|

|

市場調査レポート

商品コード

1188826

肉代用食品の世界市場-2028年までの市場規模、シェア、予測Global Meat Substitutes Market - Size, Share, & Forecasts up to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

価格

| 肉代用食品の世界市場-2028年までの市場規模、シェア、予測 |

|

出版日: 2023年01月18日

発行: Mordor Intelligence

ページ情報: 英文 377 Pages

納期: 2~3営業日

|

ご注意事項 :

本レポートは最新情報反映のため適宜更新し、内容構成変更を行う場合があります。ご検討の際はお問い合わせください。

- 全表示

- 概要

- 目次

概要

肉代用食品の世界市場はCAGR10.85%を記録すると予測されます。

主なハイライト

- タイプ別最大セグメント-TVP:一般的に大豆、小麦、エンドウ豆などから得られるTVPは、機能性と栄養価の高い肉代用食品として食品メーカーの間で人気を博しています。

- 地域別最大セグメント-欧州:タンパク質が豊富な植物ベースの食生活の人気と、健康的な生活を奨励する地域政府のプロモーションにより、欧州の人々は肉の摂取量を減らしています。

- タイプ別急成長セグメント-テンペ:テンペは、優れた肉代替特性、製造の容易さ、料理の多様性により、欧州やアジア太平洋などの地域で需要が増加しています。

- 地域別急成長セグメント-アジア太平洋:肉代用食品の消費は、適切な植物性タンパク質源を求める中国、インド、オーストラリアなどの主要国で牽引力を増しています。

主な市場動向

TVPはタイプ別で最大のセグメントです。

- TVPは、世界で最も消費されている肉代用食品です。TVPの販売額は、2016年から2021年にかけて34.44%増加しました。通常、大豆、小麦、エンドウ豆から得られるTVPは、機能的で栄養価の高い肉代用食品として、食品メーカーの間で人気を博しています。主要なTVPメーカーには、ADM、Cargill、Ingredion Incorporated、Kerry Group PLCなどがあります。主要プレイヤーは、Beyond Meat、Impossible Foods、Eat Just、Quornなどの肉代用食品メーカーと提携し、市場浸透を図っています。

- 2020年、肉代用食品の消費量は2019年と比較して11.96%増加しました。パンデミックの経済的な悪影響にもかかわらず、肉代用食品の消費は時間の経過とともに増加しました。COVID-19の発生後、消費者がより健康的な選択肢を探したため、肉代用食品の生産者は記録的な売上高を報告しました。発生初期には、消費者は保存期間が長い食品、例えばビーガン用疑似肉、豆腐缶、ミートフリーランチョンなどの缶詰を買いだめしていました。家畜由来の肉は賞味期限が限られていますが、大豆由来の肉代用食品は1年間鮮度を保つことができるため、嗜好性が高まっています。

- テンペは、予測期間(2022~2028年)のCAGRが11.81%と予測され、世界で最も消費量の多い肉代用食品となる可能性が高いです。肉代用食品の世界市場は、消費者の需要を満たすために大手企業が協力しており、急速に成長すると予想されます。これらのコラボレーションには、One Planet PizzaとBetter Nature、Greenleaf FoodsとWalmart、Keystone Natural HoldingsとWestsoy(Hain Celestial Group Inc.の一部)などが含まれます。

地域別では欧州が最大のセグメントです。

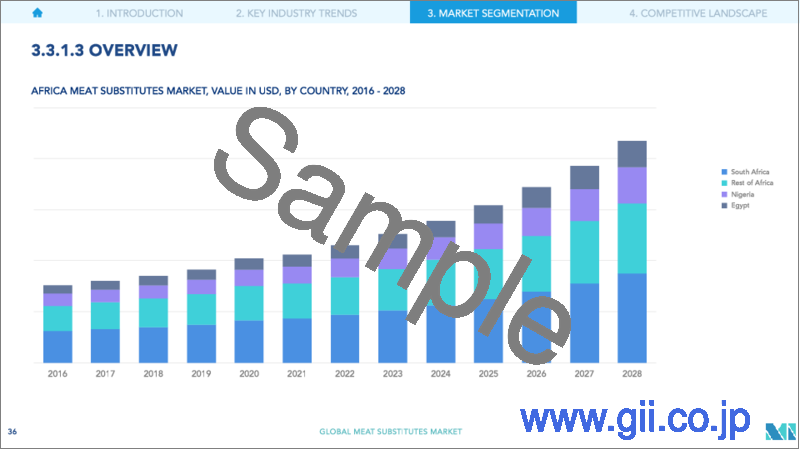

- 2016年から2021年にかけて、世界の肉代用食品市場全体の成長率は金額で38.11%に増加しました。すべての地域の中で、アジア太平洋は2017年から2021年に43.96%と肉代用食品の消費量が大幅に急増しました。この増加は主に、メーカーによる製品イノベーション、消費者の健康的な選択への採用率、人口増加によるものであり、その結果、世界の肉代用食品の売上を牽引しています。

- 2020年には、2019年と比較して11.96%、肉代用食品の売上高に急激な増加が見られました。食肉のサプライチェーンにおけるCOVID-19の混乱により、肉代用食品食に対する消費者の数が急増したのです。インターネットの普及に伴い、食肉生産に対する環境問題が世界中に広がっており、その結果、肉代用食品食にシフトする消費者が急増しました。

- 欧州は2021年に北米を4.74%上回る35.38%の市場シェアを獲得し、市場を独占しています。がんの高い死亡率(190万人の死亡)のために肉の消費を減らすことを目的としたがん撲滅特別委員会-BECAのような、肉代用食品の政府プロモーションの高まりが、欧州の肉代用食品市場を牽引しています。

- 中東は、肉代用食品を消費する地域の中で最も成長率が高く、予測期間中(2022~2028年)に金額ベースで12.35%のCAGRが予測されます。この地域では、外国人居住者の増加に伴い、Vbites、Fazenda Futuro、KBW venturesなどの多くの新しいスタートアップ企業が、肉代用食品に顧客を引き付けています。しかし、地球温暖化に対する認識や継続的な肉の消費による様々な健康への懸念も、肉代用食品の消費増加の理由の一つとなっています。

競合情勢

世界の肉代用食品市場は断片的であり、上位5社で10.32%を占めています。この市場の主要なプレーヤーは、Amy's Kitchen Inc.、Beyond Meat Inc.、China Foodstuff &Protein Group、House Foods Group Inc.、Vitasoy International Holdings Ltd(アルファベット順に並べ替え)です。

その他の特典。

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 エグゼクティブサマリー&キーファインディング

第2章 イントロダクション

- 調査の前提条件と市場の定義

- 調査対象範囲

- 調査手法

第3章 主要な産業動向

- 価格動向

- 規制の枠組み

- バリューチェーンと流通チャネル分析

第4章 市場のセグメンテーション

- 種類

- テンペ

- 植物性たん白

- 豆腐

- その他肉代用食品

- 流通経路

- オフトレード

- コンビニエンスストア

- オンラインチャネル

- スーパーマーケット、ハイパーマーケット

- その他

- オントレード

- オフトレード

- 地域別

- アフリカ

- タイプ別

- 販売経路別

- 国別

- エジプト

- ナイジェリア

- 南アフリカ

- その他のアフリカ地域

- アジア太平洋地域

- タイプ別

- 販売経路別

- 国別

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- 韓国

- その他アジア太平洋地域

- 欧州

- タイプ別

- 販売経路別

- 国別

- フランス

- ドイツ

- イタリア

- オランダ

- ロシア

- スペイン

- 英国

- その他欧州

- 中東地域

- タイプ別

- 販売経路別

- 国別

- バーレーン

- クウェート

- オマーン

- カタール

- サウジアラビア

- アラブ首長国連邦

- その他の中東地域

- 北米

- タイプ別

- 販売経路別

- 国別

- カナダ

- メキシコ

- 米国

- その他北米地域

- 南米

- タイプ別

- 販売経路別

- 国別

- アルゼンチン

- ブラジル

- その他の南米地域

- アフリカ

第5章 競合情勢

- Key Strategic Moves

- 市場シェア分析

- Company Landscape

- 企業プロファイル

- Amy's Kitchen Inc.

- Beyond Meat Inc.

- Cargill, Inc.

- China Foodstuff & Protein Group Co. Ltd

- Conagra Brands Incorporated

- House Foods Group Inc.

- Impossible Foods Inc.

- International Flavors & Fragrances Inc.

- Morinaga Milk Industry Co. Ltd

- The Kellogg Company

- Vitasoy International Holdings Ltd

第6章 CEOへの主な戦略的質問

第7章 付録

- 世界概要

- 概要

- ファイブフォース分析のフレームワーク

- 世界バリューチェーン分析

- 市場力学(DRO)

- 出典・参考文献

- 表と図のリスト

- プライマリーインサイト

- データパック

- 用語集

目次

Product Code: 92486

The Global Meat Substitutes Market is projected to register a CAGR of 10.85%

Key Highlights

- Largest Segment by Type - Textured Vegetable Protein : Typically obtained in soy, wheat, and peas among other sources, TVP has gained popularity among food manufacturers as a functional and nutritious meat substitute.

- Largest Segment by Region - Europe : The popularity of protein-enriched plant-based diets and regional government promotions encouraging healthy living has led to Europeans decreasing their meat intake.

- Fastest-growing Segment by Type - Tempeh : Tempeh is increasing in demand in regions like Europe and Asia-Pacific due to its good meat substituting properties, ease to manufacture, and culinary versatility.

- Fastest-growing Segment by Region - Asia-Pacific : Consumption of meat substitutes is gaining traction in major countries like China, India, and Australia where people are looking for an adequate plant-based protein source.

Key Market Trends

Textured Vegetable Protein is the largest segment by Type.

- Textured vegetable protein is the most consumed meat substitute worldwide. The sales value of TVP increased by 34.44% from 2016 to 2021. TVP, typically obtained from soy, wheat, and peas, has gained popularity among food manufacturers as a functional and nutritious meat substitute. Some of the major TVP manufacturers are ADM, Cargill, Ingredion Incorporated, and Kerry Group PLC. Key players are partnering with meat alternative manufacturers, like Beyond Meat, Impossible Foods, Eat Just, and Quorn, to increase their market penetration.

- In 2020, the consumption of meat substitutes rose by 11.96% compared to 2019. Despite the pandemic's adverse economic impact, the consumption of meat alternatives has increased over time. Post the COVID-19 outbreak, producers of meat substitutes reported record-breaking sales as consumers searched for healthier options. During the early stages of the outbreak, consumers stocked up on food products with longer shelf life, such as canned goods like vegan mock meat, canned tofu, and meat-free luncheon. While meat derived from livestock has a limited shelf life, meat alternatives derived from soybeans can remain fresh for a whole year, thus increasing their preference.

- Tempeh is likely to be the fastest-growing meat substitute consumed worldwide, with a projected CAGR of 11.81% during the forecasted period (2022-2028). The global market for meat substitutes is anticipated to grow swiftly, with major companies collaborating to satisfy consumer demand. Some of these collaborations include One Planet Pizza and Better Nature, Greenleaf Foods and Walmart, and Keystone Natural Holdings and Westsoy (part of Hain Celestial Group Inc.).

Europe is the largest segment by Region.

- The overall growth of the global meat substitute market increased to 38.11% by value from 2016 to 2021. Of all regions, Asia-Pacific saw a substantial spike in the consumption of meat substitutes by 43.96% in 2021 from 2017. The increase is mainly due to product innovations from manufacturers, the adoption rate of consumers toward healthier choices, and the increase in population thus driving the sales of meat substitutes globally.

- In 2020, there was a sudden spike in the sales of meat substitutes, by 11.96%, compared to 2019. The COVID-19 disruptions in the meat supply chain have resulted in a spike in the number of consumers toward meat substitutes. With the increase in internet penetration, environmental concerns about meat production are spreading across the world, which resulted in a spike in consumers shifting toward meat substitutes.

- Europe dominates the market with a market share of 35.38%, 4.74% more than North America in 2021. Rising government promotions of meat substitutes, like a special committee on beating cancer-BECA that aims to reduce meat consumption due to the high mortality rate of cancer (1.9 million deaths) and promote plant-based meats as an alternative to meat consumption, are driving the European meat substitute market.

- The Middle East is predicted to be the fastest-growing region that consumes meat substitutes, with a projected CAGR of 12.35% by value during the forecast period (2022-2028). With the increasing expat population in the region, many new start-ups, like Vbites, Fazenda Futuro, and KBW ventures, are attracting customers toward meat substitutes. However, awareness about global warming and various health concerns of continuous meat consumption are also some of the reasons for the rising consumption of meat substitutes.

Competitive Landscape

The Global Meat Substitutes Market is fragmented, with the top five companies occupying 10.32%. The major players in this market are Amy's Kitchen Inc., Beyond Meat Inc., China Foodstuff & Protein Group Co. Ltd, House Foods Group Inc. and Vitasoy International Holdings Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Type

- 4.1.1 Tempeh

- 4.1.2 Textured Vegetable Protein

- 4.1.3 Tofu

- 4.1.4 Other Meat Substitutes

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets And Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

- 4.3 Region

- 4.3.1 Africa

- 4.3.1.1 By Type

- 4.3.1.2 By Distribution Channel

- 4.3.1.3 By Country

- 4.3.1.3.1 Egypt

- 4.3.1.3.2 Nigeria

- 4.3.1.3.3 South Africa

- 4.3.1.3.4 Rest Of Africa

- 4.3.2 Asia-Pacific

- 4.3.2.1 By Type

- 4.3.2.2 By Distribution Channel

- 4.3.2.3 By Country

- 4.3.2.3.1 Australia

- 4.3.2.3.2 China

- 4.3.2.3.3 India

- 4.3.2.3.4 Indonesia

- 4.3.2.3.5 Japan

- 4.3.2.3.6 Malaysia

- 4.3.2.3.7 South Korea

- 4.3.2.3.8 Rest Of Asia-Pacific

- 4.3.3 Europe

- 4.3.3.1 By Type

- 4.3.3.2 By Distribution Channel

- 4.3.3.3 By Country

- 4.3.3.3.1 France

- 4.3.3.3.2 Germany

- 4.3.3.3.3 Italy

- 4.3.3.3.4 Netherlands

- 4.3.3.3.5 Russia

- 4.3.3.3.6 Spain

- 4.3.3.3.7 United Kingdom

- 4.3.3.3.8 Rest Of Europe

- 4.3.4 Middle East

- 4.3.4.1 By Type

- 4.3.4.2 By Distribution Channel

- 4.3.4.3 By Country

- 4.3.4.3.1 Bahrain

- 4.3.4.3.2 Kuwait

- 4.3.4.3.3 Oman

- 4.3.4.3.4 Qatar

- 4.3.4.3.5 Saudi Arabia

- 4.3.4.3.6 United Arab Emirates

- 4.3.4.3.7 Rest Of Middle East

- 4.3.5 North America

- 4.3.5.1 By Type

- 4.3.5.2 By Distribution Channel

- 4.3.5.3 By Country

- 4.3.5.3.1 Canada

- 4.3.5.3.2 Mexico

- 4.3.5.3.3 United States

- 4.3.5.3.4 Rest Of North America

- 4.3.6 South America

- 4.3.6.1 By Type

- 4.3.6.2 By Distribution Channel

- 4.3.6.3 By Country

- 4.3.6.3.1 Argentina

- 4.3.6.3.2 Brazil

- 4.3.6.3.3 Rest Of South America

- 4.3.1 Africa

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 Amy's Kitchen Inc.

- 5.4.2 Beyond Meat Inc.

- 5.4.3 Cargill, Inc.

- 5.4.4 China Foodstuff & Protein Group Co. Ltd

- 5.4.5 Conagra Brands Incorporated

- 5.4.6 House Foods Group Inc.

- 5.4.7 Impossible Foods Inc.

- 5.4.8 International Flavors & Fragrances Inc.

- 5.4.9 Morinaga Milk Industry Co. Ltd

- 5.4.10 The Kellogg Company

- 5.4.11 Vitasoy International Holdings Ltd

6 KEY STRATEGIC QUESTIONS FOR MEAT SUBSTITUTES INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

お電話でのお問い合わせ

044-952-0102

( 土日・祝日を除く )