|

市場調査レポート

商品コード

1326457

HVAC機器の市場規模・シェア分析- 成長動向と予測(2023年~2028年)HVAC Equipment Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| HVAC機器の市場規模・シェア分析- 成長動向と予測(2023年~2028年) |

|

出版日: 2023年08月08日

発行: Mordor Intelligence

ページ情報: 英文 225 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

HVAC機器の市場規模は2023年に1,413億6,000万米ドルと推定され、2028年には1,959億6,000万米ドルに達すると予測され、予測期間(2023年~2028年)のCAGRは6.75%で成長する見込みです。

HVAC機器は、ショッピングセンター、産業施設、倉庫など、幅広い場所や建物の種類に適用することができ、建物の居住者が快適で安全に過ごせるよう、必要な気圧や空気の質とともに、冷暖房による適切な気候制御を保証します。

主なハイライト

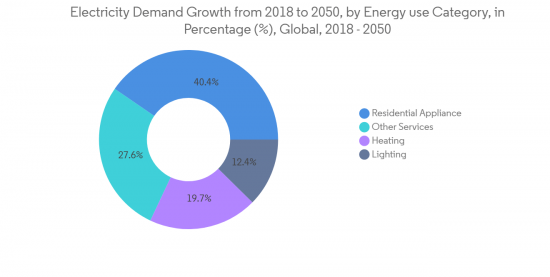

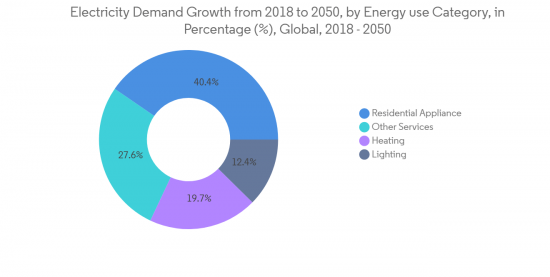

- 世界の工業化と都市化の急速な進展は、市場の成長を促す主な要因のひとつです。世界中でさまざまな商業ビルや住宅の建設が大幅に増加しているため、空間冷暖房システム、換気制御、湿度制御、空気ろ過などのHVAC機器に対する需要がかなり高まっています。例えば、IEAによると、世界のビル建設部門の金額は前年比5%増の6兆3,000億米ドル以上に達しました。

- エネルギーコストの上昇は、ビルオーナーやテナントの損益計算書に直接影響を与えます。ウクライナ侵攻は世界のエネルギー市場に影響を及ぼし、特に欧州では、欧州諸国でこれらのエネルギー源が不足しているため、ロシアの石油・ガスの主要市場となっています。しかし、ロシアのウクライナ侵攻により、欧州連合(EU)はロシアの石油輸入を3分の2に削減することを決定し、その結果、エネルギー価格が高騰しました。その結果、エネルギー効率の高いHVACシステムに対する需要が最近大幅に高まっています。

- 商業ビルの暖房、換気、空調は通常、ビル内の他のどの活動よりも多くのエネルギーを消費します。米国エネルギー省の商業ビルに関する調査によると、HVAC機器は通常、ビルのエネルギー使用量の40%以上を占めています。莫大なエネルギーを消費するため、HVACシステムは機器の効率を改善することで、ビルの運営コストを大幅に削減することができます。

- HVAC機器の初期コストの高さは、その需要にとって課題となり得る。なぜなら、コストの高さが、システムの購入やアップグレードを躊躇させる顧客もいるからです。これは特に、予算に限りがあり、新システムの初期費用を捻出できない可能性のある住宅所有者や中小企業経営者に当てはまる。第二に、HVAC機器のコストが高いため、顧客の投資回収期間が長くなる可能性があります。つまり、新システムのエネルギー効率向上によるコスト削減が、数年間は初期投資を相殺できない可能性があるということです。

- COVID-19の発生により、購入するサービスや製品が環境に与える影響について懸念を示す消費者が増えています。より環境にやさしく、より健康にやさしい選択肢のためなら、他のものよりも多く支払うことを厭わないです。スマートHVACシステムは大きな需要が見込まれます。

HVAC機器の市場動向

税額控除制度による省エネ奨励を含む政府の支援的規制が市場成長を牽引

- 世界の多くの政府は、効率的なHVAC(暖房、換気、空調)機器の設置を奨励する税制優遇措置を提供しています。これは、二酸化炭素排出量を削減し、気候変動の影響を緩和するための大きな取り組みの一環です。持続可能なエネルギーへの移行を加速させながら現在の供給を強化することで、インフレ抑制法のエネルギー条項は、エネルギー安全保障を強化し、排出量を大幅に削減し、より良い未来に向けた重要な一歩となります。

- これらの前例のない優遇措置は、消費者に対し、老朽化した低効率の空調システムを、わずかな費用で先進的な高効率技術に置き換える、魅力的な機会を提供するものです。

- 例えば、2022年12月、米国ではHVACの高効率化に対する連邦税の優遇措置が再び始まっています。特定のHVAC機器を設置する住宅所有者や、特定のエネルギー効率基準を満たすプロジェクトを行う住宅建設業者に対する税額控除が強化され、定められた省エネを達成するためにアップグレードされた商業ビルの所有者に対する税額控除は、米国下院で可決されたインフレ削減法の一部です。インフレ削減法では、住宅所有者には最高2000米ドルの税額控除が、住宅建設業者には2500~5000米ドルの税額控除が適用されます。25Cの税額控除は、対象となるHVAC機器を設置した住宅所有者が利用でき、住宅建設業者は強化された45Lの税額控除を利用できます。インフレ削減法は、179D税額控除の利用可能性を拡大し、商業ビルの所有者は、一般的にエネルギー効率を高めるために艤装を使用します。これらの税制優遇措置はすべて、特定のカテゴリーで最低限のエネルギーコスト削減を示すことを要求しています。

- 2022年7月、米国上院で審議中の2つの法案は、HVACシステムの電化を加速し、建物で使用される化石燃料(天然ガス・石油など)の数を最小限に抑え、二酸化炭素排出量を削減することを目的としていました。両法案とも、特にヒートポンプ、地熱・空気源、ヒートポンプ式給湯器など、特定の電気を動力源とするHVAC機器の製造に財政的インセンティブを与えるものでした。

- 米国議会で可決されたTax-and-Climate法案は、米国史上最大のエネルギー効率への投資であり、今後10年間にわたり、家庭の省エネ改修に対するリベートと連邦税の控除として210億米ドル以上が割り当てられました。

- これらのリベートはすべて、2023年1月から2031年9月まで、対象となるプログラムを設立した州政府および部族政府を通じて分配される予定です。

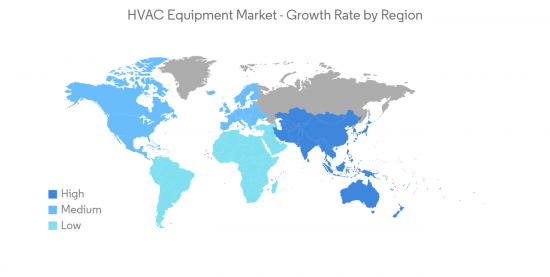

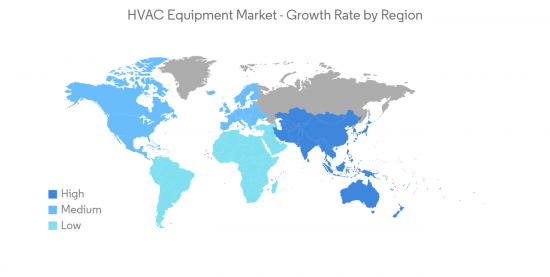

アジア太平洋地域が最速の成長を記録する見込み

- アジア太平洋地域のHVACシステム市場は、インドと中国における商業および住宅建設活動と、高級品への消費支出の増加により、着実に成長すると予測されます。アジアにおける所有率の低さと可処分所得の増加が、市場の成長を後押しする可能性が高いです。インドと中国からの需要増加により、住宅部門はアジア太平洋空調システム市場のかなりの部分を占めています。世界的に有名なメーカーよりも低価格で製品を提供する中国メーカーとの競合の激化が、売上高の成長を維持すると予測されます。西欧や米国のような確立された地域における大規模な設置ベースが、比較的未開拓のアジア太平洋市場に市場開拓の展望をもたらすと予想されます。

- エアコン最大手は、目の肥えたインドの消費者向けにインドで設計・製造されたスプリットルームエアコンの新ラインを発表しました。この新しいUシリーズ・ラインは、顧客が施設全体の空調品質をコントロールできるようにする、未来に対応した技術を特徴としています。

- 2023年2月、ゴドレイ・グループの旗艦会社であるゴドレイ&ボイス社の一部門であるゴドレイ・アプライアンス社は、インド初の漏電防止技術を搭載したスプリットエアコンを発売し、その特許を申請しました。ゴドレイのリークプルーフスプリットエアコンに搭載されている全く新しいアンチリークテクノロジーは、上記の問題を解決するよう努力しています。このACには他にも、省エネのために部屋の人数に応じて調節できる「5-in-1コンバーチブル冷却テクノロジー」、設定温度に合わせて最高の快適さを実現する「i-senseテクノロジー」、低ディレーティングで52℃でもパワフルな冷房、省電力のためのインバーター技術、オゾン層破壊ゼロで地球温暖化係数の低い環境に優しいR32冷媒など、いくつかの価値ある技術や機能が搭載されています。

- 2023年2月には、世界有数の空調メーカーであるダイキン・ジャパンが、同市周辺の社会住宅を含む公共施設にヒートポンプと冷房システムを供給し、遠隔監視と認証を受ける計画です。この英国初の契約締結により、グレーター・マンチェスターでは今後2年間で800~1000戸の住宅が、改修工事、空気熱源ヒートポンプなどの低炭素暖房システム、より広範なデジタル介入を通じて支援されることになります。

- アジア太平洋市場では、エネルギー・電力部門が暖房機器の重要なエンドユーザーとなります。発電所容量の増加が市場拡大の主な要因となります。国際エネルギー機関の世界エネルギー投資予測によると、2014年から2035年の間に、世界中で発電所の新設と既存の発電所の改修に9兆5,000億米ドル以上が費やされます。このうち3分の1以上は、化石燃料を使用する火力発電所に使われると思われます。発電容量の増加は、主に化石燃料を燃料とする火力発電所によって達成される予定であり、これらの国々における発電の一次情報です。

HVAC機器産業の概要

HVAC機器市場は、Trane Technologies PLC、Aermec SpA(Giordano Riello International Group SpA)、Daikin Industries Ltd、Clivet SpA(Midea Group)、Emicon Innovation、Comfort SRLといった大手企業が存在し、細分化されています。市場のプレーヤーは、製品提供を強化し、持続可能な競争優位性を獲得するために、提携や買収などの戦略を採用しています。

- 2022年11月、ダイキンは空気を浄化し、室内を冷暖房するよう設計された室内空調管理システム「エムラ」を発表しました。エムラはスリムで目立たない形状で、リビングルームからオフィスまで様々な屋内エリアにフィットするよう設計され、効果的な温度制御に努めています。

- 2022年9月、世界の気候イノベーターの一人であるトラン・テクノロジーズは、電化冷暖房のポートフォリオを拡大し、エネルギー効率、建物との接続性、制御性を向上させる2つの有名な屋上ユニットをアップグレードするイノベーションを発表しました。ThermafitAir-to-Waterモジュール式ヒートポンプモデルAXMを発表。また、Voyager 3とIntelliPak2ルーフトップ・ユニットにアップデートを加え、倉庫や大規模施設における室内の快適性と空気品質を向上させました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界バリューチェーン分析

- COVID-19発生の業界への影響

- 規制が市場に与える影響

- 流通チャネル分析

- 業界エコシステム分析

第5章 市場力学

- 市場促進要因

- 税額控除プログラムによる省エネインセンティブを含む、政府による支援規制

- エネルギー効率の高い機器に対する需要の増加

- 需要を支える建設・改修活動の増加

- 市場の課題

- エネルギー効率の高いシステムの初期コストの高さ

- マクロ経済状況への依存

- 競争激化による利幅制限

- 市場機会

- 置き換えを支援するIoTと製品イノベーションの出現

第6章 市場セグメンテーション

- タイプ別

- 空調機器

- 暖房機器

- ヒートポンプ

- 加湿器/除湿器

- エンドユーザー産業別

- 住宅

- 工業・商業

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- アフリカ

- その他中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Trane Technologies PLC

- Aermec SpA(Giordano Riello International Group SpA)

- Daikin Industries Ltd

- Clivet SpA(Midea Group)

- Emicon Innovation and Comfort SRL

- G.I. Industrial Holding SpA

- Mitsubishi Electric Hydronics & IT Cooling Systems

- Rhoss SpA(NIBE Group)

- MTA SpA

- Hitema International

- Swegon Group AB

- Systemair AB

- Lennox International Inc.

- Carrier Corporation

- Rheem Manufacturing Company Inc.

- Midea Group

- Gree Electric Appliances

第8章 投資分析

第9章 市場の将来

The HVAC Equipment Market size is estimated at USD 141.36 billion in 2023, and is expected to reach USD 195.96 billion by 2028, growing at a CAGR of 6.75% during the forecast period (2023-2028).

HVAC equipment can be applied in a wide range of locations, and building types, such as shopping centers, industrial facilities, warehouses, etc., ensuring that a building has proper climate control with heating and cooling, along with the necessary air pressure and air quality to make the occupants in the building comfortable and safe.

Key Highlights

- The rapid rise in industrialization and urbanization worldwide is one of the primary factors driving the market's growth. The significant increase in the construction of different commercial and residential buildings worldwide is creating considerable demand for HVAC equipment as a space heating and cooling system, ventilation control, humidity control, and air filtration. For instance, as per the IEA, the global building construction sector's value increased by 5% compared to the previous year, reaching over USD 6.3 trillion.

- Rising energy costs directly impact building owners' and tenants' profit/loss statements. The invasion of Ukraine affected energy markets worldwide, particularly in Europe, which remains the primary market for Russian oil and gas due to the lack of these energy sources in European countries. However, due to Russia's invasion of Ukraine, the European Union decided to cut Russian oil imports by two-thirds, resulting in a surge in energy prices. Consequently, the demand for energy-efficient HVAC systems has recently increased significantly.

- Heating, ventilating, and air-conditioning in a commercial building usually consume more energy than any other activity in the building. According to the US Department of Energy's studies of commercial buildings, HVAC equipment usually account for over 40% of a building's energy usage. Owing to the huge amount of energy, HVAC systems use improvements in equipment efficiency translate to significant reductions in building operating costs.

- The high initial cost of HVAC equipment can be challenging for its demand because the high cost may deter some customers from purchasing or upgrading their systems. This is especially true for homeowners or small business owners who may have limited budgets and may not be able to afford the upfront costs of a new system. Secondly, the high cost of HVAC equipment can result in long payback periods for customers. This means that the cost savings resulting from the new system's improved energy efficiency may not offset the initial investment for several years.

- With the outbreak of COVID-19, more consumers are expressing concerns about the environmental impact of the services and products they buy. They are willing to pay more for more eco-friendly and health-friendly options than others. Smart HVAC systems are expected to have significant demand.

HVAC Equipment Market Trends

Supportive Government Regulations, Including Incentives for Saving Energy Through Tax Credit Programs, Drive the Market's Growth

- Many governments worldwide are offering tax incentives to encourage the installation of efficient HVAC (heating, ventilation, and air conditioning) equipment. This is part of a larger effort to reduce carbon emissions and mitigate the impact of climate change. By bolstering current supplies while accelerating the sustainable energy transition, the energy provisions of the Inflation Reduction Act will strengthen energy security and meaningfully reduce emissions, representing an important step toward a better future.

- These unprecedented incentives present consumers with a compelling opportunity to replace any aging, lower-efficiency HVAC systems with advanced, high-efficiency technology at a fraction of the cost.

- For instance, in December 2022, the federal tax incentives in the United States for greater HVAC efficiency were on again. Enhanced tax credits have been provided for homeowners who install certain HVAC equipment and home builders whose projects meet specific energy-efficiency standards, and tax deductions for the owners of commercial buildings that are upgraded to achieve defined energy savings are part of the Inflation Reduction Act, passed in the US House of Representatives. Through the Inflation Reduction Act, a tax credit of up to USD 2,000 is available to homeowners, followed by USD 2500-5000 for home builders with qualified heat pumps installed. The 25C credit is available to homeowners with eligible HVAC equipment, while home builders can take advantage of enhanced 45L credits. The Inflation Reduction Act broadened the availability of 179D tax deductions, which commercial building owners generally use outfitted to increase energy efficiency. All these tax rebates require specific categories to show minimum energy cost savings.

- In July 2022, two bills pending in the US Senate were designed to speed the electrification of HVAC systems, minimize the number of fossil fuels (such as natural gas and oil) used in buildings, and cut carbon emissions. Both offered financial incentives for producing certain electric-powered HVAC equipment, particularly heat pumps, geothermal and air sources, and heat-pump water heaters.

- The Tax-and-Climate bill passed by Congress is the largest investment in energy efficiency in US history, with more than USD 21 billion allocated for rebates and federal tax deductions for household energy-saving upgrades over the next 10 years.

- All these rebates were expected to be distributed beginning in January 2023 and continue through September 2031 through state and tribal governments that establish their qualifying programs.

Asia-Pacific Expected to Register Fastest Growth

- The Asia-Pacific HVAC systems market is predicted to rise steadily due to commercial and residential construction activity in India and China and rising consumer expenditure on luxury products. Low ownership rates and increased disposable income in Asia are likely to boost the market's growth. Due to rising demand from India and China, the residential sector accounted for a significant portion of the Asia-Pacific air conditioning systems market. Increased competition from Chinese producers offering products at lower prices than globally recognized names is projected to sustain sales growth. A large installed base in established regions like Western Europe and the United States is expected to create development prospects in the comparatively untapped Asia-Pacific market.

- The largest air conditioning firm introduced a new line of split-room air conditioners designed and built in India for discerning Indian consumers. This new U Series line features future-ready technologies that enable clients to control the quality of air conditioning across their facilities.

- In February 2023, Godrej Appliances, a division of Godrej & Boyce, the Godrej Group's flagship firm, launched India's first leakproof split air conditioner with anti-leak technology and has filed a patent for it. The all-new anti-leak technology found in Godrej Leak Proof Split ACs strives to solve the issues mentioned above. This AC also includes several other valuable technologies and features, such as 5-in-1 Convertible Cooling Technology, which can be adjusted based on the number of people in the room to save energy, i-sense technology to match the set temperature for maximum comfort, powerful cooling even at 52°C with lower derating, inverter technology for power savings, and eco-friendly R32 refrigerant, which has zero ozone depletion and low global warming potential.

- In February 2023, Daikin Japan, one of the world's major air conditioning manufacturers, plans to supply heat pumps and cooling systems to public buildings, including social housing, around the city, which will be remotely monitored and certified. The signing of this UK-first agreement will assist between 800-1000 houses in Greater Manchester over the next two years via retrofitting efforts, low-carbon heating systems such as air-source heat pumps, and broader digital interventions.

- In the Asia-Pacific market, the energy and power sectors will be essential end users of heating equipment. Rising power plant capacity will be a primary driver of market expansion. According to the International Energy Agency's Global Energy Investment Forecast, between 2014 and 2035, over USD 9.5 trillion will be spent on constructing new power plants and rehabilitating existing ones worldwide. Over one-third of this will likely be used for fossil-fuel-based thermal power plants. Increasing generation capacity is planned to be achieved primarily through fossil-fuelled thermal power plants, which are the primary source of electricity generation in these countries.

HVAC Equipment Industry Overview

The HVAC equipment market is fragmented with the presence of major players like Trane Technologies PLC, Aermec SpA (Giordano Riello International Group SpA), Daikin Industries Ltd, Clivet SpA (Midea Group), Emicon Innovation and Comfort SRL. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In November 2022, Daikin introduced the Emuraindoor climate management system, designed to purify the air and heat and cool interior areas. Emura is a slim and unobtrusive shape designed to fit in various indoor areas, from living rooms to offices, and strives to provide effective temperature control.

- In September 2022, Trane Technologies, one of the global climate innovators, announced innovations that expanded its electrified heating and cooling portfolio and upgraded two well-known rooftop units to improve energy efficiency, building connectivity, and control. Trane introduced the new ThermafitAir-to-Water Modular Heat Pump Model AXM, which offers flexible, all-electric heating and cooling. It also added updates to its Voyager 3 and IntelliPak2 Rooftop Units to improve indoor comfort and air quality in warehouses and large facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

- 4.5 The Impact of Regulations on the Market

- 4.6 Distribution Channel Analysis

- 4.7 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations, Including Incentives for Saving Energy Through Tax Credit Programs

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.1.3 Increased Construction and Retrofit Activity to Aid Demand

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Efficient Systems

- 5.2.2 Dependence on Macro-economic Conditions

- 5.2.3 Growing Competition to Limit Margins

- 5.3 Market Opportunities

- 5.3.1 Emergence of IoT and Product Innovations to Aid Replacements

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Air Conditioning Equipment

- 6.1.2 Heating Equipment

- 6.1.3 Heat Pumps

- 6.1.4 Humidifiers/Dehumidifiers

- 6.2 By End-user Industry

- 6.2.1 Residential

- 6.2.2 Industrial and Commercial

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Africa

- 6.3.5.4 Rest of Middle East

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Trane Technologies PLC

- 7.1.2 Aermec SpA (Giordano Riello International Group SpA)

- 7.1.3 Daikin Industries Ltd

- 7.1.4 Clivet SpA (Midea Group)

- 7.1.5 Emicon Innovation and Comfort SRL

- 7.1.6 G.I. Industrial Holding SpA

- 7.1.7 Mitsubishi Electric Hydronics & IT Cooling Systems

- 7.1.8 Rhoss SpA (NIBE Group)

- 7.1.9 MTA SpA

- 7.1.10 Hitema International

- 7.1.11 Swegon Group AB

- 7.1.12 Systemair AB

- 7.1.13 Lennox International Inc.

- 7.1.14 Carrier Corporation

- 7.1.15 Rheem Manufacturing Company Inc.

- 7.1.16 Midea Group

- 7.1.17 Gree Electric Appliances