|

市場調査レポート

商品コード

1907307

インジウムガリウム亜鉛酸化物(IGZO):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| インジウムガリウム亜鉛酸化物(IGZO):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

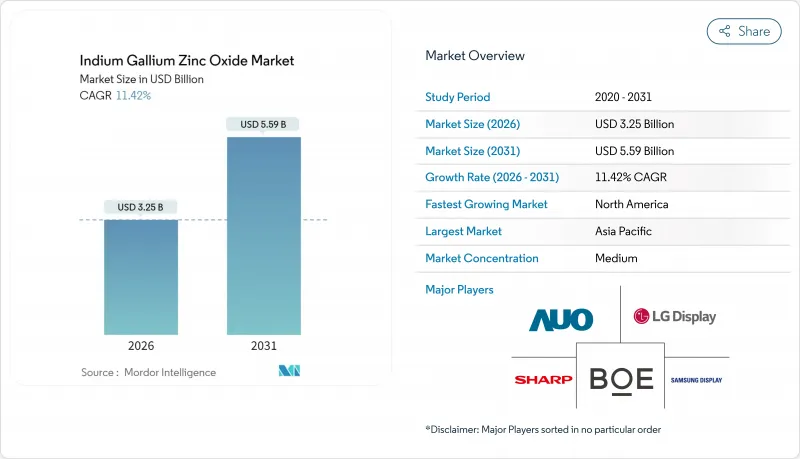

インジウムガリウム亜鉛酸化物(IGZO)市場は、2025年に29億2,000万米ドルと評価され、2026年の32億5,000万米ドルから2031年までに55億9,000万米ドルに達すると予測されています。

予測期間(2026年~2031年)におけるCAGRは11.42%と見込まれています。

この成長の勢いは、従来のシリコンバックプレーンよりも高解像度かつ低消費電力を実現する酸化物ベースの薄膜トランジスタ(TFT)へのディスプレイメーカーの移行に起因しています。エネルギー効率に優れたスマートフォン、ノートパソコン、大型テレビに対する消費者の嗜好の高まりは、アジア全域における酸化物TFT生産能力の供給増加と一致しています。また、機械的柔軟性と広温度範囲での安定性が重要な折りたたみ式ディスプレイや自動車用ディスプレイにおいても、インジウムガリウム亜鉛酸化物(IGZO)市場の採用が加速しています。同時に、主要パネルベンダーによる垂直統合により開発サイクルが短縮され、成熟したシリコン技術とのコスト競争力が実現しています。

世界のインジウムガリウム亜鉛酸化物(IGZO)市場動向と展望

高解像度OLEDおよび8Kテレビ需要の急増

8Kテレビパネルへの移行に伴い、アモルファスシリコンでは対応が困難な高速スイッチング性能が要求されます。IGZOの高い電子移動度は超高精細コンテンツに不可欠な高密度トランジスタ配列を実現し、パネル効率を維持します。LGディスプレイは2024年、酸化物TFTバックプレーン技術により単層構造比40%の省電力化を達成した13インチタンデム型OLEDノートPCパネルの量産を開始しました。サムスンも透明テレビのプロトタイプにIGZOを適用しており、駆動電流を犠牲にすることなくより多くの光を透過する小型トランジスタを活用しています。放送局やストリーミング企業が8Kコンテンツを推進する中、パネルメーカーは、電力予算を超過することなく輝度の余裕を維持できる唯一の拡張可能な手段として酸化物TFTを位置付けています。

省エネルギー型携帯機器への要求

スマートフォンやノートPCメーカーは、リフレッシュレートを犠牲にせずバッテリー駆動時間の延長を追求しています。IGZOバックプレーンは、静止画表示時にマイクロアンペアレベルの漏れ電流で維持可能であり、パネル消費電力を最大50%削減します。イメックはIGZOベースのダイナミックRAMセルを実証し、従来型SRAMを上回るエネルギー効率を達成。低消費電力コンピューティングブロックにおける酸化物技術の広範な採用を示唆しています。Apple社は第2世代LTPOスタックの全駆動用TFTをIGZOに移行し、スマートウォッチで5~15%の効率向上を達成したと報告しております。リモートワーク機器の需要増加に伴い、ディスプレイの電力消費は引き続き注視されており、インジウムガリウム亜鉛酸化物(IGZO)市場の成長には長期的な展望が開けております。

LTPS/LTPOシリコンバックプレーンとの競合

パネルメーカー各社は、既にフラッグシップスマートフォン性能目標を達成している低温ポリシリコンラインに多額の投資を行ってきました。LTPSはより高い正孔移動度を提供し、複雑なオンパネル回路を可能にすることでドライバー数を削減できます。AppleはiPhoneディスプレイにLTPOシリコンを採用し続け、IGZOを選択的に追加しており、完全な切り替えではなくハイブリッド路線を示しています。プロセス成熟度とファブにおける確立された歩留まり曲線により、コスト感度が高い分野ではシリコン系が魅力的です。この確立された資本基盤が、特定の高級セグメントにおけるインジウムガリウム亜鉛酸化物(IGZO)市場の短期的な成長余地を抑制しています。

セグメント分析

スマートフォンセグメントは、バッテリー消費を抑えつつ画素密度を向上させる酸化物TFTの採用により、2025年にインジウムガリウム亜鉛酸化物市場の43.95%を占めました。折り畳み式およびフレキシブルディスプレイは、IGZOの機械的安定性により数千回の曲げでも可動性を維持できることから、2031年までCAGR12.63%で成長し、他の用途を凌駕しています。タブレットおよび2-in-1 PCは、大型画面における均一な輝度維持に酸化物バックプレーンを活用しており、これはクリエイティブプロフェッショナルにとって重要な仕様です。ウェアラブル機器は、IGZOの超低オフ電流特性を活用し、コンパクト筐体でのバッテリー寿命を大幅に延長します。テレビおよび大型パネルは、酸化物の移動度特性を活用し、視聴体験を再定義する8K解像度や透明モードを実現します。

第二層の用途も拡大中です。自動車ディスプレイはコックピットのデジタル化に伴いIGZOへ移行しており、熱や振動によるシリコン劣化を回避します。産業用・医療用モニターは手術やプロセス制御における画像精度を重視し、酸化物TFTを統合しています。こうした多様な使用事例が相まって、インジウムガリウム亜鉛酸化物(IGZO)の応用市場規模を押し上げ、単一最終製品の周期的な変動を緩和するバランスの取れた需要構造を支えています。

2025年時点では、民生用電子機器がインジウムガリウム亜鉛酸化物(IGZO)市場の59.55%を占めており、この技術がモバイル機器やテレビ製造に起源を持つことを反映しています。自動車・輸送分野は12.44%のCAGRで最も急速な成長を示しており、OEMメーカーがアナログ計器をパノラマ式デジタルダッシュボードに置き換えているためです。医療施設では診断モニター向けにIGZOの画質忠実度を重視し、産業分野では工場現場で堅牢な酸化物パネルを導入しています。航空宇宙・防衛分野では、耐放射線性と熱安定性が必須となる航空電子機器向けに酸化物TFTを採用しています。

業界横断的な勢いが酸化物サプライチェーンに新たな資本を呼び込んでおります。BOEによる自動車向け45インチ9K酸化物パネルへの投資は、省電力バックプレーンが車載の厳しい安全基準と輝度基準を満たせるという確信の高まりを示しております。このような多様化は市場の回復力を強化し、消費者向けアップグレードへの依存度を低減するとともに、インジウムガリウム亜鉛酸化物(IGZO)市場の収益基盤を拡大するものでございます。

インジウムガリウム亜鉛酸化物(IGZO)レポートは、用途別(スマートフォン・フィーチャーフォン等)、最終用途産業別(民生用電子機器など)、ディスプレイ技術別(LCD、OLEDなど)、成膜技術別(RFマグネトロンスパッタリングなど)、導電相別(アモルファスIGZOなど)、地域別(北米、南米など)に分類されています。市場予測は金額ベース(米ドル)で提供されます。

地域別分析

2025年、BOE、LGディスプレイ、サムスンディスプレイが酸化物TFTラインを増強し、OLEDスマートフォンおよびテレビの世界の需要に対応した結果、アジア太平洋地域はインジウムガリウム亜鉛酸化物(IGZO)市場収益の65.20%を占めました。中国単独で2025年までに世界のOLED生産能力の76%を掌握する計画であり、IGZOバックプレーンへの大規模な発注が集中しています。日本は単結晶酸化物薄膜技術の開発を通じて調査分野での主導権を維持し、韓国はハイブリッドLTPO-IGZO積層技術を活用し、主力デバイスを最先端に保っています。

北米地域はCAGR12.18%と最も急速に成長しており、これはAppleによる酸化物技術の採用拡大と、高解像度・低遅延ディスプレイを必要とするAR/VRヘッドセットへの地域的な進出が要因です。アプライド・マテリアルズ社は2024年第3四半期にディスプレイ関連収益15億8,000万米ドルを計上し、年末までに先進ノード分野で25億米ドルの収益を見込んでおり、地域的な生産能力拡大を支える装置需要の高まりを裏付けています。

欧州は自動車・産業分野への展開に注力しており、エネルギー効率が持続可能性の要請と合致しています。現地の研究機関は酸化物TFT生産における原材料圧力を緩和するため、ガリウムとゲルマニウムのリサイクル研究を主導しています。中東・アフリカおよびラテンアメリカでは、民生用電子機器の普及が進むにつれ需要が拡大しており、インジウムガリウム亜鉛酸化物(IGZO)市場にとって長期的な成長余地が生まれています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高解像度OLEDおよび8Kテレビ需要の急増

- 省エネルギー型携帯機器の需要

- 折りたたみ式およびフレキシブルディスプレイにおける急速な普及

- 低リークIGZOバックプレーンを用いたウェアラブルデバイスの普及

- 空間コンピューティングヘッドセット(AR/VR/MR)への統合

- ニューロモーフィック・インメモリコンピューティングを実現するIGZOアレイ

- 市場抑制要因

- LTPS/LTPOシリコンバックプレーンとの競合

- インジウムの供給網変動性と価格設定

- 使用済みIGZOスパッタターゲットのリサイクル率の低さ

- 湿潤環境下におけるサブギャップ欠陥による電流ドリフト

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済要因が市場に与える影響

第5章 市場規模と成長予測

- 用途別

- スマートフォンおよびフィーチャーフォン

- タブレットおよび2-in-1 PC

- ウェアラブルデバイス

- テレビおよび大型ディスプレイ

- 自動車用ディスプレイ

- 産業用および医療用ディスプレイ

- 最終用途産業別

- 民生用電子機器

- 自動車および輸送機器

- ヘルスケア

- 産業および製造業

- 航空宇宙・防衛

- その他

- ディスプレイ技術別

- 液晶ディスプレイ

- 有機EL

- マイクロLEDおよびミニLED

- 電子ペーパーおよびその他の新興技術

- 成膜技術別

- RFマグネトロンスパッタリング

- パルス直流マグネトロンスパッタリング

- 原子層堆積法

- ソリューション/インクジェット印刷

- その他の技術

- 伝導フェーズ別

- アモルファスIGZO

- 多結晶IGZO

- 単結晶IGZO

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- その他アジア太平洋地域

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Sharp Corporation

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- ASUS(ASUSTeK Computer Inc.)

- Panasonic Holdings Corporation

- Innolux Corporation

- Visionox Technology, Inc.

- Everdisplay Optronics(Shanghai)Co., Ltd.

- TCL China Star Optoelectronics Technology Co., Ltd.

- Kunshan GVO Optoelectronics Co., Ltd.

- Fujitsu Limited

- Rohm Semiconductor

- ULVAC, Inc.

- Applied Materials, Inc.