクターは、急速に発展している重要なセクターのひとつです。サプライチェーン技術の浸透、競合情勢の変化、顧客の持続可能性への懸念の高まり、規制状況の高まりが、小売セクターの変革を促進しています。税務の自動化により、小売企業は効率性を高め、手作業による税務管理に伴うリスクを軽減することができます。また、新市場への参入や、成長を促進する販売チャネルの確立にも役立ちます。多くの小売企業がクラウドベースのサービスを選択しています。クラウド税務技術は、事業継続管理(BCM)やコスト削減などのメリットを提供し、総所有コストの削減やディザスタリカバリのメリットにもつながります。さらに、クラウド税務技術を採用した小売企業は、その他の特典として、クロスチャネル対応(POS、eコマース、モバイルなど)、迅速な導入、拡大性などの恩恵を受けています。したがって、小売業における税務ソフトウェア、特にクラウドベースのソリューションの採用が、市場の成長を後押ししています。

アジア太平洋の税務ソフトウェア市場概要

アジア太平洋の税務ソフトウェア市場は、オーストラリア、中国、インド、日本、韓国、その他のアジア太平洋に区分されます。同地域は、世界市場で競合優位に立つためにデジタル化に注力しています。国連アジア太平洋経済社会委員会(ESCAP)によると、COVID-19の大流行は、同地域でデジタル技術が急速に採用された主要要因の1つです。デジタル技術の導入は、公共部門と民間部門の効率を高め、金融包摂、教育へのアクセスを向上させ、公開会社が遠方の顧客にサービスを提供することで新たな市場を開拓しました。税制面では、デジタル化によってインターネット利用者数が増加し、革新的な決済システムを必要とするeコマース市場が促進されました。これを支援するため、経済協力開発機構(OECD)は2022年3月、eコマースにおける付加価値税(VAT)戦略の実施をガイドする新しい「アジア太平洋向け付加価値税(VAT)デジタルツールキット」を発表しました。このツールキットの目的は、電子商取引における付加価値税の効果的な徴収を保証するための改革概要と実行について、アジア太平洋の税務当局を支援することです。このように、デジタル化を促進し、税務ソフトウェアソリューションを立ち上げようとする政府の取り組みは、アジア太平洋の税務ソフトウェア市場の成長を促進すると考えられます。

世界の市場参入企業は、この地域で事業を拡大しています。例えば、2023年5月、PwCはアジア太平洋市場をインドネシア、シンガポール、マレーシア、タイ、ベトナムで立ち上げ、同地域のデジタル化の進展に対応するため、他の地域も間もなく立ち上げる予定です。この戦略の下、PwCはサイバーセキュリティ、データと分析、税務ソリューションなどのデジタルソリューションをクライアントに提供することを目指しています。これに伴い、PwCは160を超えるソリューションを導入し、その中にはSaaS(Software as a Service)ライセンス製品も含まれています。このように、ソフトウェアソリューションの拡大と普及は、さまざまな業種における税務ソフトウェアソリューションの採用につながり、アジア太平洋の税務ソフトウェア市場をさらに牽引しています。

アジア太平洋の税務ソフトウェア市場の収益と2030年までの予測(金額)

アジア太平洋の税務ソフトウェア市場セグメンテーション

アジア太平洋の税務ソフトウェア市場は、製品タイプ、展開タイプ、税タイプ、エンドユーザー、国別に区分されます。

製品別では、アジア太平洋の税務ソフトウェア市場はソフトウェアとサービスに二分されます。2022年のアジア太平洋の税務ソフトウェア市場では、ソフトウェアセグメントが大きなシェアを占めています。

展開タイプでは、アジア太平洋の税務ソフトウェア市場はクラウド型とオンプレミス型に二分されます。2022年のアジア太平洋の税務ソフトウェア市場では、クラウドセグメントがより大きなシェアを占めています。

税金タイプによって、アジア太平洋の税務ソフトウェア市場は売上税、所得税、法人税、その他に区分されます。2022年のアジア太平洋税務ソフトウェア市場では、売上税セグメントが最大のシェアを占めています。

エンドユーザー別に見ると、アジア太平洋の税務ソフトウェア市場は営利企業と個人に二分されます。2022年のアジア太平洋税務ソフトウェア市場では、営利企業セグメントが大きなシェアを占めています。さらに、商業企業セグメントは、企業規模(大企業、中企業、小企業)と業種(IT&テレコム、小売、業界別、BFSI、政府、医療、その他)に分類されます。

国別に見ると、アジア太平洋の税務ソフトウェア市場は、中国、日本、インド、韓国、オーストラリア、その他のアジア太平洋に区分されます。2022年のアジア太平洋税務ソフトウェア市場は中国が支配的でした。

Sage Group Plc、Thomson Reuters Corp、Xero Ltd、IRIS Software Group Ltd、Wolters Kluwer NV、Intuit Inc、HRB Digital LLC、SAP SEは、アジア太平洋の税務ソフトウェア市場で事業を展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブ概要

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の税務ソフトウェア市場情勢

- 概観

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の税務ソフトウェア市場-主要産業力学

- 税務ソフトウェア市場-主要産業力学

- 市場促進要因

- 税務システムのデジタル化の進展

- 税務ソフトウェア導入の増加

- 市場抑制要因

- 高いソフトウェアとトレーニングコスト

- 市場機会

- オンライン取引の増加

- 税務業界の成長

- 今後の動向

- 先端技術の統合の高まり

- 促進要因と抑制要因の影響

第6章 税務ソフトウェア市場:アジア太平洋市場分析

- 税務ソフトウェア市場収益(2020~2030年)

- 税務ソフトウェア市場の予測と分析

第7章 アジア太平洋の税務ソフトウェア市場分析:製品

- ソフトウェア

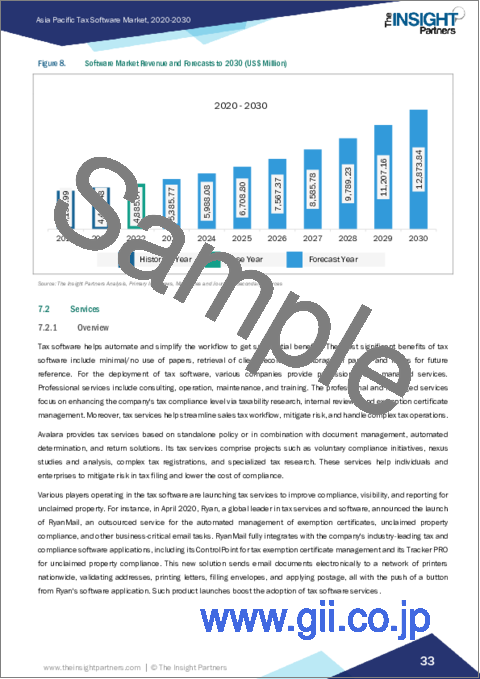

- ソフトウェア市場、収益と2030年までの予測

- サービス

- サービス概要

- サービス市場、収益と2030年までの予測

第8章 アジア太平洋の税務ソフトウェア市場分析:展開タイプ

- クラウド

- クラウド市場、収益と2030年までの予測

- オンプレミス

- オンプレミス

- オンプレミス市場、収益と2030年までの予測

第9章 アジア太平洋の税務ソフトウェア市場分析:税目別

- 売上税

- 売上税市場の収益と2030年までの予測

- 所得税

- 所得税市場の収益と2030年までの予測

- 法人税

- 法人税概要

- 法人税市場の収益と2030年までの予測

- その他

- その他概要

- その他市場の収益と2030年までの予測

第10章 アジア太平洋の税務ソフトウェア市場分析:エンドユーザー

- 営利企業

- 法人市場の収益と2030年までの予測

- 企業規模別

- 大企業

- 中堅企業

- 小企業

- 商業企業、業種別

- ITと電気通信

- 小売

- BFSI

- 政府機関

- 医療

- その他

- 個人

- 個人市場の収益と2030年までの予測

第11章 アジア太平洋の税務ソフトウェア市場:国別分析

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

第12章 業界情勢

- イントロダクション

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第13章 企業プロファイル

- Sage Group Plc

- Thomson Reuters Corp

- Xero Ltd

- IRIS Software Group Ltd

- Wolters Kluwer NV

- Intuit Inc

- HRB Digital LLC

- SAP SE

第14章 付録

List Of Tables

- Table 1. Tax Software Market Segmentation

- Table 2. Tax Software Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) - Product

- Table 4. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) -Deployment Type

- Table 5. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) - Tax Type

- Table 6. Tax Software Market Revenue and Forecasts to 2030 (US$ Million) - End User

- Table 7. China: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 8. China: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 9. China: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 10. China: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 11. China: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 12. China: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 13. Japan: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 14. Japan: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 15. Japan: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 16. Japan: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 17. Japan: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 18. Japan: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 19. India: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 20. India: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 21. India: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 22. India: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 23. India: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 24. India: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 25. South Korea: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 26. South Korea: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 27. South Korea: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 28. South Korea: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 29. South Korea: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 30. South Korea: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 31. Australia: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 32. Australia: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 33. Australia: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 34. Australia: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 35. Australia: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 36. Australia: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 37. Rest of Asia Pacific: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 38. Rest of Asia Pacific: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 39. Rest of Asia Pacific: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 40. Rest of Asia Pacific: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 41. Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 42. Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 43. List of Abbreviation

List Of Figures

- Figure 1. Tax Software Market Segmentation, By Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Tax Software Market

- Figure 4. Number of Online Transaction in India

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Tax Software Market Revenue (US$ Million), 2020 - 2030

- Figure 7. Tax Software Market Share (%) - Product, 2022 and 2030

- Figure 8. Software Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Services Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Tax Software Market Share (%) - Deployment Type, 2022 and 2030

- Figure 11. Cloud Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. On-Premise Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Tax Software Market Share (%) - Tax Type, 2022 and 2030

- Figure 14. Sales Tax Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. Income Tax Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 16. Corporate Tax Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. Tax Software Market Share (%) - End User, 2022 and 2030

- Figure 19. Commercial Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. Large Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Medium Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Small Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. IT & Telecom Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 24. Retail Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. BFSI Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. Government Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 27. Healthcare Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 28. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. Individual Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 30. Asia Pacific: Tax Software Market, By Key Country - Revenue 2022 (US$ Million)

- Figure 31. Asia Pacific: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 32. China: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Japan: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 34. India: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 35. South Korea: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 36. Australia: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 37. Rest of Asia Pacific: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

The Asia Pacific tax software market is expected to grow from US$ 5,585.40 million in 2022 to US$ 14,311.00 million by 2030. It is estimated to grow at a CAGR of 12.5% from 2022 to 2030.

Increase in Digitization of Tax Systems Boosts Asia Pacific Tax Software Market

The retail sector has experienced a tremendous transformation with the growing trend of online shopping. According to the National Retail Federation (NRF), in 2023, retail sales are expected to increase by 4-6% compared to 2022. In 2021, the retail sales grew over 7% compared to 2020. Thus, the rise of online shoppers has led to the continuous introduction of various advanced technological solutions that help retailers increase their efficiency. Companies in the tax software market catering to retail sector maintain an enormous quantity of sensitive data that varies from financial statements, invoices, and legal contracts to e-mails and receipts. Retailers face vast pressures from stakeholders to gain higher returns. With advancements in solutions offering and pricing being no longer a barrier, they are increasingly adopting automated systems to enhance order accuracy, optimize business, and maximize throughput. Tax automation is a key part of operations in the retail sector; it helps retailers compile sales data from different systems and keep up with retail sales tax requirements. Automation helps them bring convenience to their operations and ensure compliance with minimal human efforts. Moreover, introducing digitalization in retail rules out the need for tax printouts and receipts, as governments have started to accept digital records instead of paper records for VAT submissions. Therefore, the growing scope of digitalization and tax automation in the retail sector is encouraging tax software providers to cater to more retail markets. The retail sector is among the rapidly evolving and essential sectors. Increasing penetration of supply chain technologies, changing competitive landscapes, rising sustainability concerns among customers, and growing regulatory pressure are facilitating transformation in the retail sector. With the help of tax automation, retailers can increase efficiency and lower the risk associated with manual tax management. It also assists them to enter new markets and establish sales channels that drive growth. Many retail companies are opting for cloud-based services. Cloud tax technology offers benefits such as business continuity management (BCM) and cost-reduction, which leads to a lower total ownership cost and disaster recovery benefits. In addition, retailers that have adopted cloud tax technology are benefitted from cross-channel support (point-of-sale, e-commerce, mobile, etc.), speedy implementation, and scalability as additional advantages. Therefore, the adoption of tax software, especially cloud-based solutions, in the retail sector drives market growth.

Asia Pacific Tax Software Market Overview

The Asia Pacific tax software market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The region is focused on bringing digitalization to gain a competitive advantage in the global market. According to the United Nations Economic and Social Commission for Asia and Pacific (ESCAP), the COVID-19 pandemic is one of the major drivers for the rapid adoption of digital technologies in the region. The adoption of digital technologies increased the efficiency of the public and private sectors, financial inclusion, access to education, and opening new markets by letting companies serve distant customers. In the tax industry, digitalization helped boost the number of internet users and facilitate the e-commerce markets that require innovative payment systems. to support this, in March 2022, the Organization for Economic Co-operation and Development (OECD) released a new Value Added Tax (VAT) Digital toolkit for Asia Pacific to guide the implementation of VAT strategy in e-commerce. This toolkit's objective is to assist the region's tax authorities with the outline and execution of reform to guarantee the effective collection of VAT on e-commerce activities. Thus, such government initiatives to boost digitalization and launch tax software solutions are likely to foster the growth of the tax software market in Asia Pacific.

The global market players are expanding their businesses in the region. For instance, in May 2023, PwC launched the Asia Pacific Marketplace across Indonesia, Singapore, Malaysia, Thailand, and Vietnam, with other areas soon to follow to cater to growing digitalization in the region. Under this strategy, PwC aims to provide its clients with digital solutions such as cybersecurity, data and analytics, and tax solutions. With this, the company introduced over 160 solutions, which includes licensed Software as a service (SaaS) product. Thus, such expansion and proliferation of software solutions leads to the adoption of tax software solutions across various industry verticals, further driving the tax software market in Asia Pacific.

Asia Pacific Tax Software Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Tax Software Market Segmentation

The Asia Pacific tax software market is segmented into product, deployment type, tax type, end user, and country.

Based on product, the Asia Pacific tax software market is bifurcated into software and services. The software segment held a larger share of the Asia Pacific tax software market in 2022.

In terms of deployment type, the Asia Pacific tax software market is bifurcated into cloud and on-premise. The cloud segment held a larger share of the Asia Pacific tax software market in 2022.

Based on tax type, the Asia Pacific tax software market is segmented into sales tax, income tax, corporate tax, and others. The sales tax segment held the largest share of the Asia Pacific tax software market in 2022.

Based on end user, the Asia Pacific tax software market is bifurcated into commercial enterprises and individual. The commercial enterprises segment held a larger share of the Asia Pacific tax software market in 2022. Further, commercial enterprises segment is categorized into enterprise size (large enterprises, medium enterprises, and small enterprises) and vertical (IT & telecom, retail, BFSI, government, healthcare, and others).

Based on country, the Asia Pacific tax software market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific tax software market in 2022.

Sage Group Plc, Thomson Reuters Corp, Xero Ltd, IRIS Software Group Ltd, Wolters Kluwer NV, Intuit Inc, HRB Digital LLC, and SAP SE are some of the leading companies operating in the Asia Pacific tax software market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Tax Software Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in Value Chain

5. Asia Pacific Tax Software Market - Key Industry Dynamics

- 5.1 Tax Software Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Digitization of Tax Systems

- 5.2.2 Rise in Adoption of Tax Software

- 5.3 Market Restraints

- 5.3.1 High Software and Training Cost

- 5.4 Market Opportunities

- 5.4.1 Rise in Online Transactions

- 5.4.2 Growing Tax Industry

- 5.5 Future Trends

- 5.5.1 Rising Integration of Advanced Technologies

- 5.6 Impact of Drivers and Restraints:

6. Tax Software Market - Asia Pacific Market Analysis

- 6.1 Tax Software Market Revenue (US$ Million), 2020 - 2030

- 6.2 Tax Software Market Forecast and Analysis

7. Asia Pacific Tax Software Market Analysis - Product

- 7.1 Software

- 7.1.1 Overview

- 7.1.2 Software Market, Revenue and Forecast to 2030 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services Market, Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Tax Software Market Analysis - Deployment Type

- 8.1 Cloud

- 8.1.1 Overview

- 8.1.2 Cloud Market, Revenue and Forecast to 2030 (US$ Million)

- 8.2 On-Premise

- 8.2.1 Overview

- 8.2.2 On-Premise Market, Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Tax Software Market Analysis - Tax Type

- 9.1 Sales Tax

- 9.1.1 Overview

- 9.1.2 Sales Tax Market Revenue and Forecast to 2030 (US$ Million)

- 9.2 Income Tax

- 9.2.1 Overview

- 9.2.2 Income Tax Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Corporate Tax

- 9.3.1 Overview

- 9.3.2 Corporate Tax Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Tax Software Market Analysis - End User

- 10.1 Commercial Enterprises

- 10.1.1 Overview

- 10.1.2 Commercial Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3 Commercial Enterprises, By Enterprise Size

- 10.1.3.1 Large Enterprises

- 10.1.3.1.1 Overview

- 10.1.3.1.2 Large Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.2 Medium Enterprises

- 10.1.3.2.1 Overview

- 10.1.3.2.2 Medium Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.3 Small Enterprises

- 10.1.3.3.1 Overview

- 10.1.3.3.2 Small Enterprises Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.1 Large Enterprises

- 10.1.4 Commercial Enterprises, By Vertical

- 10.1.4.1 IT & Telecom

- 10.1.4.1.1 Overview

- 10.1.4.1.2 IT & Telecom Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.2 Retail

- 10.1.4.2.1 Overview

- 10.1.4.2.2 Retail Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.3 BFSI

- 10.1.4.3.1 Overview

- 10.1.4.3.2 BFSI Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.4 Government

- 10.1.4.4.1 Overview

- 10.1.4.4.2 Government Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.5 Healthcare

- 10.1.4.5.1 Overview

- 10.1.4.5.2 Healthcare Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.6 Others

- 10.1.4.6.1 Overview

- 10.1.4.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.1 IT & Telecom

- 10.2 Individual

- 10.2.1 Overview

- 10.2.2 Individual Market Revenue and Forecast to 2030 (US$ Million)

11. Asia Pacific Tax Software Market - Country Analysis

- 11.1 Asia Pacific: Tax Software Market

- 11.1.1 Asia Pacific: Tax Software Market, By Key Country - Revenue 2022 (US$ Million)

- 11.1.2 Asia Pacific: Tax Software Market, by Key Country

- 11.1.2.1 China: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.1.1 China: Tax Software Market, by Product

- 11.1.2.1.2 China: Tax Software Market, by Deployment Type

- 11.1.2.1.3 China: Tax Software Market, by Tax Type

- 11.1.2.1.4 China: Tax Software Market, by End User

- 11.1.2.1.4.1 China: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.1.4.2 China: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.2 Japan: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.2.1 Japan: Tax Software Market, by Product

- 11.1.2.2.2 Japan: Tax Software Market, by Deployment Type

- 11.1.2.2.3 Japan: Tax Software Market, by Tax Type

- 11.1.2.2.4 Japan: Tax Software Market, by End User

- 11.1.2.2.4.1 Japan: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.2.4.2 Japan: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.3 India: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.3.1 India: Tax Software Market, by Product

- 11.1.2.3.2 India: Tax Software Market, by Deployment Type

- 11.1.2.3.3 India: Tax Software Market, by Tax Type

- 11.1.2.3.4 India: Tax Software Market, by End User

- 11.1.2.3.4.1 India: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.3.4.2 India: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.4 South Korea: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.4.1 South Korea: Tax Software Market, by Product

- 11.1.2.4.2 South Korea: Tax Software Market, by Deployment Type

- 11.1.2.4.3 South Korea: Tax Software Market, by Tax Type

- 11.1.2.4.4 South Korea: Tax Software Market, by End User

- 11.1.2.4.4.1 South Korea: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.4.4.2 South Korea: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.5 Australia: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.5.1 Australia: Tax Software Market, by Product

- 11.1.2.5.2 Australia: Tax Software Market, by Deployment Type

- 11.1.2.5.3 Australia: Tax Software Market, by Tax Type

- 11.1.2.5.4 Australia: Tax Software Market, by End User

- 11.1.2.5.4.1 Australia: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.5.4.2 Australia: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.6 Rest of Asia Pacific: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.2.6.1 Rest of Asia Pacific: Tax Software Market, by Product

- 11.1.2.6.2 Rest of Asia Pacific: Tax Software Market, by Deployment Type

- 11.1.2.6.3 Rest of Asia Pacific: Tax Software Market, by Tax Type

- 11.1.2.6.4 Rest of Asia Pacific: Tax Software Market, by End User

- 11.1.2.6.4.1 Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.1.2.6.4.2 Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Vertical

- 11.1.2.1 China: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Sage Group Plc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Thomson Reuters Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Xero Ltd

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 IRIS Software Group Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Wolters Kluwer NV

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Intuit Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 HRB Digital LLC

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 SAP SE

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

14. Appendix

- 14.1 About the Insight Partners

- 14.2 Word Index