|

市場調査レポート

商品コード

1272673

農業用ロボット・メカトロニクス市場 - 成長、動向、予測(2023年-2028年)Agricultural Robots and Mechatronics Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 農業用ロボット・メカトロニクス市場 - 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年04月14日

発行: Mordor Intelligence

ページ情報: 英文 210 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の農業用ロボット・メカトロニクス市場は、予測期間中にCAGR 20.4%で成長すると予測されます。

主なハイライト

- ロボティクスは農業革命をもたらすと思われます。しかし、農家、農業ビジネス従事者、消費者がロボット工学とデジタル機械化の力をどのように活用し、この産業の未来を切り開くのか興味深いところです。食料需要の増大と都市化の進展は、世界の農業用ロボット市場の主要な成長要因のひとつです。各国政府は、意識の向上と収量の増加を図るため、世界的に有益な政策をいくつか打ち出しています。例えば、欧州連合は、労働集約的な作業を高度な自動化技術に置き換えるためのプロジェクトに資金を提供しています。これは、農業用ロボット・メカトロニクス市場をある程度牽引すると思われます。

- 移動式ロボットは半熟練労働者を置き換えると思われます。しかし、自動化された農場は決して存在しないです。農家や農場経営者、農学者の人たちが意思決定する必要性は依然としてあります。一方で、機械に向いた農作業もあります。そのため、ハイテク機械に対応するための労働力の質の向上が求められます。日本では、政府が農業用ロボットに多額の資金を投入し、労働者のスキルレベルを高めています。その結果、労働者の給与が上がり、農村部の生活の質も向上します。

- この市場の成長を後押しする主な要因は、労働力不足、人件費の増加、食糧および農業供給に対する需要の増加、作業の効率化、新興技術の採用、完璧な最終結果で人間の生活を容易にするためのさまざまなアプリケーションの研究の増加です。これは、今後数年間の市場の成長を予測させるものです。

農業用ロボット・メカトロニクスの市場動向

労働力不足とコスト高が市場を牽引

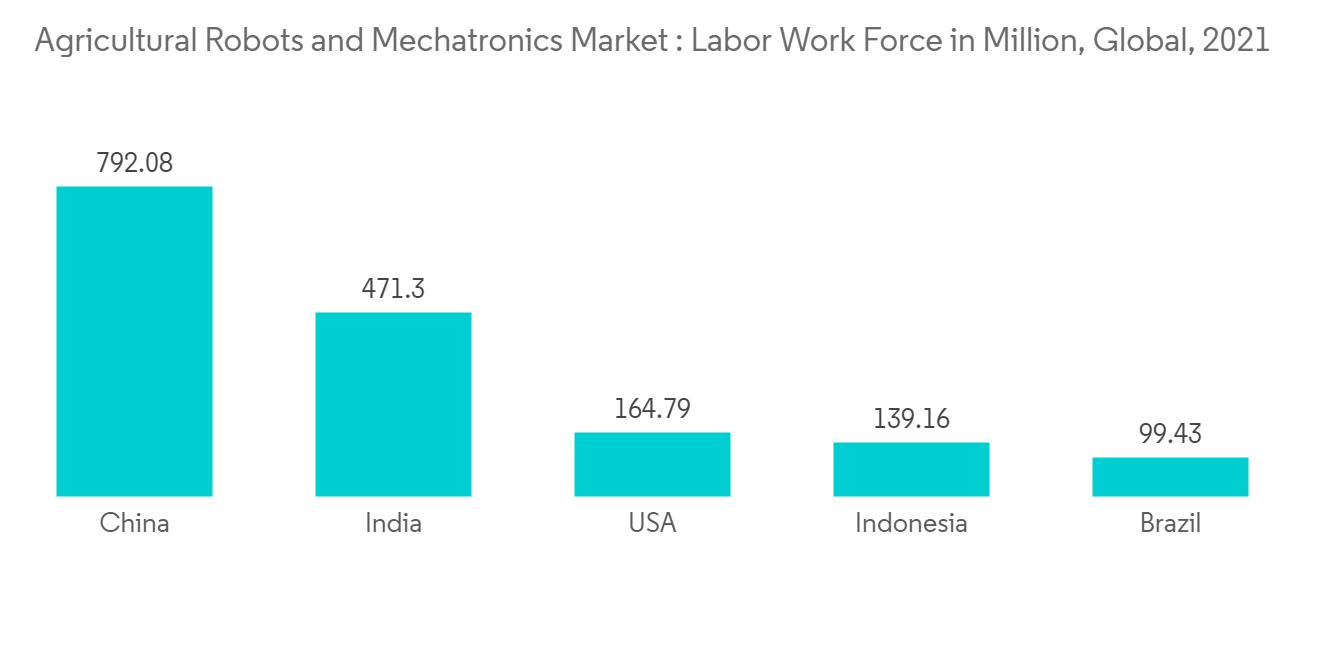

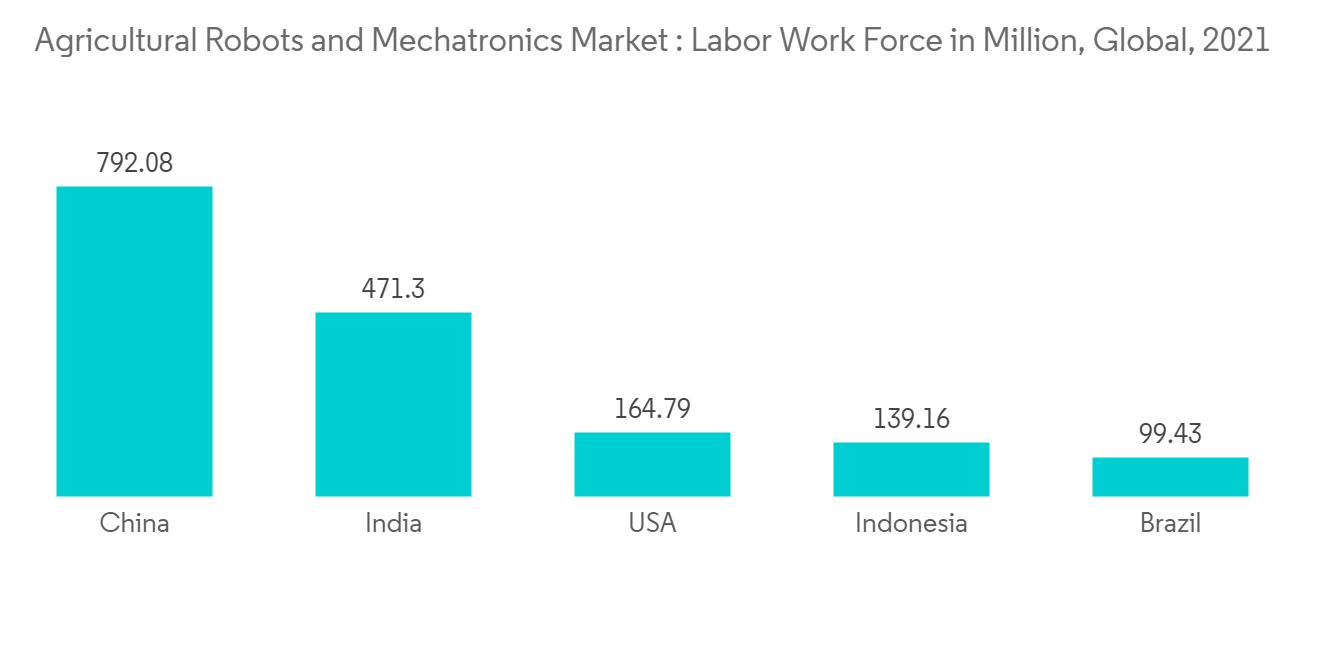

農業用ロボットは、作物の品質と効率を向上させ、手作業への依存を最小限に抑え、全体的な生産性を高めるために用いられる自律型機械です。例えば、園芸や果物の摘み取り作業において、ロボットプラットフォームに乗った作業者は、はしごを使った作業者に比べて2倍の効率で作業ができます。ピッキング作業者の不足により、すでに世界中の果物や野菜の10%以上が畑や果樹園で収穫されないまま放置されています。これはEUの年間消費量に匹敵します。ロボットは、労働力の確保に頻繁に影響を受ける業界にとって有効な解決策となり、現代の労働力においてさまざまな雇用機会を創出することができると思われます。国際労働機関(ILO)によると、労働者に占める農業労働の割合は、発展途上国では81%から48.2%に減少しています。また、先進諸国も例外ではなく、このような大きな減少が見られます。

世界政府サミットは、オリバー・ワイマン社との協力のもと、「農業4.0-農業技術の未来」という報告書を発表しました。この報告書では、こうした課題に対応するには、政府、投資家、革新的な農業技術による協調的な取り組みが必要であるとしています。農業4.0は、もはや水、肥料、農薬を畑全体に均一に散布することに依存しないです。その代わりに、農家や農業経営は、センサー、デバイス、機械、そして情報技術によって運営されるようになります。未来の農業は、ロボット、温度・水分センサー、航空画像、GPS技術などの高度な技術を駆使して行われます。これらの高度なデバイス、精密農業、ロボットシステムにより、農場はより収益性の高い、効率的で安全な、環境に優しいものになるでしょう。これにより、予測期間中の市場の成長が促進されるでしょう。

2022年、BTは、ロボットと自律的なソリューションを推進しながら、コストと労働力を削減する方法でソフトフルーツ農業業界を自動化する斬新な方法を開発するために、農業の自動化と持続可能性と運用効率を促進する新しいロボットプラットフォームと管理システムを発表し、センサー技術を提供して、作物の健康を監視して潜在的な問題を予測して、問題が発生する前に介入し、食糧廃棄とさらに不必要な労働を回避できる農家を助け、今後数年間で市場を促進する機能を提供しています。以上のことから、農業用ロボット・メカトロニクスの市場は、予測期間中に活況を呈すると予想されます。

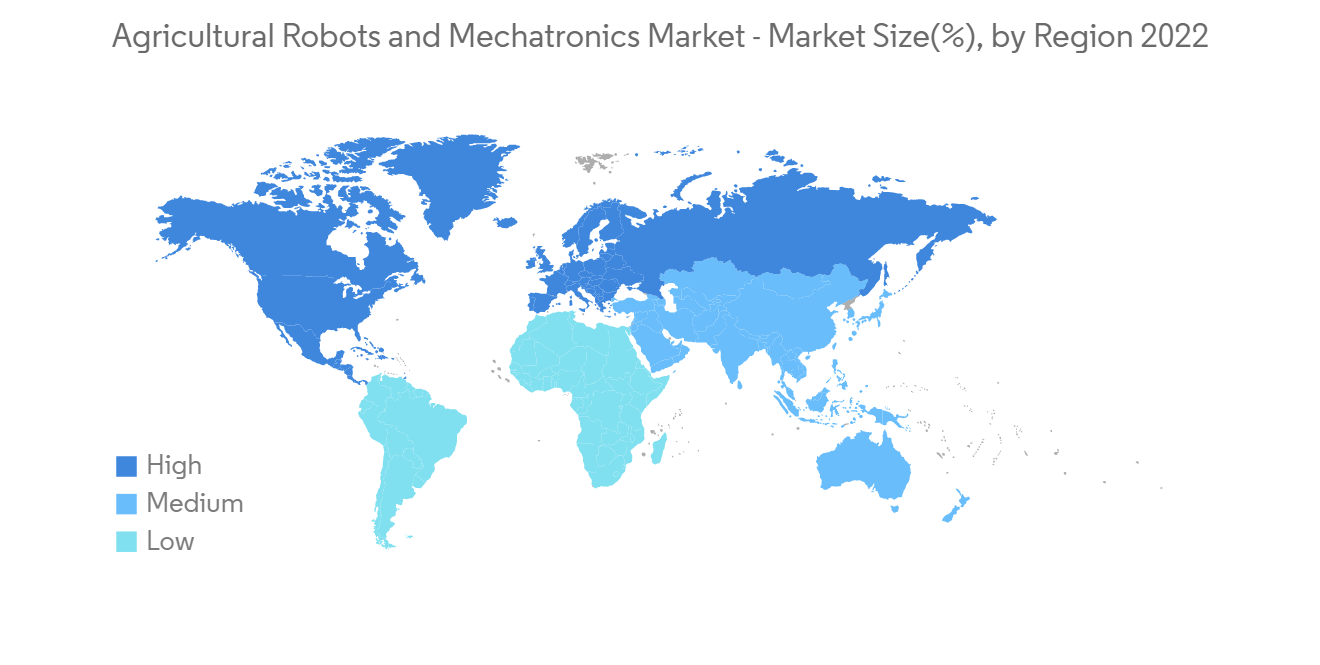

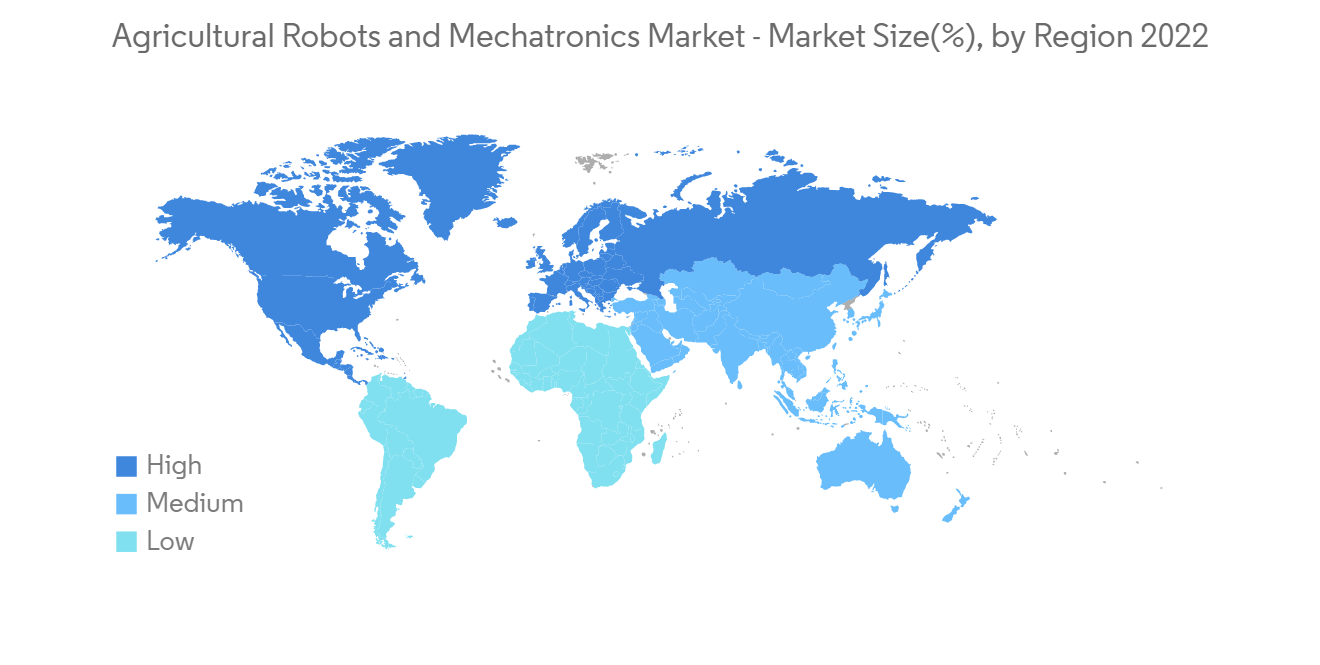

北米が世界市場を席巻

北米がこの地位にあるのは、主に米国のドローン市場の結果です。現在、米国は農業産業で最もドローンを導入している国です。米国ではすでに農薬散布、作物モニタリング、播種、灌漑管理など、さまざまな農作業に農場がドローンを活用しています。ドローンと自律走行車の展開という点では、この分野の最先端を走っています。農業分野では、ロボティクスがますます多くのアプリケーションで活用されています。そのため、技術的な進歩が世界の農業用ロボット市場の成長を促進しています。

ロボット工学は、これまで想像もつかなかった方法で世界を前進させています。過去10年間で、ロボットツールの進歩は侵襲性の低い外科手術を可能にし、探査ロボットは惑星系における人間の存在を高め、ロボット車両は自律的に数百万マイルを走行し、製造ロボットは米国を先進製造業のリーダーとして位置づけています。連邦政府は、将来の労働力ニーズに対応できるよう、STEM教育、トレーニングプログラム、現在の労働者の再教育など、適切な労働力移行を確保することが米国経済全体に大きく影響するため、米国のロボット産業の将来に既得権を有しています。

2022年、ナイオ・テクノロジーは、ロボット工学とAIの最先端技術を組み合わせることで、土壌を尊重し、作業環境を改善し、スマート農業のためのデータを収集する、除草剤に代わる新しい農業ロボット「Orio」を発表しました。Orioは、標準的な3点アタッチメントを持ち、ロボットの後部にあらゆる器具を搭載することもできます。例えば、高精度な播種は、Orioが生産者に提供する追加サービスであり、除草と組み合わせることで、より高い成果を得ることができます。同社は最近、CES 2022でブドウ園ロボット「Ted」を発表しました。

北米では、大規模農業、労働力の減少、農業の生産性向上が市場を牽引する主要因となっています。カナダなどの国では、技術や最新機器の効率的な活用によって達成されるコスト削減が主な促進要因となっており、作物の収量や品質の全体的な向上につながっています。

農業用ロボット・メカトロニクス産業の概要

世界の農業用ロボット・メカトロニクス市場は適度に細分化されており、上位9社で30~35%未満を占めています。一方、それ以外の企業が残りのシェアを占めています。市場の主要企業は、Yamaha Motor Company、GEA Group Aktiengesellschaft、DeLaval Inc.、Dere and Company(米国)、AGCO Corporationなどです。複数の企業が急速に市場での存在感を高めています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 本調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- タイプ

- 自律走行トラクター

- 無人航空機(UAV)

- 搾乳ロボット

- その他のタイプ

- 用途

- 作物生産

- 畜産

- 森林管理

- その他の用途

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- スペイン

- 英国

- フランス

- ドイツ

- ロシア

- イタリア

- その他欧州

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- 中東・アフリカ地域

- 南アフリカ

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- AgEagle Aerial Systems

- Autonomous Solutions(ASI)

- Autonomous Tractor Corporation

- AutoProbe Technologies

- BouMatic Robotics

- Clearpath Robotics Inc.

- Conic System

- Tetra Laval(DeLaval Inc.)

- EcoRobotix Ltd

- GEA Group Aktiengesellschaft

- Harvest Automation Inc.

- Deere & Company

- Lely Industries N.V.

- Naio Technologies

- PrecisionHawk

- A/S S. A. Christensen & Co.(SAC Milking)

- SenseFly

- Vision Robotics Corporation

- Vitirover

- Wall-Ye

- Yamaha Motor Co. Ltd

第7章 市場機会および将来動向

The global agricultural robots and mechatronics market are anticipated to grow at a CAGR of 20.4% during the forecast period.

Key Highlights

- Robotics will bring the agricultural revolution. However, it would be interesting to see how the farmers, agri-businessmen, and consumers will utilize the power of robotics and digital mechanization to shape the future of this industry. The growing demand for food and increasing urbanization are among the major growth drivers of the global agricultural robot market. Governments have launched several beneficial policies globally to improve awareness and enhance yields. For instance, the European Union has funded projects to replace labor-intensive tasks with advanced automated technologies. This is likely to drive the agricultural robots and mechatronics market to an extent.

- Mobile robots will replace semi-skilled workers. However, there is never going to be an automated farm. There is still a need for farmers, farm managers, and agronomists people to make decisions. On the other hand, some agricultural tasks are better suited for machines. So we will require an increased workforce quality to deal with high-tech machines. In Japan, The government there is investing a lot of money in agricultural robotics to increase the workers' skill level. This, in turn, increases the workers' pay and the quality of life in rural areas.

- The key factors propelling this market's growth are labor shortage, increasing labor cost, increasing demand for food and agriculture supply, the efficiency of work, adoption of emerging technologies, and increasing research on different applications to make human life easier with perfect end results. This will anticipate the growth of the market during the coming years.

Agricultural Robots and Mechatronics Market Trends

Shortage and Cost of Labor is Driving the Market

Agricultural robots are autonomous machines used to improve crop quality and efficiency, minimize reliance on manual labor and increase overall productivity. For example, workers on robotic platforms in horticulture and fruit picking are twice as efficient as workers using ladders. The shortage of pickers is already causing more than 10% of fruits and vegetables worldwide to be left unpicked in fields and orchards. This is equivalent to annual consumption in the European Union. Robots may be a viable solution for an industry frequently impacted by labor availability, and they will create different employment opportunities in a modern workforce. According to International Labor Organization(ILO), the agricultural labor percentage of the workforce declined from 81% to 48.2% in developing countries. Also, developed countries are not an exception in such a huge decline.

The World Government Summit launched a report called Agriculture 4.0 - The Future of Farming Technology in collaboration with Oliver Wyman. The report states that meeting these challenges will require a concerted effort by governments, investors, and innovative agricultural technologies. Agriculture 4.0 will no longer depend on applying water, fertilizers, and pesticides uniformly across entire fields. Instead, farmers, agricultural operations will run on sensors, devices, machines, and information technology. Future agriculture will use sophisticated technologies such as robots, temperature and moisture sensors, aerial images, and GPS technology. These advanced devices, precision agriculture, and robotic systems will allow farms to be more profitable, efficient, safe, and environmentally friendly. This will boost the growth of the market during the forecast period.

In 2022, BT unveiled a new robotics platform and management system to automate the agricultural industry and drive sustainability and operational efficiencies to develop novel ways of automating the soft fruit farming industry in ways that will cut costs and labor while promoting robotic and autonomous solutions and offers features sensor technology to monitor crop health and forecast potential issues, helping farmers to intervene before a problem arises, and avoid food waste and unnecessary labor further down the line and which will drive the market in coming years. Owing to the above factors, the market for agricultural robotics and mechatronics is expected to boom during the forecast period.

North America Dominates the Global Market

North America has this position mostly as a result of the US drone market. Currently, the United States is the country that has adopted drones the most in the agricultural industry. Farms are already using drones in the United States for various agricultural tasks, such as pesticide spraying, crop monitoring, sowing, irrigation control, and more. In terms of the deployment of drones and autonomous cars, they are at the forefront of the sector. Robotics is being used in an increasing number of applications in the agricultural space. As such, technological advances are driving growth in the global agricultural robot market.

Robotics is driving the world forward in ways previously unimaginable. In the past decade, advances in robotic tools have enabled less invasive surgical procedures, exploration robots have enhanced human presence in planetary systems, robotic vehicles have autonomously driven millions of miles, and manufacturing robotics have positioned the United States as a leader in advanced manufacturing. The Federal government has a vested interest in the future of the US robotics industry as it will greatly affect the overall US economy to ensure proper workforce transition, including in STEM education, training programs, and re-skilling current workers, so they are prepared to meet future workforce needs.

In 2022, Naio Technologies introduced a new Orio agricultural robot alternative to herbicides that respects soils, improves working conditions, and collects data for smart farming by combining high-edge technology in robotics and AI. Orio can also have a standard three-point attachment and carry any implement at the robot's rear. For instance, high-accuracy seeding is an additional service Orio provides to growers allowing enhanced results when combined with weeding. The company recently released its vineyard robot Ted during CES 2022.

The major factors driving the market studied in North America are large-scale farming operations, the decline in labor, and the need to enhance the productivity of agriculture. In countries like Canada, major driving factors are cost savings achieved through efficient utilization of technology and modern equipment, leading to an overall increase in yield and quality of the crops.

Agricultural Robots and Mechatronics Industry Overview

The global agricultural robots and mechatronics market is moderately fragmented, with the top nine companies accounting for less than 30-35%. In contrast, the rest of the companies account for the remaining share. The major players in the market are Yamaha Motor Company, GEA Group Aktiengesellschaft, DeLaval Inc., Deere and Company (US), and AGCO Corporation, among others. Several companies are rapidly expanding their market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Autonomous Tractors

- 5.1.2 Unmanned Aerial Vehicles (UAVs)

- 5.1.3 Milking Robots

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Crop Production

- 5.2.2 Animal Husbandry

- 5.2.3 Forest Control

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AgEagle Aerial Systems

- 6.3.2 Autonomous Solutions (ASI)

- 6.3.3 Autonomous Tractor Corporation

- 6.3.4 AutoProbe Technologies

- 6.3.5 BouMatic Robotics

- 6.3.6 Clearpath Robotics Inc.

- 6.3.7 Conic System

- 6.3.8 Tetra Laval(DeLaval Inc.)

- 6.3.9 EcoRobotix Ltd

- 6.3.10 GEA Group Aktiengesellschaft

- 6.3.11 Harvest Automation Inc.

- 6.3.12 Deere & Company

- 6.3.13 Lely Industries N.V.

- 6.3.14 Naio Technologies

- 6.3.15 PrecisionHawk

- 6.3.16 A/S S. A. Christensen & Co. (SAC Milking)

- 6.3.17 SenseFly

- 6.3.18 Vision Robotics Corporation

- 6.3.19 Vitirover

- 6.3.20 Wall-Ye

- 6.3.21 Yamaha Motor Co. Ltd