|

市場調査レポート

商品コード

1687191

CMOSイメージセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)CMOS Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| CMOSイメージセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 151 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

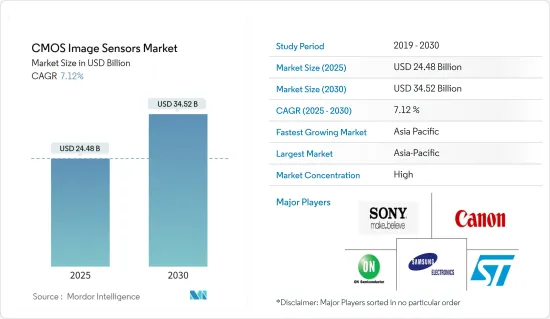

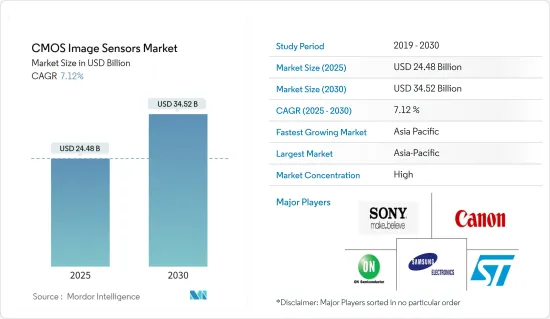

CMOSイメージセンサー市場規模は2025年に244億8,000万米ドル、2030年には345億2,000万米ドルに達する見通しで、予測期間(2025-2030年)のCAGRは7.12%と予測されます。

主なハイライト

- さまざまな産業で高精細画像キャプチャデバイスの需要が高まり、CMOS(Complementary Metal-Oxide-Semiconductor)技術の採用に拍車がかかっています。この技術は、シャッタースピードの高速化だけでなく、高画質も実現します。

- 主にスマートフォンの需要増加に牽引され、世界のCMOSイメージセンサー市場は大幅な成長を遂げています。スマートフォンでイメージセンサー付きカメラが広く使用されるようになったことは、特に家電業界に利益をもたらしています。スマートフォンのメーカーは、1つのデバイスに最大5つのカメラを組み込むことで、携帯電話での写真撮影の人気の急上昇に対応しています。これらのCMOSイメージセンサーは、スマートフォンだけでなく、ノートパソコンやデジタル一眼レフ(DSLR)カメラにも搭載され、広く普及しています。

- スマートフォンへのカメラの統合は、スマートフォンの普及率拡大に伴い、画像キャプチャを大幅に強化しています。これらの要因は、イメージセンサー市場を前進させる構えです。

- 同時に、スマートフォンのカメラで最高品質の画像を生成するための需要とCMOS技術は、技術革新により指数関数的に増加しています。さらに、マシンビジョンシステムの採用、自動運転車やADAS(先進運転支援システム)の出現が、CMOSセンサーの需要をさらに押し上げています。

- CCD(電荷結合素子)センサーは、その成熟度と品質の高さから多くの産業用アプリケーションで普及しているにもかかわらず、CMOSセンサーの需要は根強く残っています。CCDセンサーは、高画質、高解像度の画像と優れた光感度に優れており、CMOSセンサーとの競合を引き起こしています。この競争は市場の成長を制限すると予想されます。

- COVID-19パンデミックの間、電子・半導体産業は世界のサプライチェーンの閉鎖や混乱により大きな後退に直面しました。このような状況にもかかわらず、世界のCMOSイメージセンサー市場は、民生用電子機器や自動車分野からの需要増に牽引され、引き続き力強い成長が見込まれています。

CMOSイメージセンサー市場動向

自動車・運輸産業がエンドユーザーとして急成長

- さまざまなカテゴリーの自動車でADAS(先進運転支援システム)の採用が進んでいることから、自動車および運輸分野でのCMOSイメージセンサーの需要が急速に拡大しています。自動車システムへの高性能保護機能の統合は、カメラ・センサー・システムの広範な採用に影響を与えており、特に、今後世界中で運転手のいない自律走行車の普及が見込まれています。自律走行車やコネクテッドカーの開発が進むことで、新たな市場機会が生まれています。

- 例えば、米連邦運輸局(FTA)は最近、実証プロジェクトのための実質的な機会を発表し、トランジット・バスのADASに500万米ドル、自動化トランジット・バスのメンテナンスとヤード・オペレーションの初期フェーズに150万米ドルを追加するなど、最大650万米ドルを提供します。さらに2023年4月、英国はフォードのADAS(先進運転支援システム)であるBlueCruiseによるハンズフリー運転技術の認可を発表し、同国の高速道路をリードすることになります。

- さらに、電気自動車は、IEAのデータによれば、この部門が世界のエネルギー関連排出量の15%以上を占めていることから、道路交通の脱炭素化のための極めて重要な技術として浮上しています。近年、航続距離の向上、幅広いモデル展開、性能の向上により、電気自動車の販売台数は飛躍的に伸びています。乗用車の電気自動車は牽引力を増しており、IEAは2023年に販売される新車の18%が電気自動車になると予測しており、欧州、中国、米国が電気自動車市場をリードしています。

- 国家安全評議会は、2026年までに登録車の約71%がリアカメラを装備し、60%がリア・パーキング・センサーを装備すると予測しています。このようにADASが広く採用されることで、市場の成長が大きく促進されると予想されます。

- 世界経済フォーラムによると、完全自律走行車は2035年までに年間推定1,200万台が販売され、世界の自動車市場の25%を占めると予測されています。このようなコネクテッドカーや電気自動車に対する需要の急増は、CMOSイメージセンサー市場の技術革新と製品開拓に拍車をかけています。市場の主要ベンダーは、高まる消費者需要に対応するため、製品のイノベーションに注力しています。

南北アメリカが大きな成長を遂げる見込み

- 米国でCMOSイメージセンサーの採用が拡大しているのは、コンシューマーエレクトロニクス市場の存在感が強く、モバイルカメラモジュールやその他のポータブルデバイスの使用率が高いためです。コンシューマーエレクトロニクスでは、スマートフォンが主要なカメラ機器となり、カメラやデジタル一眼レフを圧倒しています。スマートフォン分野での激しい競争により、メーカーは競争相手より優位に立つためにより優れたカメラを提供するようになり、その結果、この分野での技術革新に多額の投資が行われるようになりました。

- 米国国勢調査局は、2022-2023年のスマートフォン販売額を747億米ドルと推定しています。この伸び悩みは、米国におけるスマートフォンの出荷台数が減少した結果です。経済課題、高インフレ、季節需要の低迷の中、ローエンドスマートフォンの販売減少が低迷の最大の要因であったが、これは今後数年で終息すると予想されます。こうした販売動向は、スマートフォンだけでなく、PC、ノートPC、タブレット端末を含む民生用電子機器分野におけるCMOSイメージセンサーの成長に大きな影響を与えると予想されます。

- これに加え、ロボットカメラはさまざまな産業で革命的な力を発揮し、周囲の環境のキャプチャ、モニタリング、インタラクションの方法を一変させています。最先端技術を搭載したこれらの洗練されたデバイスは、多くの利点を提供し、監視やセキュリティから製造やエンターテインメントに至るまで、幅広い用途で貴重な資産となっています。このように、CMOSセンサーはCCDよりもデジタル画像の生成効率が高く、消費電力も少ないです。CCDよりも大型化できるため高解像度の画像が得られ、製造コストもCCDに比べて経済的であるため、地域市場の需要を牽引しています。

- 生体認証、医療、車両運転支援システムによるフィルムカメラでのイメージセンサーデバイスの使用増加に伴い、セキュリティ、監視装置は将来的に大きな市場を持つと予想されます。また、米国などではドローンによる調査が盛んに行われており、メーカー各社は高度からの撮影が可能なカメラを常に模索しています。メガピクセルの解像度が高く、センサーサイズが小さいカメラは、画像の回折効果を受ける可能性があります。

- このことは、車載用途で使用されることが多くなっているCMOSイメージセンサーの需要に影響を及ぼしています。例えば、OICAによると、2022年のラテンアメリカ地域の自動車生産台数は、メキシコが350万9,800台でトップ、次いでブラジル(2,369.77台)、アルゼンチン(536.9台)、コロンビア(51.46台)となっています。

CMOSイメージセンサー市場概要

CMOSイメージセンサー市場は、STMicroelectronics NV、Sony Group Corporation、Samsung Electronics、ON Semiconductor Corporation、Canon Inc.などの主要企業が参入し、高いフラグメンテーションを示しています。これらの企業は、製品ポートフォリオを充実させ、永続的な競争力を確立するために、提携や買収などの戦略を活用しています。

2023年9月、ソニーセミコンダクタソリューションズ株式会社は、車載カメラ用に設計された最先端のCMOSイメージセンサーであるIMX735を発表しました。この革新的な製品は、高度なセンシングと認識が可能な車載カメラシステムの開発を強化し、安全・安心な自動運転の実現に大きく貢献します。

さらに2023年1月、サムスン電子は最新の200メガピクセル(MP)イメージセンサー、ISOCELL HP2を発表しました。このセンサーは、強化されたピクセル技術とフルウェル容量の増加を組み込んでおり、プレミアムスマートフォン向けに見事なモバイル画像を提供します。1/1.3インチの光学フォーマットに0.6マイクロメートル(μm)ピクセルを2億個搭載したISOCELL HP2は、108MPのスマートフォンのプライマリーカメラで広く使用されているセンサーサイズで、消費者は最新のハイエンドスマートフォンで、カメラの突起を大きくすることなく、さらに高い解像度を体験することができます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 市場力学

- 市場促進要因

- コンシューマーエレクトロニクス分野におけるCMOSイメージセンサーの導入拡大

- セキュリティ・監視分野における4Kピクセル技術の登場

- 市場抑制要因

- CCDセンサーとの競合

第6章 技術スナップショット

- 通信タイプ別

- 有線

- 無線

第7章 市場セグメンテーション

- エンドユーザー産業別

- コンシューマーエレクトロニクス

- ヘルスケア

- 産業

- セキュリティ・監視

- 自動車・運輸

- 航空宇宙・防衛

- コンピューティング

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 競合情勢

- 企業プロファイル

- STMicroelectronics NV

- Sony Corporation

- Samsung Electronics Co. Ltd

- ON Semiconductor Corporation

- Canon Inc.

- SK Hynix Inc.

- Omnivision Technologies Inc.

- Hamamatsu Photonics KK

- Panasonic Corporation

- Teledyne Technologies Inc.

- GalaxyCore Shanghai Limited Corporation

- ベンダー市場シェア分析

第9章 投資分析

第10章 市場機会と今後の動向

The CMOS Image Sensors Market size is estimated at USD 24.48 billion in 2025, and is expected to reach USD 34.52 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Key Highlights

- The rising demand for high-definition image-capturing devices in various industries has spurred a significant adoption of CMOS (Complementary Metal-Oxide-Semiconductor) technology. This technology not only provides faster shutter speeds but also ensures high-quality images.

- Primarily driven by the increasing demand for smartphones, the global CMOS image sensors market has seen substantial growth. The widespread use of cameras with image sensors in smartphones has particularly benefited the consumer electronics industry. Smartphone producers are responding to the surge in popularity of cell phone photography by incorporating up to five cameras into a single device. These CMOS image sensors are omnipresent, found not only in smartphones but also in laptops and digital single-lens reflex (DSLR) cameras.

- Integration of cameras into smartphones has significantly augmented image capturing, aligning with the expanding smartphone penetration rate. These factors are poised to propel the image sensor market forward.

- Simultaneously, the demand for producing top-quality images in smartphone cameras and for CMOS technology is exponentially increasing due to innovations. Moreover, the adoption of machine vision systems and the emergence of self-driving cars and advanced driver assistance systems (ADAS) further drive the demand for CMOS sensors.

- Despite the prevalence of CCD (Charge-Coupled Device) sensors in many industrial applications due to their maturity and higher quality, the demand for CMOS sensors persists. CCD sensors excel in high-quality, high-resolution images and excellent light sensitivity, providing competition to CMOS sensors. This competition is expected to limit the market's growth.

- The electronics and semiconductor industries faced significant setbacks during the COVID-19 pandemic due to closures and disruptions in the global supply chain. Despite this, the anticipated growth of the global CMOS image sensors market remains strong, driven by increased demand from the consumer electronics and automotive sectors.

CMOS Image Sensors Market Trends

Automotive and Transportation Industry to be the Fastest Growing End User

- The demand for CMOS image sensors in the automotive and transportation sectors is rapidly expanding due to the increasing adoption of advanced driver-assistance systems (ADAS) across various categories of vehicles. The integration of high-performance protective functions into automotive systems has influenced the widespread adoption of camera sensor systems, particularly in the context of upcoming driverless autonomous vehicles worldwide. The ongoing development of autonomous and connected vehicles is paving the way for new market opportunities.

- For instance, the Federal Transit Administration (FTA) recently announced a substantial opportunity for demonstration projects, offering up to USD 6.5 million, including USD 5 million for ADAS in Transit Buses and an additional USD 1.5 million for the initial phase of Automated Transit Bus Maintenance and Yard Operations. Additionally, in April 2023, the UK announced the approval of hands-free driving technology through Ford's advanced driver-assistance system (ADAS), BlueCruise, set to lead the way on the country's motorways.

- Moreover, electric vehicles have emerged as a pivotal technology for decarbonizing road transport, given that this sector contributes over 15% of global energy-related emissions, as per IEA data. Recent years have witnessed exponential growth in EV sales, with advancements in range, broader model availability, and enhanced performance. Passenger electric cars are gaining traction, and the IEA estimates that 18% of new cars sold in 2023 will be electric, with Europe, China, and the US leading the electric vehicle markets.

- The National Safety Council projects that by 2026, approximately 71% of registered vehicles will feature rear cameras, while 60% will be equipped with rear parking sensors. This widespread adoption of ADAS is expected to fuel the market's growth significantly.

- According to the World Economic Forum, an estimated 12 million fully autonomous cars are projected to be sold annually by 2035, encompassing 25% of the global automotive market. This surge in demand for connected and electric vehicles has spurred innovation and product development in the CMOS image sensor market. Key market vendors are concentrating on product innovation to meet the escalating consumer demand.

Americas is Expected to Witness Significant Growth

- The growing adoption of CMOS image sensors across the United States is due to the strong presence of the consumer electronics market, which is fueling the usage of mobile camera modules and other portable devices at a high rate. In consumer electronics, the smartphone has become the primary camera device, dominating cameras and DSLRs. Heavy competition in the smartphone segment has driven manufacturers to provide better cameras to have the edge over the competition, resulting in high investments in technology innovations in this field.

- The US Census Bureau estimated the smartphone sales value at USD 74.7 Billion in 2022-2023. This sluggish growth is an outcome of declined shipments of smartphones in the US. Low-end smartphone sale declines were the biggest contributing factor to the downturn amid economic challenges, high inflation, and poor seasonal demand; however, this is expected to end in the upcoming years. These sales trends are expected to have a significant impact on the growth of CMOS image sensors in the consumer electronics segment, which not only includes smartphones but also PCs, laptops, and tablets.

- In addition to this, robotic cameras have become a revolutionary force in various industries, transforming the way of capturing, monitoring, and interacting with surroundings. These sophisticated devices, equipped with cutting-edge technology, offer a plethora of advantages, making them invaluable assets in applications ranging from surveillance and security to manufacturing and entertainment. Thus, CMOS sensors are more efficient in generating a digital image and consume less power than a CCD. They can be larger than a CCD, enabling high-resolution images, and their manufacture is more economical when compared to a CCD, thus driving the demand in the regional market.

- With the increase in the use of image sensor devices in biometrics, medical, and film cameras by vehicle driver assistance systems, security, and surveillance devices are expected to have a substantial market in the future. Moreover, drones are widely used in countries such as the United States to conduct surveys, and manufacturers are constantly looking for cameras that can capture images from altitude. Cameras with high megapixel resolution and small sensor sizes can be subject to image diffraction effects.

- This is impacting the demand for CMOS image sensors as they are increasingly being used in automotive applications. For instance, according to OICA, in 2022, Mexico was the leading motor vehicle manufacturer in the Latin American region, with 3,509.8 thousand vehicles, followed by Brazil (2,369.77), Argentina (536.9), and Colombia (51.46).

CMOS Image Sensors Market Overview

The CMOS image sensor market exhibits high fragmentation, with major players such as STMicroelectronics NV, Sony Group Corporation, Samsung Electronics Co. Ltd, ON Semiconductor Corporation, and Canon Inc. These entities are leveraging strategies like partnerships and acquisitions to enrich their product portfolios and establish enduring competitive edges.

In September 2023, Sony Semiconductor Solutions Corporation unveiled the IMX735, a cutting-edge CMOS image sensor designed for automotive cameras, boasting an industry-leading pixel count of 17.42 effective megapixels. This innovative product is poised to bolster the development of automotive camera systems capable of sophisticated sensing and recognition, contributing significantly to the advancement of safe and secure automated driving.

Additionally, in January 2023, Samsung Electronics introduced its latest 200-megapixel (MP) image sensor, the ISOCELL HP2. This sensor incorporates enhanced pixel technology and increased full-well capacity, delivering stunning mobile images for premium smartphones. Packed with 200 million 0.6-micrometer (μm) pixels within a 1/1.3" optical format, a sensor size widely used in 108MP primary smartphone cameras, the ISOCELL HP2 enables consumers to experience even higher resolutions in the latest high-end smartphones without larger camera protrusions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Implementation of CMOS Image Sensors in the Consumer Electronics Segment

- 5.1.2 Emergence of 4K Pixel Technology in the Security and Surveillance Sector

- 5.2 Market Restraints

- 5.2.1 Competition from CCD Sensor

6 TECHNOLOGY SNAPSHOT

- 6.1 By Communication Type

- 6.1.1 Wired

- 6.1.2 Wireless

7 MARKET SEGMENTATION

- 7.1 By End-user Industry

- 7.1.1 Consumer Electronics

- 7.1.2 Healthcare

- 7.1.3 Industrial

- 7.1.4 Security and Surveillance

- 7.1.5 Automotive and Transportation

- 7.1.6 Aerospace and Defense

- 7.1.7 Computing

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 STMicroelectronics NV

- 8.1.2 Sony Corporation

- 8.1.3 Samsung Electronics Co. Ltd

- 8.1.4 ON Semiconductor Corporation

- 8.1.5 Canon Inc.

- 8.1.6 SK Hynix Inc.

- 8.1.7 Omnivision Technologies Inc.

- 8.1.8 Hamamatsu Photonics KK

- 8.1.9 Panasonic Corporation

- 8.1.10 Teledyne Technologies Inc.

- 8.1.11 GalaxyCore Shanghai Limited Corporation

- 8.2 Vendor Market Share Analysis