|

市場調査レポート

商品コード

1849834

リッチコミュニケーションサービス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Rich Communication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| リッチコミュニケーションサービス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月22日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

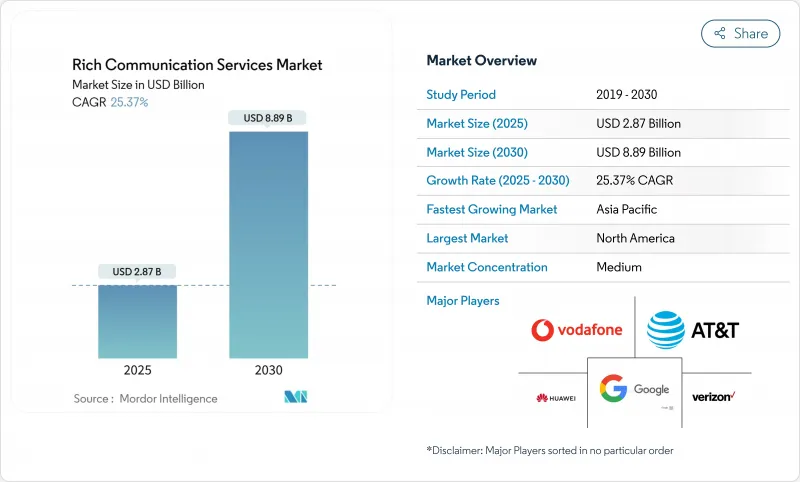

リッチコミュニケーションサービス市場は2025年に28億7,000万米ドルに達し、CAGR 25.37%を反映して2030年には88億9,000万米ドルに成長すると予測されています。

メディアリッチでブランド化された顧客エンゲージメントに対する企業の意欲の高まりにより、企業は単なるSMSから画像、動画、アクション可能なボタンに対応したインタラクティブなメッセージングへの移行を進めています。通信事業者のサポート拡大、iOS 18へのRCSの搭載、グーグルによる米国でのRCSメッセージの1日あたり10億件以上という報告は、主流採用の転換点を裏付けています。大企業が主要な収益源であることに変わりはないが、クラウドネイティブなCPaaSプラットフォームは中小企業の参入障壁を低くしています。アジア太平洋地域の通信事業者が5Gネットワークを使用してリッチメディアトラフィックをサポートしているため、アジア太平洋地域の勢いは最も強く、北米は長年にわたる通信事業者の相互運用性を背景にリードを保っています。送信者IDの認証に向けた規制の動きは、顧客との接触に安全で認証されたチャネルを必要とする企業にとって、さらなる牽引役となっています。

世界のリッチコミュニケーションサービス市場の動向と洞察

A2P RCSビジネスメッセージに対する企業の需要

A2Pキャンペーンは、従来のSMSよりもコンバージョン率やクリックスルー率が著しく高く、銀行や小売のブランドはこのチャネルにかなりの支出をシフトしています。マルチメディアカードと返信提案により、マーケティング担当者は1つのスレッド会話内で買い物客を認知から購入に導くことができ、基本的なテキストプッシュの6.2倍のROIを生み出しています。CPaaSベンダーは、ローコードテンプレート、コンプライアンスワークフロー、Eメールやアプリプッシュプログラムに対するリフトを定量化するリアルタイム分析を組み込むことで対応しています。グローバルな銀行のような早期採用企業は、パーソナライズされたローンアップセルチャットから10%のコンバージョンを報告し、収益の向上を検証しています。より多くの企業がこの効果を目の当たりにしており、A2Pの利用は予測期間中、リッチコミュニケーションサービス市場全体の拡大を下支えするものと思われます。

iOS-18サポートとAndroid OEMプリインストールの拡大

アップルがiOS 18にRCSを組み込むことを決定したことで、トラフィックをOTTアプリに誘導していた歴史的な相互運用性のギャップが解消され、約9億台のアクティブなiPhoneが事業者グレードのリッチメッセージング経由で即座にアクセス可能になります。サムスンがGalaxy端末にMessages by Googleをデフォルトで採用したことで、グローバル・リーチはさらに拡大した。統一されたエクスペリエンスにより、ピクセル化された画像、途切れたグループチャット、グリーン/ブルーチャットの断片化などが解消され、消費者の意欲をそぎます。企業は、並列のOTTチャネルを維持することなく、より多くのアドレス可能なオーディエンスのロックを解除し、オペレーティングシステム全体で予測可能なリーチを得る。このネットワーク効果は、アップル社のロールアウト後に25%高いエンゲージメントを記録した試験的キャンペーンですでに確認されています。

断片化された世界の通信事業者の相互運用性

GSMAユニバーサル・プロファイル3.0に準拠している通信事業者は57社にとどまり、国境を越えた体験を低下させるギャップを生み出しています。複数の地域にキャンペーンを発信する企業は、予備のSMSやOTTチャンネルを維持しなければならず、コストと運用の複雑さを高めています。GoogleのJibeやGSMAのInterconnectプロジェクトなどのハブは、ルーティングの合理化を意図しているもの、実装にばらつきがあるため、規模が縮小してしまいます。多国籍企業は、価値の高いトラフィックを移行する前に一貫したSLAを求め続けており、RCSに向けた収益の再編成を遅らせています。

セグメント分析

A2Pトラフィックは2024年の収益の61.8%を占め、リッチコミュニケーションサービス市場の基幹をなしています。銀行、小売業者、航空会社は、マルチメディアカードとクイック返信を使用して、日常的な通知を、売上増を促進する会話タッチポイントに変換しています。AIチャットボットが成熟し、消費者がスレッド内でトランザクションを完了することに快感を覚えるようになるにつれて、個人対アプリケーションの会話は、現在は小さいもの、毎年31.5%拡大しています。この増加により、P2Aフローのリッチコミュニケーションサービス市場規模は、2030年まで2桁のペースで拡大すると予想されます。

企業は、ロイヤリティ・プロモーションをSMSからRCSに移行する際に、コンバージョンが8~10ポイント上昇したことを記録しています。インドのケーススタディでは、CPaaSプロバイダーのGupshupがVertex AIチャットボットを統合した後、トラフィックが358%急増したことが示されています。iOSとAndroidのシームレスな相互接続が可能な市場では、個人間の利用も増加しているが、収益化は企業主導ではなく事業者主導で行われています。ゲームやチケッティングのようなエンゲージメントの高いセクターは、キャンセル待ちや認証を管理するためにP2Aフローに依存しており、コミュニケーションタイプの階層内でミックスが進化していることを示しています。

クラウド・ホスティング・プラットフォームは2024年の売上の72.9%を占め、設備投資がかさむオンプレミスのメッセージング・ゲートウェイを排除しようとする、より広範な企業の動きを反映しています。パブリッククラウドのRCSは、REST APIを通じて既存のCRM、CDP、マーケティング自動化スタックと連携できるため、多国籍ブランドが好んで利用しています。

オンプレミス環境は、防衛、ヘルスケア、政府機関など、データ居住に関する法律でローカル処理が義務付けられている分野では、依然として自明ではないです。このような環境では、機密性の高いコンテンツはファイアウォールの内側でレンダリングされ、グローバルなリーチはパブリッククラウドの相互接続を利用するハイブリッドアーキテクチャが有効です。Twilioのパブリックベータは、SDKの背後にあるキャリアの複雑さを抽象化し、開発者が1つのダッシュボードでSMS、WhatsApp、電子メールと一緒にRCSを起動できるようにするベンダーのプッシュを強調しています。

リッチコミュニケーションサービス市場は、通信タイプ別(A2P(Application-to-Person)、P2P(Person-to-Person)、その他)、展開モード別(クラウド、オンプレミス)、エンドユーザー企業規模別(大企業、中小企業)、エンドユーザー業界別(BFSI、メディア・エンターテイメント、その他)、地域別に分類されます。市場予測は金額(米ドル)で提供されます。

地域別分析

北米は、Verizon、ATandT、T-Mobileにおけるユニバーサルプロファイルの早期導入に支えられ、2024年の売上高の38.5%を占めました。グーグルが米国で1日10億件以上のRCSメッセージを公開したことは、消費者の取り込みが成熟していることを示しています。FCCは現在、911の緊急メールにRCSを認めており、自治体や企業が認証チャネルを採用することを後押ししています。この地域はARPUが高いため、通信事業者はビジネス・メッセージング料金を通じて増収を得ることができます。

アジア太平洋地域はCAGR 30.4%で最も急成長している地域であり、スマートフォンの超高普及と政府のデジタル化プログラムが刺激となっています。インドは単一のCPaaSプラットフォームで毎月5,000万件の企業向けメッセージを記録しており、2027年までにトラフィック量で北米を追い抜くと予測されています。日本と韓国ではRCSユーザー比率がプラス70%を記録しており、5Gの密度がリッチメディアの採用といかに相関しているかを証明しています。通信事業者の状況は断片化しているもの、GSMA Interconnect Hubのようなイニシアティブが国境を越えたルーティングの合理化を目指しており、この地域のリッチコミュニケーションサービス市場をさらに後押ししています。

欧州では、データ保護規制とデジタル市場法の相互運用性ルールが、規制のないOTTアプリよりも、検証済みの事業者管理メッセージングに有利なため、着実に拡大しています。ドイツテレコムの2024年売上高1,158億ユーロには、RCS対応の付加価値サービスからの売上が含まれています。逆に、アップルの暗号化RCSに対する合法的傍受をめぐる英国の議論は、規制の不確実性が導入を一時的に抑制する可能性があることを示しています。ラテンアメリカはまだ初期段階にあるが、特にブラジルでは会話型コマースの利用が非常に多く、一流通信事業者が2024年中に最初の大規模なキャンペーンを実施しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- A2P RCSビジネスメッセージングに対する企業の需要

- iOS-17のサポートとAndroid OEMプリインストールの拡大

- 5Gの展開により高解像度リッチメディアのトラフィックが増加

- 検証済み送信者IDとスパム対策ルールへの規制の移行

- CPaaS統合によるオムニチャネルオーケストレーションの実現

- 会話型コマースを可能にするメッセージ内決済(RCS MaaP)

- 市場抑制要因

- 断片化されたグローバルオペレータの相互運用性

- 完全なエンドツーエンドの暗号化の欠如

- OTTスーパーアプリが企業のウォレットシェアを食い尽くす

- 不明確な事業者収益化モデルが価格設定を遅らせる

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 業界ステークホルダー分析

- RCSの進化と実装

- RCSの進化

- ユースケースと実装研究

- 主な用途

- RCSがネイティブSMSに与える影響

- A2P vs OTTトラフィック動向分析

- デジタル広告の収益分配への影響

- 予想されるP2P移行パターン

- 主要MNO向けRCSロードマップ

第5章 市場規模と成長予測

- コミュニケーションの種類別

- A2P(アプリケーションから人へ)

- P2P(人対人)

- P2A(個人からアプリケーションへ)

- その他

- 展開モデル別

- クラウド

- オンプレミス

- エンドユーザー企業規模別

- 中小企業

- 大企業

- エンドユーザー業界別

- BFSI

- メディアとエンターテイメント

- 小売業とeコマース

- 旅行とホスピタリティ

- ヘルスケア

- ITおよび通信

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- スペイン

- スイス

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- マレーシア

- シンガポール

- ベトナム

- インドネシア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- ナイジェリア

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ATandT Inc.

- Verizon Communications Inc.

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Mavenir Systems, Inc.

- Sinch AB

- Global Message Services AG

- Juphoon System Software Co., Ltd.

- Summit Tech

- T-Mobile USA, Inc.

- SK Telecom Co., Ltd.

- Telstra Corporation Limited

- Vodafone Group plc

- Orange S.A.

- Deutsche Telekom AG

- Twilio Inc.

- Infobip Ltd.

- Gupshup Technology India Pvt. Ltd.

- Route Mobile Limited

- MessageBird B.V.