|

|

市場調査レポート

商品コード

1683140

日本の生命保険・損害保険市場:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Japan Life & Non-Life Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 日本の生命保険・損害保険市場:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 60 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

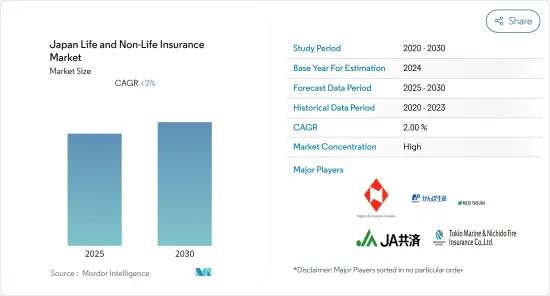

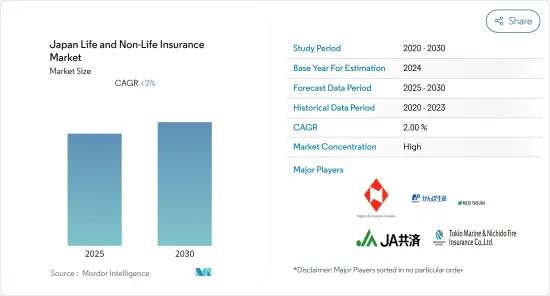

日本の生命保険・損害保険市場、予測期間中のCAGRは2%以下と予測

主要ハイライト

- >日本の生命保険・損害保険市場は世界最大級の市場です。生命保険の取扱高は約35兆円で、年間保険料総額は米国に次いで第2位。

- 個人保険の新契約年換算保険料は2兆4,800億円(前年比111.6%)。個人年金保険の新契約年換算保険料は5,016億円(同118.4%)。保有契約年換算保険料は、個人保険が22兆3,100億円(前期比103.8%)と10年連続の増加、個人年金保険が6兆3,500億円(前期比99.8%)と2年連続の減少となりました。第三セグメントでは、新契約年換算保険料は7,790億円(前年同期比111.9%)と6年連続の増加、保有契約年換算保険料は6兆8,500億円(同104.9%)と増加基調にあります。

- 損害保険では、2018年度の積立部分を含む元受正味保険料総額は9兆4,140億円となり、前期比1.5%増加しました。2018年度の正味保険料総額は8兆3,928億円となり、前期比0.1%増加しました。この増加は、大阪北部地震と平成30年北海道胆振東部地震に係る地震保険金の増加、ならびに平成30年7月豪雨に係る火災保険金の増加によるものです。

日本の生損保市場動向

個人保険契約件数・保有契約件数の増加

2018年の個人保険の新契約件数は2,253万件(前年比130.4%、転換契約含む)、給付金額は66兆7,300億円(前年比116.4%、転換による純増加含む)となりました。終身保険、定期保険、がん保険が好調で、新契約件数、給付金額は大幅に増加しました。個人保険の保有契約件数は1億8,129万件(前年同期比104.8%)、給付金額は848兆6,900億円(同99.5%)となりました。保有契約件数は11年連続で増加しています。また、近年の医療保障の補完動向が死亡保障の金額を抑制し、前年並みとなりました。

自動車保険の優位性

自動車保険(自賠責保険を含む)は日本の純保険料の6割を占めます。グレード制度により、契約者の事故歴に基づいて保険料が決定されます。自動車保険の販売は政府が独占しており、その割合は4%です。先進的テレマティクスの普及に伴い、自動車産業では大きな変化が予想されます。

日本の生命保険・損害保険産業概要

本レポートは、日本の生命保険・損害保険市場に参入している主要企業を網羅しています。市場は統合されています。生命保険セグメントの各社の市場シェアは約51%です。損害保険セグメントでは、上位3社が市場シェアの87%を占めています。市場は予測期間中に成長すると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヵ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の成果

- 調査の前提

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

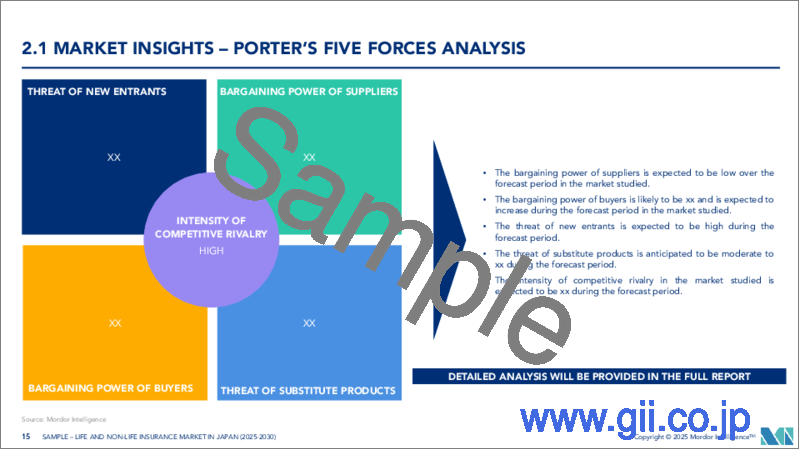

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 保険タイプ別

- 生命保険

- 個人保険

- 団体保険

- 損害保険

- ホーム

- 自動車保険

- その他

- 生命保険

- 流通チャネル別

- 直接販売

- 代理店

- 銀行

- その他

第6章 競合情勢

- ベンダー市場シェア

- 合併と買収

- 企業プロファイル

- NIPPON LIFE INSURANCE COMPANY

- JAPAN POST INSURANCE CO. LTD

- NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES

- TOKIO MARINE & NICHIDO FIRE INSURANCE CO. LTD

- MEIJI YASUDA LIFE INSURANCE COMPANY

- DAI-ICHI LIFE INSURANCE COMPANY LIMITED

- SUMITOMO LIFE INSURANCE COMPANY

- SOMPO JAPAN NIPPONKOA INSURANCE INC.

- GIBRALTAR LIFE INSURANCE CO. LTD

- AFLAC LIFE INSURANCE JAPAN LTD

第7章 市場機会と今後の動向

The Japan Life & Non-Life Insurance Market is expected to register a CAGR of less than 2% during the forecast period.

Key Highlights

- >

- The insurance market in Japan is among the biggest markets in the world. The volume of life insurance is roughly worth JPY 35 trillion, and the country ranked second in thee total annual premium, after the United States. The insurance market for property and casualty (P&C) was roughly worthJPY 9 trillion, rand it ranked fourth, globally.

- The annualized premium on new policies for individual insurance was JPY 2.48 trillion(111.6% year-on-year). The annualized premiumnew policies for individual annuity insurance was JPY 501.6 billion (118.4% year-on-year) Both these numbers resulted in an increase in the last twoyears. The annualized premium on policies in force was JPY 22.31 trillion (103.8% year-on-year) for individual insurance, which was an increase for 10 consecutive years, and 6.35 trillion JPY (99.8% year-on-year) for individual annuity insurance, which was a decrease for twoconsecutive years. Regarding the third sector, the annualized premium was JPY 779.0 billion(111.9% year-on-year) for new policies, which was an increase for sixconsecutive years, and JPY 6.85 trillion(104.9% year-on-year) for policies in force, which is constantly increasing.

- In non-life insurance, the total direct premiums, including the saving portion,in fiscal 2018, amounted to JPY 9,414 billion, which was an increase of 1.5%.The total net premiums, in 2018, was valued at JPY8,392.8 billion, up by 0.1%.The net claims paid on all classes of insurance during fiscal 2018 amounted to JPY 5,324.2 billion, which was an increase of 13.2% compared to the previous term. This increase was a result of theincrease in earthquake insurance claim payments for the Northern Osaka earthquake andthe 2018 Hokkaido eastern Iburi earthquakeand an increase in fire insurance claim payments for the heavy rain event of July 2018.

Japan Life & Non-Life Insurance Market Trends

Increase in Number of Individual Insurance Policies and Policies in Force

In 2018, there were 22.53 million new policies (130.4% year-on-year, including converted contracts), and the amount of benefits was worth JPY 66.73 trillion (116.4% year-on-year, including the net increase arising from the conversions) for new individual insurance policies. The number of new policies and the amount of benefits significantly increased due to strong sales in whole-life, term-life, and cancer insurance. There were 181.29 million individual life insurance policies in force (104.8% year-on-year), and the total amount of benefits was worth JPY 848.69 trillion (99.5% year-on-year). The number of insurance policies in force has been increasing for 11 consecutive years. Moreover, the recent trend of supplementing medical coverage suppressed the amount of death coverage, and it remained equal to the previous year.

Dominance of Automotive Insurance:

Automobile insurance (including compulsory automobile liability insurance) accounts for 60% of Japan's net premium. A "classification system" determines premiums based on histories of accidents by policyholders. Auto-policy sales are dominated by governments, at 4% floating, and the direct sales are rising. Enormous changes are anticipated within the automobile industry, as advanced telematics become more widespread.

Japan Life & Non-Life Insurance Industry Overview

The report covers the major players operating in the life and non-life insurance market in Japan. The market is consolidated. The life insurance segment companies hold approximately 51% market share. In the non-life segment, the top-three companies hold 87% of the market share. The market is expected to grow during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Insurance type

- 5.1.1 Life Insurance

- 5.1.1.1 Individual

- 5.1.1.2 Group

- 5.1.2 Non-life Insurance

- 5.1.2.1 Home

- 5.1.2.2 Motor

- 5.1.2.3 Others

- 5.1.1 Life Insurance

- 5.2 By Channel of Distribution

- 5.2.1 Direct

- 5.2.2 Agency

- 5.2.3 Banks

- 5.2.4 Other Channels of Distribution

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers and Acquisitions

- 6.3 Company Profiles

- 6.3.1 NIPPON LIFE INSURANCE COMPANY

- 6.3.2 JAPAN POST INSURANCE CO. LTD

- 6.3.3 NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES

- 6.3.4 TOKIO MARINE & NICHIDO FIRE INSURANCE CO. LTD

- 6.3.5 MEIJI YASUDA LIFE INSURANCE COMPANY

- 6.3.6 DAI-ICHI LIFE INSURANCE COMPANY LIMITED

- 6.3.7 SUMITOMO LIFE INSURANCE COMPANY

- 6.3.8 SOMPO JAPAN NIPPONKOA INSURANCE INC.

- 6.3.9 GIBRALTAR LIFE INSURANCE CO. LTD

- 6.3.10 AFLAC LIFE INSURANCE JAPAN LTD