|

市場調査レポート

商品コード

1851642

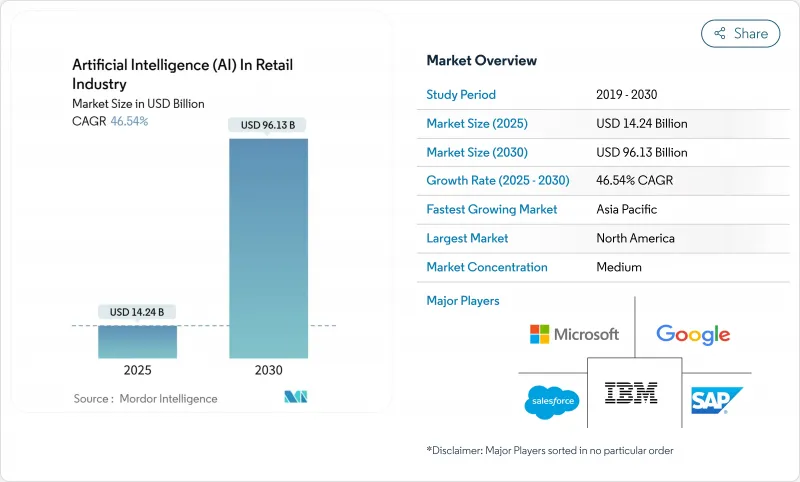

小売業における人工知能(AI):市場シェア分析、業界動向、統計、成長予測(2025年~2030年)Artificial Intelligence (AI) In Retail Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小売業における人工知能(AI):市場シェア分析、業界動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月03日

発行: Mordor Intelligence

ページ情報: 英文 136 Pages

納期: 2~3営業日

|

概要

小売業における人工知能市場は、2025年に142億4,000万米ドル、2030年には961億3,000万米ドルに達すると予測され、CAGRは46.54%を記録します。

この急成長は、高度な分析と生成モデルをプライシング、マーチャンダイジング、顧客エンゲージメントのワークフローに組み込む小売企業によって推進されます。精度を15%向上させ、過剰在庫を10%削減する需要予測エンジンは、即座に運転資本の改善を実現し、エッジベースのコンピュータビジョンシステムは、自律的なチェックアウトの導入を加速し、バスケットバリューを最大35%向上させます。クラウドのコストカーブは下がり続けており、中堅小売企業にとってはエンタープライズグレードのAIスタックへのアクセスが拡大しています。同時に、データプライバシーとアルゴリズムの公平性をめぐる地域的な規制が、ローカル推論とプライバシー保護アーキテクチャへの投資を促しています。ハイパースケーラーが小売業に特化したAIツールキットをパッケージ化し、グローバルチェーンと複数年契約を結ぶことで、競合の激しさが増しています。

世界の小売業における人工知能(AI)市場の動向と洞察

パーソナライゼーションのためのオムニチャネルAIの急速な採用

オムニチャネルAIは現在、モバイル、ウェブ、店舗の各タッチポイントにおいて、カスタマージャーニーを完全にマッピングし、リアルタイムで調整します。約2,000店舗で展開されているターゲットのストアコンパニオンAIは、生成モデルが買い物客に合わせたオファーを提供しながら、スタッフの質問に対応できることを示しています。FairPrice GroupのStore of TomorrowはGoogle Cloud上に構築され、カートデータ、店舗内センサー、eコマースプロファイルを統合し、各顧客の単一ビューを作成します。小売企業の96%がプロジェクトの成功を報告している一方で、消費者の45%しか理解されていないと感じており、実行面での不足が明らかになっています。

クラウドベースのAIスタックのコストとアクセシビリティの低下

チップの効率が上がり、ハイパースケーラーが多額の投資を行うにつれて、推論の単価は下がっています。アマゾンはAIとAWSインフラに1,000億米ドルを投じ、レイテンシーを低く、キャパシティを高く保っています。マイクロソフトのCloud for Retailは、あらかじめ設定されたAIモジュールをバンドルしており、中堅チェーンの展開サイクルを短縮しています。アクセンチュアやマイクロソフトと提携したCurrysのようなパートナーシップは、ターンキー・スタックをレンタルすることで、小売企業が人材の制約を回避する方法を浮き彫りにしています。アクセス・シフトは、レガシー・データセンターを運営する既存企業にプレッシャーを与えます。

データ採取を制限するデータプライバシー規制

EUのAI法は、小売業のアルゴリズムを「高リスク」に引き上げ、透明性、人的監視、影響評価を義務付けた。小売企業はデータ保護影響評価を実施し、コードのコミットからモデルの再トレーニングに至るまでプライバシー・バイ・デザインを組み込む必要があります。会社のファイアウォールを離れないローカライズされたLLMは、コンプライアンス・ヘッジとして台頭しつつあるが、小規模チェーンはコストとガバナンスのオーバーヘッドに苦慮しています。

セグメント分析

2024年の小売業における人工知能市場シェアは、オムニチャネル・アプローチが45.7%を占め、店舗、ウェブ、モバイルにまたがる統一されたデータフローの戦略的価値を強調しています。クラウドネイティブアーキテクチャにより、レガシーPOSレイヤーを取り壊すことなくAIパイロットサービスを開始できるため、ピュアプレイのオンラインモデルは小規模ながらCAGR 19.8%で最も急速に拡大しています。実店舗型チェーンは、店舗内のIoTセンサーを活用して行動データをレコメンデーション・エンジンにフィードバックし、クロスセルの精度を高めてコンバージョンを高めています。

英国の大手アパレルチェーンMatalanは、商品説明にジェネレーティブAIを適用し、コピー処理能力を4倍に高め、ブランドトーンを維持しながらコンテンツコストを削減しました。逆に、eコマースを店舗チームから切り離した専門チェーンは、レコメンデーションに一貫性がなく、カート放棄が急増すると報告しています。今後は、ミックスド・リアリティ・フィッティング・ルームやモバイル・チェックアウトによって、チャネル間の区別が曖昧になることが予想されます。

予測分析エンジン、LLMを利用したチャットボット、画像認識APIなどをカバーするソフトウェア・プラットフォームは、2024年の小売業における人工知能市場規模の61.3%を占めています。しかし、小売企業がモデルチューニング、MLOps、コンプライアンスをアウトソーシングしているため、マネージドサービスのCAGRは21.3%で上昇しています。資金に制約のあるバナーにとっては、数百万米ドルのライセンスよりも、オペックス形式のAIの方が守りやすいです。

サービス・スペシャリストは、棚割りのヒューリスティック、マークダウンのタイミング、労働力のスケジューリングといった専門分野のノウハウを、事前に訓練されたモデルにバンドルしています。データサイエンスのベンチを欠くチェーンでは、このような専門知識の縮小により、導入が容易になります。プロフェッショナル・サービスの成長はより安定しており、AIの準備状況の監査や倫理的リスクのマッピングなどのアドバイザリー・プロジェクトに重点を置いています。

小売業界のAI市場レポートは、チャネル別(オムニチャネル、実店舗、ピュアプレイオンライン小売)、コンポーネント別(ソフトウェア、サービス)、導入別(オンプレミス、クラウド)、アプリケーション別(サプライチェーンとロジスティクス、商品最適化とマーチャンダイジング、その他)、テクノロジー別(機械学習と予測分析、自然言語処理、その他)、地域別に業界をセグメンテーションしています。

地域分析

北米は、強固なクラウドインフラストラクチャ、ベンチャーキャピタル、最先端モデルの試験的導入に積極的な小売企業に支えられ、2024年の小売業における人工知能市場規模の37.4%を占めました。WalmartがジェネレーティブAI主導のマーチャンダイジングにより4.8%の収益向上を達成したことは、具体的なリターンを裏付けています。偏見や価格差別をめぐる規制当局の監視は強まっているが、透明性の高いモデルガバナンスの実践が、メジャー各社の事業展開を軌道に乗せるのに役立っています。ウォルマート・エレメント(Walmart Element)やターゲット・ストア・コンパニオン(Target Store Companion)といった独自のスタックへの投資は、競争力を維持するために続いています。

アジア太平洋は成長エンジンであり、2030年までのCAGRは18.9%で拡大します。モバイルファーストの消費者、政府からの資金援助、デジタルネイティブの積極的な参入が、肥沃な土壌を生み出しています。インドでは、小売企業の80%が2025年にAIを導入する意向を示しており、ジェネレイティブ・モデルによって現場の生産性が37%も向上すると期待されています。中国のソーシャルコマースの巨頭は、ライブ動画、会話型AI、統合決済を組み合わせ、衝動買いを最適化しています。ASEAN市場はクラウド・オンリーのソリューションで従来のPOSを飛躍させるが、ブロードバンドの不均一性やスキルの格差が二次都市での展開スピードを抑制しています。

欧州では、イノベーションと規制のバランスが取れています。GDPRと今後のAI法では、プライバシーへの影響に関する厳格な監査が要求され、チェーンは連携学習とエッジの暗号化に向かう。セインズベリーがマイクロソフトと結んだ5年間の契約は、コンプライアンスと最先端のツールを融合させたパートナーシップの一例です。IntermarcheのスマートカートのパイロットとIKIリトアニアの年齢推定チェックアウトは、プライバシーに沿った実用的な使用事例を示しています。この地域の忍耐強く倫理第一のアプローチは、世界的に輸出可能な責任あるAIのテンプレートを生み出しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- パーソナライゼーションのためのオムニチャネルAIの急速な採用

- クラウドベースのAIスタックのコストとアクセシビリティの低下

- リアルタイム分析が求められるeコマースの拡大

- ジェネレーティブAI搭載ビジョンチェック

- ファーストパーティデータを収益化する小売メディアネットワーク

- ESG主導のAIインベントリ・カーボン最適化

- 市場抑制要因

- データ収集を制限するデータプライバシー規制

- 小売業に特化したAI人材の不足

- ダイナミックプライシングにおけるアルゴリズムバイアスのリスク

- マイクロ・フルフィルメントにおけるエッジコンピューティングのエネルギーコスト

- 重要な規制枠組みの評価

- バリューチェーン分析

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 主要利害関係者の影響評価

- 主な使用事例とケーススタディ

- 市場のマクロ経済要因への影響

- 投資分析

第5章 市場セグメンテーション

- チャネル別

- オムニチャネル

- 実店舗

- ピュアプレーオンライン小売企業

- コンポーネント別

- ソフトウェア

- サービス

- 展開別

- クラウド

- オンプレミス

- 用途別

- サプライチェーンとロジスティクス

- 商品の最適化とマーチャンダイジング

- インストア・ナビゲーションとエクスペリエンス

- 支払い、価格設定、チェックアウト分析

- 在庫と需要予測

- 顧客関係管理

- 不正行為と損失防止

- 技術別

- 機械学習と予測分析

- 自然言語処理

- 生成AIと大規模言語モデル

- コンピュータビジョン(画像・映像)

- チャットボットとバーチャルアシスタント

- 群知能と強化知能

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧諸国

- その他欧州地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- その他アフリカ

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Accenture plc

- Amazon Web Services, Inc.

- BloomReach, Inc.

- Cognizant Technology Solutions Corporation

- Conversica, Inc.

- Daisy Intelligence Corporation

- Google LLC

- IBM Corporation

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- SymphonyAI LLC

- Tencent Holdings Ltd.

- ViSenze Pte. Ltd.