|

|

市場調査レポート

商品コード

1686267

軟包装産業:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Flexible Packaging Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軟包装産業:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 197 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

軟包装産業の生産量は、2025年の3,584万トンから2030年には4,232万トンまで、予測期間(2025年~2030年)のCAGRは3.38%で成長すると予測されます。

軟包装市場は、便利で軽量なパッケージングソリューションに対する需要の増加、持続可能性に対する消費者の意識の高まり、保存期間と製品保護を改善するためのパッケージング技術の先進化など、複合的な要因によって牽引されています。

主なハイライト

- さらに、様々な形状やサイズに対応できる軟包装の多用途性、費用対効果、輸送のしやすさなども成長の一因となっています。産業界が環境に優しいソリューションを優先し、消費者が利便性と機能性を求める中、軟包装市場は拡大に向かっています。

- 小売売上高の増加は市場の拡大につながることが多く、新製品が市場に参入し、既存製品がより多くの消費者に行き渡ることになります。軟包装はさまざまな製品カテゴリーに適応できるため、飲食品、医薬品、パーソナルケアなど、さまざまな業界に適しています。そのため、小売販売の拡大が軟包装市場の複数のセグメントの成長を促進する可能性があります。

- ポリエチレンは主にプラスチック袋、プラスチックフィルム、ジオメンブレンなどの包装に使用されます。ポリエチレンは軽量で、部分結晶性、低吸湿性の熱可塑性樹脂であり、化学薬品に対する高い耐性と遮音性を持っています。低密度ポリエチレン(LDPE)は主にポリ袋の製造に使用されます。LDPEポリエチレン袋は、低温でも柔らかく柔軟性があり、ナチュラルカラーもあります。

- 包装に関しては、リサイクルと環境への配慮が不可欠です。海洋や埋立地のプラスチック汚染は、包装ゴミの影響を受けています。プラスチック包装は環境のプラスチック汚染に影響を与えます。プラスチックは分解するのに何百年もかかるため、海洋生物や生態系に影響を与える可能性があります。

- この動向は今後も続くと予想されます。COVID-19以降、クラフト紙工場への投資は増加すると思われます。紙製包装の使用が増加するのは、eコマース分野の拡大と、環境に優しいソリューションに対する消費者の関心によるところが大きいです。

軟包装業界の動向

焼き菓子とスナック菓子分野が成長する

- 軟包装は、焼き菓子とスナック菓子の消費者と生産者の双方に利便性を提供します。消費者は軟包装の使いやすさと再封性を高く評価しており、特にクッキーやパンのように何度も消費されることが多い商品はその傾向が強いです。

- さらにUSDAによると、スナック菓子類、特にチョコレート、塩味スナック、甘いビスケット、砂糖菓子は、湾岸諸国における経済成長、富裕層の増加、若年層や移住者の拡大とともに増加の一途をたどっています。

- カナダ農業食糧省によると、米国の冷凍ベーカリー食品の価値は2026年までに25億7,600万米ドルに達し、2022年から大幅に増加する見込みです。軟包装は菓子類の包装デザインを改善するために幅広い印刷オプションを提供することができるため、菓子類やベーカリー製品の需要の増加は、結果としてパウチ、袋、ラップ、フィルムのような軟包装オプションの需要を促進するであろう。

- 多忙なライフスタイル、労働力としての女性の増加、工業化の進展といった側面が、過去10年間にこの地域ですぐに食べられる包装食品やスナックのニーズを強めてきました。また、共働きの専門職世帯は、忙しい仕事の後の食事代わりやご褒美として、間食市場に拍車をかけています。

- 人口が多く豊かなアラブ首長国連邦とサウジアラビアは、スナックと菓子の消費額の75%以上を占めています。カタールやバーレーンのような他の小国も着実な成長を遂げており、2025年までに大きな市場になると予測されています。

著しい成長を遂げるアジア太平洋

- 中国では、製品保護の強化、流通の合理化、単位用量包装、製品識別の向上など、数多くの利点があるため、医薬品分野で主にブリスター包装が採用されています。このため、同国のブリスター・パッケージング産業の範囲は大幅に拡大しています。

- 高齢化が進む日本では、日本食のパウチや、カット済みの1食分ずつ小分けされた野菜や肉が入手しやすくなり、小売店の嗜好の変化に対応しています。特筆すべきは、ラミネート・プラスティックとアルミニウムから作られるレトルトパウチが、特にソースやカレー用として日本で人気を集めていることです。これらのパウチは、加熱殺菌時の耐久性が高いため、従来の缶に取って代わりつつあります。さらに、パウチ包装は缶詰よりもコスト効率が高く、特に缶詰の金属輸入に頼っている国々では、日本での採用をさらに後押ししています。

- 日本缶詰協会によると、2022年の日本のレトルト食品生産量はカレーが約15万7,540トンとなり、農産物のレトルトパウチがわずか780トンを占めるにとどまりました。こうした動向は今後も続き、市場の成長を牽引していくと予想されます。

- 14億人の人口を擁するインドは、世界で最も人口の多い国であり、世界第5位の経済大国でもあります。同国の堅調な医薬品産業は、投資の増加、人口の増加、健康意識の高まり、平均寿命の伸びと相まって、フレキシブルな医薬品包装ソリューションの需要を後押しするものと思われます。

- オーストラリアの包装市場はアジア太平洋で際立っており、急速な成長を誇っています。特に、加工食品、生鮮食品、食肉セクターが急成長しています。健康志向の動向と消費者倫理への関心の高まりが、地元産の生鮮食品への需要を後押ししています。

- マレーシア、フィリピン、タイ、ベトナム、ニュージーランド、韓国、その他アジア太平洋は、アジア太平洋の軟包装分野で大きな市場シェアを占めています。

軟包装業界の概要

軟包装市場は、大きな市場シェアを持つ少数のベンダーが存在するため断片化されています。市場はやや集中しており、大手企業は競争力を維持するために製品革新、合併、買収などの戦略を採用しています。業界の主要企業は、Amcor Group GmbH、Mondi Group、Berry Global Inc.、Sealed Air Corporation、Huhtamaki Oyjなどです。

- 2024年3月、ベリー世界グループのフレキシブルズ部門は、同社の再生ポリマーのSustaneラインの生産を拡大する欧州全体のプロジェクトの一環として、最近欧州の3つのリサイクル施設のリサイクル能力を増強しました。この拡張プロジェクトは、価値の高い再生プラスチックへの世界のアクセスを活用することで、再生材料で作られた高性能フィルムへの需要の増加に対応することが期待されています。

- 2024年2月、アムコーはオーガニックヨーグルトメーカーのStonyfield Organic社およびスパウトパウチ包装メーカーのCheer Pack North America社と提携し、Stonyfield Organic社の冷蔵ヨーグルト「Yo Baby」向けに、従来の多層構造に代わり、より持続可能なパウチデザインを採用したオールポリエチレン(PE)ベースのスパウトパウチを発売しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

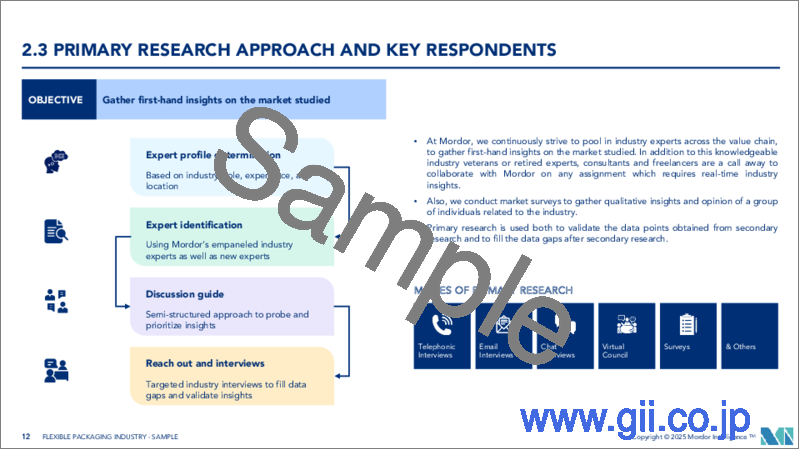

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

第5章 市場力学

- 市場促進要因

- 便利な包装への需要の高まり

- 長期保存の需要とライフスタイルの変化

- 市場の課題

- 環境とリサイクルに対する懸念

第6章 市場セグメンテーション

- 材料タイプ別

- プラスチック

- ポリエチレン(PE)

- 二軸延伸ポリプロピレン(BOPP)

- キャストポリプロピレン(CPP)

- ポリ塩化ビニル(PVC)

- エチレンビニルアルコール(EVOH)

- その他のプラスチック(PA、バイオプラスチック)

- 紙類

- アルミ箔

- プラスチック

- 製品タイプ別

- パウチ

- 袋

- フィルム&ラップ

- その他の製品タイプ(小袋、スリーブ、ブリスターパック、ライナー、ラミネートなど)

- エンドユーザー産業別

- 食品

- 冷凍・冷蔵食品

- 乳製品

- 果物・野菜

- 肉・鶏肉・魚介類

- 焼き菓子・スナック菓子

- キャンディー・菓子

- その他の食品

- 飲料

- 医薬品・医療品

- 家庭用品・パーソナルケア

- その他エンドユーザー産業(タバコ、化学、農業など)

- 食品

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- トルコ

- ポーランド

- ロシア

- アジア

- 中国

- 日本

- インド

- オーストラリア

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- エジプト

- イラン

- ナイジェリア

- 北米

第7章 競合情勢

- 企業プロファイル

- Amcor Group Gmbh

- Berry Global Inc.

- Mondi PLC

- Sealed Air Corporation

- Huhtamaki Oyj

- Uflex Limited

- Coveris Management Gmbh

- ProAmpac LLC

- Wipf AG

- Flexpak Services Llc

- Sigma Plastics Group Inc.

- KM Packaging Services Ltd

- Sonoco Products Company

- Arabian Flexible Packaging LLC

- Gulf East Paper and Plastic Industries LLC

第8章 投資分析

第9章 市場の将来

The Flexible Packaging Industry in terms of production volume is expected to grow from 35.84 million tonnes in 2025 to 42.32 million tonnes by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

The flexible packaging market is driven by a combination of factors, including increasing demand for convenient and lightweight packaging solutions, rising consumer awareness toward sustainability, and advancements in packaging technology for improved shelf life and product protection.

Key Highlights

- Additionally, the versatility of flexible packaging in accommodating various shapes and sizes, its cost-effectiveness, and ease of transportation further contribute to its growth. As industries prioritize eco-friendly solutions and consumers seek convenience and functionality, the flexible packaging market is poised to expand.

- Higher retail sales often lead to market expansion, with new products entering the market and existing ones reaching broader audiences. Flexible packaging is adaptable to different product categories, making it suitable for various industries, including food and beverage, pharmaceuticals, personal care, and more. Thus, expanding retail sales could drive growth in multiple segments of the flexible packaging market.

- Polyethylene is primarily used for packaging plastic bags, plastic films, geomembranes, etc. It is a lightweight, partially crystalline, low moisture absorbent, thermoplastic resin that has high resistance to chemicals and sound-insulating properties. Low-density polyethylene (LDPE) is mainly used to manufacture plastic bags. LDPE polyethylene bags are soft and flexible, even at low temperatures, and are available in natural colors.

- Recycling and environmental considerations are essential when it comes to packaging. Plastic contamination in oceans and landfills are impacted by packaging trash. Plastic packaging affects the environment's plastic pollution. Plastic can affect marine life and ecosystems since it takes hundreds of years to disintegrate.

- It is expected that this trend will continue. Investments in the kraft paper mills will rise post-COVID-19. The increased use of paper packaging is largely due to the growing e-commerce sector and consumer interest in eco-friendly solutions.

Flexible Packaging Industry Trends

Baked Goods and Snack Foods Segment to Witness Growth

- Flexible packaging offers convenience to both consumers and producers of baked goods and snack foods. Consumers appreciate the ease of use and resealability of flexible packaging, especially for items like cookies and bread, which are often consumed multiple times.

- Moreover, according to USDA, the snacks and confectionery, especially chocolates, salty snacks, sweet biscuits, and sugar confectionery, continue to rise along with the growing economy, rising affluence, and expanding young and migrant residents in the Gulf states.

- According to Agriculture and Agri-Food Canada, the value of frozen bakery food in the United States is expected to witness a bolstered growth amounting to USD 2.576 billion by 2026, significantly up from 2022. Since flexible packaging can provide a wide range of printing options to improve the packaging design of confectionery products, a rise in demand for confectionery and baked products would consequently drive the demand for flexible packaging options like pouches, bags, wraps, and films.

- Aspects such as busy lifestyles, more women in the workforce, and growing industrialization have strengthened the need for ready-to-eat packaged foods and snacks in the region over the last decade. Dual-income professional households have also spurred the market for snacks between meals as a meal replacement and a reward after a busy workday.

- With their extensive and affluent populations, the United Arab Emirates and Saudi Arabia account for more than 75% of snacks and sweets consumption by value. Other smaller countries like Qatar and Bahrain are witnessing steady growth and are predicted to become larger markets by 2025.

Asia Pacific to Witness Significant Growth

- China predominantly employs blister packaging in its pharmaceutical sector, owing to its numerous advantages, such as enhanced product protection, streamlined distribution, unit dosage packaging, and improved product identification. This has significantly expanded the scope of the country's blister packaging industry.

- With Japan's aging population, there's a rising availability of Japanese pouch meals and pre-cut, single-serving portions of vegetables and meats, all catering to the evolving retail preferences. Notably, retort pouches, made from laminated plastic and aluminum, are gaining traction in Japan, particularly for sauces and curries. These pouches are replacing traditional cans due to their durability during thermal sterilization. Moreover, pouch packaging proves more cost-effective than cans, especially in countries reliant on metal imports for canning, further bolstering its adoption in Japan.

- According to the Japan Canners Association, in 2022, curry emerged as the dominant retort food pouch product in Japan, with a production volume of about 157.54 thousand tons, overshadowing agricultural products in retort pouches, which accounted for a mere 780 tons. These trends are expected to persist, driving market growth in the coming years.

- With a population of 1.4 billion, India stands as the world's most populous nation and the fifth-largest economy. The country's robust pharmaceutical industry, coupled with growing investments, a rising population, heightened health awareness, and increasing life expectancy, is set to bolster the demand for flexible pharmaceutical packaging solutions.

- The Australian packaging market has been a standout in the Asia-Pacific region, boasting rapid growth. Notably, the country is witnessing a surge in its processed food, fresh produce, and meat sectors. Health-conscious trends and a heightened focus on consumer ethics are propelling the demand for locally-grown fresh food.

- The Rest of Asia-Pacific, encompassing Malaysia, the Philippines, Thailand, Vietnam, New Zealand, South Korea, and other countries in the region, commands a significant market share in the Asia-Pacific flexible packaging sector.

Flexible Packaging Industry Overview

The flexible packaging market is fragmented owing to the presence of a few vendors with significant market share. The market is slightly concentrated, with the major players adopting strategies like product innovation, mergers, and acquisitions to remain competitive. The key players in the industry are Amcor Group GmbH, Mondi Group, Berry Global Inc., Sealed Air Corporation, and Huhtamaki Oyj, among others.

- In March 2024, Berry Global Group, Inc.'s Flexibles division recently increased recycling capacity at three European recycling facilities as part of a Europe-wide project to scale up production of the company's Sustane line of recycled polymers. The expansion project is expected to meet the increasing demand for high-performing films created with recycled content by leveraging the company's global access to high-value recycled plastic.

- In February 2024, Amcor partnered with Stonyfield Organic, the organic yogurt maker, and Cheer Pack North America, a spouted pouch packaging manufacturer, to introduce an all-polyethylene (PE)-based spouted pouch that replaces Stonyfield Organic's previous multilayered structure with a more sustainable pouch design for their Yo Baby refrigerated yogurt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Convenient Packaging

- 5.1.2 Demand for Longer Shelf Life and Changing Lifestyles

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast polypropylene (CPP)

- 6.1.1.4 Polyvinyl Chloride (PVC)

- 6.1.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.1.1.6 Other Plastic Types (PA, Bioplastics)

- 6.1.2 Paper

- 6.1.3 Aluminum Foil

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films & Wraps

- 6.2.4 Other Product Types (Sachets, Sleeves, Blister Packs, Liners, Laminates, etc.)

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen and Chilled Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Meat, Poultry, and Seafood

- 6.3.1.5 Baked Goods and Snack Foods

- 6.3.1.6 Candy and Confections

- 6.3.1.7 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries (Tobacco, Chemical, and Agriculture, Among Others)

- 6.3.1 Food

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Turkey

- 6.4.2.7 Poland

- 6.4.2.8 Russia

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Egypt

- 6.4.5.5 Iran

- 6.4.5.6 Nigeria

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group Gmbh

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi PLC

- 7.1.4 Sealed Air Corporation

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Uflex Limited

- 7.1.7 Coveris Management Gmbh

- 7.1.8 ProAmpac LLC

- 7.1.9 Wipf AG

- 7.1.10 Flexpak Services Llc

- 7.1.11 Sigma Plastics Group Inc.

- 7.1.12 KM Packaging Services Ltd

- 7.1.13 Sonoco Products Company

- 7.1.14 Arabian Flexible Packaging LLC

- 7.1.15 Gulf East Paper and Plastic Industries LLC