|

|

市場調査レポート

商品コード

1190446

受託研究機関市場- 成長、動向、予測(2023年-2028年)Contract Research Organization Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 受託研究機関市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年01月18日

発行: Mordor Intelligence

ページ情報: 英文 115 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

受託研究機関市場は、2021年に440億4,976万米ドルとされました。

2027年には661億681万米ドルの収益が見込まれ、予測期間のCAGRは7.0%で成長すると予測されています。

SARS-CoV2ウイルスに対する効果的な治療薬やワクチンを開発するための臨床試験が進行しているため、COVID-19の大流行が受託研究機関市場に与える影響は大きいです。例えば、2021年1月、ICON PLCは、ファイザー社およびバイオNTech社の治験用COVID-19ワクチンプログラムの開発のための臨床試験サービスを提供するために、ファイザー社およびバイオNTech社と協力することを発表しました。このプログラムの一環として、アイコンは欧州、南アフリカ、米国、ラテンアメリカの153以上の施設で、臨床試験研究に参加する44,000人の被験者募集に取り組みました。また、治験施設でのトレーニング、文書管理、患者さんのインフォームド・コンセントの審査に関する業務支援も行いました。アイコンは、ほとんどの国でeConsentを調整し、臨床供給管理サービスも支援しました。2020年7月、IQVIAとアストラゼネカは、COVID-19ワクチン、治療薬、診断薬の開発、製造、流通に焦点を当てた米国政府の「ワープスピードプロジェクト」の一環として、アストラゼネカのCOVID-19ワクチンの開発支援に協力しました。このように、COVID-19に対するワクチン開発に注目が集まっているため、臨床試験が増加しており、予測期間中に受託研究機関市場を押し上げると予想されています。

受託研究機関は、製薬、バイオテクノロジー、医療機器業界をサポートしています。市場の成長は、研究開発費の増加、研究開発活動のアウトソーシングの増加、臨床試験数の増加などに起因すると考えられます。製薬会社はあらゆる方向から財政的な負担を強いられており、効率性が最も重要な要素と考えられています。ジェネリック医薬品の競合を引き起こす特許切れや、規制当局からの厳しい要求が、製薬会社の収益に影響を与え続けています。

米国研究製薬工業協会(PhRMA)によると、PhRMA加盟企業は2019年、研究開発活動に830億米ドル近くを投資していました。さらに、PhRMA, 2020によると、COVID-19を含む様々な疾患に対して、260以上のワクチンがバイオ医薬品会社によってパイプラインにあります。United Kingdom Parliament, 2021の発表記事によると、研究開発への総支出は371億ユーロであり、United Kingdomにおける2018年のGDPの1.7%に相当する1人当たり558ユーロを占めています。したがって、開発中の治療薬のパイプラインを持つ研究開発活動への強力な投資により、アウトソーシングサービスは成長を示し、予測期間中のCRO市場の成長につながると予想されます。

また、CROが提供するサービス数の増加や、共同研究の動向も市場の成長を後押ししています。例えば、PPD Inc.は2020年10月、中国・蘇州に多目的臨床研究所を新設し、医薬品開発の全フェーズにおける臨床試験向けのバイオ分析、バイオマーカー、ワクチンサービスを提供することで事業拡大を発表しています。これらのことから、同市場は予測期間中に大きな成長を遂げると予想されます。

受託研究機関の市場動向

開発初期段階のサービスセグメントが予測期間中に力強い成長を遂げる見通し

特許切れが相次ぐ中、ジェネリック医薬品との競争は激化し、製薬会社はジェネリック医薬品による収入減を補う必要に迫られています。医薬品分子の複雑化と規制要件の厳格化により、研究開発コストが増加しています。創薬・開発プロセスはますます複雑化しています。製薬会社は、この複雑さに対処し、業務を合理化するために、医薬品開発の初期プロセスをアウトソーシングしています。また、大手CROは初期開発分野で大きな専門性を身につけており、CROはこの専門性を活かして高効率で正確な初期開発サービスを提供しています。また、CROは、中小企業が多額の設備投資をすることなく、複雑な医薬品開発プロセスに参入することを可能にしています。こうした理由から、初期段階開発サービス分野は力強い成長を記録するものと思われます。

さらに、clinical trials.govによると、2020年3月現在、がん領域の早期開発段階では、全世界で1,058件近くの臨床試験が実施されているとのことです。また、2020年11月には、パレクセル・インターナショナルが、ドイツのベルリンにあるパレクセル社の早期臨床ユニット(EPCU)と、ハンブルク・エッペンドルフ大学医療センター(英国)にあるフルサービスCROのクリニカル・トライアル・センター(CTC)ノースと戦略提携し、COVID-19の流行時の初期臨床試験の需要増に対応しています。したがって、このような要因は、予測期間にわたって早期開発サービスセグメントを後押しすると予想されます。

北米が最大の市場シェアを獲得し、予測期間中もその優位性を維持すると予想される

償還シナリオの変化やジェネリック医薬品との競争による価格圧力が、大手製薬会社の研究開発や臨床試験のアウトソーシングを引き起こし、北米におけるCROサービスの成長を補完しています。製薬会社による新規治療薬開発のための研究開発投資の増加は、同地域の市場成長を促進しています。2020年10月、FDAは「Orphan Products Grants Program」を通じて、アカデミアや業界関係者による臨床試験の資金として、4年間で1600万米ドル相当の助成金を新たに6件授与しました。このプログラムは、希少疾病の治療における治療薬の開発を進めることを目的としています。

また、米国の「Research and Development Funding and Performance:Fact Sheet, 2020によると、2018年の米国における研究開発費は5800億米ドルと推定され、そのうち基礎研究に965億米ドル、応用研究に1150億米ドル、開発部門に3685億米ドルが投資されています。この地域における主要プレイヤーの存在と、これらの企業による戦略的なコラボレーションが、市場の成長を促進しています。例えば、2021年2月、Parexel InternationalはNeogenomicsと提携し、Neogenomicsのリアルワールドゲノミクスデータをオンコロジー臨床試験に適用できるようにすることで、患者マッチングの効率化と試験デザイン、サイト選択、臨床開発、トランスレーショナル研究の最適化につなげました。このように、高い研究開発投資と製品ポートフォリオの拡大に向けた主要企業の取り組みが新薬開発を後押しし、臨床試験や医薬品開発のアウトソーシングサービスに対する需要が高まると予想されます。したがって、これらの要因が北米の受託研究機関市場の成長を後押しすると期待されます。

受託研究機関市場の競合分析

受託研究機関市場は競争が激しく、多くのプレーヤーが存在します。しかし、少数の大規模なプレーヤーが世界的に市場の主要なシェアを支配しています。残りの市場シェアは、いくつかのローカルプレーヤーやニッチプレーヤーが存在するため、大きく断片化されています。IQVIA、ICON PLC、Charles River Laboratories、Envigo、PPD Inc.などの企業が、開発業務受託機関市場をリードしています。市場の主要企業は膨大な量のデータを蓄積し、市場での競争力を獲得するために活用しています。さらに、主要なプレーヤーは、市場での地位を確保するために戦略的提携に関与しています。例えば、2020年9月、PPD Inc.は、PPDの製薬およびバイオテクノロジーの顧客のためのループス臨床研究を拡大および強化する戦略で、LUPUS Therapeuticsと協力しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査対象範囲

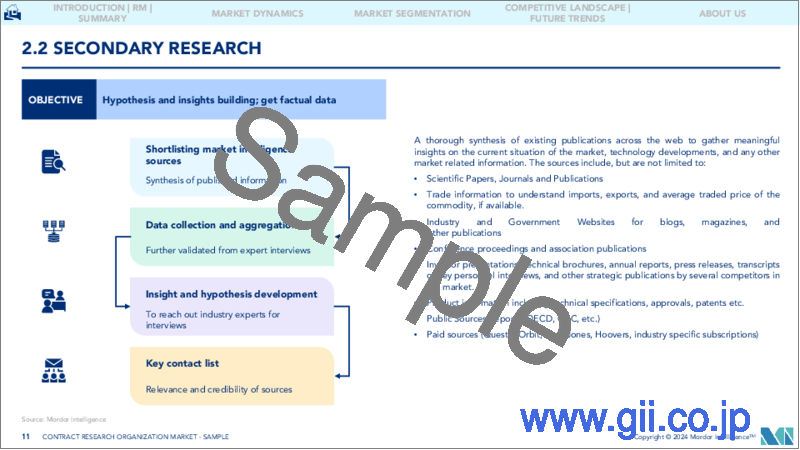

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- バイオ製薬企業による研究開発活動の活発化

- 臨床試験数の増加

- アウトソーシングの動向とCROサービス利用によるコスト削減の進展

- 市場抑制要因

- 熟練した専門家の不足

- ファイブフォース分析分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション(金額ベース市場規模:100万米ドル)

- サービスタイプ別

- 臨床研究サービス

- 第I相臨床研究サービス

- フェーズII臨床研究サービス

- フェーズIII臨床研究サービス

- 第IV相臨床研究サービス

- 開発初期サービス

- ラボラトリーサービス

- コンサルティングサービス

- 臨床研究サービス

- 治療領域別

- オンコロジー

- 感染症

- 中枢神経系(CNS)疾患

- 免疫系疾患

- 循環器系疾患

- 呼吸器系疾患

- 糖尿病

- その他の治療領域

- エンドユーザー別

- 製薬会社、バイオ製薬会社

- 医療機器メーカー

- 学術機関

- 地域別情報

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ地域

- GCC

- 南アフリカ共和国

- その他の中東・アフリカ地域

- 南米地域

- ブラジル

- アルゼンチン

- その他の南米地域

- 北米

第6章 競合情勢

- 企業プロファイル

- Charles River Laboratories

- Envigo

- ICON PLC

- IQVIA

- Laboratoty Corporation of America Holdings(Labcorp)

- MeDPace Holdings Inc.

- PSI CRO AG

- Parexel International

- PPD Inc.

- PRA Health Sciences

- SGS SA

- Syneos Health

- WuXi Pharmatech

- Axcent Advanced Analytics(A3)

- BIO Agile Therapeutics

第7章 市場機会と今後の動向

The contract research organization market was valued at USD 44,049.76 million in 2021. It is expected to witness a revenue of USD 66,106.81 million in 2027, with a CAGR of 7.0% over the forecast period.

The impact of the COVID-19 pandemic on the contract research organization market has been significant due to the ongoing clinical trials to develop effective therapeutics and vaccines against the SARS-CoV2 virus. For instance, in January 2021, ICON PLC announced a collaboration with Pfizer Inc. and BioNTech to provide clinical trial services for the development of Pfizer and BioNTech's investigational COVID-19 vaccine program. As a part of this program, ICON worked in more than 153 sites in Europe, South Africa, United States, and Latin America for the recruitment of 44,000 participants for the clinical trial studies. It also provided site training, document management, and operational support for patient informed consent form review. ICON also coordinated eConsent in most countries and assisted with clinical supply management services. In July 2020, IQVIA and AstraZeneca collaborated to aid in developing AstraZeneca's COVID-19 vaccine as a part of the US government's Operation Warp Speed Project, focused on the development, manufacturing, and distribution of COVID-19 vaccines, therapeutics, and diagnostics. Thus, due to the increased focus on vaccine development against COVID-19, there has been an increase in clinical trials, which is expected to boost the contract research organization market during the forecast period.

Contract research organizations support the pharmaceutical, biotechnology, and medical device industries. The market growth can be attributed to the growing R&D expenditure, increased outsourcing of R&D activities, and a rising number of clinical trials. Efficiency is considered the most crucial factor in light of the financial burden faced by pharmaceutical companies from all directions. Patent expiries leading to generic rivalry and stringent demands from regulators continue to impact the bottom lines of pharmaceutical companies.

According to the Pharmaceutical Research and Manufacturers of America (PhRMA), the PhRMA members had invested nearly USD 83 billion in R&D activities in 2019. Furthermore, more than 260 vaccines are in the pipeline by the biopharmaceutical companies for various diseases, including COVID-19, as per PhRMA, 2020. As per the article published by United Kingdom Parliament, 2021, the total expenditure on R&D was EUR 37.1 billion, which accounted for EUR 558 per head, or the equivalent of 1.7% of GDP in 2018 in United Kingdom. Hence, with strong investments in R&D activities with a pipeline of therapeutics under development, the outsourcing services are expected to witness growth, leading to the growth of the contract research organization market during the forecast period.

The increasing number of services offered by CROs and the rising trend of collaborations are also driving the market's growth. For instance, in October 2020, PPD Inc. announced its expansion by opening a new multipurpose clinical research laboratory in Suzhou, China, to offer bioanalytical, biomarker, and vaccine services for clinical trials across all phases of pharmaceutical development. Thus, due to these factors, the market is expected to register significant growth over the forecast period.

Contract Research Organization Market Trends

The Early-phase Development Services Segment is Poised to Witness Robust Growth During the Forecast Period

With a growing number of patents expiring, the competition from generic counterparts of drugs is increasing, and drug makers are under pressure to replace the revenue loss due to generics. R&D costs are increasing due to the complexity of drug molecules and more stringent regulatory requirements. Drug discovery and development processes are becoming increasingly complex. Pharmaceutical firms are outsourcing early drug development processes to counter this complexity and streamline operations. Additionally, leading CROs have developed significant expertise in the field of early-phase development, and CROs are leveraging this expertise to offer highly efficient and accurate early-phase development services. CROs are also allowing small- and mid-size firms to enter the complex drug development process without significant investment in capital equipment. Due to these reasons, the early-phase development services segment is poised to register robust growth.

Additionally, as per clinical trials.gov, as of March 2020, nearly 1,058 clinical trials were being conducted globally in the early phase development stage in oncology. In November 2020, Parexel International also entered a strategic partnership with Parexel's Early Phase Clinical Unit (EPCU) in Berlin, Germany, and Clinical Trial Center (CTC) North, a full-service CRO located at the University Medical Center Hamburg-Eppendorf (UKE), to meet the increasing demand for the early phase clinical trials during the COVID-19 pandemic. Thus, such factors are expected to boost the early-phase development services segment over the forecast period.

North America Captured the Largest Market Share and is Expected to Retain its Dominance During the Forecast Period

Pricing pressure due to the changing reimbursement scenario and generic competition is causing major pharmaceutical firms to outsource R&D and clinical trials, which is supplementing the growth of CRO services in North America. The increasing R&D investment by pharmaceutical companies in developing novel therapeutics is driving the market's growth in the region. In October 2020, the FDA awarded six new grants worth USD 16 million for four years to fund the clinical trials by academia and industry players through the Orphan Products Grants Program. This program aims to advance the development of therapeutics in the treatment of rare diseases.

Additionally, as per the US Research and Development Funding and Performance: Fact Sheet, 2020, the R&D expenditures in United States in 2018 were estimated at USD 580 billion, of which USD 96.5 billion was invested on basic research, USD 115.0 billion on applied research, and USD 368.5 billion was employed in the development sector. The presence of key players in the region and strategic collaborations by these companies are driving the market's growth. For instance, in February 2021, Parexel International partnered with Neogenomics to enable the application of Neogenomics' real-world genomics data in oncology clinical trials, thereby leading to increased efficiency in patient matching and optimizing trial design, site selection, clinical development, and translational research. Thus, the high R&D investment and initiatives by key players in the expansion of the product portfolio are expected to boost the development of new drugs, thus increasing the demand for outsourcing services for clinical trials and drug development. Thus, these factors are expected to boost the growth of the contract research organization market in North America.

Contract Research Organization Market Competitive Analysis

The contract research organization market is highly competitive and consists of many players. However, few large players control a major share of the market globally. The remaining market share is heavily fragmented, with the presence of several local and niche players. Companies like IQVIA, ICON PLC, Charles River Laboratories, Envigo, and PPD Inc. lead the contract research organization market. The major players in the market accumulated a huge amount of data, which is being employed to attain a competitive edge in the market. Additionally, the key players are involved in strategic alliances to secure a position in the market. For instance, in September 2020, PPD Inc. collaborated with LUPUS Therapeutics with a strategy to expand and enhance lupus clinical research for PPD's pharmaceutical and biotech customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing R&D Activities by Biopharmaceutical Companies

- 4.2.2 Increasing Number of Clinical Trials

- 4.2.3 Growing Trend of Outsourcing and Cost Savings Enabled by Using CRO Services

- 4.3 Market Restraints

- 4.3.1 Shortage of Skilled Professionals

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Service Type

- 5.1.1 Clinical Research Services

- 5.1.1.1 Phase I Clinical Research Services

- 5.1.1.2 Phase II Clinical Research Services

- 5.1.1.3 Phase III Clinical Research Services

- 5.1.1.4 Phase IV Clinical Research Services

- 5.1.2 Early-phase Development Services

- 5.1.3 Laboratory Services

- 5.1.4 Consulting Services

- 5.1.1 Clinical Research Services

- 5.2 By Therapeutic Area

- 5.2.1 Oncology

- 5.2.2 Infectious Diseases

- 5.2.3 Central Nervous System (CNS) Disorders

- 5.2.4 Immunological Disorders

- 5.2.5 Cardiovascular Diseases

- 5.2.6 Respiratory Disorders

- 5.2.7 Diabetes

- 5.2.8 Other Therapeutic Areas

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biopharmaceutical Companies

- 5.3.2 Medical Device Companies

- 5.3.3 Academic Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Charles River Laboratories

- 6.1.2 Envigo

- 6.1.3 ICON PLC

- 6.1.4 IQVIA

- 6.1.5 Laboratoty Corporation of America Holdings (Labcorp)

- 6.1.6 MeDPace Holdings Inc.

- 6.1.7 PSI CRO AG

- 6.1.8 Parexel International

- 6.1.9 PPD Inc.

- 6.1.10 PRA Health Sciences

- 6.1.11 SGS SA

- 6.1.12 Syneos Health

- 6.1.13 WuXi Pharmatech

- 6.1.14 Axcent Advanced Analytics (A3)

- 6.1.15 BIO Agile Therapeutics