|

市場調査レポート

商品コード

1404365

油田機器:市場シェア分析、産業動向と統計、2024~2029年の成長予測Oilfield Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 油田機器:市場シェア分析、産業動向と統計、2024~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

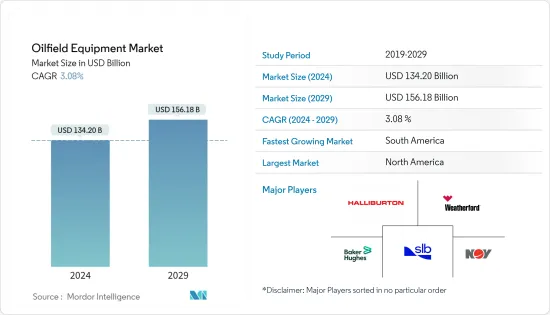

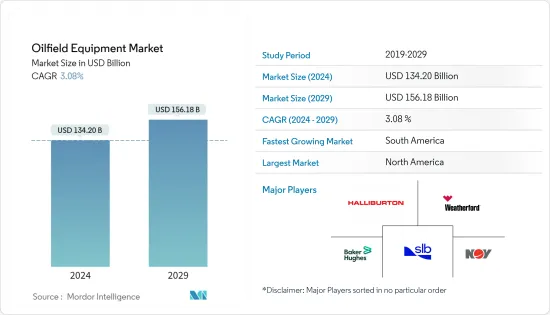

油田機器市場規模は2024年に1,342億米ドルと推定され、2029年には1,561億8,000万米ドルに達すると予測され、予測期間中(2024~2029年)のCAGRは3.08%で成長すると予測されます。

主要ハイライト

- 中期的には、深海・超深海油田の増加や(南米、北米、中東・アフリカなどの)地域における掘削作業の増加といった要因が、予測期間中の油田機器市場を牽引するとみられます。

- その一方で、需給ギャップや地政学的要因による原油価格の不安定さは、市場の成長を抑制する大きな要因となっています。

- とはいえ、石油・ガスの発見増加や業界の世界の自由化は、参入企業に新たな投資機会を創出しました。

油田機器市場の動向

市場を独占する陸上セグメント

- 陸上掘削は、乾いた土地にあるすべての掘削現場を含み、世界の石油生産量の70%を占める。陸上掘削は、海上掘削と似ているが、プラットフォームと石油の間に深海があるという困難はないです。

- 世界の原油価格は回復の兆しを見せ、急速に改善しています。したがって、原油価格の回復に伴う楽観論に乗って、陸上プロジェクトは予測期間中に大きな成長を記録し、油田機器市場の需要を牽引すると予想されます。

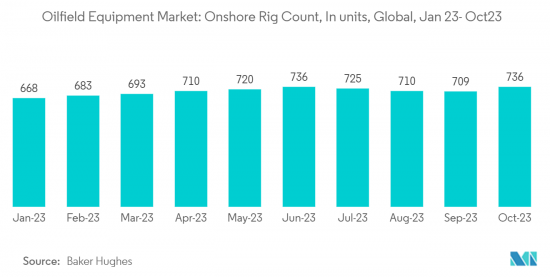

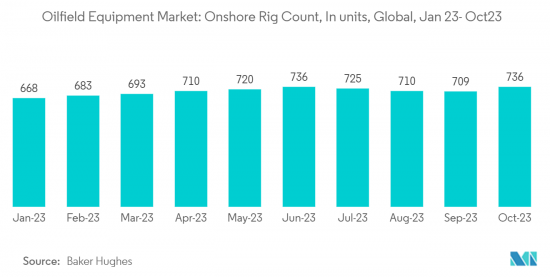

- Baker Hughes Companyによると、2023年10月現在、陸上リグ総数は736基で、リグ総数の約75%を占めています。陸上地域でのリグ数の増加に伴い、掘削、生産、その他の油田活動の需要が見込まれます。ひいては、陸上地域の油田機器市場を牽引すると思われます。

- 油田サービスを提供するシュルンベルジェ(SLB)によると、同社は2023年に四半期配当を43%増配(1株当たり25セント)し、好調なエネルギー市場に対応して自社株買いプログラムを再開します。2021年の企業収益は5億8,600万米ドルで、うち陸上部門は4億3,900万米ドルと全体の75%を占めました。オフショア部門は1億4,700万米ドルを計上し、総収益の25%を占めました。

- さらに、2021年の石油生産量は全世界で1.6%増加しました。2021年の石油生産量は日量8,987万7,000バレルで、2020年の日量8,849万4,000バレルと比較しました。

- したがって、陸上部門が世界の油田機器市場を独占すると予想されます。

北米が市場を独占する見込み

- 北米が2023年の油田機器市場を独占すると予想されます。予測期間中もその優位性は続くと予想されます。

- 世界の原油生産量に占める北米のシェアは2013年の17.3%から2021年には22.7%程度に増加し、その結果、同地域の油田機器の需要が増加しました。

- さらに、カナダの石油・ガス産業は、石油資源の豊富なアルバータ州で価格が急落する中、ニューファンドランド・ラブラドール州が積極的に推進していることから、今後、投資意欲の高まりが予想されます。

- 2022年5月、カナダエネルギー請負業者協会は、予想を上回る石油・ガス価格により第1四半期が好調だったことを受け、石油・天然ガスの掘削予測を上方修正しました。修正された掘削予測では、年間の稼働日数が62,121日となり、前回予測の5万8,111日から増加、稼働リグ数も159から170に増加しました。

- さらに、原油価格の上昇と掘削コストの低下により、米国のオフショア・リグ数とオフショア石油生産量は大幅に増加し、オフショア掘削だけでなく生産活動も伸びていることを示しています。ひいては、それが同国の油田機器市場の主要な促進要因になると予想されます。

- したがって、石油・ガス活動の活発化などの要因が、予測期間中に油田機器市場を成長させると予想されます。

油田機器業界概要

油田機器市場は統合されており、一部のトップ企業が市場の主要シェアを占めています。その中には、Schlumberger Limited、Baker Hughes Company、Halliburton Company、Weatherford International PLC、National Oilwell Varco Inc.などが含まれる(順不同)。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2028年までの市場規模と需要予測(単位:10億米ドル)

- 2028年までの陸上・海上リグ数と予測

- 2028年までの石油・天然ガス生産量と予測

- 2028年までのCAPEXの歴史と需要予測(10億米ドル、陸上・海上別)

- 今後の主要上流プロジェクト

- 最近の動向と展開

- 市場力学

- 促進要因

- 深海・超深海鉱区の増加

- 地域(南米、北米、中東・アフリカなど)における掘削作業の増加

- 抑制要因

- 需給ギャップと地政学に起因する不安定な原油価格

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- 事業展開

- オンショア

- オフショア

- 機器タイプ

- 掘削機器

- 生産機器

- その他の機器

- 地域

- 北米

- 米国

- カナダ

- その他の北米地域

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 韓国

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- イラン

- その他の中東とアフリカ

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Schlumberger Limited

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

- Tenaris SA

- TMK Ipsco Enterprises Inc.

- National Oilwell Varco Inc.

- Vallourec SA

- Aker Solutions ASA

- Stabil Drill

第7章 市場機会と今後の動向

- 石油・ガス発見の増加と業界の自由化

The Oilfield Equipment Market size is estimated at USD 134.20 billion in 2024, and is expected to reach USD 156.18 billion by 2029, growing at a CAGR of 3.08% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increasing number of deep-water and ultra-deepwater fields and the growing drilling operations in regions (like South America, North America, the Middle East, and Africa) will likely drive the oilfield equipment market during the forecast period.

- On the other hand, the volatile oil prices due to the supply-demand gap and geopolitics are major factors restraining the market's growth.

- Nevertheless, the increasing oil and gas discoveries and the global liberalization in the industry created new opportunities for the players to invest in.

Oilfield Equipment Market Trends

Onshore Segment to Dominate the Market

- Onshore drilling encompasses all the drilling sites located on dry land and accounts for 70% of worldwide oil production. Onshore drilling is similar to offshore drilling but without the difficulty of deep water between the platform and oil.

- The global crude oil prices showed signs of recovery and are improving quickly, and the onshore projects are easier to kick start than offshore ones. Therefore, riding on the optimism associated with the recovery of crude oil prices, onshore projects are expected to record significant growth over the forecast period, driving the demand for the oilfield equipment market.

- According to Baker Hughes, as of October 2023, the total onshore rig counts accounted for 736 units, approximately 75% of the total rig counts. With the increasing rig counts on the land region, drilling, production, and other oil field activity are expected to be in demand. It, in turn, will drive the oilfield equipment market for the onshore region.

- According to Schlumberger (SLB), a provider of oilfield services, the company would increase its quarterly dividend in 2023 by 43% (to 25 cents per share) and resume its share buyback program in reaction to the strong energy markets. In 2021, the company recorded total revenue of USD 586 million, out of which the onshore segment recorded revenue of USD 439 million, representing 75% of the total revenues. The offshore segment reported USD 147 million, representing 25% of the total revenue.

- Moreover, oil Production increased by 1.6% in 2021 worldwide. In 2021, the oil production was 89877 thousand barrels per day compared to 2020, which was 88494 thousand barrels per day.

- Hence, the onshore segment is expected to dominate the oilfield equipment market worldwide.

North America is expected to Dominate the Market

- North America is expected to dominate the oilfield equipment market in 2023. It is expected to continue its dominance during the forecast period.

- The share of North America in global crude oil production increased from 17.3% in 2013 to around 22.7% in 2021, which resulted in an increased demand for oilfield equipment in the region.

- Further, Canada's oil and gas industry is expected to attract rising investment interests in the future due to an aggressive push by Newfoundland and Labrador as prices plummet in oil-rich Alberta.

- In May 2022, the Canadian Association of Energy Contractors raised its drilling prediction for oil and natural gas after a good first quarter due to higher-than-expected oil and gas prices. The revised drilling projection predicts 62,121 working days for the year, up from the earlier forecast of 58,111, and 170 active rigs, up from 159.

- Furthermore, due to higher oil prices and declining drilling costs, the offshore rig count and offshore oil production in the United States increased significantly, indicating that growth is not only offshore drilling but also production activity. It, in turn, is expected to be the major driver for the oilfield equipment market in the country.

- Therefore, factors such as rising oil and gas activities are expected to grow the oilfield equipment market in the forecast period.

Oilfield Equipment Industry Overview

The oilfield equipment market is consolidated, with some of the top companies holding the major share of the market. Some companies include (in no particular order) Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International PLC, and National Oilwell Varco Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Onshore and Offshore Active Rig Count and Forecast, till 2028

- 4.4 Crude Oil and Natural Gas Production and Forecast, till 2028

- 4.5 Historic and Demand Forecast of CAPEX in USD billion, by Onshore and Offshore, till 2028

- 4.6 Major Upcoming Upstream Projects

- 4.7 Recent Trends and Developments

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 The Increasing Number of Deep-Water and Ultra-Deepwater Fields

- 4.8.1.2 The Growing Drilling Operations in Regions (like South America, North America, and Middle-East and Africa)

- 4.8.2 Restraints

- 4.8.2.1 The Volatile Oil Prices, Owing to the Supply-Demand Gap and Geopolitics

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Equipment Type

- 5.2.1 Drilling Equipment

- 5.2.2 Production Equipment

- 5.2.3 Other Equipment Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Iran

- 5.3.5.4 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Weatherford International PLC

- 6.3.3 Baker Hughes Company

- 6.3.4 Halliburton Company

- 6.3.5 Tenaris SA

- 6.3.6 TMK Ipsco Enterprises Inc.

- 6.3.7 National Oilwell Varco Inc.

- 6.3.8 Vallourec SA

- 6.3.9 Aker Solutions ASA

- 6.3.10 Stabil Drill

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Oil and Gas Discoveries, Coupled With the Liberalization in the Industry