|

|

市場調査レポート

商品コード

1687228

ウェアラブルセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ウェアラブルセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

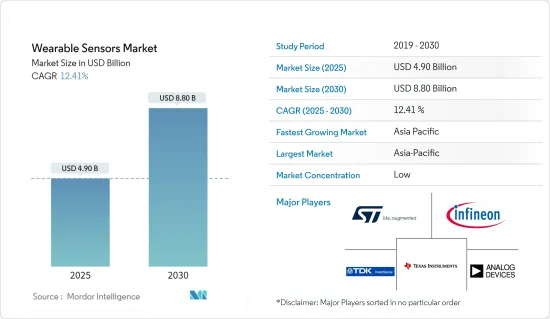

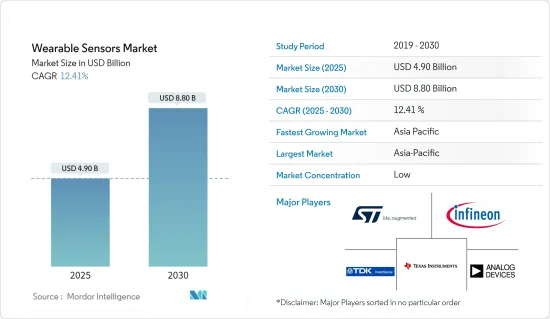

ウェアラブルセンサー市場規模は2025年に49億米ドルと推定され、予測期間(2025-2030年)のCAGRは12.41%で、2030年には88億米ドルに達すると予測されます。

エレクトロニクス産業は、主にデジタル化により著しく繁栄しており、自己健康モニタリング用途に広く使用されるウェアラブル技術デバイスの需要を牽引しています。

主なハイライト

- ウェアラブルセンサーは、歩数カウントや歩行距離のようなリアルタイムモーションセンシング活動のトラッキングに対する消費者の関心の高まりから、ウェアラブルデバイスにとって極めて重要です。ユーザーは、生成されたデータを分析することで得られる具体的な結果を利用して、フィットネスや健康の目標を定めることができます。ウェアラブル・テクノロジーは、消費者の健康とデータをモニターし、有意義な意思決定を支援するセンサーに完全に依存しています。進化するセンサー技術により、ウェアラブルはスマート化し、消費者の間で人気を集めています。

- 家電製品への支出もウェアラブルデバイスの成長を刺激しています。さらに、人口の増加による都市化の進展とライフスタイルの変化によって、健康と安全に対する意識が高まっています。これが、フィットネストラッカー、イヤーウェア、スマートウォッチなどのウェアラブルデバイスの成長を刺激する大きな要因となっています。

- センサーや関連部品の小型化が進む中、スマートウェアラブルの高機能センサーの成長、バッテリーサイズの向上、効率化がウェアラブルモーションセンサー市場を押し上げる主な要因となっています。

- 消費者のスマートウェアラブル志向の高まりに伴い、コンポーネントのコスト上昇に伴いデバイスの価格も高騰しており、市場での採用が制限されています。スマートウォッチとフィットネストラッカーは、消費者の大きな注目を集める低価格のセグメントを持っています。しかし、技術の普及に伴い、フットウェア、アイウェア、ボディウェア製品などの他のデバイスは高価格で、採用率が低くなっています。ウェアラブル・テクノロジーの大半は現在高価格であり、これが市場での採用にマイナスの影響を与えています。

- COVID-19パンデミックはウェアラブルセンサー市場に好影響を与え、患者の遠隔モニタリングにデジタルインフラを活用する必要性を浮き彫りにしました。現在のウイルス検査やワクチンは開発に時間がかかるため、ウェアラブルセンサーは病気の検出や個人や集団の健康状態の追跡に役立つ可能性があります。

ウェアラブルセンサー市場動向

スポーツ・フィットネス分野が市場シェアの大半を占める

- ウェルネスモニターやフィットネストラッカーに対する需要の高まりが、ウェアラブルセンサーの世界の出荷台数の伸びを牽引する重要な要因となっています。ウェルネスやフィットネスの遠隔モニタリングなど、これらのデバイスが提供する機能に対する消費者の認識が高まるにつれ、センサーベースのデバイスに対する需要が世界的に高まっています。シスコシステムズによると、2022年にウェアラブル端末を使った5G接続が最も多かったのは北米でした。北米とアジアのウェアラブル端末を合わせると、2022年の世界のウェアラブル5G接続の約70%を占める。

- ウェアラブル・パフォーマンス・デバイスは、一般の人々やアスレチック・チームが利用できるようになっています。技術の進歩により、個人の持久力アスリート、スポーツチーム、医師が機能的な動き、作業負荷、生体測定マーカーをモニターしてパフォーマンスを向上させることができるようになりました。成長の増大が市場を牽引しています。

- 技術組織は、運動チーム向けのウェアラブルガジェットの成長と宣伝に大きく前進しています。Zephyr Technology社、Viperpod社、Smartlife社、miCoach社、Catapult社などの企業は、アスレチックコーチの意思決定方法、スポーツ活動のプレー方法、プロスポーツ選手のパフォーマンス、健康、安全性を改革しています。これらのテクノロジーはまた、プロスポーツの分野から一般消費者向けの市場へと急速に移行しています。

- 2022年6月、ガーミン社は、ソーラー充電機能を備えた同社初のランニング専用スマートウォッチ、Forerunner 955 Solarを発表しました。Forerunner 955 Solarは、Power Glassソーラー充電レンズを搭載し、スマートウォッチモードで最大20日間1、GPSモードで最大49時間2のバッテリー寿命をアスリートに提供します。このスマートウォッチは、直射日光の下でも見やすい常時点灯のフルカラーディスプレイを搭載しています。応答性の高いタッチスクリーンは、伝統的な5ボタンデザインと相まって、標準的な健康機能への素早いアクセス、より簡単な地図操作などを可能にします。

- さらに2021年9月、Whoopはアスリートに特化したフィットネス・ウェアラブル向けに2億米ドルを調達しました。シリーズFの球形により、Whoopの一般投資額は約4億500万米ドルに達しました。ソフトバンクのVision Fund 2を利用した球状シリーズにより、評価額は36億米ドルに達します。追加投資家には、IVP、Cavu Venture Partners、GP Bullhound、Accomplice、NextView Ventures、Animal Capitalが含まれます。彼らはすべて、ナショナル・フットボール・リーグ選手協会、ジャック・ドーシー、そして何人かの専門家スポーツ選手とともに、かつての後援者の拡大リストの一部となっています。

アジア太平洋地域が急成長

- 中国は長年にわたりチップ産業で重要な役割を担ってきたが、現在ではチップ微細化のリーダーとして台頭しつつあります。中国におけるチップ小型化の重要な原動力のひとつは、より微細で効率的なチップの製造を可能にするナノテクノロジーなどの高度な製造技術の開発です。これにより、ウェアラブルセンサーの開発に不可欠な、より小型で効率的なチップの生産が急増しています。さらに中国政府は、ウェアラブルセンサーを含むデジタルヘルスケアと医療技術の開発を促進するために、いくつかのイニシアチブを立ち上げています。

- 日本は近年デジタル化が進んでいるため、ウェアラブルセンサー市場で大きな成長が見込まれます。この動向は、デジタル技術の導入を促進する政府の取り組み、デジタルネイティブな消費者の増加、さまざまな産業における生産性と効率性の向上の必要性など、いくつかの要因に後押しされています。

- インドでは、デジタル技術の採用の増加、健康とフィットネスへの関心の高まり、ウェアラブルデバイスの利点に対する意識の高まりなど、いくつかの要因によってウェアラブルセンサー市場が急速に成長しています。

- その他アジア太平洋地域のウェアラブルセンサー需要は、フィットネスとウェルネスへの関心の高まり、高齢化人口の増加、テクノロジーとヘルスケアの進歩などを背景に、過去数年間で着実に増加しています。

- ASEAN Postによると、増え続ける高齢者人口に対応するには老人ホームだけでは不十分です。これらの施設で提供されるサービスも不十分で、生活の質に影響を与え、入居者の間に孤立感を生み出しています。不動産開発業者も、都市居住者向けの住宅を建設する際に高齢化社会の問題を考慮しており、ウェアラブルセンサーの未開拓の潜在市場を提示しています。

ウェアラブルセンサー産業の概要

ウェアラブルセンサー市場は、STMicroelectronics NV、Texas Instruments Incorporated、Infineon Technologies AG、Analog Devices Inc.、InvenSense Inc.(TDK株式会社)などの大手企業が存在し、競争が激しいです。市場のプレーヤーは、製品ラインナップを強化し、持続可能な競争優位性を獲得するために、パートナーシップ、コラボレーション、イノベーション、買収などの戦略を採用しています。

- 2022年12月-アナログ・デバイセズ社はオレゴン健康科学大学(OHSU)と提携し、10代の若者のメンタルヘルス危機の高まりに対処するため、主要なメンタルヘルス指標を検出するスマートウォッチを開発しました。OHSUは、世界的に急増しているメンタルヘルス危機に対して、ADIの革新的な技術と製品を活用し、人々の生活を救い、改善し、豊かにすることを目指します。

- 2022年12月-パナソニックは、90°レンズを搭載した有名なGrid-Eyeセンサーファミリーの新メンバーを発表しました。Grid-Eye 90°は、他のアプリケーションと同様に、個人の動きを追跡・カウントするために構築されたシステムを改善します。プライバシーを重視する設計者は、Grid-Eyeファミリーの64ピクセルの解像度を高く評価しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

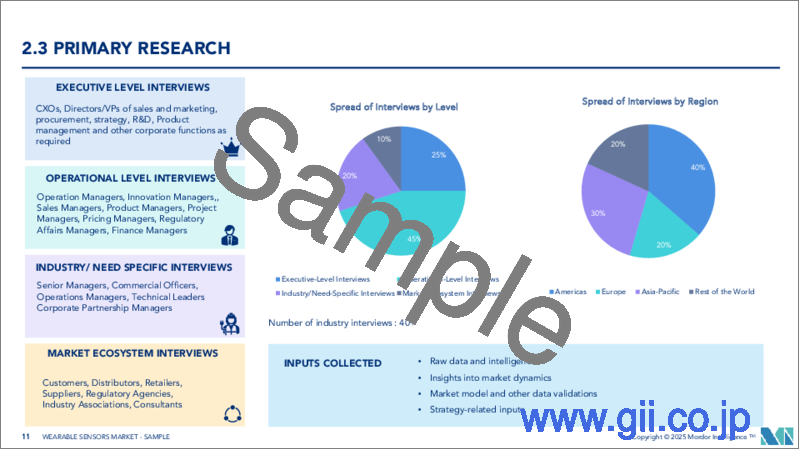

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- COVID-19の業界への影響評価

第5章 市場力学

- 市場促進要因

- 健康とフィットネスに対する意識の高まり

- スマートウェアラブルデバイスの動向の高まり

- 市場の課題

- ガジェットのコスト上昇

第6章 市場セグメンテーション

- タイプ別

- 化学・ガス

- 圧力

- 画像/光学

- 運動

- その他のセンサー

- 用途別

- 健康と福祉

- 安全モニタリング

- スポーツ・フィットネス

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- STMicroelectronics NV

- Texas Instruments Incorporated

- Infineon Technologies AG

- Analog Devices Inc.

- InvenSense Inc.(TDK Corporation)

- AMS OSRAM AG

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第8章 投資分析

第9章 市場の将来

The Wearable Sensors Market size is estimated at USD 4.90 billion in 2025, and is expected to reach USD 8.80 billion by 2030, at a CAGR of 12.41% during the forecast period (2025-2030).

The electronics industry has thrived significantly, primarily due to digitalization, which drives the demand for wearable technology devices widely used for self-health monitoring applications.

Key Highlights

- Wearable sensors are crucial to wearable devices due to consumers' growing interest in tracking real-time motion-sensing activities, such as step counting and walking distance covered. Users can define their goals for fitness and health using the specific results provided by analyzing the generated data. Wearable technology completely relies on sensors to monitor consumers' health and data and helps make meaningful decisions. With evolving sensor technology, wearables are becoming smart and gaining popularity among consumers.

- Spending on consumer electronic products is also stimulating the growth of wearable devices. Further, the growing population's increasing urbanization and changing lifestyle have raised its health and safety awareness. This has been the major factor stimulating the growth of wearable devices, such as fitness trackers, ear wears, and smartwatches.

- With the ongoing miniaturization of sensors and related components, the growth of the advanced function sensors in smart wearables, the improvement in the battery sizes, and efficiency are the key drivers boosting the wearable motion sensors market.

- With consumers' growing propensity toward smart wearables, the prices of devices are also soaring along with the growing cost of components, thus limiting adoption in the market. Smartwatches and fitness trackers have low-cost segments that drive significant attention from consumers. However, with the proliferation of technology, other devices such as footwear, eyewear, and body wear products are highly priced and have lower adoption rates. Most wearable technologies are currently highly-priced, which is negatively impacting adoption in the market.

- The COVID-19 pandemic had a favorable effect on the market for wearable sensors and highlighted the necessity of utilizing digital infrastructure for remote patient monitoring. Wearable sensors could help with disease detection and tracking individual and population health since current viral tests and vaccines take a while to develop.

Wearable Sensors Market Trends

Sports and Fitness Segment to Hold Major Market Share

- The increasing demand for wellness monitors and fitness trackers is a crucial factor driving the growth of shipments of wearable sensors globally. Globally, demand for sensor-based devices is increasing as consumers become more aware of the features that these devices provide, such as remote monitoring of wellness and fitness. According to Cisco Systems, North America had the most 5G connections made using wearable devices in 2022. Together, wearables in North America and Asia accounted for around 70% of the wearable 5G connections worldwide in 2022.

- Wearable performance devices are significantly available to the general population and athletic teams. Advancements in technology have allowed individual endurance athletes, sports teams, and physicians to monitor functional movements, workloads, and biometric markers to increase performance. The increased growth is driving the market.

- Technology organizations are making significant strides in growing and advertising wearable gadgets for athletic teams. Companies like Zephyr Technology, Viperpod, Smartlife, miCoach, and Catapult are remodeling how athletic coaches make decisions, how sports activities are played, and professional sports players' performance, health, and safety. These technologies are also moving rapidly from the professional sports arena into markets for the general public.

- In June 2022, Garmin Ltd introduced the Forerunner 955 Solar, the company's first dedicated running smartwatch featuring solar charging. The Forerunner 955 Solar features a Power Glass solar charging lens, providing athletes with up to 20 days of battery life in smartwatch mode1 and up to 49 hours in GPS mode2. The smartwatch features an always-on, full-color display that is easy to read in direct sunlight. The responsive touchscreen, coupled with the traditional 5-button design, allows fast access to standard health features, easier map control, etc.

- Further, in September 2021, Whoop raised USD 200 million for athlete-focused fitness wearables. The Series F spherical brings Whoop's general investment to nearly USD 405 million. The spherical series, with the aid of using SoftBank's Vision Fund 2, places the valuation at USD 3.6 billion valuations. Additional investors include IVP, Cavu Venture Partners, GP Bullhound, Accomplice, NextView Ventures, and Animal Capital. They have all been part of an extended listing of former backers, together with the National Football League Players Association, Jack Dorsey, and some expert athletes.

Asia-Pacific to Register Fastest Growth

- China has been a significant player in the chip industry for many years, and the country is now emerging as a leader in chip miniaturization. One of the critical drivers of chip miniaturization in China is the development of advanced manufacturing techniques, such as nanotechnology, which enable the production of more minor and more efficient chips. This has led to a surge in the production of smaller and more efficient chips, which are essential for developing wearable sensors. In addition, the Chinese government has launched several initiatives to promote the development of digital healthcare and medical technologies, including wearable sensors.

- Japan is expected to observe significant growth in the wearable sensors market as it has experienced increasing digitization in recent years. This trend has been driven by several factors, including government initiatives to promote the adoption of digital technologies, a growing number of digital-native consumers, and the need to improve productivity and efficiency in various industries.

- The market for wearable sensors is rapidly growing in India, driven by several factors, including the increasing adoption of digital technologies, a growing focus on health and fitness, and a rising awareness of the benefits of wearable devices.

- The demand for wearable sensors in the Rest of Asia-Pacific has steadily increased over the past few years, driven by a growing interest in fitness and wellness, a rising aging population, and advancements in technology and healthcare.

- According to the ASEAN Post, nursing homes are not enough to meet the ever-growing aged population. The services provided at these homes are also inadequate, impacting the quality of life and creating isolation among residents. Property developers are also considering the issue of an aging society when creating housing for urban dwellers, thus presenting an untapped potential market for wearable sensors.

Wearable Sensors Industry Overview

The wearable sensors market is competitive with the presence of major players like STMicroelectronics NV, Texas Instruments Incorporated, Infineon Technologies AG, Analog Devices Inc., and InvenSense Inc. (TDK Corporation). Players in the market are adopting strategies such as partnerships, collaborations, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Analog Devices Inc. collaborated with Oregon Health & Science University (OHSU) to develop a smartwatch that detects key mental health indicators to help address the rising mental health crisis in teens. As per the collaboration on the first and one-of-a-kind project, OHSU would leverage ADI's innovative technology and products for the burgeoning worldwide mental health crisis to save, improve, and enrich human lives.

- December 2022 - Panasonic Industries introduced a new member of its famous Grid-Eye sensor family with a 90° lens that provides a broader field of vision (FoV) and reduces the number of sensors needed to cover a given area, enabling people to count and track applications. Grid-Eye 90° will improve systems built to track and count the movement of individuals as well as other applications. Privacy-conscious designers have praised the Grid-Eye family's 64-pixel resolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Awareness of Health and Fitness

- 5.1.2 Increasing Trend of Smart Wearable Devices

- 5.2 Market Challenges

- 5.2.1 Higher Costs Associated with Gadgets

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Chemical and Gas

- 6.1.2 Pressure

- 6.1.3 Image/Optical

- 6.1.4 Motion

- 6.1.5 Other Types of Sensors

- 6.2 By Application

- 6.2.1 Health and Wellness

- 6.2.2 Safety Monitoring

- 6.2.3 Sports and Fitness

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 Texas Instruments Incorporated

- 7.1.3 Infineon Technologies AG

- 7.1.4 Analog Devices Inc.

- 7.1.5 InvenSense Inc. (TDK Corporation)

- 7.1.6 AMS OSRAM AG

- 7.1.7 Panasonic Corporation

- 7.1.8 NXP Semiconductors NV

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Bosch Sensortec GmbH (Robert Bosch GmbH)