|

市場調査レポート

商品コード

1907221

非破壊検査(NDT):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Non-Destructive Testing (NDT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 非破壊検査(NDT):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 191 Pages

納期: 2~3営業日

|

概要

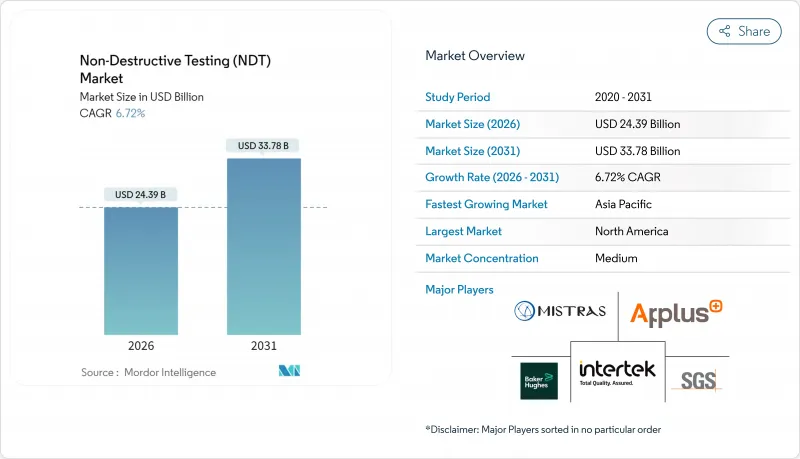

非破壊検査(NDT)市場は、2025年に228億6,000万米ドルと評価され、2026年の243億9,000万米ドルから2031年までに337億8,000万米ドルに達すると予測されています。

予測期間(2026年~2031年)におけるCAGRは6.72%と見込まれています。

世界の安全基準の強化、老朽化した資産の加速的な更新、AI搭載診断プラットフォームの急速な普及により、非破壊評価は事後的な欠陥発見から予知保全型資産管理へと移行しつつあります。北米および欧州の規制当局は現在、圧力容器、パイプライン、航空機構造物、原子炉に対する検査頻度の増加を義務付けており、安定した需要基盤を確立しています。一方、AI駆動型分析技術は検査サイクルの短縮、データ処理時間の大幅削減を実現し、ソフトウェアベンダーにとって新たなサブスクリプション収益源を生み出しています。サービスプロバイダーは、ポータブルフェーズドアレイ装置やデジタル放射線撮影装置をクラウド分析と組み合わせることで生産性を向上させ、検査総コストの削減を図っています。統合型プレイヤーがハードウェア、ソフトウェア、認定作業員を包括したターンキーソリューションを提供し、エンドユーザーのコンプライアンス対応を簡素化しようとする動きに伴い、合併・買収を通じた業界再編が加速しています。

世界の非破壊検査(NDT)市場の動向と洞察

安全・品質規制の強化がコンプライアンス主導の成長を促進

米国機械学会(ASME)、原子力規制委員会(NRC)、連邦航空局(FAA)などの規制機関は2024年に基準を改定し、圧力容器、原子炉部品、複合材航空機部品に対する非破壊検査の頻度と包括性を強化しました。これらの厳格な規制により、購買判断は任意支出から必須のコンプライアンス対応へと移行し、景気後退期においても基盤需要が保証される状況が生じています。高温圧力容器へのフェーズドアレイ超音波検査の義務化とデジタル記録保存規則の組み合わせにより、資産所有者は設備群の近代化を推進しています。サービスプロバイダーは収益予測性を高める複数年検査契約の恩恵を受け、機器ベンダーは規格準拠更新に伴う交換需要の加速と継続的なソフトウェアサブスクリプションで利益を得ています。さらに多くの管轄区域が米国および欧州の基準に準拠するにつれ、この促進要因の影響力は拡大し、非破壊検査市場の長期的な成長傾向を強化しています。

老朽化インフラの交換サイクルが検査需要を加速

北米の橋梁の40%以上が設計寿命を超過しており、1960年代に敷設されたパイプラインは重要な点検間隔に差し掛かっています。1970年代に稼働した原子力発電所の寿命延長プログラムでは、運転許可更新前に広範な超音波容器スキャンが必須となります。これにより生じた検査のバックログが、高スループット検査サービス、インテリジェントピグツール、自動データ解析への記録的な需要を喚起しています。インフラ故障は社会的・経済的コストが高いため、規制当局は資産所有者が延期できない厳格な検査スケジュールを義務付けています。この長期的な動向は非破壊検査サービス収益の長期的な見通しを確固たるものとし、現場の生産性を向上させる携帯型機器への投資を促進します。アジア太平洋地域の公益事業も同様の更新サイクルに着手するにつれ、世界の需要曲線はさらに急勾配を保ち続けています。

高コストの自動化非破壊検査システムは価格敏感市場での導入を制限

完全自動化されたフェーズドアレイスキャナーは20万~50万米ドルの価格帯であり、中小規模のサービス企業の予算を圧迫します。年次校正、ライセンシング、研修費用によりライフサイクルコストは倍増し、損益分岐点までの期間が長期化します。人件費が低い新興市場では、サイクルタイムが長くても手動検査を好む事業者が多く、高収益の自動化ソリューションの普及を遅らせています。資本規模が不足する中小ベンダーは競争に苦戦し、市場の統合が加速しています。融資ツールや設備リースモデルが成熟するまでは、この制約が導入を抑制し続けるでしょう。特に高付加価値のエネルギー・航空宇宙分野以外では顕著です。

セグメント分析

2025年の収益構成比はサービスが78.90%を占めましたが、ソフトウェア分野はCAGR11.71%で拡大が見込まれ、非破壊検査市場に新たな価値創造の弧を描いています。AI駆動の画像認識エンジンは、テラバイト級のスキャンデータを数分で実用的な保守知見に変換し、サービス経済を時間単位課金から成果連動型価格設定へと再構築しています。機器ベンダーは現在、ハードウェアにクラウド分析機能をバンドルし、年間サブスクリプションを組み込むことで、初期販売を超えた収益の持続を実現しています。エッジコンピューティングモジュールの急増により、検査現場でのリアルタイム分析が可能となり、データ主権に関する懸念を緩和し、帯域幅コストを削減しています。

ソフトウェアの台頭は現場作業を代替するものではなく、業務分担の再定義をもたらします。技術者はより高品質なデータを迅速に収集し、中央の分析担当者がAI生成のフラグを検証し、コンプライアンス対応の報告書を作成します。このモデルは現場の残業削減、設備稼働率向上、プラットフォーム提供者への新たな継続的収益創出を実現します。規制当局がデジタル署名付き報告書を承認するにつれ、非破壊検査業界はスピードと監査可能性の両方を獲得し、現代の検査ワークフローにおけるソフトウェアの重要な役割が浮き彫りとなります。

超音波検査法は、溶接部・鍛造品・複合材料の検査における汎用性から、2025年の非破壊検査市場シェアの27.95%を占めました。高度なフェーズドアレイ構成により、機器の分解を必要とせずに迅速な腐食マッピングや体積欠陥のサイズ測定が可能となります。しかしながら、渦電流探傷試験は、航空宇宙複合材や積層造形部品に使用される導電性材料の微小亀裂を検出できる能力に支えられ、2031年までにCAGR9.07%で成長すると予測されています。

改良されたプローブ設計と多周波数アレイにより、より深い浸透性と高速スキャンが実現され、薄肉検査における超音波検査の従来の優位性に課題しています。一方、デジタル放射線撮影はパイプライン溶接部の検証において重要な役割を果たし続けており、磁粉探傷試験は強磁性部品の表面欠陥検出に不可欠です。これらの補完的な手法を組み合わせることで、資産所有者は欠陥の種類や材料に応じて、速度、感度、規制適合性を兼ね備えたバランスの取れたツールボックスを導入することが可能となります。

地域別分析

北米は2025年時点で36.30%のシェアを維持しました。これは成熟した規制監視体制、老朽化したインフラ、AIの早期導入が牽引しています。同地域には圧力容器、パイプライン、航空機構造物といった大規模な既存設備が存在するため、検査量は安定しています。また石油・ガス事業者は資産寿命延長のため、高度なロボットピグ検査に投資しています。原子力発電所の寿命延長プログラムを支援する政府補助金も、体積超音波スキャンの需要を支えています。

欧州は若干遅れをとっていますが、厳格な安全指令と、欧州連合(EU)のグリーンディールに基づく再生可能エネルギープロジェクト推進の恩恵を受けています。風力タービンブレードの検査、複合材ローターの欠陥監視、水素パイプラインのパイロット事業が相まって、地域の非破壊検査市場を後押ししています。フランスと英国における原子炉の継続的なアップグレードが長期検査契約の増加を牽引する一方、ESGへの関心の高まりがフィルムからデジタル放射線撮影への移行を加速させ、有害廃棄物の削減に貢献しています。

アジア太平洋地域は7.61%のCAGRで最も強い成長勢いを示しており、中国とインドにおける大規模インフラプロジェクト、ならびに拡大する航空宇宙・半導体製造が牽引しています。日本と韓国の政府は国内規格をASMEおよびIEC規格に整合させ、検査の厳格化を図っています。新興東南アジア諸国では、国際認証機関による適合性評価が頻繁に利用されており、世界の企業にとってサービス提供の機会が生まれています。一帯一路のパイプライン網はインテリジェント・ピグ検査の需要を牽引し、地域内の新規造船所では大型船体溶接部の磁粉探傷検査およびフェーズドアレイ検査が求められています。

中東・アフリカ地域では、海洋石油・ガス投資や石油化学プラント拡張が需要を牽引します。紅海や西アフリカ沖の海底プロジェクトでは、深海対応の検査技術が求められます。一部の国における政治的不安定はプロジェクト遅延を招き、地域予測に変動性をもたらす一方、短縮されたスケジュールでプロジェクトが進行する際には高収益率を生み出します。ラテンアメリカでは、ブラジルのプレソルト層開発とメキシコの製油所改修を中心に緩やかな成長が見込まれ、いずれも高仕様の非破壊検査が求められます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- より厳格な安全・品質規制

- 老朽化したインフラの更新サイクル

- オフショア石油・ガスプロジェクトの拡大

- ポータブル位相配列装置およびDR装置の導入状況

- AIを活用した欠陥解析プラットフォーム

- 積層造形における品質保証要件

- 市場抑制要因

- 自動化非破壊検査システムの高コスト

- 認定技術者の不足

- サイバーセキュリティとデータ主権に関する障壁

- 放射線検査廃棄物に対するESGの反発

- 業界バリューチェーン分析

- マクロ経済的要因の影響

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- コンポーネント別

- 設備

- ソフトウェア

- サービス

- 消耗品

- 試験方法別

- 超音波検査

- 放射線検査

- 磁粉探傷試験

- 液体浸透探傷試験

- 目視検査

- 渦電流探傷試験

- 音響エミッション試験

- サーモグラフィー/赤外線検査

- コンピュータ断層撮影検査

- 技術別

- 従来型/従来方式

- AI搭載

- エンドユーザー業界別

- 石油・ガス

- 発電

- 航空宇宙産業

- 防衛

- 自動車・輸送機器

- 製造業および重工業

- 建設・インフラ

- 化学・石油化学

- 海洋・造船

- 電子機器および半導体

- 鉱業

- 医療機器

- その他のエンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Baker Hughes Company

- MISTRAS Group, Inc.

- SGS SA

- Intertek Group plc

- Applus+Services, S.A.

- Olympus Corporation

- Eddyfi/NDT Inc.

- Yxlon International GmbH

- Magnaflux(Illinois Tool Works Inc.)

- Ashtead Technology Ltd.

- Zetec Inc.

- Sonatest Ltd.

- Bureau Veritas SA

- TUV Rheinland AG

- Element Materials Technology Group Ltd.

- DEKRA SE

- DNV AS

- Acuren Inspection, Inc.

- NDT Global GmbH and Co. KG

- Cygnus Instruments Ltd.

- Sonotron NDT

- Bosello High Technology Srl

- LynX Inspection Inc.

- T.D. Williamson, Inc.