|

市場調査レポート

商品コード

1444391

風力タービン - 市場シェア分析、業界動向と統計、成長予測(2024年~2029年)Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 風力タービン - 市場シェア分析、業界動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

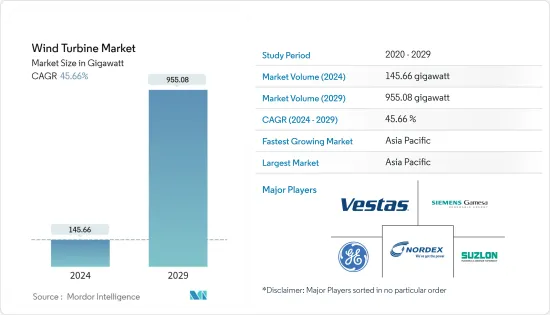

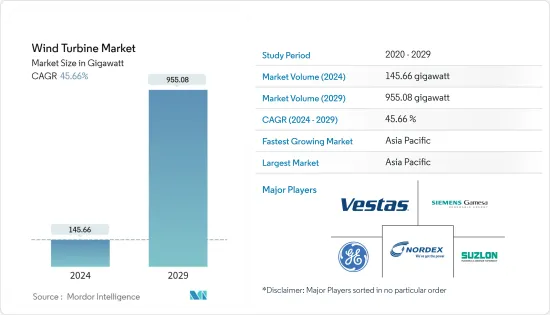

風力タービンの市場規模は、2024年に145.66ギガワットと推定され、2029年までに955.08ギガワットに達すると予測されており、予測期間(2024年から2029年)中に45.66%のCAGRで成長します。

2020年、COVID-19は市場に悪影響を及ぼしました。現在、市場はパンデミック前のレベルに達しています。

主なハイライト

- 中期的には、発電構成における再生可能エネルギー源、特に風力発電の需要の増加、化石燃料ベースの発電への依存を減らす取り組み、エネルギー効率に関する規制などの要因が風力タービンの普及を促進すると予想されます。予測期間中の市場。

- 一方で、太陽光やその他の代替エネルギー源などの代替クリーンエネルギー源の導入は、市場の成長を妨げる可能性があります。

- それにもかかわらず、世界風力エネルギー評議会は、世界中で2030年までに380GW、2050年までに2,000GWの洋上風力発電を達成することを約束しており、これは近い将来、風力タービンの導入に大きな機会をもたらすと考えられます。

- アジア太平洋地域は、風力発電の最大のシェアと、中国、インド、日本などの国々に製造拠点や技術拠点が存在することにより、最大かつ急成長する市場になると予想されています。

主要な市場動向

洋上風力タービンが大幅な成長を遂げる

- エネルギー需要が高まる中、主要国や企業は、クリーンなエネルギーを提供できる再生可能エネルギー源、特に風力エネルギーの導入に目を向けています。先進技術を備えた洋上風力エネルギーの導入は、多くの国や企業を惹きつけ、多額の投資を行っています。

- 導入場所別にみると、洋上産業は、コストの低下、技術の向上、世界中の洋上風力エネルギープロジェクトの開発と投資の増加により、予測期間中に世界の風力タービン産業への投資が大幅に増加すると予想されています。

- 二酸化炭素排出量を削減しながら、英国の手頃な価格のエネルギー供給を大幅に増やすため、英国政府は、洋上風力産業と政府との間の分野協定の一環として、電力の少なくとも3分の1を洋上風力から供給する長期戦略を策定しました。英国の気候変動委員会の報告書は、同国が2050年に向けた「実質ゼロ」排出目標を法制化する最初の大規模経済国となる可能性があることを示唆しています。

- 2022年5月、英国の浮体式洋上風力発電投資スキーム(FLOWMIS)は最近の発表で、英国全土のスコットランド、ウェールズ、そして他の場所でも。メーカーを支援し、将来的に過剰成長が見込まれるこの新興分野への投資に対する自信を民間投資家に提供することで、政府はこれらのプロジェクトに資金を提供する予定です。

- 2022年5月、ノルウェー政府は2040年までに洋上風力発電開発に海域を割り当てる投資計画を開始し、容量30GWを目標としました。

- 再生可能エネルギー法(EEG)を受けて、ドイツは洋上風力エネルギーを大規模に増強する計画を立てています。連立合意の一環として、ドイツは洋上風力発電の目標を2030年までに30GWに増やすと述べた。

- 世界風力エネルギー評議会(GWEC)の統計によると、2022年に世界の洋上風力発電容量は64.3 GWに達し、2022年には新たに8.8 GWの容量が追加されました。

- これに加えて、両社は、使用される風力タービンの材料の改良により、より高い風力タービンを設置することができ、タービンが高高度の風を利用できるようになりました。また、これらの新しいタービンはブレードが大きいため、小型のタービンよりも広い範囲を掃除することができます。風力タービンの大型化は風力エネルギーのコスト削減に貢献し、米国、ドイツ、フランスなどの一部の地域では風力エネルギーが化石燃料の代替動向と経済的に競争力があることを示しています。予測期間中の洋上風力タービン市場。

アジア太平洋が市場を独占する

- アジア太平洋地域では、風力エネルギーは最も豊富なエネルギー資源の1つであり、この地域のエネルギー需要を満たす理想的な供給源となっています。風力エネルギーの大きな成長の可能性を考慮して、中国、インド、日本などのアジア諸国は現在、このエネルギー資源の広範な導入の実施に焦点を当てています。

- 持続可能な開発と温室効果ガス排出削減への取り組みがますます重視されるようになった結果、洋上風力エネルギーは人気のエネルギー源となっています。発電用の主流のエネルギー源として、洋上風力エネルギーは代替エネルギー源から大きく変化しました。洋上風力エネルギー技術はアジア諸国で急速に開発されており、最近のタービン技術の進歩と政府の奨励金により風力エネルギーへの依存が高まっています。

- 中国風力エネルギー協会(CWEA)によると、2022年には44.7 GWの陸上風力発電設備が設置されました。しかし、国家エネルギー局(NEA)が発表した最新の統計によると、新たに系統導入された陸上風力発電設備は32.6 GWのみです。同じ年につながりました。

- GWECによると、世界の洋上風力産業は2022年に新たに8.7 GWの設備を導入しました。中国は新規設備で引き続き世界をリードし、2022年には5 GW以上の洋上風力発電網が接続されました。

- インドは2022年中に約1.8 GWの風力発電を新たに設置し、同年末までに総設置容量は41.9 GWになりました。これらのプロジェクトは主に国の北部、南部、西部に広がっています。

- 2022年5月、インド政府は洋上風力発電開発の最初のステップを発表し、オークション開始の戦略とスケジュールの概要を説明しました。今後数カ月以内に開催される予定の最初のオークションに向けて、少なくとも10~12GWの洋上風力タービンを建設するという初期戦略の概要が示されています。最近発表された計画では、最初のオークションの対象となる地域は2つになる予定です。 1つはタミル・ナドゥ州とグジャラート州です。この分野での最初のオークションでは、4GWの容量が目標となります。

- 世界銀行グループによると、フィリピンのEEZには約178GWの洋上風力発電の技術資源の可能性があり、主に浮体式風力発電と18GWの固定底洋上風力発電があります。これが国の総発電設備容量の7倍以上であることを考慮すると、脱炭素化とエネルギー安全保障の目標を達成する機会は重要です。

- 世界銀行グループのESMAP-IFC洋上風力開発プログラムと提携して、フィリピンエネルギー省は洋上風力ロードマップを作成しています。ロードマップ草案では、洋上風力発電開発のための6つの異なるゾーンが特定されており、2030年までに合計2.8GW、2050年までに58GWとなり、そのほとんどが浮体式洋上風力プロジェクトとなります。

- これにより、予測期間中に風力タービン事業に携わる市場関係者にとって、アジア太平洋が優れたビジネス目的地として提示されることが予想されます。

競合情勢

風力タービン市場は適度に細分化されています。市場の主要企業には(順不同)、Vestas Wind Systems AS、Siemens Gamesa Renewable Energy SA、General Electric Company、Nordex SE、Suzlon Energy Limitedなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提条件

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- GWにおける風力タービンの設置容量と2028年までの予測

- 最近の動向と発展

- 政府の政策と規制

- 市場力学

- 促進要因

- 抑制要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替製品やサービスの脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 展開場所

- オンショア

- オフショア

- 容量

- 小

- 中

- 大

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- 合併と買収、合弁事業、コラボレーション、および契約

- 有力企業が採用した戦略

- 企業プロファイル

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Nordex SE

- Suzlon Energy Limited

- Xinjiang Goldwind Science &Technology Co. Ltd.

- Eaton Corporation PLC

- Enercon GmbH

- Hitachi Ltd.

- Vergnet

第7章 市場機会と将来の動向

The Wind Turbine Market size is estimated at 145.66 gigawatt in 2024, and is expected to reach 955.08 gigawatt by 2029, growing at a CAGR of 45.66% during the forecast period (2024-2029).

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium period, factors such as increasing demand for renewable energy sources, especially wind power, in the power generation mix, efforts to reduce the reliance on fossil fuel-based power generation, and regulations on energy efficiency are expected to drive the wind turbine market during the forecast period.

- On the other hand, the adoption of alternative clean energy sources like solar and other alternatives is likely to hinder the market's growth.

- Nevertheless, the global wind energy council committed to achieving 380 GW of offshore wind by 2030 and 2,000 GW by 2050 worldwide, which is likely to provide significant opportunities for the deployment of wind turbines soon.

- The Asia-Pacific region is expected to be the largest and fastest-growing market, owing to the largest share in terms of wind power generation and the presence of manufacturing and technology hubs in countries like China, India, Japan, etc.

Key Market Trends

Offshore Wind Turbine to Witness a Significant Growth

- As energy demand is rising, major countries and companies are turning toward the adoption of renewable energy sources, especially wind energy, as they can provide clean energy. The adoption of offshore wind energy with advanced technologies has attracted many countries and companies with high investments.

- By location of deployment, the offshore industry is expected to witness significant growth in global wind turbine industry investments during the forecast period, owing to declining costs, improved technology, and increased developments and investments in offshore wind energy projects worldwide.

- To significantly increase the United Kingdom's affordable energy supply while reducing carbon emissions, the UK government developed a long-term strategy to deliver at least one-third of its electricity from offshore wind as part of a sector deal between the offshore wind industry and the government. A report by the UK's Committee on Climate Change indicates the country could become the first large economy to legislate a "net zero" emissions target for 2050.

- In May 2022, in a recent announcement, the Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) of the United Kingdom announced that it would provide the government with GBP 160 million to boost floating offshore wind capability around the UK at locations in Scotland, Wales, and elsewhere. By supporting manufacturers and providing private investors with the confidence to invest in this emerging sector, which is expected to overgrow in the future, the government is going to provide funding for these projects.

- In May 2022, the Government of Norway launched an investment plan to allocate sea areas for offshore wind development by 2040, targeting 30 GW of capacity.

- Following the Renewable Energy Act (EEG), Germany plans to boost offshore wind energy massively. As part of the Coalition Agreement, Germany stated it would increase its offshore wind target to 30 GW by 2030.

- According to Global Wind Energy Council (GWEC) statistics, in 2022, the global offshore wind capacity reached 64.3 GW and the new 8.8 GW of capacity was added in 2022.

- Besides this, the companies have been able to install taller wind turbines due to improvements in the wind turbine materials used, which allow the turbines to exploit higher-altitude winds. Also, these new turbines have larger blades and, hence, can sweep a larger area than the smaller turbines. The growing size of the wind turbines helped lower the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives in some locations such as the United States, Germany, France, etc. Therefore, these recent trends are expected to drive the offshore wind turbine market during the forecast period.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific region, wind energy is one of the most abundant energy resources, making it an ideal source for fulfilling the region's energy needs. In view of wind energy's tremendous growth potential, Asian countries, including China, India, Japan, and others, are currently focusing on implementing a widespread deployment of this energy resource.

- As a result of an increasing focus on sustainable development and a commitment to reducing greenhouse gas emissions, offshore wind energy has become a popular source of energy. As a mainstream energy source for power generation, offshore wind energy has significantly changed from being a source of alternative energy. Offshore wind energy technology is being developed at a rapid pace in Asian countries, which has contributed to the growing reliance on wind energy due to recent advancements in turbine technology and government incentives.

- According to the Chinese Wind Energy Association (CWEA), 44.7 GW of onshore wind capacity was installed in 2022. However, the most recent statistics released by the National Energy Administration (NEA) indicate that only 32.6 GW of new onshore wind capacity was grid-connected in the same year.

- According to GWEC, the global offshore wind industry installed a new capacity of 8.7 GW in 2022. China consecutively led the world in new installations, with more than 5 GW of offshore wind grid-connected in 2022.

- During 2022, India installed around 1.8 GW of new wind power, making 41.9 GW of total installed capcity by end of the same year. These projects are mostly spread in the northern, southern, and western parts of the country.

- In May 2022, the Indian government announced the first steps in offshore wind power development and outlined a strategy and timetable for starting auctions. An initial strategy of building at least 10 to 12 GW of offshore wind turbines is outlined for the first auctions, which are expected to take place in the coming months. There are going to be two regions targeted for the first auctions in the recently released plan. One is going to be Tamil Nadu and Gujarat. The first auctions in this area will target 4 GW of capacity.

- According to the World Bank Group, the Philippines' EEZ has around 178 GW of technical resource potential for offshore wind, primarily floating wind with 18 GW of fixed-bottom offshore wind. Considering that this is more than seven times the country's total installed electricity generation capacity, the opportunity to meet decarbonization and energy security goals is significant.

- In partnership with the World Bank Group's ESMAP-IFC Offshore Wind Development Program, the Philippine Department of Energy is developing an offshore wind roadmap. A draft roadmap identifies six different zones for offshore wind development, totaling 2.8 GW by 2030 and 58 GW by 2050, with mostly floating offshore wind projects.

- This, in turn, is expected to present Asia-Pacific as an excellent business destination for market players involved in the wind turbine business during the forecast period.

Competitive Landscape

The wind turbine market is moderately fragmented. Some of the major players in the market (in no particular order) include Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, General Electric Company, Nordex SE, and Suzlon Energy Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Turbine Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Capacity

- 5.2.1 Small

- 5.2.2 Medium

- 5.2.3 Large

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 General Electric Company

- 6.3.4 Nordex SE

- 6.3.5 Suzlon Energy Limited

- 6.3.6 Xinjiang Goldwind Science & Technology Co. Ltd.

- 6.3.7 Eaton Corporation PLC

- 6.3.8 Enercon GmbH

- 6.3.9 Hitachi Ltd.

- 6.3.10 Vergnet