|

|

市場調査レポート

商品コード

1735894

廃水処理サービスの世界市場:サービスタイプ別、最終用途産業別、地域別 - 2030年までの予測Wastewater Treatment Services Market by Service Type, End-Use Industry (Municipal, Industrial ), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 廃水処理サービスの世界市場:サービスタイプ別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月23日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の廃水処理サービスの市場規模は、6.87%のCAGRで拡大し、2025年の665億3,000万米ドルから2030年には927億4,000万米ドルに達すると予測さています。

廃水処理サービス市場のメンテナンス・修理分野は、処理インフラの複雑さと老朽化が進んでいるため、予測期間中に最も高い成長率を示すと予測されています。膜バイオリアクターや人工知能ベースのシステムなど最先端の技術を持つ処理プラントでは、定期的なメンテナンスが最大の運転性能とEUの都市廃水処理指令などの厳しい規制への準拠を保証するために重要です。産業界や自治体の顧客からの需要が高まり、ダウンタイムを最小限に抑え、機器の稼動寿命を延ばす必要があるため、予知保全や修理サービスへの投資が促進され、このセグメントの成長を促しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | サービスタイプ別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

廃水処理サービス市場の最終用途産業別では、自治体セグメントが2024年に金額ベースで最大のシェアを占めました。この需要を牽引している主な要因は、世界の都市化と世界中の人口密集都市からの水量の増加です。また、公衆衛生と水域を保護するために高度な水処理を義務付ける厳しい規制も、自治体分野の最大市場シェアに大きな役割を果たしています。世界各国の政府は、水不足に対処するため、廃水処理施設への投資を優先しています。スマートウォーターシステムや効率的な処理プロセスのような革新的な技術の採用は、効果的な廃水管理と環境保護を確実にする自治体セグメントの優位性を証明しています。

中国、インド、東南アジアのような国々の急速な都市化、人口増加、工業化により、アジア太平洋地域は2024年に廃水処理サービスの最大市場となっています。世界人口の半分以上が住むこの地域は、責任を持って水資源を管理しなければならないという大きなプレッシャーにさらされています。汚染と闘い、減少しつつある水源を守るため、各国政府は行動を起こし、より強力な廃水排出規制を実施しています。工業生産、特に製造業と繊維産業は経済成長の原動力となっており、高度な治療を必要とする複雑な排水を生み出しています。環境悪化や水系感染症に対する意識の高まりにより、強力なインフラの必要性はさらに高まっています。官民パートナーシップの助けもあり、膜分離活性汚泥法やゼロ液体排出システムなどの技術が普及しつつあります。

当レポートでは、世界の廃水処理サービス市場について調査し、サービスタイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが廃水処理サービス市場に与える影響

- 2025年の米国関税の影響- 廃水処理サービス市場

第7章 廃水処理サービス市場(サービスタイプ別)

- イントロダクション

- 設計・エンジニアリングコンサルティング

- 構築と設置

- オペレーションとプロセス制御

- メンテナンスと修理

- その他

第8章 廃水処理サービス市場(最終用途産業別)

- イントロダクション

- 自治体

- 産業

第9章 廃水処理サービス市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- マレーシア

- オーストラリアとニュージーランド

- 欧州

- ドイツ

- フランス

- ロシア

- 英国

- ノルウェー

- スペイン

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド比較

- 企業評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- VEOLIA

- XYLEM

- ECOLAB INC.

- THERMAX LIMITED

- SOLENIS

- PENTAIR

- WOG TECHNOLOGIES

- GOLDER ASSOCIATES

- SWA WATER AUSTRALIA

- ITALMATCH CHEMICALS S.P.A.

- その他の企業

- TERRAPURE ENVIRONMENTAL

- ARIES CHEMICAL, INC.

- KURITA WATER INDUSTRIES LTD.

- BUCKMAN

- VA TECH WABAG LTD.

- FERALCO AB

- CANADIAN WATER TECHNOLOGIES, LTD.

- INNOSPEC

- BAUMINAS QUIMICA

- HYDRITE CHEMICAL

- AQUATECH INTERNATIONAL LLC

- CORTEC CORPORATION

- DORF KETAL CHEMICALS

- GEO SPECIALTY CHEMICALS, INC.

- OSTARA NUTRIENT RECOVERY TECHNOLOGIES INC.

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 WASTEWATER TREATMENT SERVICES MARKET: DEFINITION AND INCLUSIONS, BY SERVICE TYPE

- TABLE 2 WASTEWATER TREATMENT SERVICES MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 3 WASTEWATER TREATMENT SERVICES MARKET: DEFINITION AND INCLUSIONS, BY INDUSTRIAL TYPE

- TABLE 4 WASTEWATER TREATMENT SERVICES MARKET: RISK ASSESSMENT

- TABLE 5 WASTEWATER TREATMENT SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP SERVICE THREE TYPES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE TYPES

- TABLE 8 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2021-2029 (USD BILLION)

- TABLE 9 ROLES OF COMPANIES IN WASTEWATER TREATMENT SERVICES ECOSYSTEM

- TABLE 10 IMPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 12 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 WASTEWATER TREATMENT SERVICES MATERIALS: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 19 WASTEWATER TREATMENT SERVICES MARKET: FUNDING/INVESTMENT SCENARIO

- TABLE 20 WASTEWATER TREATMENT SERVICES MARKET: PATENT STATUS, 2014-2024

- TABLE 21 LIST OF MAJOR PATENTS FOR WASTEWATER TREATMENT SERVICES, 2014-2024

- TABLE 22 PATENTS BY EVOQUA WATER TECH LLC, 2014-2024

- TABLE 23 PATENTS BY XYLECO INC, 2014-2024

- TABLE 24 PATENTS BY EASTMAN CHEM CO., 2014-2024

- TABLE 25 TOP 10 PATENT OWNERS IN US, 2014-2024

- TABLE 26 TARIFF RATES

- TABLE 27 WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 28 WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 29 DESIGN & ENGINEERING CONSULTING: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 DESIGN & ENGINEERING CONSULTING: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 BUILDING & INSTALLATION: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 BUILDING & INSTALLATION: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 OPERATIONS & PROCESS CONTROL: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 OPERATIONS & PROCESS CONTROL: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 MAINTENANCE & REPAIR: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 MAINTENANCE & REPAIR: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 OTHER SERVICE TYPES: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 OTHER SERVICE TYPES: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 40 WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 MUNICIPAL: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 MUNICIPAL: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 46 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 47 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR CHEMICAL & PHARMA, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR CHEMICAL & PHARMA, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR OIL & GAS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR OIL & GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR FOOD, PULP & PAPER, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR FOOD, PULP & PAPER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR METAL & MINING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR METAL & MINING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR POWER GENERATION, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR POWER GENERATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR OTHERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 INDUSTRIAL: WASTEWATER TREATMENT SERVICES MARKET FOR OTHERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 WASTEWATER TREATMENT SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 US: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 70 US: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 71 US: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 72 US: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 US: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 74 US: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 75 LARGEST UPCOMING WATER TREATMENT CONSTRUCTION PROJECTS

- TABLE 76 CANADA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 77 CANADA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 78 CANADA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 79 CANADA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 CANADA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 81 CANADA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 82 MEXICO: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 83 MEXICO: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 84 MEXICO: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 85 MEXICO: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 MEXICO: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 87 MEXICO: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 89 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 95 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 CHINA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 97 CHINA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 98 CHINA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 99 CHINA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 100 CHINA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 101 CHINA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 102 INDIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 103 INDIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 104 INDIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 105 INDIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 106 INDIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 107 INDIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 108 JAPAN: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 109 JAPAN: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 110 JAPAN: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 111 JAPAN: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 JAPAN: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 113 JAPAN: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 114 SOUTH KOREA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 115 SOUTH KOREA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 116 SOUTH KOREA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 117 SOUTH KOREA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 118 SOUTH KOREA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 119 SOUTH KOREA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 120 INDONESIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 121 INDONESIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 122 INDONESIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 123 INDONESIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 INDONESIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 125 INDONESIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 126 MALAYSIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 127 MALAYSIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 128 MALAYSIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 129 MALAYSIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 130 MALAYSIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 131 MALAYSIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 132 AUSTRALIA & NEW ZEALAND: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 134 AUSTRALIA & NEW ZEALAND: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 135 AUSTRALIA & NEW ZEALAND: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 AUSTRALIA & NEW ZEALAND: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 137 AUSTRALIA & NEW ZEALAND: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 139 EUROPE: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 143 EUROPE: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 GERMANY: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 147 GERMANY: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 148 GERMANY: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 149 GERMANY: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 150 GERMANY: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 151 GERMANY: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 152 FRANCE: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 153 FRANCE: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 154 FRANCE: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 155 FRANCE: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 FRANCE: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 157 FRANCE: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 158 RUSSIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 159 RUSSIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 160 RUSSIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 161 RUSSIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 RUSSIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 163 RUSSIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 164 UK: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 165 UK: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 166 UK: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 167 UK: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 UK: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 169 UK: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 170 NORWAY: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 171 NORWAY: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 172 NORWAY: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 173 NORWAY: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 174 NORWAY: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 175 NORWAY: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 176 SPAIN: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 177 SPAIN: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 178 SPAIN: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 179 SPAIN: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 180 SPAIN: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 181 SPAIN: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 SAUDI ARABIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 191 SAUDI ARABIA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 192 SAUDI ARABIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 193 SAUDI ARABIA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 194 SAUDI ARABIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 195 SAUDI ARABIA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 197 SOUTH AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 199 SOUTH AFRICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH AFRICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 201 SOUTH AFRICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 202 SOUTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 203 SOUTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 207 SOUTH AMERICA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 208 SOUTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 209 SOUTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 210 BRAZIL: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 211 BRAZIL: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 212 BRAZIL: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 213 BRAZIL: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 214 BRAZIL: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 215 BRAZIL: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 216 ARGENTINA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 217 ARGENTINA: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 218 ARGENTINA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 219 ARGENTINA: WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 220 ARGENTINA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2020-2024 (USD MILLION)

- TABLE 221 ARGENTINA: INDUSTRIAL WASTEWATER TREATMENT SERVICES MARKET, BY INDUSTRIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 222 WASTEWATER TREATMENT SERVICES MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 223 WASTEWATER TREATMENT SERVICES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 224 WASTEWATER TREATMENT SERVICES MARKET: REGION FOOTPRINT

- TABLE 225 WASTEWATER TREATMENT SERVICES MATERIAL MARKET: SERVICE TYPE FOOTPRINT

- TABLE 226 WASTEWATER TREATMENT SERVICES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 227 WASTEWATER TREATMENT SERVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 228 WASTEWATER TREATMENT SERVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 229 WASTEWATER TREATMENT SERVICES MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 230 WASTEWATER TREATMENT SERVICES MARKET: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 231 WASTEWATER TREATMENT SERVICES MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 232 VEOLIA: COMPANY OVERVIEW

- TABLE 233 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 VEOLIA: SERVICE LAUNCHES

- TABLE 235 VEOLIA: DEALS

- TABLE 236 VEOLIA: OTHERS

- TABLE 237 XYLEM: COMPANY OVERVIEW

- TABLE 238 XYLEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 XYLEM: SERVICE LAUNCHES

- TABLE 240 XYLEM: DEALS

- TABLE 241 XYLEM: EXPANSIONS

- TABLE 242 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 243 ECOLAB INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ECOLAB INC.: DEALS

- TABLE 245 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 246 THERMAX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 THERMAX LIMITED: EXPANSIONS

- TABLE 248 SOLENIS: COMPANY OVERVIEW

- TABLE 249 SOLENIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 SOLENIS: DEALS

- TABLE 251 SOLENIS: EXPANSIONS

- TABLE 252 PENTAIR: COMPANY OVERVIEW

- TABLE 253 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 PENTAIR: DEALS

- TABLE 255 WOG TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 256 WOG TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 GOLDER ASSOCIATES: COMPANY OVERVIEW

- TABLE 258 GOLDER ASSOCIATES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 GOLDER ASSOCIATES: DEALS

- TABLE 260 SWA WATER AUSTRALIA: COMPANY OVERVIEW

- TABLE 261 SWA WATER AUSTRALIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 ITALMATCH CHEMICALS S.P.A.: COMPANY OVERVIEW

- TABLE 263 ITALMATCH CHEMICALS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 ITALMATCH CHEMICALS S.P.A.: DEALS

- TABLE 265 TERAPURE ENVIRONMENTAL: COMPANY OVERVIEW

- TABLE 266 ARIES CHEMICAL, INC.: COMPANY OVERVIEW

- TABLE 267 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 268 BUCKMAN: COMPANY OVERVIEW

- TABLE 269 VA TECH WABAG LTD.: COMPANY OVERVIEW

- TABLE 270 FERALCO AB: COMPANY OVERVIEW

- TABLE 271 CANADIAN WATER TECHNOLOGIES, LTD.: COMPANY OVERVIEW

- TABLE 272 INNOSPEC: COMPANY OVERVIEW

- TABLE 273 BAUMINAS QUIMICA: COMPANY OVERVIEW

- TABLE 274 HYDRITE CHEMICAL: COMPANY OVERVIEW

- TABLE 275 AQUATECH INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 276 CORTEC CORPORATION: COMPANY OVERVIEW

- TABLE 277 DORF KETAL CHEMICALS: COMPANY OVERVIEW

- TABLE 278 GEO SPECIALTY CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 279 OSTARA NUTRIENT RECOVERY TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 280 WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2019-2026 (KILOTON)

- TABLE 281 WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2019-2026 (USD MILLION)

- TABLE 282 WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2019-2026 (USD MILLION)

- TABLE 283 WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2019-2026 (KILOTON)

List of Figures

- FIGURE 1 WASTEWATER TREATMENT SERVICES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 WASTEWATER TREATMENT SERVICES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARES OF MAJOR PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 2 (DEMAND SIDE): END-USE INDUSTRY

- FIGURE 6 WASTEWATER TREATMENT SERVICES MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE

- FIGURE 9 MUNICIPAL END-USE INDUSTRY TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 OPERATIONS & PROCESS CONTROL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 POWER GENERATION TO LEAD MARKET IN INDUSTRIAL END-USE SEGMENT DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 INCREASING AWARENESS ABOUT ENVIRONMENTAL CONCERNS RELATED TO WASTEWATER TO BOOST MARKET

- FIGURE 14 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 CHINA AND OPERATIONS & PROCESS CONTROL ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 16 OPERATIONS & PROCESS CONTROL LED MARKET IN 2024

- FIGURE 17 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 WASTEWATER TREATMENT SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 WASTEWATER TREATMENT SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SERVICE TYPES

- FIGURE 21 KEY BUYING CRITERIA, BY TOP SERVICE THREE TYPES

- FIGURE 22 WASTEWATER TREATMENT SERVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 WASTEWATER TREATMENT SERVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 842121-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024

- FIGURE 26 EXPORT DATA RELATED TO HS CODE 842121-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 27 PATENTS REGISTERED RELATED TO WASTEWATER TREATMENT SERVICES, 2014-2024

- FIGURE 28 TOP PATENT OWNERS DURING LAST 11 YEARS, 2014-2024

- FIGURE 29 LEGAL STATUS OF PATENTS FILED FOR WASTEWATER TREATMENT SERVICES, 2014-2024

- FIGURE 30 MAXIMUM PATENTS FILED IN US JURISDICTION, 2014-2024

- FIGURE 31 OPERATION & PROCESS CONTROL TO DOMINATE MARKET DURING THE FORECAST PERIOD

- FIGURE 32 MUNICIPAL END-USE INDUSTRY TO LEAD MARKET DURING THE FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: WASTEWATER TREATMENT SERVICES MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET SNAPSHOT

- FIGURE 36 EUROPE: WASTEWATER TREATMENT SERVICES MARKET SNAPSHOT

- FIGURE 37 WASTEWATER TREATMENT SERVICES MARKET, SHARE OF KEY MARKET PLAYERS, 2024

- FIGURE 38 WASTEWATER TREATMENT SERVICES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 39 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 40 WASTEWATER TREATMENT SERVICES MARKET: COMPANY FOOTPRINT

- FIGURE 41 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 42 WASTEWATER TREATMENT SERVICES MARKET: BRAND COMPARISON

- FIGURE 43 WASTEWATER TREATMENT SERVICES MARKET: EV/EBITDA OF KEY SERVICE PROVIDERS

- FIGURE 44 WASTEWATER TREATMENT SERVICES MARKET: ENTERPRISE VALUATION OF KEY PLAYERS (USD BILLION)

- FIGURE 45 VEOLIA: COMPANY SNAPSHOT

- FIGURE 46 XYLEM: COMPANY SNAPSHOT

- FIGURE 47 ECOLAB INC.: COMPANY SNAPSHOT

- FIGURE 48 THERMAX LIMITED: COMPANY SNAPSHOT

- FIGURE 49 PENTAIR: COMPANY SNAPSHOT

The global wastewater treatment services market is projected to reach USD 92.74 billion by 2030 from USD 66.53 billion in 2025, at a CAGR of 6.87%. The maintenance and repair segment of the wastewater treatment services market is projected to witness the highest value growth during the forecast period due to rising complexity and age of treatment infrastructure. With treatment plants having the most advanced technologies, such as membrane bioreactors and artificial intelligence-based systems, regular maintenance is critical to guarantee maximum operational performance and compliance with stringent regulations, such as the EU's Urban Wastewater Treatment Directive. Growing demand from industrial and municipal customers, and the need to minimize downtime and extend the operational life of equipment, drives investments in predictive maintenance and repair services, thus driving growth in this segment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Service Type, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"The municipal segment accounted for the largest share of the wastewater treatment services market in terms of value in 2024."

The municipal segment by end-use industry of the wastewater treatment services market accounted for the largest share in terms of value in 2024. The main factors driving this demand are global urbanization and escalating water volumes from densely populated cities across the world. Stringent regulations, which mandate the advanced treatment of water to protect public health and water bodies, also play a major role in the largest market share of municipal segment. The governments worldwide are prioritizing investments in the wastewater treatments facilities to address the water scarcity. The adoption of innovative technologies such as smart water systems and efficient treatment processes have proven the dominance of municipal segment, which ensures effective wastewater management and environment protection.

"Asia Pacific was the largest wastewater treatement services market, in terms of value, in 2024."

Due to the rapid urbanization, population growth, and industrialization of countries like China, India, and Southeast Asia, the Asia Pacific region became the largest market for wastewater treatment services in 2024. The region, which is home to more than half of the world's population, is under tremendous pressure to manage water resources responsibly. To combat pollution and safeguard diminishing water supplies, governments are taking action and implementing stronger wastewater discharge regulations. Industrial output, especially in manufacturing and textiles, is fueled by economic growth and produces complex effluents that require sophisticated treatment. The need for strong infrastructure is further increased by growing awareness of environmental degradation and waterborne illnesses. With the help of public-private partnerships, technologies such as membrane bioreactors and zero-liquid discharge systems are becoming more popular.

- By Company Type: Tier 1 - 32%, Tier 2 - 42%, and Tier 3 - 27%

- By Designation: Directors - 23%, Managers - 21%, and Others - 56%

- By Region: North America - 41%, Europe - 30%, Asia Pacific - 18%, Rest of World - 11%

The key players profiled in the report include Veolia, Xylem Inc., Ecolab Inc., Thermax Limited, Evoqua Water Technologies, Pentair, WOG Technologies, Golder Associates, SWA Water Australia, and Italmatch Chemicals S.p.A, and among others.

Research Coverage

This report segments the market for wastewater treatment services market based on service type, end-use industry, and region and provides estimations of value (USD million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for wastewater treatment services.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the automotive interior materials market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on wastewater treatment services offered by top players in the global market

- Analysis of key drivers (Stringent environmental services), restraints (High cost of wastewater treatment technologies), opportunities (Sustainable approach through reduce-recycle-reuse), and challenges (lack of techno-commercial awareness) influencing the growth of the wastewater treatment services market.

- Service Development/Innovation: Detailed insight into research & development activities, and new service launches in the wastewater treatment services market.

- Market Development: Comprehensive information about markets - the report analyses the wastewater treatment services market across varied regions.

- Market Diversification: Exclusive information about the new services untapped geographies, recent developments, and investments in the wastewater treatment services market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Veolia, Xylem Inc., Ecolab Inc., Thermax Limited, Evoqua Water Technologies, Pentair, WOG Technologies, Golder Associates, Italmatch Chemicals S.p.A., and SWA Water Australia.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN WASTEWATER TREATMENT SERVICES MARKET

- 4.2 WASTEWATER TREATMENT SERVICES MARKET, BY REGION

- 4.3 ASIA PACIFIC: WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE AND COUNTRY

- 4.4 WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE

- 4.5 WASTEWATER TREATMENT SERVICES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent environmental regulations

- 5.2.1.2 Initiatives for zero liquid discharge

- 5.2.1.3 Growth of global manufacturing industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of wastewater treatment technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Sustainable approach through reduce-recycle-reuse

- 5.2.3.2 Curbing risks of environmental noncompliance

- 5.2.3.3 Adoption of green technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of techno-commercial awareness

- 5.2.4.2 Competition from alternative water sources

- 5.2.4.3 Complex permitting and approval processes

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST OF MOST PROMINENT ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 CHEMICAL AND EQUIPMENT MANUFACTURERS

- 6.1.2 WASTEWATER TREATMENT SERVICES

- 6.1.3 END-USE INDUSTRIES

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 KEY TECHNOLOGIES

- 6.4.1.1 Advanced Oxidation Processes (AOPs)

- 6.4.1.2 Reverse Osmosis (RO)

- 6.4.2 COMPLEMENTARY TECHNOLOGIES

- 6.4.2.1 Nutrient Recovery Systems

- 6.4.2.2 Electrocoagulation

- 6.4.1 KEY TECHNOLOGIES

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 MAYAN ZVI WASTEWATER TREATMENT RETROFIT: DOUBLING CAPACITY WITH MABR INNOVATION

- 6.5.2 LOS ANGELES COUNTY STORMWATER DIVERSION: ENHANCING WATER REUSE THROUGH INNOVATION

- 6.5.3 ITALCANDITI-VITALFOOD, ITALY: SUSTAINABLE WASTEWATER TREATMENT THROUGH BIOGAS INNOVATION

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT SCENARIO (HS CODE 842121)

- 6.6.2 EXPORT SCENARIO (HS CODE 842121)

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.2 REGULATORY FRAMEWORK

- 6.7.2.1 Clean Water Act (CWA)

- 6.7.2.2 The Safe Drinking Water Act (SDWA)

- 6.7.2.3 The Urban Wastewater Treatment Directive (UWTD) 1991

- 6.7.2.4 Water Pollution Prevention and Control Action Plan (2015)

- 6.7.2.5 Water (Prevention and Control of Pollution) Act, 1974

- 6.7.2.6 National Water Law, 1997

- 6.8 KEY CONFERENCES AND EVENTS, 2025

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.10 PATENT ANALYSIS

- 6.10.1 APPROACH

- 6.10.2 PATENT TYPES

- 6.10.3 TOP APPLICANTS

- 6.10.4 JURISDICTION ANALYSIS

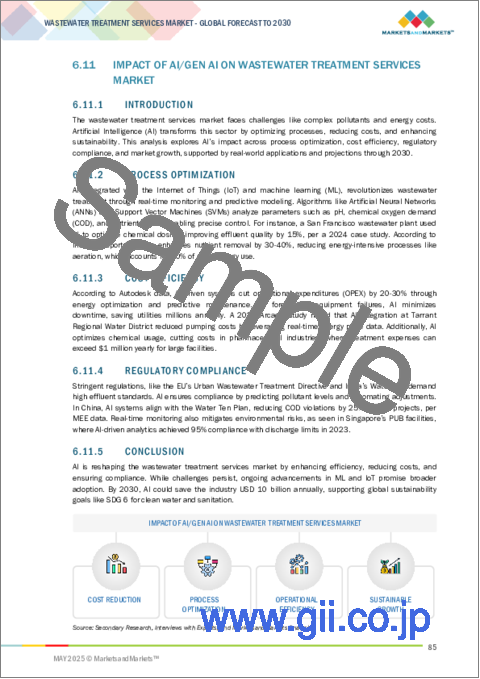

- 6.11 IMPACT OF AI/GEN AI ON WASTEWATER TREATMENT SERVICES MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 PROCESS OPTIMIZATION

- 6.11.3 COST EFFICIENCY

- 6.11.4 REGULATORY COMPLIANCE

- 6.11.5 CONCLUSION

- 6.12 IMPACT OF 2025 US TARIFF - WASTEWATER TREATMENT SERVICES MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFFS

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE

- 7.1 INTRODUCTION

- 7.2 DESIGN & ENGINEERING CONSULTING

- 7.2.1 PROCESS DESIGN EXPERTISE TO EVALUATE PERFORMANCE OF TREATMENT UNITS

- 7.3 BUILDING & INSTALLATION

- 7.3.1 SMOOTH FUNCTIONING OF WASTEWATER TREATMENT PLANT

- 7.4 OPERATIONS & PROCESS CONTROL

- 7.4.1 PROCESS OPTIMIZATION TO IMPROVE WASTEWATER QUALITY

- 7.5 MAINTENANCE & REPAIR

- 7.5.1 CORRECTIVE AND PREVENTIVE MAINTENANCE FOR OPTIMUM PLANT PERFORMANCE

- 7.6 OTHER SERVICE TYPES

8 WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 MUNICIPAL

- 8.2.1 URBAN GROWTH AND REGULATORY PUSH TO PROPEL MUNICIPAL WASTEWATER TREATMENT DEMAND

- 8.3 INDUSTRIAL

- 8.3.1 CHEMICAL & PHARMA

- 8.3.1.1 Stringent regulations and complex effluents to boost demand

- 8.3.2 OIL & GAS

- 8.3.2.1 Escalating production and environmental compliance to drive market

- 8.3.3 FOOD, PULP & PAPER

- 8.3.3.1 Growing demand for food & beverage products to drive market

- 8.3.4 METAL & MINING

- 8.3.4.1 High TDS content to increase demand for wastewater treatment

- 8.3.5 POWER GENERATION

- 8.3.5.1 Increasing investment in industrial wastewater treatment to boost market

- 8.3.6 OTHERS

- 8.3.1 CHEMICAL & PHARMA

9 WASTEWATER TREATMENT SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Strict environmental regulations to fuel market

- 9.2.2 CANADA

- 9.2.2.1 Significant electricity generation to propel the market

- 9.2.3 MEXICO

- 9.2.3.1 Rapid industrialization to drive market

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 CHINA

- 9.3.1.1 Industrial expansion and stringent regulations to drive market

- 9.3.2 INDIA

- 9.3.2.1 New manufacturing policies to drive market

- 9.3.3 JAPAN

- 9.3.3.1 Reduced groundwater supply to fuel demand for wastewater treatment

- 9.3.4 SOUTH KOREA

- 9.3.4.1 Adoption of advanced membrane technology to propel market

- 9.3.5 INDONESIA

- 9.3.5.1 Government initiatives to boost supply of clean drinking water

- 9.3.6 MALAYSIA

- 9.3.6.1 Business-friendly policies and new regulations to attract foreign investments

- 9.3.7 AUSTRALIA & NEW ZEALAND

- 9.3.7.1 Growth of power industry to increase demand for wastewater treatment services

- 9.3.1 CHINA

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Improved standard of living to fuel demand for wastewater treatment

- 9.4.2 FRANCE

- 9.4.2.1 Use of fuel-based power plants to drive market

- 9.4.3 RUSSIA

- 9.4.3.1 Increased power generation and oil production to drive market

- 9.4.4 UK

- 9.4.4.1 Stringent standards for enhancing water quality to drive market

- 9.4.5 NORWAY

- 9.4.5.1 Stringent environmental regulations to bolster market

- 9.4.6 SPAIN

- 9.4.6.1 Water scarcity and reuse mandates to drive market

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Rapid urbanization and tourism to fuel demand for water resources

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Increased electricity demand and consumption to propel market

- 9.5.1 SAUDI ARABIA

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Growth of industrial sector to fuel demand

- 9.6.2 ARGENTINA

- 9.6.2.1 Increased electricity demand to drive market

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Service type footprint

- 10.5.5.4 End-use industry footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND COMPARISON

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT/SERVICE LAUNCHES

- 10.9.2 EXPANSIONS

- 10.9.3 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 VEOLIA

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Service launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Others

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 XYLEM

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Service launches

- 11.1.2.3.2 Service launches

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ECOLAB INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 THERMAX LIMITED

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 SOLENIS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 PENTAIR

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 WOG TECHNOLOGIES

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 GOLDER ASSOCIATES

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 SWA WATER AUSTRALIA

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 ITALMATCH CHEMICALS S.P.A.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.1 VEOLIA

- 11.2 OTHER PLAYERS

- 11.2.1 TERRAPURE ENVIRONMENTAL

- 11.2.2 ARIES CHEMICAL, INC.

- 11.2.3 KURITA WATER INDUSTRIES LTD.

- 11.2.4 BUCKMAN

- 11.2.5 VA TECH WABAG LTD.

- 11.2.6 FERALCO AB

- 11.2.7 CANADIAN WATER TECHNOLOGIES, LTD.

- 11.2.8 INNOSPEC

- 11.2.9 BAUMINAS QUIMICA

- 11.2.10 HYDRITE CHEMICAL

- 11.2.11 AQUATECH INTERNATIONAL LLC

- 11.2.12 CORTEC CORPORATION

- 11.2.13 DORF KETAL CHEMICALS

- 11.2.14 GEO SPECIALTY CHEMICALS, INC.

- 11.2.15 OSTARA NUTRIENT RECOVERY TECHNOLOGIES INC.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 WATER TREATMENT CHEMICALS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 WATER TREATMENT CHEMICALS MARKET, BY TYPE

- 12.5 WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS