|

市場調査レポート

商品コード

1851983

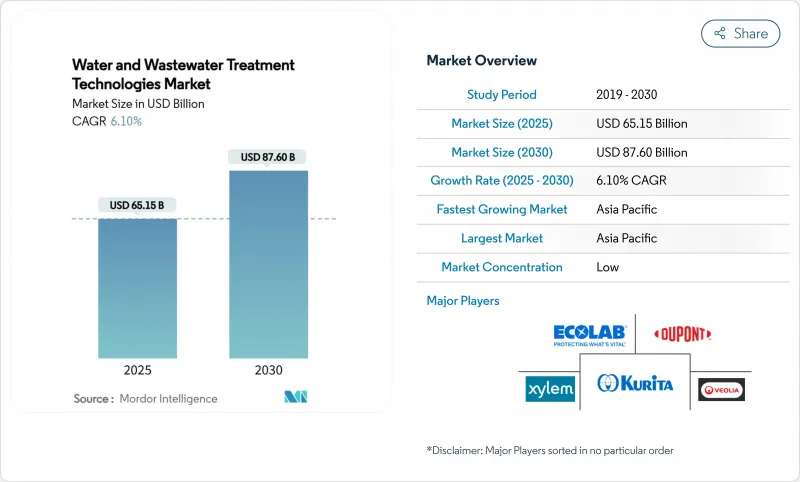

上下水道処理技術:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Water And Wastewater Treatment Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 上下水道処理技術:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年08月11日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

上下水道処理技術市場規模は2025年に651億5,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは6.10%で、2030年には876億米ドルに達すると予測されます。

堅調な成長の背景には、環境規制の強化、液体排出ゼロへの期待の高まり、成熟経済圏と新興経済圏で並行して進む積極的なインフラ整備があります。自治体公益事業者は、老朽化したネットワークを更新するために先行投資を行っており、一方、水不足に悩む地域の工業用水利用者は、許認可を確保し資源を再生利用するために高度なシステムを導入しています。同時に、人工知能ツールは化学薬品の投与と資産の稼働時間を最適化し、運用の節約を有機的な需要の原動力に変えています。また、PFASの破壊やマイクロプラスチックの除去など、特殊なニッチ分野での技術革新競争が激化し、メガマージャーによる統合プラットフォームが登場することで、競合の力学も再編成されつつあります。

世界の上下水道処理技術市場の動向と洞察

液体排出ゼロ義務化の厳格化

電力、石油化学、鉱業の各分野で施行が強化され、施設は、排出をゼロに近づけながら塩分やミネラルを回収する統合熱蒸発、晶析、膜ラインを設置するため、コンプライアンス予算を戦略的資本に転換しています。早期導入企業は、回収した製品別を活用して設備投資の一部を相殺し、依然として基本的な物理化学的処理に頼っている後発企業とのコスト格差を広げています。この指令はアジアと湾岸地域で最も大きな力を持っており、そこでは新しい許認可が運転の前提条件としてZLDの準備を要求するようになっています。そのため投資家は、ZLDの能力を長期的なライセンスの安全性の代用品とみなし、バリューチェーン全体で設備の滞留率を高めています。中期的には、こうした規則が上下水道処理技術市場のCAGRを約1.8ポイント押し上げると予想されます。

分散型モジュール式処理プラントの成長

都市の急速なスプロール化は、集中型施設の設置や資金調達のペースを上回っており、数年ではなく数カ月で納入可能なコンテナ型システムへの関心を高めています。モジュラー・ラインは、不動産開発サイクルに同期した段階的な容量増設を可能にし、ユーティリティ企業が大型資産への座礁投資を回避できるようにします。このアプローチは、大規模プラントのための債券資金を利用できない中小規模の自治体にとって参入障壁を低くし、機器サプライヤーにとって新たな対応可能なポケットを開くことになります。欧州と北米が先駆的なパイロット事業を実施したが、人口密度の高いアジアの回廊での再現可能性は、規模を拡大しつつあります。長期的に見れば、この動向は上下水道処理技術市場の成長に1.2%ポイント寄与します。

先進膜の高い総所有コスト

ナノろ過および逆浸透膜モジュールの導入は、初期購入価格ではなく運転経済性によって制限されます。汚れの進行は、洗浄頻度を高め、耐用年数を短くし、典型的な12年間の視野で初期設備コストを上回る経常的な資本支出を促します。60バールの供給ポンプによる高い電力消費も相まって、化学物質の一括調達や信頼できるグリッド電力を活用できない発展途上市場の小規模ユーティリティにとって、このハードルは最も高いです。その結果、多くの施設がアップグレードを延期するか、膜のデューティーサイクルを希薄化するハイブリッド・フローシートを採用しています。このような構造的なコスト負担は、上下水道処理技術市場のCAGRを1.1%ポイント低下させると予想されます。

セグメント分析

溶存固形物除去システムは、逆浸透とナノろ過が海水淡水化、汽水再生、高回収率工業ラインでの地位を固め、2024年の上下水道処理技術市場シェアの31.39%を獲得しました。このセグメントの設置ベースは、2024年半ばに着工した台湾の100,000m3/日プラントのような大規模な自治体海水淡水化プロジェクトを背景に拡大し続けています。

しかし、成長の勢いは生物学的処理と栄養塩回収技術に傾いており、2030年までのCAGRは7.28%と市場全体の平均を1ポイント上回ると予測されています。これは、回収リンを取引可能な肥料クレジットに変える規制上のインセンティブが後押ししています。プロセスレベルでは、Fe(III)をトリガーとする部分的異化型硝酸塩還元とアナモックスの組み合わせのような画期的な技術により、窒素除去率が95%を超える一方でエネルギー需要が削減され、自治体のバイオソリッド改良の投資回収のハードルが下がっています。

上下水道処理技術レポートは、処理タイプ(油水分離、浮遊固形物除去、溶解固形物除去、その他)、エンドユーザー産業(市水・廃水処理、飲食品、パルプ・製紙、石油・ガス、ヘルスケア、その他)、地域(アジア太平洋、北米、欧州、南米、中東・アフリカ)で区分されています。

地域分析

アジア太平洋地域は、2024年の売上高で34.87%の圧倒的なシェアを占め、同時に最高のCAGR 8.76%を記録しており、成熟したインフラ分野ではめったに見られない二重のリーダーシップを強調しています。中国は沿岸の工業団地に沿ってメガ脱塩ラインを建設し続けており、台湾の巨大な海水ROプラントは、半導体クラスターがいかに自治体の水政策を左右しているかを浮き彫りにしています。

北米は、1970年代の老朽化した資産と先進的な規制の枠組みに結びついた旺盛な更新投資を維持しています。この地域では、飲用水の直接再利用が早くから採用され、PFASの規制が保留されていることから、高品位膜、粒状活性炭、新型の電気化学的破壊セルへの技術採用パターンが導かれています。テキサス州、コロラド州、カリフォルニア州の各自治体の水道委員会は、現在、高回収率アーキテクチャーとAI対応モニタリングを好む詳細なライフサイクルコスト分析を要求しており、上下水道処理技術市場のソフトウェアベンダーを上昇させています。

欧州は知的財産の坩堝であり続け、1992年から2021年の間に世界の水関連特許の40%を生み出し、PFASの浄化、資源に前向きなバイオソリッド、エネルギーニュートラルなろ過がその最前線にあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ゼロ液体排出(ZLD)規制の強化

- 分散型モジュール式処理プラントの成長

- 水不足地域における工業用再利用割当量の増加

- 頁岩ベースの随伴水再利用のための設備投資が急増

- AI対応スマートメータリングと予知保全

- 市場抑制要因

- 先進膜の高い総所有コスト

- 新興国における運転・保守技術基盤の限界

- 技術採用を遅らせるPFAS規制の不確実性

- バリューチェーン分析

- ポーターのファイブフォース

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 治療タイプ別

- 油水分離

- 浮遊物質除去

- 溶存固形物の除去

- 生物処理/栄養塩・金属回収

- 消毒/酸化

- その他のタイプ

- エンドユーザー業界別

- 地方自治体の上下水道処理

- 食品および飲料

- パルプ・紙

- 石油・ガス

- ヘルスケア

- 養鶏・養殖

- 化学・石油化学

- その他のエンドユーザー産業

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/ランキング分析

- 企業プロファイル

- AECOM

- Aquatech

- Black & Veatch Corporation

- Doosan Enerbility

- DuPont

- Ecolab

- HDO

- Hitachi, Ltd.

- Kurita Water Industries Ltd.

- Mott MacDonald

- Pentair

- REMONDIS SE & Co. KG

- Siemens

- SLB

- Thermax Limited

- Veolia

- WABAG

- Xylem