|

|

市場調査レポート

商品コード

1389636

税務ソフトウェア市場規模・動向、世界および地域シェア、動向、成長機会分析レポート対象範囲:製品タイプ別、税務タイプ別、導入タイプ別、エンドユーザー別、企業規模別、業界別Tax Software Market Size and Forecasts, Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product ; Tax Type ; Deployment Type ; End-User ; Enterprise Size ; Vertical |

||||||

|

|||||||

| 税務ソフトウェア市場規模・動向、世界および地域シェア、動向、成長機会分析レポート対象範囲:製品タイプ別、税務タイプ別、導入タイプ別、エンドユーザー別、企業規模別、業界別 |

|

出版日: 2023年11月02日

発行: The Insight Partners

ページ情報: 英文 212 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

税務ソフトウェアの市場規模は、2022年の209億5,000万米ドルから2030年には469億米ドルに成長すると予想されており、2022年から2030年までのCAGRは10.6%で成長すると推定されています。

会計部門は急速なペースで成長しており、税務プロセスを合理化する高度なテクノロジーへのニーズが高まっています。例えば、国際貿易機関(ITA)によると、2020年の米国からカナダへの会計サービスの輸出額は3億3,500万米ドル、米国からカナダへの輸入額は4億5,000万米ドルでした。会計業界全体が、デジタル革命の中でクラウド・コンピューティングと自動化の出現を目の当たりにしています。クラウド会計は、会計士が定期的に仕事をし、顧客とコミュニケーションをとる方法を広く変えました。クラウドベースのソリューションにより、会計士は場所を選ばず会計業務を行うことができます。Xero Corporationによると、クラウド会計を利用している会計事務所は、対前年比で15%の売上増を報告しています。また、クラウド会計を利用している会計事務所は、このプロセスを利用していない会計事務所に比べ、5倍の顧客を集め、サービスを提供することに成功しています。

会計事務所によるAI技術の使用は、生産性を高め、会計業界を繁栄させるために増加しています。生産性を向上させ、より多くの情報に基づいた意思決定を行うために高度なツールを使用することは、今後数年間でより多くの支持を集めると予想されます。AIのような技術の使用は、会計事務所がより多くの洞察を生み出し、支出を削減するのに役立つと思われます。Sage Groupによると、会計士の55%が今後数年間でAIを活用する可能性があるといわれています。

AIは、自動化された税務申告などのサービスを改善し、税務申告の手続きを通じて納税者を教育するのに役立ちます。さらに、AIは脱税の特定、税務書類からの主要データの抽出、会計ソフトへの自動的な情報投入のために導入され、税務専門家の負担を軽減することができます。このように、税務ソフトウェアにおけるAIの利点は、ソフトウェアの効率を向上させ、その採用につながり、それによって税務ソフトウェア市場の成長を促進します。

今後数年間は、税務申告、銀行業務、監査、給与計算など、労働集約的な業務を時間短縮するための業務プロセスの自動化が勢いを増すと予想されます。自動化を利用することで、会計事務所はプロセスの完了に必要な全体的な時間を短縮し、エラーの数を減らすことができます。このように、自動化とクラウド技術は会計業界における最も重要な動向となり、税務ソフトウェア市場の成長にプラスに働くと予想されます。

IT・通信業界では、手作業による文書化を減らすために税務ソフトが広く採用されています。IT・通信業界でスタートアップに携わる起業家は、税額控除や納税手続きについて理解する時間が必要です。そのため、IT・通信業界は税務プロセスを容易にするために税務ソフトウェアを採用する傾向にあり、税務ソフトウェア市場規模を押し上げています。適切な税務ソフトを導入することで、事業運営を合理化し、有利な納税機会を評価し、適切な管轄区域での申告の必要性に対処することができます。Avalara社のAvaTaxは、企業の請求書発行システムや統合基幹業務システム(ERP)、またはAPIを通じて構築された社内システムに直接接続することで、幅広い通信取引に関する税金計算を提供します。CCHインコーポレイテッドは、クラウドベースの通信税計算と報告に関連するリスクとコンプライアンス・コスト全体を削減するため、CCH SureTax通信ソリューションを提供しており、主に通信サービス・プロバイダー向けに設計されています。

さまざまな業界でデジタル化が浸透するにつれ、税務ソフトは企業や個人にとって、効率的で強化された税務エコシステムを実行するための基本的な要素となっており、特に金融機関や成長する小売業界では、税務ソフト市場の成長を後押ししています。これらのソリューションにより、企業は様々な税率、規則、規制を遵守することができるため、企業における税務ソフトウェアの需要は増加しています。北米の税務ソフトウェア市場の成長は、主にBFSI、政府、ヘルスケアなどの産業部門からの需要の高まりによって牽引されています。2022年、北米は世界市場全体の売上高で最大の税務ソフトウェア市場シェアに貢献しました。北米は、技術革新と先端技術の導入の両面で最も急成長している地域のひとつです。

Sage Group Plc、Thomson Reuters Corp、Xero Ltd、IRIS Software Group Ltd、Wolters Kluwer NV、Intuit Inc、HRB Digital LLC、Wealthsimple Technologies Inc、SAP SE、CloudTax Incは、この市場調査で紹介された主要な税務ソフトウェア市場プレイヤーの1つです。その他、いくつかの重要な税務ソフトウェア市場プレイヤーを分析し、市場とそのエコシステムの全体像を明らかにしました。

税務ソフトウェア市場全体の規模は、一次情報と二次情報の両方を用いて導き出されました。税務ソフトウェア市場の調査プロセスを開始するにあたり、税務ソフトウェア市場に関連する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。このプロセスは、すべての市場セグメントに関する税務ソフトウェア市場の成長の概要と市場予測を得る目的もあります。また、データを検証し、このテーマについてより分析的な洞察を得るために、業界関係者やコメンテーターに対して複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、市場開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家や、税務ソフトウェア市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 税務ソフトウェア市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 税務ソフトウェア市場-主要産業力学

- 税務ソフトウェア市場- 主要産業力学

- 市場促進要因

- 税務システムのデジタル化の増加

- 税務ソフトウェア導入の増加

- 市場抑制要因

- 高いソフトウェアとトレーニングコスト

- 市場機会

- オンライン取引の増加

- 税務業界の成長

- 今後の動向

- 先端技術の統合の高まり

- 促進要因と抑制要因の影響

第6章 税務ソフトウェア市場:世界市場分析

- 税務ソフトウェア市場の収益、2022年~2030年

- 税務ソフトウェア市場の予測と分析

第7章 税務ソフトウェア市場分析-製品

- ソフトウェア

- サービス

- サービス概要

第8章 税務ソフトウェア市場分析-導入タイプ

- クラウド

- オンプレミス

- オンプレミス

第9章 税務ソフトウェア市場分析:税タイプ

- 売上税

- 消費税市場の2030年までの収益と予測

- 所得税

- 所得税市場の2030年までの収益と予測

- 法人税

- 法人税の概要

- 法人税市場の2030年までの収益と予測

- その他

- その他の概要

- その他市場の2030年までの収益と予測

第10章 税務ソフトウェア市場分析-エンドユーザー

- 営利企業

- 法人市場の2030年までの収益と予測

- 企業規模別

- 大企業

- 中堅企業

- 小企業

- 民間企業:業界別

- IT&テレコム

- 小売

- BFSI

- 政府機関

- ヘルスケア

- その他

- 個人

- 個人市場の2030年までの収益と予測

第11章 税務ソフトウェア市場分析:地域別

- 北米

- メキシコ

- 欧州

- その他欧州

- アジア太平洋

- その他アジア太平洋地域

- 中東・アフリカ

- その他中東とアフリカ

- 南米

- その他南米

第12章 税務ソフトウェア市場:COVID-19パンデミックの影響

- COVID-19前後の影響

第13章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第14章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第15章 企業プロファイル

- Sage Group Plc

- Thomson Reuters Corp

- Xero Ltd

- IRIS Software Group Ltd

- Wolters Kluwer NV

- Intuit Inc

- HRB Digital LLC

- Wealthsimple Technologies Inc

- SAP SE

- CloudTax Inc

第16章 付録

List Of Tables

- Table 1. Tax Software Market Segmentation

- Table 2. Tax Software Market Revenue and Forecasts To 2030 (US$ Million)

- Table 3. Tax Software Market Revenue and Forecasts To 2030 (US$ Million) - Product

- Table 4. Tax Software Market Revenue and Forecasts To 2030 (US$ Million) -Deployment Type

- Table 5. Tax Software Market Revenue and Forecasts To 2030 (US$ Million) - Tax Type

- Table 6. Tax Software Market Revenue and Forecasts To 2030 (US$ Million) - End User

- Table 7. North America: Tax Software Market, by Product - Revenue and Forecast to 2030 (US$ Million)

- Table 8. North America: Tax Software Market, by Deployment Type - Revenue and Forecast to 2030 (US$ Million)

- Table 9. North America: Tax Software Market, by Tax Type - Revenue and Forecast to 2030 (US$ Million)

- Table 10. North America: Tax Software Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 11. North America: Tax Software Market, Commercial Enterprises by Enterprise Size - Revenue and Forecast to 2030 (US$ Million)

- Table 12. North America: Tax Software Market, Commercial Enterprises by Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 13. US: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 14. US: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 15. US: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 16. US: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 17. US: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 18. US: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 19. Canada: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 20. Canada: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 21. Canada: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 22. Canada: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 23. Canada: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 24. Canada: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 25. Mexico: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 26. Mexico: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 27. Mexico: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 28. Mexico: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 29. Mexico: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 30. Mexico: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 31. Europe: Tax Software Market, by Product - Revenue and Forecast to 2030 (US$ Million)

- Table 32. Europe: Tax Software Market, by Deployment Type - Revenue and Forecast to 2030 (US$ Million)

- Table 33. Europe: Tax Software Market, by Tax Type - Revenue and Forecast to 2030 (US$ Million)

- Table 34. Europe: Tax Software Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 35. Europe: Tax Software Market, Commercial Enterprises by Enterprise Size - Revenue and Forecast to 2030 (US$ Million)

- Table 36. Europe: Tax Software Market, Commercial Enterprises by Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 37. Germany: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 38. Germany: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 39. Germany: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 40. Germany: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 41. Germany: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 42. Germany: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 43. UK: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 44. UK: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 45. UK: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 46. UK: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 47. UK: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 48. UK: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 49. France: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 50. France: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 51. France: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 52. France: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 53. France: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 54. France: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 55. Italy: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 56. Italy: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 57. Italy: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 58. Italy: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 59. Italy: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 60. Italy: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 61. Russia: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 62. Russia: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 63. Russia: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 64. Russia: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 65. Russia: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 66. Russia: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 67. Rest of Europe: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 68. Rest of Europe: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 69. Rest of Europe: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 70. Rest of Europe: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 71. Rest of Europe: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 72. Rest of Europe: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 73. Asia Pacific: Tax Software Market, by Product - Revenue and Forecast to 2030 (US$ Million)

- Table 74. Asia Pacific: Tax Software Market, by Deployment Type - Revenue and Forecast to 2030 (US$ Million)

- Table 75. Asia Pacific: Tax Software Market, by Tax Type - Revenue and Forecast to 2030 (US$ Million)

- Table 76. Asia Pacific: Tax Software Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 77. Asia Pacific: Tax Software Market, Commercial Enterprises by Enterprise Size - Revenue and Forecast to 2030 (US$ Million)

- Table 78. Asia Pacific: Tax Software Market, Commercial Enterprises by Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 79. China: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 80. China: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 81. China: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 82. China: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 83. China: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 84. China: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 85. Japan: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 86. Japan: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 87. Japan: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 88. Japan: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 89. Japan: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 90. Japan: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 91. India: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 92. India: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 93. India: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 94. India: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 95. India: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 96. India: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 97. South Korea: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 98. South Korea: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 99. South Korea: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 100. South Korea: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 101. South Korea: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 102. South Korea: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 103. Australia: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 104. Australia: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 105. Australia: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 106. Australia: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 107. Australia: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 108. Australia: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 109. Rest of Asia Pacific: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 110. Rest of Asia Pacific: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 111. Rest of Asia Pacific: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 112. Rest of Asia Pacific: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 113. Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 114. Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 115. Middle East & Africa: Tax Software Market, by Product - Revenue and Forecast to 2030 (US$ Million)

- Table 116. Middle East & Africa: Tax Software Market, by Deployment Type - Revenue and Forecast to 2030 (US$ Million)

- Table 117. Middle East & Africa: Tax Software Market, by Tax Type - Revenue and Forecast to 2030 (US$ Million)

- Table 118. Middle East & Africa: Tax Software Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 119. Middle East & Africa: Tax Software Market, Commercial Enterprises by Enterprise Size - Revenue and Forecast to 2030 (US$ Million)

- Table 120. Middle East & Africa: Tax Software Market, Commercial Enterprises by Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 121. UAE: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 122. UAE: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 123. UAE: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 124. UAE: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 125. UAE: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 126. UAE: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 127. Saudi Arabia: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 128. Saudi Arabia: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 129. Saudi Arabia: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 130. Saudi Arabia: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 131. Saudi Arabia: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 132. Saudi Arabia: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 133. South Africa: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 134. South Africa: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 135. South Africa: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 136. South Africa: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 137. South Africa: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 138. South Africa: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 139. Rest of Middle East & Africa: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 140. Rest of Middle East & Africa: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 141. Rest of Middle East & Africa: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 142. Rest of Middle East & Africa: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 143. Rest of Middle East & Africa: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 144. Rest of Middle East & Africa: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 145. South America: Tax Software Market, by Product - Revenue and Forecast to 2030 (US$ Million)

- Table 146. South America: Tax Software Market, by Deployment Type - Revenue and Forecast to 2030 (US$ Million)

- Table 147. South America: Tax Software Market, by Tax Type - Revenue and Forecast to 2030 (US$ Million)

- Table 148. South America: Tax Software Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 149. South America: Tax Software Market, Commercial Enterprises by Enterprise Size - Revenue and Forecast to 2030 (US$ Million)

- Table 150. South America: Tax Software Market, Commercial Enterprises by Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 151. Brazil: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 152. Brazil: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 153. Brazil: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 154. Brazil: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 155. Brazil: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 156. Brazil: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 157. Argentina: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 158. Argentina: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 159. Argentina: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 160. Argentina: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 161. Argentina: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 162. Argentina: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 163. Rest of South America: Tax Software Market, by Product -Revenue and Forecast to 2030 (US$ Million)

- Table 164. Rest of South America: Tax Software Market, by Deployment Type -Revenue and Forecast to 2030 (US$ Million)

- Table 165. Rest of South America: Tax Software Market, by Tax Type -Revenue and Forecast to 2030 (US$ Million)

- Table 166. Rest of South America: Tax Software Market, by End User -Revenue and Forecast to 2030 (US$ Million)

- Table 167. Rest of South America: Tax Software Market, Commercial Enterprises by Enterprise Size -Revenue and Forecast to 2030 (US$ Million)

- Table 168. Rest of South America: Tax Software Market, Commercial Enterprises by Vertical -Revenue and Forecast to 2030 (US$ Million)

- Table 169. Heat Map Analysis By Key Players

- Table 170. List of Abbreviation

List Of Figures

- Figure 1. Tax Software Market Segmentation, By Geography

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Tax Software Market

- Figure 4. Number of Online Transaction in India

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Tax Software Market Breakdown by Geography, 2022 and 2030 (%)

- Figure 7. Tax Software Market Revenue (US$ Million), 2022 - 2030

- Figure 8. Tax Software Market Share (%) - Product, 2022 and 2030

- Figure 9. Software Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Tax Software Market Share (%) - Deployment Type, 2022 and 2030

- Figure 12. Cloud Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. On-Premise Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Tax Software Market Share (%) - Tax Type, 2022 and 2030

- Figure 15. Sales Tax Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Income Tax Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Corporate Tax Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Tax Software Market Share (%) - End User, 2022 and 2030

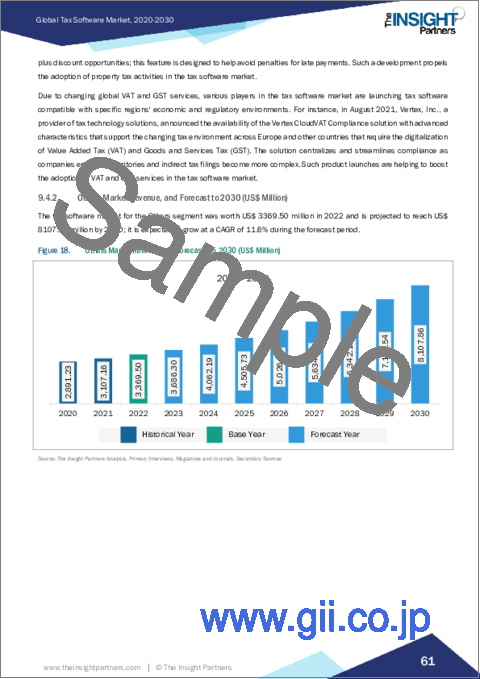

- Figure 20. Commercial Enterprises Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 21. Large Enterprises Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Medium Enterprises Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Small Enterprises Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. IT& Telecom Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Retail Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. BFSI Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 27. Government Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. Healthcare Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 29. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 30. Individual Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 31. Tax Software Market Breakdown by Region, 2022 and 2030 (%)

- Figure 32. North America: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. North America: Tax Software Market Revenue Share, by Product (2022 and 2030)

- Figure 34. North America: Tax Software Market Revenue Share, by Deployment Type (2022 and 2030)

- Figure 35. North America: Tax Software Market Revenue Share, by Tax Type (2022 and 2030)

- Figure 36. North America: Tax Software Market Revenue Share, by End User (2022 and 2030)

- Figure 37. North America: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 38. US: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 39. Canada: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 40. Mexico: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 41. Europe: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 42. Europe: Tax Software Market Revenue Share, by Product (2022 and 2030)

- Figure 43. Europe: Tax Software Market Revenue Share, by Deployment Type (2022 and 2030)

- Figure 44. Europe: Tax Software Market Revenue Share, by Tax Type (2022 and 2030)

- Figure 45. Europe: Tax Software Market Revenue Share, by End User (2022 and 2030)

- Figure 46. Europe: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 47. Germany: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 48. UK: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 49. France: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 50. Italy: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 51. Russia: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 52. Rest of Europe: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 53. Asia Pacific: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 54. Asia Pacific: Tax Software Market Revenue Share, by Product (2022 and 2030)

- Figure 55. Asia Pacific: Tax Software Market Revenue Share, by Deployment Type (2022 and 2030)

- Figure 56. Asia Pacific: Tax Software Market Revenue Share, by Tax Type (2022 and 2030)

- Figure 57. Asia Pacific: Tax Software Market Revenue Share, by End User (2022 and 2030)

- Figure 58. Asia Pacific: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 59. China: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 60. Japan: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 61. India: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 62. South Korea: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 63. Australia: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 64. Rest of Asia Pacific: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 65. Middle East & Africa: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 66. Middle East & Africa: Tax Software Market Revenue Share, by Product (2022 and 2030)

- Figure 67. Middle East & Africa: Tax Software Market Revenue Share, by Deployment Type (2022 and 2030)

- Figure 68. Middle East & Africa: Tax Software Market Revenue Share, by Tax Type (2022 and 2030)

- Figure 69. Middle East & Africa: Tax Software Market Revenue Share, by End User (2022 and 2030)

- Figure 70. Middle East & Africa: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 71. UAE: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 72. Saudi Arabia: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 73. South Africa: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 74. Rest of Middle East & Africa: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 75. South America: Tax Software Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 76. South America: Tax Software Market Revenue Share, by Product (2022 and 2030)

- Figure 77. South America: Tax Software Market Revenue Share, by Deployment Type (2022 and 2030)

- Figure 78. South America: Tax Software Market Revenue Share, by Tax Type (2022 and 2030)

- Figure 79. South America: Tax Software Market Revenue Share, by End User (2022 and 2030)

- Figure 80. South America: Tax Software Market Revenue Share, by Key Country (2022 and 2030)

- Figure 81. Brazil: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 82. Argentina: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 83. Rest of South America: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 84. Company Positioning & Concentration

The tax software market size is expected to grow from US$ 20.95 billion in 2022 to US$ 46.90 billion by 2030; it is estimated to record a CAGR of 10.6% from 2022 to 2030.

The accountancy sector is growing at a fast pace, increasing the need for advanced technologies to streamline tax processes. For example, according to the International Trade Agency (ITA), in 2020, US exports to Canada in accounting services were valued at US$ 335 million, and US imports from Canada were valued at US$ 450 million. The entire accountancy industry is witnessing the emergence of cloud computing and automation amid the digital revolution. Cloud accountancy has widely transformed how accountants work regularly and communicate with their customers. Cloud-based solutions enable accountants to run accounting tasks from any location. According to Xero Corporation, accounting firms using cloud accounting have reported a 15% growth in year-over-year revenue. Also, the accounting practices using cloud accounting have managed to gather and serve five times more customers than those who do not use this process.

The use of AI technology by accounting firms is increasing to boost productivity and flourish the accounting industry. Using advanced tools to increase productivity and make more informed decisions are expected to gain more traction in the coming years. The use of technologies such as AI will help accounting firms generate more insight and reduce expenditures. According to the Sage Group, 55% of accountants are likely to leverage AI in the coming years.

AI helps improve services such as automated tax filing and helps educate taxpayers through the procedure of tax filing. Moreover, AI can be implemented for identifying tax evasion, extracting key data from tax documents, and automatically feeding information into accounting software, lowering the load on tax professionals. Thus, the AI benefits in the tax software improve the software efficiency and leads to its adoption, thereby fuels the tax software market growth.

In the coming years, automation of business processes for making labor-intensive activities such as tax preparation, banking, audits, and payroll less time-consuming is expected to gain strong momentum. Using automation would allow accounting firms to reduce the overall time required to complete processes and lower the number of errors. Thus, automation and cloud technologies are expected to be the most significant trends in the accounting industry, thereby positively favoring tax software market growth.

The IT & telecom industry is widely adopting tax software to reduce manual documentation. Entrepreneurs working on a startup in the IT & telecom industry need time to understand tax credits and payment procedures for filling their taxes. Thus, the IT & telecom industry is more inclined toward adopting tax software to ease the tax process, thereby fuels the tax software market size. Implementing the right tax software streamlines business operations assesses favorable tax opportunities, and addresses filing necessities in appropriate jurisdictions. Avalara's AvaTax provides tax calculations on a broad range of communication transactions by directly connecting to the company's billing or enterprise resource planning (ERP) system or an in-house system built through API. CCH Incorporated provides a CCH SureTax communications solution to reduce the risk and overall compliance costs associated with cloud-based communications tax calculation and reporting, and it is designed mainly for service providers of communications.

With the increasing penetration of digitization in various industries, tax software has become a fundamental component of businesses and individuals to carry out efficient and enhanced tax ecosystems, notably in financial institutions and growing retail sectors which fuels the tax software market growth. The demand for tax software in companies is increasing as these solutions allow businesses to comply with various tax rates, rules, and regulations. North America tax software market growth is primarily driven by rising demand from industry sectors such as BFSI, government, and healthcare. In 2022, North America contributed to the largest tax software market share in terms of the overall revenue of the global market. North America is one of the fastest-growing regions in terms of both technological innovations and the adoption of advanced technologies.

Sage Group Plc, Thomson Reuters Corp, Xero Ltd, IRIS Software Group Ltd, Wolters Kluwer NV, Intuit Inc, HRB Digital LLC, Wealthsimple Technologies Inc, SAP SE, and CloudTax Inc are among the key tax software market players profiled in this market study. Several other essential tax software market players were analyzed for a holistic view of the market and its ecosystem.

The overall tax software market size has been derived using both primary and secondary sources. To begin the tax software market research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the tax software market. The process also serves the purpose of obtaining an overview and market forecast of the tax software market growth with respect to all market segments. Also, multiple primary interviews have been conducted with industry participants and commentators to validate the data and gain more analytical insights about the topic. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants such as valuation experts, research analysts, and key opinion leaders-specializing in the tax software market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the tax software market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations such as specific country and segmental insight highlights crucial progressive industry trends in the tax software market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Tax Software Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in Value Chain

5. Tax Software Market - Key Industry Dynamics

- 5.1 Tax Software Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Digitization of Tax Systems

- 5.2.2 Rise in Adoption of Tax Software

- 5.3 Market Restraints

- 5.3.1 High Software and Training Cost

- 5.4 Market Opportunities

- 5.4.1 Rise In Online Transactions

- 5.4.2 Growing Tax Industry

- 5.5 Future Trends

- 5.5.1 Rising Integration of Advanced Technologies

- 5.6 Impact of Drivers and Restraints:

6. Tax Software Market - Global Market Analysis

- 6.1 Tax Software Market Revenue (US$ Million), 2022 - 2030

- 6.2 Tax Software Market Forecast and Analysis

7. Tax Software Market Analysis - Product

- 7.1 Software

- 7.1.1 Overview

- 7.1.2 Software Market, Revenue and Forecast to 2030 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services Market, Revenue and Forecast to 2030 (US$ Million)

8. Tax Software Market Analysis - Deployment Type

- 8.1 Cloud

- 8.1.1 Overview

- 8.1.2 Cloud Market, Revenue and Forecast to 2030 (US$ Million)

- 8.2 On-Premise

- 8.2.1 Overview

- 8.2.2 On-Premise Market, Revenue and Forecast to 2030 (US$ Million)

9. Tax Software Market Analysis - Tax Type

- 9.1 Sales Tax

- 9.1.1 Overview

- 9.1.2 Sales Tax Market Revenue, and Forecast to 2030 (US$ Million)

- 9.2 Income Tax

- 9.2.1 Overview

- 9.2.2 Income Tax Market Revenue, and Forecast to 2030 (US$ Million)

- 9.3 Corporate Tax

- 9.3.1 Overview

- 9.3.2 Corporate Tax Market Revenue, and Forecast to 2030 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others Market Revenue, and Forecast to 2030 (US$ Million)

10. Tax Software Market Analysis - End User

- 10.1 Commercial Enterprises

- 10.1.1 Overview

- 10.1.2 Commercial Enterprises Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.3 Commercial Enterprises, By Enterprise Size

- 10.1.3.1 Large Enterprises

- 10.1.3.1.1 Overview

- 10.1.3.1.2 Large Enterprises Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.3.2 Medium Enterprises

- 10.1.3.2.1 Overview

- 10.1.3.2.2 Medium Enterprises Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.3.3 Small Enterprises

- 10.1.3.3.1 Overview

- 10.1.3.3.2 Small Enterprises Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.3.1 Large Enterprises

- 10.1.4 Commercial Enterprises, By Vertical

- 10.1.4.1 IT& Telecom

- 10.1.4.1.1 Overview

- 10.1.4.1.2 IT& Telecom Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.4.2 Retail

- 10.1.4.2.1 Overview

- 10.1.4.2.2 Retail Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.4.3 BFSI

- 10.1.4.3.1 Overview

- 10.1.4.3.2 BFSI Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.4.4 Government

- 10.1.4.4.1 Overview

- 10.1.4.4.2 Government Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.4.5 Healthcare

- 10.1.4.5.1 Overview

- 10.1.4.5.2 Healthcare Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.4.6 Others

- 10.1.4.6.1 Overview

- 10.1.4.6.2 Others Market Revenue, and Forecast to 2030 (US$ Million)

- 10.1.4.1 IT& Telecom

- 10.2 Individual

- 10.2.1 Overview

- 10.2.2 Individual Market Revenue, and Forecast to 2030 (US$ Million)

11. Tax Software Market - Geographical Analysis

- 11.1 Overview

- 11.2 North America: Tax Software Market

- 11.2.1 North America: Revenue, and Forecast to 2030 (US$ Million)

- 11.2.2 North America: Tax Software Market, by Product

- 11.2.3 North America: Tax Software Market, by Deployment Type

- 11.2.4 North America: Tax Software Market, by Tax Type

- 11.2.5 North America: Tax Software Market, by End User

- 11.2.6 North America: Tax Software Market, by Key Country

- 11.2.6.1 US: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.2.6.1.1 US: Tax Software Market, by Product

- 11.2.6.1.2 US: Tax Software Market, by Deployment Type

- 11.2.6.1.3 US: Tax Software Market, by Tax Type

- 11.2.6.1.4 US: Tax Software Market, by End User

- 11.2.6.1.4.1 US: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.2.6.1.4.2 US: Tax Software Market, Commercial Enterprises by Vertical

- 11.2.6.2 Canada: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.2.6.2.1 Canada: Tax Software Market, by Product

- 11.2.6.2.2 Canada: Tax Software Market, by Deployment Type

- 11.2.6.2.3 Canada: Tax Software Market, by Tax Type

- 11.2.6.2.4 Canada: Tax Software Market, by End User

- 11.2.6.2.4.1 Canada: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.2.6.2.4.2 Canada: Tax Software Market, Commercial Enterprises by Vertical

- 11.2.6.3 Mexico: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.2.6.3.1 Mexico: Tax Software Market, by Product

- 11.2.6.3.2 Mexico: Tax Software Market, by Deployment Type

- 11.2.6.3.3 Mexico: Tax Software Market, by Tax Type

- 11.2.6.3.4 Mexico: Tax Software Market, by End User

- 11.2.6.3.4.1 Mexico: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.2.6.3.4.2 Mexico: Tax Software Market, Commercial Enterprises by Vertical

- 11.2.6.1 US: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3 Europe: Tax Software Market

- 11.3.1 Europe: Revenue, and Forecast to 2030 (US$ Million)

- 11.3.2 Europe: Tax Software Market, by Product

- 11.3.3 Europe: Tax Software Market, by Deployment Type

- 11.3.4 Europe: Tax Software Market, by Tax Type

- 11.3.5 Europe: Tax Software Market, by End User

- 11.3.6 Europe: Tax Software Market, by Key Country

- 11.3.6.1 Germany: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3.6.1.1 Germany: Tax Software Market, by Product

- 11.3.6.1.2 Germany: Tax Software Market, by Deployment Type

- 11.3.6.1.3 Germany: Tax Software Market, by Tax Type

- 11.3.6.1.4 Germany: Tax Software Market, by End User

- 11.3.6.1.4.1 Germany: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.3.6.1.4.2 Germany: Tax Software Market, Commercial Enterprises by Vertical

- 11.3.6.2 UK: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3.6.2.1 UK: Tax Software Market, by Product

- 11.3.6.2.2 UK: Tax Software Market, by Deployment Type

- 11.3.6.2.3 UK: Tax Software Market, by Tax Type

- 11.3.6.2.4 UK: Tax Software Market, by End User

- 11.3.6.2.5 UK: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.3.6.2.6 UK: Tax Software Market, Commercial Enterprises by Vertical

- 11.3.6.3 France: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3.6.3.1 France: Tax Software Market, by Product

- 11.3.6.3.2 France: Tax Software Market, by Deployment Type

- 11.3.6.3.3 France: Tax Software Market, by Tax Type

- 11.3.6.3.4 France: Tax Software Market, by End User

- 11.3.6.3.4.1 France: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.3.6.3.4.2 France: Tax Software Market, Commercial Enterprises by Vertical

- 11.3.6.4 Italy: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3.6.4.1 Italy: Tax Software Market, by Product

- 11.3.6.4.2 Italy: Tax Software Market, by Deployment Type

- 11.3.6.4.3 Italy: Tax Software Market, by Tax Type

- 11.3.6.4.4 Italy: Tax Software Market, by End User

- 11.3.6.4.4.1 Italy: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.3.6.4.4.2 Italy: Tax Software Market, Commercial Enterprises by Vertical

- 11.3.6.5 Russia: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3.6.5.1 Russia: Tax Software Market, by Product

- 11.3.6.5.2 Russia: Tax Software Market, by Deployment Type

- 11.3.6.5.3 Russia: Tax Software Market, by Tax Type

- 11.3.6.5.4 Russia: Tax Software Market, by End User

- 11.3.6.5.4.1 Russia: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.3.6.5.4.2 Russia: Tax Software Market, Commercial Enterprises by Vertical

- 11.3.6.6 Rest of Europe: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.3.6.6.1 Rest of Europe: Tax Software Market, by Product

- 11.3.6.6.2 Rest of Europe: Tax Software Market, by Deployment Type

- 11.3.6.6.3 Rest of Europe: Tax Software Market, by Tax Type

- 11.3.6.6.4 Rest of Europe: Tax Software Market, by End User

- 11.3.6.6.4.1 Rest of Europe: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.3.6.6.4.2 Rest of Europe: Tax Software Market, Commercial Enterprises by Vertical

- 11.3.6.1 Germany: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4 Asia Pacific: Tax Software Market

- 11.4.1 Asia Pacific: Revenue, and Forecast to 2030 (US$ Million)

- 11.4.2 Asia Pacific: Tax Software Market, by Product

- 11.4.3 Asia Pacific: Tax Software Market, by Deployment Type

- 11.4.4 Asia Pacific: Tax Software Market, by Tax Type

- 11.4.5 Asia Pacific: Tax Software Market, by End User

- 11.4.6 Asia Pacific: Tax Software Market, by Key Country

- 11.4.6.1 China: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4.6.1.1 China: Tax Software Market, by Product

- 11.4.6.1.2 China: Tax Software Market, by Deployment Type

- 11.4.6.1.3 China: Tax Software Market, by Tax Type

- 11.4.6.1.4 China: Tax Software Market, by End User

- 11.4.6.1.4.1 China: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.4.6.1.4.2 China: Tax Software Market, Commercial Enterprises by Vertical

- 11.4.6.2 Japan: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4.6.2.1 Japan: Tax Software Market, by Product

- 11.4.6.2.2 Japan: Tax Software Market, by Deployment Type

- 11.4.6.2.3 Japan: Tax Software Market, by Tax Type

- 11.4.6.2.4 Japan: Tax Software Market, by End User

- 11.4.6.2.4.1 Japan: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.4.6.2.4.2 Japan: Tax Software Market, Commercial Enterprises by Vertical

- 11.4.6.3 India: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4.6.3.1 India: Tax Software Market, by Product

- 11.4.6.3.2 India: Tax Software Market, by Deployment Type

- 11.4.6.3.3 India: Tax Software Market, by Tax Type

- 11.4.6.3.4 India: Tax Software Market, by End User

- 11.4.6.3.4.1 India: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.4.6.3.4.2 India: Tax Software Market, Commercial Enterprises by Vertical

- 11.4.6.4 South Korea: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4.6.4.1 South Korea: Tax Software Market, by Product

- 11.4.6.4.2 South Korea: Tax Software Market, by Deployment Type

- 11.4.6.4.3 South Korea: Tax Software Market, by Tax Type

- 11.4.6.4.4 South Korea: Tax Software Market, by End User

- 11.4.6.4.4.1 South Korea: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.4.6.4.4.2 South Korea: Tax Software Market, Commercial Enterprises by Vertical

- 11.4.6.5 Australia: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4.6.5.1 Australia: Tax Software Market, by Product

- 11.4.6.5.2 Australia: Tax Software Market, by Deployment Type

- 11.4.6.5.3 Australia: Tax Software Market, by Tax Type

- 11.4.6.5.4 Australia: Tax Software Market, by End User

- 11.4.6.5.4.1 Australia: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.4.6.5.4.2 Australia: Tax Software Market, Commercial Enterprises by Vertical

- 11.4.6.6 Rest of Asia Pacific: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.4.6.6.1 Rest of Asia Pacific: Tax Software Market, by Product

- 11.4.6.6.2 Rest of Asia Pacific: Tax Software Market, by Deployment Type

- 11.4.6.6.3 Rest of Asia Pacific: Tax Software Market, by Tax Type

- 11.4.6.6.4 Rest of Asia Pacific: Tax Software Market, by End User

- 11.4.6.6.4.1 Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.4.6.6.4.2 Rest of Asia Pacific: Tax Software Market, Commercial Enterprises by Vertical

- 11.4.6.1 China: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.5 Middle East & Africa: Tax Software Market

- 11.5.1 Middle East & Africa: Revenue, and Forecast to 2030 (US$ Million)

- 11.5.2 Middle East & Africa: Tax Software Market, by Product

- 11.5.3 Middle East & Africa: Tax Software Market, by Deployment Type

- 11.5.4 Middle East & Africa: Tax Software Market, by Tax Type

- 11.5.5 Middle East & Africa: Tax Software Market, by End User

- 11.5.6 Middle East & Africa: Tax Software Market, by Key Country

- 11.5.6.1 UAE: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.5.6.1.1 UAE: Tax Software Market, by Product

- 11.5.6.1.2 UAE: Tax Software Market, by Deployment Type

- 11.5.6.1.3 UAE: Tax Software Market, by Tax Type

- 11.5.6.1.4 UAE: Tax Software Market, by End User

- 11.5.6.1.4.1 UAE: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.5.6.1.4.2 UAE: Tax Software Market, Commercial Enterprises by Vertical

- 11.5.6.2 Saudi Arabia: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.5.6.2.1 Saudi Arabia: Tax Software Market, by Product

- 11.5.6.2.2 Saudi Arabia: Tax Software Market, by Deployment Type

- 11.5.6.2.3 Saudi Arabia: Tax Software Market, by Tax Type

- 11.5.6.2.4 Saudi Arabia: Tax Software Market, by End User

- 11.5.6.2.4.1 Saudi Arabia: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.5.6.2.4.2 Saudi Arabia: Tax Software Market, Commercial Enterprises by Vertical

- 11.5.6.3 South Africa: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.5.6.3.1 South Africa: Tax Software Market, by Product

- 11.5.6.3.2 South Africa: Tax Software Market, by Deployment Type

- 11.5.6.3.3 South Africa: Tax Software Market, by Tax Type

- 11.5.6.3.4 South Africa: Tax Software Market, by End User

- 11.5.6.3.4.1 South Africa: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.5.6.3.4.2 South Africa: Tax Software Market, Commercial Enterprises by Vertical

- 11.5.6.4 Rest of Middle East & Africa: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.5.6.4.1 Rest of Middle East & Africa: Tax Software Market, by Product

- 11.5.6.4.2 Rest of Middle East & Africa: Tax Software Market, by Deployment Type

- 11.5.6.4.3 Rest of Middle East & Africa: Tax Software Market, by Tax Type

- 11.5.6.4.4 Rest of Middle East & Africa: Tax Software Market, by End User

- 11.5.6.4.4.1 Rest of Middle East & Africa: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.5.6.4.4.2 Rest of Middle East & Africa: Tax Software Market, Commercial Enterprises by Vertical

- 11.5.6.1 UAE: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.6 South America: Tax Software Market

- 11.6.1 South America: Revenue, and Forecast to 2030 (US$ Million)

- 11.6.2 South America: Tax Software Market, by Product

- 11.6.3 South America: Tax Software Market, by Deployment Type

- 11.6.4 South America: Tax Software Market, by Tax Type

- 11.6.5 South America: Tax Software Market, by End User

- 11.6.6 South America: Tax Software Market, by Key Country

- 11.6.6.1 Brazil: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.6.6.1.1 Brazil: Tax Software Market, by Product

- 11.6.6.1.2 Brazil: Tax Software Market, by Deployment Type

- 11.6.6.1.3 Brazil: Tax Software Market, by Tax Type

- 11.6.6.1.4 Brazil: Tax Software Market, by End User

- 11.6.6.1.4.1 Brazil: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.6.6.1.4.2 Brazil: Tax Software Market, Commercial Enterprises by Vertical

- 11.6.6.2 Argentina: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.6.6.2.1 Argentina: Tax Software Market, by Product

- 11.6.6.2.2 Argentina: Tax Software Market, by Deployment Type

- 11.6.6.2.3 Argentina: Tax Software Market, by Tax Type

- 11.6.6.2.4 Argentina: Tax Software Market, by End User

- 11.6.6.2.4.1 Argentina: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.6.6.2.4.2 Argentina: Tax Software Market, Commercial Enterprises by Vertical

- 11.6.6.3 Rest of South America: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

- 11.6.6.3.1 Rest of South America: Tax Software Market, by Product

- 11.6.6.3.2 Rest of South America: Tax Software Market, by Deployment Type

- 11.6.6.3.3 Rest of South America: Tax Software Market, by Tax Type

- 11.6.6.3.4 Rest of South America: Tax Software Market, by End User

- 11.6.6.3.4.1 Rest of South America: Tax Software Market, Commercial Enterprises by Enterprise Size

- 11.6.6.3.4.2 Rest of South America: Tax Software Market, Commercial Enterprises by Vertical

- 11.6.6.1 Brazil: Tax Software Market - Revenue, and Forecast to 2030 (US$ Million)

12. Tax Software Market - Impact of COVID-19 Pandemic

- 12.1 Pre & Post Covid-19 Impact

13. Competitive Landscape

- 13.1 Heat Map Analysis by Key Players

- 13.2 Company Positioning & Concentration

14. Industry Landscape

- 14.1 Overview

- 14.2 Market Initiative

- 14.3 New Product Development

- 14.4 Mergers & Acquisitions

15. Company Profiles

- 15.1 Sage Group Plc

- 15.1.1 Key Facts

- 15.1.2 Business Description

- 15.1.3 Products and Services

- 15.1.4 Financial Overview

- 15.1.5 SWOT Analysis

- 15.1.6 Key Developments

- 15.2 Thomson Reuters Corp

- 15.2.1 Key Facts

- 15.2.2 Business Description

- 15.2.3 Products and Services

- 15.2.4 Financial Overview

- 15.2.5 SWOT Analysis

- 15.2.6 Key Developments

- 15.3 Xero Ltd

- 15.3.1 Key Facts

- 15.3.2 Business Description

- 15.3.3 Products and Services

- 15.3.4 Financial Overview

- 15.3.5 SWOT Analysis

- 15.3.6 Key Developments

- 15.4 IRIS Software Group Ltd

- 15.4.1 Key Facts

- 15.4.2 Business Description

- 15.4.3 Products and Services

- 15.4.4 Financial Overview

- 15.4.5 SWOT Analysis

- 15.4.6 Key Developments

- 15.5 Wolters Kluwer NV

- 15.5.1 Key Facts

- 15.5.2 Business Description

- 15.5.3 Products and Services

- 15.5.4 Financial Overview

- 15.5.5 SWOT Analysis

- 15.5.6 Key Developments

- 15.6 Intuit Inc

- 15.6.1 Key Facts

- 15.6.2 Business Description

- 15.6.3 Products and Services

- 15.6.4 Financial Overview

- 15.6.5 SWOT Analysis

- 15.6.6 Key Developments

- 15.7 HRB Digital LLC

- 15.7.1 Key Facts

- 15.7.2 Business Description

- 15.7.3 Products and Services

- 15.7.4 Financial Overview

- 15.7.5 SWOT Analysis

- 15.7.6 Key Developments

- 15.8 Wealthsimple Technologies Inc

- 15.8.1 Key Facts

- 15.8.2 Business Description

- 15.8.3 Products and Services

- 15.8.4 Financial Overview

- 15.8.5 SWOT Analysis

- 15.8.6 Key Developments

- 15.9 SAP SE

- 15.9.1 Key Facts

- 15.9.2 Business Description

- 15.9.3 Products and Services

- 15.9.4 Financial Overview

- 15.9.5 SWOT Analysis

- 15.9.6 Key Developments

- 15.9.7 Key Developments

- 15.10 CloudTax Inc

- 15.10.1 Key Facts

- 15.10.2 Business Description

- 15.10.3 Products and Services

- 15.10.4 Financial Overview

- 15.10.5 SWOT Analysis

- 15.10.6 Key Developments

16. Appendix

- 16.1 About The Insight Partners

- 16.2 Word Index