|

市場調査レポート

商品コード

1640423

タクティカル慣性システム:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Tactical Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| タクティカル慣性システム:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

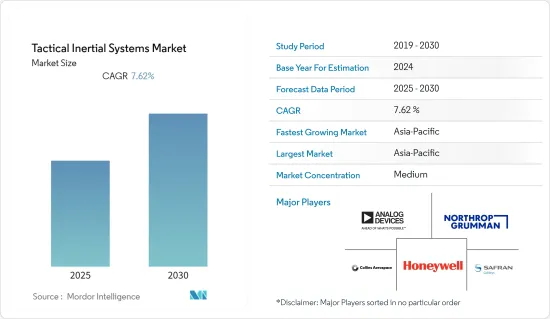

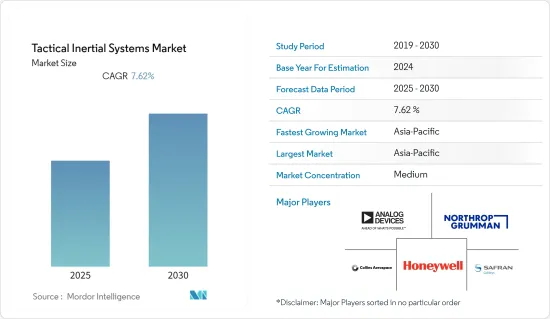

タクティカル慣性システム市場は予測期間中にCAGR 7.62%を記録する見込みです。

主なハイライト

- タクティカル慣性システム市場の成長は、広範囲の戦術的用途に適合させるために慣性システムの小型化を求める受託製造業者への圧力の高まりが主因です。

- MEMSは、小さなユニットサイズで強化された機能を提供するため、ポータブルデバイスの急速な増加を大きくサポートしています。タクティカル慣性MEMS市場予測では、今後5年間で慣性MEMSデバイスの数量が劇的に増加すると予測しています。

- また、近年では、有人のパイロットが搭乗しない航空機の導入が増加しており、無人航空機(UAV)と呼ばれることもあります。これらの乗り物は、航空宇宙・防衛分野で広く応用されています。慣性航法システムは、このようなビークルに不可欠なコンポーネントを形成しています。

- しかし、慣性航法システムは故障率や修理費用が高い傾向にあり、その結果、システムのメンテナンス費用が高くなります。こうした要因が市場の成長を制限する可能性があります。

- COVID-19パンデミックは航空宇宙・防衛産業に大きな影響を及ぼし、民間航空業界の多くの企業がパンデミック期間中の操業停止により生産の中断や需要の鈍化を経験しました。しかし、パンデミック後の防衛・航空宇宙産業への成長傾斜は、ナビゲーションシステムの技術的進歩と相まって、今後数年間は市場に明るい展望をもたらすと予想されます。

タクティカル慣性システム市場動向

加速度計セグメントが最も高い市場シェアを占める見込み

- 従来の加速度計は、機械的振動の原理に基づいて作られていました。加速度計の主要部品は、バネで支持された質量です。シリコンベースの製品と小型化技術の使用により、加速度計の構造は急速に縮小しました。

- 現在の市場で販売されているMEMS加速度計は、上部に質量が取り付けられた微細な結晶構造を持ち、加速力によって応力がかかり、電圧が発生します。

- 長年にわたり、低加速度計はその用途で人気を博してきました。3D MEMS技術により、両社は表面実装およびリフローはんだ付け用のピンを備えたデュアル・イン・ラインまたはデュアル・イン・フラット・ラインのプラスチック・パッケージで組み立てられた加速器を提供します。これらはシリコンゲルで環境保護されており、湿度の高い環境や温度サイクルにおいて優れた性能と信頼性を発揮します。

- 世界の軍事・防衛費の増加も、この産業で加速度計が広く使用されていることから、このセグメントの重要な推進力となっています。例えば、加速度計は爆発の威力を測定するために一般的に使用されています。また、爆発力の影響を定量化できる兵士装着型や装甲車搭載型デバイスにも組み込まれています。

- さらに、2022年3月、ハネウェルは新しい加速度計、MV60微小電気機械システム(MEMS)を発売しました。MV60は主に航空宇宙・防衛用に設計されているが、小型・軽量で動作にほとんど電力を必要としない高精度のナビゲーショングレードの加速度計を必要とする産業用および海洋用アプリケーションにも使用できる可能性があります。

アジア太平洋が最大の市場シェアを占める

- 現在の市場シナリオでは、アジア太平洋がタクティカル慣性システムの最大市場です。中国、日本、インドなどの国々で生産量が多いため、この地域ではタクティカル慣性システムの需要が絶えないです。

- さらに、この成長は、インドや中国などの経済成長国による防衛分野への投資の増加によるものです。中国とインドの防衛部門は、防衛支出を増やし、軍事用途の高度遠隔操作車両の調達を増やしています。

- また、インド国防省は昨年10月、106基の慣性航法システムをBuy(インド)カテゴリーでFast Track Procedureにより調達する計画を明らかにし、調達プロセスへの前向きな参加を求めました。このような事例も、市場に大きな成長の勢いをもたらすと予想されます。

- さらに、多くの地域プレーヤーが、市場の巨大な成長の可能性により、製品ラインを拡大しています。例えば、日本のセイコーエプソン株式会社は昨年11月、高性能6軸センサーを搭載した慣性計測ユニット(IMU)のラインアップを拡充し、新開発のスタンダードモデル「M-G366PDG」(M-G366)とベーシックモデル「M-G330PDG」(M-G330)を追加しました。

- M-G366」と「M-G330」は、加速度センサの出力レンジを「+-8G」と「+-16G」から選択できるほか、ジャイロセンサの全出力レンジで0.05%の非直線性を実現し、正確な動きの計測を可能にする見込み。

タクティカル慣性システム産業の概要

タクティカル慣性システム市場の競争は中程度です。アプリケーションの増加、技術の進歩、航空宇宙・防衛予算の増加が主に市場の成長を後押ししています。さらに、誘導、制御、照準、精密誘導兵器、その他の兵器における精度と校正の需要が増加していることも成長の要因となっています。

- 2022年12月-ハネウェルは、ミネアポリスの製造施設から100万個目のタクティカルグレード慣性測定ユニット(IMU)を納入したと発表しました。これらのIMUは、軍事機器や無人航空機を含む幅広い用途で使用されます。

- 2022年9月- コリンズエアロスペースは、英国の兵器分野研究枠組み(WSRF)の一環として、将来の複雑な兵器プラットフォームで使用するナビゲーショングレードの慣性計測ユニット(IMU)を開発する数百万ポンドのプログラムを獲得しました。この契約では、同社の(MEMS)技術を使用してタクティカルグレードまたは「クラスA」のIMUを構築することが求められています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

- 調査手法

- 調査フェーズ

第3章 市場分析

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- バリューチェーン分析

第4章 市場力学

- 市場促進要因

- 防衛・航空宇宙分野の成長傾向

- 市場抑制要因

- 運用の複雑さとメンテナンスコストの高さ

第5章 技術スナップショット

第6章 市場セグメンテーション

- エンドユーザー別

- 航空宇宙・防衛

- 海洋/海軍

- 技術別

- MEM

- 光ファイバージャイロ(FOG)

- リングレーザージャイロ(RLG)

- その他の技術

- コンポーネント別

- 加速度計

- 磁力計

- ジャイロスコープ

- その他のコンポーネント

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他アジア太平洋地域

- 世界のその他の地域

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Analog Devices Inc.

- Northrop Grumman Corporation

- Safran Group(Colibrys Switzerland)Ltd

- Rockwell Collins Inc.

- Honeywell International Inc.

- Invensense Inc.(TDK Corporation)

- Ixbluesas

- Kearfott Corporation

- KVH Industries Inc.

- Thales Group

- Xsens Technologies BV

- Sparton Corporation

- Epson Europe Electronic

- Vector NAV

第8章 投資分析

第9章 市場の将来

目次

Product Code: 52801

The Tactical Inertial Systems Market is expected to register a CAGR of 7.62% during the forecast period.

Key Highlights

- The growth in the tactical inertial systems market is majorly driven by the increasing pressure on contract manufacturers to reduce the size of the inertial systems to make them suitable for a broad range of tactical applications.

- MEMS greatly supports the rapid increase in portable devices, as they offer enhanced capabilities within small unit sizes. The tactical inertial MEMS market forecast predicts a dramatic rise in the volume of inertial MEMS devices over the next five years.

- Also, recent years have seen an increasing deployment of aircraft that do not have a manned pilot on board, often termed unmanned aerial vehicles (UAV). These vehicles are finding widespread applications in the aerospace and defense sector. The inertial navigation system forms an essential component of such vehicles.

- However, inertial navigation systems tend to have high failure rates and repair costs, resulting in high maintenance costs for these systems. Such factors might restrict the growth of the market.

- The Covid-19 pandemic had a significant impact on the aerospace and defense industries, with many companies in commercial aviation experiencing disruption in production and slowing demand owing to the lockdowns imposed during the pandemic. However, the inclination of growth toward defense and aerospace post-pandemic, combined with the technological advancements in navigation systems, is expected to create a positive outlook for the market in the coming years.

Tactical Inertial Systems Market Trends

The Accelerometer Segment is Expected to Hold the Highest Market Share

- Traditional accelerometers were built on the principle of mechanical vibration. The principal components of an accelerometer are mass supported by springs. With the use of silicon-based products and miniaturization techniques, the accelerometer structure has shrunk rapidly.

- MEMS accelerometers sold in the current market scenario contain microscopic crystal structures with a mass attached to the top that gets stressed by accelerative forces, which causes a voltage to be generated.

- Over the years, low-g accelerators have gained traction for their applications. With the 3D MEMS technology, the companies offer accelerators assembled in a dual-in-line or dual-in-flat-line plastic package with pins for surface mount and re-flow soldering. They are environmentally protected with silicone gel, resulting in excellent performance and reliability in a humid environment and at temperature cycling.

- The rising military and defense expenditures worldwide also act as a critical driving force for the segment owing to the widespread use of accelerometers in this industry. For instance, accelerometers have been commonly used to measure explosions' power. They are also incorporated into soldier-worn and armored vehicle-mounted devices that can quantify the effects of explosive forces.

- Moreover, in March 2022, Honeywell launched a new accelerometer - its MV60 micro-electro-mechanical system (MEMS) - primarily designed for aerospace and defense but also has potential uses for industrial and marine applications that need high-precision, navigation-grade accelerometers that are small, lightweight and require little power to operate.

Asia-Pacific Accounts for the Largest Market Share

- Asia-Pacific is the largest market for tactical inertial systems in the current market scenario. The large production volume in countries such as China, Japan, and India keeps a constant demand for tactical inertial systems in the region.

- In addition, this growth is due to increased investment in the defense sector from growing economies, such as India and China. The defense sectors in China and India are increasing the defense spending and procurement of advanced remotely operated vehicles for military applications.

- Also, in October last year, the Ministry of Defence, Government of India revealed plans to procure 106 Inertial Navigation Systems through Fast Track Procedure under Buy (Indian) category and sought participation in the procurement process from prospective. Such instances are also expected to provide significant growth momentum to the market.

- Moreover, many regional players are expanding their product line due to the market's huge growth potential. For instance, in November last year, Japan-based Seiko Epson Corporation expanded its lineup of inertial measurement units (IMU) equipped with high-performance six-axis sensors by adding a newly developed standard model called the M-G366PDG (M-G366) and a basic model called the M-G330PDG (M-G330).

- The M-G366 and M-G330 are expected to allow the users to select an accelerometer output range of either +-8 G or +-16 G. Additionally, they offer 0.05% non-linearity in all output ranges of the gyroscopic sensors, enabling accurate measurement of movements.

Tactical Inertial Systems Industry Overview

The Tactical Inertial Systemes market is moderately competitive. Increasing applications, technological advancements, and rising aerospace and defense budgets primarily fuel the market's growth. Furthermore, the growth can be attributed to the increasing demand for accuracy and calibration in guidance, control and targeting, precision-guided armaments, and other weaponry.

- December 2022 - Honeywell announced that it had delivered its one millionth tactical-grade inertial measurement unit (IMU) from its manufacturing facility in Minneapolis. These IMUs are used in a wide range of applications, including military equipment and unmanned aerial vehicles.

- September 2022 - Collins Aerospace was awarded a multi-million-pound program as part of the United Kingdom's Weapons Sector Research Framework (WSRF) to develop a navigation grade Inertial Measurement Unit (IMU) for use in future complex weapons platforms. The agreement calls for constructing a tactical grade or 'Class A' IMU using the company's (MEMS) technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Methodology

- 2.2 Research Phases

3 MARKET ANALYSIS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Value Chain Analysis

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Inclination of Growth in Defense and Aerospace

- 4.2 Market Restraints

- 4.2.1 Operational Complexity Coupled with High Maintenance Costs

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 End User

- 6.1.1 Aerospace and Defense

- 6.1.2 Marine/Naval

- 6.2 Technology

- 6.2.1 MEMs

- 6.2.2 Fiber Optic Gyro (FOG)

- 6.2.3 Ring Laser Gyro (RLG)

- 6.2.4 Other Technologies

- 6.3 Component

- 6.3.1 Accelerometers

- 6.3.2 Magnetometers

- 6.3.3 Gyroscopes

- 6.3.4 Other Components

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle-East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Safran Group (Colibrys Switzerland) Ltd

- 7.1.4 Rockwell Collins Inc.

- 7.1.5 Honeywell International Inc.

- 7.1.6 Invensense Inc. (TDK Corporation)

- 7.1.7 Ixbluesas

- 7.1.8 Kearfott Corporation

- 7.1.9 KVH Industries Inc.

- 7.1.10 Thales Group

- 7.1.11 Xsens Technologies BV

- 7.1.12 Sparton Corporation

- 7.1.13 Epson Europe Electronic

- 7.1.14 Vector NAV