|

市場調査レポート

商品コード

1637739

電子包装:市場シェア分析、産業動向と統計、成長予測(2025~2030年)Electronic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電子包装:市場シェア分析、産業動向と統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

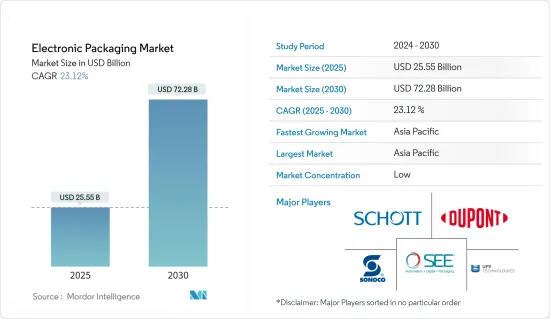

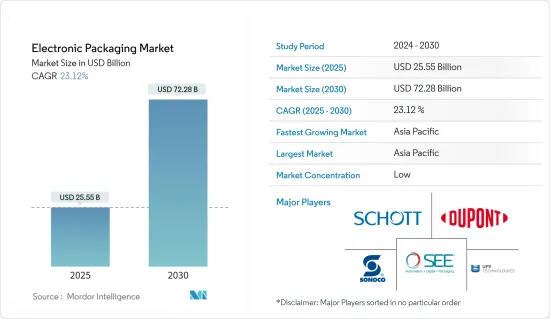

電子包装市場規模は2025年に255億5,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは23.12%で、2030年には722億8,000万米ドルに達すると予測されます。

主要ハイライト

- テレビ、セットトップボックス、MP3参入企業、デジタルカメラなどの需要が急増する中、エレクトロニクス包装は大量生産にますます好まれるようになっています。IoTとAIの台頭は、複雑なエレクトロニクスの普及と相まって、民生用エレクトロニクスと自動車産業内のハイ最終用途セグメントを推進しています。その結果、この急増する需要に対応するため、エレクトロニクス包装の先進技術が急速に採用されています。

- 電子機器を販売する企業は、消費者の選択を形成する上で極めて重要な役割を担っていることを認識し、包装設計に持続可能性を着実に織り込んでいます。例えば、ハイテク大手のSamsungは、2025年までに全製品ラインに環境に優しい材料を採用することを約束しています。この野心的な動きには、従来のプラスチック包装から生分解性またはリサイクル可能な代替品への移行が含まれます。こうした取り組みは、環境意識の高い消費者の共感を呼ぶだけでなく、環境問題への関心が高まる市場において、ブランドを責任あるフロントランナーとして位置づけることにもなります。

- デジタルの時代は、包装デザインを再構築しています。最近の民生用電子機器製品の包装には、QRコード、AR(拡張現実)インターフェース、NFC(近距離無線通信)タグなどの機能が備わっています。これらのイノベーションは、消費者と包装とのインタラクションに革命をもたらしつつあります。

- 物理的な包装をデジタル体験と融合させることで、これらの技術はユーザーエンゲージメントを増幅させます。例えば、包装上のQRコードをスキャンすることで、消費者は詳細な製品スペックやユーザーレビュー、あるいは没入型のバーチャルリアリティ・デモンストレイションを発表するウェブサイトへと誘導される可能性があります。このような機能は、民生用電子機器包装市場においてこれらの技術の重要性が高まっていることを裏付けています。

- 自動車産業は、特に電気自動車やハイブリッド車への移行が急速に進んでおり、市場情勢において支配的な役割を果たしています。これらの自動車では、メモリーデバイス、プロセッサ、アナログ回路、センサが幅広く使用されているため、エレクトロニクス包装の需要は大幅に増加する見込みです。

- IBEFの予測によると、インドの電気自動車(EV)市場は2025年までに5,000億インドルピー(70億9,000万米ドル)に達する可能性があります。さらに、CEEW Centre for Energy Financeの調査によると、2030年までにインドにおけるEVの市場規模は2,060億米ドルに達するといいます。このような強気の予測は、エレクトロニクス包装市場をさらに活性化させると考えられます。

- COVID-19パンデミックは多くの産業に影を落としたが、エレクトロニクス包装ソリューションとコンシューマー・エレクトロニクス包装は回復力を見せた。主に携帯電話とコンピュータ産業が民生用電子機器用包装の需要を牽引しています。生産停止、原料不足、サプライチェーンの混乱などの課題にもかかわらず、これらの産業の生産高は比較的無傷でした。

電子包装市場の動向

航空宇宙・防衛セグメントはエレクトロニクス包装の採用が増加する見込み

- 米国、フランス、英国などの先進国でも、ロシア、インド、中国などの発展途上国でも、防衛予算は増加傾向にあります。これらの国の多くは、兵器の輸出にも熱心です。その結果、航空宇宙・防衛市場への研究開発投資が持続的に推進されています。

- 今日のダイナミックな地政学的情勢において、集団防衛の重要性はいくら強調してもしすぎることはないです。武器や誘導システムから武装車両やその動力源に至るまで、軍事・防衛力は、国家を外部の脅威から守る上で極めて重要な役割を果たしています。強固な軍事システムを維持するためには、モニタリング部隊も軍事も最大限の効率と効果を発揮しなければならないです。

- インド国防生産省の報告によると、2022~23会計年度の国防生産は歴史的な節目を達成し、2021~22会計年度の9,500億インドルピー(約114億5,000万米ドル)から初めて1,000インドルピー(約120億5,000万米ドル)を突破しました。さらに、インドの防衛用バッテリーの需要は倍増し、2022年の4ギガワット時から2030年には10ギガワット時になると予測されています。防衛用バッテリーの採用拡大とともに、防衛生産が一貫して増加していることが、今後数年間の市場成長を促進する展望です。

- 海軍の軍艦、船上の衛星通信チャネル、武器制御システム、沿岸警備隊はすべて先進的電子製品に依存しています。これらのコンポーネントは、特に湿度や過酷な環境による課題を考えると、軍用グレードの包装が必要です。こうした需要は、高品質な製品の必要性を強調するだけでなく、研究開発への投資にも拍車をかけています。

アジア太平洋が大幅な市場成長を遂げる

- 予測期間中、アジア太平洋は、自動車インフラの拡大と電気自動車販売の急増に牽引され、市場を席巻する展望です。中間所得層の所得が上昇し、若者の人口が大幅に増加していることから、自動車産業における需要は拡大するとみられます。インド自動車工業会(SIAM)の報告によると、2023年のインドの乗用車生産台数は454万台で、2022年の365万台から顕著に増加しており、今後の市場の堅調な成長を示唆しています。

- エレクトロニクスのハブとして世界的に認知されている中国は、電気部品や電子製品の大量生産に秀でており、一流の品質、性能、納期のベンチマークを遵守しています。この実力は、エレクトロニクス包装市場の大きな成長の可能性を裏付けています。

- 中国の産業成長は、急増する国内需要、技術革新、高級製品の生産への取り組みによって促進されています。中国における紙と板紙の大規模な生産は、エレクトロニクス包装の販売に適した環境を育んでいます。

- インドの電子機器製造産業は、強力な施策的支援、多額の投資、電子製品に対する需要の高まりに後押しされ、国家投資促進・円滑化庁(NIPFA)の報告によると、2025年までに2,200億米ドルに達すると予測されています。

電子包装産業概要

エレクトロニクス包装市場は細分化されています。マイクロシステムは、ほぼすべての産業セグメントで使用されており、コンシューマーエレクトロニクス、医療機器、航空宇宙・防衛、通信などが主要なセグメントです。主要市場参入企業は、UFP Technologies、Schott AG、Sealed Air Corporation、DuPont de Nemours Inc.、Sonoco Products Companyなどがあります。

- 2023年9月、Sealed Airは3D自動包装ソリューションの主要プロバイダーであるSparck Technologiesと提携。シールドエアーはオーストラリア、韓国、日本、韓国でSparck Technologiesの3D CVP自動包装ソリューションを独占的に販売する予定。提携の一環として、Sealed Airの顧客は産業最先端の自動包装ソリューションへのアクセスから恩恵を受け、プロセスを合理化し、より安全な作業環境を作ることができるようになります。

- 2023年11月、Mondiは、段ボール包装を完全にリサイクル可能で堆肥化可能な選択肢として推進することで、サステイナブル代替案を先導すると発表しました。再生繊維を原料とする同社の段ボールは、欧州で注目される紙製包装のリサイクル率82.5%の達成に極めて重要な役割を果たしています。白物民生用電子機器や電子機器の循環型包装に取り組むMondiの材料と設計の専門家は、EPS材料の代替となる先進的な段ボールソリューションを構築しています。

- 2023年9月、Schott AGは、航空宇宙産業向けの新しいマイクロエレクトロニクス包装を発表しました。この包装は、コバール鉄ニッケル合金で作られた従来の電子機器包装と比較して、重量を最大75%削減しながら、航空電子機器保護の寿命を延ばすことを目的としています。また、この製品は、無線周波数設計、直流/直流コンバータ(DC/DC)、蓄電装置、センサ部品などの高感度電子機器を保護するとも言われています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 産業バリューチェーン分析

- 市場促進要因

- 世界の電気自動車販売の加速

- 技術進歩による製品の品質向上

- 市場抑制要因

- 電子包装の高コストと熟練した専門家の不足が市場成長の課題

- 技術スナップショット

第5章 市場セグメンテーション

- 材料別

- プラスチック

- 金属

- ガラス

- エンドユーザー産業別

- コンシューマー・エレクトロニクス

- 航空宇宙・防衛

- 自動車

- 医療

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- 企業プロファイル

- SCHOTT AG

- DuPont de Nemours Inc.

- Sealed Air Corporation

- GY Packaging

- UFP Technologies Inc.

- Sonoco Products Company

- Smurfit Kappa Group PLC

- Dunapack Packaging Group

- WestRock Company

- Mondi Group

- Dordan Manufacturing Company

第7章 投資分析

第8章 市場の将来

The Electronic Packaging Market size is estimated at USD 25.55 billion in 2025, and is expected to reach USD 72.28 billion by 2030, at a CAGR of 23.12% during the forecast period (2025-2030).

Key Highlights

- As demand surges for TVs, set-top boxes, MP3 players, and digital cameras, electronics packaging is increasingly favored for mass production. The rise of IoT and AI, coupled with the proliferation of intricate electronics, propels the high-end application segment within the consumer electronics and automotive industries. Consequently, to meet this burgeoning demand, advanced technologies for electronics packaging have been swiftly adopted.

- Companies selling electronics are steadily weaving sustainability into their packaging designs, recognizing its pivotal role in shaping consumer choices. For example, tech giant Samsung has committed to integrating eco-friendly materials across its entire product line by 2025. This ambitious move encompasses a shift from conventional plastic packaging to biodegradable or recycled alternatives. Such initiatives not only resonate with eco-conscious consumers but also position the brand as a responsible frontrunner in a market increasingly attuned to environmental issues.

- The digital age is reshaping packaging design. Modern consumer electronics packaging now boasts features like QR codes, augmented reality (AR) interfaces, and NFC (near-field communication) tags. These innovations are revolutionizing consumer interactions with packaging.

- By blending physical packaging with digital experiences, these technologies amplify user engagement. For example, scanning a QR code on a package might lead consumers to a website showcasing detailed product specs, user reviews, or even immersive virtual reality demonstrations. Such capabilities underscore the growing importance of these technologies in the consumer electronics packaging market.

- The automotive industry, particularly with its swift pivot toward electric and hybrid vehicles, plays a dominant role in the market landscape. Given the extensive use of memory devices, processors, analog circuits, and sensors in these vehicles, the demand for electronics packaging is poised for a significant uptick.

- Forecasts from IBEF suggest that the Indian electric vehicles (EV) market could touch INR 50,000 crores (USD 7.09 billion) by 2025. Additionally, insights from a CEEW Centre for Energy Finance study indicate a whopping USD 206 billion opportunity for EVs in India by 2030. Such bullish projections are set to further fuel the electronics packaging market.

- While the COVID-19 pandemic cast a shadow on many industries, electronics packaging solutions and consumer electronics packaging showed resilience. The mobile phone and computer industries primarily drive the demand for consumer electronics packaging. Despite challenges like production halts, raw material shortages, and supply chain disruptions, these industries' output remained relatively unscathed.

Electronic Packaging Market Trends

Aerospace and Defense Segment Expected to Increasingly Adopt Electronics Packaging

- Defense budgets are on the rise in both developed nations, including the United States, France, and the United Kingdom, and in developing nations like Russia, India, and China. Many of these countries are also keen on weapon exports. Consequently, there has been a sustained push for R&D investments in the aerospace and defense market.

- In today's dynamic geopolitical climate, the significance of collective defense cannot be overstated. Military and defense forces, encompassing everything from weapons and guidance systems to armed vehicles and their power sources, play a pivotal role in safeguarding a nation from external threats. To uphold a robust military system, both surveillance and armed forces must function with utmost efficiency and effectiveness.

- As reported by the Department of Defence Production (India), defense production in the Financial Year (FY) 2022-23 achieved a historic milestone, surpassing INR 1 lakh crore (~USD 12.05 billion) for the first time, up from INR 95,000 crore (~USD 11.45 billion) in FY 2021-22. Additionally, India's demand for defense batteries is projected to double, rising from 4 gigawatt hours in 2022 to 10 gigawatt hours by 2030. This consistent uptick in defense production, alongside the growing adoption of defense batteries, is poised to drive market growth over the coming years.

- Naval warships, onboard satellite communication channels, weapon control systems, and coastguards all rely on advanced electronic products. These components necessitate military-grade packaging, especially given the challenges posed by humidity and harsh environments. Such demands not only underscore the need for high-quality products but also fuel investments in R&D.

Asia-Pacific to Experience Significant Market Growth

- During the forecast period, Asia-Pacific is poised to dominate the market, driven by expanding automotive infrastructure and a surge in electric vehicle sales. With rising incomes among the middle-income group and a substantial youth demographic, demand in the automotive industry is set to escalate. The Society of Indian Automobile Manufacturers (SIAM) reported that in 2023, India produced 4.54 million passenger vehicles, a notable rise from 3.65 million units in 2022, signaling robust future market growth.

- China, recognized globally as the electronics hub, excels in mass-producing electrical components and electronic products, adhering to top-notch quality, performance, and delivery benchmarks. This prowess underscores the vast growth potential of the electronics packaging market.

- China's industry growth is fueled by surging domestic demand, technological innovations, and a commitment to producing premium products. Such extensive production of paper and paperboard in China fosters a thriving environment for electronics packaging sales.

- The Indian electronic manufacturing industry, buoyed by strong policy backing, substantial investments, and a rising demand for electronic products, is projected to hit USD 220 billion by 2025, as reported by the National Investment Promotion & Facilitation Agency (NIPFA).

Electronic Packaging Industry Overview

The electronics packaging market is fragmented. Microsystems are used in almost every industry vertical, with some significant sections being consumer electronics, healthcare equipment, aerospace and defense, and communications. The major market players include UFP Technologies, Schott AG, Sealed Air Corporation, DuPont de Nemours Inc., and Sonoco Products Company.

- September 2023: Sealed Air collaborated with Sparck Technologies, a key 3D automated packaging solutions provider. Sealed Air is expected to exclusively distribute Sparck Technologies' 3D CVP automated packaging solutions in Australia, South Korea, Japan, and South Korea. As part of the alliance, Sealed Air's customers will benefit from access to the industry's most advanced automated packaging solutions, allowing them to streamline processes and create a more secure work environment.

- November 2023: Mondi announced that it was leading the charge for sustainable alternatives by promoting corrugated packaging as a fully recyclable and compostable option. The company's corrugated boxes, made from recycled fibers, play a pivotal role in achieving Europe's notable 82.5% recycling rate for paper-based packaging. Committed to circular packaging for white goods and electronics, Mondi's experts in materials and designs are crafting advanced corrugated solutions as substitutes for EPS materials.

- September 2023: Schott AG unveiled new microelectronic packages for the aerospace industry. The packages aim to extend the life of avionics protection while reducing the weight by up to 75% compared to conventional electronics packaging made from Kovar iron-nickel alloy. The products are also said to protect sensitive electronics, such as radio frequency designs, direct current/direct current converters (DC/DC), electrical storage devices, and sensor components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Accelerated Sales of Electrical Automotive Worldwide

- 4.4.2 Technological Advancements Driving Product Quality

- 4.5 Market Restraints

- 4.5.1 High Costs of Electronic Packaging and Lack of Skilled Professionals to Challenge Market Growth

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.2 By End-user Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Healthcare

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SCHOTT AG

- 6.1.2 DuPont de Nemours Inc.

- 6.1.3 Sealed Air Corporation

- 6.1.4 GY Packaging

- 6.1.5 UFP Technologies Inc.

- 6.1.6 Sonoco Products Company

- 6.1.7 Smurfit Kappa Group PLC

- 6.1.8 Dunapack Packaging Group

- 6.1.9 WestRock Company

- 6.1.10 Mondi Group

- 6.1.11 Dordan Manufacturing Company