|

市場調査レポート

商品コード

1850304

航空機用バッテリー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aircraft Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機用バッテリー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月04日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

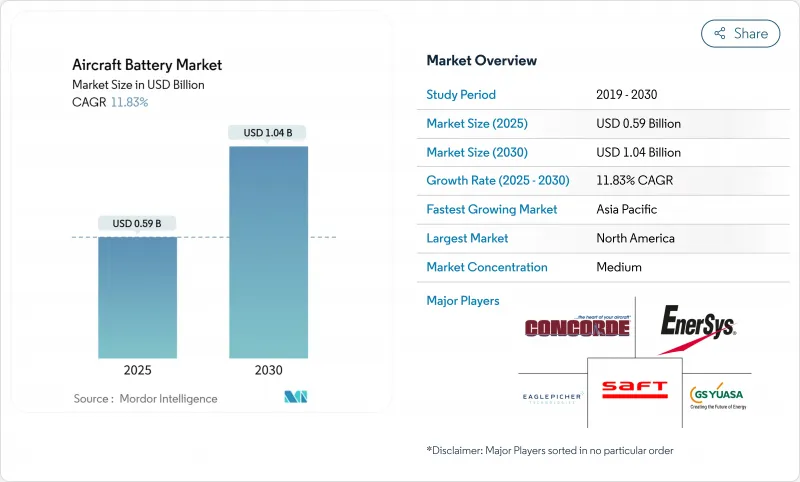

航空機用バッテリーの市場規模は2025年に5億9,000万米ドルと推定され、CAGR 11.83%を反映して2030年には10億4,000万米ドルに達すると予測されます。

航空会社やメーカーが推進力の電動化を急ピッチで進めていること、認証サイクルを短縮する規制上の優遇措置があること、先進的な航空モビリティ・プログラムに多額のベンチャー資金が提供されていることなどが成長の要因です。リチウムベースの化学物質が製品戦略の主流を占め、ソリッドステート・セルとハイレート・セルは実験室規模からパイロット生産へと進展しています。北米がリーダーシップを維持しているが、中国、日本、南米が低高度経済への取り組みを加速させているため、アジア太平洋が最も力強い成長を記録しています。プラットフォーム全体では、eVTOLとハイブリッド・エレクトリック・プログラムがサプライヤーとの関係を再構築しており、自動車用バッテリーのリーダーが、高エネルギー密度と厳格な安全コンプライアンスに報いる航空セグメントに引き込まれています。

世界の航空機用バッテリー市場の動向と洞察

北米のナローボディ・プログラムにおける電動航空機の普及

北米の航空会社は、単通路ジェット機の設計を、空気圧アーキテクチャに代わる電気サブシステムを中心に見直し、離陸時と上昇時のピーク負荷を3倍に高めています。RTX社の1MWモーターのような実証機は、燃料消費を30%削減することを目指しており、高性能バッテリーの研究に共同出資しているClean Aviationイニシアチブに合致しています。航空会社は、メンテナンスコストの削減と炭素コンプライアンスに価値を見いだし、早期の改修に意欲を燃やしています。連邦航空局(FAA)の指導の下、急速充電、ハイサイクルパックを検証できるバッテリーメーカーは、長期供給契約を確保できる立場にあります。

アジアにおける高負荷アビオニクス用リチウムイオン電池へのOEMシフト

中国、日本、韓国のOEMは、ニッケルカドミウムユニットを廃止し、リチウムイオンパックに移行しつつあります。CATLやGotion High-Techのような国内サプライヤーは、すでにそれぞれ500Wh/kgや300Wh/kgに達しており、地域メーカーに先進化学物質への確実なアクセスを与えています。ソフトバンクが全固体プロトタイプで350Wh/kgを報告したことで、競争圧力が強まり、地域的な技術競争に拍車がかかりました。このシフトは、飛行制御コンピュータ、レーダー、および厨房システムに波及し、重量を削減し、追加のペイロードのためのスペースを確保します。

熱暴走事故がワイドボディの採用を遅らせる

2024年、連邦航空局(FAA)は旅客機内で69件のリチウム電池の発煙・発火事故を記録し、大型パックに対する航空会社の警戒を強化しました。EASAは、フラウンホーファーのLOKI-PED試験を委託し、客室とコックピットの火災リスクを定量化しました。規制当局が新たなハンドリング・プロトコルを準備する一方で、無防備なパウチセルが衝突速度で粉々になる可能性があることが調査で明らかになり、堅牢なハウジングが必須となりました。そのため、ワイドボディ・プログラムではレガシー・バッテリー・システムを長く維持することになり、単通路やリージョナル・プラットフォームが電動化されても、台数の伸びは制限されることになります。

セグメント分析

リチウムイオンは2024年の航空機用バッテリー市場シェアの52.88%を占め、これは成熟したサプライチェーンとよく理解された性能エンベロープによるものです。リチウムイオンは、スターター・ジェネレーターやハイブリッド・エレクトリックの推進力としての需要が高まっており、その高い重量エネルギーが設計者に支持されています。シリコンリッチ陽極を含む最近の性能向上は、サイクル寿命を2,000回を超える深放電に押し上げ、航空会社の調達を左右する総所有コスト指標を引き下げています。逆に、ニッケルカドミウムや鉛酸は、極地航路や回転翼ミッションのような低温回復力が重量効率に勝るような過酷な環境では、依然として使用可能です。

その勢いはリチウム硫黄へと移っており、シャトル効果による耐久性のハードルを解決するための共同研究が進むにつれて、2030年まで毎年24.49%の割合で増加すると予測されています。初期の飛行テストでは、軽量ドローンの航続距離が20%向上し、性能の主張が実証されました。米国海軍の資金提供によるナトリウムイオン・ソリューションは、空母運用における熱的に安定した化学物質の将来的なニッチを示しています。これらの開発は競争分野を広げ、小規模な革新的企業が航空業界の厳しい安全規範に最適化されたセル構造のライセンスを取得することを奨励しています。

バックアップと緊急システムは、2024年の航空機用バッテリー市場規模の38.29%を占めています。しかし、eVTOL航空機の推進分野は、CAGR30.04%ですべてのカテゴリーを凌駕しており、ドバイ、ロサンゼルス、シンガポールで都市移動の試験が行われています。パワーエレクトロニクスのムーアの法則的なコスト曲線は、経済的なケースを増幅させ、オペレーターは、200km未満のミッションでは、リージョナル・ターボプロップを下回る座席マイルあたりのコストを予測することができます。

補助動力装置(APU)とアビオニクス・パックは、定期保守を削減し、燃料消費を減少させる軽量なリチウムイオン・フォーマットの恩恵を受ける。BAEシステムズのハイブリッドナローボディ実証機用200kWhパックのような、熱管理ハードウェアと統合された先進的なバッテリーシステムは、モジュール式で交換可能なユニットへのシフトを示唆しています。このアーキテクチャの進化により、航空会社は機体を大幅に改造することなく化学物質をアップグレードすることができ、残存価値を高く保つことができます。

地域分析

インフレ削減法のような連邦政府の政策により、国内のセル生産と電気航空機実証プログラムに資金が回されたため、北米は2024年に30.58%の売上を確保しました。FAAのInnovate28ロードマップは、段階的な統合のマイルストーンを示しており、航空会社は認証された電気またはハイブリッドモデルを中心に機体の更新を計画することができます。しかし、輸入リチウムとレアアースへの材料依存は、長期的な拡大を抑制しかねないサプライチェーン・リスクを露呈しています。

アジア太平洋は、2025~2030年のCAGRが最速の10.14%を記録し、これは中国の低高度経済設計図と製造規模に後押しされたもので、世界のリチウムイオン生産量の約85%を生産しています。日本の全固体リチウムの躍進と韓国の正極の専門知識は、地域の自給自足を強化し、現地OEMが競争力のある価格を確保することを可能にします。インドでは航空産業が好調で、ドローンによる輸送実験も行われています。

欧州は、エアバス、レオナルド、そして密集したティアワン・サプライヤー・ネットワークを基盤として牙城を維持しています。EU電池規制は、リサイクル含有量の閾値とカーボンフットプリントの宣言を義務付け、製品設計を循環型経済原則に向かわせる。クリーンアビエーション(Clean Aviation)の資金枠はハイブリッド車の地域実証試験を加速させ、各国のエネルギー戦略はスカンジナビアからスペインまでのギガファクトリー建設を引き受ける。このようなイニシアティブの収束により、プレミアム価格の持続可能な航空分野における欧州の関連性が確保されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場促進要因

- 北米のナローボディ機プログラムにおけるMore-Electric Aircraft(MEA)アーキテクチャの採用

- アジアにおける高負荷航空電子機器向けOEMのリチウムイオン電池への移行

- 欧州におけるeVTOLエアタクシーの迅速な認証パイプライン

- 軍用無人機の近代化が中東の高率セルを推進

- 政府の政策支援とクリーン航空への資金提供

- 固体電池技術のブレークスルー

- 市場抑制要因

- 熱暴走事故によりワイドボディの採用が遅れている

- 航空宇宙グレードのリチウム硫黄(Li-S)生産能力の不足

- ニッケルとコバルトの価格変動がOEMの利益率を圧迫

- サプライチェーンの脆弱性と地政学的緊張

- バリューチェーン分析

- 規制または技術の見通し

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- バッテリータイプ別

- 鉛蓄電池

- ニッケルカドミウム(NiCd)

- リチウムイオン(Li-ion)

- リチウム硫黄(Li-S)

- 用途別

- 推進

- 補助動力装置(APU)

- 緊急時/バックアップ

- 航空電子機器と飛行制御アクチュエーション

- 先進バッテリーシステム

- 航空機技術

- 伝統的

- より電動化

- ハイブリッド電気

- 完全電動

- 航空機の種類別

- 固定翼

- 商用航空

- ナローボディ機

- ワイドボディ機

- リージョナルジェット

- ビジネスおよび一般航空

- ビジネスジェット

- 軽飛行機

- 軍事航空

- 戦闘機

- 輸送機

- 特殊任務航空機

- 回転翼

- 商用ヘリコプター

- 軍用ヘリコプター

- 無人航空機

- 先進航空モビリティ

- 固定翼

- 電力密度別

- 100Wh/kg未満

- 100~300Wh/kg

- 300Wh/kg以上

- エンドユーザー別

- オリジナル機器製造会社(OEM)

- アフターマーケット

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Saft Groupe SAS

- EnerSys

- EaglePicher Technologies, LLC

- GS Yuasa International Ltd.

- HBL Engineering Limited

- True Blue Power(Mid-Continent Instrument Co., Inc)

- Teledyne Technologies Incorporated

- Sichuan Changhong Battery Co., Ltd.

- Meggitt PLC

- Cella Energy Ltd.

- Kokam Co. Ltd.

- Epsilor-Electric Fuel Ltd.

- Securaplane Technologies Inc.

- Tesla Industries, Inc.

- Concorde Battery Corporation

- InoBat