|

市場調査レポート

商品コード

1851109

スマートフォン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Smartphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマートフォン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

概要

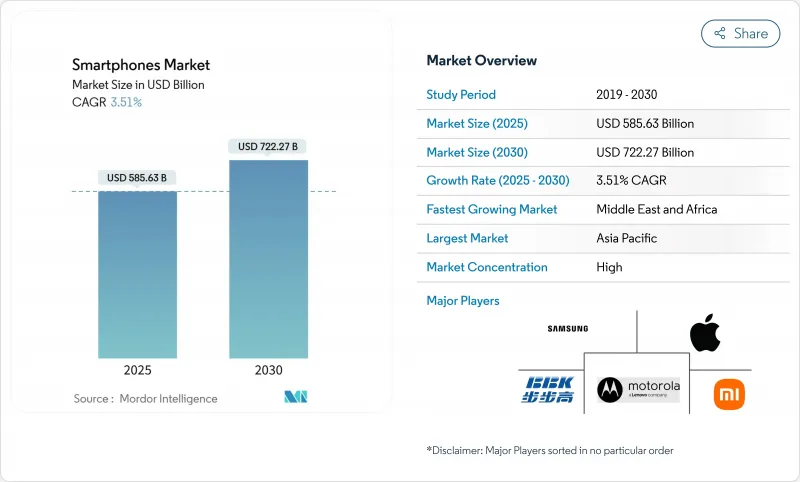

スマートフォン市場規模は2025年に5,856億3,000万米ドルと推定され、2030年には7,222億7,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは3.51%です。

収益が出荷台数よりも急速に増加しているのは、ユーザーがより高いメモリ構成、マルチカメラアレイ、組み込み人工知能(AI)エンジンを選択し、プレミアム価格を要求しているためです。800米ドルを超える価格のデバイスは、世界の販売台数の少数派であるにもかかわらず、業界の利益に占める割合が拡大しています。アジア太平洋地域のスマートフォン市場シェアは2024年には56.9%に達するが、成長のベクトルはさまざまである:中国は現在、買い替え主導の市場である一方、インド、インドネシア、ベトナムは初めてスマートフォンを購入する層を引き続き多く受け入れています。最近の小売価格と関税のデータを見ると、いくつかの新興国で自国通貨安が国内での組み立てを加速させており、為替レートの変動にもかかわらずエントリーレベルの価格設定が安定していることがわかる。

スマートフォン業界は今後10年間、3つの構造的な要因によって形成されるであろう。第一に、全国的な5Gのカバーエリアが、これまで4Gの堅牢さを享受できなかった人口の少ない地域にも広がりつつあり、後発組がネットワーク世代を1つ飛び越えることを可能にしています。第二に、リアルタイム翻訳、画像作成、会議メモ要約などのジェネレーティブAI機能は、クラウド依存から端末レベルの処理に移行しつつあり、ニューラル処理ユニットとメモリ帯域幅をめぐる新たな仕様競争に火をつけています。第三に、先端半導体に対する地政学的な制約が、各ブランドに部品調達の多様化とサプライチェーンの再設計を促しています。これらの複合的な効果により、このセクターは、大枠の普及率こそ成熟しているもの、ベンダーが機能展開と柔軟な製造フットプリントを一致させることで、依然として収益性の高いニッチを実現しています。2024~2025年の製品発売カレンダーは、この調整を示しています。多くのブランドは、フラッグシップの導入間隔を12ヶ月ではなく、およそ18ヶ月にしています。

世界のスマートフォン市場の動向と洞察

5Gネットワークの商用化:デバイスのアップグレードサイクルの加速

5Gの普及により、消費者がより高いスループットと低遅延を求めるようになり、買い替えの間隔が短くなっています。現在、世界で300近い商用ネットワークが稼働しており、通信事業者はミッドバンド5Gの容量を拡大するため、古い3G周波数帯の切り替えを開始しています。鋳造メーカーがコスト効率の高い6nmおよび4nmノードを提供し、価格に敏感な市場でも主流への採用が進んでいるため、デバイスのASPは下がり続けています。エンハンスト・モバイル・ブロードバンドは依然として中心的な使用事例であるが、FWA契約は急速に拡大しており、十分なサービスを受けていない地方におけるデバイス需要の増加を支えています。この勢いは無線アクセス投資全体を引き上げ、アップグレード志向のユーザーにアピールする機能豊富なミッドレンジスマートフォンの健全なパイプラインを保証します。

インドと東南アジアにおけるミッドプレミアム端末の需要急増

インド、インドネシア、ベトナムにおける可処分所得の増加と意欲的な消費が、200~499米ドルのスウィートスポットを引き上げています。消費者は、高リフレッシュレートのOLEDパネル、マルチレンズイメージング、5Gを入手しやすい価格帯で求めており、中国のOEMが積極的にターゲットとしています。インドの平均販売価格は2023年に255米ドルまで上昇し、エントリー・デバイスからの移行が顕著になりました。ローカライズされたオンライン・チャネルとターゲットを絞った発売カレンダーは、祭りの季節に合わせ、スマートフォン市場の売上に定期的なスパイクを生み出しています。その結果、ミッドプレミアム・モデルがeコマース・フラッシュ・イベントで大きなシェアを占めるようになり、ネットワークのアップグレードとデバイス機能需要のサイクルが強化されています。

世界経済の減速が買い替えサイクルに影響

インフレ圧力と為替変動により、消費者は携帯端末の寿命を3年以上に延ばそうとします。ベンダーは、7年間のセキュリティアップデートを約束し、バッテリー交換サービスを提供することで対応しているが、全体的な台数は低迷しています。整備済スマートフォン市場は、4Gまたは5Gバンドをサポートする低価格のエントリー端末を通信事業者に提供することで利益を得ています。また、高金利が発展途上地域での資金調達の動きを鈍らせ、小売業者の慎重な在庫管理につながっています。ASPは上昇するもの、部品コストの上昇によってマージンの拡大は抑制されます。

セグメント分析

2024年の販売台数ではAndroidが84.1%のシェアを維持するが、CAGR見通しではiOSが最速の4.5%を記録し、収益の勢いを支えます。アップルが中価格帯での販売を拡大し、新興国でのローカライズされた決済をサポートするため、iOSデバイスのスマートフォン市場規模は急速に拡大すると予想されます。95%近いロイヤルティが安定したアップグレードフローを確保し、アップルシリコンの持続的な統合が電力効率の向上をもたらし、デバイスの寿命を延ばし、残存価値を高める。アンドロイドは、完全にデバイス上で動作するGemini AIエンジンで対抗し、プライバシーとコンテキスト認識を強化します。OEMのスキンは、オープンソースの柔軟性を活用して差別化を図っているが、断片化は依然としてタイムリーなセキュリティパッチを複雑にしています。

アップルは、新しいSEラインを通じて小型スクリーン市場に参入し、マクロ不況時に購入を延期したユーザーの買い替えサイクルをターゲットにしています。HarmonyOS Nextはマイクロカーネル・アーキテクチャを採用し、ファーウェイを中国で唯一の垂直統合型代替エコシステムとして位置付けています。KaiOSは、コストに敏感な市場における機能豊富な4Gデバイスに引き続き適しており、最小限のメモリしか必要としない音声中心のサービスを提供します。将来的には、相互運用可能なAIフレームワークがOSの境界を曖昧にする可能性もあるが、iOSとAndroidの確立されたアプリケーション・ライブラリは引き続き開発者のコミットメントを支え、スマートフォン市場における両社の優位性を強化すると思われます。

2024年の出荷台数の38.5%を200米ドル以下のエントリー層が占め、数百万人に初めてのインターネットアクセスを提供します。それにもかかわらず、ウルトラプレミアム層はCAGR 6.2%を記録し、消費者がより高額な出費をより長い所有期間にわたって償却しようとする意欲を示しています。発売週には、台数シェアが低下するにもかかわらず、プレミアム・フラッグシップが売上高の最大75%に貢献し、ベンダーの収益性を緩和しています。折りたたみ式端末やAIを中心としたモデルは、高額な部材を必要とするにもかかわらず、旺盛な需要を享受しているため、ウルトラプレミアムカテゴリーのスマートフォン市場規模は着実に拡大すると予測されます。

200~499米ドルのミッドレンジ端末には、以前は高価格帯の製品にのみ搭載されていた高解像度ディスプレイ、大型センサー、即時充電が搭載されるようになりました。中国のOEMメーカーが話題性を維持するために四半期ごとにリフレッシュを実施するため、競争力学は激化しています。ブラジルのような市場では、輸入関税がコストを吊り上げ、購入者をミッドプレミアム・デバイスの再生品に向かわせています。500~799米ドルのプレミアム・モデルはハロー製品として機能し、クラウド・ストレージのようなアフターサービスを収益化するエコシステムにユーザーを誘導します。このような連鎖構造は、スマートフォン市場における健全なセグメント収益性の前提条件である数量と価値のバランスを取っています。

地域分析

アジア太平洋地域は2024年の世界出荷台数の56.9%を占め、中国とインドの膨大なインストールベースと急速な5G導入が牽引しました。中国国内ブランドは競争力のある価格設定とカメラのイノベーションによってシェアを拡大し、インドでは政府が支援する生産連動型インセンティブが新たな工場を誘致して輸入関税を引き下げました。地方のブロードバンドイニシアチブがスマートフォン市場への初めての参入を促し、全体的な普及率を押し上げました。下取りプログラムとEMIオプションは、特に第2級都市でのアップグレードをさらに刺激します。現地化義務の高まりは、サプライヤーにディスプレイとバッテリーの国内調達を促し、地域供給の回復力を強化します。データのローカライゼーションを強化する規制の動きは、コンプライアンス・コストを増加させる可能性があるが、同時に、ソブリン・クラウド統合によるベンダーのビジネスチャンスを生み出す可能性もあります。

北米は金額ベースでは第2位だが、飽和度が高いため販売台数の伸びは鈍化しています。iOSのシェアは57.9%で、ハードウェア、サービス、コンテンツにまたがるエコシステムの統合を反映しています。通信事業者は遠隔地での安全機能として衛星メッセージングを試行しており、Lバンドリンクに対応したモデムが必要とされています。フィールド診断用AI対応デバイスの企業採用により、企業の買い替えサイクルが24ヵ月に近づき、消費者の買い替えサイクルの長期化を一部相殺。ミッドバンド5Gの周波数オークションが継続中で、ネットワークの継続的な強化が確保され、互換性のあるフラッグシップ機への需要を支えます。

中東・アフリカのスマートフォン市場は、2030年までにCAGR 5.2%で拡大すると予測されます。若年層の人口動態、段階的な5Gの展開、小口融資アプリを通じた端末資金調達の台頭が需要を下支えします。エジプトは地域的な組み立てのハブとして台頭しており、大陸内流通のための通関上の利点を提供しています。給料日のサイクルに合わせたフラッシュセールは、短期間での量販に拍車をかけ、ロジスティクスを効果的に調整するブランドに利益をもたらします。サハラ以南のアフリカでは、太陽光発電キオスクがオフグリッド充電を提供し、農村地帯でのデバイスの実用性を高めています。キャリアとフィンテック・プラットフォームの提携により、ナノクレジットが実現し、エントリー・レベルのスマートフォンが初めて購入する人にとって手頃な価格になるため、スマートフォン市場全体の普及が拡大します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- デバイスのアップグレードサイクルを加速させる5Gネットワークの商用化

- インドと東南アジアにおけるミッドプレミアム端末の需要急増

- ファブライト・ファウンドリー(TSMC 6nmなど)による手頃な5Gチップセットの台頭

- 北米で拡大するキャリア主導のデバイス融資モデル

- eコマース・フラッシュセール・イベントがアフリカでの販売量を牽引

- 企業モビリティ・プログラムが鉱業における堅牢なスマートフォンの採用を増加(オーストラリア)

- 市場抑制要因

- 買い替えサイクルに影響する世界経済の減速

- ハイエンド部品供給を制限する米国と中国の技術制裁

- メモリとディスプレイパネルの価格上昇がOEMのマージンを圧迫

- ソフトウェア・サポートの長期化に対する規制強化がコスト構造を引き上げる

- バリュー/サプライチェーン分析

- マクロ経済影響分析(COVID-19とインフレ率)

- 規制とテクノロジーの展望

- 電波スペクトラム割当動向

- ESIMとIoT対応OSの動向

- スマートフォン端末ライフサイクル分析

- 利害関係者ライフサイクルマッピング

- 利害関係者別主要ペインポイント分析

- 技術ロードマップ

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- オペレーティングシステム別

- Android

- iOS

- その他(KaiOS、HarmonyOSなど)

- 価格帯別

- エントリーレベル(200米ドル未満)

- ミッドレンジ(USD 200-499)

- プレミアム(USD 500-799)

- ウルトラプレミアム(800米ドル以上)

- 技術別

- 5G

- 4G/LTE

- 3G以下

- フォームファクター別

- バー

- 折りたたみ/フリップ

- 堅牢/産業用

- 流通チャネル別

- オペレーター/キャリア店舗

- ブランド小売

- マルチブランド小売

- オンラインD2C

- 地域別

- 北米

- 米国

- カナダ

- ラテンアメリカ

- メキシコ

- ブラジル

- アルゼンチン

- その他ラテンアメリカ地域

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他欧州地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- その他アジア太平洋地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Samsung Electronics Co. Ltd

- Apple Inc.

- BBK Electronics Corp. Ltd(Oppo, Vivo, Realme, OnePlus)

- Xiaomi Corp.

- Transsion Holdings

- Huawei Technologies Co. Ltd

- Motorola Mobility LLC(Lenovo Group Ltd)

- Google LLC(Pixel)

- Sony Corp.

- ZTE Corp.

- HMD Global Oy(Nokia)

- ASUSTeK Computer Inc.

- Honor Device Co. Ltd

- TCL Technology(Group)Co. Ltd(Alcatel)

- Sharp Corp.

- Panasonic Holding Corp.

- Nothing Technology Ltd

- Fairphone BV

- CAT Phones(Bullitt Group)

- Meizu Technology Co. Ltd