|

|

市場調査レポート

商品コード

1642544

農業用ロボットの市場レポート:製品タイプ別、用途別、オファリング別、地域別、2025年~2033年Agricultural Robots Market Report by Product Type (Unmanned Aerial Vehicles /Drones, Milking Robots, Automated Harvesting Systems, Driverless Tractors, and Others), Application, Offering, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 農業用ロボットの市場レポート:製品タイプ別、用途別、オファリング別、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 131 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界の農業用ロボットの市場規模は、2024年に104億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに380億米ドルに達し、2025年から2033年にかけて15.4%の成長率(CAGR)を示すと予測しています。労働力不足、大幅な技術進歩、環境問題への関心の高まり、政府の支援、コスト削減と資源の最適化、農作業の効率化と生産性向上へのニーズの高まりなどが、市場を推進している主な要因です。

農業用ロボットはアグリボットとも呼ばれ、農業における様々な作業を行うために設計された特殊な機械です。これらのロボットは高度な技術と能力を備えており、特定の農業活動を自律的に、あるいは人間の介入を最小限に抑えて実行することができます。植え付け、播種、除草、収穫、作物のモニタリングなど、幅広い用途で活用されています。これらのロボットは、圃場内を移動し、多様な気象条件下で動作し、植物や土壌と相互作用するように設計されています。これらのロボットは、作業を効率的かつ正確に実行するようにプログラムすることができ、農業分野における生産性の向上と人件費の削減に貢献します。これらのロボットの機能は、その目的によって異なります。例えば、植え付けロボットは、精密技術を駆使して最適な深さと間隔で種をまき、均一な生育を確保します。除草ロボットは、コンピューター・ビジョンと機械学習アルゴリズムを採用し、作物に害を与えることなく雑草を識別・除去します。収穫ロボットは、センサーとロボットアームを搭載し、熟した果物や野菜を収穫・回収します。

農業分野は、世界中の多くの地域で熟練労働者の不足に直面しています。そのため、農業用ロボットは労働力不足の影響を緩和する有効な解決策となるため、需要が高まっています。さらに、農業用ロボットは農作業を最適化し、生産性を高めるように設計されています。これらのロボットはその精度と正確さにより、植え付け、除草、収穫などの作業を人間の労働力よりも効率的に行うことができます。これ以外にも、これらのロボットは、一度セットアップすれば人間の介入を最小限に抑えることができるため、長期的な人件費の削減に役立ちます。ロボットは、水、肥料、農薬などの資源の使用を最適化し、正確で的を絞った方法で作業することができます。必要な場所にのみ投入することで、農業用ロボットはコスト削減とより持続可能な農法に貢献します。このほか、ロボット工学、自動化、人工知能(AI)の急速な進歩により、農業用ロボットの能力は大幅に向上しています。これらの技術により、ロボットは複雑な作業をこなし、自律的に圃場を移動し、リアルタイムの情報に基づいてデータ駆動型の意思決定を行うことができます。さらに、環境問題への意識の高まりと持続可能な農業実践の必要性が、製品採用を後押ししています。

農業用ロボット市場傾向 / 促進要因:

農業セクターにおける労働力不足

農業用ロボット導入の主な促進要因のひとつは、農業セクターにおける熟練労働者の持続的な不足です。様々な地域で農業従事者の減少が起きており、労働集約的な作業を行う上での課題となっています。これらのロボットは、人間の労働力への依存を減らすことで解決策を提供します。これらのロボットは、常に監視する必要なく自律的に作業することができ、反復作業を効率的かつ正確に行うことができます。植え付け、除草、収穫などの作業を自動化することで、農業用ロボットは農家が労働力不足を克服し、生産性を向上させ、運営コストを削減するのに役立っています。

技術の進歩

ロボット工学、自動化、AIの急速な進歩が農業用ロボットの採用を後押ししています。これらの技術は農業用ロボットの能力を大幅に向上させ、より多用途で効率的、コスト効率の高いものとなっています。例えば、コンピュータ・ビジョンと機械学習アルゴリズムの統合により、ロボットは作物と雑草を識別・区別できるようになり、的を絞った正確な雑草防除が可能になりました。ナビゲーション・システムとセンサーにより、ロボットは圃場内を操縦し、障害物を回避することができます。カメラやマルチスペクトル画像などの高度なセンサーを利用することで、作物のモニタリングや最適化のためのデータをリアルタイムで得ることができます。このような技術の進歩により、農業用ロボットは複雑な作業や意思決定ができるようになり、農業業界での採用が進んでいます。

環境への関心念

環境への関心の高まりと持続可能な農法へのニーズが、製品採用の主な促進要因となっています。従来の農法では、肥料や農薬、水を過剰に使用することが多く、環境汚染や資源の枯渇につながっています。農業用ロボットは、より正確で的を絞った資源の散布を可能にし、その結果、化学薬品の使用量を削減し、資源の利用を最適化します。例えば、精密散布システムを搭載したロボットは、必要な場所にのみ農薬を散布することができ、化学物質の流出や環境への影響を最小限に抑えることができます。同様に、灌漑用のロボットシステムは、リアルタイムの水分データに基づいて植物の根に直接水を供給することで、水の使用量を最適化することができます。精密農業技術を促進することで、これらのロボットは農家がより持続可能な農法を採用し、環境フットプリントを削減し、農業が生態系に与える悪影響を軽減するのに役立ちます。

目次

第1章 序文

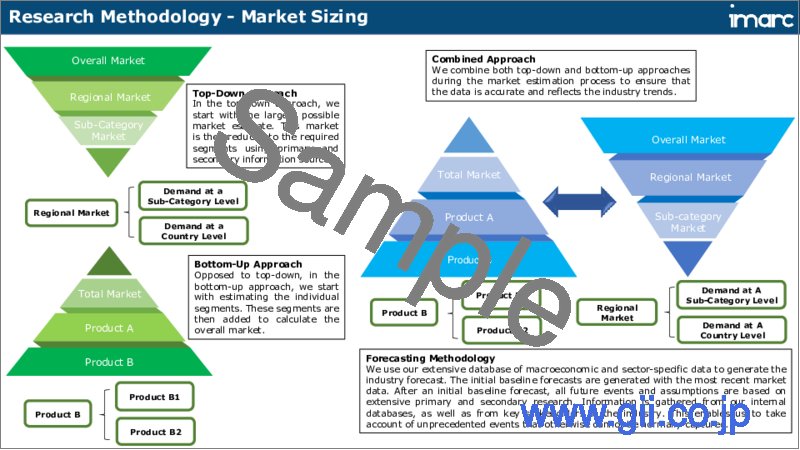

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 予測調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の農業用ロボット市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:製品タイプ別

- 市場内訳:用途別

- 市場内訳:オファリング別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:製品タイプ別

- 無人航空機(UAV)/ドローン

- 市場動向

- 市場予測

- 搾乳ロボット

- 市場動向

- 市場予測

- 自動収穫システム

- 市場動向

- 市場予測

- 無人トラクター

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:用途別

- 畑作

- 市場動向

- 市場予測

- 酪農経営

- 市場動向

- 市場予測

- 動物管理

- 市場動向

- 市場予測

- 土壌管理

- 市場動向

- 市場予測

- 作物管理

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:オファリング別

- ハードウェア

- 市場動向

- 市場予測

- ソフトウェア

- 市場動向

- 市場予測

- サービス

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- 北米

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- アジア太平洋

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第10章 世界の農業用ロボット産業:SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 世界の農業用ロボット産業:バリューチェーン分析

第12章 世界の農業用ロボット産業:ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 世界の農業用ロボット産業:価格分析

第14章 農業用ロボットの製造プロセス

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Deere & Company

- Trimble Inc.

- Agco Corporation

- Lely Holding S.A.R.L

- AG Eagle LLC

- Agribotix LLC

- Agrobot

- Harvest Automation

- Naio Technologies

- Precision Hawk

- IBM

- Agjunction, Inc.

- DJI

- Boumatic Robotics, B.V.

- AG Leader Technology

- Topcon Positioning Systems, Inc.

- Autocopter Corp

- Auroras S.R.L.

- Grownetics Inc.

- Autonomous Tractor Corporation

List of Figures

- Figure 1: Global: Agricultural Robots Market: Major Drivers and Challenges

- Figure 2: Global: Agricultural Robots Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Agricultural Robots Market: Breakup by Product Type (in %), 2024

- Figure 4: Global: Agricultural Robots Market: Breakup by Application (in %), 2024

- Figure 5: Global: Agricultural Robots Market: Breakup by Offering (in %), 2024

- Figure 6: Global: Agricultural Robots Market: Breakup by Region (in %), 2024

- Figure 7: Global: Agricultural Robots Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Agricultural Robots Industry: SWOT Analysis

- Figure 9: Global: Agricultural Robots Industry: Value Chain Analysis

- Figure 10: Global: Agricultural Robots Industry: Porter's Five Forces Analysis

- Figure 11: Global: Agricultural Robots (Unmanned Aerial Vehicles (UAVs)/Drones) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Agricultural Robots (Unmanned Aerial Vehicles (UAVs)/Drones) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Agricultural Robots (Milking Robots) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Agricultural Robots (Milking Robots) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Agricultural Robots (Automated Harvesting Systems) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Agricultural Robots (Automated Harvesting Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Agricultural Robots (Driverless Tractors) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Agricultural Robots (Driverless Tractors) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Agricultural Robots (Other Product Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Agricultural Robots (Other Product Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Agricultural Robots (Field Farming) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Agricultural Robots (Field Farming) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Agricultural Robots (Dairy Farm Management) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Agricultural Robots (Dairy Farm Management) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Agricultural Robots (Animal Management) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Agricultural Robots (Animal Management) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Agricultural Robots (Soil Management) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Agricultural Robots (Soil Management) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Agricultural Robots (Crop Management) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Agricultural Robots (Crop Management) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Agricultural Robots (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Agricultural Robots (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Agricultural Robots (Hardware) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Agricultural Robots (Hardware) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Global: Agricultural Robots (Software) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Agricultural Robots (Software) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Agricultural Robots (Services) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Agricultural Robots (Services) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: North America: Agricultural Robots Market: Sales Value (In Million USD), 2019 & 2024

- Figure 40: North America: Agricultural Robots Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Europe: Agricultural Robots Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Europe: Agricultural Robots Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Asia Pacific: Agricultural Robots Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Asia Pacific: Agricultural Robots Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Middle East and Africa: Agricultural Robots Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: Middle East and Africa: Agricultural Robots Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Latin America: Agricultural Robots Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Latin America: Agricultural Robots Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Agricultural Robots Manufacturing: Process Flow

List of Tables

- Table 1: Global: Agricultural Robots Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Agricultural Robots Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

- Table 3: Global: Agricultural Robots Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Agricultural Robots Market Forecast: Breakup by Offering (in Million USD), 2025-2033

- Table 5: Global: Agricultural Robots Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Agricultural Robots: Raw Material Requirements

- Table 7: Global: Agricultural Robots Market Structure

- Table 8: Global: Agricultural Robots Market: Key Players

The global agricultural robots market size reached USD 10.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.0 Billion by 2033, exhibiting a growth rate (CAGR) of 15.4% during 2025-2033. The labor shortages, significant technological advancements, growing environmental concerns, government support, cost reduction and resource optimization and the rising need for increased efficiency and productivity in farming operations are some of the major factors propelling the market.

Agricultural robots, also known as agribots, are specialized machines designed to perform various tasks in the agricultural industry. These robots are equipped with advanced technologies and capabilities that enable them to carry out specific agricultural activities autonomously or with minimal human intervention. They are utilized in a wide range of applications, including planting, seeding, weeding, harvesting, and crop monitoring. They are designed to navigate through fields, operate in diverse weather conditions, and interact with plants and soil. These robots can be programmed to perform tasks efficiently and accurately, contributing to increased productivity and reduced labor costs in the agricultural sector. The functionality of these robots varies depending on their purpose. For instance, planting robots use precision techniques to sow seeds at optimal depths and spacing, ensuring uniform growth. Weeding robots employ computer vision and machine learning algorithms to identify and remove weeds without harming the crops. Harvesting robots are equipped with sensors and robotic arms to pick and collect ripe fruits or vegetables.

The agricultural sector is facing a shortage of skilled labor in many regions around the world. This has led to an increased demand for agricultural robots as they offer a viable solution to mitigate the impact of labor shortages. Additionally, they are designed to optimize farming operations and enhance productivity. With their precision and accuracy, these robots can perform tasks such as planting, weeding, and harvesting more efficiently than human labor. Other than this, these robots help in reducing labor costs over time, as they require minimal human intervention once set up. They can operate in a precise and targeted manner, optimizing the use of resources such as water, fertilizers, and pesticides. By applying these inputs only where needed, agricultural robots contribute to cost reduction and more sustainable farming practices. Besides this, rapid advancements in robotics, automation, and artificial intelligence (AI) have significantly improved the capabilities of agricultural robots. These technologies enable robots to perform complex tasks, navigate through fields autonomously, and make data-driven decisions based on real-time information. Moreover, the growing awareness of environmental issues and the need for sustainable agricultural practices is driving the product adoption.

Agricultural Robots Market Trends/Drivers:

Labor Shortage in the Agriculture Sector

One of the major drivers for the adoption of agricultural robots is the persistent shortage of skilled labor in the agricultural sector. Various regions are experiencing a decline in the availability of farm workers, leading to challenges in carrying out labor-intensive tasks. These robots provide a solution by reducing the reliance on human labor. These robots can work autonomously, without the need for constant supervision, and can perform repetitive tasks efficiently and accurately. By automating tasks such as planting, weeding, and harvesting, agricultural robots help farmers overcome labor shortages, increase productivity, and reduce operational costs.

Technological Advancements

Rapid advancements in robotics, automation, and AI are driving the adoption of agribots. These technologies have significantly improved the capabilities of agricultural robots, making them more versatile, efficient, and cost-effective. For instance, the integration of computer vision and machine learning algorithms allows robots to identify and differentiate between crops and weeds, enabling targeted and precise weed control. Navigation systems and sensors enable robots to maneuver through fields and avoid obstacles. The availability of advanced sensors, such as cameras and multispectral imaging, provides real-time data for crop monitoring and optimization. These technological advancements make agricultural robots more capable of performing complex tasks and decision-making, thus driving their adoption in the agricultural industry.

Environmental Concerns

The growing environmental concerns and the need for sustainable farming practices are major drivers for the product adoption. Traditional farming practices often involve the excessive use of fertilizers, pesticides, and water, leading to environmental pollution and resource depletion. Agricultural robots offer more precise and targeted application of resources, resulting in reduced chemical usage and optimized resource utilization. For instance, robots equipped with precision spraying systems can apply pesticides only where needed, minimizing chemical runoff and environmental impact. Similarly, robotic systems for irrigation can optimize water usage by delivering water directly to plant roots based on real-time moisture data. By promoting precision farming techniques, these robots help farmers adopt more sustainable practices, reduce environmental footprint, and mitigate the negative impact of agriculture on ecosystems.

Agricultural Robots Industry Segmentation:

Breakup by Product Type:

Unmanned Aerial Vehicles (UAVs)/Drones

Milking Robots

Automated Harvesting Systems

Driverless Tractors

Others

Unmanned aerial vehicles, commonly known as drones, have gained significant traction in the agricultural industry. They are equipped with cameras and sensors to capture aerial imagery and collect data for crop monitoring, pest detection, and yield estimation. UAVs enable farmers to obtain a bird's-eye view of their fields, identify crop health issues, and make informed decisions about irrigation, fertilization, and pest control.

Milking robots have revolutionized the dairy industry by automating the milking process. These robots use sensors to identify and attach milking cups to cows' udders, monitor milk yield and quality, and ensure proper hygiene. Milking robots offer increased efficiency, reduced labor requirements, and improved animal welfare. They enable farmers to optimize milk production, monitor individual cow health, and manage milking schedules more effectively.

Automated harvesting systems encompass a range of robots and machinery designed to perform harvesting tasks, such as fruit picking and vegetable harvesting, with minimal human intervention. These systems utilize sensors, computer vision, and robotic arms to identify ripe crops, perform delicate harvesting actions, and sort harvested produce. Automated harvesting systems improve efficiency, reduce labor costs, and minimize damage to crops during the harvesting process.

Driverless tractors, also known as autonomous or self-driving tractors, are equipped with advanced navigation systems, sensors, and GPS technology. These tractors can operate autonomously, performing tasks such as plowing, seeding, and field preparation. They offer precision and accuracy in operations, enable continuous working hours, and reduce human error. Driverless tractors contribute to increased efficiency, improved productivity, and reduced labor requirements in agricultural fields. They also provide benefits such as optimized fuel consumption, reduced soil compaction, and enhanced safety on farms.

Breakup by Application:

Field Farming

Dairy Farm Management

Animal Management

Soil Management

Crop Management

Others

Field farming represent the largest application segment

Agricultural robots in field farming offer several advantages, they enable precise planting and seeding by accurately placing seeds at optimal depths and spacing, resulting in improved crop germination and uniform growth. Weeding robots use computer vision algorithms to identify and remove weeds without damaging the crops, reducing the need for herbicides and minimizing crop competition. Harvesting robots equipped with sensors and robotic arms can efficiently harvest crops, reducing labor requirements and improving productivity. Furthermore, agribots in field farming contribute to the adoption of precision agriculture techniques. By collecting and analyzing real-time data, they provide valuable insights into crop health, growth patterns, and resource requirements. This data-driven approach enables farmers to make informed decisions regarding irrigation, fertilization, and pest management, resulting in optimized resource utilization, increased crop yield, and reduced environmental impact.

Breakup by Offering:

Hardware

Software

Services

Hardware dominates the market

Hardware components form the backbone of agribots, encompassing the physical infrastructure and machinery required for their operation. These components include unmanned aerial vehicles, milking robots, automated harvesting systems, driverless tractors, and various sensors and robotic arms. These hardware offerings are essential for performing specific tasks in the agricultural industry, such as planting, harvesting, and monitoring. Additionally, the demand for hardware components is driven by the diverse range of applications and tasks that agribots are designed to perform. Different types of robots and equipment are required for various agricultural operations, such as field farming, dairy farming, and soil management. Farmers and agricultural businesses rely on these hardware components to carry out tasks efficiently, increase productivity, and optimize resource utilization. Other than this, hardware components often involve significant investment and represent a substantial portion of the overall cost associated with implementing agricultural robots. Therefore, the revenue generated from hardware sales contributes significantly to the market size. As the market for these robots continues to grow, advancements in hardware technologies, such as improved sensors, better robotic arms, and more precise navigation systems, further drive the demand for these components.

Breakup by Region:

North America

Europe

Asia Pacific

Middle East and Africa

Latin America

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America exhibits a clear dominance in the market.

North America has a highly developed and technologically advanced agricultural sector. The region has a long history of embracing innovation in agriculture and has a strong culture of adopting new technologies. This favorable environment has facilitated the rapid adoption of agricultural robots in the region. Additionally, labor shortages in certain agricultural sectors have become a significant challenge in North America. The availability of skilled labor for manual farm operations has declined in recent years. This has created a strong demand for agribots as a solution to address the labor gap and increase operational efficiency. Furthermore, North America is home to several prominent agricultural robot manufacturers and research institutions. These companies and organizations have been at the forefront of developing and commercializing advanced agricultural robots. Their presence in the region has not only contributed to the availability of a wide range of robotic solutions but has also fostered an ecosystem of innovation, knowledge sharing, and expertise in the field. Additionally, government initiatives and support have played a vital role in accelerating the product sales in North America. Governments at various levels have provided funding, incentives, and regulatory support to promote the adoption of advanced technologies in agriculture. These initiatives have encouraged farmers to invest in agricultural robots and have facilitated their integration into existing farming practices.

Competitive Landscape:

The key players are investing in research and development to enhance the capabilities of agricultural robots and develop new solutions to meet the evolving needs of farmers. They are also focusing on strategic partnerships and collaborations to leverage complementary expertise and broaden their market reach. Additionally major players are continuously introducing advanced hardware and software technologies to improve the performance, functionality, and ease of use of agricultural robots. They are integrating sensors, artificial intelligence, and automation technologies to enable robots to perform tasks with greater precision, efficiency, and autonomy. Besides this, key players are investing in data analytics and cloud-based platforms to provide farmers with real-time insights and decision support. Market leaders are expanding their product portfolios to cater to various agricultural applications. They are developing specialized robots for specific tasks such as seeding, weeding, harvesting, and crop monitoring. Key players are also addressing the needs of different farming sectors, including field farming, dairy farming, and greenhouse operations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Deere & Company

Trimble Inc.

Agco Corporation

Lely Holding S.A.R.L

AG Eagle LLC

Agribotix LLC

Agrobot

Harvest Automation

Naio Technologies

Precision Hawk

IBM

Agjunction Inc.

DJI

BouMatic Robotics B.V.

AG Leader Technology

Topcon Positioning Systems Inc.

Autocopter Corp.

Auroras S.R.L.

Grownetics Inc.

Autonomous Tractor Corporation

Key Questions Answered in This Report

- 1. What is the market size of agricultural robots?

- 2. What is the expected growth rate of the global agricultural robots market during 2025-2033?

- 3. What are the key factors driving the global agricultural robots market?

- 4. What has been the impact of COVID-19 on the global agricultural robots market?

- 5. What is the breakup of global agricultural robots market based on the product type?

- 6. What is the breakup of global agricultural robots market based on the application?

- 7. What is the breakup of global agricultural robots market based on the offering?

- 8. What are the major regions in the global agricultural robots market?

- 9. Who are the key players/companies in the global agricultural robots market?

- 10. What are the current trends in the agricultural robotics market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Agricultural Robots Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Product Type

- 5.5 Market Breakup by Application

- 5.6 Market Breakup by Offering

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

6 Market Breakup by Product Type

- 6.1 Unmanned Aerial Vehicles (UAVs)/Drones

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Milking Robots

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Automated Harvesting Systems

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Driverless Tractors

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Application

- 7.1 Field Farming

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Dairy Farm Management

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Animal Management

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Soil Management

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Crop Management

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Others

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by Offering

- 8.1 Hardware

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Software

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Services

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Asia Pacific

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 Global Agricultural Robots Industry: SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Global Agricultural Robots Industry: Value Chain Analysis

12 Global Agricultural Robots Industry: Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Global Agricultural Robots Industry: Price Analysis

14 Agricultural Robots Manufacturing Process

- 14.1 Product Overview

- 14.2 Raw Material Requirements

- 14.3 Manufacturing Process

- 14.4 Key Success and Risk Factors

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 Deere & Company

- 15.3.2 Trimble Inc.

- 15.3.3 Agco Corporation

- 15.3.4 Lely Holding S.A.R.L

- 15.3.5 AG Eagle LLC

- 15.3.6 Agribotix LLC

- 15.3.7 Agrobot

- 15.3.8 Harvest Automation

- 15.3.9 Naio Technologies

- 15.3.10 Precision Hawk

- 15.3.11 IBM

- 15.3.12 Agjunction, Inc.

- 15.3.13 DJI

- 15.3.14 Boumatic Robotics, B.V.

- 15.3.15 AG Leader Technology

- 15.3.16 Topcon Positioning Systems, Inc.

- 15.3.17 Autocopter Corp

- 15.3.18 Auroras S.R.L.

- 15.3.19 Grownetics Inc.

- 15.3.20 Autonomous Tractor Corporation