|

|

市場調査レポート

商品コード

1769563

乳製品原料の世界市場、2034年までの機会と戦略Dairy Ingredients Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| 乳製品原料の世界市場、2034年までの機会と戦略 |

|

出版日: 2025年07月09日

発行: The Business Research Company

ページ情報: 英文 369 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の乳製品原料市場は2019年に596億6,643万米ドルとなり、CAGR4.00%以上で成長しました。

健康志向の高まり

実績期間において、健康志向の高まりが乳製品原料市場の成長を牽引しました。健康意識とは、健康的な食事、定期的な身体活動、予防的ヘルスケアの実践など、十分な情報に基づいたライフスタイルの選択を通じて、全身の健康を維持・改善しようとする個人の意識の高まりと積極的な姿勢を指します。乳製品原料は、バランスの取れた食生活と全身の健康に寄与する高品質のタンパク質、カルシウム、必須ビタミンを豊富に含む栄養密度の高い選択肢を提供することで、健康志向をサポートします。例えば、米国を拠点とする多国籍戦略・経営コンサルティング会社のマッキンゼー・アンド・カンパニーが2022年10月に米国、英国、フランス、ドイツの消費者約8,000人を対象に実施したオンライン調査によると、様々な市場で回答者の70%が健康増進を目指しており、50%が健康的な食生活を優先しています。参加者の約40%が新鮮な農産物を好み、33%が人工的な成分を含まない食品を選んでいます。さらに、米国を拠点とする非営利団体フード・インサイトが2022年7月に発表した報告書によると、米国の食品・健康調査参加者の52%が2022年に特定の食事や食事パターンを守っており、2021年の39%から増加しています。上位はクリーン・イーティング(16%)、マインドフル・イーティング(14%)、カロリー計算(13%)でした。したがって、健康志向の高まりが乳製品原料市場を牽引しました。

目次

第1章 エグゼクティブサマリー

- 乳製品原料-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- 乳製品原料市場定義とセグメンテーション

- 市場セグメンテーション:タイプ別

- 粉ミルク

- ホエイプロテイン

- 乳タンパク質

- 第三世代の原料

- カゼイン

- バターミルクパウダー

- ミルクパーミエート

- ホエイパーミエート

- 乳糖

- 市場セグメンテーション:原料別

- 牛乳

- 乳清

- 市場セグメンテーション:形態別

- 粉末

- 液体

- 市場セグメンテーション:製造方法別

- 従来式

- 膜分離

- 市場セグメンテーション:用途別

- 乳製品

- インスタント食品

- パン屋・菓子類

- 乳児用調合乳

- スポーツ栄養

- 医療栄養学

- 動物栄養

- その他の用途

第7章 主要な市場動向

- 食品廃棄物を削減する革新的な製品の発売

- 精密発酵技術を用いた乳製品代替品の革新に向けた戦略的パートナーシップ

- 自給率向上のための乳製品原料生産施設の拡張

第8章 乳製品原料の成長分析と戦略分析フレームワーク

- 世界の乳製品原料のPESTEL分析(政治、社会、技術、環境、法的要因)

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- エンドユーザー(B2B)の分析

- 栄養補助食品と機能性食品

- 化粧品・パーソナルケア業界

- 食品サービス業界

- 乳製品原料市場:成長率分析

- 市場成長実績、2019年~2024年

- 市場促進要因、2019年~2024年

- 市場抑制要因、2019年~2024年

- 市場成長予測、2024年~2029年、2034年

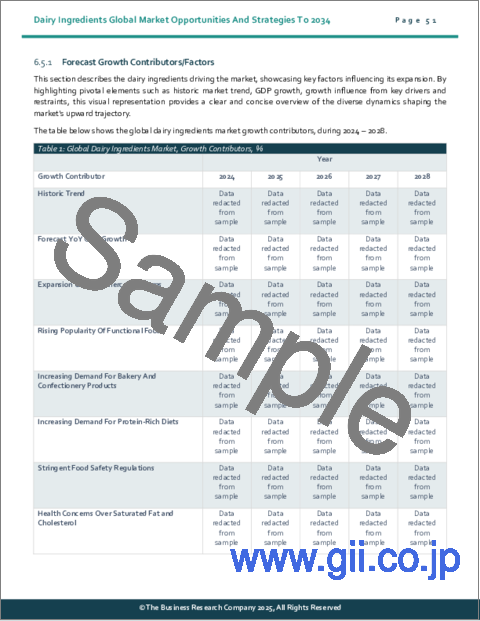

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 乳製品原料:総潜在市場規模(TAM)

第9章 乳製品原料市場:セグメンテーション

- 乳製品原料市場:タイプ別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場:原料別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場:形態別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場:製造方法別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場:用途別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場、粉ミルク別、種類別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場、ホエイプロテインのサブセグメンテーション、タイプ別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場、乳タンパクのサブセグメンテーション、タイプ別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場、カゼインのサブセグメンテーション、タイプ別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場、バターミルクパウダーのサブセグメンテーション、タイプ別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場、乳糖のサブセグメンテーション、タイプ別、実績と予測、2019年~2024年、2029年、2034年

第10章 乳製品原料市場:地域・国別分析

- 乳製品原料市場:地域別、実績と予測、2019年~2024年、2029年、2034年

- 乳製品原料市場:国別、実績と予測、2019年~2024年、2029年、2034年

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Fonterra Co-Operative Group Limited

- Dairy Farmers of America Inc

- Groupe Lactalis

- Agropur Dairy Cooperative

- Royal FrieslandCampina N.V.

第19章 その他の大手企業と革新的企業

- Saputo Inc

- Arla Foods Inc

- Sodiaal Group

- Kerry Group

- Glanbia plc

- Savencia Fromage & Dairy

- Volac International Limited

- Meiji Holdings Co., Ltd

- Almarai Company

- Emmi AG

- Danone S.A

- Milk Specialties Global

- Dairygold Co

- Inner Mongolia Yili Industrial Group Co. Ltd

- Valio Ltd

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Hatsun Agro Product Ltd Acquired Milk Mantra Dairy Pvt. Ltd.

- Prairie Farms Dairy Inc. Acquired SmithFoods Inc.

- Royal A-ware Food Group Agreed To Acquire The Dairy Food Group

- Butterfly Equity Acquired Milk Specialties Global

- Dodla Dairy Ltd. Acquired Sri Krishna Milks Pvt. Ltd.

第23章 最近の動向乳製品原料市場

第24章 機会と戦略

- 乳製品原料市場2029年:新たな機会を提供する国

- 乳製品原料市場2029年:新たな機会を提供するセグメント

- 乳製品原料市場2029年:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 乳製品原料市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々

第26章 付録

Dairy ingredients refers to components derived from the milk of mammals such as cows, goats, sheep, or buffaloes. These ingredients form the basis of a wide variety of dairy products and are used both as foods and functional ingredients in food processing.

The dairy ingredients market consists of the sales of dairy ingredients by entities (organizations, sole traders and partnerships) that refer to the foods that are made from milk, which are further transformed to butter, cheese and yogurt. Milk is utilized to provide fresh and storable nutritious foods. Milk or dairy ingredients contain essential nutrients like amino acids and minerals in a form that is easily absorbed by the body.

The global dairy ingredients market was valued at $59,666.43 million in 2019 which grew till at a compound annual growth rate (CAGR) of more than 4.00%.

Rise In Health-Consciousness

During the historic period, the rise in health-consciousness drove the growth of the dairy ingredients market. Health-consciousness refers to an individual's heightened awareness and proactive attitude toward maintaining and improving their overall well-being through informed lifestyle choices, such as healthy eating, regular physical activity and preventive healthcare practices. Dairy ingredients support health-consciousness by offering nutrient-dense options rich in high-quality protein, calcium and essential vitamins, which contribute to balanced diets and overall well-being. For example, in October 2022, according to an online survey of some 8,000 consumers in the United States, the United Kingdom, France and Germany conducted by McKinsey & Company, a US-based multinational strategy and management consulting company, 70% of respondents across various markets aim to improve their health, with 50% prioritizing healthy eating. Approximately 40% of participants prefer fresh produce, while 33% choose food free from artificial ingredients. Additionally, in July 2022, according to reports published by Food Insight, a US-based non-profit organization, 52% of food and health survey participants in the USA followed a specific diet or eating pattern in 2022, up from 39% in 2021. The top choices were clean eating (16%), mindful eating (14%) and calorie counting (13%). Therefore, the rise in health-consciousness drove the dairy ingredients market.

Innovative Product Launch To Reduce Food Waste

Major companies operating in the dairy ingredients market are focusing on developing innovative products to reduce food waste. Food waste refers to food that is fit for consumption but is discarded, lost, or uneaten at any point along the food supply chain - from production and processing to retail and consumer levels. For instance, in February 2025, Maison Riviera B.V., a Netherlands-based dairy product company, launched Canada's first certified upcycled drinkable yogurt, made with up to 30% upcycled ingredients to help reduce food waste. These unique yogurts are crafted using surplus fruits and other high-quality ingredients that would otherwise go to waste, transforming them into delicious, nutrient-rich beverages. Beyond reducing food waste, the line offers a variety of gourmet French-inspired flavors, maintaining Maison Riviera's signature commitment to premium taste and artisanal quality.

The global dairy ingredients market is fairly concentrated, with large players operating in the market. The top ten competitors in the market made up to 32.80% of the total market in 2023.

Dairy Ingredients Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global dairy ingredients market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for dairy ingredients? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The dairy ingredients market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider dairy ingredients market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics:- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type, by source, by form, by production method and by application.

- Key Trends:- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework Analysis:- on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth:- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis:- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation:- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by type, by source, by form, by production method and by application in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth: - Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape:- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies: - Details on the company profiles of other major and innovative companies in the market

- Competitive Benchmarking:- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions:- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Market Opportunities And Strategies:- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations:- This section includes recommendations for dairy ingredients market providers in terms of product/service offerings geographic expansion, marketing strategies and target groups next five years.

- Appendix:- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Type: Milk Powder; Whey Protein; Milk Protein; Third-Generation Ingredient; Casein; Butter Milk Powder; Milk Permeate; Whey Permeate; Lactose

- 2) By Source: Milk; Whey

- 3) By Form: Powder; Liquid

- 4) By Production Method: Traditional Method; Membrane Seperation

- 5) By Application: Dairy Products; Convenience Food; Bakery And Confectionery; Infant Milk Formula; Sports Nutrition; Medical Nutrition; Animal Nutrition; Other Applications

- Companies Mentioned: Fonterra Co-operative Group; Dairy Farmers of America Inc; Groupe Lactalis SA; Agropur Dairy Cooperative; Royal FrieslandCampina N.V

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; dairy ingredients indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Dairy Ingredients - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Dairy Ingredients Market Definition And Segmentations

- 6.4 Market Segmentation By Type

- 6.4.1 Milk Powder

- 6.4.2 Whey Protein

- 6.4.3 Milk Protein

- 6.4.4 Third-Generation Ingredient

- 6.4.5 Casein

- 6.4.6 Butter Milk Powder

- 6.4.7 Milk Permeate

- 6.4.8 Whey Permeate

- 6.4.9 Lactose

- 6.5 Market Segmentation By Source

- 6.5.1 Milk

- 6.5.2 Whey

- 6.6 Market Segmentation By Form

- 6.6.1 Powder

- 6.6.2 Liquid

- 6.7 Market Segmentation By Production Method

- 6.7.1 Traditional Method

- 6.7.2 Membrane Separation

- 6.8 Market Segmentation By Application

- 6.8.1 Dairy Products

- 6.8.2 Convenience Food

- 6.8.3 Bakery and Confectionery

- 6.8.4 Infant Milk Formula

- 6.8.5 Sports Nutrition

- 6.8.6 Medical Nutrition

- 6.8.7 Animal Nutrition

- 6.8.8 Other Applications

7 Major Market Trends

- 7.1 Innovative Product Launch To Reduce Food Waste

- 7.2 Strategic Partnership To Innovate Dairy Alternatives Using Precision Fermentation

- 7.3 Expansion Of Dairy Ingredient Production Facilities To Boost Self-Sufficiency

8 Dairy Ingredients Growth Analysis And Strategic Analysis Framework

- 8.1 Global Dairy Ingredients PESTEL Analysis (Political, Social, Technological, Environmental and Legal Factors)

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End User (B2B)

- 8.2.1 Nutraceuticals And Functional Foods

- 8.2.2 Cosmetics And Personal Care Industry

- 8.2.3 Foodservice Industry

- 8.3 Dairy Ingredients Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019 - 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Dairy Ingredients Total Addressable Market (TAM)

9 Dairy Ingredients Market Segmentation

- 9.1 Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Dairy Ingredients Market, Segmentation By Production Method, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Dairy Ingredients Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Dairy Ingredients Market, Sub-Segmentation By Milk Powder, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Dairy Ingredients Market, Sub-Segmentation Whey Protein, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.8 Dairy Ingredients Market, Sub-Segmentation By Milk Protein, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.9 Dairy Ingredients Market, Sub-Segmentation By Casein, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.10 Dairy Ingredients Market, Sub-Segmentation By Butter Milk Powder, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.11 Dairy Ingredients Market, Sub-Segmentation By Lactose, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Dairy Ingredients Market, Regional and Country Analysis

- 10.1 Dairy Ingredients Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Dairy Ingredients Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

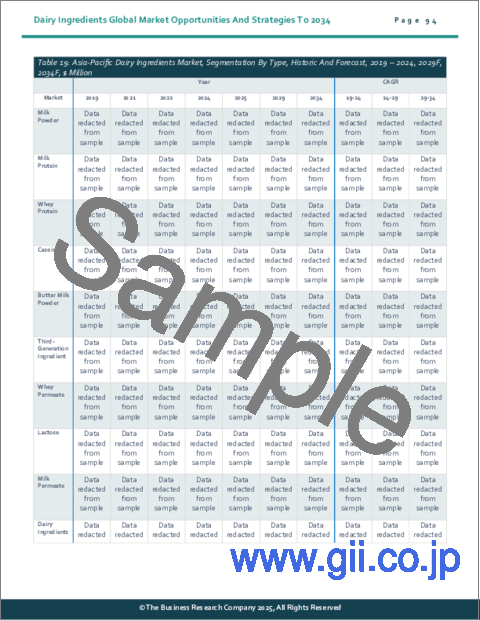

- 11.3 Asia-Pacific Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific Dairy Ingredients Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 Australia Market

- 11.24 Australia Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Australia Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 Indonesia Market

- 11.28 Indonesia Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Indonesia Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.30 Indonesia Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 South Korea Market

- 11.32 Summary

- 11.33 Market Overview

- 11.33.1 Country Information

- 11.33.2 Market Information

- 11.33.3 Background Information

- 11.33.4 Government Initiatives

- 11.33.5 Regulations

- 11.33.6 Regulatory Bodies

- 11.33.7 Major Associations

- 11.33.8 Taxes Levied

- 11.33.9 Corporate Tax Structure

- 11.33.10 Investments

- 11.33.11 Major Companies

- 11.34 South Korea Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 South Korea Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 South Korea Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe Dairy Ingredients Market: Country Analysis

- 12.7 UK Market

- 12.8 UK Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major companies

- 13.3 Eastern Europe Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Eastern Europe Dairy Ingredients Market: Country Analysis

- 13.7 Russia Market

- 13.8 Russia Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.10 Russia Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America Dairy Ingredients Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Region Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investments

- 14.15.11 Major Companies

- 14.16 Canada Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 South America Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 South America Dairy Ingredients Market: Country Analysis

- 15.7 Brazil Market

- 15.8 Brazil Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.10 Brazil Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa Dairy Ingredients Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Dairy Ingredients Market, Segmentation By Source, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa Dairy Ingredients Market, Segmentation By Form, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape And Company Profiles

- 18.1 Company Profiles

- 18.2 Fonterra Co-Operative Group Limited

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial Overview

- 18.3 Dairy Farmers of America Inc

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Overview

- 18.4 Groupe Lactalis

- 18.4.1 Company Overview

- 18.4.2 Products And Services.

- 18.4.3 Business Strategy

- 18.4.4 Financial Overview

- 18.5 Agropur Dairy Cooperative

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Business Strategy

- 18.5.4 Financial Overview

- 18.6 Royal FrieslandCampina N.V.

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial Overview

19 Other Major And Innovative Companies

- 19.1 Saputo Inc

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 Arla Foods Inc

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 Sodiaal Group

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Kerry Group

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 Glanbia plc

- 19.5.1 Company Overview

- 19.5.2 Products and Services

- 19.6 Savencia Fromage & Dairy

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 Volac International Limited

- 19.7.1 Company Overview

- 19.7.2 Products And Services

- 19.8 Meiji Holdings Co., Ltd

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 Almarai Company

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 Emmi AG

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Danone S.A

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 Milk Specialties Global

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 Dairygold Co

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 Inner Mongolia Yili Industrial Group Co. Ltd

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 Valio Ltd

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 Hatsun Agro Product Ltd Acquired Milk Mantra Dairy Pvt. Ltd.

- 22.2 Prairie Farms Dairy Inc. Acquired SmithFoods Inc.

- 22.3 Royal A-ware Food Group Agreed To Acquire The Dairy Food Group

- 22.4 Butterfly Equity Acquired Milk Specialties Global

- 22.5 Dodla Dairy Ltd. Acquired Sri Krishna Milks Pvt. Ltd.

23 Recent Developments In The Dairy Ingredients Market

- 23.1 Mother Dairy Launches 'Promilk' To Tap into Growing Protein-Rich Dairy Market

- 23.2 Enzymatic Solution To Enhance Umami Flavor In Dairy Products

- 23.3 Arla Foods Unveils Initiative To Promote High-Protein Dairy Products With Innovative Concepts

24 Opportunities And Strategies

- 24.1 Dairy Ingredients Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Dairy Ingredients Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Dairy Ingredients Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Dairy Ingredients Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer