|

市場調査レポート

商品コード

1850311

アプリケーションデリバリコントローラ(ADC):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Application Delivery Controllers (ADC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アプリケーションデリバリコントローラ(ADC):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月20日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

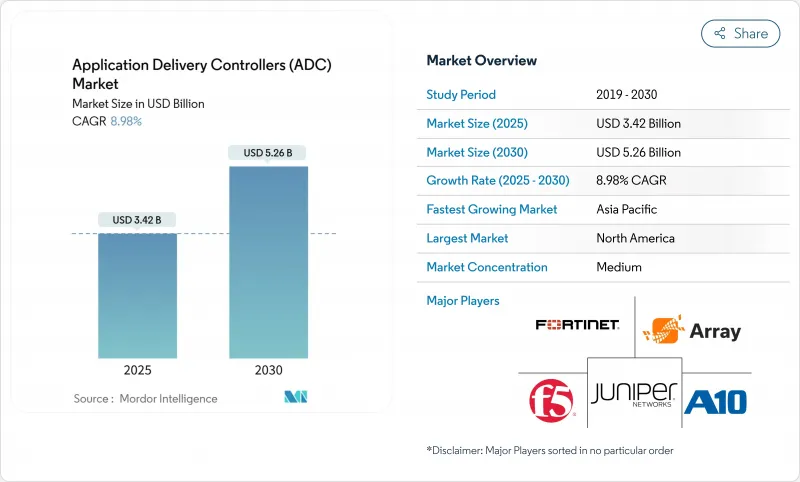

アプリケーションデリバリコントローラ(ADC)の市場規模は2025年に34億2,000万米ドル、2030年には52億6,000万米ドルに達し、CAGR 8.98%で拡大すると予測されています。

クラウドネイティブアーキテクチャへの急速な移行、データセンターの東西トラフィックの増加、永続的なマルチクラウド戦略により、インテリジェントでセキュリティを意識したトラフィック管理プラットフォームへの需要が高まっています。ベンダーは現在、高度なレイヤー7セキュリティ、API保護、AI支援アナリティクスを単一の製品にバンドルしており、企業はリスクを抑えながらユーザー・エクスペリエンスを向上させることができます。パフォーマンスが重視されるワークロードでは、依然としてハードウェア・アプライアンスが優位を占めているが、企業が俊敏性と消費ベースの経済性を優先するにつれて、仮想およびクラウド管理型のフォームファクターが急速に拡大しています。地域別では、北米が成熟したIT資産と規制の追い風を活かしてリーダーシップを維持する一方、アジア太平洋では5Gの構築とデジタルイニシアティブが最も急な成長曲線を描いています。

世界のアプリケーションデリバリコントローラ(ADC)市場の動向と洞察

クラウドネイティブとマイクロサービスアーキテクチャへのシフト

アプリケーションデリバリコントローラ市場は、Kubernetesクラスタやサービスメッシュ内に配置される軽量でAPI中心のフォームファクタへと軸足を移すことを余儀なくされています。これらのマイクロゲートウェイは、きめ細かいトラフィックステアリング、相互TLSターミネーション、自動化されたスケーリングフックを注入し、最新のアプリケーションのエフェメラルな性質にマッチさせる。ベンダーは、スキーマを意識したAPIファイアウォールと分散型レートリミッターを組み込み、東西のサービスコールによって生じるセキュリティギャップを埋めようとしています。CIOがプラットフォーム・エンジニアリングを推し進める中、宣言型の「ADC-as-code」はGitOpsパイプラインとシームレスに統合され、開発部門とNetOps間のハンドオフを削減します。

指数関数的な東西データセンターのトラフィック増加

仮想サーバーの高密度化により、内部フローは従来の南北パターンを凌駕し、レイテンシに敏感なマイクロトランザクションが増加しています。分散ADCインスタンスは現在、ワークロードポッドの近くに配置され、ボトルネックを発生させることなく、広範な遠隔測定とインライン復号化を提供しています。金融取引所、通信事業者、ゲームプロバイダーは、レイヤー7ポリシーを一括して適用しつつ、バースト的なリソースプールに適応する数千もの軽量プロキシを導入しています。

複雑なレイヤー7ポリシーのコンフィギュレーションがIT運用の負担に

企業チームは何百もの異種アプリケーションに直面しており、それぞれが特注のルーティング、書き換え、またはWAFロジックを要求しています。マルチクラウドの環境全体で正確性を維持することは、少ないDevSecOpsの人材に負担をかけ、より広範なADCのロールアウトを停滞させる可能性があります。ベンダーは、インテント・ベースのテンプレート、AIによるルール作成、視覚的な依存関係マップなどで対応していますが、スキル・ギャップは依然として残っています。

セグメント分析

ハードウェアアプライアンスは2024年のアプリケーションデリバリコントローラ市場の59%を占め、SSLオフロードに特化したチップと確定的なスループットに支えられています。しかし、DevOpsチームがADCイメージをCI/CDパイプラインに直接組み込み、ラックの設置面積を減らし、ロールアウト期間を短縮するため、仮想セグメントのCAGRは14.6%で拡大しています。仮想ソリューションのアプリケーションデリバリコントローラの市場規模は、コンテナの採用とともに急増し、ミッションクリティカルな層におけるハードウェアの支配に課題すると予測されます。

成熟したベンダーは、アプライアンスのオーバーヘッドを削減しながらポリシーエンジンを継承するコンテナネイティブなプロキシをリリースすることでヘッジしています。コストの透明性とクラウドマーケットプレースへの課金がアジャイルチームにアピールし、伝統的な企業内でもソフトウェアのシェア拡大が進みます。TLS 1.3とQUICの採用が進むにつれて、コードレベルの俊敏性はさらにソフトウェア・フォームファクターに決定を傾けると思われます。

2024年のアプリケーションデリバリコントローラ市場規模は、オンプレミスインスタンスが依然として64%を占め、データ主権に縛られる部門に支持されます。統合された脅威分析モジュールと従量制のキャパシティ・ライセンスは、フォークリフトによるリプレースなしでレガシーエステートをリフレッシュします。

逆に、クラウド管理モデルは、プラットフォーム・チームがパッチ適用、スケーリング、テレメトリをベンダーが運用するコントロール・プレーンにオフロードすることで、CAGR 15.2%で上昇します。マルチリージョンのロールアウトは数時間で完了し、統一されたAPIポリシーの施行はサイトレベルのドリフトを排除します。アプリケーションデリバリコントローラ市場は、単一のコンソールからハードウェア、仮想、SaaSエンドポイントを設定するハイブリッドダッシュボードを通じて、これらのモードを融合し続けています。

アプリケーションデリバリコントローラ(ADC)市場は、タイプ(ハードウェアベースADC、仮想/ソフトウェアADC)、展開(オンプレミス、クラウド管理/ホステッド)、コンポーネント(ソリューション(コントロール、アクセラレーション、セキュリティ)、サービス(統合、マネージド、トレーニング))、企業規模(大企業、中小企業)、エンドユーザー業種(ITおよびテレコム、BFSI、その他)、地域別に区分されます。市場予測は金額(米ドル)で提供されます。

地域分析

北米は2024年にアプリケーションデリバリコントローラ市場の34%を占め、ハイパースケーラのエコシステムと、統合セキュリティ要件を高める厳しいデータプライバシー規制が後押し。F5が報告した何百ものCitrix NetScaler施設の置き換えのような統合プレーは、成熟したアカウント内の解約を示します。

アジア太平洋地域は、5Gの展開とインダストリー4.0への取り組みにより、工場やスマートシティにおける低レイテンシー、マルチテナントADCファブリックへの需要が高まっており、CAGRは12.8%と最も急上昇しています。中国とインドの政府クラウドプログラムは、ADC機能を主権クラウド内に組み込み、現地ベンダーとのパートナーシップを促進しています。

欧州では、銀行やフィンテックのアップグレードに影響するDORAコンプライアンス期限が強化され、オンプレミスとクラウドの導入のバランスが取れています。規制当局によるデータレジデンシーへの注目が、ポリシー主導のロケーションフェンスへの需要を後押し。

中東とアフリカでは、3兆7,000億米ドルの巨大プロジェクト建設、IoT対応の公共事業、全国的なデジタル政府ポータルを支えるためにADCを活用。ハイブリッド・モデルは、パフォーマンス・ニーズと限られた地域のデータセンター・フットプリントの両方を満たします。

南米では金融サービスの近代化と小売のeコマースにより、クラウドベースのADCの導入が加速しており、経済変動の中で資本制約を回避するために好まれています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- クラウドネイティブとマイクロサービスアーキテクチャへの移行

- 東西データセンタートラフィックの急激な増加

- 北米およびEUにおけるセキュアデジタルバンキングに関する規制要件

- アジアにおける5G展開の拡大がエッジADCの採用を促進

- グローバル2000におけるマルチクラウドとハイブリッドIT戦略の台頭

- 市場抑制要因

- 複雑なレイヤー7ポリシー構成がIT運用の負担となる

- 高度なADCライセンシングモデルのコスト高騰

- 基本的な負荷分散機能のコモディティ化

- 熟練したNetOpsおよびDevSecOps人材の不足

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済要因が業界に与える影響の評価

第5章 市場規模と成長予測

- タイプ別

- ハードウェアベースのADC

- 仮想/ソフトウェアADC

- 展開別

- オンプレミス

- クラウド管理/ホスト

- コンポーネント別

- ソリューション(制御、加速、セキュリティ)

- サービス(統合、管理、トレーニング)

- 企業規模別

- 大企業

- 中小企業

- エンドユーザー別

- ITおよび通信

- BFSI

- 小売業とeコマース

- ヘルスケアとライフサイエンス

- 政府および公共部門

- 製造業とインダストリアル4.0

- メディアとエンターテイメント

- エネルギーと公益事業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- ペルー

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- トルコ

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 戦略的開発

- ベンダーポジショニング分析

- 企業プロファイル

- F5 Networks Inc.

- NetScaler(Citrix Systems)

- Fortinet Inc.

- A10 Networks Inc.

- Array Networks Inc.

- Radware Ltd.

- Akamai Technologies Inc.

- Cisco Systems Inc.

- Barracuda Networks Inc.

- HAProxy Technologies LLC

- Kemp Technologies(Progress Software)

- Loadbalancer.org Inc.

- Cloudflare Inc.

- Dell Technologies Inc.

- Amazon Web Services(ALB/NLB)

- Microsoft Azure(Application Gateway)

- Alibaba Cloud(Global Server Load Balancer)

- Piolink Inc.

- Sangfor Technologies Inc.

- NGINX Inc.(F5)