|

|

市場調査レポート

商品コード

1535294

乳製品原料の市場規模、シェア、予測、動向分析:供給源別(乳、ホエイ)、製品タイプ別(ミルクパウダー、ホエイプロテイン、ミルクプロテイン、乳糖、バターミルクパウダー、ホエイ透過液)、用途別(食品{乳製品}、飲食品)-2031年までの世界予測Dairy Ingredients Market Size, Share, Forecast, & Trends Analysis by Source (Milk, Whey), Type (Milk Powder, Whey Protein, Milk Protein, Lactose, Buttermilk Powder, Whey Permeate), Application (Food {Dairy Products}, Beverages) - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| 乳製品原料の市場規模、シェア、予測、動向分析:供給源別(乳、ホエイ)、製品タイプ別(ミルクパウダー、ホエイプロテイン、ミルクプロテイン、乳糖、バターミルクパウダー、ホエイ透過液)、用途別(食品{乳製品}、飲食品)-2031年までの世界予測 |

|

出版日: 2024年08月14日

発行: Meticulous Research

ページ情報: 英文 426 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

乳製品原料の市場規模、シェア、予測、動向:供給源(ミルク、ホエイ)、タイプ(ミルクパウダー、ホエイプロテイン、ミルクプロテイン、乳糖、バターミルクパウダー、ホエイ透過液)、用途(食品{乳製品}、飲食品)別-2031年までの世界予測

この調査レポートは「乳製品原料の市場規模、シェア、推定・動向分析:供給源(ミルク、ホエイ)、タイプ(ミルクパウダー、ホエイプロテイン、ミルクプロテイン、乳糖、バターミルクパウダー、ホエイ透過液)、用途(食品{乳製品}、飲食品)-2031年までの世界予測」を掲載し、乳製品原料市場は2031年までにCAGR 4.9%で932億2,000万米ドルに達すると予測しています。当レポートでは、主要5地域の乳製品原料市場を詳細に分析し、現在の市場動向、市場規模、最近の動向、2031年までの予測などをまとめています。

広範な2次調査と1次調査、市場シナリオの詳細な分析を経て、主要な業界促進要因、市場抑制要因、機会、動向の影響分析を実施しています。乳製品原料市場の成長は、食品業界における乳製品原料の採用拡大、健康・ウェルネス動向の高まり、サプライチェーン管理の改善、栄養食品に関する消費者意識の高まり、生乳生産量の増加によってもたらされます。しかし、植物由来の代替乳製品への需要や乳糖不耐症の増加が市場の成長を抑制する可能性があります。

さらに、乳製品産業と新興国における技術の進歩は、市場成長の機会を生み出すと予想されます。しかし、ビーガン食の利点に関する消費者意識の高まりは、市場の成長にとって大きな課題となります。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

- 概要

- セグメント分析

- 乳製品原料市場:供給源別

- 乳製品原料市場:タイプ別

- 乳製品原料市場:用途別

- 乳製品原料市場-地域別分析

第4章 市場洞察

- 市場

- 促進

- 要因

- 概要

- 食品業界における乳製品の採用増加

- ヘルス&ウェルネス動向の高まり

- サプライチェーン管理の改善

- 栄養食品に対する消費者の意識の高まり

- 牛乳生産の増加

- 抑制要因

- 植物由来の非乳製品代替品への需要

- 乳糖不耐症の増加

- 機会

- 乳業における技術の進歩

- 新興経済国

- 課題

- ビーガン食の利点に関する消費者意識の高まり

- 動向

- ヘルシースナッキング

- 価格分析

- 概要

- 粉乳

- 全粉乳(WMP)

- 脱脂粉乳(SMP)

- 脂肪充填粉乳(FFMP)

- ホエイプロテイン

- ホエイプロテインアイソレート(WPI)

- ホエイプロテイン濃縮物(WPC)

- ホエイプロテイン加水分解物(WPH)

- 乳タンパク質

- ミルクプロテイン濃縮物(MPC)

- ミルクプロテインアイソレート(MPI)

- 乳タンパク質加水分解物(Mph)

- カゼインとカゼイネート

- 第三世代乳成分

- ラクトフェリン

- ラクトパーオキシダーゼ

- α-ラクトアルブミン

- 乳糖

- 乳糖誘導体

- ガラクトース

- ラクチュロース

- ラクチトール

- 乳果オリゴ糖

- その他の乳糖誘導体

- バターミルクパウダー

- ホエイ透過液

- 規制分析

- 概要

- 北米

- 米国

- 欧州

- アジア太平洋

- 中国

- インド

- ラテンアメリカ

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- ポーターのファイブフォース分析

- バリューチェーン分析

第5章 乳製品原料市場の評価-供給源別

- 概要

- 牛乳

- ホエイ

第6章 乳製品原料市場の評価-製品タイプ別

- 概要

- 粉乳

- 全粉乳(WMP)

- 脱脂粉乳(SMP)

- 脂肪充填粉乳(FFMP)

- ホエイプロテイン

- ホエイプロテイン濃縮物(WPC)

- ホエイプロテインアイソレート(WPI)

- ホエイプロテイン加水分解物(WPH)

- 乳タンパク質

- ミルクプロテイン濃縮物(MPC)

- ミルクプロテインアイソレート(MPI)

- 乳タンパク質加水分解物(MPH)

- カゼインとカゼイネート

- 第三世代乳成分

- ラクトフェリン

- ラクトパーオキシダーゼ

- α-ラクトアルブミン

- 乳糖

- 乳糖誘導体

- ラクチュロース

- ガラクトース

- ラクチトール

- 乳果オリゴ糖

- その他の乳糖誘導体

- バターミルクパウダー

- ホエイ透過液

第7章 乳製品原料市場の評価-用途別

- 概要

- 食品

- 乳製品

- ベーカリー&菓子

- 乳児用食品

- その他の食品用途

- 飲料

- エナジードリンク

- スポーツ飲料

- 乳飲料

- その他の飲料用途

- 栄養補助食品

- 動物飼料

- その他の用途

第8章 乳製品原料市場の評価-地域別

- 概要

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- タイ

- ニュージーランド

- その他アジア太平洋地域

- 欧州

- ドイツ

- ロシア

- 英国

- スペイン

- フランス

- イタリア

- その他欧州

- 北米

- 米国

- カナダ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

第9章 競合分析

- 概要

- 主要成長戦略

- 競合ベンチマーキング

- 競合ダッシュボード

- 業界リーダー

- 市場差別化要因

- 先行企業

- 新興企業

第10章 企業プロファイル

- Lactalis Group

- 企業概要

- 財務概要(2023年)

- SWOT分析ラクタリスグループ

- 製品ポートフォリオ

- 戦略的展開

- Dairy Farmers of America, Inc.

- 会社概要

- 財務概要(2022年)

- SWOT Analysis:Dairy Farmers of America, Inc.

- Product Portfolio

- Fonterra Co-Operative Group Limited

- 会社概要

- 財務概要(2023年)

- SWOT Analysis:Fonterra Co-Operative Group Limited

- Product Portfolio

- Strategic Developments

- Arla Foods amba

- 会社概要

- 財務概要(2023年)

- SWOT Analysis:Arla Foods amba

- Product Portfolio

- Strategic Developments

- Saputo Inc.

- 会社概要

- 財務概要(2023年)

- SWOT Analysis:Saputo Inc.

- Product Portfolio

- Strategic Developments

- Royal FrieslandCampina N.V.(A Part of Zuivelcooperatie FrieslandCampina U.A.)

- 会社概要

- 財務概要(2023年)

- 製品ポートフォリオ

- 戦略的展開

- Savencia SA

- 会社概要

- 財務概要(2023年)

- 製品ポートフォリオ

- 戦略的展開

- Sodiaal International

- 会社概要

- 財務概要(2023年)

- 製品ポートフォリオ

- Glanbia PLC

- 会社概要

- 財務概要(2023年)

- 製品ポートフォリオ

- Agropur Cooperative

- 会社概要

- 財務概要(2023年)

- 製品ポートフォリオ

- Schreiber Foods Inc.

- 会社概要

- 財務概要(2023年)

- 製品ポートフォリオ

- Morinaga Milk Industry Co., Ltd.

- 会社概要

- 財務概要(2024年)

- 製品ポートフォリオ

- AMCO Proteins

- 会社概要

- 製品ポートフォリオ

- KOMOS GROUP LLC

- 会社概要

- 製品ポートフォリオ

- Prolactal GmbH

- 会社概要

- 製品ポートフォリオ

- 戦略的展開

第11章 付録

LIST OF TABLES

- Table 1 Average Prices of Whole Milk Powder, by Country/Region, 2022-2031 (USD/Ton)

- Table 2 Average Prices of Skim Milk Powder, by Country/Region, 2022-2031 (USD/Ton)

- Table 3 Average Prices of Fat Filled Milk Powder, by Country/Region, 2022-2031 (USD/Ton)

- Table 4 Average Prices of Whey Protein Isolate, by Country/Region, 2022-2031 (USD/Ton)

- Table 5 Average Prices of Whey Protein Concentrate, by Country/Region, 2022-2031 (USD/Ton)

- Table 6 Average Prices of Whey Protein Hydrolysate, by Country/Region, 2022-2031 (USD/Ton)

- Table 7 Average Prices of Milk Protein Concentrate, by Country/Region, 2022-2031 (USD/Ton)

- Table 8 Average Prices of Milk Protein Isolate, by Country/Region, 2022-2031 (USD/Ton)

- Table 9 Average Prices of Milk Protein Hydrolysate, by Country/Region, 2022-2031 (USD/Ton)

- Table 10 Average Prices of Casein and Caseinates, by Country/Region, 2022-2031 (USD/Ton)

- Table 11 Average Prices of Lactoferrin, by Country/Region, 2022-2031 (USD/Ton)

- Table 12 Average Prices of Lactoperoxidase, by Country/Region, 2022-2031 (USD/Ton)

- Table 13 Average Prices of Alpha-lactalbumin, by Country/Region, 2022-2031 (USD/Ton)

- Table 14 Average Prices of Lactose, by Country/Region, 2022-2031 (USD/Ton)

- Table 15 Average Prices of Galactose, by Country/Region, 2022-2031 (USD/Ton)

- Table 16 Average Prices of Lactulose, by Country/Region, 2022-2031 (USD/Ton)

- Table 17 Average Prices of Lactitol, by Country/Region, 2022-2031 (USD/Ton)

- Table 18 Average Prices of Lactosucrose, by Country/Region, 2022-2031 (USD/Ton)

- Table 19 Average Prices of Other Lactose Derivatives, by Country/Region, 2022-2031 (USD/Ton)

- Table 20 Average Prices of Butter Milk Powder, by Country/Region, 2022-2031 (USD/Ton)

- Table 21 Average Prices of Whey Permeate, by Country/Region, 2022-2031 (USD/Ton)

- Table 22 Codex Standards for the General Composition of Dairy Ingredients

- Table 23 Global Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 24 Global Milk-based Dairy Ingredients Market, by Country/Region, 2022-2031 (USD Million)

- Table 25 Global Whey-based Dairy Ingredients Market, by Country/Region, 2022-2031 (USD Million)

- Table 26 Global Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 27 Global Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 28 Global Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 29 Global Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 30 Global Milk Powder Market, by Country/Region, 2022-2031 (USD Million)

- Table 31 Global Milk Powder Market, by Country/Region, 2022-2031 (Tons)

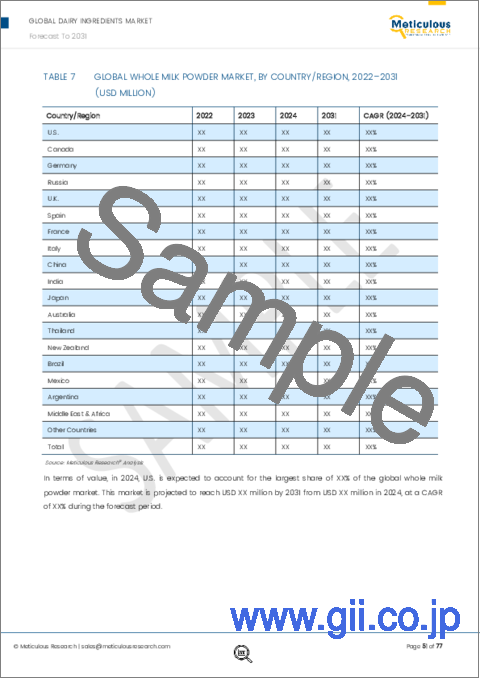

- Table 32 Global Whole Milk Powder Market, by Country/Region, 2022-2031 (USD Million)

- Table 33 Global Whole Milk Powder Market, by Country/Region, 2022-2031 (Tons)

- Table 34 Global Skim Milk Powder Market, by Country/Region, 2022-2031 (USD Million)

- Table 35 Global Skim Milk Powder Market, by Country/Region, 2022-2031 (Tons)

- Table 36 Global Fat Filled Milk Powder Market, by Country/Region, 2022-2031 (USD Million)

- Table 37 Global Fat Filled Milk Powder Market, by Country/Region, 2022-2031 (Tons)

- Table 38 Global Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 39 Global Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 40 Global Whey Protein Market, by Country/Region, 2022-2031 (USD Million)

- Table 41 Global Whey Protein Market, by Country/Region, 2022-2031 (Tons)

- Table 42 Global Whey Protein Concentrate Market, by Country/Region, 2022-2031 (USD Million)

- Table 43 Global Whey Protein Concentrate Market, by Country/Region, 2022-2031 (Tons)

- Table 44 Global Whey Protein Isolate Market, by Country/Region, 2022-2031 (USD Million)

- Table 45 Global Whey Protein Isolate Market, by Country/Region, 2022-2031 (Tons)

- Table 46 Global Whey Protein Hydrolysate Market, by Country/Region, 2022-2031 (USD Million)

- Table 47 Global Whey Protein Hydrolysate Market, by Country/Region, 2022-2031 (Tons)

- Table 48 Global Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 49 Global Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 50 Global Milk Protein Market, by Country/Region, 2022-2031 (USD Million)

- Table 51 Global Milk Protein Market, by Country/Region, 2022-2031 (Tons)

- Table 52 Global Milk Protein Concentrate Market, by Country/Region, 2022-2031 (USD Million)

- Table 53 Global Milk Protein Concentrate Market, by Country/Region, 2022-2031 (Tons)

- Table 54 Global Milk Protein Isolate Market, by Country/Region, 2022-2031 (USD Million)

- Table 55 Global Milk Protein Isolate Market, by Country/Region, 2022-2031 (Tons)

- Table 56 Global Milk Protein Hydrolysates Market, by Country/Region, 2022-2031 (USD Million)

- Table 57 Global Milk Protein Hydrolysates Market, by Country/Region, 2022-2031 (Tons)

- Table 58 Global Casein and Caseinates Market, by Country/Region, 2022-2031 (USD Million)

- Table 59 Global Casein and Caseinates Market, by Country/Region, 2022-2031 (Tons)

- Table 60 Global Third-generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 61 Global Third-generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 62 Global Third-generation Dairy Ingredients Market, by Country/Region, 2022-2031 (USD Million)

- Table 63 Global Third-generation Dairy Ingredients Market, by Country/Region, 2022-2031 (Tons)

- Table 64 Global Lactoferrin Market, by Country/Region, 2022-2031 (USD Million)

- Table 65 Global Lactoferrin Market, by Country/Region, 2022-2031 (Tons)

- Table 66 Global Lactoperoxidase Market, by Country/Region, 2022-2031 (USD Million)

- Table 67 Global Lactoperoxidase Market, by Country/Region, 2022-2031 (Tons)

- Table 68 Global Alpha-lactalbumin Market, by Country/Region, 2022-2031 (USD Million)

- Table 69 Global Alpha-lactalbumin Market, by Country/Region, 2022-2031 (Tons)

- Table 70 Global Lactose Market, by Country/Region, 2022-2031 (USD Million)

- Table 71 Global Lactose Market, by Country/Region, 2022-2031 (Tons)

- Table 72 Global Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 73 Global Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 74 Global Lactose Derivatives Market, by Country/Region, 2022-2031 (USD Million)

- Table 75 Global Lactose Derivatives Market, by Country/Region, 2022-2031 (Tons)

- Table 76 Global Lactulose Market, by Country/Region, 2022-2031 (USD Million)

- Table 77 Global Lactulose Market, by Country/Region, 2022-2031 (Tons)

- Table 78 Global Galactose Market, by Country/Region, 2022-2031 (USD Million)

- Table 79 Global Galactose Market, by Country/Region, 2022-2031 (Tons)

- Table 80 Global Lactitol Market, by Country/Region, 2022-2031 (USD Million)

- Table 81 Global Lactitol Market, by Country/Region, 2022-2031 (Tons)

- Table 82 Global Lactosucrose Market, by Country/Region, 2022-2031 (USD Million)

- Table 83 Global Lactosucrose Market, by Country/Region, 2022-2031 (Tons)

- Table 84 Global Other Lactose Derivatives Market, by Country/Region, 2022-2031 (USD Million)

- Table 85 Global Other Lactose Derivatives Market, by Country/Region, 2022-2031 (Tons)

- Table 86 Global Buttermilk Powder Market, by Country/Region, 2022-2031 (USD Million)

- Table 87 Global Buttermilk Powder Market, by Country/Region, 2022-2031 (Tons)

- Table 88 Global Whey Permeate Market, by Country/Region, 2022-2031 (USD Million)

- Table 89 Global Whey Permeate Market, by Country/Region, 2022-2031 (Tons)

- Table 90 Global Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 91 Global Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 92 Global Dairy Ingredients Market for Food, by Country/Region, 2022-2031 (USD Million)

- Table 93 Global Dairy Ingredients Market for Dairy Products, by Country/Region, 2022-2031 (USD Million)

- Table 94 Global Dairy Ingredients Market for Bakery & Confectionary, by Country/Region, 2022-2031 (USD Million)

- Table 95 Global Dairy Ingredients Market for Infant Food, by Country/Region, 2022-2031 (USD Million)

- Table 96 Global Dairy Ingredients Market for Other Food Applications, by Country/Region, 2022-2031 (USD Million)

- Table 97 Global Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 98 Global Dairy Ingredients Market for Beverages, by Country/Region, 2022-2031 (USD Million)

- Table 99 Global Dairy Ingredients Market for Energy Drinks, by Country/Region, 2022-2031 (USD Million)

- Table 100 Global Dairy Ingredients Market for Sports Drinks, by Country/Region, 2022-2031 (USD Million)

- Table 101 Global Dairy Ingredients Market for Dairy-based Beverages, by Country/Region, 2022-2031 (USD Million)

- Table 102 Global Dairy Ingredients Market for Other Beverage Applications, by Country/Region, 2022-2031 (USD Million)

- Table 103 Global Dairy Ingredients Market for Nutritional Health Supplements, by Country/Region, 2022-2031 (USD Million)

- Table 104 Global Dairy Ingredients Market for Animal Feed, by Country/Region, 2022-2031 (USD Million)

- Table 105 Global Dairy Ingredients Market for Other Applications, by Country/Region, 2022-2031 (USD Million)

- Table 106 Global Dairy Ingredients Market, by Region, 2022-2031 (USD Million)

- Table 107 Global Dairy Ingredients Market, by Region, 2022-2031 (Tons)

- Table 108 Asia-Pacific: Dairy Ingredients Market, by Country/Region, 2022-2031 (USD Million)

- Table 109 Asia-Pacific: Dairy Ingredients Market, by Country/Region, 2022-2031 (Tons)

- Table 110 Asia-Pacific: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 111 Asia-Pacific: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 112 Asia-Pacific: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 113 Asia-Pacific: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 114 Asia-Pacific: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 115 Asia-Pacific: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 116 Asia-Pacific: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 117 Asia-Pacific: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 118 Asia-Pacific: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 119 Asia-Pacific: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 120 Asia-Pacific: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 121 Asia-Pacific: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 122 Asia-Pacific: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 123 Asia-Pacific: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 124 Asia-Pacific: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 125 Asia-Pacific: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 126 China: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 127 China: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 128 China: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 129 China: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 130 China: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 131 China: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 132 China: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 133 China: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 134 China: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 135 China: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 136 China: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 137 China: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 138 China: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 139 China: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 140 China: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 141 China: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 142 India: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 143 India: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 144 India: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 145 India: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 146 India: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 147 India: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 148 India: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 149 India: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 150 India: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 151 India: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 152 India: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 153 India: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 154 India: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 155 India: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 156 India: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 157 India: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 158 Japan: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 159 Japan: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 160 Japan: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 161 Japan: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 162 Japan: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 163 Japan: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 164 Japan: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 165 Japan: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 166 Japan: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 167 Japan: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 168 Japan: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 169 Japan: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 170 Japan: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 171 Japan: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 172 Japan: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 173 Japan: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 174 Australia: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 175 Australia: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 176 Australia: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 177 Australia: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 178 Australia: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 179 Australia: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 180 Australia: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 181 Australia: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 182 Australia: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 183 Australia: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 184 Australia: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 185 Australia: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 186 Australia: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 187 Australia: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 188 Australia: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 189 Australia: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 190 Thailand: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 191 Thailand: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 192 Thailand: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 193 Thailand: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 194 Thailand: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 195 Thailand: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 196 Thailand: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 197 Thailand: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 198 Thailand: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 199 Thailand: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 200 Thailand: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 201 Thailand: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 202 Thailand: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 203 Thailand: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 204 Thailand: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 205 Thailand: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 206 New Zealand: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 207 New Zealand: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 208 New Zealand: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 209 New Zealand: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 210 New Zealand: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 211 New Zealand: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 212 New Zealand: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 213 New Zealand: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 214 New Zealand: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 215 New Zealand: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 216 New Zealand: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 217 New Zealand: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 218 New Zealand: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 219 New Zealand: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 220 New Zealand: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 221 New Zealand: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 222 Rest of Asia-Pacific: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 223 Rest of Asia-Pacific: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 224 Rest of Asia-Pacific: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 225 Rest of Asia-Pacific: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 226 Rest of Asia-Pacific: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 227 Rest of Asia-Pacific: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 228 Rest of Asia-Pacific: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 229 Rest of Asia-Pacific: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 230 Rest of Asia-Pacific: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 231 Rest of Asia-Pacific: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 232 Rest of Asia-Pacific: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 233 Rest of Asia-Pacific: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 234 Rest of Asia-Pacific: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 235 Rest of Asia-Pacific: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 236 Rest of Asia-Pacific: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 237 Rest of Asia-Pacific: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 238 Europe: Dairy Ingredients Market, by Country/Region, 2022-2031 (USD Million)

- Table 239 Europe: Dairy Ingredients Market, by Country/Region, 2022-2031 (Tons)

- Table 240 Europe: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 241 Europe: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 242 Europe: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 243 Europe: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 244 Europe: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 245 Europe: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 246 Europe: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 247 Europe: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 248 Europe: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 249 Europe: Third Generation Dairy Ingredient Market, by Type, 2022-2031 (USD Million)

- Table 250 Europe: Third Generation Dairy Ingredient Market, by Type, 2022-2031 (Tons)

- Table 251 Europe: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 252 Europe: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 253 Europe: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 254 Europe: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 255 Europe: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 256 Germany: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 257 Germany: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 258 Germany: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 259 Germany: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 260 Germany: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 261 Germany: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 262 Germany: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 263 Germany: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 264 Germany: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 265 Germany: Third Generation Dairy Ingredient Market, by Type, 2022-2031 (USD Million)

- Table 266 Germany: Third Generation Dairy Ingredient Market, by Type, 2022-2031 (Tons)

- Table 267 Germany: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 268 Germany: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 269 Germany: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 270 Germany: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 271 Germany: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 272 Russia: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 273 Russia: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 274 Russia: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 275 Russia: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 276 Russia: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 277 Russia: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 278 Russia: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 279 Russia: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 280 Russia: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 281 Russia: Third Generation Dairy Ingredient Market, by Type, 2022-2031 (USD Million)

- Table 282 Russia: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 283 Russia: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 284 Russia: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 285 Russia: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 286 Russia: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 287 Russia: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 288 U.K.: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 289 U.K.: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 290 U.K.: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 291 U.K.: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 292 U.K.: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 293 U.K.: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 294 U.K.: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 295 U.K.: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 296 U.K.: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 297 U.K.: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 298 U.K.: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 299 U.K.: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 300 U.K.: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 301 U.K.: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 302 U.K.: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 303 U.K.: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 304 Spain: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 305 Spain: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 306 Spain: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 307 Spain: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 308 Spain: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 309 Spain: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 310 Spain: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 311 Spain: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 312 Spain: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 313 Spain: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 314 Spain: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 315 Spain: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 316 Spain: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 317 Spain: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 318 Spain: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 319 Spain: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 320 France: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 321 France: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 322 France: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 323 France: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 324 France: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 325 France: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 326 France: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 327 France: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 328 France: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 329 France: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 330 France: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 331 France: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 332 France: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 333 France: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 334 France: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 335 France: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 336 Italy: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 337 Italy: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 338 Italy: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 339 Italy: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 340 Italy: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 341 Italy: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 342 Italy: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 343 Italy: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 344 Italy: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 345 Italy: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 346 Italy: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 347 Italy: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 348 Italy: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 349 Italy: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 350 Italy: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 351 Italy: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 352 Rest of Europe: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 353 Rest of Europe: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 354 Rest of Europe: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 355 Rest of Europe: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 356 Rest of Europe: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 357 Rest of Europe: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 358 Rest of Europe: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 359 Rest of Europe: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 360 Rest of Europe: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 361 Rest of Europe: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 362 Rest of Europe: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 363 Rest of Europe: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 364 Rest of Europe: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 365 Rest of Europe: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 366 Rest of Europe: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 367 Rest of Europe: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 368 North America: Dairy Ingredients Market, by COUNTRY, 2022-2031 (USD Million)

- Table 369 North America: Dairy Ingredients Market, by COUNTRY, 2022-2031 (Tons)

- Table 370 North America: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 371 North America: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 372 North America: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 373 North America: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 374 North America: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 375 North America: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 376 North America: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 377 North America: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 378 North America: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 379 North America: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 380 North America: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 381 North America: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 382 North America: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 383 North America: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 384 North America: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 385 North America: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 386 U.S.: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 387 U.S.: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 388 U.S.: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 389 U.S.: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 390 U.S.: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 391 U.S.: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 392 U.S.: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 393 U.S.: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 394 U.S.: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 395 U.S.: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 396 U.S.: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 397 U.S.: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 398 U.S.: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 399 U.S.: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 400 U.S.: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 401 U.S.: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 402 Canada: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 403 Canada: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 404 Canada: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 405 Canada: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 406 Canada: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 407 Canada: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 408 Canada: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 409 Canada: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 410 Canada: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 411 Canada: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 412 Canada: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 413 Canada: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 414 Canada: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 415 Canada: Dairy Ingredients Market, by Application, 2022-2031 (USD Million)

- Table 416 Canada: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 417 Canada: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 418 Latin America: Dairy Ingredients Market, by Country/Region, 2022-2031 (USD Million)

- Table 419 Latin America: Dairy Ingredients Market, by Country/Region, 2022-2031 (Tons)

- Table 420 Latin America: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 421 Latin America: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 422 Latin America: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 423 Latin America: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 424 Latin America: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 425 Latin America: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 426 Latin America: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 427 Latin America: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 428 Latin America: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 429 Latin America: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 430 Latin America: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 431 Latin America: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 432 Latin America: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 433 Latin America: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 434 Latin America: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 435 Latin America: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 436 Brazil: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 437 Brazil: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 438 Brazil: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 439 Brazil: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 440 Brazil: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 441 Brazil: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 442 Brazil: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 443 Brazil: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 444 Brazil: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 445 Brazil: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 446 Brazil: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 447 Brazil: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 448 Brazil: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 449 Brazil: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 450 Brazil: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 451 Brazil: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 452 Mexico: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 453 Mexico: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 454 Mexico: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 455 Mexico: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 456 Mexico: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 457 Mexico: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 458 Mexico: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 459 Mexico: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 460 Mexico: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 461 Mexico: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 462 Mexico: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 463 Mexico: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 464 Mexico: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 465 Mexico: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 466 Mexico: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 467 Mexico: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 468 Argentina: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 469 Argentina: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 470 Argentina: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 471 Argentina: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 472 Argentina: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 473 Argentina: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 474 Argentina: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 475 Argentina: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 476 Argentina: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 477 Argentina: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 478 Argentina: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 479 Argentina: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 480 Argentina: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 481 Argentina: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 482 Argentina: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 483 Argentina: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 484 Rest of Latin America: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 485 Rest of Latin America: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 486 Rest of Latin America: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 487 Rest of Latin America: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 488 Rest of Latin America: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 489 Rest of Latin America: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 490 Rest of Latin America: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 491 Rest of Latin America: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 492 Rest of Latin America: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 493 Rest of Latin America: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 494 Rest of Latin America: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 495 Rest of Latin America: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 496 Rest of Latin America: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 497 Rest of Latin America: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 498 Rest of Latin America: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 499 Rest of Latin America: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 500 Middle East & Africa: Dairy Ingredients Market, by Source, 2022-2031 (USD Million)

- Table 501 Middle East & Africa: Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 502 Middle East & Africa: Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 503 Middle East & Africa: Milk Powder Market, by Type, 2022-2031 (USD Million)

- Table 504 Middle East & Africa: Milk Powder Market, by Type, 2022-2031 (Tons)

- Table 505 Middle East & Africa: Whey Protein Market, by Type, 2022-2031 (USD Million)

- Table 506 Middle East & Africa: Whey Protein Market, by Type, 2022-2031 (Tons)

- Table 507 Middle East & Africa: Milk Protein Market, by Type, 2022-2031 (USD Million)

- Table 508 Middle East & Africa: Milk Protein Market, by Type, 2022-2031 (Tons)

- Table 509 Middle East & Africa: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (USD Million)

- Table 510 Middle East & Africa: Third Generation Dairy Ingredients Market, by Type, 2022-2031 (Tons)

- Table 511 Middle East & Africa: Lactose Derivatives Market, by Type, 2022-2031 (USD Million)

- Table 512 Middle East & Africa: Lactose Derivatives Market, by Type, 2022-2031 (Tons)

- Table 513 Middle East & Africa: Dairy Ingredient Market, by Application, 2022-2031 (USD Million)

- Table 514 Middle East & Africa: Dairy Ingredients Market for Food, by Type, 2022-2031 (USD Million)

- Table 515 Middle East & Africa: Dairy Ingredients Market for Beverages, by Type, 2022-2031 (USD Million)

- Table 516 Recent Developments, by Company (2021-2024)

LIST OF FIGURES

- Figure 1 Research Process

- Figure 2 Secondary Sources Referenced for this Study

- Figure 3 Primary Research Techniques

- Figure 4 Key Executives Interviewed

- Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

- Figure 6 Market Sizing and Growth Forecast Approach

- Figure 7 In 2024, the Milk Segment is Expected to Dominate the Market

- Figure 8 In 2024, the Milk Powder Segment is Expected to Dominate the Market

- Figure 9 In 2024, the Food Segment is Expected to Dominate the Market

- Figure 10 Asia-Pacific Dominates the Overall Dairy Ingredients Market

- Figure 11 Market Dynamics

- Figure 12 Porter's Five Forces Analysis: Global Dairy Ingredients Market

- Figure 13 Value Chain Analysis: Dairy Ingredients Market

- Figure 14 Global Dairy Ingredients Market, by Source, 2024 Vs. 2031 (USD Million)

- Figure 15 Global Dairy Ingredients Market, by Type, 2024 Vs. 2031 (USD Million)

- Figure 16 Global Dairy Ingredients Market, by Type, 2024 Vs. 2031 (USD Million)

- Figure 17 Global Dairy Ingredients Market, by Application, 2024 Vs. 2031 (USD Million)

- Figure 18 Global Dairy Ingredients Market, by Region, 2024 Vs. 2031 (USD Million)

- Figure 19 Global Dairy Ingredients Market, by Region, 2024 Vs. 2031 (Tons)

- Figure 20 Asia-Pacific Dairy Ingredients Market Snapshot (2024)

- Figure 21 Production of Milk Powders in Australia, 2021-2023 (Tons)

- Figure 22 Europe: Dairy Ingredients Market Snapshot (2024)

- Figure 23 Germany: Dairy Ingredients Production, by Type, 2019 Vs.2023 (Tons)

- Figure 24 Italy: Dairy Ingredients Import, by Type, 2020-2023 (Tons)

- Figure 25 North America: Dairy Ingredients Market Snapshot (2024)

- Figure 26 Latin America: Dairy Ingredients Market Snapshot (2024)

- Figure 27 Middle East & Africa: Dairy Ingredients Market Snapshot (2024)

- Figure 28 Key Growth Strategies Adopted by Leading Players (2021-2024)

- Figure 29 Global Dairy Ingredients Market Competitive Benchmarking, by Type

- Figure 30 Competitive Dashboard: Dairy Ingredients Market

- Figure 31 Lactalis Group: Financial Overview (2023)

- Figure 32 Fonterra Co-Operative Group Limited: Financial Overview (2023)

- Figure 33 Arla Foods amba: Financial Overview (2023)

- Figure 34 Saputo Inc.: Financial Overview (2023)

- Figure 35 Royal FrieslandCampina N.V.: Financial Overview (2023)

- Figure 36 Savencia SA: Financial Overview (2023)

- Figure 37 Sodiaal International: Financial Overview (2023)

- Figure 38 Glanbia PLC: Financial Overview (2023)

- Figure 39 Agropur Cooperative Ltd: Financial Overview (2023)

- Figure 40 Morinaga Milk Industry Co., Ltd.: Financial Overview (2024)

Dairy Ingredients Market Size, Share, Forecast, & Trends Analysis by Source (Milk, Whey), Type (Milk Powder, Whey Protein, Milk Protein, Lactose, Buttermilk Powder, Whey Permeate), Application (Food {Dairy Products}, Beverages)-Global Forecast to 2031

According to the research report titled, 'Dairy Ingredients Market Size, Share, Forecast, & Trends Analysis by Source (Milk, Whey), Type (Milk Powder, Whey Protein, Milk Protein, Lactose, Buttermilk Powder, Whey Permeate), Application (Food {Dairy Products}, Beverages)-Global Forecast to 2031,' the dairy ingredients market is estimated to reach $93.22 billion by 2031, at a CAGR of 4.9% during the forecast period. The report provides an in-depth analysis of the dairy ingredients market across five major regions, emphasizing the current market trends, market sizes, recent developments, and forecasts till 2031.

Succeeding extensive secondary and primary research and an in-depth analysis of the market scenario, the report conducts the impact analysis of the key industry drivers, restraints, opportunities, and trends. Dairy Ingredients market's growth is driven by the growing adoption of dairy ingredients in the food industry, increasing health & wellness trends, improvements in supply chain management, rising consumer awareness regarding nutritional foods, and increasing milk production. However, demand for plant-based dairy alternatives and the increasing incidence of lactose intolerance may restrain market growth.

Moreover, technological advances in the dairy industry and emerging economies are expected to create market growth opportunities. However, rising consumer awareness about the benefits of a vegan diet poses a significant challenge to the market's growth.

The key players operating in the dairy ingredients market are Lactalis Group (France), Dairy Farmers of America, Inc. (U.S.), Fonterra Co-Operative Group Limited (New Zealand), Arla Foods amba (Denmark), Saputo Inc. (Canada), Royal FrieslandCampina N.V. (Netherlands), Savencia SA (France), Sodiaal International (France), Glanbia PLC (Ireland), Agropur Cooperative (Canada), Schreiber Foods Inc. (U.S.), Morinaga Milk Industry Co., Ltd. (Japan), AMCO Proteins (U.S.), KOMOS GROUP LLC (Russia), and Prolactal GmbH (Austria).

Based on source, this market is segmented into milk and whey. In 2024, the milk segment is expected to account for a larger share of 78.9% of the global dairy ingredients market. This segment's large share is primarily due to its broad range of applications and milk's versatility and beneficial properties. Furthermore, milk's high protein and vitamin content make it a staple food, propelling market growth.

Based on type, this market is segmented into milk powder, whey protein, milk protein, casein and caseinates, third-generation dairy ingredients, lactose, lactose derivatives, buttermilk powder, and whey permeate. The milk protein segment is expected to grow at the fastest CAGR of 6.1% during the forecast period. The segment's rapid growth is attributed to its versatile, functional properties and high protein content, which have increased its usage in sports nutrition and the nutraceutical industry.

Based on application, this market is segmented into food, beverages, nutritional health supplements, animal feed, and other applications. In 2024, the food segment is expected to account for the largest share of 37.3% of the global dairy ingredients market. This segment's large market share is primarily attributed to the increased demand for nutrient- and fortifying-rich food products, growing consumption of functional food products, and increasing awareness of dairy components and their multiple uses in processed foods.

An in-depth geographic analysis of the industry provides detailed qualitative and quantitative insights into the five major regions (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa) and the coverage of major countries in each region. Asia-Pacific is expected to record the highest CAGR during the forecast period, mainly due to the growing number of infants and rising demand for organic dairy components.

Key Questions Answered in the Report-

- What is the current revenue generated by the dairy ingredients market globally?

- At what rate is the dairy ingredients demand projected to grow for the next 5-7 years?

- What are the historical market sizes and growth rates of the dairy ingredients market?

- What are the major factors impacting the growth of this market at the regional and country levels? What are the major opportunities for existing players and new entrants in the market?

- Which segments, in terms of source, type, and application, are expected to create traction for the manufacturers in this market during the forecast period 2024-2031?

- What are the key geographical trends in this market? Which regions/countries are expected to offer significant growth opportunities for the manufacturers operating in the dairy ingredients market?

- Who are the major players in the dairy ingredients market? What are their specific product offerings in this market?

- What are the recent strategic developments in the dairy ingredients market? What are the impacts of these strategic developments on the market?

Scope of the Report:

Global Dairy Ingredients Market Assessment-by Source

- Milk

- Whey

Global Dairy Ingredients Market Assessment-by Type

- Milk Powder

- Whole Milk Powder

- Skim milk powder

- Fat Filled Milk Powder

- Whey Protein

- Whey Protein Concentrate

- Whey Protein Isolate

- Whey Protein Hydrolysate

- Milk Protein

- Milk Protein Concentrate

- Milk Protein Isolate

- Milk Protein Hydrolysates

- Casein and Caseinates

- Third-generation Dairy Ingredients

- Lactoferrin

- Lactoperoxidase

- Alpha-lactalbumin

- Lactose

- Lactose Derivatives

- Galactose

- Lactulose

- Lactitol

- Lactosucrose

- Other Lactose Derivates

- Buttermilk Powder

- Whey Permeate

Global Dairy Ingredients Market Assessment-by Application

- Food

- Bakery & Confectionery

- Dairy Products

- Infant Food

- Other Food Applications

- Beverages

- Energy Drinks

- Sports Drinks

- Dairy-based Beverages

- Other Beverage Applications

- Nutritional Health Supplements

- Animal Feed

- Other Applications

Global Dairy Ingredients Market Assessment-by Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- Russia

- U.K.

- Spain

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- Thailand

- New Zealand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

TABLE OF CONTENTS

1. Introduction

- 1.1. Market Definition & Scope

- 1.2. Market Ecosystem

- 1.3. Currency

- 1.4. Key Stakeholders

2. Research Methodology

- 2.1. Research Approach

- 2.2. Process of Data Collection & Validation

- 2.2.1. Secondary Research

- 2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

- 2.3. Market Sizing and Forecast

- 2.3.1. Market Size Estimation Approach

- 2.3.2. Growth Forecast Approach

- 2.4. Assumptions for the Study

3. Executive Summary

- 3.1. Overview

- 3.2. Segment Analysis

- 3.2.1. Dairy Ingredients Market, by Source

- 3.2.2. Dairy Ingredients Market, by Type

- 3.2.3. Dairy Ingredients Market, by Application

- 3.3. Dairy Ingredients Market-Regional Analysis

4. Market Insights

- 4.1. Overview

- 4.2. Factors Affecting Market Growth

- 4.3. Drivers

- 4.3.1. Rising Adoption of Dairy Ingredients in the Food Industry

- 4.3.2. Increasing Health & Wellness Trends

- 4.3.3. Improvements in Supply Chain Management

- 4.3.4. Rising Consumer Awareness Regarding Nutritional Foods

- 4.3.5. Increasing Milk Production

- 4.4. Restraints

- 4.4.1. Demand for Plant-Based Non-Dairy Alternatives

- 4.4.2. Increasing Incidence of Lactose Intolerance

- 4.5. Opportunities

- 4.5.1. Technological Advances in the Dairy Industry

- 4.5.2. Emerging Economies

- 4.6. Challenge

- 4.6.1. Rising Consumer Awareness About the Benefits of Vegan Diet

- 4.7. Trends

- 4.7.1. Healthy Snacking

- 4.8. Pricing Analysis

- 4.8.1. Overview

- 4.8.2. Milk Powder

- 4.8.2.1. Whole Milk Powder (WMP)

- 4.8.2.2. Skim Milk Powder (SMP)

- 4.8.2.3. Fat Filled Milk Powder (FFMP)

- 4.8.3. Whey Protein

- 4.8.3.1. Whey Protein Isolate (WPI)

- 4.8.3.2. Whey Protein Concentrate (WPC)

- 4.8.3.3. Whey Protein Hydrolysate (WPH)

- 4.8.4. Milk Protein

- 4.8.4.1. Milk Protein Concentrate (MPC)

- 4.8.4.2. Milk Protein Isolate (MPI)

- 4.8.4.3. Milk Protein Hydrolysates (Mph)

- 4.8.5. Casein and Caseinates

- 4.8.6. Third Generation Dairy Ingredients

- 4.8.6.1. Lactoferrin

- 4.8.6.2. Lactoperoxidase

- 4.8.6.3. Alpha-Lactalbumin

- 4.8.7. Lactose

- 4.8.8. Lactose Derivatives

- 4.8.8.1. Galactose

- 4.8.8.2. Lactulose

- 4.8.8.3. Lactitol

- 4.8.8.4. Lactosucrose

- 4.8.8.5. Other Lactose Derivatives

- 4.8.9. Butter Milk Powder

- 4.8.10. Whey Permeate

- 4.9. Regulatory Analysis

- 4.9.1. Overview

- 4.9.2. North America

- 4.9.2.1. U.S.

- 4.9.3. Europe

- 4.9.4. Asia-Pacific

- 4.9.4.1. China

- 4.9.4.2. India

- 4.9.5. Latin America

- 4.9.5.1. Argentina

- 4.9.6. Middle East & Africa

- 4.9.6.1. Saudi Arabia

- 4.10. Porter's Five Forces Analysis

- 4.10.1. Bargaining Power of Suppliers

- 4.10.2. Bargaining Power of Buyers

- 4.10.3. Threat of Substitutes

- 4.10.4. Threat of New Entrants

- 4.10.5. Degree of Competition

- 4.11. Value Chain Analysis

5. Dairy Ingredients Market Assessment-By Source

- 5.1. Overview

- 5.2. Milk

- 5.3. Whey

6. Dairy Ingredients Market Assessment-by Type

- 6.1. Overview

- 6.2. Milk Powder

- 6.2.1. Whole Milk Powder (WMP)

- 6.2.2. Skim Milk Powder (SMP)

- 6.2.3. Fat Filled Milk Powder (FFMP)

- 6.3. Whey Protein

- 6.3.1. Whey Protein Concentrate (WPC)

- 6.3.2. Whey Protein Isolate (WPI)

- 6.3.3. Whey Protein Hydrolysate (WPH)

- 6.4. Milk Protein

- 6.4.1. Milk Protein Concentrate (MPC)

- 6.4.2. Milk Protein Isolate (MPI)

- 6.4.3. Milk Protein Hydrolysates (MPH)

- 6.5. Casein and Caseinates

- 6.6. Third-generation Dairy Ingredients

- 6.6.1. Lactoferrin

- 6.6.2. Lactoperoxidase

- 6.6.3. Alpha-lactalbumin

- 6.7. Lactose

- 6.8. Lactose Derivatives

- 6.8.1. Lactulose

- 6.8.2. Galactose

- 6.8.3. Lactitol

- 6.8.4. Lactosucrose

- 6.8.5. Other Lactose Derivatives

- 6.9. Buttermilk Powder

- 6.10. Whey Permeate

7. Dairy Ingredients Market Assessment-by Application

- 7.1. Overview

- 7.2. Food

- 7.2.1. Dairy Products

- 7.2.2. Bakery & Confectionary

- 7.2.3. Infant Food

- 7.2.4. Other Food Applications

- 7.3. Beverages

- 7.3.1. Energy Drinks

- 7.3.2. Sports Drinks

- 7.3.3. Dairy-based Beverages

- 7.3.4. Other Beverage Applications

- 7.4. Nutritional Health Supplements

- 7.5. Animal Feed

- 7.6. Other Applications

8. Dairy Ingredients Market Assessment-by Geography

- 8.1. Overview

- 8.2. Asia-Pacific

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Australia

- 8.2.5. Thailand

- 8.2.6. New Zealand

- 8.2.7. Rest of Asia-Pacific

- 8.3. Europe

- 8.3.1. Germany

- 8.3.2. Russia

- 8.3.3. U.K.

- 8.3.4. Spain

- 8.3.5. France

- 8.3.6. Italy

- 8.3.7. Rest of Europe

- 8.4. North America

- 8.4.1. U.S.

- 8.4.2. Canada

- 8.5. Latin America

- 8.5.1. Brazil

- 8.5.2. Mexico

- 8.5.3. Argentina

- 8.5.4. Rest of Latin America

- 8.6. Middle East & Africa

9. Competition Analysis

- 9.1. Overview

- 9.2. Key Growth Strategies

- 9.3. Competitive Benchmarking

- 9.4. Competitive Dashboard

- 9.4.1. Industry Leaders

- 9.4.2. Market Differentiators

- 9.4.3. Vanguards

- 9.4.4. Emerging Companies

10. Company Profiles

- 10.1. Lactalis Group

- 10.1.1. Company Overview

- 10.1.2. Financial Overview (2023)

- 10.1.3. SWOT Analysis: Lactalis Group

- 10.1.4. Product Portfolio

- 10.1.5. Strategic Developments

- 10.2. Dairy Farmers of America, Inc.

- 10.2.1. Company Overview

- 10.2.2. Financial Overview (2022)

- 10.2.3. SWOT Analysis: Dairy Farmers of America, Inc.

- 10.2.4. Product Portfolio

- 10.3. Fonterra Co-Operative Group Limited

- 10.3.1. Company Overview

- 10.3.2. Financial Overview (2023)

- 10.3.3. SWOT Analysis: Fonterra Co-Operative Group Limited

- 10.3.4. Product Portfolio

- 10.3.5. Strategic Developments

- 10.4. Arla Foods amba

- 10.4.1. Company Overview

- 10.4.2. Financial Overview (2023)

- 10.4.3. SWOT Analysis: Arla Foods amba

- 10.4.4. Product Portfolio

- 10.4.5. Strategic Developments

- 10.5. Saputo Inc.

- 10.5.1. Company Overview

- 10.5.2. Financial Overview (2023)

- 10.5.3. SWOT Analysis: Saputo Inc.

- 10.5.4. Product Portfolio

- 10.5.5. Strategic Developments

- 10.6. Royal FrieslandCampina N.V. (A Part of Zuivelcooperatie FrieslandCampina U.A.)

- 10.6.1. Company Overview

- 10.6.2. Financial Overview (2023)

- 10.6.3. Product Portfolio

- 10.6.4. Strategic Developments

- 10.7. Savencia SA

- 10.7.1. Company Overview

- 10.7.2. Financial Overview (2023)

- 10.7.3. Product Portfolio

- 10.7.4. Strategic Developments

- 10.8. Sodiaal International

- 10.8.1. Company Overview

- 10.8.2. Financial Overview (2023)

- 10.8.3. Product Portfolio

- 10.9. Glanbia PLC

- 10.9.1. Company Overview

- 10.9.2. Financial Overview (2023)

- 10.9.3. Product Portfolio

- 10.10. Agropur Cooperative

- 10.10.1. Company Overview

- 10.10.2. Financial Overview (2023)

- 10.10.3. Product Portfolio

- 10.11. Schreiber Foods Inc.

- 10.11.1. Company Overview

- 10.11.2. Financial Overview (2023)

- 10.11.3. Product Portfolio

- 10.12. Morinaga Milk Industry Co., Ltd.

- 10.12.1. Company Overview

- 10.12.2. Financial Overview (2024)

- 10.12.3. Product Portfolio

- 10.13. AMCO Proteins

- 10.13.1. Company Overview

- 10.13.2. Product Portfolio

- 10.14. KOMOS GROUP LLC

- 10.14.1. Company Overview

- 10.14.2. Product Portfolio

- 10.15. Prolactal GmbH

- 10.15.1. Company Overview

- 10.15.2. Product Portfolio

- 10.15.3. Strategic Developments

11. Appendix

- 11.1. Available Customization

- 11.2. Related Reports