|

市場調査レポート

商品コード

1686645

スマートメーター(AMI)-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Smart Meters (AMI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマートメーター(AMI)-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 149 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

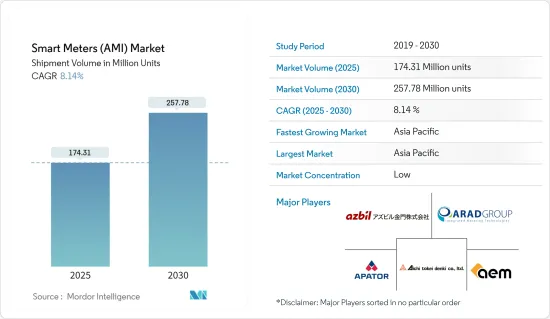

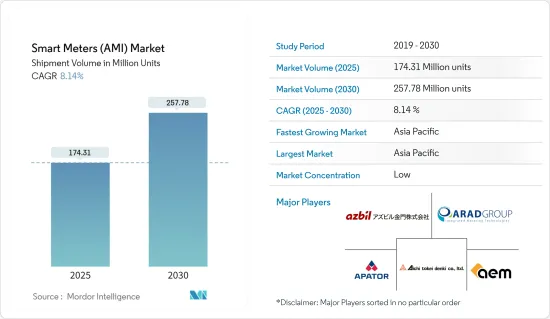

スマートメーター市場規模(出荷台数ベース)は、2025年の1億7,431万台から2030年には2億5,778万台に拡大し、予測期間(2025年~2030年)のCAGRは8.14%と予測されます。

主なハイライト

- 世界的に、電気、ガス、水道などの公益事業でスマートメーターの導入が進んでいます。これらのメーターは、双方向通信機能により、供給者と消費者の双方にとって、光熱費使用量のリアルタイム追跡を可能にします。この機能により、供給者は遠隔操作で供給を開始、検針、遮断できるだけでなく、家庭用エネルギー管理システム(HEMS)やビル用エネルギー管理システム(BEMS)の導入にも役立ちます。このようなシステムは、個々の家庭とビル全体の両方に対応し、電力消費の透明なビューを提供します。スマートメーターが普及するにつれ、エネルギー管理と効率性が強化され、さまざまな地域の持続可能性目標に合致するようになります。

- 経済活動の急増がエネルギー消費の増加につながる中、エネルギー効率は世界の優先事項の中心となっています。これを踏まえ、世界の各地域では、エネルギーとユーティリティの利用を最適化するため、スマートメーターのようなエネルギー効率の高いソリューションを多様な産業に急速に統合しています。政府や組織は持続可能なエネルギー慣行をますます重視するようになっており、この勢いは今後も続くと思われます。スマートメーターは、より効率的なエネルギー配給と消費を促進し、こうした努力に貢献する態勢を整えています。

- グリッドのデジタル化に対する財政的インセンティブと政府の支援政策が、スマートメーター市場の成長を後押ししています。これらの要素は、今後数年間でスマートメーター市場を拡大し、この分野における将来の革新と進歩のための強固な基盤を築くことになります。

- しかし、スマートメーター市場は、特に電力会社の切り替えに伴うコストに関する課題に直面しています。これらのシステムはデジタル・コンポーネントと接続性に依存しているため、技術シフトによって陳腐化するリスクがあり、様々な供給業者間での適応性が制限される可能性があります。さらに、各電力会社独自のユーザー・インターフェースは、スマート・メーターの互換性を複雑にしており、標準化されたインターフェース開発の欠如によって、この課題はさらに深刻化しています。

- さらに、現在進行中の世界の景気後退は、電子機器に対する需要を減退させ、スマート・メーターに対する意欲の減退につながり、市場の成長を妨げる可能性があります。

スマートメーター(AMI)市場動向

スマート電力メーターが市場を独占、予測期間中も動向は続く

- スマート電力メーターは商業ビル内での需要が高いです。企業は、課金を最適化するために、オフィスやその他のスペースでこれらのメーターを採用しています。商業スペースは複数のフロアにまたがることが多いため、電力消費を監視して無駄を最小限に抑えることが重要です。これらのスマートメーターは、供給ラインの障害も検知できるため、迅速な対応が可能です。

- 英国の大手新築住宅保証・保険業者であるNational House Building Council(NHBC)のデータによると、2024年第2四半期には29,281戸の新築住宅が建設登録されました。このような建設の増加は、英国におけるスマート・メーターの需要の高まりを示唆しています。

- さらに、スマートメーターの需要増に対応するため、数多くの企業が革新的なソリューションを発表しています。例えば、アレティ社は2024年5月、ローマで100万台のスマートメーターを突破したことを発表し、2025年末までにローマとその近郊のフォルメッロ市の約170万台のメーターを交換する計画です。

- エネルギー情報局(EIA)によると、2023年には米国内の電力会社規模の発電施設で約4兆1,780億キロワット時(kWh)が発電され、米国の電力需要が継続的に伸びていることを示しています。電力会社にとって、エネルギー配給網をよりよく管理し、最適化する必要性が高まっています。そのため、エネルギー消費に関する詳細な情報が入手でき、消費者がスマート電力計でエネルギー使用量を削減し、費用を節約する機会を特定するのに役立つことから、同国ではスマート電力計の採用が増加すると予測されています。

- スマートグリッドプロジェクトへの投資の増加は、市場成長を促進する主な要因のひとつです。中国国家電網総公司(State Grid Corp of China)によると、北京に本社を置く国営企業は今年、国内の雇用とエネルギー消費を安定させるため、国内送電網建設への投資を増やす計画です。同社は、2023年に送電網プロジェクトに5,200億人民元(769億5,000万米ドル)以上を割り当てると発表しました。今年の電力消費量は、経済を安定させるための後続措置により、さらに増加すると予想されています。

- エネルギー情報局(EIA)によると、世界の発電能力は今後30年間で2倍以上になり、2050年には約14.7テラワットに達すると予想されています。2020年の世界の発電設備容量は7.1テラワットで、世界中の電力需要が継続的に伸びていることを示しています。電力会社がエネルギー配給網を管理・最適化する必要性が高まっています。

アジア太平洋が主要市場シェアを占める

- 中国におけるスマート電力計の需要増加は、政府の政策、急速な都市化、スマートグリッド技術の進歩、エネルギー効率と二酸化炭素削減の重視の高まりなど、さまざまな要因の影響を受けた重要な動向です。世界最大のエネルギー消費国の1つである中国は、電力網の近代化に多額の投資を行っており、スマートメーターの導入はその戦略的イニシアチブの中心的な要素となっています。

- 中国は現在、アジア太平洋のスマートメーター導入でリードしているが、これは中国唯一の送電網運営会社である中国国家電網公司と中国南方電力集団公司からの厳しい指令によるものです。しかし、中国がスマートメーターの完全配備に近づくにつれ、年間需要が顕著に減少しており、これは導入段階が徐々に終了していることを示しています。

- 中国はスマート電力メーターの製造において主要な企業であり、現地企業の存在感が強いです。また、スマート電力メーターの最大生産国のひとつでもあり、主に展開段階において国内で消費されます。中国市場は国有企業によって支配されており、中国以外の企業が国内で効果的に競争することはほぼ不可能です。

- さらに、スマート電力メーターに対する国内需要の高まりを受けて、企業はいくつかの投資を行ってきました。例えば、三菱電機株式会社は2024年6月、システムインテグレーターのグローリーテクノロジーサービス株式会社および台湾の主要通信企業である中華電信と共同で、スマートメーターシステムを提供することを発表しました。

- 日本政府は、新しい送電網技術、エネルギー効率の高い住宅、および国の二酸化炭素排出量を削減するその他の技術への投資を促進するため、20兆円(1,550億米ドル)を充てる計画を発表しました。この多額の資金投入は、持続可能なエネルギー・ソリューションの推進に対する政府の献身を強調するものです。

- インド政府は、スマート電力メーターの開発を熱心に進めています。インド全土で普遍的な電力アクセスを実現するため、政府はまた、手頃な価格とその他の顧客メリットを約束するスマートグリッドを設立しました。こうしたスマートグリッドの実現に向けた最初の一歩は、高度計測インフラ(AMI)の導入です。スマートメーター・ナショナル・プログラム(SMNP)は、スマートメーターの全国展開を促進します。このイニシアチブは、電力省傘下の公共部門の合弁事業であるEnergy Efficiency Services Limited(EESL)が統括しています。

スマートメーター(AMI)市場概要

スマートメーター市場は特定の地域で成長しています。これは、AEM、愛知時計電機、Apator SA、Arad Group、Azbil Kimmonなどの主要企業が、市場での競争力を維持しようと努力しているためです。例えば、中国市場の後退は、世界レベルでの競争激化をもたらしました。同時に、欧州での展開や米国でのリプレースプロジェクトは、市場ベンダーに新たな機会を提供しました。

さらに、大規模投資の関与も既存事業者の障壁を高め、競争を激化させています。また、スマートメーターは様々なエンドユーザーや地域で導入が進んでいます。したがって、需要の大幅な増加と、さまざまな地域での展開数を増やすための政府の取り組みが相まって、需要の増加に対応するための市場企業間の競合の度合いが高まると予想されます。

さらに、スマートホームや産業用ソリューションの普及が進んでいることと、政府の支援策が相まって、複数の新規参入企業が市場に参入しています。SteamaCoのような製造新興企業は、アフリカ向けのスマートなオフグリッド電力メーターを構築するためにシード投資を確保しました。

同社は、電力会社がスマートメーター機器をエンドユーザーに接続し、メーターデータを利用して信頼性の高いスマートグリッドを構築するのを支援するSympower社など、複数のソリューション・プロバイダーの新興企業に支えられています。そのため、競合の程度は高く、予測期間中の市場調査においても、エネルギー問題への関心の高まりにより、同様に競争が激化すると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

- 産業バリューチェーン分析

- マクロ経済要因がスマートメーターの世界市場に与える影響

第5章 市場力学

- 市場促進要因

- スマートグリッドプロジェクトへの投資の増加

- ユーティリティ効率の改善ニーズ

- 政府の規制強化

- スマートシティ展開の成長

- すべてのエンドユーザーに対する持続可能なユーティリティ供給の需要

- 市場の課題

- 高コストとセキュリティへの懸念

- スマートメーターとの統合の難しさ

- インフラ導入のための設備投資不足とROIの欠如

- 電力供給会社の切り替えコスト

第6章 市場セグメンテーション

- 地域別- スマートガスメーター

- 北米

- 米国

- カナダおよび中米

- 欧州

- 英国

- フランス

- イタリア

- アジア

- 中国

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

- 地域別- スマート水道メーター

- 北米

- 米国

- カナダおよび中米

- 欧州

- 英国

- フランス

- イタリア

- アジア

- 中国

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

- 地域別- スマート電力メーター

- 北米

- 米国

- カナダおよび中米

- 欧州

- 英国

- フランス

- イタリア

- アジア

- 中国

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- AEM

- Aichi Tokei Denki Co.Ltd.

- Apator SA

- Arad Group

- Azbil Kimmon Co. Ltd.

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Elster Group GmbH(Honeywell International Inc.)

- General Electric Company

- Hexing Electric company Ltd.

- Holley Technology Ltd.

- Itron Inc.

- Jiangsu Linyang Energy Co. Ltd.

- Kamstrup A/S

- Landis+GYR Group AG

- Mueller Systems LLC(Muller Water Products Inc.)

- EDMI Limited(OSAKI ELECTRIC CO. LTD.)

- Neptune Technology Group Inc.(Roper Technologies, Inc.)

- Ningbo Sanxing Medical Electric Co., Ltd

- Pietro Fiorentini SpA

- Sagemcom SAS

- Sensus USA Inc.(Xylem Inc.)

- Aclara Technologies LLC(Hubbell Inc.)

- Wasion Holdings Limited

- Yazaki Corporation

- Zenner International GmbH & Co. KG

- Market Rankings Analysis

- Smart Electricity Meter Market

- Smart Gas Meter Market

- Smart Water Meter Market

第8章 市場機会と今後の動向

- スマート電力メーター市場の将来

- スマートガス・メーター市場の将来

- スマート水道メーター市場の将来

The Smart Meters Market size in terms of shipment volume is expected to grow from 174.31 million units in 2025 to 257.78 million units by 2030, at a CAGR of 8.14% during the forecast period (2025-2030).

Key Highlights

- Globally, utilities such as electricity, gas, and water are increasingly adopting smart meters. These meters enable real-time tracking of utility usage for both suppliers and consumers through their two-way communication feature. This functionality not only allows suppliers to remotely start, read, and cut off supply but also aids in implementing home energy management systems (HEMS) and building energy management systems (BEMS). Such systems offer a transparent view of electric power consumption, catering to both individual homes and entire buildings. As smart meters become more prevalent, they are set to enhance energy management and efficiency, aligning with the sustainability goals of various regions.

- As economic activities surge, leading to increased energy consumption, energy efficiency has taken center stage as a global priority. In light of this, regions worldwide are rapidly integrating energy-efficient solutions, like smart meters, across diverse industries to optimize energy and utility usage. This momentum is likely to persist, with governments and organizations increasingly valuing sustainable energy practices. Smart meters are poised to be instrumental in these endeavors, promoting more efficient energy distribution and consumption.

- Financial incentives for grid digitalization, coupled with supportive government policies, are fueling growth in the smart metering market. These elements are set to broaden the market for smart meters in the years ahead, laying a solid groundwork for future innovations and advancements in the sector.

- However, the smart metering market faces challenges, particularly concerning the costs associated with switching utility suppliers. Given that these systems depend on digital components and connectivity, they risk becoming obsolete with technological shifts, which can restrict their adaptability across various suppliers. Furthermore, the unique user interfaces of each utility provider complicate the interchangeability of smart meters, a challenge intensified by the lack of standardized interface developments.

- Additionally, the ongoing global economic downturn has dampened the demand for electronic devices, leading to a reduced appetite for smart meters, which could hinder market growth.

Smart Meters (AMI) Market Trends

Smart Electricity Meter Dominates the Market and will Continue the Trend Over the Forecast Period

- Smart electricity meters are in high demand within commercial buildings. Businesses are adopting these meters in offices and other spaces to optimize billing. Since commercial spaces often span multiple floors, monitoring power consumption and minimizing waste is crucial. These smart meters can also detect supply line disturbances, allowing for swift responses.

- Data from the National House Building Council (NHBC), the UK's leading new home warranties and insurance provider, reveals that 29,281 new homes were registered for construction in Q2 2024. This uptick in construction signals a rising demand for smart meters in the UK.

- Furthermore, numerous companies are launching innovative solutions to meet the rising demand for smart meters. For example, in May 2024, Areti announced surpassing the milestone of 1 million smart meters in Rome, with plans to replace the roughly 1.7 million meters in Rome and the nearby municipality of Formello by the close of 2025.

- According to the Energy Information Administration (EIA), in 2023, nearly 4,178 billion kilowatt hours (kWh) of electricity were generated at utility-scale electricity generation facilities in the United States, which shows the demand for electricity in the United States is growing continuously. There is a growing need for utilities to manage better and optimize their energy distribution network. Thus, the availability of detailed information about energy consumption, which can help the consumer identify opportunities to reduce energy usage and save money with smart electricity meters, is projected to increase the adoption of smart electricity meters in the country.

- Increased investments in smart grid projects are one of the main drivers fueling market growth. According to the State Grid Corp. of China, the Beijing-based state-owned company plans to increase its investment in domestic grid construction this year to stabilize the nation's employment and energy consumption. The company announced it would allocate more than CNY 520 billion (USD 76.95 billion) to power grid projects in 2023. This year's power consumption is anticipated to rise further due to follow-up measures to stabilize the economy.

- According to the Energy Information Administration (EIA), global electricity generation capacity is expected to more than double in the next three decades, reaching approximately 14.7 terawatts by 2050. In 2020, the world's installed electricity capacity stood at 7.1 terawatts, which shows the demand for electricity around the globe is growing continuously. There is a growing need for utilities to manage and optimize their energy distribution networks.

Asia Pacific Holds Major Market Share

- The increasing demand for smart electricity meters in China represents a significant trend influenced by various factors, including government policies, rapid urbanization, advancements in smart grid technology, and a growing emphasis on energy efficiency and carbon reduction. As one of the world's largest energy consumers, China has been making substantial investments in modernizing its electricity grid, with the deployment of smart meters being a central component of its strategic initiatives.

- China currently leads the Asia Pacific region in smart meter rollouts, driven by stringent mandates from the State Grid Corporation of China and China Southern Power Grid, the country's sole grid operators. However, as China approaches the full deployment of smart meters, there is a noticeable reduction in annual demand, signaling the gradual conclusion of the rollout phase.

- China is a major player in the manufacturing of smart electricity meters, with a strong presence of local companies. It is also one of the largest producers of smart electricity meters, primarily consumed domestically during the rollout phase. The Chinese market is dominated by state-owned enterprises, making it nearly impossible for non-Chinese companies to compete effectively within the country.

- Additionally, companies have made several investments in response to the country's growing demand for smart electricity meters. For instance, in June 2024, Mitsubishi Electric Corporation announced its collaboration with system integrator Glory Technology Service Inc. and Taiwan's leading telecommunications company, Chunghwa Telecom Co., Ltd., to deliver a Smart-meter System.

- The Japanese government has announced plans to allocate JPY 20 trillion (USD 155 billion) to foster investments in new power grid technology, energy-efficient homes, and other technologies to reduce the nation's carbon footprint. This substantial financial commitment underscores the government's dedication to promoting sustainable energy solutions.

- The Indian government is diligently advancing the development of smart electricity meters. To achieve universal power access across India, the government also established smart grids that promise affordability and other customer benefits. The initial stride toward realizing these smart grids is the adoption of Advanced Metering Infrastructure (AMI). The Smart Meter National Program (SMNP) facilitates the nationwide deployment of smart meters. This initiative is overseen by Energy Efficiency Services Limited (EESL), a joint venture of public sector undertakings under the Ministry of Power.

Smart Meters (AMI) Market Overview

The smart meters market has grown in certain regions. This is leading companies like AEM, Aichi Tokei Denki Co.Ltd., Apator SA, Arad Group, and Azbil Kimmon Co. Ltd., strive to maintain a competitive edge in the market. For instance, the receding market in China increased this competitive intensity at a global level. At the same time, the rollouts in Europe and replacement projects in the United States offered new opportunities for the market vendors.

Moreover, the involvement of large-scale investment also increases the barriers for the existing players, thereby pushing the industry toward increasing competition. Also, smart meters are increasingly being deployed in various end users and regions. Hence, the substantial increase in demand, coupled with government initiatives to increase the number of rollouts in various regions, is expected to increase the degree of competition amongst the market players to meet the increasing demand.

Additionally, the growing penetration of smart home and industrial solutions coupled with supportive government initiatives has attracted several new players to the market. Manufacturing startups, such as SteamaCo, secured seed investments to build smart off-grid electricity meters for Africa.

The company is supported by several solution provider startups, such as Sympower, which helps utilities connect smart metering devices to their end users and use the metering data to build a reliable smart grid. Therefore, the degree of competition is high and expected to increase in the same in the market study for the forecasted period, owing to the increasing emphasis on energy concerns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 mpact of Macroeconomic Factors on the Global Smart Meter Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Need for Improvement in Utility Efficiency

- 5.1.3 Supportive Government Regulations

- 5.1.4 Growth in Smart City Deployment

- 5.1.5 Demand for Sustainable Utility Supply for All End Users

- 5.2 Market Challenges

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Lack of Capital Investment for Infrastructure Installation and Lack of ROI

- 5.2.4 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Geography - Smart Gas Meter

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada and Central America

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 France

- 6.1.2.3 Italy

- 6.1.3 Asia

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.4 Australia and New Zealand

- 6.1.5 Latin America

- 6.1.6 Middle East and Africa

- 6.1.1 North America

- 6.2 By Geography - Smart Water Meter

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada and Central America

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 France

- 6.2.2.3 Italy

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

- 6.3 By Geography - Smart Electricity Meter

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada and Central America

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEM

- 7.1.2 Aichi Tokei Denki Co.Ltd.

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Azbil Kimmon Co. Ltd.

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Elster Group GmbH (Honeywell International Inc.)

- 7.1.9 General Electric Company

- 7.1.10 Hexing Electric company Ltd.

- 7.1.11 Holley Technology Ltd.

- 7.1.12 Itron Inc.

- 7.1.13 Jiangsu Linyang Energy Co. Ltd.

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+ GYR Group AG

- 7.1.16 Mueller Systems LLC (Muller Water Products Inc.)

- 7.1.17 EDMI Limited (OSAKI ELECTRIC CO. LTD.)

- 7.1.18 Neptune Technology Group Inc. (Roper Technologies, Inc.)

- 7.1.19 Ningbo Sanxing Medical Electric Co., Ltd

- 7.1.20 Pietro Fiorentini SpA

- 7.1.21 Sagemcom SAS

- 7.1.22 Sensus USA Inc. (Xylem Inc.)

- 7.1.23 Aclara Technologies LLC (Hubbell Inc.)

- 7.1.24 Wasion Holdings Limited

- 7.1.25 Yazaki Corporation

- 7.1.26 Zenner International GmbH & Co. KG

- 7.2 Market Rankings Analysis

- 7.2.1 Smart Electricity Meter Market

- 7.2.2 Smart Gas Meter Market

- 7.2.3 Smart Water Meter Market

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 Future of the Market - Smart Electricity Meter

- 8.2 Future of the Market - Smart Gas Meter

- 8.3 Future of the Market - Smart Water Meter