|

|

市場調査レポート

商品コード

1323867

農業用ロボットの世界市場:タイプ別(無人航空機/ドローン、搾乳ロボット、無人トラクター、自動収穫システム)、農業環境別(屋内・屋外)、最終用途別、地域別-2028年までの予測Agriculture Robots Market by Type (Unmanned Aerial Vehicles/Drones, Milking Robots, Driverless Tractors, Automated Harvesting Systems), Farming Environment (Indoor and Outdoor), End-use Application and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 農業用ロボットの世界市場:タイプ別(無人航空機/ドローン、搾乳ロボット、無人トラクター、自動収穫システム)、農業環境別(屋内・屋外)、最終用途別、地域別-2028年までの予測 |

|

出版日: 2023年07月26日

発行: MarketsandMarkets

ページ情報: 英文 315 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

農業用ロボットの市場規模は、2023年の135億米ドルから2028年には401億米ドルに成長すると予測され、予測期間中のCAGRは24.3%と見込まれています。

デジタル農業に対する意識の高まりが、農業用ロボットの普及を後押ししています。これは、農家が農作業の近代化と最適化における先進技術の変革の可能性を認識しているためです。デジタル農業には、ロボット工学、人工知能、データ分析、モノのインターネット(IoT)などの最先端技術を従来の農法に統合することが含まれ、効率性、持続可能性、生産性を向上させる新たな可能性を引き出しています。農業用ロボット導入の主な原動力のひとつは、ロボットがもたらすメリットへの理解が高まっていることです。認知度が高まるにつれ、農家はこれらのロボットが労働集約的な作業を自動化し、運用コストを削減し、農場管理全体を強化できることを認識しつつあります。高度なセンサーとAIアルゴリズムを活用することで、農業用ロボットは土壌の健康状態、作物の状態、天候パターンに関するデータをリアルタイムで収集し、データ主導の意思決定と精密農業の実践を可能にします。

農業用ロボットは、屋外農業に革命をもたらし、農業の実施方法を変革する数多くの利点を提供します。最先端技術を搭載したこれらの高度な機械は、農家が直面する重大な課題に対処し、屋外農業の生産性、持続可能性、効率を高める態勢を整えています。農業用ロボットは、その高度なセンサー、GPS技術、人工知能機能により、比類のない精度で作業を行うことができます。種まき、肥料散布、農薬散布を正確に行い、無駄を省き、資源利用を最適化することができます。精密農業は、作物が必要な場所に必要な量の投入物を正確に受け取ることを保証し、収穫量の増加とコスト削減につながります。

農業用ロボットは、効率性と生産性を高めることで農産物に革命をもたらすと思われます。これらのロボットは、作物の植え付け、除草、収穫、モニタリングなど、さまざまな作業を自律的に行うことができます。正確なデータ収集と分析により、資源の利用を最適化し、無駄を省くことができます。さらに、ロボットは24時間365日稼働し、悪条件下でもタイムリーな行動を保証します。その安定したパフォーマンスにより、作物の品質と収量が向上します。手作業を最小限に抑えることで、農家は時間とコストを節約し、収益性を高めることができます。さらに、農業用ロボットは、化学薬品の使用を減らし、環境への影響を軽減することで、持続可能な慣行を促進します。全体として、これらの技術的進歩は、農家が高まる需要に対応し、より食糧安全で持続可能な未来を確保するための力となっています。

欧州の農業用ロボット市場は、高い専門性と技術導入を示しています。しかし、大規模農場がなく、投入コストがやや高いため、米国市場と比較すると限界的な不利が生じます。欧州では現在、自律型収穫システムや無人トラクターの導入が初期段階にあるため、欧州の農業用ロボット市場は近い将来に大幅な成長を遂げると予測されます。欧州農業機械メーカー協会委員会(CEMA)によると、欧州の農業機械市場は現在成長しており、これが農業用ロボット市場の成長にも拍車をかけると予想されています。欧州における農業用ロボット市場の成長に寄与する主な要因としては、機械化による生産性の向上、サプライチェーンの最適化、熟練労働者の不足による人件費の増加などが挙げられます。政府の支援に関する不確実性、低農家所得、ロシアからの輸入制限が主な阻害要因です。

当レポートでは、世界の農業用ロボット市場について調査し、市場の概要とともに、タイプ別、農業環境別、最終用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- 規制の枠組み

- 特許分析

- バリューチェーン分析

- 農業用ロボット市場のバイヤーに影響を与える動向/混乱

- 市場エコシステム

- 貿易分析

- 主要な会議とイベント

- ケーススタディ分析

- 技術分析

- ポーターのファイブフォース分析

- 購入プロセスにおける主要な利害関係者

- 購入基準

- 平均販売価格(ASP)分析

第7章 農業用ロボット市場、タイプ別

- イントロダクション

- 無人航空機/ドローン

- 搾乳ロボット

- 無人トラクター

- 自動収穫システム

- その他

第8章 農業用ロボット市場、用途別

- イントロダクション

- 収穫管理

- 畑作

- 乳製品・家畜管理

- 土壌・灌漑管理

- その他

第9章 農業用ロボット市場、最終用途別

- イントロダクション

- 農産物

- 乳製品と家畜

第10章 農業用ロボット市場、農業環境別

- イントロダクション

- 屋外

- 屋内

第11章 農業用ロボット市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 市場シェア分析、2022年

- 主要参入企業が採用した戦略

- 主要企業の収益分析

- 企業評価クアドラント(主要企業)

- 農業用ロボット市場:スタートアップ/中小企業向けの評価クアドラント、2022年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- DEERE & COMPANY

- DJI

- CNH INDUSTRIAL NV

- AGCO CORPORATION

- DELAVAL

- TRIMBLE INC.

- BOUMATIC ROBOTICS

- LELY

- AGJUNCTION

- AGEAGLE AERIAL SYSTEMS INC.

- YANMAR CO.

- DEEPFIELD ROBOTICS

- ECOROBOTIX

- HARVEST AUTOMATION

- NAIO TECHNOLOGIES

- その他の企業

- ROBOTICS PLUS

- KUBOTA CORPORATION

- HARVEST CROO ROBOTICS

- AUTONOMOUS TRACTOR CORPORATION

- CLEARPATH ROBOTICS, INC.

- DRONEDEPLOY

- AGROBOTS

- FFROBOTICS

- FULLWOOD JOZ

- MONARCH TRACTOR

第14章 隣接市場および関連市場

第15章 付録

The agricultural robots market is projected to grow from USD 13.5 Billion in 2023 to USD 40.1 Billion by 2028, at a CAGR of 24.3% during the forecast period. Increased awareness about digital agriculture is driving the widespread usage of agriculture robots as farmers recognize the transformative potential of advanced technologies in modernizing and optimizing farming practices. Digital agriculture encompasses the integration of cutting-edge technologies such as robotics, artificial intelligence, data analytics, and the Internet of Things (IoT) into traditional farming methods, unlocking new possibilities for increased efficiency, sustainability, and productivity. One of the key drivers of agriculture robot adoption is the growing understanding of the benefits they offer. With increased awareness, farmers are recognizing that these robots can automate labor-intensive tasks, reduce operational costs, and enhance overall farm management. By leveraging advanced sensors and AI algorithms, agriculture robots can collect real-time data on soil health, crop conditions, and weather patterns, enabling data-driven decision-making and precision farming practices.

"The Outdoor segment is expected to account for the largest share in 2023."

Agriculture robots are set to revolutionize outdoor farming applications, offering numerous benefits that will transform the way farming is conducted. These advanced machines, equipped with cutting-edge technologies, are poised to address critical challenges faced by farmers and enhance productivity, sustainability, and efficiency in outdoor farming. Agriculture robots can perform tasks with unmatched precision, thanks to their advanced sensors, GPS technology, and artificial intelligence capabilities. They can accurately plant seeds, apply fertilizers, and dispense pesticides, reducing waste and optimizing resource usage. Precision farming ensures that crops receive the right amount of inputs precisely where they are needed, leading to increased yields and cost savings.

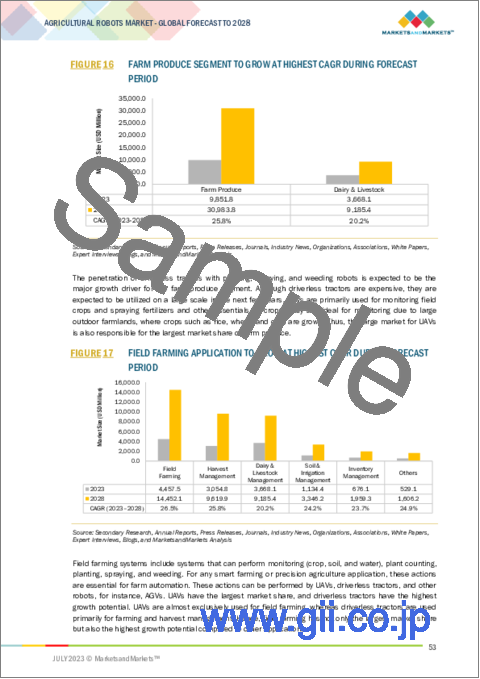

"The Farm produce sub-segment is projected to dominate the market share in the end-user segment during the forecast period."

Agricultural robots will revolutionize farm produce by enhancing efficiency and productivity. These robots can autonomously perform various tasks, such as planting, weeding, harvesting, and monitoring crops. With precise data collection and analysis, they optimize resource usage and reduce waste. Additionally, robots can operate 24/7, ensuring timely actions, even in adverse conditions. Their consistent performance improves crop quality and yield. By minimizing manual labor, farmers save time and costs, enhancing their profitability. Moreover, agricultural robots promote sustainable practices by using fewer chemicals and reducing environmental impact. Overall, these technological advancements empower farmers to meet rising demands and secure a more food-secure and sustainable future.

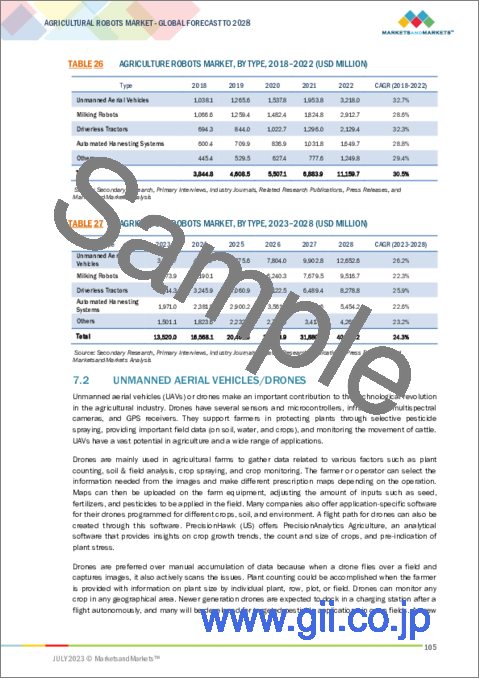

Driverless tractors are expected to be utilized on a large scale-despite their high price-as labor costs keep rising. Various AGVs are expected to be utilized for farming field crops for planting, spraying, and weeding. Since field crops require extensive farmlands, UAVs are also expected to be utilized on a large scale in field crops compared with other types of agricultural produce. Hence, field crops are expected to have the highest share of the market and the highest growth rate during the forecast period.

Europe is to grow significantly during the forecast period.

The agricultural robots market in Europe exhibits a high degree of professionalism and technological adoption. However, the lack of large farms and slightly higher input costs create a marginal disadvantage compared to the US market. The agricultural robots market in Europe is projected to witness substantial growth in the near future as this region is currently in the early stage of the adoption of autonomous harvesting systems and driverless tractors. According to the European Committee of Farm Machinery Manufacturer's Associations (CEMA), the European agricultural machinery market is currently growing, which is expected to fuel the growth of the agricultural robots market as well. The major factors contributing to the agricultural robots market's growth in Europe include improved productivity through mechanization, an optimized supply chain, and increasing labor cost owing to the shortage of skilled labor. Uncertainty regarding government support, low farm income, and import restrictions from Russia are the major restraints.

The European agricultural machinery industry is one of the most developed in the world and is supported by the presence of global players, such as John Deere (US), Small Robot Company (UK), Earth Rover (UK), Saga Robotics (Norway), CNH Industrial (The Netherlands), and AGCO Corporation (US).

The break-up of the profile of primary participants in the agricultural robots market:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: CXOs - 25%, Manager- 50%, Executives-25%

- By Region: North America - 25%, Europe - 25%, Asia Pacific - 40%, Rest of the world- 10%

Prominent companies include DJI (China), PrecisionHawk (US), Trimble Inc. (US), Parrot Drones (France), AeroVironment, Inc. (US), Yamaha Motor Co., Ltd. (Japan), AgEagle Aerial Systems, Inc. (US), DroneDeploy (US), 3DR (US), and Sentera Inc. (US) among others.

Research Coverage:

This research report categorizes the Agricultural Robots Market by Type, End Use, Application, Farming Environment, and Region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Agricultural robots market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the Agricultural robots market. Competitive analysis of upcoming startups in the Agricultural robots market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agricultural robots market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Labour Shortages and rising costs, Environmental concerns, Government incentives, and subsidies ), restraints (High initial investments, technological complexity, Regulations, and standards), opportunities (Customisations and modularity, IoT, and AI, and growing research and developments ), challenges (Resistance to change and connectivity and costing issues ) influencing the growth of the agriculture robots market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the agriculture robots market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the agriculture robots market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the agriculture robots market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like DJI (China), PrecisionHawk (US), Trimble Inc. (US), Deere & Company (US), AGCO Corporation (US), DroneDeploy (US), 3DR (US), and Sentera Inc. (US) among others in the agricultural robots market strategies. The report also helps stakeholders understand the agricultural robots market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 2 AGRICULTURE ROBOTS MARKET, BY REGION

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 AGRICULTURE ROBOTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 AGRICULTURE ROBOTS MARKET SIZE ESTIMATION, BY TYPE (DEMAND SIDE)

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 AGRICULTURE ROBOTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 AGRICULTURE ROBOTS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- 2.3 GROWTH RATE FORECAST ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- 2.7 MACROINDICATORS OF RECESSION

- FIGURE 10 INDICATORS OF RECESSION

- FIGURE 11 WORLD INFLATION RATE: 2011-2021

- FIGURE 12 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON AGRICULTURE ROBOTS MARKET

- FIGURE 14 AGRICULTURE ROBOTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 4 AGRICULTURE ROBOTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 15 UNMANNED AERIAL VEHICLES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 FARM PRODUCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 FIELD FARMING APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AGRICULTURE ROBOTS MARKET

- FIGURE 19 INCREASING DEMAND FOR PRECISION FARMING SOLUTIONS, POTENTIAL FOR LABOR OPTIMIZATION, AND GROWING FOCUS ON SUSTAINABLE AGRICULTURE PRACTICES TO DRIVE MARKET GROWTH

- 4.2 AGRICULTURE ROBOTS MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 20 US TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY KEY FUNCTION & COUNTRY

- FIGURE 21 FARM PRODUCE SEGMENT AND US TO ACCOUNT FOR LARGEST SHARES IN NORTH AMERICA IN 2023

- 4.4 AGRICULTURE ROBOTS MARKET, BY TYPE

- FIGURE 22 UNMANNED AERIAL VEHICLES TO DOMINATE AGRICULTURE ROBOTS MARKET IN 2023

- 4.5 AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT

- FIGURE 23 OUTDOOR SEGMENT TO DOMINATE AGRICULTURE ROBOTS MARKET DURING FORECAST PERIOD

- 4.6 AGRICULTURE ROBOTS MARKET, BY END USE

- FIGURE 24 FARM PRODUCE TO DOMINATE AGRICULTURE ROBOTS MARKET DURING FORECAST PERIOD

- 4.7 AGRICULTURE ROBOTS MARKET, BY APPLICATION

- FIGURE 25 FIELD FARMING TO DOMINATE AGRICULTURE ROBOTS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 REDUCTION IN ARABLE LAND

- FIGURE 26 PER CAPITA ARABLE LAND, 2002-2022 (HA)

- 5.2.2 RAPID DIGITALIZATION

- FIGURE 27 SMARTPHONE PENETRATION, BY REGION, 2019 VS. 2025

- FIGURE 28 GLOBAL GNSS DEMAND, 2021 VS. 2031 (EUR BILLION)

- 5.3 MARKET DYNAMICS

- 5.3.1 INTRODUCTION

- FIGURE 29 AGRICULTURE ROBOTS MARKET DYNAMICS

- 5.3.2 DRIVERS

- 5.3.2.1 Increase in IoT devices connected with farm management to analyze data on various factors

- 5.3.2.2 Demand for optimization of farm management using agricultural drones and robots

- 5.3.2.3 Rapid adoption of advanced technologies

- 5.3.2.4 Growth in concerns regarding ecosystem change

- 5.3.2.5 Benefits offered by livestock monitoring

- 5.3.3 RESTRAINTS

- 5.3.3.1 High cost of automation for small farms

- 5.3.3.2 Technological barriers pertaining to fully autonomous robots

- 5.3.3.3 Compared to drones and milking robots, most harvesting and weeding robots still in prototype stage

- 5.3.3.4 Fragmented nature of farmland in developing countries to make it difficult to adopt agricultural robots

- 5.3.3.5 Lack of training activities in operating drones

- 5.3.4 OPPORTUNITIES

- 5.3.4.1 Untapped market potential and scope for automation in agriculture

- 5.3.4.2 Use of real-time multimodal robot systems in fields

- 5.3.4.3 Increased use of electrification in agricultural robots

- 5.3.4.4 High adoption of aerial data collection tools in agriculture

- 5.3.4.5 Increase in use of agricultural-based software via smartphones

- 5.3.4.6 Early detection of crop diseases and ease of farm management

- 5.3.4.7 Convergence of digital technologies with farming practices

- 5.3.5 CHALLENGES

- 5.3.5.1 Lack of standardization of agricultural robot technologies globally to post as challenge

- 5.3.5.2 High cost and complexity of fully autonomous robots

- TABLE 5 PRICES OF VARIOUS AUTONOMOUS ROBOTS (FRUIT-PICKING, PRUNING, WEEDING, SPRAYING, AND MOVING)

- 5.3.5.3 Standardization of communication interfaces and protocols for precision agriculture

- 5.3.5.4 Lack of technical knowledge among farmers

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.2 GLOBAL STANDARDS FOR AGRICULTURAL MACHINERY

- 6.2.3 NORTH AMERICA

- 6.2.3.1 United States (US)

- TABLE 10 US: ROBOTICS FOR AGRICULTURAL AND INDUSTRIAL USE

- 6.2.3.2 Canada

- TABLE 11 CANADA: ROBOTIC MACHINERY AND ROBOT USAGE

- 6.2.3.3 Mexico

- TABLE 12 MEXICO: DRONE CATEGORIES

- 6.2.4 EUROPEAN UNION (EU)

- TABLE 13 EU: DRONE FLYING BASED ON INTENDED OPERATIONS

- TABLE 14 EUROPE: AGRICULTURAL MACHINERY AND ROBOT PRODUCTION STANDARDS

- 6.2.5 ASIA PACIFIC

- 6.2.5.1 India

- 6.2.5.2 China

- TABLE 15 CHINA: ARTICLES REGARDING AGRICULTURAL TECHNOLOGIES

- TABLE 16 CHINA: DRONE CLASSIFICATION BASED ON WEIGHT

- 6.2.5.3 Australia

- 6.2.6 REST OF THE WORLD

- 6.3 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS APPROVED FOR AGRICULTURE ROBOTS IN GLOBAL MARKET, 2012-2022

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH & DEVELOPMENT (R&D)

- 6.4.2 HARDWARE COMPONENT MANUFACTURERS AND SOFTWARE PROVIDERS

- 6.4.3 ROBOT MANUFACTURERS

- 6.4.4 END USERS

- 6.4.5 AFTER-SALES SERVICES

- FIGURE 32 VALUE CHAIN ANALYSIS: AGRICULTURE ROBOTS MARKET

- 6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN AGRICULTURE ROBOTS MARKET

- FIGURE 33 AGRICULTURE ROBOTS MARKET: TRENDS IMPACTING BUYERS

- 6.6 MARKET ECOSYSTEM

- 6.6.1 UPSTREAM

- 6.6.2 DOWNSTREAM

- 6.6.3 RESEARCH & DEVELOPMENT CENTERS

- 6.6.4 HARDWARE COMPONENT PROVIDERS AND SOFTWARE PROVIDERS

- 6.6.4.1 Hardware component providers

- 6.6.4.2 Software providers

- 6.6.4.2.1 Software solution providers

- 6.6.4.2.2 IT/Big data companies

- 6.6.5 AGRICULTURE ROBOTS OEMS

- TABLE 18 AGRICULTURE ROBOTS: ECOSYSTEM VIEW

- 6.7 TRADE ANALYSIS

- TABLE 19 IMPORT DATA OF AGRICULTURAL MACHINERY, BY COUNTRY, 2022 (USD MILLION)

- TABLE 20 EXPORT DATA OF AGRICULTURAL MACHINERY, BY COUNTRY, 2022 (USD MILLION)

- 6.8 KEY CONFERENCES & EVENTS

- TABLE 21 AGRICULTURE ROBOTS MARKET: CONFERENCES & EVENTS, 2023-2024

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 USE CASE 1: EAVISION LAUNCHES INTELLIGENT AGRICULTURAL SPRAYING DRONE IN CHINA

- 6.9.2 USE CASE 2: PARROT LAUNCHES ANAFI THERMAL

- 6.9.3 USE CASE 3: ANNA BINNA FARMS USED AGWORLD SOFTWARE PLATFORM FOR FARM RECORD-KEEPING

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 AI IN AGRICULTURE

- 6.10.1.1 Crop yield & price forecast

- 6.10.2 IOT

- 6.10.3 ADVANCED UNMANNED AERIAL VEHICLES

- 6.10.1 AI IN AGRICULTURE

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 AGRICULTURE ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FARMING ENVIRONMENT

- 6.13 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA FOR AGRICULTURE ROBOTS, BY FARMING ENVIRONMENT

- 6.14 AVERAGE SELLING PRICE (ASP) ANALYSIS

- TABLE 25 HEAVYWEIGHT DRONES: GLOBAL AGRICULTURE ROBOTS MARKET, PRICES BY PAYLOAD CAPACITY, 2020-2022 (USD)

7 AGRICULTURAL ROBOTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 37 MARKET FOR UNMANNED AERIAL VEHICLES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 26 AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 27 AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 UNMANNED AERIAL VEHICLES/DRONES

- TABLE 28 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 UNMANNED AERIAL VEHICLES/DRONES, BY TYPE

- 7.2.1.1 Fixed-wing drones

- 7.2.1.1.1 Fixed-wing drones to offer efficient aerial coverage, leading to accurate field surveys in farms

- 7.2.1.1 Fixed-wing drones

- TABLE 30 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 31 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1.2 Rotary blade drones

- 7.2.1.2.1 With multiple propellers, rotary blade drones to offer agile and precise maneuverability

- 7.2.1.3 Hybrid drones

- 7.2.1.3.1 With VTOL features, hybrid drones to excel in precision farming tasks

- 7.2.1.2 Rotary blade drones

- 7.2.2 UNMANNED AERIAL VEHICLES/DRONES, BY COMPONENT

- TABLE 32 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 33 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.2.2.1 Hardware

- 7.2.2.1.1 Increasing adoption of hardware in agricultural sector to drive market

- 7.2.2.1 Hardware

- TABLE 34 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 35 UNMANNED AERIAL VEHICLES: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- 7.2.2.1.2 Frames

- 7.2.2.1.3 Controllers

- 7.2.2.1.4 Propulsion systems

- 7.2.2.1.5 Camera systems

- 7.2.2.1.6 Navigation systems

- 7.2.2.1.7 Batteries

- 7.2.2.1.8 Others

- 7.2.2.2 Software

- 7.2.2.2.1 Software in agricultural UAV components to be used for data management, imaging, and data analytics

- 7.3 MILKING ROBOTS

- TABLE 36 MILKING ROBOTS: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 MILKING ROBOTS: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.1 MILKING ROBOTS, BY COMPONENT

- TABLE 38 MILKING ROBOTS: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 39 MILKING ROBOTS: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.3.1.1 Hardware

- 7.3.1.1.1 Efficient hardware to optimize automated milking processes in robots

- 7.3.1.1 Hardware

- TABLE 40 MILKING ROBOTS: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 41 MILKING ROBOTS: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- 7.3.1.1.2 Automation and control devices

- 7.3.1.1.3 Sensing & monitoring devices

- 7.3.1.2 Software

- 7.4 DRIVERLESS TRACTORS

- 7.4.1 DRIVERLESS TRACTORS TO LEAD TO LESS DAMAGE TO SOIL DUE TO AUTOMATED SOFTWARE AND LESS HUMAN ERROR

- TABLE 42 DRIVERLESS TRACTORS: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 DRIVERLESS TRACTORS: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 AUTOMATED HARVESTING SYSTEMS

- 7.5.1 AUTOMATED HARVESTING SYSTEMS' ABILITY TO REVOLUTIONIZE HARVESTING PROCESSES TO FUEL MARKET GROWTH

- TABLE 44 AUTOMATED HARVESTED SYSTEMS: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 AUTOMATED HARVESTED SYSTEMS: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 OTHERS

- TABLE 46 OTHERS: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 OTHERS: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AGRICULTURAL ROBOTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 38 FIELD FARMING APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 48 AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 49 AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 HARVEST MANAGEMENT

- 8.2.1 HARVEST MANAGEMENT APPLICATIONS TO DRIVE UTILIZATION OF UAV AND AUTOMATED HARVESTING SYSTEMS

- TABLE 50 HARVEST MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 HARVEST MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 FIELD FARMING

- TABLE 52 FIELD FARMING: AGRICULTURAL ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 FIELD FARMING: AGRICULTURAL ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1 PLOWING AND SEEDING

- 8.3.1.1 Usage of robots in plowing and seeding to yield better productivity

- 8.3.2 CROP MONITORING AND WEED DETECTION

- 8.3.2.1 Usage of agricultural drones for crop monitoring to further enhance weed detection

- 8.3.3 PLANT SCOUTING

- 8.3.3.1 AGV platforms to be used for crop scouting for efficient weed detection

- 8.3.4 CROP PROTECTION AND SCOUTING

- 8.3.4.1 Crop protection and scouting robots to help measure traits and readings of individual plants

- 8.3.5 WEATHER TRACKING & MONITORING

- 8.3.5.1 Adoption of drones for weather tracking & monitoring applications to drive market

- 8.4 DAIRY & LIVESTOCK MANAGEMENT

- TABLE 54 DAIRY & LIVESTOCK MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 DAIRY & LIVESTOCK MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.1 DAIRY FARM MANAGEMENT

- 8.4.1.1 Milking robots to automate manual processes in dairy farms

- 8.4.2 LIVESTOCK MONITORING

- 8.4.2.1 Smart tags to be placed in farm animals to transmit remote monitoring data and real-time updates

- 8.4.3 INVENTORY MANAGEMENT

- 8.4.3.1 Inventory management to streamline tracking and organizing of agricultural products and resources

- TABLE 56 INVENTORY MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 INVENTORY MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 SOIL & IRRIGATION MANAGEMENT

- 8.5.1 USAGE OF DRONES IN SOIL & IRRIGATION MANAGEMENT TO DRIVE MARKET

- TABLE 58 SOIL & IRRIGATION MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 SOIL & IRRIGATION MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 OTHERS

- TABLE 60 OTHER APPLICATIONS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 OTHER APPLICATIONS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AGRICULTURAL ROBOTS MARKET, BY END USE

- 9.1 INTRODUCTION

- FIGURE 39 FARM PRODUCE SEGMENT TO LEAD DURING FORECAST PERIOD

- TABLE 62 AGRICULTURE ROBOTS MARKET: AREA UNDER DRONES APPLICATION, BY REGION (2021-2022)

- TABLE 63 AGRICULTURE ROBOTS MARKET, BY END USE, 2018-2022 (USD MILLION)

- TABLE 64 AGRICULTURE ROBOTS MARKET, BY END USE, 2023-2028 (USD MILLION)

- 9.2 FARM PRODUCE

- TABLE 65 AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2018-2022 (USD MILLION)

- TABLE 66 AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2023-2028 (USD MILLION)

- TABLE 67 CEREALS & GRAINS: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 CEREALS & GRAINS: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 69 OILSEEDS & PULSES: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 OILSEEDS & PULSES: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 FRUITS & VEGETABLES: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 FRUITS & VEGETABLES: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 OTHER CROP TYPES: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 OTHER CROP TYPES: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 CEREALS & GRAINS

- 9.2.1.1 Promotion of innovative and technological advancements in cereals & grains to boost market

- TABLE 75 FARM PRODUCE IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY CEREALS & GRAINS, 2018-2022 (USD MILLION)

- TABLE 76 FARM PRODUCE IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY CEREALS & GRAINS, 2023-2028 (USD MILLION)

- 9.2.1.1.1 Corn

- 9.2.1.1.2 Wheat

- 9.2.1.1.3 Rice

- 9.2.1.1.4 Other cereals & grains

- 9.2.2 OILSEEDS & PULSES

- 9.2.2.1 Assistance of robots in post-harvest operations for oilseeds & pulses to drive market

- TABLE 77 FARM PRODUCE IN NORTH AMERICA, AGRICULTURE ROBOTS MARKET, BY OILSEEDS & PULSES, 2018-2022 (USD MILLION)

- TABLE 78 FARM PRODUCE IN NORTH AMERICA, AGRICULTURE ROBOTS MARKET, BY OILSEEDS & PULSES, 2023-2028 (USD MILLION)

- 9.2.2.1.1 Soybean

- 9.2.2.1.2 Sunflower

- 9.2.2.1.3 Other oilseeds & pulses

- 9.2.3 FRUITS & VEGETABLES

- 9.2.3.1 Revolutionizing traditional farming practices in fruits & vegetables to propel market growth

- TABLE 79 FARM PRODUCE IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FRUITS & VEGETABLES, 2018-2022 (USD MILLION)

- TABLE 80 FARM PRODUCE IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FRUITS & VEGETABLES, 2023-2028 (USD MILLION)

- 9.2.3.1.1 Pome fruits

- 9.2.3.1.2 Citrus fruits

- 9.2.3.1.3 Berries

- 9.2.3.1.4 Root and tuber vegetables

- 9.2.3.1.5 Leafy vegetables

- 9.2.3.1.6 Other fruits & vegetables

- 9.2.4 OTHER PRODUCE TYPES

- 9.3 DAIRY & LIVESTOCK

- 9.3.1 USAGE OF MILKING ROBOTS IN DAIRY & LIVESTOCK PRODUCE SEGMENT TO DRIVE MARKET

10 AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT

- 10.1 INTRODUCTION

- FIGURE 40 OUTDOOR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 81 AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2018-2022 (USD MILLION)

- TABLE 82 AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

- 10.2 OUTDOOR

- 10.2.1 ADOPTION OF AGRICULTURE ROBOTS FOR LIVESTOCK MONITORING AND VARIABLE RATE APPLICATION TO DRIVE MARKET GROWTH

- TABLE 83 OUTDOOR: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 OUTDOOR: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 INDOOR

- 10.3.1 USAGE OF ROBOTS IN OPTIMIZING RESOURCE USAGE IN HYDROPONICS TO DRIVE MARKET GROWTH

- TABLE 85 INDOOR: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 INDOOR: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 AGRICULTURE ROBOTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 41 AGRICULTURE ROBOTS MARKET: GEOGRAPHICAL SNAPSHOT

- TABLE 87 AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 88 AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 89 AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 90 AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (UNITS)

- 11.2 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 91 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 93 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 94 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT 2018-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 100 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 102 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 103 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 104 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 105 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 106 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 107 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 108 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY END USE, 2018-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2018-2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Leveraging unmanned aerial vehicles for improved farming practices to bolster market growth

- TABLE 115 UNMANNED AERIAL VEHICLES IN US: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 116 UNMANNED AERIAL VEHICLES IN US: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Constant enhancements and developments in precision farming practices to drive market growth

- TABLE 117 UNMANNED AERIAL VEHICLES IN CANADA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 118 UNMANNED AERIAL VEHICLES IN CANADA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Adoption of drones and other smart technologies through government's financial support to drive market

- TABLE 119 UNMANNED AERIAL VEHICLES IN MEXICO: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 120 UNMANNED AERIAL VEHICLES IN MEXICO: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- TABLE 121 EUROPE: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 122 EUROPE: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 123 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 124 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 125 EUROPE: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT 2018-2022 (USD MILLION)

- TABLE 126 EUROPE: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

- TABLE 127 EUROPE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 128 EUROPE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 130 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 131 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 132 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 133 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 134 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 135 MILKING ROBOTS IN EUROPE: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 136 MILKING ROBOTS IN EUROPE: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 137 MILKING ROBOTS IN EUROPE: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 138 MILKING ROBOTS IN EUROPE: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 139 EUROPE: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 140 EUROPE: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 141 EUROPE: AGRICULTURE ROBOTS MARKET, BY END USE, 2018-2022 (USD MILLION)

- TABLE 142 EUROPE: AGRICULTURE ROBOTS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 143 EUROPE: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2018-2022 (USD MILLION)

- TABLE 144 EUROPE: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2023-2028 (USD MILLION)

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- 11.3.2 GERMANY

- 11.3.2.1 Government incentives and ongoing collaborative research projects to propel market growth

- TABLE 145 UNMANNED AERIAL VEHICLES IN GERMANY: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 146 UNMANNED AERIAL VEHICLES IN GERMANY: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Adopting advanced digital technologies to enhance farming practices in UK

- TABLE 147 UNMANNED AERIAL VEHICLES IN UK: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 148 UNMANNED AERIAL VEHICLES IN UK: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Increasing robotic startups in France for agricultural applications to lead to market growth

- TABLE 149 UNMANNED AERIAL VEHICLES IN FRANCE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 150 UNMANNED AERIAL VEHICLES IN FRANCE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Usage of latest agricultural sensor technologies in Italy to drive market

- TABLE 151 UNMANNED AERIAL VEHICLES IN ITALY: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 152 UNMANNED AERIAL VEHICLES IN ITALY: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.6 NETHERLANDS

- 11.3.6.1 Technology-driven economy and focus on sustainable agriculture to boost market

- TABLE 153 UNMANNED AERIAL VEHICLES IN NETHERLANDS: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 154 UNMANNED AERIAL VEHICLES IN NETHERLANDS: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 155 UNMANNED AERIAL VEHICLES IN REST OF EUROPE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 156 UNMANNED AERIAL VEHICLES IN REST OF EUROPE: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- TABLE 157 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 159 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 160 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT 2018-2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 165 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 166 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 167 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 168 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 169 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 170 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 171 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 172 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 173 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 174 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY END USE, 2018-2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2018-2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing government incentives and investments to boost market

- TABLE 181 UNMANNED AERIAL VEHICLES IN CHINA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 182 UNMANNED AERIAL VEHICLES IN CHINA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Agriculture drones to be used for surveying farms and assessing crop losses

- TABLE 183 UNMANNED AERIAL VEHICLES IN SOUTH KOREA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 184 UNMANNED AERIAL VEHICLES IN SOUTH KOREA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Rising adoption of advanced technology in Japan to drive market growth

- TABLE 185 UNMANNED AERIAL VEHICLES IN JAPAN: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 186 UNMANNED AERIAL VEHICLES IN JAPAN: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.5 AUSTRALIA

- 11.4.5.1 Usage of agriculture drones in different applications to boost demand in Australia

- TABLE 187 UNMANNED AERIAL VEHICLES IN AUSTRALIA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 188 UNMANNED AERIAL VEHICLES IN AUSTRALIA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 189 UNMANNED AERIAL VEHICLES IN REST OF ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 190 UNMANNED AERIAL VEHICLES IN REST OF ASIA PACIFIC: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT

- TABLE 191 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 192 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 193 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 194 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 195 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT 2018-2022 (USD MILLION)

- TABLE 196 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

- TABLE 197 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 198 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 199 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 200 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 201 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 202 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 203 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 204 UNMANNED AERIAL VEHICLES IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 205 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 206 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 207 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 208 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 209 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 210 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 211 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY END USE, 2018-2022 (USD MILLION)

- TABLE 212 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 213 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2018-2022 (USD MILLION)

- TABLE 214 SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Rise in digital agriculture activities to drive market

- TABLE 215 UNMANNED AERIAL VEHICLES IN BRAZIL: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 216 UNMANNED AERIAL VEHICLES IN BRAZIL: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Increase in public-private partnerships for agriculture innovations in Argentina to drive market growth

- TABLE 217 UNMANNED AERIAL VEHICLES IN ARGENTINA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 218 UNMANNED AERIAL VEHICLES IN ARGENTINA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 219 UNMANNED AERIAL VEHICLES IN REST OF SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 220 UNMANNED AERIAL VEHICLES IN REST OF SOUTH AMERICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6 REST OF THE WORLD

- 11.6.1 REST OF THE WORLD: RECESSION IMPACT

- TABLE 221 ROW: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 222 ROW: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 223 UNMANNED AERIAL VEHICLE IN ROW: AGRICULTURE ROBOTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 224 UNMANNED AERIAL VEHICLE IN ROW: AGRICULTURE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 225 ROW: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2018-2022 (USD MILLION)

- TABLE 226 ROW: AGRICULTURE ROBOTS MARKET, BY FARMING ENVIRONMENT, 2023-2028 (USD MILLION)

- TABLE 227 ROW: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 228 ROW: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 229 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 230 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 231 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 232 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 233 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 234 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 235 MILKING ROBOTS IN ROW: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 236 MILKING ROBOTS IN ROW: AGRICULTURE ROBOTS MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 237 MILKING ROBOTS IN ROW: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 238 MILKING ROBOTS IN ROW: AGRICULTURE ROBOTS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 239 ROW: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 240 ROW: AGRICULTURE ROBOTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 241 ROW: AGRICULTURE ROBOTS MARKET, BY END USE, 2018-2022 (USD MILLION)

- TABLE 242 ROW: AGRICULTURE ROBOTS MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 243 ROW: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2018-2022 (USD MILLION)

- TABLE 244 ROW: AGRICULTURE ROBOTS MARKET, BY FARM PRODUCE, 2023-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Growth in agriculture monitoring activities in Middle east to boost market

- TABLE 245 UNMANNED AERIAL VEHICLES IN MIDDLE EAST: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 246 UNMANNED AERIAL VEHICLES IN MIDDLE EAST: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6.3 AFRICA

- 11.6.3.1 Increase in investments for agriculture innovations in Africa to drive market growth

- TABLE 247 UNMANNED AERIAL VEHICLES IN AFRICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 248 UNMANNED AERIAL VEHICLES IN AFRICA: AGRICULTURE ROBOTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 249 AGRICULTURE ROBOTS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 250 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018-2022 (USD BILLION)

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- FIGURE 44 AGRICULTURE ROBOTS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 45 AGRICULTURE ROBOTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 12.5.5 PRODUCT FOOTPRINT

- TABLE 251 COMPANY FOOTPRINT, BY TYPE

- TABLE 252 COMPANY FOOTPRINT, BY FARMING ENVIRONMENT

- TABLE 253 COMPANY FOOTPRINT, BY REGION

- TABLE 254 OVERALL COMPANY FOOTPRINT

- 12.6 AGRICULTURE ROBOTS MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 46 AGRICULTURE ROBOTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 12.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 255 AGRICULTURE ROBOTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 256 AGRICULTURE ROBOTS MARKET: PRODUCT LAUNCHES

- 12.7.2 DEALS

- TABLE 257 AGRICULTURE ROBOTS MARKET: DEALS

- 12.7.3 OTHERS

- TABLE 258 AGRICULTURE ROBOTS MARKET: OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 13.1.1 DEERE & COMPANY

- TABLE 259 DEERE & COMPANY: BUSINESS OVERVIEW

- FIGURE 47 DEERE & COMPANY: COMPANY SNAPSHOT

- TABLE 260 DEERE & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 261 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 262 DEERE & COMPANY: DEALS

- TABLE 263 DEERE & COMPANY: OTHERS

- 13.1.2 DJI

- TABLE 264 DJI: BUSINESS OVERVIEW

- TABLE 265 DJI: PRODUCTS OFFERED

- TABLE 266 DJI: PRODUCT LAUNCHES

- TABLE 267 DJI: DEALS

- 13.1.3 CNH INDUSTRIAL NV

- TABLE 268 CNH INDUSTRIAL NV: BUSINESS OVERVIEW

- FIGURE 48 CNH INDUSTRIAL NV: COMPANY SNAPSHOT

- TABLE 269 CNH INDUSTRIAL NV: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

- TABLE 270 CNH INDUSTRIAL NV: DEALS

- 13.1.4 AGCO CORPORATION

- TABLE 271 AGCO CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 AGCO CORPORATION: COMPANY SNAPSHOT

- TABLE 272 AGCO CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

- TABLE 273 AGCO CORPORATION: PRODUCT LAUNCHES

- TABLE 274 AGCO CORPORATION: DEALS

- TABLE 275 AGCO CORPORATION: OTHERS

- 13.1.5 DELAVAL

- TABLE 276 DELAVAL: BUSINESS OVERVIEW

- FIGURE 50 DELAVAL: COMPANY SNAPSHOT

- TABLE 277 DELAVAL: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

- TABLE 278 DELAVAL: PRODUCT LAUNCHES

- TABLE 279 DELAVAL: DEALS

- TABLE 280 DELAVAL: OTHERS

- 13.1.6 TRIMBLE INC.

- TABLE 281 TRIMBLE INC.: BUSINESS OVERVIEW

- FIGURE 51 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 282 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 283 TRIMBLE INC.: DEALS

- TABLE 284 TRIMBLE INC.: OTHERS

- 13.1.7 BOUMATIC ROBOTICS

- TABLE 285 BOUMATIC ROBOTICS: BUSINESS OVERVIEW

- TABLE 286 BOUMATIC ROBOTICS: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

- TABLE 287 BOUMATIC ROBOTICS: PRODUCT LAUNCHES

- 13.1.8 LELY

- TABLE 288 LELY: BUSINESS OVERVIEW

- TABLE 289 LELY: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

- TABLE 290 LELY: PRODUCT LAUNCHES

- 13.1.9 AGJUNCTION

- TABLE 291 AGJUNCTION: BUSINESS OVERVIEW

- FIGURE 52 AGJUNCTION: COMPANY SNAPSHOT

- TABLE 292 AGJUNCTION: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

- TABLE 293 AGJUNCTION: PRODUCT LAUNCHES

- TABLE 294 AGJUNCTION: DEALS

- 13.1.10 AGEAGLE AERIAL SYSTEMS INC.

- TABLE 295 AGEAGLE AERIAL SYSTEMS INC.: BUSINESS OVERVIEW

- TABLE 296 AGEAGLE AERIAL SYSTEMS INC.: PRODUCTS OFFERED

- TABLE 297 AGEAGLE AERIAL SYSTEMS INC.: PRODUCT LAUNCHES

- TABLE 298 AGEAGLE AERIAL SYSTEMS INC.: DEALS

- TABLE 299 AGEAGLE AERIAL SYSTEMS INC.: OTHERS

- 13.1.11 YANMAR CO.

- TABLE 300 YANMAR CO.: BUSINESS OVERVIEW

- TABLE 301 YANMAR CO.: PRODUCT OFFERINGS

- 13.1.12 DEEPFIELD ROBOTICS

- TABLE 302 DEEPFIELD ROBOTICS: BUSINESS OVERVIEW

- TABLE 303 DEEPFIELD ROBOTICS: PRODUCT OFFERINGS

- 13.1.13 ECOROBOTIX

- TABLE 304 ECOROBOTIX: BUSINESS OVERVIEW

- TABLE 305 ECOROBOTIX: PRODUCT OFFERINGS

- 13.1.14 HARVEST AUTOMATION

- TABLE 306 HARVEST AUTOMATION: BUSINESS OVERVIEW

- TABLE 307 HARVEST AUTOMATION: PRODUCT OFFERINGS

- 13.1.15 NAIO TECHNOLOGIES

- TABLE 308 NAIO TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 309 NAIO TECHNOLOGIES: PRODUCT OFFERINGS

- 13.2 OTHER PLAYERS

- 13.2.1 ROBOTICS PLUS

- TABLE 310 ROBOTICS PLUS: BUSINESS OVERVIEW

- TABLE 311 ROBOTICS PLUS: PRODUCT OFFERINGS

- 13.2.2 KUBOTA CORPORATION

- TABLE 312 KUBOTA CORPORATION: BUSINESS OVERVIEW

- TABLE 313 KUBOTA CORPORATION.: PRODUCT OFFERINGS

- 13.2.3 HARVEST CROO ROBOTICS

- TABLE 314 HARVEST CROO ROBOTICS: BUSINESS OVERVIEW

- TABLE 315 HARVEST CROO ROBOTICS: PRODUCT OFFERINGS

- 13.2.4 AUTONOMOUS TRACTOR CORPORATION

- TABLE 316 AUTONOMOUS TRACTOR CORPORATION: BUSINESS OVERVIEW

- TABLE 317 AUTONOMOUS TRACTOR CORPORATION.: PRODUCT OFFERINGS

- 13.2.5 CLEARPATH ROBOTICS, INC.

- TABLE 318 CLEARPATH ROBOTICS, INC.: BUSINESS OVERVIEW

- TABLE 319 CLEARPATH ROBOTICS, INC.: PRODUCT OFFERINGS

- 13.2.6 DRONEDEPLOY

- TABLE 320 DRONEDEPLOY: BUSINESS OVERVIEW

- 13.2.7 AGROBOTS

- TABLE 321 AGROBOTS: BUSINESS OVERVIEW

- 13.2.8 FFROBOTICS

- TABLE 322 FFROBOTICS: BUSINESS OVERVIEW

- 13.2.9 FULLWOOD JOZ

- TABLE 323 FULLWOOD JOZ: BUSINESS OVERVIEW

- 13.2.10 MONARCH TRACTOR

- TABLE 324 MONARCH TRACTOR: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 325 ADJACENT MARKETS TO AGRICULTURE ROBOTS MARKET

- 14.2 LIMITATIONS

- 14.3 SMART AGRICULTURE MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 326 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2017-2020 (USD MILLION)

- TABLE 327 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2021-2026 (USD MILLION)

- 14.4 FARM MANAGEMENT SOFTWARE MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 328 FARM MANAGEMENT SOFTWARE MARKET, BY FARM PRODUCTION PLANNING, 2017-2020 (USD MILLION)

- TABLE 329 FARM MANAGEMENT SOFTWARE MARKET, BY FARM PRODUCTION PLANNING, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS