|

市場調査レポート

商品コード

1850983

スマートカード:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマートカード:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月10日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

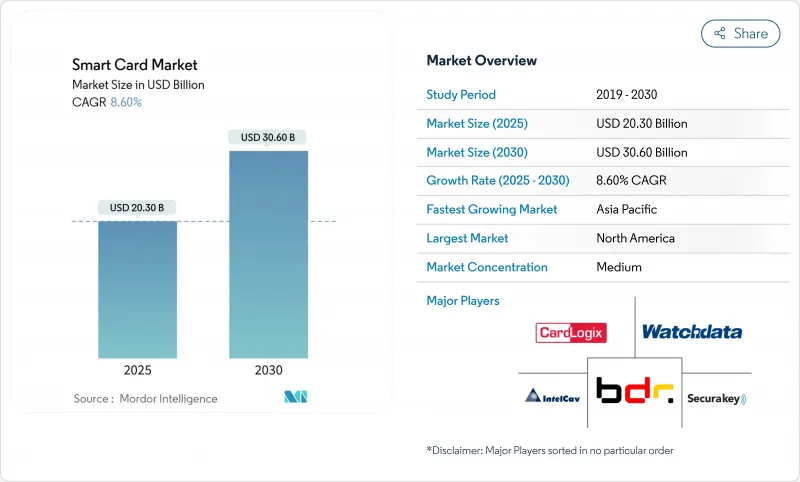

スマートカード市場規模は2025年に203億米ドル、2030年には306億米ドルに達し、予測期間を通じてCAGR 8.6%で成長すると予測されています。

EMVへの一貫した移行、国家デジタルIDプログラムの拡大、マルチアプリケーション・クレデンシャルに対する需要の高まりが、引き続き成長を支えています。非接触技術は現在、小売決済の主流となっており、デュアルインターフェースカードは、従来の接触型カードのみを保有する発行会社に段階的なアップグレードパスを提供しています。政府や企業が物理的IDとデジタルIDを融合させるのに伴い、カードに搭載されるセキュアエレメントは急速に普及しており、この動向はサイバーセキュリティサービスに新たなビジネスチャンスをもたらしています。地域別では、アジアが最大の設置基盤を持つが、最も拡大が見込まれるのはアフリカで、そこではモバイル・ファーストの決済エコシステムが、これまで未開拓だった顧客層でのカード発行を可能にしています。競合の激しさは中程度であるが、ティアワンメーカーは、価格以外の差別化を生み出す持続可能性に関連した製品やバイオメトリック・イノベーションを通じてシェアを強化しています。

世界のスマートカード市場の動向と洞察

アジア新興国における非接触型EMVへの移行

2024年、バングラデシュとネパールが、認証サイクルの短縮と発行体のコスト削減を実現するEMVレベル3テストラボを現地に設置したことで、ロールアウトの勢いが加速。中国では非接触型トランザクションが年間37%増加し、インドでは発行件数が42%増加しました。この数字はタップ・ツー・ペイの主流化を反映したもので、端末のアップグレードに対応可能な基盤があることを裏付けています。銀行は、過密な小売市場において、非接触型カード発行は顧客維持のテコになると考えており、加盟店は、スループットを向上させるチェックアウトの高速化から利益を得ています。EMV対応カードはすでに世界の発行枚数の70%を占めており、アジアの発行会社はデュアル・インターフェース・ポートフォリオに直接移行できる立場にあります。したがって、当面の売上成長は、交通機関の発券や少額のオフライン決済などの付加価値サービスをサポートできる安全なマイクロコントローラカードに偏る。

EUとGCCの国民eIDとデジタル・ヘルス・カードの展開

2024年5月にEUデジタルID規則が施行されると、加盟国は物理的クレデンシャルとモバイル・クレデンシャルを並行して提供することが義務付けられ、高セキュリティのポリカーボネート・カードに対する需要が維持されます。GCC諸国もヘルスケア提供や国境管理の枠組みを近代化する中で、同様の道を歩んでいます。CoreLamのようなポリカーボネート製インレイは、現在20以上の国家プログラムに導入されています。メーカーは、パーソナライゼーション、キー管理、セキュアなアプレットローディングが可能な垂直統合型のプレーヤーに有利な複数年の供給契約から利益を得ています。ウォレットの普及には時間がかかるため、物理的なeIDの発行は強制的な予備手段であり続け、移行期間中の基本単位数量を固定します。

トークン化されたバーチャル・カードの台頭による物理的需要の減少

仮想カード取引は2027年までに4倍の1,210億件以上になると予測されており、Mastercardは2030年までに欧州で100%のeコマース・トークナイゼーションを目標としています。このシフトは、発行体の予算をデジタル・エンゲージメントに振り向け、価値の低いデビット・ポートフォリオの交換サイクルを縮小します。物理的なカードは、対面での受け入れやオフラインでのフォールバックに不可欠であることに変わりはないが、成熟市場ではウォレットのシェアが仮想通貨に傾き、販売枚数の伸びを鈍らせる可能性があります。

セグメント分析

非接触型カードは、2024年のスマートカード市場規模の54%を占め、日常的な決済における事実上のフォームファクターとしての地位を再確認しています。デュアルインターフェースの発行枚数はCAGR 8.7%で増加しており、これは発行会社がタップ・トゥ・ペイ機能を損なうことなく、従来のコンタクト専用端末との下位互換性を求めているためです。EMV C-8ユニバーサル・カーネルのようなイノベーションは、端末認証の複雑さを軽減し、受け入れ拡大を促進します。これと並行して、インフィニオンのチップセットの改良は、トランザクション時間を短縮し、高スループットの小売環境におけるユーザーエクスペリエンスを向上させます。

接触型カードに対する発行者の意欲は、物理的インターフェイスがリレー攻撃に対するセキュリティー層を追加する政府機関や防衛分野で根強いです。ハイブリッド・カードは、単一の基板上に複数の技術を組み込んだもので、論理的アクセスと物理的アクセスの融合というニッチな企業要件を満たします。したがって、競合の構図は、単なるインターフェイス・タイプから、バイオメトリクス・マッチ・オン・カードや発行後のパーソナライゼーションといった付加価値機能へとシフトしています。

マイクロコントローラカードは2024年にスマートカード市場シェアの62%を占めたが、これはペイメント、テレコム、アイデンティティの使用事例における汎用性を反映しています。一方、セキュアエレメントカードは、eIDやデジタルウォレットのエコシステムにおける暗号化要件の高まりにより、CAGR 10.2%で拡大しています。SECORA Pay Bioのターンキー・プラットフォームは、センサーの統合とセキュア・エレメントをどのようにバンドルすれば、材料費と市場投入までの時間を短縮できるかを例証しています。

メモリー・オンリーのカードは、コスト感覚が処理ニーズを上回る大量輸送やプリペイド・ギフト・アプリケーションに依然として適しています。NXPのMOB10のような超薄型モジュールは、曲げ応力に対する耐久性を向上させることで、新しいパスポート・アプリケーションを解放します。全体として、セキュアエレメントへの製品ミックスシフトは、コモンクライテリア認定製品ラインを持つ半導体サプライヤーに有利であり、市場競争において技術主導の堀を維持しています。

地域分析

2024年のスマートカード市場は、急速なEMV普及と国民ID発行に支えられ、アジアが44%の収益シェアでリード。中国では、QR決済エコシステムとの共存にもかかわらず、非接触トランザクションが前年比37%増となりました。インドでは、農村部でのインフラ格差が本格的な普及を妨げているもの、非接触型カード発行枚数は42%の伸びを記録しました。日本は、クレジットカード詐欺の30%急増に対応するため、バイオメトリクス決済カードを試験的に導入しており、2028年までに非接触決済額は8,700億米ドルに達すると予想しています。

欧州は金額で2位を占めています。eIDAS-2.0の義務化は物理的およびデジタルIDの需要を促進し、北欧の企業はFIDO2ハードウェア・キーを開拓しています。GDPRに関連した複雑さが、複数国にまたがる発行プラットフォームを遅らせ、発行者を国内でホストされるパーソナライゼーションセンターへと向かわせる。Mastercardは2030年までに完全なトークン化を実現するというコミットメントを掲げており、デジタル・クレデンシャルへの移行が徐々に進んでいることを示しています。

アフリカはCAGR 9.3%で最も急成長している地域です。モバイルマネーサービスは2024年に1兆6,800億米ドルの取引を処理し、付随するデビットカードの需要を喚起します。南アフリカのカード決済は2025年に1,580億米ドルを超え、エジプトは2030年までに1,040億米ドルのデジタル決済を目標としています。オレンジMEAとマスターカードなどの戦略的提携は、2025年までに4,000万人のユーザーの決済をデジタル化することを目指しています。北米はデジタル詐欺の軽減を重視し、南米はSIMの拡大から恩恵を受け、オーストラリアは2025-2028年のセキュリティロードマップでトークン化を優先している(visa.com.au)。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 新興アジア経済における非接触型EMVへの移行

- EUおよびGCCの国民eIDおよびデジタル健康カードの展開

- プリペイドSIMの拡大により、ラテンアメリカにおけるセキュアエレメントの普及が進む

- EU eIDAS-2.0デジタルウォレット規制の導入

- 持続可能性を重視したリサイクルカードとバイオプラスチックカードへの移行

- 北欧における生体認証FIDO2オンカード認証の普及

- 市場抑制要因

- トークン化された仮想カードの台頭により物理的な需要が減少

- MCUサプライチェーンの不安定性への対応

- GDPRによる越境発行プラットフォームの遅延

- CNPチャネルへの不正行為の移行によりNAカードのアップグレードが減少

- サプライチェーン分析

- 規制とテクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- ベンダーポジショニング分析

- 投資分析

第5章 市場規模と成長予測

- インターフェースタイプ別

- 接触

- 非接触

- デュアルインターフェース

- ハイブリッド

- カードチップの種類別

- メモリ

- マイクロコントローラ

- セキュアエレメント/システムオンカード

- 素材別

- PVC

- ポリカーボネート(PC)

- ABS

- PETGとバイオベースプラスチック

- 金属および複合材料

- 機能/用途別

- 支払いと銀行

- 識別とeID

- アクセス制御と物理的セキュリティ

- 通信とSIM

- 交通チケット

- ヘルスケアと保険

- 小売とロイヤルティ

- エンドユーザー業界別

- BFSI

- ITおよび通信

- 政府および公共部門

- 運輸・物流

- ヘルスケア

- 小売・ホスピタリティ

- 教育その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東

- GCC

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- ケニア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- Vendor Positioning Analysis

- 企業プロファイル

- Thales Group(Gemalto)

- IDEMIA

- Giesecke and Devrient GmbH

- Infineon Technologies AG

- HID Global(Assa Abloy AB)

- NXP Semiconductors N.V.

- CPI Card Group Inc.

- Watchdata Technologies

- Bundesdruckerei GmbH

- Fingerprint Cards AB

- Samsung Electronics Co., Ltd.

- KONA I Co., Ltd.

- CardLogix Corporation

- IntelCav

- Secura Key

- Alioth LLC

- Eastcompeace Technology Co., Ltd.

- American Banknote Corporation(ABCorp)

- Paragon ID(ASK)

- Shenzhen Hengbao Co., Ltd.

- VALID S.A.