|

市場調査レポート

商品コード

1852151

乳製品原料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Dairy Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 乳製品原料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年09月15日

発行: Mordor Intelligence

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

概要

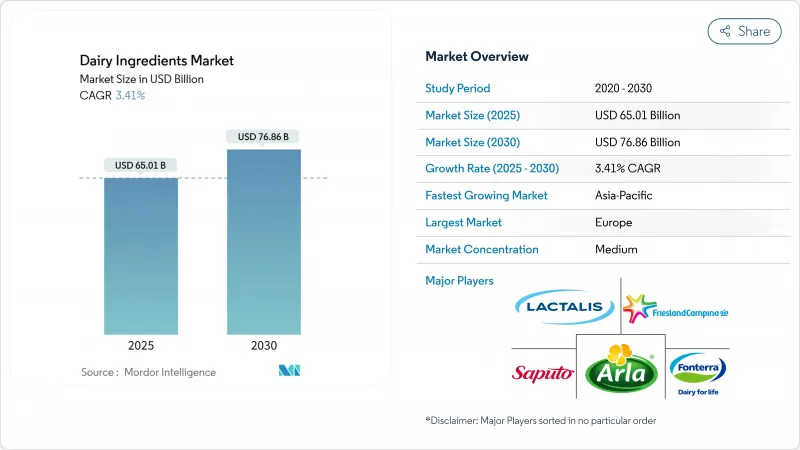

乳製品原料の市場規模は2025年に650億1,000万米ドルと推定され、2030年には768億6,000万米ドルに達し、CAGR 3.41%で成長すると予測されています。

市場の成長は、タンパク質が豊富な製品に対する消費者の嗜好の高まり、確立された加工技術、食糧安全保障プログラムにおける特殊粉末の利用率の高まりによって続いています。欧州は依然として最大の地域市場であり、規制上の品質要件と発達した生乳収集ネットワークに支えられています。アジア太平洋地域は最も高い成長率を示しており、これは所得水準の向上、都市人口の増加、生乳生産と原料需要を増加させる有利な政府政策に後押しされています。市場の用途はスポーツ栄養製品、乳児用調製粉乳、機能性食品を通じて拡大し、発酵プロセスや自動化された工場運営の進歩は生産効率を向上させ、乳製品原料市場全体の環境への影響を軽減します。

世界の乳製品原料市場の動向と洞察

タンパク質が豊富な食品への需要の高まり

タンパク質市場の拡大は食品業界を変革し、乳製品成分の用途をスポーツ栄養だけでなく主流の食品や飲食品カテゴリーにまで拡大しています。市場の需要は、消費者が朝食用シリアルや焼き菓子などの標準的な製品から、筋肉サポート、満腹感、持続的エネルギーなどの機能的メリットを求めていることを示しています。デイリー・マネジメント社の研究と技術投資は、栄養価を保ちながら品質を維持する、高タンパクで保存可能な飲料や便利な形態の製造を促進しています。市場の成長は、すぐに飲めるシェイク、プロテインバー、機能性乳製品スナックに顕著であり、ホエイとカゼインのタンパク質は、多くの植物由来の代替品を凌ぐ完全なアミノ酸プロファイルを提供しています。市場分析によると、ミレニアル世代とZ世代の消費者は大きな需要を示しており、製品仕様を分析し、タンパク質含有量を主な購入要因として評価しています。乳性タンパク質を統合している企業は、乳製品原料市場の拡大する機能性栄養セグメントにおいて、市場での強力なポジショニングを示しています。

スポーツ栄養製品への採用増加

2024年には、Arla Foods Ingredients社がVolac社の乳清栄養事業を戦略的に買収したことで、この分野の成長の可能性が浮き彫りになり、同社は今後5年間で乳清タンパク質分離物の売上が大幅に伸びると予測しています。市場の拡大は、フィットネスとウェルネスが消費者のアイデンティティに欠かせないものとなり、乳製品原料市場において便利で高品質なタンパク質源に対する需要を生み出している、より広範なライフスタイルの変化を反映しています。スポーツ栄養学の革新は、従来のプロテインパウダーから、高度な乳製品原料を組み込んだレディ・トゥ・ドリンク飲料、プロテインバー、機能性スナックへと製品の多様化を促進しています。この分野は、フィットネス活動への女性の参加の増加と、パフォーマンスの最適化のために高品質の動物性タンパク質を含む植物性志向の食事の人気の高まりから利益を得ています。Helaina社のような企業は、運動能力用途に優れた生物学的利用能を提供するヒトラクトフェリン同等物を開発しています。

乳糖不耐症と乳製品アレルギー

2025年のWorld Population Reviewのデータによると、オーストラリア人の44%が乳糖不耐症です。この課題は、ラクターゼ持続性があまり一般的でないアジア市場で特に深刻であるが、これらの地域は乳製品消費市場が最も急速に成長している地域であり、業界関係者にとって複雑な力学を生み出しています。メーカー各社は、製品の品質と栄養の完全性を維持しながら効率的な無乳糖乳製品の生産を可能にするDSM-Firmenich社の即効性酵素であるMaxilact Nextを含む、高度なラクターゼ酵素技術で対応しています。ガラクトオリゴ糖を使用したプレバイオティクス戦略は、補完的な解決策として浮上しており、乳糖を完全に除去することなく、腸内細菌叢を変化させて乳糖消化を改善する可能性があります。この制約は、企業が乳糖を含まない乳製品と同じタンパク質を生産できる乳製品原料市場向けの精密発酵による代替乳製品タンパク質の技術革新を促しています。特に、乳糖代謝に影響を及ぼす遺伝的要因によって乳製品の消費が伝統的に制限されてきた地域では、乳糖低減製品とその健康上の利点に関する消費者教育が市場拡大にとって極めて重要になっています。

セグメント分析

粉ミルクは2024年に乳製品原料市場シェアの45.56%を占めると同時に、製品タイプの中でCAGR 3.61%と最速の成長率を達成するが、これは用途の多様性と世界的な食糧安全保障の取り組みにおける重要な役割を反映しています。この2つのリーダー的地位は、噴霧乾燥とローラー乾燥法の技術的進歩が製品の品質と機能特性を向上させ、コスト効率の良いタンパク質強化ソリューションを求めるメーカーにとって粉乳をますます魅力的なものにしていることに起因しています。脱脂粉乳と全粉乳が最大のサブセグメントを占め、保存安定性と栄養密度が食糧安全保障プログラムにとって最重要事項である新興市場からの需要が伸びています。

ホエイ原料は第2位のカテゴリーを占め、ホエイタンパク濃縮物および分離物はスポーツ栄養および機能性食品用途からの需要が旺盛です。このセグメントは、植物由来の代替品と比較して乳清タンパク質の優れたアミノ酸プロファイルと生物学的利用能に対する消費者の意識の高まりから恩恵を受けています。乳タンパク質濃縮物および分離物は、乳製品原料市場全体で牽引力を増しています。メーカー各社は、クリーンラベルの製剤において機能性と栄養の両方のメリットを提供する原料を求めています。乳糖とその誘導体は、市場シェアは小さいもの、プレバイオティクスの効果を目的としたラクチュロースの製造のような革新的な用途を通じて、再び関心を集めています。

従来型の乳製品原料は、確立されたサプライ・チェーンとコスト優位性を反映して、2024年の市場シェア88.72%を維持する一方、オーガニック原料は、健康と環境に対するメリットを認識してプレミアム価格を支払う消費者の意欲によって、2030年までのCAGRが6.85%と最も高い成長率を達成します。米国農務省の報告によると、2024年9月の有機全乳販売量は前年比で15.5%増加し、有機流動乳販売量は合計で2億4,900万ポンドに達し、価格帯が上昇したにもかかわらず消費者の需要が堅調であることを実証しました。有機牛乳の輸出は累計で36.2%増加し、乳製品原料市場におけるプレミアムの勢いを示しています。前年と比較すると、これはプレミアム乳製品原料に対する国際的な需要が旺盛であることを示しています。

オーガニック部門の成長は、小売流通の拡大と、歴史的に生産能力に制約のあったオーガニック飼料原料の入手可能性の増加によって支えられています。従来型原料は、その信頼性、安定した品質、大規模な製造作業を支える確立された加工インフラにより、引き続き優位を占めています。有機飼料の生産規模が拡大し、慣行飼料の価格が持続可能性要件による上昇圧力に直面するにつれて、有機飼料と慣行飼料の価格差は一部の地域で縮小しています。規制の枠組みは、プレミアムな位置付けに対する消費者の信頼を確保する厳格な品質基準を維持しながら、有機認証プロセスをサポートするように進化しています。

地域分析

欧州は、高度な加工インフラ、厳格な品質基準、プレミアム乳製品に対する旺盛な消費者需要に支えられ、2024年には29.99%の地域別市場シェアで最大を占める。この地域の生乳生産量の増加は、乳製品原料の生産量の増加に直接寄与しています。確立された乳製品加工施設は、生産方法の技術的進歩と相まって、生乳を様々な乳製品原料に効率的に変換することを可能にしています。DEFRAのデータによると、英国は2024年に148億9,000万リットルの生乳総生産量を記録しました。この膨大な生産量は、この地域が乳製品原料市場における国内および国際的な需要を満たす能力を有していることを裏付けています。

アジア太平洋地域の乳製品原料市場は、可処分所得の増加、人口の拡大、健康志向の高まりに後押しされ、2030年までのCAGRが5.41%と最も高い成長率を示しています。同地域の乳製品原料市場は、生産施設の近代化、サプライチェーン・インフラの改善、欧米食習慣の採用増加などの恩恵を受けています。米国農務省によると、インドの生乳生産量は2025年には2億1,650万トンに達すると予想され、政府の支援と良好な気象条件に支えられています。国内の牛乳消費量は9,100万トンに達すると予測されています。この成長軌道は、この地域の乳製品加工能力の拡大と乳製品ベースの製品に対する消費者の嗜好の高まりを反映しています。

北米は、乳製品原料市場における高度な加工技術と、タンパク質が豊富な製品に対する旺盛な国内需要から恩恵を受ける一方、都市部市場では植物由来の代替品との競争激化に直面しています。この地域の強みは、技術革新能力と、国内市場と輸出市場の両方で大規模な原料生産を支える確立されたサプライチェーンにあります。南米、中東・アフリカは、可処分所得の上昇と都市化が乳製品消費の増加を促す新興のビジネスチャンスであるが、インフラの制約と価格感応度が、高級食材の普及に課題をもたらしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- タンパク質が豊富な食品に対する需要の高まり

- スポーツ栄養製品の採用増加

- 粉ミルク市場の拡大

- 機能性食品・飲料分野での採用拡大

- ベーカリー・菓子業界における利用急増

- 新興市場における消費の高まり

- 市場抑制要因

- 乳糖不耐症と乳製品アレルギー

- 植物由来の代替品の人気の高まり

- 生乳価格の変動

- 健康関連の食生活への懸念

- サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- 粉乳

- 脱脂粉乳

- 全粉乳

- その他

- 乳タンパク質濃縮物および分離物

- ホエイ成分

- ホエイプロテイン濃縮物

- ホエイプロテインアイソレート

- 加水分解ホエイプロテイン

- 乳糖とその誘導体

- カゼインとカゼイネート

- その他

- 粉乳

- 由来別

- 従来型

- オーガニック

- 原料家畜別

- 牛

- バッファロー

- ヤギと羊

- 用途別

- ベーカリー・菓子

- 乳製品

- 乳児用調製乳

- スポーツと臨床栄養

- コンビニエンス・フードおよび調理済み食品

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- ポーランド

- ベルギー

- スウェーデン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- ペルー

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランク分析

- 企業プロファイル

- Arla Foods amba

- Fonterra Co-operative Group Ltd

- Royal FrieslandCampina N.V.

- Groupe Lactalis(Lactalis Ingredients)

- Kerry Group plc

- Dairy Farmers of America Inc.

- Saputo Inc.

- Glanbia plc

- Nestle S.A.

- Danone S.A.

- Agropur Co-operative

- Hilmar Cheese Company Inc.

- Cargill Inc.

- Sodiaal Group

- Volac International Ltd

- Hoogwegt International B.V.

- Kanegrade Ltd

- Valio Ltd

- DMK Group

- Meggle Group