|

市場調査レポート

商品コード

1687476

スーパーフードの市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Superfoods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スーパーフードの市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

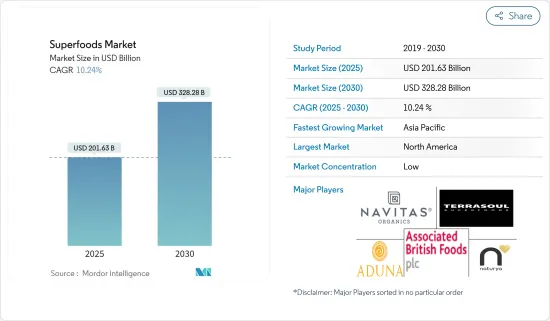

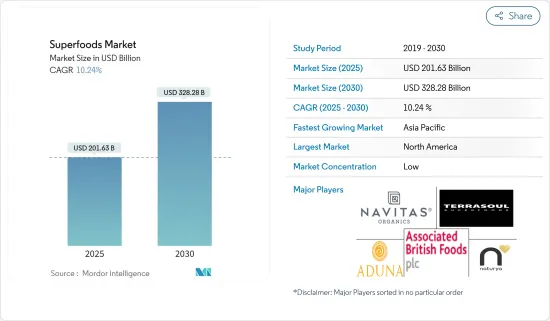

スーパーフードの市場規模は2025年に2,016億3,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは10.24%で、2030年には3,282億8,000万米ドルに達すると予測されます。

世界中の健康志向の消費者は、特定の健康問題を対象とし、全体的な幸福感を高めるために、機能的で健康的な製品を食生活に取り入れるようになっています。スーパーフードは、その優れた健康効果が評価され、ウェルネスを重視する消費者の間で広く普及しています。スーパーフードは優れた栄養価を持ち、ポリフェノール、抗酸化物質、ビタミン、ミネラルの豊富な供給源です。さらに、慢性疾患の増加により、低カロリーで栄養価の高い食品を食生活に取り入れることが奨励されています。米国保健社会福祉省によると、主な慢性疾患(心臓病、がん、糖尿病、肥満、高血圧など)を合わせると、2024年には米国で推定1億2,900万人が罹患するといいます。

企業はまた、消費者の需要に合わせて戦略的に事業を拡大しています。例えば、インドに本社を置くSupreem Pharma社は、2022年11月、プネーとムンバイでSupreem Super Foods社を立ち上げ、これらの都市で2,000店舗に拡大しました。このほか、生産方法における倫理的慣行を重視する消費者の増加に伴い、企業は環境的・社会的意識の高い消費者の需要に応えるため、持続可能な調達方法や透明性の高いサプライチェーンを取り入れるようになっています。例えば、2022年3月、パンガイアは植物由来のスーパーフードバーを新発売しました。この栄養価の高いスナックは、健康志向の消費者を対象としており、持続可能な方法で調達された原材料を使用しています。このバーは、植物ベースで環境に配慮した製品に対する需要の高まりに対応する態勢を整えています。

スーパーフードの市場動向

スーパーフードとしての果物の人気の高まりとスーパーフルーツ原料が市場を牽引

消費者は、長期的な健康を強化するための積極的な手段として、スーパーフルーツを戦略的に食生活に取り入れています。アサイー、ゴジベリー、ブルーベリーなどのスーパーフルーツには、ビタミン、抗酸化物質、その他の生物活性化合物が豊富に含まれており、免疫強化、認知機能強化、消化器系の健康増進など、総合的な健康ソリューションに対する需要の高まりに対応しています。

さらに、世界のスーパーフルーツ市場と盛んな果実生産・加工産業との相互依存関係は、市場拡大の極めて重要な触媒となっています。米国農務省の報告によると、2023年には米国の果実生産量が23%増の81万9,000トンと大幅に急増しました。カリフォルニア州が約半分の面積で全米をリードし、フロリダ州がほぼ4分の1、ワシントン州が約10分の1で続きます。アサイーベリー、マンゴスチン、グアバ、ドラゴンフルーツ、パッションフルーツなどのトロピカル・スーパーフルーツは、それぞれユニークな風味と栄養プロファイルを持ち、抗酸化物質、ビタミン、ミネラルを豊富に含む高い栄養価で知られ、多くの健康上のメリットを提供しています。2023年の主要熱帯果実の世界貿易額は112億米ドルと新たなピークに達し、2022年から約12%増加しました。

さらに、ナチュラル・オーガニック製品への動向は、消費者行動の顕著かつ継続的な変化であり、スーパーフルーツ加工品の販売に大きな影響を及ぼしています。この動向は、消費者が添加物、保存料、人工成分を最小限に抑えた食品を積極的に求めるようになった、より広範な動きを反映しています。例えば、パウバブは2024年、オーガニックの「パウバブ・オーガニック・バオバブ・スーパーフルーツ・パウダー」を新発売し、ナチュラルで強力な製品ラインを充実させました。このバオバブ果実パウダーはオーガニック認定を受けており、その天然で高品質な特性が強調され、パウバブのプレミアム製品へのコミットメントと一致しています。

スーパーフードの潜在的成長にとって重要な市場として台頭するアジア太平洋

アジア太平洋はスーパーフードの需要が急増すると予想されており、この動向は予防ヘルスケアを好む消費者の傾向の変化に起因しています。健康を維持し、病気を食い止めるための積極的なアプローチにより、個人は健康を維持するための手段を積極的に模索しています。加えて、急速な都市化と欧米の食習慣の影響が、より健康的で多様な食生活を求める都市部の消費者に、キヌア、ブルーベリー、アボカドなどのスーパーフード食材を受け入れてもらう重要な要因となっています。

さらに、政府の取り組みが健康的な食習慣の推進を積極的に提唱し、栄養と食事の選択の重要性を強調しています。例えば2022年、CNSは中国疾病予防管理センター栄養健康研究所、農業農村部食品栄養開発研究所、上海栄養健康研究所と共同で、"全国栄養週間"を導入しました。2022年国家栄養週間の包括的テーマは「栄養意識の向上、慎重な買い物、賢い調理」で、中国国民の栄養意識と全体的な健康と幸福を高めることを目的としています。

スーパーフード業界の概要

スーパーフード市場は競争が激しく、様々な地域企業や小規模企業が市場シェアを争っています。著名な企業としては、Naturya Bath、Associated British Foods PLC、Nutiva Inc.、Aduna Ltd.、Terrasoul Superfoodsなどが挙げられます。市場企業は、生産施設の拡張から食品安全ガイドラインの遵守、ブランド価値を高めるためのM&Aの採用まで、様々な戦略を駆使して競争しています。各社はまた、主に世界中の農家との協同組合で協力し、パートナーシップを結ぶことで、原料の調達と調達を容易にしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- ヘルス&ウェルネス動向の高まり

- 主要企業による戦略的取り組み

- 市場抑制要因

- 代替品の入手可能性とコスト面の考慮

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- 果物

- 野菜

- 穀物と種子

- ハーブと根

- その他のタイプ

- 流通チャネル

- スーパーマーケット/ハイパーマーケット

- オンライン・チャネル

- コンビニエンスストア/伝統的食料品店

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- Market Positioning Analysis

- 企業プロファイル

- Sunfood

- Nature's Superfoods LLP

- OMG!Organic Meets Good

- Raw Nutrition

- Barleans

- Aduna Ltd

- Impact Foods International Ltd

- Naturya Bath

- Mannatech Incorporated

- Nevitas Organics

第7章 市場機会と今後の動向

The Superfoods Market size is estimated at USD 201.63 billion in 2025, and is expected to reach USD 328.28 billion by 2030, at a CAGR of 10.24% during the forecast period (2025-2030).

Health-conscious consumers worldwide are increasingly integrating functional and healthy products into their diets to target specific health issues and enhance overall well-being. Superfoods are valued for their exceptional health benefits, contributing to their widespread popularity among consumers focused on wellness. Superfoods have superior nutritional value and are rich sources of polyphenols, antioxidants, vitamins, and minerals. Moreover, the increasing prevalence of chronic diseases is encouraging individuals to incorporate low-calorie and nutritious food into their diets. According to the US Department of Health and Human Services, major chronic diseases (e.g., heart disease, cancer, diabetes, obesity, hypertension) collectively affect an estimated 129 million people in the United States in 2024.

Companies are also strategically expanding their business operations to align with consumer demand. For instance, in November 2022, India-based Supreem Pharma launched Supreem Super Foods in Pune and Mumbai to extend its reach to 2,000 stores in these cities. Besides this, with growing consumer emphasis on ethical practices in production methods, companies increasingly incorporate sustainable sourcing methods and transparent supply chains to meet the demands of environmentally and socially conscious consumers. For instance, in March 2022, Pangaia introduced a new plant-based superfood bar. This nutritious snack, aimed at health-conscious consumers, is made with sustainably sourced ingredients. The bar is poised to cater to the growing demand for plant-based, environmentally responsible products.

Superfoods Market Trends

Growing Popularity of Fruits as Superfood and Superfruit Ingredients Driving the Market

Consumers are strategically incorporating superfruits into their dietary regimens as a proactive measure to fortify their long-term health. Superfruits, such as acai, goji berries, and blueberries, are replete with an array of vitamins, antioxidants, and other bioactive compounds, meeting the growing demand for comprehensive health solutions, including immune fortification, cognitive enhancement, and digestive well-being.

Moreover, the interdependence between the global superfruit market and the flourishing fruit production and processing industry serves as a pivotal catalyst for market expansion. In 2023, there was a significant surge of 23% in US fruit production, totaling 819,000 metric tons, as reported by USDA. The state of California leads the nation with roughly half the fruit acreage, followed by Florida with nearly a quarter, and Washington with around one-tenth. Tropical superfruit like acai berries, mangosteen, guava, dragon fruit, and passion fruit, each with unique flavors and nutritional profiles, are known for their high nutritional value, rich in antioxidants, vitamins, and minerals, offering numerous health benefits. The volume of global trade in major tropical fruits in 2023 rose to a new peak of USD 11.2 billion, marking an increase of approximately 12% from 2022.

Additionally, the trend toward natural and organic products is a prominent and ongoing shift in consumer behavior that is significantly influencing the sales of processed superfruit. This trend reflects a broader movement where consumers are actively seeking out food options with minimal additives, preservatives, and artificial ingredients. For instance, in 2024, Powbab launched its new organic Powbab Organic Baobab Superfruit Powder, enriching its product line with a natural and potent offering. The baobab fruit powder is certified organic, underscoring its natural and high-quality attributes, aligning with Powbab's commitment to premium offerings.

Asia-Pacific Emerging as a Significant Market for Superfoods' Potential Growth

Asia-Pacific is anticipated to experience a surge in the demand for superfoods, a trend attributed to evolving consumer inclinations favoring preventive healthcare. With a proactive approach to preserving well-being and staving off illnesses, individuals are actively seeking avenues for maintaining good health. Additionally, the rapid urbanization and the impact of Western dietary practices are pivotal factors driving the acceptance of superfood ingredients such as quinoa, blueberries, and avocados among urban consumers in search of healthier and more varied dietary choices.

Moreover, government initiatives are actively advocating for the promotion of healthy eating habits and emphasizing the significance of nutrition and dietary choices. For instance, in 2022, CNS, in collaboration with the Institute of Nutrition and Health of the China Center for Disease Control and Prevention, the Institute of Food and Nutrition Development of the Ministry of Agriculture and Rural Affairs, and the Shanghai Institute of Nutrition and Health, introduced the "National Nutrition Week." The overarching theme for the 2022 National Nutrition Week was "Enhancing nutritional awareness, prudent shopping, and intelligent cooking," aimed at elevating the nutritional consciousness and overall health and well-being of the Chinese populace.

Superfoods Industry Overview

The superfoods market is highly competitive, with various regional and small players competing for market share. Some prominent players include Naturya Bath, Associated British Foods PLC, Nutiva Inc., Aduna Ltd, and Terrasoul Superfoods. The market players compete using various strategies, from expanding their production facilities to adhering to food safety guidelines and adopting mergers and acquisitions to enhance their brand value. Companies also collaborate and form partnerships, mainly in co-operatives with farmers worldwide, making sourcing and procuring ingredients easier.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Health & Wellness Trends

- 4.1.2 Strategic Initiatives by Key Players

- 4.2 Market Restraints

- 4.2.1 Cost Considerations, Coupled With Availability of Alternatives

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fruits

- 5.1.2 Vegetables

- 5.1.3 Grains and Seeds

- 5.1.4 Herbs and Roots

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Online Channels

- 5.2.3 Convenience Stores/Traditional Grocery Stores

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Sunfood

- 6.3.2 Nature's Superfoods LLP

- 6.3.3 OMG! Organic Meets Good

- 6.3.4 Raw Nutrition

- 6.3.5 Barleans

- 6.3.6 Aduna Ltd

- 6.3.7 Impact Foods International Ltd

- 6.3.8 Naturya Bath

- 6.3.9 Mannatech Incorporated

- 6.3.10 Nevitas Organics